-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(1): 22-26

doi:10.5923/j.economics.20160601.03

Returns to Major Agricultural R&D Sources in Thailand

Waleerat Suphannachart

Faculty of Economics, Kasetsart University, Bangkok, Thailand

Correspondence to: Waleerat Suphannachart, Faculty of Economics, Kasetsart University, Bangkok, Thailand.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper aims at addressing the attribution issue among major agricultural R&D sources in Thailand. The public, private, university and foreign R&D are investigated as sources of agricultural productivity growth along with other economic and noneconomic factors using an econometric model. The model employs the error correction modeling technique using time-series data during 1980 to 2014. The estimated coefficients of the organized R&D variables are then used to compute the associated marginal internal rates of return on the local sources of R&D. The results show that all the major sources of agricultural R&D have statistically significant positive impacts on the productivity gain. However, the magnitude of the impacts and the associated rates of return are quite small. The university R&D payoff is shown to be slightly higher than those of the public and the private R&D, respectively. The findings also highlight the importance of the attribution among R&D sources and the systematic records of the R&D data.

Keywords: Agricultural R&D, Rate of return, Research Attribution, Thai agriculture

Cite this paper: Waleerat Suphannachart, Returns to Major Agricultural R&D Sources in Thailand, American Journal of Economics, Vol. 6 No. 1, 2016, pp. 22-26. doi: 10.5923/j.economics.20160601.03.

Article Outline

1. Introduction

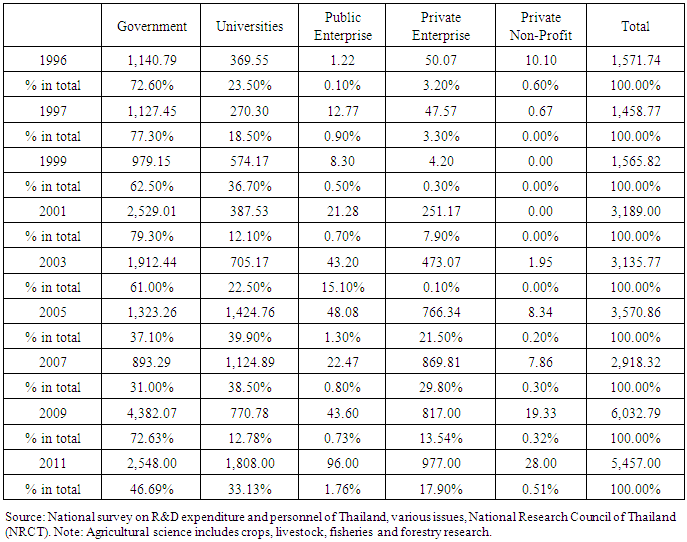

- Agricultural research plays an important role in sustaining agricultural growth in many developing countries including Thailand. Previous studies show the public investment in agricultural research had contributed to the Thai agricultural productivity growth which has important implications on living standards, poverty alleviation, food security, and overall economic growth. The returns on public research investment have also shown to be high implying an underinvestment in agricultural research (Suphannachart and Warr, 2011, 2012). However, the public sector is not the only research performer in Thailand and in fact its role in terms of research expenditure has recently declined. Among major research performers in Thailand, agricultural research activities have primarily been conducted by the government, followed by universities and private enterprises. The public R&D used to be the dominant source of agricultural R&D and so previous studies assumed it represents the entire agricultural R&D in the country but the situation has recently changed. The government share in total agricultural R&D spending has declined while that of universities increased, as shown in Table 1. The role of university research has become increasingly important in recent years; particularly in 2005 and 2007 when its R&D spending share slightly exceeded that of the government. The private sector also conducts research, well-known in seeds and livestock research but a systematic record of private R&D data still suffers from low surveyed responding rate and missing data from earlier years (Suphannachart, 2015, National Research Council of Thailand, 2007).

|

2. Literature Review

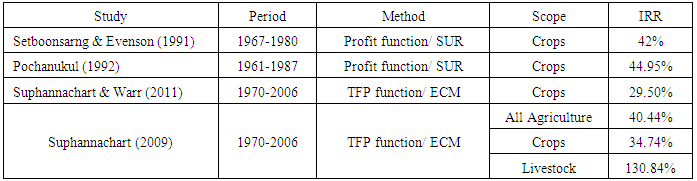

- Measuring the economic impact of research investment in the form of productivity growth has been a standard practice in evaluating an overall agricultural system in many countries (Agricultural Science and Technology Indicator, 2013). Total factor productivity (TFP) is often used as a measure of productivity that results from agricultural research. Research variables are regressed on the TFP to obtain the marginal research impact on productivity. The associated rates of return on research investment are then computed accordingly. Measuring returns on research investment is of particular importance to developing countries where agriculture plays a crucial role and a limited budget has to be allocated to various competing alternatives. The attribution issue has become increasingly important when estimating the agricultural research impact on productivity and computing the associated rates of return on research investment. As many sectors are involved in conducting research, it is not clear which research has actually contributed most to productivity change. As a result, more recent studies have focused on the attribution problem ignored in the earlier literature. These studies try to determine who has conducted particular research that has led to productivity improvement (Alston and Pardey, 2001, Pardey et al., 2004). Nonetheless, estimation models distinguishing among types of research expenditure place a heavy burden on the data.In a broader sense, the attribution issue not only accounts for different types of research expenditure but also addresses all important factors affecting productivity and specifies appropriate research lags in econometric models (Alston and Pardey, 2001). Failure to account for one source of innovation may overattribute observed gains in productivity to another source (Fuglie and Heisey, 2007). Agricultural productivity growth might be attributable to evolving weather patterns, institutional changes, or economies of size associated with changing structure of agriculture, however, in many cases it is likely that organized R&D has been the primary contributor to the observed growth. Thus, the important issue is the attribution among R&D sources (Alston, 2010). At a country-level, economic impact of agricultural research is often measured as an internal rate of return (IRR), in which the research benefits are estimated based on agricultural productivity growth that is deem as a result of R&D and the research costs are annual R&D expenditure (Evenson, 2001). Agricultural Science and Technology Indicator (ASTI) (2013) and Flaherty et al. (2013) show that the accelerated growth of global agricultural R&D spending has yielded very high payoffs. The rate of return on R&D investment for developing countries as a whole is 82 percent and for countries that achieved remarkable growth in R&D spending like China and Brazil the returns are 136 percent and for is 176 percent, respectively. Numerous studies have provided evidence of high rates of return on agricultural R&D in various countries and commodities as reviewed by many studies (Alston et al., 2000, Hurley et al., 2014, Evenson, 2001).In Thailand, there are few studies measuring returns on the public agricultural R&D but there are none for other types of research performers, mainly due to data constraint. Existing studies that measured IRR on the public investment in agricultural research are summarized in Table 2. The first two studies by Setboonsarng and Evenson (1991) and Pochanukul (1992) employed similar methods using profit function and seemingly unrelated regression (SUR) and found IRR on the public crop research around 42 percent and 44.95 percent, respectively. Suphannachart and Warr (2011) also measured IRR on the public crop research using total factor productivity (TFP) function and error correction modeling (ECM) technique and found the IRR equal to 29.5 percent. Suphannachart (2009) estimated IRRs, using similar method but controls for different explanatory variables, for overall agricultural R&D and crops and livestock R&D separately. The IRRs for the overall agriculture is 40.44 percent, for crops is 34.74 percent and for livestock is 130.84 percent. Despite different methodologies and study period previous studies have confirmed the returns on agricultural R&D are higher than the opportunity cost of public funds and high enough to justify continued public investment in agricultural research.

|

3. Methodologies and Data

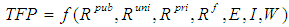

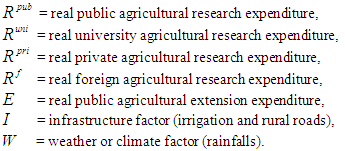

- This study follows the same methodologies used in Suphannachart and Warr (2011). They consist of two stages. First is estimating the agricultural productivity determinant model using the error correction modeling (ECM) technique, developed by Hendry and his co-researchers (Davidson et al., 1978, Hendry et al., 1984, Hendry, 1995), to obtain each source of research impact on the productivity. Under the ECM, the long-run relationship is embedded within a detailed dynamic specification, including both lagged dependent and independent variables, which helps minimize the possibility of estimating a spurious regression. Second is computing the associated marginal internal rates of return (MIRR) using the typical IRR formula but replacing the cost streams with unit research cost and the benefit streams with marginal benefits obtained from the regression analysis. The agricultural total factor productivity (TFP) determinant model include major sources of local R&D; namely public, university, and private-sector R&D, foreign research spillovers, agricultural extension, and weather factor. It is expressed in stylized form as in equation (1).

| (1) |

= total factor productivity in the agricultural sector,

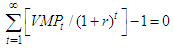

= total factor productivity in the agricultural sector, The formula for computing the MIRR is shown in equation (2). It is computed based on the estimated coefficients of the level terms of the local research variables or the long-term TFP elasticities with respect to the public, university, and private R&D variables. This regression-based rate of return is calculated as the discount rate r, such that:

The formula for computing the MIRR is shown in equation (2). It is computed based on the estimated coefficients of the level terms of the local research variables or the long-term TFP elasticities with respect to the public, university, and private R&D variables. This regression-based rate of return is calculated as the discount rate r, such that:  | (2) |

4. Results and Discussion

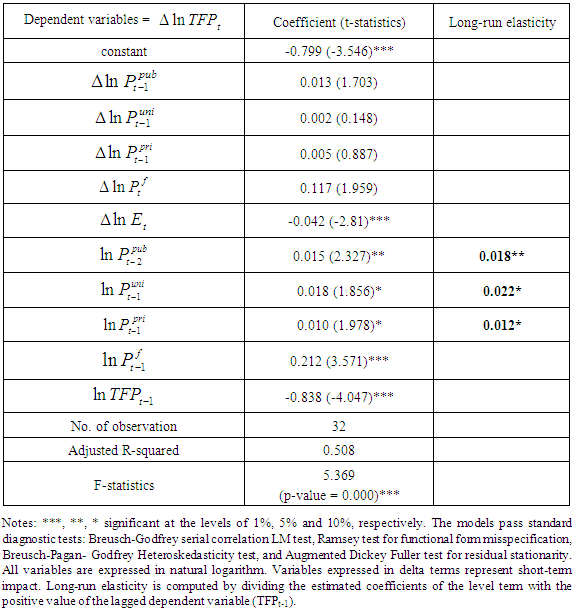

- From the estimation of the productivity determinant model using the ECM method, the TFP determinant equations are statistically significant at the 1% level in terms of the standard F test and perform well in terms of standard diagnostic tests for serial correlation, functional form specification, heteroskedasticity and stationarity of the residuals. The final parsimonious equations are shown in Table 3. The choice of dropping or keeping variables in the final models was statistical acceptance in terms of the joint variable deletion tests against the maintained hypothesis. The interaction terms among major sources of R&D was also tested. Since all variables are measured in logarithms, the regression coefficients can be interpreted as elasticities and the size of the coefficients also indicate the magnitude of their relative influence.

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML