-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2016; 6(1): 1-14

doi:10.5923/j.economics.20160601.01

Congo’s Twin Deficit Hypothesis: An Empirical Evaluation Case Study

Antoine Ngakosso

Financial economics department, Marien Ngouabi University, Brazzaville, Republic of Congo

Correspondence to: Antoine Ngakosso, Financial economics department, Marien Ngouabi University, Brazzaville, Republic of Congo.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article aims to analyze the twin deficit hypothesis in the Republic of Congo from 1980-2013. Its methodology is based on ARDL approach to cointegration. This paper illustrates a long-term causal relationship from the current account balance to the budget balance. Keynesian hypothesis of a positive link from the budget balance to the current account is not valid for Congo, but rather a positive link from the current account balance to the budget balance is verified. In the short term, the two balances diverge before converging in the long run through the restoring force. The Keynesian twin deficit hypothesis sense is not validated in this work. The consolidation of public finance in Congo requires a good command of the current account because the predictability of the current account balance is improved when the budget deficit is incorporated in the analysis of economic policy to be implemented.

Keywords: Twin deficits, Cointegration, ARDL approach, Republic of Congo

Cite this paper: Antoine Ngakosso, Congo’s Twin Deficit Hypothesis: An Empirical Evaluation Case Study, American Journal of Economics, Vol. 6 No. 1, 2016, pp. 1-14. doi: 10.5923/j.economics.20160601.01.

Article Outline

1. Introduction

- The analysis of the relationship between budget deficit and the balance of payment current account deficit has a renewed interest, on the one hand, due to conjectural budget policy (Barro, 1989) and on the other hand to the persistence of the juxtaposition of the public deficits and foreign deficits in USA in the 1990s. The juxtaposition of the budget deficit and the balance of payment current account deficit in the economy raises the question of the existence and non-existence of cause and effect relation between the two balances. In fact, the debate on the link between the two balances arises from the high American budget deficits in the 1980s which gave rise to the dollar appreciation and the degradation of the American current account (Diarra, 2014).The twin deficit hypothesis has been called into question since the financial crisis within the euro zone followed by the requirement of the settlement of the austerity of budget policies. Trachanas and Katrakilidis (2013) put forward the twin deficit hypothesis which has proven its efficiency in Spain, Greece, Ireland and Portugal. It thus comes out from these countries that a budget deficit causes a current account deficit. This insight has also been extended to sub-Saharan Africa countries namely those of UEMOA (West African Economic and Monetary Union) though that crisis did not directly affect their economies. These countries generally resort to obligatory loans from regional financial markets to finance their budget deficits. Based on the observed deficits of their current balances, Diarra (2014) confirms the twin deficit hypothesis for UEMOA countries except Niger whatever be the sense of causal relation.Under these circumstances, it is interesting to apply the twin deficit hypothesis to one of the CEMAC countries notably the Republic of Congo. Thus due to the hardships of the Republic of Congo to meet requirements for the criteria of the balanced budget within the CEMAC zone and the enrolment of the current balance deficit; it is important in case of Congo to provide answers to the following questions:(i) Is there any link between the budget balance and the current balance in Congo?(ii) If so, what is the causality sense between the two balances in Congo?The determination of the link and the sense of causality between the two balances has a particular interest as it enables economic policy decision makers to view one as the instrument and the other as a priority objective. In addition, this paper aims to strengthen the analysis in terms of efforts to improve the budget deficit on the current account balance.This article consists of three sections. Section one paves the way with the theoretical and empirical review of the related literature on the twin deficit hypothesis. Then follow the evolutions of budget balances and the current account in Congo; finally there is the presentation of the methodological approach together with the results of economic estimations.

2. Review of the Related Literature on the Twin Deficit Hypothesis

2.1. Theoretical Analysis of the Twin Deficit Hypothesis

- There is an abundant traditional literature on the development of the twin deficit hypothesis. One can set up the following typology:- Those which validate the twin deficit hypothesis,- Those which point out the reverse causality between the two balances,- Those which highlight the absence of link between the two balances.

2.1.1. Validation of the Twin Deficit Hypothesis

- Regarding the plausibility of the twin deficit hypothesis, it results that the theoretical analysis has been grounded on the unidirectional causality of the budget deficit to external deficit. Two theoretical approaches can account for such a causality.The first approach is taken from Mundell (1963) and Fleming (1962) through IS-LM-BP model. According to this approach, an increase of the public deficit due to the rise of public expenses leads to the increase of the interest rate, which attracts the fund incomes, the exchange rate is valued encouraging the imports rather than exports, hence the degradation of foreign accounts. The results look dubious because the increase of the interest rate should lead to the reduction of the private investment through eviction effect. Accordingly, the validation of the twin deficit hypothesis presupposes that the associated effects of the evaluation of the rate of exchange dominate those issuing from the increase of the rate of interest.The second approach derives from Keynesian absorption theory. The rise of public deficit allows the increase of the internal demand which is partly met via the imports of goods and services, what degrades foreign balance. This approach has recently been updated by Romer (2000). In fact, a rise of public expenses by exchangeable goods damages commercial balance and require a true depreciation in order to guarantee the sustainability of the external position of the country.In view of the aforementioned approaches, when private investors are lower than the investment, the budget balance shows a deficit, exports become less than imports, which leads to the deficit of the current balance. In this respect, the saving deficit is made up by direct foreign investment which increases foreign debt. So, the positive link between the budget deficit and the foreign deficit is carried out via an increase of the foreign debt (Circa, 2000).These two main approaches can be supplemented by some other approaches.Firstly, it is the monetary approach of payment balance. The foreign deficit is due to the budget deficit via the imbalance of the monetary domestic market further to the funding of budget deficit by seigneurial process. So, the link between the foreign balance and the budget deficit closely depends on the monetary policy set up to support the expansionist budget policy (Fischer and Easterly, 1990). Secondly, there is an assumption of the new neoclassic synthesis on the analysis of the checking of the twin deficit hypothesis which lays emphasis on microeconomic models and rational anticipations. In this connection, the twin deficit hypothesis is scrutinized under the validation of Ricardian equivalence hypothesis. Such an approach which takes into account the behavior of economic agents considers the effects of shock. We can distinguish two categories of shocks: the effects of the public spending shocks and the effects of tax shock. In fact, when there is a change in the government expenses, the positive relationship of the budget balance towards the balance of the current account is particularly important if:- The public expenses are equivalent to the purchase of domestic services, the economy has an important open degree, the elasticity of intra temporal substitution between the foreign and domestic goods is very high;- The rise of public expenses is transitory (Müller, 2008; Monacelli and Perotti, 2010). However, whenever there is a tax change, the twin deficit hypothesis is attested when there are embedded generations wherein the agents are not altruists and do not donate their heritage or when the rate of birth is high to the extent that it is possible to transfer the burden of the debts to the future generations (Normadin, 1999; Kumhof and Laxton, 2013). The two balances being interwoven, the validation of the twin deficit hypothesis also subsumes the validation of the twin surplus hypothesis (Bluedom and Leigh, 2011).

2.1.2. Reverse Causality between the Two Balances

- There are three approaches which highlight the reverse causality, i.e., that of foreign deficit towards the budget deficit.The first is based on the Laursen-Metzeler effect. The core idea is that the deterioration of the exchange terms brings about the mechanic degradation of the current account and a reduction of the net income, which implies the decrease of the savings finally leading to budget deficit (Harberger-Laursen-Metzeker, 1950; Svensson and Razin, 1983). Given the nature of shocks, the Laursen-Metzeler effect (1950) can be qualified (Sachs, 1981; Razin-Svensson, 1983). In fact, if the shock is appropriately anticipated as permanent, the agents immediately adjust their behaviours according to the new environment, hence avoiding foreign imbalance. Yet, if the shock is taken as temporary, it is obvious to keep decisions on the production and expenses, what leads to a transitory current deficit which must be funded at least. The second approach justifies the reverse causality via the postulation of the imperfect substitutability hypothesis of assets, the effect of richness and the rigidity of prices and salaries (Summers, 1988). Finally, the last approach maintains that a rise in the exports further to an expansion of the world demand brings about an improvement of the balance of the current account (Bispham, 1975). In this respect, there is an increase of the production and domestic employment, what is likely to rise of the tax receipts as well as budget balance. The approaches that substantiate the reverse causality also validate the two surplus balances.

2.1.3. Absence of Link between the Two Balances

- The assumptions about the inexistence of the links between the two balances are traditionally based on three types of analysis: the theory of Ricardian equivalence (Barro, 1989), the second hypothesis of tax approach of balance of payment by International Monetary Fund (IMF) and the monetary theory of balance of payments (Polak, 1957; Johnson, 1976).According to the Ricardian theory of equivalence, all rise of budget deficit induces taxpayers to immediately increase their savings in order tocover the anticipated reimbursement of the public debt, provided that the conditions for the validation of the Ricardian theory of equivalences are met (Berheim, 1989)1. The improvement of the balance savings-investment shall permit to cover the public balance without affecting the current balance. Regarding the IMF tax approach of balance of payments2, the saving gap which causes foreign deficit does not result from the increase of the budget deficit, but rather to an important decrease of private investors (Feldstein, 1992). In fact, the investment level or rather the consumption level can be higher, what requires a funding by the equivalent money input. The country is then a net borrower on the foreign markets, this has a bad impact on the current transactions. Under these circumstances, the degradation of the foreign account balance is not synonymous to the budget deficit, but rather to the deficit of the private sector.Finally, the foreign deficit, in connection to the monetary approach of the balance of payment, is accounted by in terms of the imbalance of the domestic money market. Such an imbalance is no longer the result of the production of the necessary money for financing the budget deficit. Thus, the foreign deficit results from the failure of the sterilization of monetary authority policies. To sum up, these theoretical analysis do not provide an adequate answer to the double concern of the link and the causality sense between the two budget balances and that of the current account. So, a brief review of the results of the empirical studies is more than needed.

2.2. Some Results about Empirical Studies

- The empirical results on the causal link between the budget deficit and the foreign deficit are mixed. The overview of the empirical works carried out either at developed countries or developing countries sort out four kinds of results.The first type of results corroborates Keynesian hypothesis. The related works show that the link of causality between the budget balance and the current balance goes from the former to the latter (Piersanti, 2000; Leachman and Francis, 2002; Ganchev, 2010; Endegnanew et al, 2012; Trachanas and Katrakilidis, 2013; Kwame, 2013) thus confirming the twin deficit hypothesis. The second signals out the causal link stepping from the current account deficit to the State balance deficit (Alkswami, 2000; Marashdeh et al, 2006; Marinheiro, 2008; Ardiyanto, 2006).The third establishes a bidirectional link between the two variables (Islam, 1998; Lau and Baharumshah, 2004; Mukhtar et al, 2007; Omoniyi et al, 2013).The last one validates the Ricardian theory of equivalences, that is to say, the inexistence of any link between the two balances (Kaufman and Kraay, 2002; Halicioglu and Eren, 2013; Sobrino, 2013, Algieri, 2013).This diversity of results can be accounted by in terms of the usage of different techniques of econometrics (Granger test of causality and cointegration, Auto regressive vector methods (henceforth VAR). Some works explore different approaches indeed.Thus Ganchev (2010) utilizes several econometric tools (Granger’s causality test, VAR, Vector model for Error correction (henceforth VEC) in order to capture the only relationship between the budget deficit and tax deficit in Bulgaria. Based on Granger’s test of causality, he shows a bidirectional causal relationship between the two balances. From the two other methods, he attests the twin deficit hypothesis in short term only.However, one of the issues that raise difficulties in econometrics concerns the estimation of the relationship between the budget deficit and the current account deficit regarding the degree of integration or rather stationarity. In fact, the use of auto regressive techniques or vector model for error correction is appropriate when the variables have the same order of integration (stationary at the same level). In contrast, the resulted estimations are distorted. It is worth using the auto regressive model for staggered delays (henceforth ARDL, Pesaran et al, 2011). This approach considers the long-term relationship between the dependent variable and a number of parameters when it is not known before that the variables are stationary at the level or with primary difference. Diarra (2014) resorts to this approach for UEMOA countries. He has succeeded to point out a long-term causal relationship going from budget deficit to the current account deficit in Senegal and Togo; a reverse sense in Benin and Mali and finally the inexistence of any link in Niger.

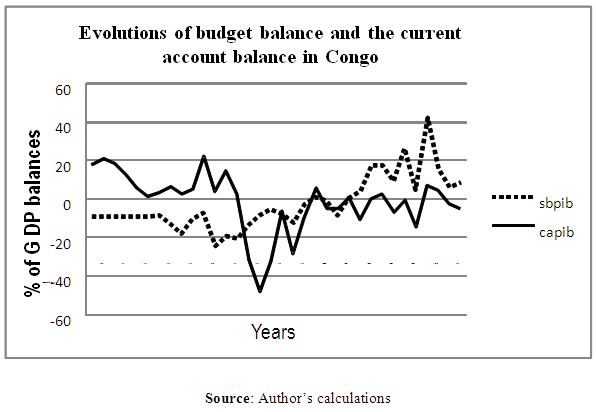

3. Some Facts on the Evolutions of Budget Balance and the Current Account Balance

- The token budget variable is the budget balance base engagement donations included and expressed by gross domestic product (henceforth SBPIB). The series of statistics is drawn from financial statistics of Central African State Bank. The current account data (CAPIB hereafter) are extracted from the database of International Monetary Funds (World Economic Outlook Database, April 2014). The series is annual and goes from 1980 to 2013. Table 1 permits to appreciate the conjoint evolutions of the budget balance and that of the current account balance.There are three periods which picture out the evolution of the current account balance. The first period, from 1980 to 1995, is generally marked by the current account balance which is decreasing till to be negative further to the status of the oil market resulting from the oil shock in 1979, to the depreciation of the American dollar and the political instability from 1993 to 1995. Furthermore, it is worth quoting the beginning of the FCFA devaluation in January 1994, whence in accordance with J curve. During the second period, from 1999 to 2006, despite strong decrease fluctuation, the current account balance remains generally positive thanks to the rise of the oil price after having reached its lowest level in 1998. This period is also characterized by the net flows of direct foreign investments which are mainly related to the exploration of oil field.The third period, going from 2000 to 2009, shows a deficit of the current account balance. Despite the rise of the commercial surplus thanks to the good status of the oil market, the balance of services, the balance of incomes and the balance of transfers have accumulated deficits which have annihilated the commercial surplus.Two periods can be distinguished concerning the evolution of the public finance. One of them goes from 1980 to 1998 and is marked by budget deficits resulting from the weakness of oil or non-oil revenues on the one hand, on the other hand the accumulation of the foreign debt further to the finance of the investment program from 1982 to 1986. We should mention the devaluation of the FCFA in 1994 on the foreign debt.The second period covers the period from 1999 to 2010. This period shows positive budget balance because of the rise of public revenues further to the uprising of the oil price and the improvement of the fiscal administration capacity.

4. Research Methods and Result Analysis

4.1. Research Methodology

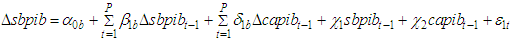

- The research methodology falls in Diarra (2014) which is inspired from Pesaran et al (2001): ARDL cointegration modelling and bound test.The ARDL approach has been established by Pesaran et al (2001) in order to incorporate in the same estimation two variables which do not have the same level of integration. In fact, if variables are all stationary at the same level, the Ordinary Least Square method (OLS hereafter) is well grounded for the estimation of the parameters. In contrast, Johansen approach (1988, 1991); Vector model for error correction is adequate for simple model if all variables are stationary on primary difference. However, it is well grounded to have estimation on OLS on variables if one of them (or all) is integrated at I level, that is, I (1) for this variable will not behave like a constant. So, it is important to keep one model which can be estimated with variables of the type I (1) and/or I (0) whereof ARDL model.

| Figure 1. Graph representing the budget and the current account balances |

| (1) |

| (2) |

|

|

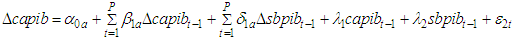

| Table 3. Results of cointegration test to ARDL approach |

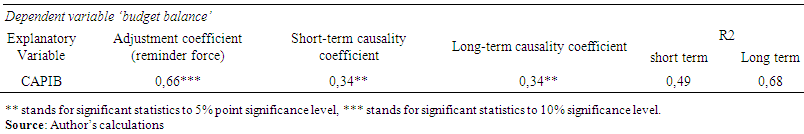

| Table 4. Results of the estimation of the relation between the budget balance and the current account balance |

| (3) |

| (4) |

4.2. Presentation and Analysis of Results

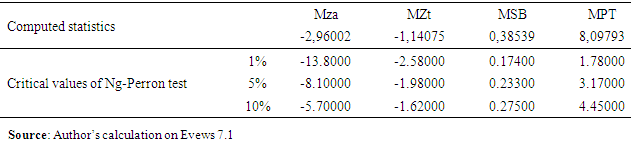

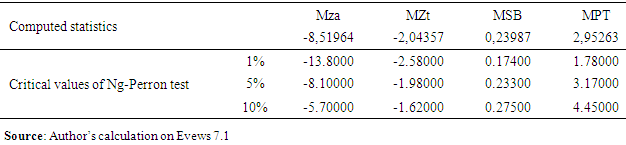

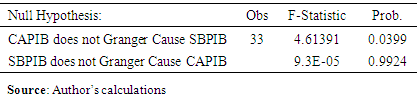

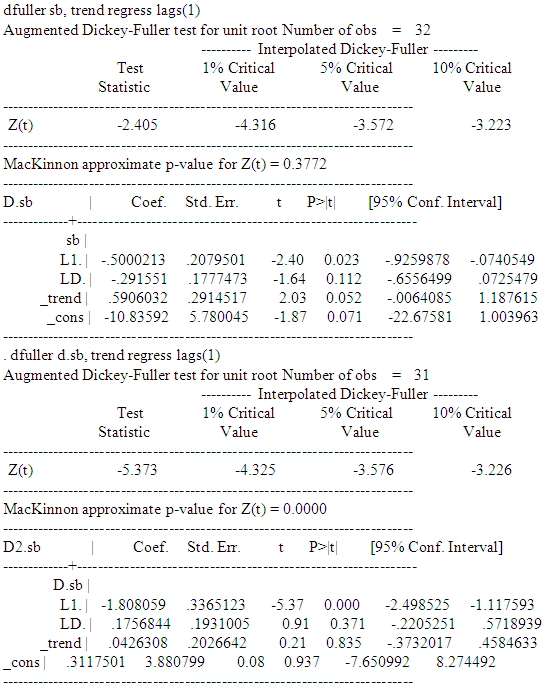

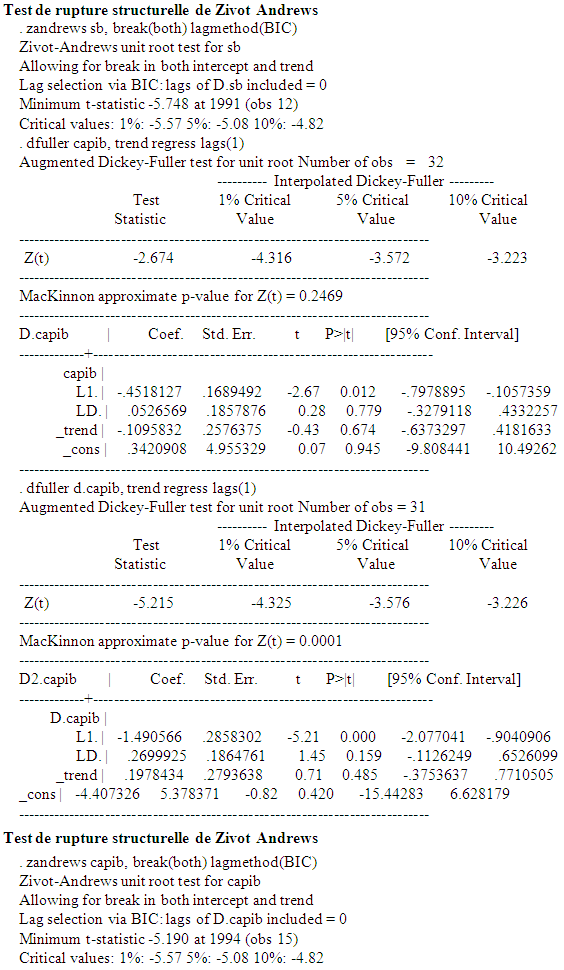

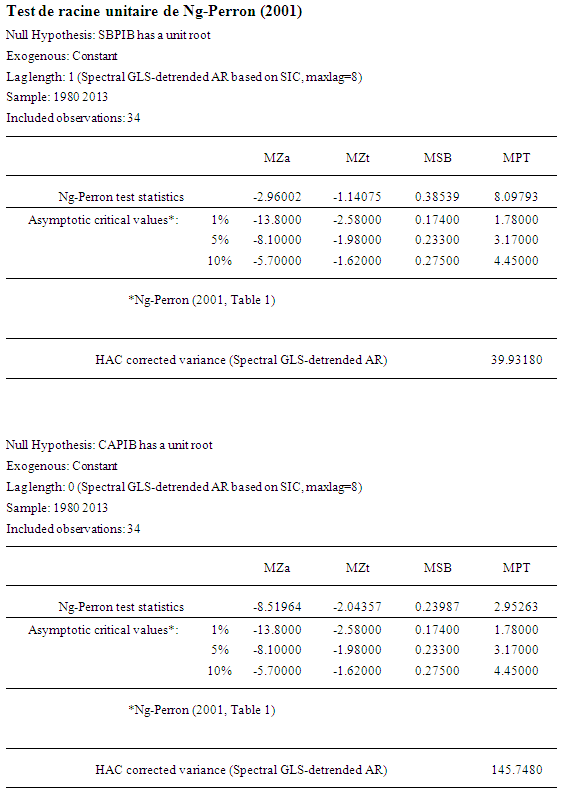

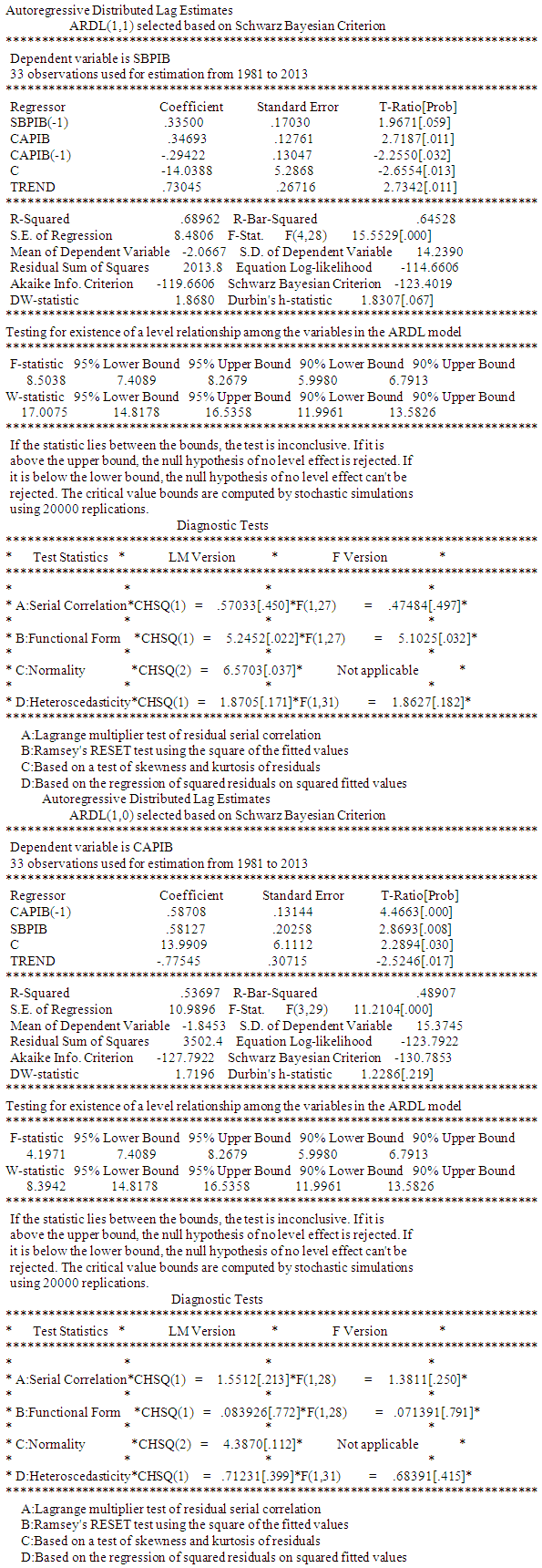

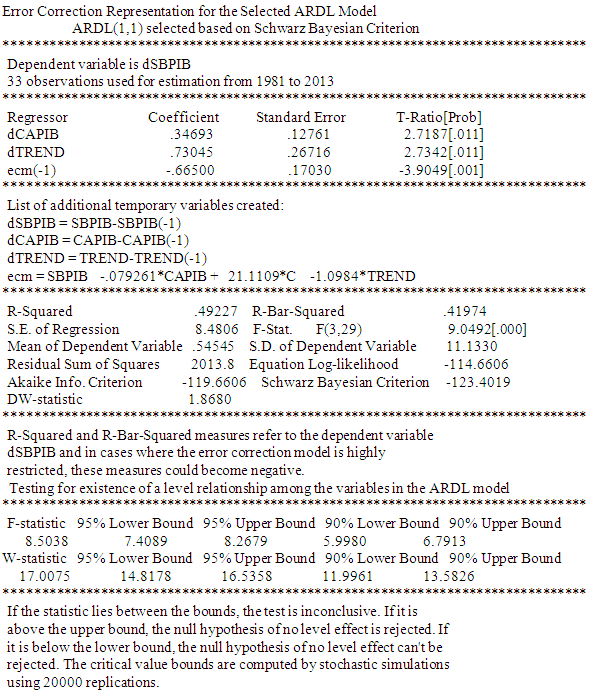

- We firstly present the results of the unit root, the cointegration test, Granger’s test of causality and CUSUM test.Ÿ Unit root testingThe unit root test ADS points out that the variables of the budget balance and the current account balance are not stationary according to the level because the respective z-statistics -2.405 and -2.674 are inferior to absolute value at 5% significance level of the critical value (cf. annex 1). However, according to Perron (1889) the classic tests of unit root (Dickey-Fuller Augmented, ADF) and Phillipe Perron (PP) are distorted in favour of the acceptance of the null hypothesis of the unit root if the chronological series is stationary around a trend highlighting a structural rupture. But Zivot Andrew’s test (cf. annex 1) shows a structural rupture in 1991 in a chronological series of the budget balance and in 1994 that of the current account balance. Under this perspective, Ng-Perron test (2001), which is an efficient version of ADF tests and Phillipe Perron (1998) is preferable to Ng-Perron test and PP. Tables 1 and 2 show the results of Ng-Perron test (2001).It comes out from tables 1 and 2 that the ‘SBPIB’ variables is non stationary at due level (computed Mza and Mzt statistics are below critical values of Ng-Perron test, to absolute value, but the ‘CAPIB’ variables are also to 5% level. Ÿ Cointegration testingThe theoretical model 4 has been selected thanks to Microfit 5 software in order to carry out cointegration test, that is to say, no constraint constant model with constrained trend. In addition, Bayesian de Schwartz criterion (SBC) has permitted to select the optimal number of delay to integrate in VAR model before estimation. This delay is r=1. An error correction model has then been preferred in order to observe the long-term adjustment mechanism of the relation between the budget balance and that of the current account. Table 3 show the cointegration test results. It transpires from table 3 that there is a long-term relation between the budget balance and the current account balance when the variable of the budget balance is taken as a dependent variable. Yet, when the variable of the current account balance is dependent, there is not any long-term relation between the two aforementioned variables. In fact, the computed F-statistic and W-statistics are above the upper bound to 5% significance level. Thus there is a cointegration between the current account balance and the budget balance.Table 4 indicates that the coefficient standing for the reminder strength for a short-term model is negative (-0.66) and significant statistically to 1% significance level. This maintains the existence of the relation between the budget balance and that of the current account. After a disruption or a shock on one of the variables, there is an adjustment mechanism which brings to the long-term balance. When considering ‘CAPIB’ variable as a dependent variable, the null hypothesis, the absence of long-term relation is accepted because F-statistic (4.19) is inferior to the critical value of Pesaran et al test (2001) to 5% significance level (7.40) (cf. table 3). It results from table 4 that the increase of one point of the current account balance leads to 0.34 increase of the budget balance. In considering Granger causality test (1969) illustrated in table 5, one can determine the relation between the budget balance and the current account balance.

|

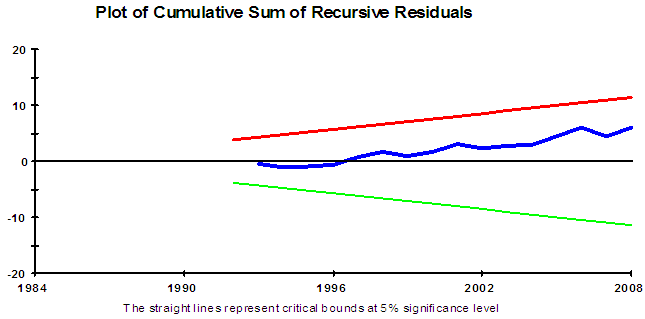

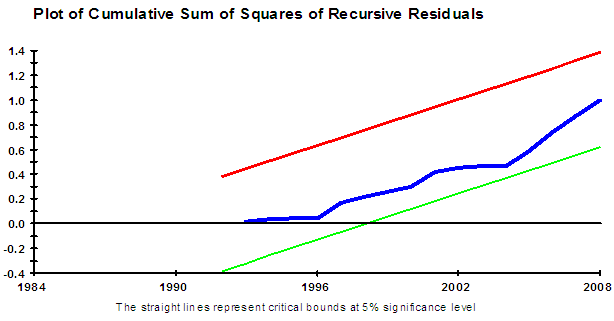

This finding is similar to that of Diarra (2014) concerning Burkina Faso and Cote d’Ivoire cases. The CUSUM tests of stability model have been carried out and the results certify the stability of the model to 5% significance level (cf. annex). Keynesian hypothesis of a positive link stepping from the budget balance to the current account is not adequate for the case of the Republic of Congo, but it is rather a positive relation going from the current account balance to the budget balance which is testified. The two balances diverge on a short term then converge during a long term through the reminder strength ECM (-1).The Republic of Congo exports a great many natural resources (oil, timber, minerals, etc.). Moreover, the rise of exports, further to an expansion of world demand, betters the current account balance. An increase of the world demand has a positive impact on the production and domestic employment. This situation contributes to the improvement of the budget balance through a rise of fiscal revenues.It comes out from discussions that Keynesian twin deficit hypothesis is not attested for this case study based on Congo from 1981 to 2013. This finding is identical to that of Marashden et al (2006), Marinheiro (2008) and Ardiyanto (2006).

This finding is similar to that of Diarra (2014) concerning Burkina Faso and Cote d’Ivoire cases. The CUSUM tests of stability model have been carried out and the results certify the stability of the model to 5% significance level (cf. annex). Keynesian hypothesis of a positive link stepping from the budget balance to the current account is not adequate for the case of the Republic of Congo, but it is rather a positive relation going from the current account balance to the budget balance which is testified. The two balances diverge on a short term then converge during a long term through the reminder strength ECM (-1).The Republic of Congo exports a great many natural resources (oil, timber, minerals, etc.). Moreover, the rise of exports, further to an expansion of world demand, betters the current account balance. An increase of the world demand has a positive impact on the production and domestic employment. This situation contributes to the improvement of the budget balance through a rise of fiscal revenues.It comes out from discussions that Keynesian twin deficit hypothesis is not attested for this case study based on Congo from 1981 to 2013. This finding is identical to that of Marashden et al (2006), Marinheiro (2008) and Ardiyanto (2006).5. Summary and Concluding Remarks

- The Republic of Congo experiences important budget deficits on alternate and irregular basis. We should, in addition, mention the current account deficits even though exports are important. A long-term causal relation going from the current account to the budget balance has been highlighted based on ARDL cointegration approach. If it is true that the volume of exports is significant in the Republic of Congo, this also holds for the export value which is closely dependent to the US dollar market and the fluctuation of the oil price. In addition, the main actors in the oil exploitation in Congo are international firm subsidiaries which realize significant current transfers towards their mother firms. In this connection, the fiscal revenues can lower down and lead to the budget balance deficit.The stabilization of the public finance in Congo should pass through a good mastery of the current account because the predictability of the current account balance is bettered when the budget deficit is incorporated in the analysis of the economic policy to be applied.

Annexes

- Annexe 1: Tests de racines unitaires et rupture structurelle de Zivot

Annexe 2: Estimations de cointégration et du modèle vectoriel à correction d’erreur

Annexe 2: Estimations de cointégration et du modèle vectoriel à correction d’erreur Annexe: estimation du modèle vectoriel à correction d’erreur

Annexe: estimation du modèle vectoriel à correction d’erreur Annexe 3

Annexe 3

Notes

- 1. H1: Economic agents notably consumers are rational, warned and have an infinite life horizon (Haque and Montiel, 1989); H2: Capital markets are satisfactory and do not show liquidity constraints; H3: Successive generations are related by altruist links motivating transfers among them; H4: The carrying forward of fiscal charge does have redistribution effects; H5: Taxes are flat per capita and do not have bias effect (Giorgiani and Holden, 2001, 2003); H6: The usage of deficit is not creative enough and even through financial bubbles; H7: The existence of a deficit financed by fiscal tool does not alter the politicalprocess of election or the choice of a government; H8: A null population growth rate, flows of revenues and a safe future fiscal charge. 2. The foreign deficit is issued from the home saving deficit.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML