-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(6): 587-594

doi:10.5923/j.economics.20150506.04

Fiscal and Monetary Policy Instruments and Economic Growth Sustainability in Nigeria

Olanipekun Emmanuel Falade, Benjamin Ayodele Folorunso

Department of Economics, Faculty of Social Sciences, Obafemi Awolowo University, Ile-Ife, Nigeria

Correspondence to: Olanipekun Emmanuel Falade, Department of Economics, Faculty of Social Sciences, Obafemi Awolowo University, Ile-Ife, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The paper examined the relative effectiveness of fiscal and monetary policy instruments on economic growth sustainability in Nigeria in order to determine the appropriate mix of both policies. The paper employed error correction mechanism whereby the time series properties of fiscal and monetary variables were first examined using Augmented Dickey-Fuller and Philip Perron unit root tests, followed by Johansen cointegration test among the series using annual data for the period 1970-2013. Data were sourced mainly from Statistical Bulletin published by the Central Bank Nigeria. The unit root test results revealed that all fiscal and monetary policy variables are non-stationary and attained stationarity at first difference. The result also showed that all the fiscal and monetary variables of interest cointegrated with the economic growth series in the country. This suggests that there is a long run relationship among fiscal and monetary variables and economic growth. The paper, however, found that the current level of exchange rate and its immediate past level, domestic interest rate, current level of government revenue and current level of money supply are the appropriate policy instrument mix in promoting economic growth both in the short and long run. The paper concluded that fiscal and monetary are still complementary.

Keywords: Macroeconomic policy, Economic growth sustainability, Nigeria

Cite this paper: Olanipekun Emmanuel Falade, Benjamin Ayodele Folorunso, Fiscal and Monetary Policy Instruments and Economic Growth Sustainability in Nigeria, American Journal of Economics, Vol. 5 No. 6, 2015, pp. 587-594. doi: 10.5923/j.economics.20150506.04.

Article Outline

1. Introduction

- Monetary policy can be described a deliberate effort by the monetary authority to control the money supply and the credit conditions for the purpose of achieving certain broad economic objectives which might be mutually exclusive. For most economies, the objectives of monetary policy include price stability, maintenance of balance of payments equilibrium, promotion of employment and output growth, and sustainable development. These monetary policy measures are necessary for the attainment of internal and external balance, and the promotion of long-run economic growth. For example, an expansionary monetary policy designed to stimulate economic growth will lower the rate of interest and may generate higher inflation which the level of growth may not be able to prevent (Gertler and Gilchrist, 1991). The effectiveness of monetary policy in achieving its target objectives, therefore, depends strongly on the operating economic environment, the institutional framework adopted, and the choice and mix of the instruments used.Fiscal policy, on the other hand, involves the use of parameters such as taxation, budget and quotas that will influence government revenue and expenditure with a view to achieving macroeconomic objectives which monetary policy also stands to achieve. For instance, tax revenue will increase when an economy is expanding, all things being equal, even when there is no change in fiscal policy. The increase in tax revenue could further increase government spending, thus promoting more expansion given the fact that such spendings are channeled into provision of basic infrastructures that complement private investment. Government can therefore use fiscal policy to stimulate the economy through manipulation of taxes and expenditure.Ample evidence from the literature has shown that monetary and fiscal policy play significant role in achieving macroeconomic objectives in both developed and developing countries. Indeed, several authors have shown that efficient monetary and fiscal policy are impetus for maintaining price, financial sector and external balance stability which ultimately lead to rapid and sustainable economic growth. However, several earlier and recent studies have adjudged the impact of monetary variables on income growth to be stronger than that of fiscal variables in the developed countries (Andersen and Jordan, 1968; Keran, 1970; Elliot, 1975; Batten and Hafer, 1983; Senbet, 2011) while similar result has also been reported for some developing countries (Ajisaje and Folorunso, 2002; Shahid et al., 2008; Anna, 2012; Ezigbo, 2012). Some other authors have found greater role for fiscal policy in some developed countries (Poddar and Hunking, 1971; Artis and Nobay, 1972) and developing countries (Hussain, 1982; Darrat, 1984; Chowdhury, 1986; Munongo, 2012) while some other authors have significant complementary role for both policies (Simorangkir and Adamanti, 2010; Mahmood and Sail, 2011). There seems, as evident from the literature, to be a general support for monetary policy in developed countries while the finding on developing countries is mixed.Nigeria, like any other developing countries, is presently facing serious development problems. For instance, despite the various economic reforms undertaken by the country in the last four decades, the country entered the year 2013 with an average per capita income which is lower than the level attained at the end of the 1970s and also among the countries experiencing lowest investment rate in the world. It has also been opined that the pursuit of sound monetary and fiscal policies and good governance can exert a strong moderating influence on the exogenous factors that have militated against the rapid growth of the Nigerian economy (Soludo, 2001). Both fiscal and monetary policy measures have been employed by the government to influence economic activities in the country.Evidence has, also shown support for both monetary and fiscal policy in promoting economic growth in Nigeria. It is also evident from some studies that monetary rather than fiscal policy impacted a strong and significant influence on the growth of the Nigerian economy (Ajisafe and Folorunso, 2002; Adefeso and Mobolaji, 2010) while some other studies have also reported significant role for fiscal policy (Olaloye and Ikhide, 1995; Philip, 2009 and 2011; Medee and Menbee, 2011). Some recent evidence supports the view that none of the two policies is superior as each has important role to play (Effiong, 2012; Ogege and Shiro, 2012; Sanni et al, 2012; Enahoro, 2013). The general consensus, however, in the literature is the advocacy of policy mix in Nigeria as well as the developing countries in general.The recent global financial crisis has now led further credence to the debate on the relative effectiveness of monetary and fiscal policies among economic analysts. Indeed, the issue of appropriate mix of the two policy options is still controversial especially in developing countries. The issue of appropriate mix of policy measures is not yet addressed in Nigeria. Thus, the paper fills this gap by determining the appropriate policy mix instruments of monetary and fiscal policy in achieving satisfactory and sustainable economic growth in the country. The rest of the paper is organized structured into the following sections as follows: Section II reviews the existing literature on the relative effectiveness of monetary and fiscal policy in developed and developing countries while Section III focuses on the research methodology. Section IV presents and discusses the results obtained while Section V concludes the paper.

2. Review of Literature

- Several authors have examined the relative impact of monetary and fiscal policy on various macroeconomic aggregates and economic activities in both developed and developing countries. The earlier studies on developed countries confirm that monetary rather than fiscal policy impacted greater influence on economic growth. For instance, Andersen and Jordan (1968) and Carlson (1978) found that the response of economic activity to monetary actions compared with that of fiscal action was larger, more predictable and faster in the U.S. Studies by Keran (1970), Elliot (1975) and Batten and Hafer (1983) also found that the monetary influence on investment and economic activity was more important than that of fiscal influence in Canada, Germany, Japan and England. The earlier evidence from developed countries, thus, strongly supports monetary policy while fiscal policy has little role, if any, to play in enhancing economic activities in these economies. In a more recent study on developed countries, Senbet (2011) criticized the single equation model used in most of the previous studies in testing the relative importance of monetary and fiscal policy on nominal GNP stabilization. The author opined that there is possible endogeneity between both policies and economic activity and misspecification of the model coupled with the wrong use of nominal instead of real economic growth. The results further confirmed that monetary policy is relatively better than fiscal policy in affecting the real output.Contrary to the finding above, some other studies on developed countries have found fiscal policy performing better than monetary actions. For instance, Poddar and Hunking (1971) and Artis and Nobay (1972) found that fiscal rather than monetary measures were more powerful and quicker-acting on economic activities in Canada and UK respectively. Cardia (1991), however, found that monetary policy and fiscal policy play only a small role in varying investment, consumption and output in Canada. Irrespective of this finding, the general consensus remains that monetary and not fiscal policy impacted stronger influence on nominal and real economic activities in developed countries which therefore calls for proper implementation of monetary policies in these countries.In the case of developing countries, however, the bulk of empirical research has not reached a consensus concerning the relative power of fiscal and monetary policy to promote economic growth. For instance, Hussain (1982) and Chowdhury (1986) found that both the monetary and fiscal variables are significant in all the regression equations, but concluded that the changes in government expenditures exert a larger, more predictable and faster impact on Pakistan's and Bangladesh’s economy respectively than do changes in money stock or the monetary base. In a more recent study, Shahid et al (2008) confirmed that monetary policy is a powerful tool than fiscal policy in South Asian countries. The result of Simorangkir and Adamanti (2010), however, showed that the combination of fiscal and monetary expansion boosts economic growth of Indonesia effectively. Similar result by Mahmood and Sial (2011) showed that monetary and fiscal policies both play significant role in the economic growth of Pakistan.The study of Anna (2012), however, suggested that monetary influence is relatively stronger and more predictable than fiscal policy in determining economic activity in Zimbabwe. Nevertheless, Munongo (2012) found no significant role for monetary policy but has support for fiscal policy. Contrary to this finding, Ezigbo (2012) revealed that monetary policy in a developing country plays an important role in increasing the growth rate of the economy by controlling inflation and maintaining equilibrium in the balance of payments.In the case of Nigeria, Ajayi (1974), Ajisafe and Folorunso (2002) and Adefeso and Mobolaji (2010) found that monetary policy impacted greater influence than fiscal policy while Olaloye and Ikhide (1995), Philip (2009) and Medee and Nenbee (2011) argued that fiscal policies are more crucial for economic growth in the country. Familoni (1989) also denounced the classical preference of monetary policy over fiscal policy on the basis of their empirical evidence and predicted that it would only work for a developed economy.Effiong (2012), however, investigated accounting implications of fiscal and monetary policies on the development of the Nigerian stock market. It was discovered that only a mixture of monetary and fiscal policy exerted a significant impact on the development of Nigerian stock market. Also, Enahoro (2013) reported that fiscal and monetary policies had enhanced operational efficiency in the Nigerian financial institutions, by reducing financial indiscipline in the financial and fiscal systems. The paper concluded that fiscal and monetary policies had galvanized government to commit budgetary management which would also address anomalies in the financial system.Ogege and Shiro (2012), however, investigated the dynamics of Nigeria’s monetary and fiscal policies, focusing specifically on their effects on the growth of Nigerian economy. The paper revealed that both monetary and fiscal policy contributed to the growth of Nigerian economy. Similarly, Sanni, et al (2012) found that none of the policies can be said to be superior to another and that a proper mix of the policies may enhance a better economic growth.The review of the existing literature from developed countries indicates a general support for monetary rather fiscal policy while the general consensus is that there should be policy mix in the developing countries. However, the issue of appropriate policy mix as suggested by many authors is not yet addressed. The present study, thus, fills the gap by examining the appropriate policy mix that is necessary for economic sustainability in Nigeria.

3. Model Specification and Techniques of Analysis

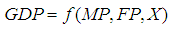

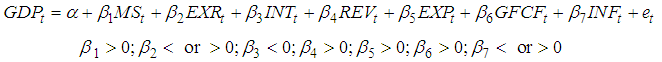

- Since the objective of the paper is to examine the policy mix that will enhance economic growth sustainability, the paper adapts a modified version of St. Louis model where income series (GDP) is the dependent variable while monetary (MP) and fiscal policy (FP) indicators and control variables (X) are the explanatory variables. The model specified for the study is thus expressed as:

| (1) |

| (2) |

4. Presentation and Discussion of Major Results

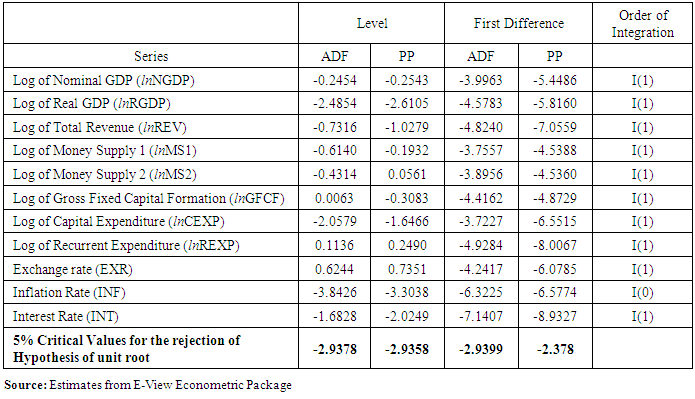

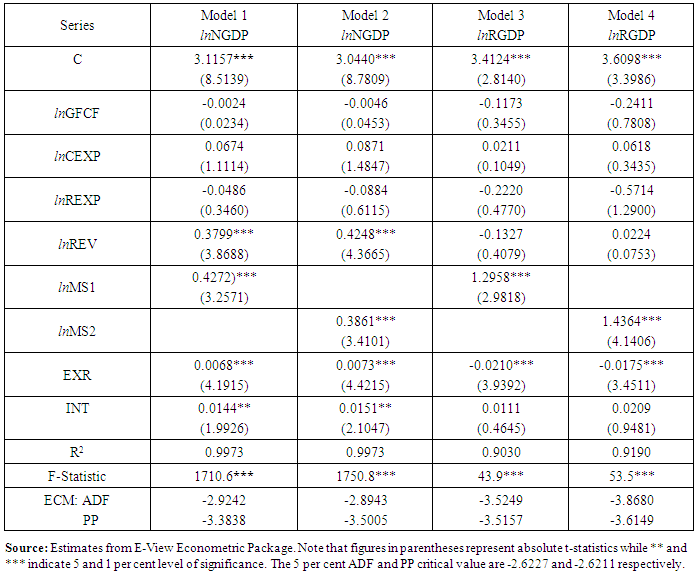

- The results presented in Table 1 clearly indicate that all series exhibit unit root property using both ADF and PP test statistics except for inflation rate. They are I(1) series and therefore achieve stationary at first difference using 5 per cent level of significance. The results imply that all series has to be differenced once in our models in order to avoid spurious results. However, first differencing only account for short run relationships among series and this problem is addressed by finding cointegration among the series and results reported in Table 2.

|

|

|

5. Conclusions

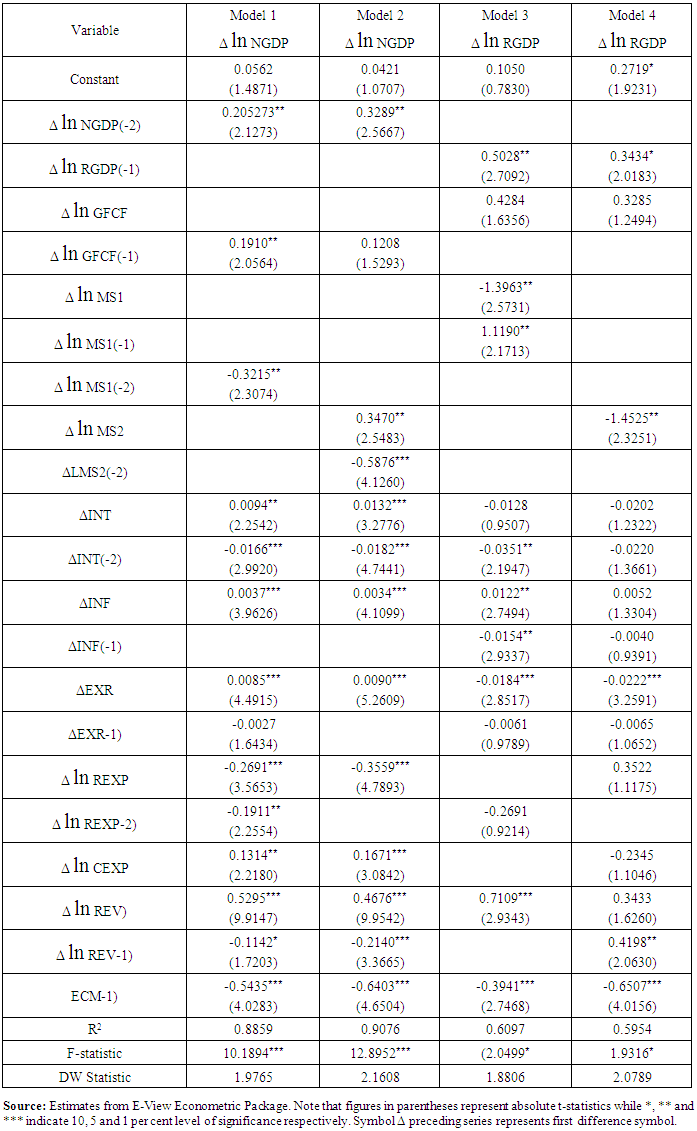

- The paper determined the appropriate mix of fiscal and monetary policy indicators in attaining rapid and sustainable economic growth in Nigeria. Both nominal and real income series were employed. Narrow and broad money, domestic interest and foreign currency exchange rates were used as monetary policy indicators while public revenue and expenditure served as fiscal policy measures. Public expenditure was further divided into recurrent and capital components. The paper revealed that public revenue had significant positive impact on income growth both in the short and long run. The current interest rate had significant positive influence on nominal income growth while its lagged value portended significant negative influence on nominal income in the short run and also possessed significant positive influence in the long run. The result also showed that all the fiscal and monetary variables of interest cointegrated with the economic growth series in the country. This suggests that there is a long run relationship among fiscal and monetary variables and economic growth.The appropriate monetary and fiscal policy mix for the long run included money supply, whether narrowly or broadly defined, foreign currency exchange rate, interest rate and public revenue resulting from tax policy of the government. In the short run, capital spending is added to the same policy mix reported for long run. The paper, indeed, found positive influence of monetary and fiscal policy indicators on both nominal and real economic growth in the long run.The paper, thus, established that the level of government revenue, level of foreign exchange rate, domestic interest rate and level of money supply are the appropriate instrument mix in promoting and sustaining economic growth in the country. The paper concluded that fiscal and monetary policies are still complementary. It is however expected that further studies on this issue will extend the frontier of knowledge by incorporating different components of money supply measures and public revenue as the neglect of these components serves a major limitation of this paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML