-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(6): 565-573

doi:10.5923/j.economics.20150506.02

Empirical Assessment of Economic Growth on Poverty Reduction in Nigeria

Faloye Oyewale1, Bakare Abiodun Musiliu2

1Department of Economics, Adeniran Ogunsanya College of Education, Otto /Ijanikin, Ojodu Study Campus, Lagos, Nigeria

2Tax Field Audit Unit (TAFU), Lagos State Internal Revenue, Lagos, Nigeria

Correspondence to: Faloye Oyewale, Department of Economics, Adeniran Ogunsanya College of Education, Otto /Ijanikin, Ojodu Study Campus, Lagos, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Poverty situation in this country is a special scenario that is beyond human reasoning because the nation is endowed with numerous material resources, but more than two-third of its population is living in abject poverty. This study examines the impact of economic growth on poverty reduction in Nigeria using secondary data spanning from 1999 to 2014. Ordinary Least Squared (OLS) model was employed. Findings show that economic growth has impact in reducing poverty. Moreover, gross national income growth rate, agricultural vale added growth rate, export of goods and service growth rate, and real interest rate have impact in reducing poverty but their contributions here are statistically insignificant. The contributions of manufacturing valued added growth rate, industrial value added growth rate, service value added growth rate and gross capital formation growth rate failed apriori expectations and statistically insignificant. The work recommends among other; massive investment in both human and material capital, reforms in agricultural, industrial, manufacturing, and service sectors so as to create jobs for the teeming unemployed youths.

Keywords: Agricultural value added growth, Cointegration test, Economic growth, Manufacturing value added growth, Poverty rate, Real interest rate, Unit Root

Cite this paper: Faloye Oyewale, Bakare Abiodun Musiliu, Empirical Assessment of Economic Growth on Poverty Reduction in Nigeria, American Journal of Economics, Vol. 5 No. 6, 2015, pp. 565-573. doi: 10.5923/j.economics.20150506.02.

Article Outline

1. Introduction

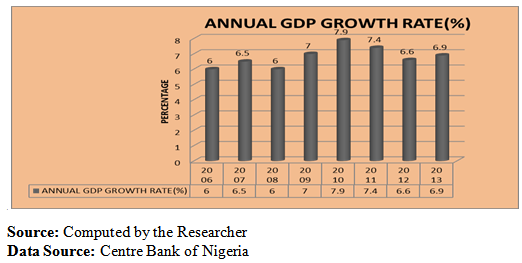

- A critical examination of the growth rate of Nigeria’s GDP shows that there has been an appreciable upward trend in her growth rate particularly in the present democratic political dispensation. For instance, according CBN (2013), the annual growth rate of GDP in 2006 stood at 6.0% and this rose to 6.50 %, in 2007. This trend declined in 2008 to 6.0% and later jumped to 7.90% in 2010. This trend suffered a setback in 2011 and 2012 but made a reverse in 2013 and 2014 during which the growth rate of the economy stood at 6.90% and 6.90% respectively. Having rebased the Nigerian GDP by President Jonathan’s administration in 2014, the annual growth rate of GDP later rose to 7.44% (National Bureau of Statistics 2014). Looking at this appreciable economic growth in Nigeria during the year under study, one will expect the rate of poverty in Nigeria to be at its minimum level. The question here is: has this growth impacted in reducing poverty? The findings of this study will justify our stand as a Nation. Nigeria as a Nation is bedevilled with a lot of crises ranging from economic, social and political. All these could be attributed to poverty that has eaten deep to the fabric of the Nation. Successive Governments at all levels (Federal, State and Local) had initiated several programmes, that aimed at reducing and alleviating poverty but the poverty situation in Nigeria keeps worsening day-by-day. The prevailing high rate of poverty in Nigeria may be attributed to some factors which include corruption in all tiers of government, private sector, mismanagement of human and material resources, inordinate ambition of Nigerian politicians to amass wealth and resources at expense of the masses, poor implementation of economic policies that could alleviate poverty. If the present rate of wind of poverty that is ravaging the nation is not curtailed, the ripple effects of associated social vices may be difficult to bear not only for this present generation but also the generation yet unborn. Those who have made the economies of the masses difficult (the politicians) may find it impossible to enjoy the benefits of the ill-gotten wealth obtained by impoverishing the average Nigeria. It is against this background this study seeks to examine the impact of economic growth in poverty reduction in Nigeria. Following the introduction the remaining sections of this study are organized as follows: Section 2 covers a literature review on poverty. Section 3 spells out the methodology, Section 4 discusses the results and Section 5 envelopes summary of findings, conclusion and recommendations.

2. Literature Review

- Poverty has received scholarly attention in the past few decades in Nigeria, bordering on an in-depth examination of the characteristics of poverty, poverty alleviation programmes and their effectiveness or otherwise. A number of attempts have been made to define poverty, yet poverty defies objective definition because of its multidimensional nature. There is yet no universally accepted definition of poverty. This is because there is difficulty in deciding where to draw line between poor and non-poor. Aluko (1975) poverty is a lack of command over basic consumption needs which means, in other words, that there is an inadequate level of consumption which gave rise to insufficient food, clothing and/shelter, and moreover the lack of certain capacities, such as being able to participate with dignity in society. Poverty has been defined as the inability to attain a minimum standard of living (World Bank 1990). Poverty has been conceptualized in both the ‘relative’ and ‘absolute’ terms. This is generally based on whether relative or absolute standards are adopted in the determination of the minimum income required to meet basic life’s necessities. The relative perspective of poverty is of income-based. According (Townsend 1962) poverty depicts a situation in which a given material means of sustenance, within a given society, is hardly enough for subsistence in that society. Several authorities have conducted studies in the causes, size, and impacts of poverty rate on economic growth, but few studies are available on the impact of economic growth on poverty on country and cross-country basis. For instance, Aye (2013) investigates the dynamic causal relationship between financial deepening, economic growth and poverty in Nigeria using annual time series spanning from 1960 to 2011. This study adopts Johansen cointegration test to establish the long-run relationship between finance, growth and poverty while Hsaio-Granger causality within a Vector Autoregressive (VAR) and Vector Error Correction Model (VECM) was applied to examine both the short and long-run causality between the variables under study. Findings show that there exist a long run equilibrium relationship between finance, economic growth and poverty. Also, a short-run unidirectional causality from growth to poverty conditional on finance was established through the results and that causality relationship between growth and poverty through finance. It was put forward as recommendation that a robust policy that will facilitate growth which includes institution and human and physical capital development so as to enhance the synergy between finance, growth and poverty. Onyedikachi and Chinweoke (2013), examine the impact of poverty on the level of economic growth in Nigeria from 1990 to 2011. The study adopts OLS to estimate a linear functional impact of poverty and discomfort index on economic growth. The results of the study show zero correlation between poverty, discomfort index and economic growth in Nigeria. Also, all the estimates of the Human Development Index and Discomfort Index were statistically insignificant. They submit that investment in human capital development should be a priority of the government and that entrepreneurship development that will spring up small and medium enterprises should be encouraged by the government among the Nigerians. Ewere (2014), evaluates the relationship between globalization and Poverty rate in Nigeria. The study adopts a co-integration test and error correction model using an annual time series data from 1981 to 2009. The study shows an evidence of co-integration between poverty rate and the explanatory variables used in the study. Findings reveal negative relationship between poverty and openness of the economy. By implications, a one percent increase in openness will result to a decline in poverty rate by 0.46209 percent in the current period. Domestic investment (INV) had a positive impact on poverty and statistically significant. However, foreign direct investment (FDI) in current year impacted negatively on poverty reduction but statistically insignificant whereas, the one year lagged FDI was not only rightly or negatively signed but also statistically significant. The researchers submit that government should facilitate globalization through proper liberalization policies as to enhance industrial growth with effect of reducing poverty and that growth and development of domestic industries should be encouraged so as to boost production locally such that people are employed and rate of poverty is reduced. Ijaiya et al (2011), investigate an empirical study on economic growth and poverty reduction, in Nigeria. A functional relationship was established between poverty reduction as endogenous variable and economic growth as exogenous variable using ordinary Least Square Analysis to estimate the coefficient of the parameters. Results show that initial level of economic growth had no impact in poverty reduction whereas a positive change in economic growth caused poverty reduction. Therefore, to reduce poverty, a sustainable increase in economic growth should be achieved by government through stable macroeconomic policies, good governance and development in infrastructure. Kolawole et al (2015), examine the relationship among poverty, inequality and economic growth in Nigeria using time series data spanning from 1980 to 2012. Ordinary Least Square and error correction mechanism (ECM) were adopted. The data were exposed to unit root test, cointegration test using Johansen approach. GDP growth rate, per capita income, literacy rate, government expenditure on education, and government expenditure on health were used as variables. The study argues that gross domestic product should be boosted and that government investment on education and health infrastructure should be increased along-side economic programmes that are pro-poor should be put in place to reduce poverty and inequality in Nigeria. Ngerebo (2014), investigates the relationship between domestic debt and the poverty of Nigeria (1986-2012), using the OLS and Auto regression (VAR) to estimate the coefficients of variables modelled. Unit root test and Cointegration test were carried out to validate the data. Granger Causality tests was adopted to ascertain the directional relationship among the variables. Findings show that there exist a long-run relationship between poverty [proxied by real gross domestic product, per capita gross domestic product, and basic secondary school enrolment] and domestic debt in Nigeria. Also, the study shows significant positive relationship between domestic debt and bank credit. Yelwa and Emmanuel (2013) examine Impact of poverty alleviation and wealth creation on economic growth in Nigeria using an Ordinary Regression Analysis to estimate the linear functional relationship between poverty alleviation as well as wealth creation and the selected variables. Their study shows that that there is positive and significant relationship between poverty reduction and populations, microfinance credit in Nigeria. They argue that Government should provide infrastructural facilities (electricity, road network and training institutions to enhance the activities of Small and Medium Enterprises in Nigeria so as to foster wealth creation and economic growth with aim of poverty reduction. Aiyedogbon and Ohwofasa (2012), investigate an empirical study on the topic “Poverty and Unemployment in Nigeria” suing OLS with secondary data from 1987 to 2011. The researchers modelled linear functional relation between incidence of poverty and unemployment, agricultural contribution to real gross domestic product, manufacturing and services contributions to real GDP, population and inflation rate. The results of theirs study show positive relationship between poverty level and unemployment, agricultural and services contributions to real GDP while the relationship between poverty level and inflation, manufacturing contribution to real GDP. Also, findings reveal that contribution of manufacturing sector to real GDP was statistically significant while the contribution of agricultural sector to real GDP was statistically insignificant. Policies of job creation were recommended to arrest the rate of poverty. Stephen and Simoen (2013) evaluate if Economic Growth has reduced poverty in Nigeria using Ordinary Least Square Multiple Regression. Data were subjected to unit root and co integration tests to avoid non-stationarity that is associated with time series data. Findings show significant and direct relationship between economic growth and poverty in Nigeria. They argues that economic growth does not reduce poverty rate in Nigeria during the period under study. However, there exist a negative relationship between literacy rate and poverty which means increase in literacy rate will have a significant impact in reducing poverty rate in Nigeria. They advocate that the policy makers should examine government expenditure and ensure that it is properly expended on programs that will benefit the poor so as to escape from the poverty trap. Ukpong et al (2013) examines issues of poverty and population growth in Nigeria using ordinary least squares (OLS) regression. Augmented Dickey-Fuller tests and Engle Granger and Johansen’s cointegration tests were carried out to test for cointegration and stationarity of the time series data on all the variable; poverty rate, population growth and gross domestic product (GDP) real growth rate in Nigeria. The Augmented Dickey-Fuller tests and Engle Granger and Johansen’s cointegration tests show that the variables are trended and cointegrated. Also, their findings reveal positive relationship between poverty rate and population growth, and negative relationship between GDP real growth rate and poverty rate in Nigeria. It was submitted by the researchers that polices should be adopted by the Government to reduce the growth rate of the population and encourage investment in human capita development, agriculture and technology to boost productivity so as to reduce poverty.

2.1. Poverty Profile in Nigeria between 1999-2014

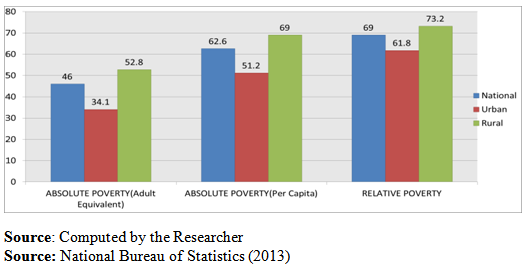

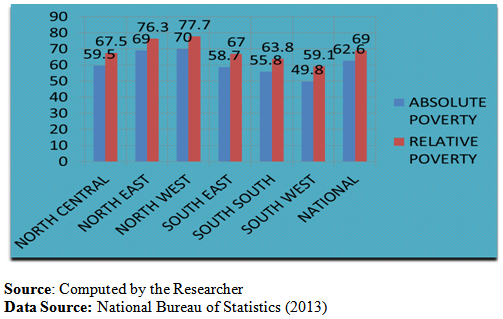

- Considering the huge natural resources and human resources the country is endowed, one will think that the citizen of this country should be swimming in prosperity and abundance of wealth and riches but the reverse is the case. Nigeria has a population of close 170 million but over 110 million is said to be living in abject poverty according to Vice President Osinbajo in his recent speech (The Sun online 2015). Available data show that Poverty prevalence in Nigeria has been on increase over the years. According to UNDP (2010), it was recorded that percentage of the absolute poverty in Nigeria rose from 6.2% to 29.3% between 1980 and 1996 which later declined to 22.0% in 2004. According to Daniel (2011), over 100 million of Nigerians are living on less than $1 per day. It is revealed that Nigerians living in absolute poverty rose from 54.7% in 2004 to 60.9% in 2010(NBS 2011). Analysis of poverty rates across geopolitical zones shows that both in terms of absolute poverty rate and relative poverty rate, the North West has the highest poverty rate (70.0%, 77.7%) while the South West has the least which stands at (49.8%, 59.1%). Absolute poverty rates in terms of adult equivalent and per capita are higher in rural area (52.8% and 69.0%) that urban area (34.1% and 51.2%) respectively. This is also the case in terms of relative poverty where the value in rural area (73.2%) is higher than the urban area (61.8%). This implies that in the face of being the largest economy in Africa almost two-third of Nigerian population is living poverty. Despite the fact that the Nigerian economy is expected to keep on growing in view of different economic programmes being put in place by the past President Jonathan and the current President Buhari, it is believed that the poverty rate will continue to be on the rising side if war against corruption is not won. The Nigeria poverty situation has become a paradox in which in the face of increased economic growth the larger percentage of Nigerian population still live in miserable poverty (Kale, 2012).

|

|

|

3. Methodology

- This study examines the impact of economic growth proxied by RGDP on the poverty rate in Nigeria. This is to establish if the increased RGDP in Nigeria during the period under study has positively impacted significantly in reducing the poverty rate in Nigeria.

3.1. The Data Set and Description

- The data set for this study consists of secondary time series spanning 1999 through 2014. The variables under consideration are: Poverty rate (POVR) proxied by household consumption expenditure growth rate; Economic Growth rate (GDPR); Gross National Income Rate (GNIR), Agriculture Value Added Growth Rate (AVGR), Manufacture Value Added Growth Rate (MVGR), Industry Value Added Growth Rate (IVGR), Service Value Added Growth Rate (SVAR), Gross Capital Formation Growth Rate (GCFR), Export of Goods and Services Growth Rate(EGSR), and Real Interest Rate (RIR). The variables are obtained from the World Bank’s World Development Indicators (2015) online, National Bureau of Statistics, Central Bank of Nigeria Publications including Statistical Bluttetin, Central Bank of Nigeria (CBN) Annual Reports and Statement of Account and CBN: Economic and Financial Review (Various Years).

3.2. Model Specification

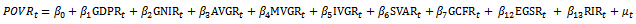

- In order to examine the impact of Economic Growth rate

on the poverty rate

on the poverty rate  a linear functional relationship of the form is established;

a linear functional relationship of the form is established; | (1) |

| (2) |

3.3. Model Estimation

- The method of analysis shall be purely econometric using Error Correction Model (ECM). To evaluate the validity and reliability of econometric model, coefficient of multiple determination(R-Square) standard Error test, F-test, Unit root test, cointegration test and Durbing Watson test shall be employed.

3.4. Coefficient of Determination (R-Square)

- The coefficient of determination(R-Square) is a measure of the goodness of fit of the regression model. It measures the percentage of the total variation of the dependent variable as explained by explanatory variable.

3.5. Fisher F-Test

- The F-test is one of the econometric criteria to ascertain the overall significance of the model and stability of coefficients.

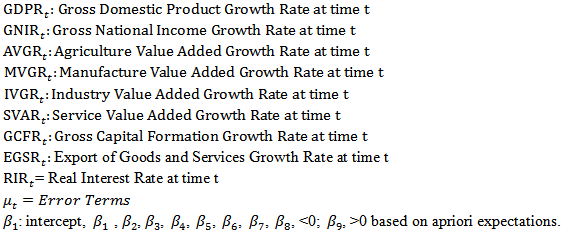

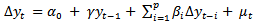

3.6. Unit Root Test

- In literature, most macroeconomic time series variables are trended and therefor in most cases are non-stationary and using non-stationary variable in the estimation of model leads to spurious regression (Granger and Newbold, 1977, Asteriou and Hall 2010). The first and second difference terms of the variables will usually be stationary (Asteriou and Hall 2010). All the variables in this study shall be tested at levels, first and second differences for stationarity using Augmented Dickey-Fuller (ADF) test. As the error terms is usually to be white noise, Dickey and Fuller extended their test procedure suggesting an augmented version of the test which includes extra lagged terms of the dependent variable in order to eliminate autocorrelation. The three possible form of the ADF test are given by the following equations;

| (3) |

| (4) |

| (5) |

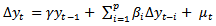

3.7. Cointegration Test

- The theory of cointegration has been developed to eliminate the problem of spurious correlation often associated with non-stationary macroeconomic time series data. According (Mill 1990) cointegration establishes the link between integrated processes and the concept of steady state equilibrium. The idea behind cointegration is that ‘although two different series may not themselves be stationary, some linear combination of them may be stationary with more than two series (Komolafe 1996). According to Asteriou and Hall (2010), cointegration is an over-riding requirement for any economic model using non-stationary time series data. It the variable do not cointegrated then there exists problem of spurious regression and the econometric work becomes almost meaningless. The key point here is that if there really is a genuine long-run relationship between two variables say

then although the variables will rise over time, there will be a common trend that links them together. For an equilibrium, or long-run relationship to exist, what we require, then, is linear combination of

then although the variables will rise over time, there will be a common trend that links them together. For an equilibrium, or long-run relationship to exist, what we require, then, is linear combination of  and

and  can be directly taken from estimating the following regression:

can be directly taken from estimating the following regression: And taking the residuals:

And taking the residuals: If

If  then the variables

then the variables  and

and  are said to be cointegrated.All the variables under study shall be subjected to Engle-Granger cointegration test to avoid spurious correlation often associated with non-stationary time series data. The Engle-Granger allows for the OLS residuals to be tested for unit root and stationarity.

are said to be cointegrated.All the variables under study shall be subjected to Engle-Granger cointegration test to avoid spurious correlation often associated with non-stationary time series data. The Engle-Granger allows for the OLS residuals to be tested for unit root and stationarity.4. Results

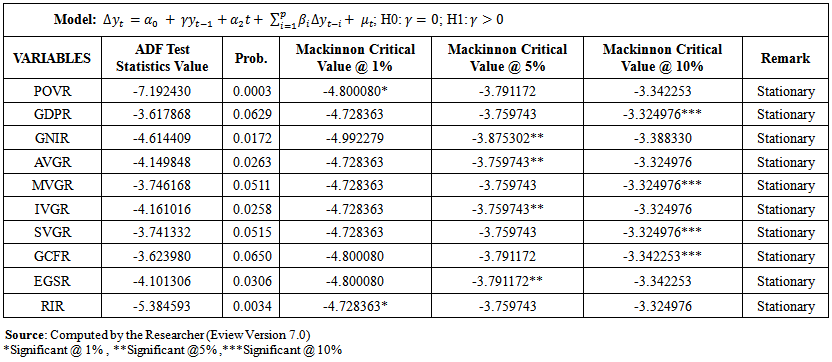

4.1. Unit Root Test Estimation

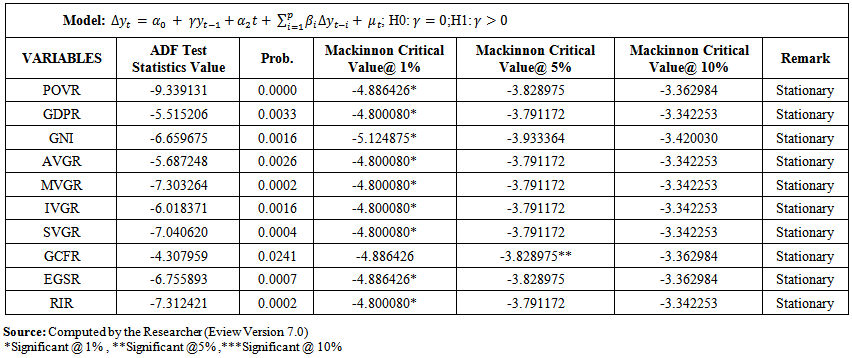

- The table 4.1.1 and table 4.1.2 show the results of the unit root test at level and first difference respectively to ascertain the stationarity of the variables under consideration. The results reveal that both at level and first difference the variables are stationary. Since the variables are stationary at level, it means adopting OLS will give reliable and efficient estimates.

| Table 4.1.1. Unit Root Test at Level |

| Table 4.1.2. Unit Root Test at First Difference |

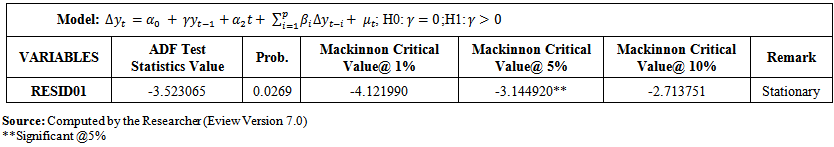

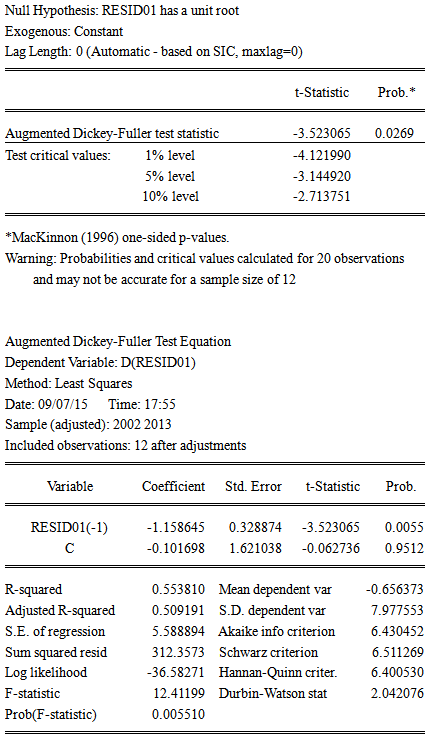

4.2. Engel-Granger Cointegration Test

- The result in Table 4.2.1 shows that the null hypothesis that the series is a unit root was rejected which implies that the OLS residual of poverty rate is not a unit root, hence, stationary. As discussed above, the result means that the time series of poverty rate(POVR), Economic Growth rate (GDPR); Gross National Income Rate(GNIR), Agriculture Value Added Growth Rate(AVGR), Manufacture Value Added Growth Rate(MVGR), Industry Value Added Growth Rate(IVGR), Service Value Added Growth Rate(SVAR), Gross Capital Formation Growth Rate(GCFR), Export of Goods and Services Growth Rate(EGSR), and Real Interest Rate(RIR) are stationary and cointegrated. Therefore, it is appropriate to make inferences from the OLS linear regression model describing the relationship between the variables.

| Table 4.2.1. Engel-Granger Cointegration Test Estimation (Using OLS Residual) |

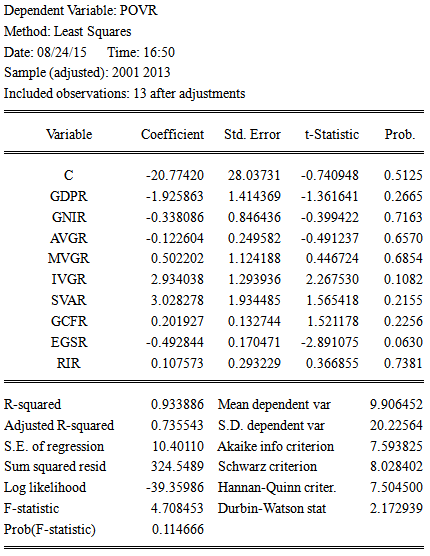

4.3. Model Estimation Using (OLS)

4.4. Interpretation of OLS Results

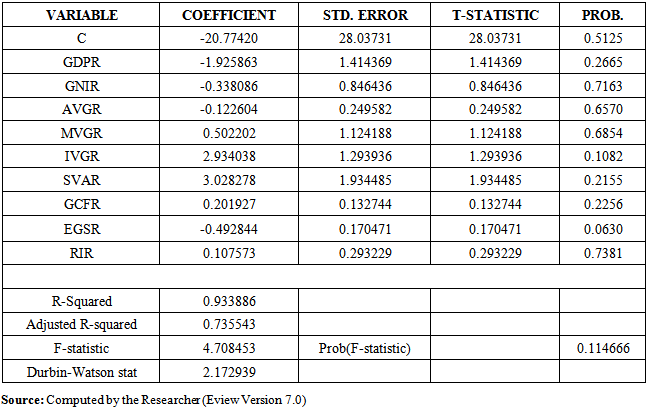

- From table 4.3.1 above, the values of our exogenous variables in equation (2) Economic Growth rate (GDPR); Gross National Income Rate(GNIR), Agriculture Value Added Growth Rate(AVGR) , Export of Goods and Services Growth Rate(EGSR) and Real Interest Rate(RIR). are correctly signed but statistically insignificant while Manufacture Value Added Growth Rate(MVGR), Industry Value Added Growth Rate(IVGR), Service Value Added Growth Rate(SVAR), Gross Capital Formation Growth are not only not in line with a priori expectations but also statistically insignificant. Despite the fact that the estimated parameters are not statistically significant, the value of R-squared shows that 93% variation in poverty rate in Nigeria during the year under study is explained by the independent variables, even after R-squared is adjusted.The value of F-statistic (4.708453) is said to be statistically insignificant, given the fact that the probability value (0.114666) is greater than 0.05. This implies that the overall model is not statistically significant. However, the Durbin-Watson statistic, which is 2.17239, falls within the acceptable rage in applied research of no autocorrelation. The model is thus free from autocorrelation.

5. Summary of Findings, Conclusions and Policy Recommendations

5.1. Summary of Findings

- An overview of the Ordinary Least Squares (OLS) results show that Economic Growth rate (GDPR) Gross National Income Rate(GNIR), Agriculture Value Added Growth Rate(AVGR) and Export of Goods and Services Growth Rate(EGSR) have impact of reducing poverty rate given the negative linear relationship between poverty rate and these variables but in this study given the contributions of these variables to the growth and development of the Nigerian economy, their impacts have not significantly reduced the poverty rate in Nigeria. This may be due to poor policies implementation and corruption on the part of government officials who have been diverting public funds meant for developments of programs that could enhance most of these variables to contribute optimally to poverty reduction in Nigeria. If truly Nigerian GDP is the highest in Africa as said by the last administration, it means this has not translated to inclusive growth. Also, the improvement the country has recorded in some areas such as national income, agriculture reforms; and expansion in export of goods and services has not really contributed to poverty reduction in country. Also, the results of the study show that real interest rate has effect of reducing poverty rate but not significant. This may be attributed to high interest rate in Nigeria which is far and above two digits which has made it difficult for both domestic and foreign investors to borrow funds for further investments and discouraged prospective (SMEs) in going into business that can create employment so as to help average Nigerian who is unemployed to come out of poverty.In the aspect of Manufacture Value Added Growth Rate (MVGR), Industry Value Added Growth Rate (IVGR), Service Value Added Growth Rate (SVAR), Gross Capital Formation Growth(GCFR), findings reveal that they are not only wrongly signed but also insignificant. This may be attributed to poor contributions of these sectors to the economy over the years due to total neglects and pervasive corruption at all level of governments. If the manufacturing, industrial and service sector are revived these sector can generate employment for teeming Nigerian youths who are swimming in abject poverty due to unemployment. One should expect that increase in gross capital formation should have effect on the economy with the trickle effect on the wellbeing of the people. The failure of gross capital formation to be rightly signed and significant could be hinged on the fact that the nation has been facing acute challenges of security, corruption and failure of the government to create policies that can bring prosperity, dignity and hope for all. Almost all economist lay emphasis on capital formation as the major determinant of economic growth. Nigeria has failed in investing in capital goods both in material and human capital that can greatly increase the efficiency of productive effort of the nation and its people so as to break out from the cycle of poverty. It is believed that when capital formation leads to the proper exploitation of natural resources and the establishment of different types of industries, levels of income increase and the varied wants of the people are satisfied. The people will consume a variety of commodities and their standard of living will rise and the economic welfare of Nigerian will increase.

5.2. Conclusions

- This study has explored empirically the impact of economic growth on poverty reduction in Nigeria using ordinary least squared method. The study reveals that, though not significant, increase in economic growth, national income growth rate, export of goods and services growth rate, reduction in real interest rate do have effect in reducing poverty rate in Nigeria. Also, the manufacturing sector, industrial sector, service sector and gross capital formation seem to have impact in reducing poverty but their contributions in this study are not only insignificant but also wrongly signed. Therefore, there is much room for improvement on the contributions of these variables to the reduction of poverty in Nigeria. However, the deplorable state of the economy demands urgent attention both from government at all levels and all the stakeholders who are players within the economy. As a matter of fact, if the recommendations proffered in this study are implemented by the policy makers, the economic disease called poverty will not only be reduced but also eradicated in our land.

5.3. Policy Recommendations

- In view of the fact that most crises (economic, political and social) facing Nigeria could be traceable to poverty and the fact that this rate keeps increasing, there is urgent need on the part of government to arrest this ugly situation. The failure of the government to bring this situation under control may imply that the nation is biting more than it can chew considering the present insecurity in all parts of the country -Boko Haram in the North and kidnapping, robbery and vandalization of oil pipes in South. This study puts forward the following recommendations based on the findings;1. Government at all levels should embark on massive investment in both human and material capital that can bring about exploitation of untapped natural resources and the establishment of different industries which of course can increase the standard of living of average Nigerian.2. The reforms in agricultural sector, industrial sector and manufacturing sector started by the last administration should be made to work so as to create more jobs in the country. This can only be possible by implementing policies that are people-oriented and void of corruption.3. The government should ensure that more values are added to our primary products so as to compete at international market so that more proceeds will accrue to the government which can be used to build infrastructures like roads, hospitals, schools, and even creation of employment for the teeming youths that are unemployed.4. The apex bank CBN should make it as point of urgent need to reduce the discount rate so that the commercial banks could offer credits for prospective investor at much reduced rate of one-digit. The present real interest rate is too far and above what an average investor can bear. The outrageous two-digit interest rate does not encourage investment in the country. Where there is low level of investment, poverty is inevitable. Therefore, our monetary policy should be investment-inducing if the present unemployment rate is to be arrested.5. The current campaign against corruption should be intensified and sustained if the backbone of poverty must be broken in Nigeria.

Appendix A

- EVIEW OUTPUT OF OLS RESULT

Appendix B

- EVIEW OUTPUT OF ENGEL-GRANGER COINTEGRATION TEST(OLS RESIDUAL)

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML