-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(6): 553-564

doi:10.5923/j.economics.20150506.01

Finance and Growth in Transition Economies: What does Bootstrapping Tell us?

Emilia Yaroson

Department of Business Administration, Faculty of Social and Management Sciences, Kaduna State University

Correspondence to: Emilia Yaroson , Department of Business Administration, Faculty of Social and Management Sciences, Kaduna State University.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study aims at examining the impact financial development has on growth of real GDP in transition economies by employing a panel data for 25 countries over the period of 1995-2013. The data employed are annual and the financial development proxies used include liquid liabilities, domestic credit to the private sector and market capitalization as a share of GDP. The Pesaran unit root test and Im, Pesaran and Shin panel unit-root test are employed to test the stationary properties of the data, the Westerlund co integration test is applied to explore the existence of co integration relationship amongst the dynamic variables and the feedback process is determined using the granger causality test. The study finds that financial development and growth have a long and stable relationship although this sector has been affected by the series of financial crises in the region. Furthermore, the direction of causality runs from Liquid Liabilities to growth which denotes that the growth of the economy leads to the expansion of the financial sector. This finding is in consonance with literature which explains that financial development follows growth as a result of their developing financial sector and relevant for policy decision making.

Keywords: Financial Development, Growth, Market Capitalization, Westerlund Cointegration

Cite this paper: Emilia Yaroson , Finance and Growth in Transition Economies: What does Bootstrapping Tell us?, American Journal of Economics, Vol. 5 No. 6, 2015, pp. 553-564. doi: 10.5923/j.economics.20150506.01.

Article Outline

1. Introduction

- The evolution of financial systems from centrally planned economies to market planned economies was one of the most challenging phases for transition economies. This is because; the financial systems in centrally planned economies were primarily responsible for accounting functions and implementing economic plans, as they were not designed to allocate resources from areas of excesses to areas of scarcity and their heavily regulated economies were said to impede investments (Conjaru, 2015). Over the past two decades however, the transition process has experienced tremendous strides particularly in the development of their financial sector as most countries have opened up their economies to foreign investors particular foreign banks. While opening up their markets has given room for considerable expansion in the financial sector, the challenge still remains the impact these financial development has on real GDP.Although a vast array of researchers have provided empirical evidence of the contribution of financial development to economic growth (King & Levine, 1193; Levine, 2000; Kim & Zang; 2007), there is limited and inconclusive knowledge about this nexus under the precise conditions for transition economies. For instance, Dawson (2003) examined the impact financial development has measured by liquid liabilities has on growth on a panel of 13 transition economies and finds no significant relationship. Fink, Hass and Vuksic (2004) on the other hand find that while the banking sector plays a significant role in promoting growth, the stock markets in transition economies have no significant impact on growth.These existing results have also rarely investigated the finance-growth nexus in transition economies across the full range of transition economies. To date, (Cojaru et al. 2015; Alexander & Wijiwera, 2006; and Levioian, 2001) are the only studies that have provided empirical evidence of this issue but the results are also inconclusive. This may stem from the variables employed as well as the econometric techniques used in these studies. More so, the time frame does not cover the recent global financial crises where these economies were worse hit. This paper therefore attempts to fill a gap in literature by providing empirical evidence of the relationship between financial development and economic growth on a panel of 25 transition economies of Central and Eastern Europe (CEE) and the Commonwealth of Independent States (CIS) for a time frame from 1995-2013 by employing the structural based co integration test developed by Westerlund (2007) that is devoid of factor restriction and has higher testing power. Essentially, the test aims to examine if the error correction term is present for individual panel members or the group panel as a whole. The Westerlund test allows for heterogeneity and provides robust p-values in case of cross relation between members obtained through bootstrapping thereby making inferences possible. This is an introduction to the study, the remainder of the paper is organized as follows: the second section provides review of theoretical and empirical literature of the relationship between the nexus; the next section will present the data and necessary information on the datasets to be used and the econometric approach, as well as the panel evidence on the nexus between financial development and economic growth, section four discusses the findings and section five concludes the paper with necessary recommendation.

2. Literature Review

2.1. Theoretical Framework

- The underlying concept surrounding developing an economy’s financial system is that it erects appropriate structures that enable funds move from units of excesses to units of insufficiencies. In economic terms; this process boosts the economy and hence promotes economic growth. As such, financial system development entails improving the quantity and quality of factors, policies and institutions that lead to the effective workings of financial intermediaries and markets as well as broad access to capital and financial services within an economy (FDI, 2012). Different economic literature exist surrounding the theories of the relationship between these two macroeconomic variables but remain inconclusive. The first of its kind could be dated as far back as Smith (1776) where the economic expansion noted in that era was associated with the increased availability of financial services. In his argument, financial markets and intermediaries exist as a result of market friction (information cost and transaction cost). Therefore, increasing these financial services aid in mitigating these frictions and this leads to economic boom. Schumpeter (1911), complementing this theory elucidates the need for credit markets as a tool for financing new productive technologies and that regularly improving these financial transactions is a necessary ingredient for innovation and development. These assumptions are founded on the fact that banks as financial institution are obligated to assist in technological innovation through mobilization of savings; adequately allocating resources to the right investment project; appraisal of investment projects; diversification, and pooling of risk; providing insurance services; and facilitating of exchange of goods and services (McKinnon (1973); Shaw (1973)). Consequently, firms become more competitive which results in innovation and in turn directs economic growth. Following the Schumpeterian school of thought, is Goldsmith (1969) with a noteworthy work on the finance-growth nexus who maintains that the development of an economy’s financial system is important in stimulating economic growth; Explaining that an under-developed financial system impedes economic growth. This point of view in policy decision making, entails the expansion of less developed financial systems in an attempt to propel growth. Hence, by creating more financial institutions and by providing better assortment of financial tools, optimistic results are bred on the saving–investment procedure, and hereafter on economic growth.This opinion however is restrictive in policy making with the presence of financial repression which is viewed as measures that limit financial systems from expanding, such as interest rate controls, trade openness, high reserve requirements, inflationary measures and directed credit programmes. These deterring policies are common in developing countries, as the government of these economies seek for ways to finance fiscal deficits without increasing tax. However, these actions dwindles the motivation to hold money and other financial assets, thus reduces the amount of credit made available to investors financial repression inhibits the size of the banking system and the financial system as a whole (Keynes, 1936). In line with the financial repressions’ ideology, Levine et al (2000) theorizes that nations with well-developed financial system experience faster growth. In their opinion, improving financial institutions’ and services such as; financial innovation, expanding the level of the banking segment as well as making financial infrastructures available provides prolific avenue for efficient allocation of resources, reduces asymmetric information and significantly increases growth. This invariably means that the limiting measures to financial deepening have been taken care of. McKinnon (1973) contending the Keynesian view, assumes that most investment in developing economies stem from accumulation of savings in form of bank deposits rather than from credits granted by financial institutions. Shaw (1973) also opposing the Keynesian view, posits that borrowing and lending for investment projects through financial intermediation accounts for output growth. These two point of views provide new insights to policy decision making as regards to financial system deepening referred to as ‘financial liberalization’ which is the purging of all distortion in the financial sector that can impede growth. Furthermore, charging of artificially low interest rates on loans and high reserve requirements are pointless in fiscal policy making as these can hinder capital accumulation and distort efficient allocation of resources. Also when interest rates are allowed to move in line with the markets mechanisms investors are propelled to invest in high yielding projects and these in turn leads to increase in output and then higher economic growth.Robinson (1952) on the other hand posits that a financial system inertly reacts to economic growth. Here, due to economic expansion, consumers and firms request for more financial services, financial institutions and financial products thereby leading to an expansion of the financial systems. Based on these theoretical assertions two major hypotheses can be deduced: the supply-led hypothesis which considers the expansion of the financial sector as a precondition for growth, while the demand following hypothesis sees financial development as a response to the growth of the economy. This paper therefore seeks to identify the casual relationship between the two macroeconomic variables in transition economies.

2.2. Empirical Evidence

- The debate about the relationship between of finance and growth has been ongoing for over a century, to ascertain the existence of this link, economist have taken diverse econometric approaches and yet varying conclusions have been reached. For instance King and Levine (1993a) aimed at determining what financial indices lead to growth by controlling for other factors that could affect long run growth. They employed a cross section of 80 countries for a period of 30 years (1960-1989) and their proxy for financial expansion was based on the averages of liquid liabilities, the ratio of domestic credit to private enterprise and ratio of domestic credit provided by the banks. Although their results reveal a statistical significant relationship between the two macro-economic variables and that financial development leads growth, the cross country OLS technique used is subject to some econometric problems which include their failure to test for stationarity in the data since they aimed at establishing long run relationship (co integration). Also, their analysis is based on the assumption that all countries in the data have the same finance -growth link on the average. Also, Levine et al (2000) in examining empirically if financial development variables influence growth, improved on the work of King and Levine (1993a, b) by adopting domestic credit to private sector, liquid liabilities and commercial-central bank ratio as measures of bank development and correcting for potential bias induced by simultaneity in 71 countries for a period of thirty six years and find statistically significant relationship between the macroeconomic variables.Kim and Zang (2007) On the other hand, implements the Sim-Geweke casualty framework, using the same sample data by Levine and king (1999) in trying to test the links that exist between financial expansion and economic growth, explain that contrary to established theories their research showed that FD had no effect whatsoever on growth, although the growth of an economy enhances savings and investment. Going further to explain that this study is provisional, as suitable measures for establishing the level of impact needs to be developed. Evidence supporting this finding is Gray et al., (2007) who examined the effect financial development has on growth in northern Cyprus from 1986 to 2004, while employing the ratio of domestic credit to GDP and the ratio of domestic loan to GDP as indices of financial development. Using the Ordinary Least Squares (OLS) estimators, they conclude that financial development does not promote growth. These studies however, are limited to only banking development without taking into consideration the impact the stock market may have on growth in those economies. More so, researchers (Levine et and Zervos, 1998; Shan, 2005) argue about the need to complement liquid liabilities as a measure of the size of a financial sector, since no single financial proxy can appropriately measure the financial sector. Furthermore, Fitzgerald (2006) points out that the proxy is not a reliable indicator of financial deepening as it responds greatly to monetary policies standpoint and differs extremely across countries and over time. In view of this coupled with the need to include the control for other financial sector indicators other than banking intermediation, Levine and Zervos (1998) empirically investigate the relationship between financial expansion and growth using the Ordinary Least Square (OLS) approach. They applied the initial values for both the financial deepening indicators–domestic credit to private sector- and the stock market development indicators – turnover ratio, market capitalization. They conclude that the economies with bigger financial systems experience faster growth though they did not control for country fixed effects and simultaneity bias. More so the use of initial values of variables account for information loss. Similarly, Shen and Lee (2009), in trying to comprehend why countries have the same financial system but different economic growth in empirical sense used a sample size of 48 mixed economies for a period of 33 years (1976-2009) came to the conclusion on the efficacy of financial development variables as a necessary ingredient in promoting growth. Evidence being that amongst the financial development variables used, stock market variable had the most impact on economic growth. More so, Tang (2006) carries out this study specifically to test if growth is higher in financial developed relative to the less developed financial in APEC countries for a period from 1981-2000. Adapting the panel data estimation based on a model developed by Levine et al (2000) and employing liquid liabilities, market capitalization and total value of shares as proxies of financial development whilst controlling for investment, labour growth and trade openness as factors that affect growth. The results provide positive evidence that the level of financial intermediation is necessary for growth with financial market variables statistically significant. This finding is in consonance with the works of Beck and Levine (2002), Becket et al (2001); Levine and Zervos (1998) propose three major indicators of financial development that are efficient in explaining the variations in output among countries over long period of time: liquid liabilities indicating the size of the financial sector; turnover ratio or value of shares traded as proxy for stock market activity and domestic credit to the private sector representing the efficiency of the banking sector. Researchers have also approached the investigation of the finance-growth nexus with different econometric techniques. For panel data, Rousseau and Wachtel (2000) use the GMM method with difference panel estimator and annual data to examine the link between finance, stock markets and growth. They employed liquid liabilities, turnover ratio and market capitalization deflated by price index as indicators of financial deepening. Their findings reveal that all variables account for subsequent growth. Levine and Beck (2002) points out the shortfall of Rousseau and Wachtel (2000) which include their failure to control for business cycle phenomena and the instrument used in difference panel estimator are often weak. Therefore in examining the link between finance and growth, Levine and Beck (2002) create a panel of forty countries with data averaged over a five year interval for period from 1976-1998 and employ the system panel estimator which incorporates both level and difference estimators. The outcome of their investigation show both banks and stock markets contribute significantly to the process growth. Other studies include; Tsionas and Christopolus (2004) adopting the panel unit roots test (IPS test, Madala and Wu test) and panel co integration test (Levine and Lin test), in analyzing the link between economic growth and financial depth for ten developing countries provide evidence of affiliation of the two macro-economic variables. Dawson (2008) in re-examining the hypothesis that financial development enhances economic growth in developing countries, used a panel of 44 countries from 1974-2001. The Odedokun (1996) model was adapted with liquid liabilities as an indicator of financial expansion. The Im, Pesaran and shin (IPS) test was used in testing for stationarity, the Schwartz criterion was used to choose among non-nested models whilst the Wu-Hausman test is used determine the link. The results produced are positive to relevant literature. Andini (2009) re-evaluated the empirical evidence of Levine et al (2000) approach to ascertain if the relationship was sensitive to the presence of outliers. He succeeded in replicating his work by employing the two step GMM efficient estimators and the median regression technique for potential outliers in a panel of 71 countries from 1961-1995. Hassan, Sanchez and Yu (2011) also try to offer proof on the significance financial expansion in low income nations, by combining variations of annual GDP per capita and panel regressions to study important variables necessary for measuring growth for a certain length of time. The study reveals an affirmative connection between both macroeconomic variables with all proxies of financial development. More so, Dawson (2010) in investigating the link between the financial expansion and GDP in 58 least developed countries for a sample period from 1960-2002 employed the IPS stationary test, the Pedroni’s co-integration test for panel data. The results show a significantly positive affiliation. Leitao (2010) in examining the link between financial development and growth used a panel of twenty seven EU countries and the BRICS countries from 1980-2006 provide evidence that financial development plays a key role in their economic growth. Econometric techniques employed in his study include the pooled OLS and the GMM systems. Ghimire and Giorgioni (2009) in trying to study the link between financial development and growth applied a sample data of 107 countries over the period for 1970-2006.they employed domestic credit to private sector, domestic credit by banks and turnover ratio in their panel data analysis and their results show a negative and significant relationship between domestic credit to private sector and growth. Only recently have researchers begun to explain the need for financial development in enhancing growth in transition economies. Although there are very limited studies as regards these, their conclusion still vary. Dawson (2003), in testing the hypotheses that financial development promotes growth in a panel of 13 transition economies for the period 1994-1999, employed liquid liability(M2/GDP) as the only proxy for financial expansion in a production function style regression with investment as a percentage of GDP and population growth as other growth variables. He employed the Wald test to determine if simultaneity exists between financial sectors; his results show that financial development does not promote growth in these economies. Also adopting the production function style regression is Fink and Haiss (1999), they investigate the link between finance and growth on a cross sectional basis for 10 Central and East Europe countries using proxies for bank development, stock market activity and bond markets. Their findings provide evidence of a statistically significant relationship between banking sector development and growth, but uncertain evidence for both stock and bond markets relationship with growth the limitation of this research is that associated with cross sectional relationship. Fink et al (2005) empirically explored the finance and growth relationship for 22 market economies and 11 transition economies on a panel data platform for an annual observation from 1990-2001, where bank credit, stock market capitalization and bonds outstanding are used as indicators of financial development. The results explain that finance promotes growth strongly in transition economies. More so, by applying the GMM- SYS two step estimator, the findings reveal that finance can trigger growth in the short run, but the development of the financial sector may not lead to growth in the long run. Also, Mehl and Winkler (2003) study the finance-growth nexus in a panel of 8 transition economies in South East Europe from 1993-2001. Their focus was on the development of the banking sector and the findings reveal that the expansion of this sector did not significantly influence economic growth during the time period they considered. They also suggest that these economies financial sector may not lead to growth unless the legal institutional frame work is put in place. Similarly, Caporale et al (2009) in investigating the link between financial development and growth in 9 transition economies from 1994-2007, measured the level of financial expansion using stock market capitalization, liquid liabilities and domestic credit to private sector. The model adopted is the augmented Barro growth regression model and the two step GMM system was used in its analysis. The outcome submits that the banking sector accelerates growth, whilst the stock market and credit market play no role in accounting for growth. The granger causality test for panel data show that causality runs in one direction from financial development to growth. However, very few of these researches have examined the finance growth nexus on a full range of financial economies except the works Alexander and Wijeweera (2006) who carry out a research to analyze if the effect of financial expansion on growth in a panel of 27 transition economies from 1989-2004. While using four financial development indicators – liquid liabilities, commercial bank-central bank ratio domestic credit to the private sector and domestic credit provided by banks, the results show evidence of a relationship between the two macroeconomic variables. Jaffee and Levonian (2001) also investigate the finance and growth theory in a cross section of 23transition economies. Their results proffer evidence of a finance growth relationship in this region. Similarly, Cojaru, et al., (2015) examine the role of financial development in economic growth in the 23 transition economies during the first two decades since the beginning of transition. They find that measures of financial market efficiency and competitiveness are more important than the size of the market in terms of promoting economic growth. In view of the foregoing, this paper aims at contributing to existing literature by providing empirical evidence on the relationship between fiancé and growth in transition economies, using a full range of transition economies of Central and Eastern Europe(CEE) as well as the Common Wealth Independent(CIS) states using the bootstrapping method of co integration.

2.3. Financial Development in Transition Economies

- Over the past two decades, growing consideration has been given to the development of financial systems; particularly in economies migrating from centrally planned system to market planned system as the efficiency of carrying out theses duties is crucial to their economic performance. Under the planning system, financial transactions were a bit like bookkeeping for presenting government expenditure decisions and allocating of resources. There was no strict regulation as regards banking activities since the government regulated its activities. Also, since the government did not create any marketable financial market instruments, security markets did not exist in these economies. Bank Credit to private individuals has grown tremendously in transition economies making it one of the major features of its financial sector particularly in Central and Eastern Europe since the second half of the 1990s. For example, Albania experienced a steady rise in credit to private sector from a 39% in 1995 to 68.54% in 2009 as well as Croatia with a 26% increase in the span of five years. On the other hand the least developed transition economies particularly those in central Asia experienced a low level of domestic lending. Bulgaria also had a drastic decline in credit lending from 121% in 1996 to 14% in 2000. These economies were greatly affected by the non-performing loans as a result of weak financial structures and bad bank governance which were incapable of handling the financial bubbles. Stringent regulations were put in place which included bank closures, recapitalization, bank privatization and high interest rates to curb inflation. However as the economic conditions improved and interest rates decreased, bank lending started to grow again. But this is not the case in all economies as some experienced real downturn and bad debt problem as such their credit level shrunk to record low. The recent financial crises in 2007/2008 is another economic shock that led to the shrinking of credit in these economies, although this time around they were more equipped to handle the crises. The worst hit were Poland and Romania that saw a decline in domestic credit as a share of GDP from 61% in 2007 to 25% in 2008 and stand at 50% as at 2015.Similarly, the ratio of liquid liabilities to GDP in an economy depicts the size of the financial sector. The highest monetization ratios are found in China (159% in 2009) and the lowest in Georgia with a record low of 5.84% in 1996. Romania also recorded a decline in this ratio (from 46% in 1991 to 36% in 2007) while Vietnam had a steady rise of 9.83% in 1995 to 103% in 2009. Other transition economies record a 46% ratio on the average. Generally, the ratio of broad money to GDP is at least 60% in high-income countries with developed banking sectors. Thus, the banking sectors in the transition economies cannot be considered to be highly developed with a few exceptions.Furthermore, the entrance of financial markets into these formerly planned economies accounts for one of the most intense experience in the transition process, as stock and bond markets symbolizes capitalism. One of the measures of the level of stock market activity is market capitalization as a ratio to GDP which signifies the number of companies listed on the stock exchange markets. By 1999, 20 out of 26 economies in transition had stock markets within their countries with differing level of activities. Economies like Hungary with deep banking sector accounted for the largest financial markets.

3. Research Methodology

3.1. Data and Sources

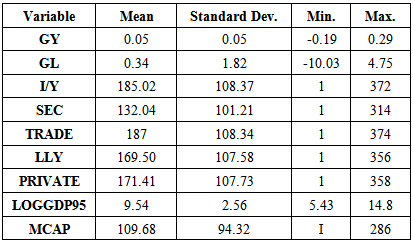

- This paper investigates the relationship between financial development and real GDP per capita in transition economies. A panel data of twenty five (25) economies in transition from regions of Central and Eastern Europe, Commonwealth Independent States, Baltic’s and Eastern Asia with annual observations for 1995-2013 are used for the statistical analysis. the data is annual to include dynamic effects as well as to increase sample size while the choice of the sample period is based on availability of substantial data which also covers the era of financial crises and credit booms in the region and. Real GDP per capita is sourced from the IMF International Financial statistics (IFS), while the World Bank (WB) database permits us to collect data for all financial development indicators.

3.2. Choice of Variables

- Three financial development indicators are employed in this research to examine the size, depth and activity of financial systems of economies in transition as no single financial index can accurately capture the dimension and complexities of the expansion of a country’s financial sector. Hence, two bank development variables and one stock market development variables are used in this study. The choices of these variables are in accordance with literature and as specified by the World Economic Forum for Financial. They include; Domestic Credit to the Private Sector as a percentage of GDP (PRIVATE) in trying to measure the activity of the banking sector, this proxy is used. This is based on the premise that the amount of credit given to private individuals are adequately channelled for investment, as such it measures the quality and quantity of investment. This index isolates credit provided by the government and other development banks and this can also be seen as a shortfall (Levine and Zervos, 1998), (Ghirmay 2004), (Caporale et al 2009).Liquid Liabilities M2/GDP (LLY); is the simplest and most available proxy used in measuring the size of an economy’s financial sector is money as a percentage of GDP. It measures the degree of monetization of the financial sector as well as its size. It is robustly correlated with the rate of change of GDP per capita. Hence a higher ratio means a larger financial sector and therefore greater financial development (Dawson, 2003, 2008, and 2010), (King and Levine 1993a).Market Capitalization as a share of GDP (MCAP) is a measure of the size of the stock market, which is the market value of shares listed on major domestic stock exchanges divided by GDP. This proxy is used to measure stock market development as it shows the capacity of the market by the amount of companies listed. This however does not reveal the whole development of the stock markets as distortions like high taxes hinder investors from listing on the stock market. Other variables; the study also controls for other variables that may affect economic growth other than financial development which include; labour force, a positive coefficient is expected. Gross fixed capital formation is as a share of GDP (I/Y) as a measure for investment. Secondary school enrolment as a percentage (SEC) is used to measure human capital Also, to control for convergence effect we use the log of initial GDP. The neo-classical theory explains that when the growth of GDP per capita is regressed on its initial level of GDP, the convergence effect is obtained. If the regression coefficient beta has negative sign it will indicate that the GDP per capita of countries with lower initial GDP per capita grow more rapidly than the countries with higher initial GDP per capita. Trade which measures the volume of trade as a proportion of GDP is used as a proxy for trade openness which is a policy controlling variable. The higher the level of trade openness the higher the economic growth.GDP per capita is used as a measure for Economic growth.

3.3. Model Specification

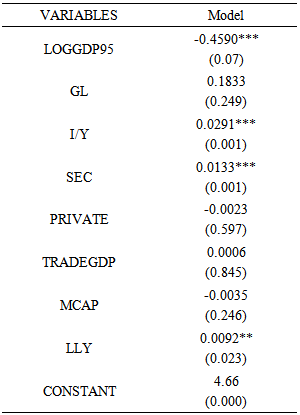

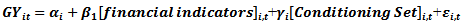

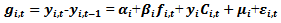

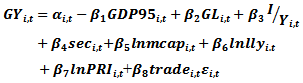

- This paper employs an augmented Barro-Growth model, in examining the impact financial development has on transition economies. Here, GDP growth (GY) is expressed as a function of simple conditioning informative set; a policy set and a set of financial indicators. The model is expressed below:

| (1) |

| (2) |

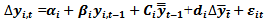

is the individual dummy for each country (constant in time), financial indicators represents either PRIVATE, LLY, MCAP and the conditioning set is a vector of information that controls for growth. The policy variable set includes the simple conditioning set plus either trade as a ratio of GDP with a positive coefficient to explain international trade openness or inflation. Financial indicators include Liquid liabilities (LLY) as a percentage of GDP, market capitalization and credit to the private sector (PRI) as a percentage of GDP. The model is expressed in econometric terms below:

is the individual dummy for each country (constant in time), financial indicators represents either PRIVATE, LLY, MCAP and the conditioning set is a vector of information that controls for growth. The policy variable set includes the simple conditioning set plus either trade as a ratio of GDP with a positive coefficient to explain international trade openness or inflation. Financial indicators include Liquid liabilities (LLY) as a percentage of GDP, market capitalization and credit to the private sector (PRI) as a percentage of GDP. The model is expressed in econometric terms below:  | (3) |

Represents the parameter of the model to be estimated which may vary across countries,

Represents the parameter of the model to be estimated which may vary across countries,  is the investment as a percentage of GDP

is the investment as a percentage of GDP  is the error term.

is the error term. 3.4. Econometric Strategy

3.4.1. Hausman Test

- In order to choose between the fixed effect model and the random effect model, we run the Hausman test. Here the null hypothesis is that the model is random effect versus the alternative hypothesis of fixed effect. The underlying objective is to test if the error term is correlated with the regressors. The absence of such correlation may present the random effects model to be more powerful. The existence of correlation makes the random effects model inconsistent in estimation and the fixed effects model would be the choice model. The fixed effect model is preferred as it allows for cross sectional heterogeneity by letting the intercept differ across entities/individuals. It also tries to explain the causes of variation within individuals or entities.

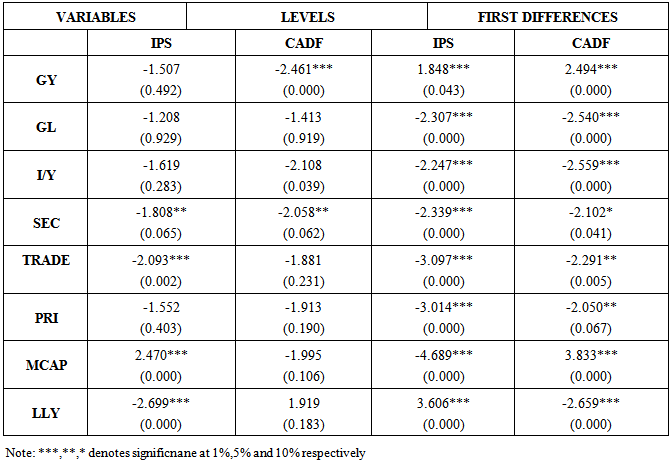

3.4.2. Panel Unit Root test

- Two sets of panel unit root test in this study is adopted; a first generation test developed by Im et al (2003) and a second generation test by Pesaran (2003). To apply the first generation test (IPS) we estimate an augmented Dickey Fuller equation for each member in the panel. Here the mean of each individual ADF statistics, is adjusted to be asymptotically standard normal. Null hypothesis is that it contains unit root, therefore non rejection of the null implies that the individual series are I (1). The panel unit root test by Pesaran (2003) also augments the Dickey Fuller unit root test but it allows for cross sectional dependence (CADF). To remove the cross sectional dependence, augmenting of the standard Dickey Fuller (DF) or (ADF) regressions with the cross section mean of lagged levels and first-differences of the individual series is carried out.

| (4) |

the average values at time t for all N observations. The null hypothesis assumes that all individual series in the panel are non-stationary against the alternative of at least one time series containing unit root. The critical values are provided by Pesaran (2003) and the Z [t-bar] statistics is normally distributed. The unit root test is employed on the level and first differences of the variables. The variables should be integrated in the first difference I(1) as the existence of long-run finance–growth relationship requires that both variables are integrated in the first order.

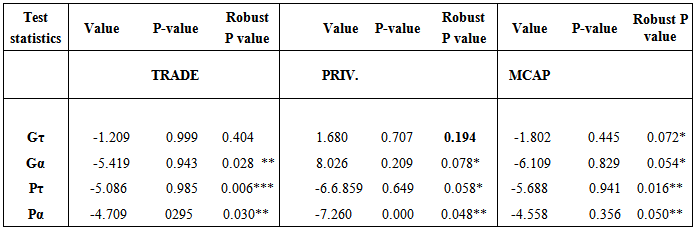

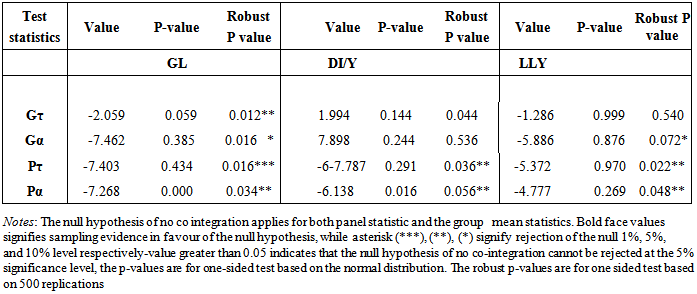

the average values at time t for all N observations. The null hypothesis assumes that all individual series in the panel are non-stationary against the alternative of at least one time series containing unit root. The critical values are provided by Pesaran (2003) and the Z [t-bar] statistics is normally distributed. The unit root test is employed on the level and first differences of the variables. The variables should be integrated in the first difference I(1) as the existence of long-run finance–growth relationship requires that both variables are integrated in the first order.3.4.3. Panel Cointegration Test

- If the variables used in the panel data are integrated in the first order I (1) after panel unit root test, then co integration test can be carried out. The purpose of carrying out Panel co-integration test is to ascertain if long term or equilibrium relationship exist amongst variables that are integrated taking into consideration both time and cross sectional dimension. There are two sets of Panel co integration techniques; the residual based co integration test and the structural based co integration test. The former test entails that the long-run parameter for the variables in their levels are equal to the short-run structures for the variables in their differences. This requirement is factor restricting and leads to significant loss of power as studies that adapted this technique, also failed to reject the hypothesis of no co integration even when economic theory strongly supports the relationship. Based on these shortfalls, we adopt a structural based co integration test developed by Westerlund (2007) that is devoid of factor restriction and has higher testing power. Essentially, the test aims to examine if the error correction term is present for individual panel members or the group panel as a whole. The Westerlund test allows for heterogeneity but provides robust p-values in case of cross relation members obtained through bootstrapping thereby making inferences possible. The Westerlund co integration test assumes the following generating process:

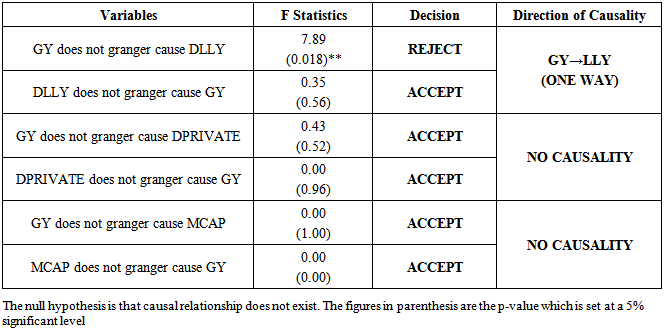

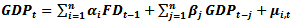

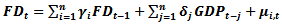

3.4.4. Panel Causality Test

- To examine if a change in financial development leads to a change in economic growth in transition economics or vice versa, granger causality test for panel data is employed. The test involves estimating the following pair of regressions. GDP represents economic growth rate and FD represents financial development variables. In investigating the causal linkages in both ways we estimate equation (6) and (7) for the following pair of variables

| (6) |

| (7) |

4. Presentation and Discussion of Finding

|

|

|

|

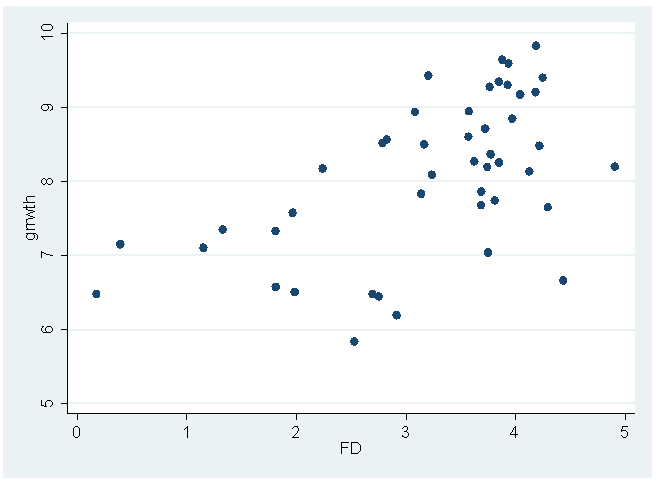

| Figure 4.1. A scatter plot showing the Long run relationship between financial development and Economic growth |

|

|

4.1. Discussion of Findings

- From the table above, the result show that liquid liability has a positive and significant impact on economic growth. This finding is consistent with the notion that money supply promotes growth. The results of the Cointegration test also show that liquid liability as a proxy for financial development has a long term relationship (King and Levine, 1993; Levine et al., 2000; Rousseau and Wachtel, 2000; Caporale, et al., 2009). However, the causality test reveals the increased monetization of the financial sector, is in reaction to economic growth in transition economies. This invariably means that although.Similarly, the results show that although the stock markets and economic growth in transition economies have a long run cointegrating relationship. The impact it has on economic growth is negative and statistically insignificant. The negative impact of stock markets in accounting for growth may stem from the fact that the financial markets in these economies are relatively new with rather small sized capital markets. In essence, financial markets in transition economies have not reached the stage where they can account for growth. Singh (1997) explains that the since regulatory structures for financial markets in transition economies are still developing, the stock markets in transition economies are very thin (Caporale et al., 2009; Mehl et al., 2006). This study also finds out that apart from the size of the financial sector, investment in human and physical capital are necessary ingredients for growth which follows the general wisdom. Labour growth meanwhile proves to be insignificant and can be attributed to the evolution process which generated unemployment which was formerly non existents. In controlling for convergence effect, Solow-Swan (1956) explains that economies with low initial GDP will grow faster and converge to a steady state as compared to economies that have high initial GDP. Since the variable entered the model with an expected negative coefficient. As such GDP is expected to grow and reach a steady state given the time sample. Transition economies actually achieved convergence in GDP with other developed economies as postulated in 2003 (Demetriades and Hussein (1996), Habibulah and Eng (2006)).

5. Conclusions

- In this study, the effect of the development of the financial sector in 25 transition economies of CEE and CIS states have on economic growth over a period of years from 1995 through 2013 is empirically investigated. An adequate understanding of the link between these two macroeconomic variables is of importance in these countries as their transition to market planned economies was faced with undeveloped financial systems and because there is substantial variation among them in the pace of financial development. To this end the study sought to identify the contributions of the financial sector to economic growth and to determine the direction of causality between the two variables. Various panel data techniques were employed in order to achieve the objective of the study which include; Westerlund co integration test and granger causality for panel data. The results provide evidence that financial development and economic growth have a co integrating relationship in transition economies.However, the channels of financial development in transition economies do not efficiently promote growth as these channels such as- the banking sector and the stock markets -are relatively new and fragile as such they are unable to propel growth. The granger causality test shows that causality runs in one direction from growth to financial development measured as liquid liabilities which may be due to the fact that inflow of foreign investors has led to the need to adequately channel available resources to the appropriate investment projects hence growth, these has led to the increased demand for financial services.On policy implications it is recommended that adequate steps be taken to designs regulations that would create growth enhancing economy. More so, strict banking supervision and training of highly skilled personnel are required in order to curtail the amount of bad and non-performing loans in the region. Furthermore, strong and viable structures are to be put in place for efficient stock market activities as over dependence on the banking sector is one of the reasons for the numerous banking crises in the region. Further research should include other control variables like financial crises, language, culture and globalization.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML