-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(5): 540-546

doi:10.5923/j.economics.20150505.15

Comparative Study and Economic Review of the Privatization Law in the Legal System of United Kingdom and Iran

Nastaran Sharifan, Hasan Badini

Department of law, University of Tehran, Tehran, Iran

Correspondence to: Nastaran Sharifan, Department of law, University of Tehran, Tehran, Iran.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Nowadays, all countries around the world have decided on privatization or are involved in implementing the privatization programs. In fact, it can be stated that implementing privatization programs is the one only option to cure the ailing economy of these countries, especially in developing countries. Proper planning and implementation of privatization policy lead to improved efficiency of public companies, increased public ownership, capital market development, more equitable distribution of wealth, increased government revenue, downsized government, etc. Thus, precise identification of privatization programs can determine different and broad dimensions of this important economic component. The present study aimed to review the privatization, its history, comparative privatization in the United Kingdom and its functions.

Keywords: Privatization Law, Economic Review, Legal System

Cite this paper: Nastaran Sharifan, Hasan Badini, Comparative Study and Economic Review of the Privatization Law in the Legal System of United Kingdom and Iran, American Journal of Economics, Vol. 5 No. 5, 2015, pp. 540-546. doi: 10.5923/j.economics.20150505.15.

Article Outline

1. Introduction

- Peter Drucker, the renowned Professor of Management, is well known due to great discussion on privatization. Implementation of public services should be distinct from the policy of the public (governmental) sector because although the government masterfully make the required decisions, implementation of those decisions would not be as great if solely done by the government [1]. Nowadays, few nations in the world can be found, which are not implementing privatization programs. It can be stated with certainty that privatization is one of the most important components of the 21st century. Proponents of privatization have cited several advantages for this economic component. They believe that the performance of economy will improve by reducing the scope of economic activities because production factors in public sector are not effectively used with high productivity. If the industry was transferred to the public people through sale of shares, many people will find opportunities for industrial ownership, which leads to greater economic independence and enhanced individual and social freedoms. Opponents of privatization also stated that this is sheer credulity to believe that privatization will reduce production (operation) costs. They documented their case through the claim that the organizations solely focusing on reducing costs and improving privatization-expected performance offer their services to profitable and available customers and neglect those customers with no interests for the organizations [1]. From the perspective of opponents of privatization, sale of public assets to the private individuals is identical to sale of familial diamond or loss of assets [2]. Moving from state ownership to private ownership (privatization) has many advantages for various companies involved in diverse industries. For example, private companies are more efficient and profitable than public companies. There are many international evidence on improving corporate performance after privatization around the world.

2. Privatization

- The privatization is a process through which corporate and governmental facilities are entrusted to the private sector. International supporters of privatization defined privatization of the economy as making the people involved in economic activities. In broad sense, privatization refers to the culture according to which the government and all the institutions making decision for the government would believe that the government should entrust people with the tasks they had devoted their best efforts to undertake. Public investment is allocated where no private sector is willing to invest. For example, there are some private companies, which can extract coal and iron ore but the government does not allow these companies to do so. The officials believe that the government can make better investment. Some experts believe that the government might be able to do so due to huge and 50-year-old financial backing. Otherwise, the private sector should be more involved if this was a comparative case between involvement of private and public sector. The term “privatization” implies a change in the balance between government and markets for benefit of the market. Privatization increases (financial and social) performance of operation of an economic entity since supply and demand mechanism as well as the market would use more production factors and increase efficiency of the production factors in competitive circumstances. Thus, more diverse goods and services would be produced and the prices would be decreased. Experiences of other countries should also be considered. The forecast can be proved and answered according to theoretical and scientific principles in microeconomics. However, implementation of privatization is complicated. In addition, transfer of ownership as well as formation of the private sector in society is more complicated than implementation of privatization. According to this insight, privatization provides more context for public involvement in all areas, especially in social, political, cultural and economic activities. The extended public involvement would undoubtedly strengthen foundations of democracy in a society and increase public supervision on governmental performance, particularly economic performance.

3. History of Privatization

- In the first half of the twentieth century, the government accepted responsibility of national economy and undertook many economic activities on the grounds that market mechanism and pricing system failed to allocate optimal resources and increase welfare and could not positively respond to basic social needs (production and supply of goods and public services, development of economic infrastructure, appropriate income distribution, provision of education and health facilities, major investments in strategic industries, etc.).Thus, the government took such responsibilities as resolving shortcomings in the market, optimal allocation of resources, development of economic infrastructure, production and supply of goods and public services, fair distribution of income, preserving individual freedoms, establishing social justice, economic stabilization, increased employment and poverty alleviation, provision of societal health education facilities and providing favorable conditions for development of talent and creativity in most countries. The government was recognized as vanguard of development. In summary, governmental involvement in economic activity was satisfactory in the early stages. The economic growth accelerated in 1960s and 1950s. In addition, many commercial problems, limitations, instability were resolved and trade cycles were established. It can be stated that a significant initial development in Eastern European countries were due to efficient governmental involvement.However, efficiency of economic activities of public enterprises and agencies gradually declined by expanding the scope of governmental economic activities in the late 1970s. Such factors as lack of motivation to work, multiplicity of objectives, superiority and priority of political goals over economic goals, severe bureaucracy, misuse of monopolies, mismanagement, rapid changes in management, lack of reward and punishment mechanism, growing number of employees, subsidies and uneconomic support of industries resulted in “government failure”.Performance of economic activities of public agencies declined in the late 1980s. In the 1970s, the performance of these activities severely declined. It was commonly believed that the economy planned, led and guided by the government would eventually lead to stagnation and recession. In global and broad sense, the spell of government involvement in economic activities was broken.At the beginning of privatization programs, the share of public enterprises from gross domestic production was decreased.Accordingly, the privatization process was globalized and increased day by day; so that the share of public enterprises from gross domestic production decreased from 1997 to the present day.It is noteworthy that privatization programs implemented from 1993 to 2003 and after this period varied from those program developed prior to 1993. This is due to several reasons as follows. First, the value of privatization has largely increased in terms of volume and price during these years. Second, globalization process has accelerated according to such documents as increasing domestic trade balance and foreign direct investment. Finally, the government have learned how to design more efficient privatization programs during 1993-2003 and after this period compared to previous periods, which can be proved through many academic journal and research reports on privatization [3].

4. Reasons and Objectives of Privatization

- In developing countries, privatization policy is the means to release the government from the problems caused by inefficiency and loss of public companies. Since underdevelopment and the relevant consequences are not solved in these countries, privatization policy offers a new role to the government in development process. It can be explained that social and political objectives are pursued in addition to economic objectives of privatization. Privatization objectives vary according to economic characteristics and position of each country. However, privatization mainly aim to improve the economic conditions in all countries. In addition, other objectives can also be cited.The privatization objectives are as follows in Paul Greve economic culture:1- Improving the economic performance of public enterprises and services2- Making non-political economic decisions3- Increasing the governmental operating budget and consequently reducing taxes and optimally benefiting from the existing facilities4- Reducing the operational cost of government and consequently reducing taxes and optimally benefiting from the existing facilities5- Reducing power of the unions in public sector6- Encouraging capitalism through extensive asset ownership by the private sectorA brief description of the main objectives of privatization in developing countries is presented:Improved efficiencyImproved efficiency is one of the most fundamental objectives of adopting privatization policy. Government agencies are not adequately efficient for survival and optimal resource allocation due to lack of motivation and an environment full of monopolistic activities. Incentives for acquiring profit would reduce operating costs and accomplish productive efficiency. On the other hand, expanding market forces and mechanisms associated with development of competition effectively lead to professional performance. Increased competition improves efficiency and maximizes social welfare. If all available potential benefits were efficiently realized through privatization, private markets would be certainly competitive.Reducing financial debt and budget deficitOne of the goals and outcomes of privatization lies in reducing the budget deficit by transferring money-losing public companies to the private sector. Major losses of public enterprises are financed through the government and from governmental budget, which will consequently increase the budget deficit. The costs caused by offsetting public financial deficit would be eliminated from the state budget by adopting privatization policy. As a result, government expenditure and budget deficit would be reduced. On the other hand, sale of public enterprises as a source of income for the government can reduce the deficit by increasing revenues. In addition, cost savings in government expenditure by intermediation of the private sector in order to offer various services reduces the budget deficit. Finally, putting more emphasis and paying more attention to payment by final consumer of goods and services increases continuous government income and reduces costs due to reduced government subsidies, which consequently reduces the government budget deficit.Development of capital market and facilitating use of small savingsPrivatization process extends the stock ownership by submitting the shares (sale of shares). The volume of capital market and public participation in economic affairs may expand by collecting cash and savings of the private sector. As a result, extending stock ownership increases the amount of transactions in the capital market and creates new financial and diverse institutions, which identify the new investment opportunities and make massive investment by facilitating small savings.Creating interest and attachment in employeesWorkers, employees and managers benefit from their proper performance and show an interest and attachment in ownership of the enterprise. As a result, they would be more initiative, innovative, creative and diligent to reduce costs and improve quality.Expansion of investment and democratic capitalismThis is associated with positive economic effects in the privatization process. Democratic capitalism not only has political objectives but also distribution goals. Certainly, the government faces two problems in achieving democratic capitalism. First, the government should create incentives for purchase of shares among the workers, which is associated with offering and sale of shares at the lowest price. Second, since normal people expend a lot of time to sell their shares, the government should provide positive incentives and apply special conditions to keep the shares in the hands of people.Adjustment and deregulationInefficiency of public companies is not limited to the operating environment and lack of motivation. Cumbersome regulations effectively annihilate flexibility and dynamism of public economic activities.Privatization and consequently deregulation are the first and most important step to provide competitive conditions and environment. It should be noted that the countries implementing intelligent privatization with superior goals would achieve great progress. However, the countries with the goal of privatization or transfer of ownership from public sector to the private sector did not gain economic growth and their situation worsened.

5. A Model for Privatization of Iran

- Public companies and institutions can be privatized in different ways. These methods include either transferring of one hundred percent ownership of the company, transferring a part of the corporate ownership or not transferring the corporate ownership and solely privatization of corporate management. In the following, the methods of transferring economic activities to the private sector are discussed:1- Offering shares to the publicOffering shares to the public is one of the most common methods of transferring public enterprises to the private sector. In this method, all or a large part of the shares of the given unit are offered to the public. In many cases, the public sector privately offers shares of the given unit due to lack of knowledge on market condition in order to acquire information on stock prices and market conditions relevant to the unit desired by public. Technically, offering shares of a public enterprise to the public is referred to as sale of shares at second hand but the shares are mostly offered as initial sales in most cases. If the offered enterprise was accepted in stock exchange, the enterprise can be easily transferred to the public because only the shares of stock can be offered. In these cases, few formalities should be observed prior to offering the shares.2- Offering shares to certain groupsOffering shares of the desired unit to certain group is another type of transferring the ownership. In this method, the government sells all or part of the shares of public companies to one or more predetermined applicants. The applicant may be either investment institutions or the individuals with capital and sufficient experience in the relevant industrial field. The stock price may be determined through negotiation on the basis of stock price of similar companies in the stock exchange. Privately offering the shares has a unique advantage, which lies in providing context for establishing creative entrepreneur class. The disadvantage of privately offering the shares lies in maximum likelihood of manipulated transaction in presence of a variety of parties. A specific coordination should be established between the policies adopted in the different stages of transferring process in developing countries where public entities are largely transferred to the private sector, so that there would be no illusion on the behaviors contrary to economic principles.3- Private sector participation in increasing capital of public companiesIn this method, the government increases investment in public companies in order to enhance production capacities to allow private sector participation in increasing the capital. The important feature of this method lies in the fact that the government does not transfer its shares to a company but transfers a part of ownership of the public company to the private sector by selling new shares to the private sector. As a result, the percentage of government ownership in the company is reduced. Then, the company will be semi-private and semi-public after transferring the ownership. In some cases, if a public company has high debt, the government may dissolve the company and establish a new company in partnership with the private sector. In this case, the government will offer machinery and assets of the company on the verge of dissolution as a non-cash capital in the new company. Private sector finances the financial resources necessary to provide working capital by depositing cash capital. Naturally, the government would not acquire new funds for sale of shares in such privatization method but this can lead to increased efficiency of the government. The government could raise capital simultaneously with transferring its stock to the private sector through offering the shares or public offering of stock shares in the case of those government units where the government has no control over the company.4- Sale of asset of a public company or institutionIn this method, physical assets of the public unit are sold instead of shares. This method is used when corporate activities cannot be continued; there would be great losses even if continued. Thus, it is proper to separately sell major corporate assets to the applicant. In some cases, physical assets are used as public non-cash capital instead of selling to establish a mixed public and private company. The received stock could be sold by the government later. In general, executive participation of this method lies in determining debts of the public unit after sale of its assets. No problem would rise if the assets in excess of needs of the public unit were sold. If the assets were sold and the company was dissolved, the debts should be settled and the personnel should be dismissed. The buyer of assets should be oblige to hire the majority of workers of the public unit to facilitate this case.5- Dissolving the institute to smaller companiesIn this method, the public unit is dissolved into several smaller companies or is converted to a central company with several affiliated ones. Public unit is dissolved through following ways:A) Dissolving the public unit to several companies, each with a distinct legal identityB) Converting a public unit to a parent company. In this method, assets and liabilities of the large public company are transferred to several smaller companies and the parent company is shareholder of the newly established company. The parent company sells shares of the affiliated companied to the public.C) Separating a part of activities of the public company and allocating the separated activities to one or more subsidiary company and selling the subsidiary companies to the private sectorD) Dissolving a large public company to smaller companies and selling any of the smaller companies to different buyers in order to create competition between them.6- Selling the company to the employees and managersIn this method, all or majority of the corporate shares are sold to the employees and managers of the company, which is usually associated with credit facilities and bank loans. The purchased stock are usually used as collateral loan to completely settle the debt.7- Managerial contractIn managerial contract, the management skills, technology and other capabilities in the private sector required for operation of the public unit are given to the public company in exchange for certain fees for a specific period. Although no ownership is transferred and assets of the public unit belong to the government, these arrangements can be referred to as a kind of privatization in corporate management and operations, which leads to increased efficiency using public assets.8- Privatization through leaseLeasing method is used in cases where the government cannot privatized through stock ownership transfer and only aims to privatize corporate governance. In this method, the private sector accepts to use government-owned assets in exchange for rent fees. This can lead to improved efficiency and efficient use of public assets.

6. Privatization in United Kingdom

- In Britain a significant proportion of the major industries were owned by the state prior to 1980. Most of these industries were taken into public ownership under the postwar labour government of Clement Attlee [4]. British industry urgently needed rationalization and modernization to recover from the devastation of the war, and it was a belief widely held at the time that recovery was most effectively achieved by nationalization. Nationalization, despite its outward appearance, is not synonymous with state-ownership in the sense that these enterprises were run directly by the government of the day. The model of nationalization adopted in Britain is largely due to the thinking of Herbert Morrison, the Deputy Leader of Labour in the Attlee government. The nationalized industries soon posed a problem for successive governments.These governments became increasingly concerned about the efficiency and accountability of such industries, and this was mirrored by the management of nationalized industries' hostility to what they saw as unnecessary ministerial interference. The nationalized industries were clearly being used to promote the government's macroeconomic policy. In the early1970's the industries were told to keep prices down as part of the government's anti-inflation strategy.In the implementation of the privatization program, the capacity for government to interfere in the pricing policies of the nationalized sector, particularly British Gas and Thames Water, was amply demonstrated.

7. Privatization under Thatcher

- The British privatization program which has gained momentum since1980 provides a real life example of a major shift in the property rights structure of an industrial economy [5]. Not only have major state-owned industries been sold to the private sector but a very large number of council houses have been sold to their tenants. Although the British Conservative Party has always evinced a distaste for state ownership, it was not very committed to the protection of private property. The party accepted what in Britain is called consensus politics a general acceptance of the "mixed economy" which involved substantial involvement of the state. Britain's privatization policies can be divided into two distinct phases.The first phase, 1979-1983, involved the sale of firms without any special characteristics that would justify their retention in the public sector. The first, Amersham International, was a producer of medical radioisotopes.The others, operating in the oil (BP, Britoil), hotels (British Rail Hotels), computers, electronics, telecommunications (ICL, Ferranti, Cable and Wireless, British Aerospace) and transport (British Freight, British Ports) sectors, all carried out activities which were carried out in the private sector and which faced active domestic or international competition. The second phase began with the sale of British Telecom. These are the so called public utility industries, such as telephone, gas, water, and electricity, where total output is produced by one organization because it involves a network and therefore competition in the provision of the service is not practical. Privatization of these industries means that a public monopoly is converted into a private one which must be regulated in order to curb its power to exploit consumers. It is the government's plan to privatize all the natural monopolies based on the belief that regulated private ownership of natural monopolies is preferable to nationalization. Two have so far been privatized - British Telecom and British Gas- and plans are being publicly drawn up for the privatization of the water authorities and electricity.' [6]

8. Objective of Privatization

- It is a mistake to regard the Thatcher program of privatization as a well thought and coherent program with a single or fully consistent set of objectives [7].It was not until 1983 that the then Financial Secretary to the Treasury first stated what the objectives of the privatization program were [8]. Among the prominent ones which can be identified are:(1) Reduce government involvement in the decision making of industry; (2) Permit industry to raise funds from the capital market on commercial terms and without government guarantee; (3) Raise revenue and reduce the public sector borrowing requirement (the PSBR);(4) Permit wide share ownership; (5) create an enterprise culture; (6) encourage worker share-ownership in their companies;(7) increase competition and efficiency; (8) Replace ownership and financial controls with a more effective system of economic regulation designed to ensure that benefits of greater efficiency are passed onto consumers. Some have argued that the government's program, rather than having a complex rationale has none, and that the multiplicity of objectives is a smoke screen for a general incoherence of the policy.' [9]The debate over British privatization has not been carried on in terms of a sophisticated analysis of its underlying premises or in terms of the assertion that private enterprise is more efficient than public enterprise. In many areas the issue has simply not arisen because of a feeling that there is no legitimate reason the industry should be in the public sector, and hence has given rise to little comment other than the price that should be set for the shares. There is a wide spread feeling that many enterprises were sold too cheaply [10]." The subsequent performance of shares in privatized firms gives a certain credence to this allegation.

9. Nature of Privatization

- The debate over privatization is usually cast in terms of a contrast between state ownership and private enterprise. Nationalization or state ownership is an infinitely varying concept because the property rights structure of these industries, and privatized industries as well, can take many different forms.

10. Potential Benefits of Privatization

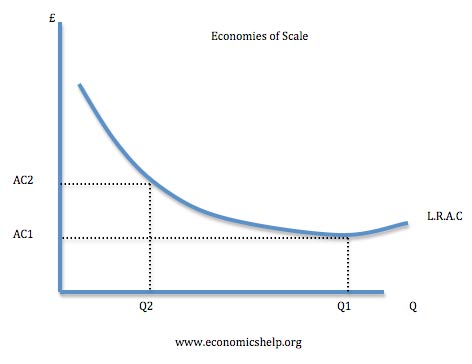

- 1. Improved Efficiency.The main argument for privatization is that private companies have a profit incentive to cut costs and be more efficient. If you work for a government run industry, managers do not usually share in any profits. However, a private firm is interested in making profit and so it is more likely to cut costs and be efficient. Since privatization, companies such as BT, and British Airways have shown degrees of improved efficiency and higher profitability.2. Lack of Political Interference.It is argued governments make poor economic managers. They are motivated by political pressures rather than sound economic and business sense. For example a state enterprise may employ surplus workers which is inefficient. The government may be reluctant to get rid of the workers because of the negative publicity involved in job losses. Therefore, state owned enterprises often employ too many workers increasing inefficiency.3. Short Term view.A government many think only in terms of next election. Therefore, they may be unwilling to invest in infrastructure improvements which will benefit the firm in the long term because they are more concerned about projects that give a benefit before the election.4. ShareholdersIt is argued that a private firm has pressure from shareholders to perform efficiently. If the firm is inefficient then the firm could be subject to a takeover. A state owned firm doesn’t have this pressure and so it is easier for them to be inefficient.5. Increased Competition.Often privatization of state owned monopolies occurs alongside deregulation – i.e. policies to allow more firms to enter the industry and increase the competitiveness of the market. It is this increase in competition that can be the greatest spur to improvements in efficiency. For example, there is now more competition in telecoms and distribution of gas and electricity.However, privatization doesn’t necessarily increase competition, it depends on the nature of the market. E.g. there is no competition in tap water. There is very little competition within the rail industry.6. Government will raise revenue from the saleSelling state owned assets to the private sector raised significant sums for the UK government in the 1980s. However, this is a one off benefit. It also means we lose out on future dividends from the profits of public companies.

11. Disadvantages of Privatization

1. Natural MonopolyA natural monopoly occurs when the most efficient number of firms in an industry is one. For example tap water has very significant fixed costs, therefore there is no scope for having competition amongst several firms. Therefore, in this case, privatization would just create a private monopoly which might seek to set higher prices which exploit consumers. Therefore it is better to have a public monopoly rather than a private monopoly which can exploit the consumer.2. Public InterestThere are many industries which perform an important public service, e.g health care, education and public transport. In these industries, the profit motive shouldn’t be the primary objective of firms and the industry. For example, in the case of health care, it is feared privatizing health care would mean a greater priority is given to profit rather than patient care. Also, in an industry like health care, arguably we don’t need a profit motive to improve standards. When doctors treat patients they are unlikely to try harder if they get a bonus.3. Government loses out on potential dividends.Many of the privatized companies in the UK are quite profitable. This means the government misses out on their dividends, instead going to wealthy shareholders.4. Problem of regulating private monopolies.Privatization creates private monopolies, such as the water companies and rail companies. These need regulating to prevent abuse of monopoly power. Therefore, there is still need for government regulation, similar to under state ownership.5. Fragmentation of industries.In the UK, rail privatization led to breaking up the rail network into infrastructure and train operating companies. This led to areas where it was unclear who had responsibility. For example, the Hatfield rail crash was blamed on no one taking responsibility for safety. Different rail companies has increased the complexity of rail tickets.6. Short-Termism of Firms.As well as the government being motivated by short term pressures, this is something private firms may do as well. To please shareholders they may seek to increase short term profits and avoid investing in long term projects. For example, the UK is suffering from a lack of investment in new energy sources; the privatized companies are trying to make use of existing plants rather than invest in new ones.

1. Natural MonopolyA natural monopoly occurs when the most efficient number of firms in an industry is one. For example tap water has very significant fixed costs, therefore there is no scope for having competition amongst several firms. Therefore, in this case, privatization would just create a private monopoly which might seek to set higher prices which exploit consumers. Therefore it is better to have a public monopoly rather than a private monopoly which can exploit the consumer.2. Public InterestThere are many industries which perform an important public service, e.g health care, education and public transport. In these industries, the profit motive shouldn’t be the primary objective of firms and the industry. For example, in the case of health care, it is feared privatizing health care would mean a greater priority is given to profit rather than patient care. Also, in an industry like health care, arguably we don’t need a profit motive to improve standards. When doctors treat patients they are unlikely to try harder if they get a bonus.3. Government loses out on potential dividends.Many of the privatized companies in the UK are quite profitable. This means the government misses out on their dividends, instead going to wealthy shareholders.4. Problem of regulating private monopolies.Privatization creates private monopolies, such as the water companies and rail companies. These need regulating to prevent abuse of monopoly power. Therefore, there is still need for government regulation, similar to under state ownership.5. Fragmentation of industries.In the UK, rail privatization led to breaking up the rail network into infrastructure and train operating companies. This led to areas where it was unclear who had responsibility. For example, the Hatfield rail crash was blamed on no one taking responsibility for safety. Different rail companies has increased the complexity of rail tickets.6. Short-Termism of Firms.As well as the government being motivated by short term pressures, this is something private firms may do as well. To please shareholders they may seek to increase short term profits and avoid investing in long term projects. For example, the UK is suffering from a lack of investment in new energy sources; the privatized companies are trying to make use of existing plants rather than invest in new ones.12. Conclusions

- Nowadays, almost all experts believe that public economies of the countries are suffering great losses from massive government ownership, exclusive structure, introspection and lack of interaction with the outside world. In order to solve this problem, a competitive structure of extraversion should be established and interaction with the world economy should be increased, which is possible through expanding role of the private sector as the main element in economic activity of the enterprises. In fact, privatization is seriously as an alternative to governmental responsibilities in both production and distribution of goods and services in many developing countries. The privatization mainly aims to increase efficiency of the economy through market forces (supply and demand) but privatization is not observed as an objective by itself. Nevertheless, privatization is a means to achieve other economic goals. Research in the country and foreign countries shows that transferring public agencies to the private sector does not necessarily improve corporate and economic growth because there is a sheer line between victory and defeat in privatization programs. Therefore, proper implementation and planning of privatization process help the countries to accomplish the pre-determined goals.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML