-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(5): 513-525

doi:10.5923/j.economics.20150505.12

Evaluation of Exchanges Rate Pass-through to Domestic Prices in Morocco

Omar Bakkou1, El Mahdi Zahir2, Et Hafida Idrissi3

1Université Mohammed V – Agdal, Rabat

2National Institute of Statistics and Applied Economics

3Université Mohammed V-Rabat-Suissi Rabat

Correspondence to: Omar Bakkou, Université Mohammed V – Agdal, Rabat.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

In this article we have evaluated the degree of exchanges rate pass-through to domestic prices (ERPT) during the period spanning from 1979 to 2014, with the aim of exploring the possibility of setting up a more flexible exchange rates system in Morocco. The study showed that ERPT in Morocco is low overall suggesting that the implementation option of a more flexible exchange rate system can be considered in Morocco.

Keywords: Exchange rate, Exchange policy, Morocco

Cite this paper: Omar Bakkou, El Mahdi Zahir, Et Hafida Idrissi, Evaluation of Exchanges Rate Pass-through to Domestic Prices in Morocco, American Journal of Economics, Vol. 5 No. 5, 2015, pp. 513-525. doi: 10.5923/j.economics.20150505.12.

Article Outline

1. Introduction

- The concept of Exchange-rate pass-through (ERPT) refers to the percentage change in domestic prices resulting from a change in exchange rates for a given country.This concept has a great theoretical and practical importance for economic policy in a context influenced by external openness. Actually RPT determine the choices made in terms of monetary and exchange rate policies, and therefore it has an impact on the adjustment instruments used to address imbalances in the external account of a given country.The external openness in both commercial and financial dimensions is an inevitable option for any economic development strategy set by developing and emerging countries in a globalized economy. Even if this opening offers many advantages, it brings additional constraints on macroeconomic level, including monetary and exchange policies.Actually, these constraints have been the focus of theoretical controversies between Mundell and Fleming construction related to the impossible trinity and the "fear of floating", developed by Calvo and Reinhart in 2002.Indeed, Mundell and Fleming construction consists of the impossible achievement by a country of three objectives simultaneously, namely having a fixed exchange rate, the free movement of capital and the autonomy in conducting monetary policy. The adaptation of this construction to the reality of developing and emerging countries inevitably lead to the choice of a flexible exchange rate policy for countries that wish to maintain the autonomy of monetary policy in a context of capital mobility.However, the “fear of floating” thesis questions the possibility to keep the autonomy of monetary policy through the introduction of a flexible exchange rate regime since the “passthrough” effect cancels for small and emerging economies, the supposed advantage of flexibility in terms of monetary policy autonomy.Indeed, the balance of the currency market, which is enabled by the flexibility and its effect on the autonomy of monetary policy is replaced by another type of autonomy loss consisting of the reduction of the link between money and prices, to the extent that the "pass-through" effect tends to be strongest in developing and small countries in general given its positive correlation with the degree of openness and the size of these economies.Morocco is an economy characterized by a degree of commercial and financial openness relatively high. It is thus at the center of this controversy between Mundell and Fleming construction, and the "fear of floating" for the following reasons:- a significant capital mobility characterized by a liberal foreign exchange control policy for incoming capital flows of non-residents (full convertibility for non-residents capital account transactions) and a partial opening system for capital account transactions performed by residents (outgoing capital flows);- a fixed exchange rate system ;- an independent monetary policy at the institutional level, this autonomy will be enhanced by the establishment of an inflation targeting policy.Indeed, the application of Mundell and Fleming construction to the characteristics of the economy makes the option of setting up a flexible exchange rate system inevitable for managing the external account imbalances in Morocco.However, taking into account the size of the Moroccan economy and its degree of trade openness, including the import share in GDP suggests a relatively high ERPT in Morocco, hence the necessity to monitor carefully the implementation of a flexible exchange rate system.The purpose of this paper is to evaluate the degree of ERPT, with the aim to assess the relevance of the current exchange rate system in Morocco and consider the possibilities of its change.The approach that will be used to assess the degree of ERPT in Morocco is the following:- presenting beforehand a synthesis of theoretical and empirical studies about the ERPT (literature review);- establishing a description of the assessment indicators of the ERPT in Morocco;- finally carrying out an assessment of the degree of ERPT in Morocco through an econometric study.

2. Literature Review

- The ERPT has been the subject of several studies that can be divided into two major categories namely; wide studies that cover groups consisting of a large number of countries (with different levels of development) and restricted studies focusing on a specific country or group of countries having relatively close economic development levels.Thus, among the most important wide studies, we find the study by Goldfajn and Werlang in 2000 that examined 71 developed and emerging countries where the impact on consumer prices is examined using panel estimation methods on data from 1980 to 1998. Another study was developed by "Merou" in 1995 that consisted of 43 empirical studies on industrial products. Within the category of restricted studies, we find a range of studies, including those conducted in developed countries (Anderlou in 2003, Campa and Goldberg in 2004, Campa and al in 2005, Gagnou and Ihrig in 2004, Hahn in 2003, Mac carthy in 2000) and those focused on emerging countries (Choudri and Hakura in 2006, Frankel and al and 2005 et Mihaljek and al in 2000).Overall, we can synthesize the results of these studies as follows:The ERPT to internal prices is usually incomplete; it means that the change in the exchange rate of a given country is not transmitted with the same amplitude to internal prices. The incomplete transmission of exchange rate variations to domestic prices depends on the level of development and the country size. Indeed, ERPT tends to be greater in relatively small low-income economies that are more open with a high share of tradable goods, high import content and limited domestic substitutes (Edwards 2006).In addition to the size factor, ERPT to internal prices depends within the same category of countries on other microeconomic and macroeconomic factors.For the microeconomic factors, we can distinguish two categories of factors affecting the ERPT. The first category is related to exchange rates, the second one concerns the nature of the products constituting the foreign trade of a given country.As regards the factors related to exchange rate, there are three elements impacting effect of exchange rates changes namely, the duration of exchange rate changes, the size of exchange rate changes and the management of exchange rate changes.For the duration exchange rates changes, the studies conducted by Mueras (2003) on USA, Japan, Germany, France and Italy have shown that ERPT tends to be relatively more complete in the case of persistent shocks of exchange rate. However, the ERPT tends to be less complete in the case of temporary shocks of exchange rate.The reasons given to explain this assertion lies in the fact that in the case of temporary depreciation of the exchange rate, exporters may be willing to reduce their profit margins to maintain market share in the importing country, given the possibility of hysteresis effect.Regarding the size of exchange rate changes, studies in this respect, particularly in the USA (Krugman, 1987) have shown that when the magnitude of changes in exchange rates is small, the effect on domestic price is zero because companies prefer to absorb the capital loss due to a depreciation of the exchange rate of the importing country given the costs associated with price changes (menu costs).As far as the elements related to the sens of exchange rate changes, the literature suggests that the reactivity of exporters to changes in the exchange rate is often asymmetrical depending on the direction of changes in exchange rate (appreciation or depreciation).In fact, a depreciation of the exchange rate of the destination market, enforce the exporter to reduce its export prices expressed in its currency and to keep the prices of importing country relatively stable which implies a lower ERPT.In addition to this, factors related to the nature of the products constituting the foreign trade of a given country, Campa and Goldberg (2005) have shown that manufactured goods have a low ERPT compared to agricultural primary products.The explanation given to the relationship between the nature of the product and the degree of ERPT consists in the fact that manufactured products operate usually in highly competitive markets. In order to keep their market share, exporters are enforced to absorb exchange rate changes.Conversely, for primary products, the configuration of international and domestic markets is often less competitive. As a result, exporters are less responsive to changes in the value of the exchange rate. Exchange rate changes are thus fully passed on the currency of the importer. In terms of macroeconomic factors, the key element is the monetary stability of a given country which has a negative effect on the level of ERPT (according to studies conducted by Taylor in 2000, Devereux, Engel and storgaard (2003). Indeed, the more monetary conditions and inflation rates are stable, the more the degree of ERPT is low.This correlation has been proven by several econometric studies, including those carried out by Devereux and Engel (2001), Taylor (2000) and Campa & Golherg in 2005 (effective study that concerns 25 OECD countries for the period 75-99).The results of empirical studies on the ERPT in different countries of the world presented above helped understanding that the degree of transmission of exchange rate changes to domestic prices depends on several parameters including inflation, the size of a country, its degree of openness, the nature of products imported, the duration of exchange rate fluctuations, their magnitude and their direction (appreciation or depreciation).These analytical elements will be used to identify relevant information required to make assumptions as regards the degree of ERPT in Morocco. Secondly, it will enable us to refine and frame the econometric study of the ERPT evaluation (selection of appropriate evaluation periods of the degree of ERPT in Morocco, analysis of the results emerging from that assessment etc).

3. Assessment of the Level of ERPT Alleged to the Morocco

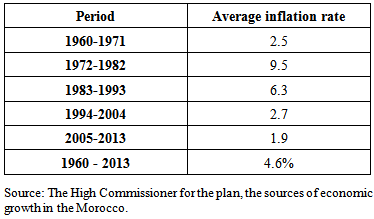

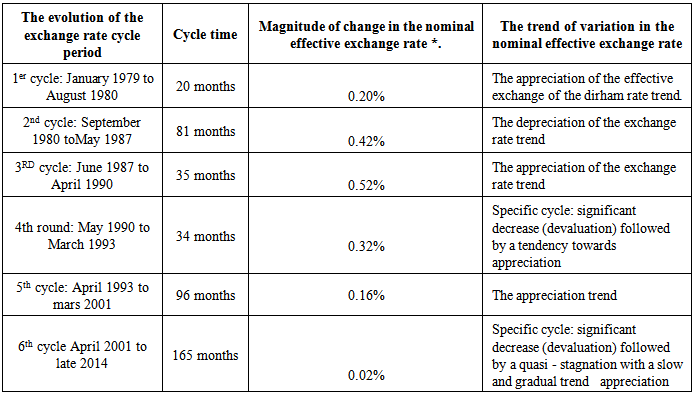

- As indicated above, the level of ERPT depends on the rate of inflation, the rate of opening, the structure of imports and the characteristics of changes in the rate of Exchange (duration, amplitude and direction of variation).Appreciation in this regard of the degree alleged ERPT requires the analysis of these different factors in the case of the Morocco.Rate of inflation to the MoroccoAnalysis of data relating to the rate of inflation registered in Morocco during the period 1960 a2014 reveals the following key findings:-the rate of inflation in Morocco remains overall control. Indeed, this rate was on average 2.3% over the period 1994 to 2013 against an average rate of inflation of 6,5% in the comparable to the Moroccan country during that period.-the rate of inflation is part of a downward trend continues since the beginning of the 1980s, since it moved from an average rate of 9.5% during the period 1972-1982 to 1, 9% in the period 2005 a2013.

|

|

|

4. Econometric Study of Assessing the Degree of ERPT in Morocco

- As noted above, the econometric study for the evaluation of the degree of ERPT in Morocco will be performed in two main steps:- a first step will be to:. assess the degree of ERPT through an econometric model for the period from 1979 to 2014;.assess the degree of ERPT over different time periods chosen according to breaking tests carried through the DEMETRA software;- a second step will be to assess the degree of ERPT through an econometric model built on different periods for each corresponding to patterns having a uniform direction: tendency to appreciation or depreciation of the exchange rate.

4.1. Assessment Model ERPT Degree during the Period between 1979-2014

- - Variables Proposed for modeling the ERPTThe variables used in this model are the Consumer Price Index(CPI) and the nominal effective exchange rate. The data for these two variables are monthly and cover the period spanning from January 1979 to December 2014, are 432 observations.The choice of these variables is explained by the following reasons:For the choice of the nominal effective exchange rate, instead of the bilateral exchange rates (dirham / dollar rate and the dirham / euro) to apprehend the exchange rate, this choice corresponds to the methodology commonly used in the various studies conducted As such, the fact that this rate is more relevant to learn about the exchange rate which were carried out external transactions including imports of goods.The choice of this rate avoids the use of bilateral exchange rates which inform only on part of the rates at which were made import of goods operations. According to the data of the balance of settlements of the Foreign Exchange Office, settlements under import transactions carried out in dollars have shown that 50% of all the settlements in respect of goods import.As for the consumer price index, it is the indicator usually used to understand the level of prices in Morocco.- Methodology: The chosen modeling to assess the degree of transmission of exchange rate changes to prices is that of an error correction model. This type of model has the advantage of allowing to specify long-term stable relations while jointly analyzing the short-term dynamics of the variables considered.The error correction model takes the following form:

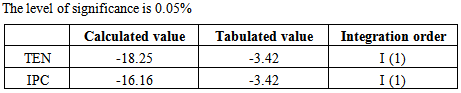

yt : explained variablext : Explanatory variableµ : constantρ : coefficient of error correctionε't : residual.This type of model describes a process of adjustment to a long-term equilibrium taking into account other variables involved in the explanation of the dynamic process of the dependent variable. The latter which is the long-term target, is usually following a theoretical underlying relationship to the model. In other words, restraint relationship combines co-integration relationship (long-term target) and a specification of a short-term dynamics as a reminder to the target. ρ represents the rate of convergence or the restoring force to long term equilibrium.The formalization of the ERPT proceeds according to a multi-step method. The first is to study the order of integration of the series used. This procedure is justified by the fact that we can bond together as variables with similar properties. This phase will also be devoted to the analysis of co-integration between the dependent variable and those explanatory.As for the second step, it is devoted to the estimation of the model. The tool used to make this body of work is the Eviews software dedicated to this type of investigations.- Analysis of stationary and co-integration testsThe analysis of the stationary series which is a preliminary to any econometric estimation, is to verify that the order of integration of the time series used in the model is zero.The methodology is to check the properties of the series with stationary tests Dickey-Fuller and stability.Stationary tests series of TEN and CPI (shown in Table No. above) show that the CPI is stationary in levels and TEN is stationary in first differences.This result allows the acceptance of the stationary of the two variables in the first difference.

yt : explained variablext : Explanatory variableµ : constantρ : coefficient of error correctionε't : residual.This type of model describes a process of adjustment to a long-term equilibrium taking into account other variables involved in the explanation of the dynamic process of the dependent variable. The latter which is the long-term target, is usually following a theoretical underlying relationship to the model. In other words, restraint relationship combines co-integration relationship (long-term target) and a specification of a short-term dynamics as a reminder to the target. ρ represents the rate of convergence or the restoring force to long term equilibrium.The formalization of the ERPT proceeds according to a multi-step method. The first is to study the order of integration of the series used. This procedure is justified by the fact that we can bond together as variables with similar properties. This phase will also be devoted to the analysis of co-integration between the dependent variable and those explanatory.As for the second step, it is devoted to the estimation of the model. The tool used to make this body of work is the Eviews software dedicated to this type of investigations.- Analysis of stationary and co-integration testsThe analysis of the stationary series which is a preliminary to any econometric estimation, is to verify that the order of integration of the time series used in the model is zero.The methodology is to check the properties of the series with stationary tests Dickey-Fuller and stability.Stationary tests series of TEN and CPI (shown in Table No. above) show that the CPI is stationary in levels and TEN is stationary in first differences.This result allows the acceptance of the stationary of the two variables in the first difference.

|

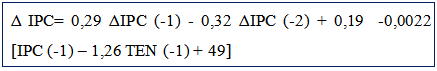

As for the stability test, it helped to check the stability (unit roots are less than 1). Verification of stationary and co-integration tests allowed us to choose the Error Correction model.Main results from the estimation of the model [33]The econometric estimation of the ERPT by ECM gave rise to the following results:

As for the stability test, it helped to check the stability (unit roots are less than 1). Verification of stationary and co-integration tests allowed us to choose the Error Correction model.Main results from the estimation of the model [33]The econometric estimation of the ERPT by ECM gave rise to the following results: - Interpretation of results It is from the above results that all of the usual statistical tests are satisfactory and that the variables have the expected signs. Indeed, the equation shows that short term variation of the index in the consumer price depends only on its previous variation and does not affect by variations in the exchange rate.On the contrary, in the long term the equation shows the existence of impact of changes in the rate of nominal effective exchange on those of the CPI. Indeed when the value of the nominal exchange rate decrease of 1%, the CPI increased by 0,00277% (1, 26 * 0, 0022) which corresponds to a degree of low transmission.The 0.0022 coefficient indicates the speed of return to the balance in the event of shocks. Indeed when a shock is observed at the level of the nominal effective exchange rate, the CPI will return to equilibrium with a speed equal to (0, 0022 * 1) per month.

- Interpretation of results It is from the above results that all of the usual statistical tests are satisfactory and that the variables have the expected signs. Indeed, the equation shows that short term variation of the index in the consumer price depends only on its previous variation and does not affect by variations in the exchange rate.On the contrary, in the long term the equation shows the existence of impact of changes in the rate of nominal effective exchange on those of the CPI. Indeed when the value of the nominal exchange rate decrease of 1%, the CPI increased by 0,00277% (1, 26 * 0, 0022) which corresponds to a degree of low transmission.The 0.0022 coefficient indicates the speed of return to the balance in the event of shocks. Indeed when a shock is observed at the level of the nominal effective exchange rate, the CPI will return to equilibrium with a speed equal to (0, 0022 * 1) per month.4.2. Model for Assessing the Degree of ERPT during the Seven Sub-periods Spanning 1979-2014

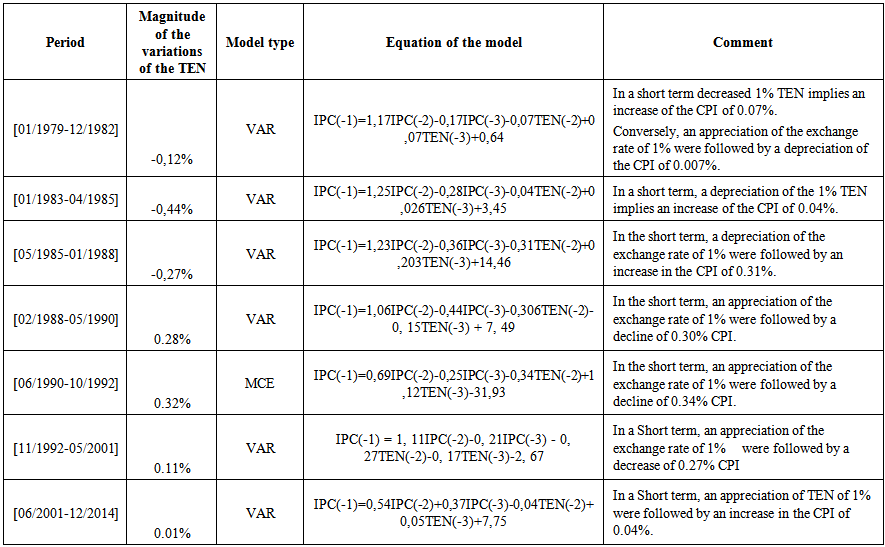

- The models chosen for the assessment of the degree of ERPT during the period seven sub-periods spanning 1979-2014 consist of models VAR. The choice of the VAR models is explained by the fact that ECM cannot be used during many sub-periods (05/1985 to 01/1988;02/1985 to 05/1990;06/1990 to 10/1992; 11/1992 to05/2001), and this on the basis of the verification of the co-integration test.The results are presented in the table below:

| Table 5. Results of the modeling of the ERPT using VAR models covering six sub-periods spanning 1979-2014 |

4.3. Models for Assessing the Degree of ERPT Established on Different Periods Corresponding to Trends with a Uniform Meaning

- The variables used in this model are the Consumer Price Index (CPI) and the nominal effective exchange rate (TEN). Selected sub-periods are those indicated in the table below.The model in each period is the VAR. The choice of the VAR models is explained by the fact that ECM is unable to be used years all the sub periods since the variables are not co-integrated on all of the sub-periods. The results of the models and their interpretations are presented in the table below.

| Table 6. Results of the modeling of the evaluation of the degree of ERPT on the six sub-periods corresponding to trends with a meaning uniform |

5. Conclusions

- The evaluation of exchanges rate pass-through to domestic prices (ERPT) during the period spanning from 1979 to 2014 through the use of various econometric models presented above allows to highlight the following main conclusions:- the ERPT remains globally low in Morocco what corresponds to the hypothesis of departure emitted on this matter. This result which takes out again various used models confirms the predictions getting free of the application of the main teachings of the economic literature regarding determiners of the effect of the ERPT in the case of Morocco and remains besides coherent with the studies made about the ERPT in the case of Morocco.Indeed, this literature clarified above, stipulates that the effect of the ERPT is negatively correlated in the degree of opening of the Moroccan economy and in the control (master's degree) of the inflation rate.Regarding studies made in the case of Morocco, Aziz Ragbi demonstrated, on the basis of two models (SVAR and the BVAR) that, the pass-through in Morocco is incomplete and the transmission of the variations of the exchange rate at the prices (prizes) of exchangeable goods is more important than than posted price of non-tradables. Thus, the pass-through to prices estimated by the SVAR and BVAR tradable goods was 29% and 10% respectively. While the pass-through to the prices of non-tradables is estimated at 1% in both models.- This result must be; however, qualified with regard to the following elements:The variations of the exchange rate seems dominated by the trends(tendencies) to the appreciation of the exchange rate what does not allow to express himself in a definitive way on the degree of ERPT, with regard to the fact that the degree of ERPT remains small-scale in the case of the appreciation of the exchange rate.The magnitude of variation of the exchange rate seems globally average (0,27%) what does not consequently allow to release definitive conclusions about the ERPT, because of the fact that the ERPT seems to appear only on the occasion of variation of exchange rate of strong magnitude.

Annex

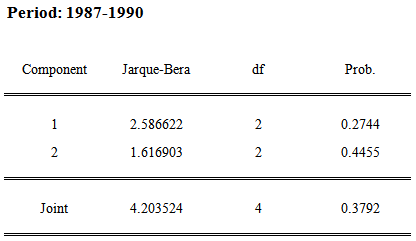

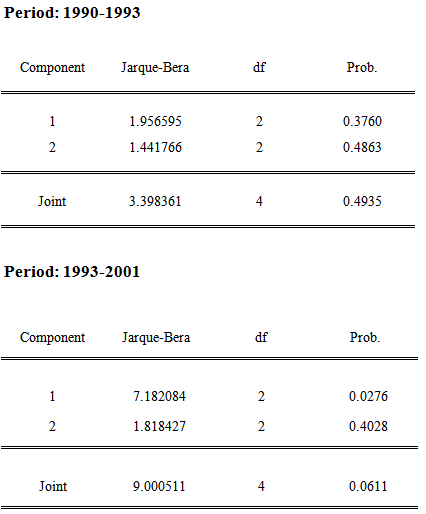

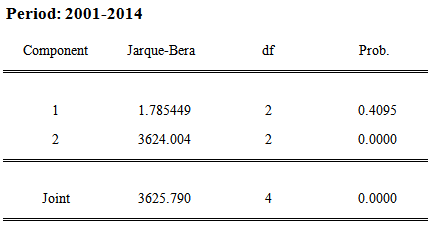

- Validation tests:1. Normality test:

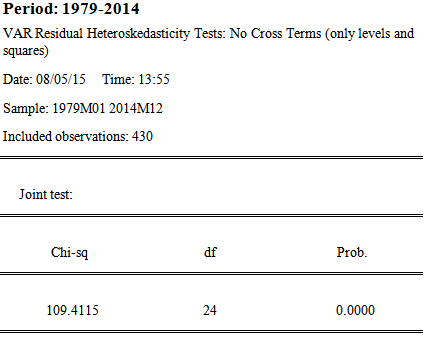

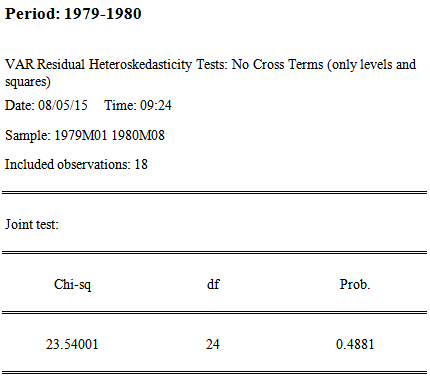

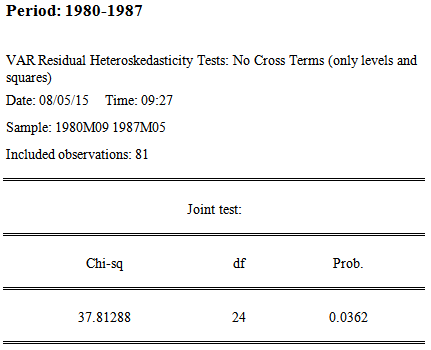

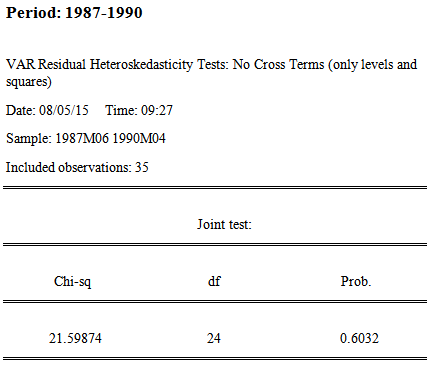

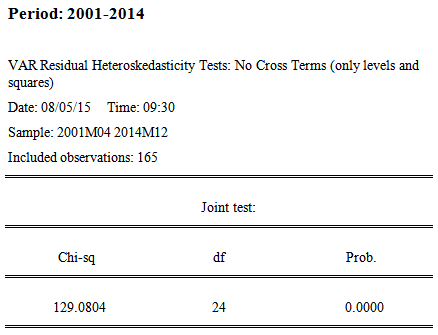

2. Homoscedasticity test

2. Homoscedasticity test

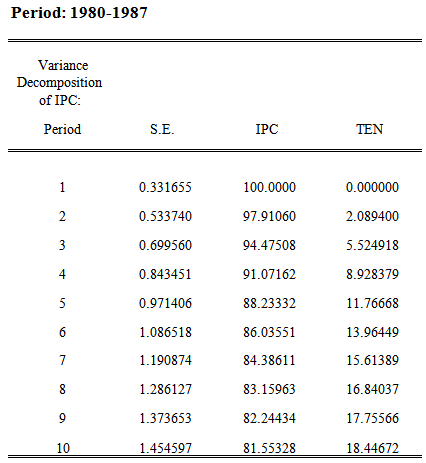

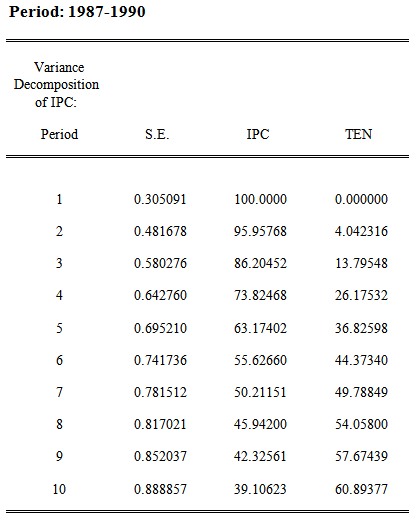

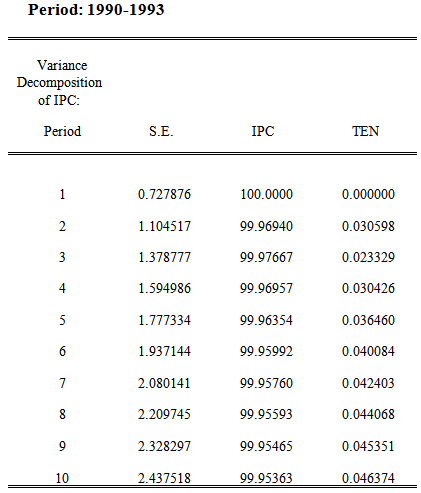

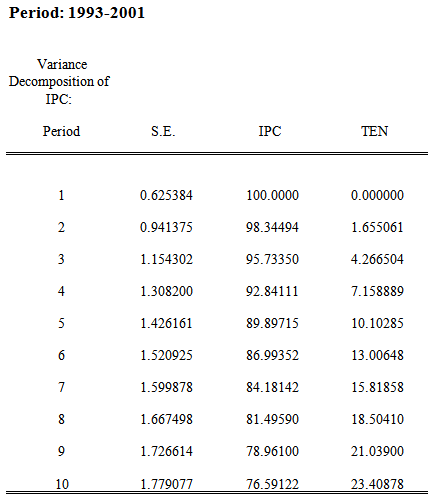

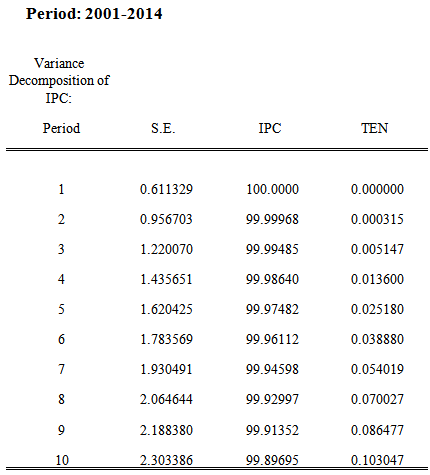

3. Variance decomposition:

3. Variance decomposition:

Notes

- 1. Peter Rowland, Exchange Rate Pass-through to Domestic Prices: The case of Colombia, Colombian Central Bank, page 6.2. Jean-Pierre Allegret, les régimes de change dans les marchés émergents: quelle perspective pour le 21ème siècle, édition Vuibert, 2006, page 170.3. Peter Rowland, Op cit, page 9.4. Michel ca’ zorzi, Elke Hahn et Marcelo Sanchez, Exchange rate Pass -Through in Emerging Markets, European Central Bank, Working Paper Series, n° 739/March 2007, page 6.5. Michel ca’ zorzi, Elke Hahn et Marcelo Sanchez,Op cit page 66. Michel ca’ zorzi, Elke Hahn et Marcelo Sanchez, Op cit, page 5.7. Peter Rowland, Op cit, page9.8. Baldwin, Richard E(1988): «Hysteresis Import Prices : The Beachhead Effect », American Economic Review, Vol 78, n°4, pages 773à 785 .9. Jonas Stulz, Exchange Rate Pass-Through in Switzerland: Evidence from Vector Autoregressions, Swiww National Bank Economic Studiesn n°4, 2007, page 8.10. Jonas Stulz, Op cit, page 711. Michel ca’ zorzi, Elke Hahn et Marcelo Sanchez,, Op cit, page 7.12. The average of the inflation rates of countries belonging to the category of intermediate income according to the last classification of the World Bank; certain countries were not taken into account because of the not availability of the data ( 65 countries). The data on inflation rates were extracted from the database of UNCTAD (UNCTADSTAT).13. Michel ca’ zorzi, Elke Hahn et Marcelo Sanchez,, Op cit, page 7.14. Adil Hidane, calcul du taux de change effectif nominal et réel du dirham, Minsitère des Finances et de la Privatisation, Direction de la Politique Economique Générale, document de travail n°86, Mars 2003, page 6.15. Aziz Ragbi, ciblage de l’inflation et flexibilisation du régime de change au Maroc, Thèse de doctorat en sciences économiques, Université Mohamed V Rabat –Agdal, Faculté des Sciences Juridiques Economiques et Sociales6Rabat, page 87.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML