-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(5): 495-500

doi:10.5923/j.economics.20150505.09

Financial Inclusion and the Impact of ICT: An Overview

Angella Faith Lapukeni

Reserve Bank of Malawi, Lilongwe, Malawi

Correspondence to: Angella Faith Lapukeni, Reserve Bank of Malawi, Lilongwe, Malawi.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Financial inclusion has become a global policy priority and the growth Information and Communications Technology (ICT) has become almost identical with the topic. This paper looks at an overview of financial inclusion globally and in Africa and discusses the impact of ICT on reaching individuals who were otherwise financially excluded, mainly through mobile payments. Trend analysis shows a faster growth in mobile telephone subscriptions than financial inclusion in Africa thus presenting the opportunity this aspect of ICT development has for increasing financial inclusion through mobile financial services. The paper also discusses the opportunity costs of increasing ICT both at a microeconomic and macroeconomic level and concludes with possible recommendation for policy in leveraging ICT for increased financial inclusion.

Keywords: ICT, Financial Inclusion, Mobile-Cellular Telephone

Cite this paper: Angella Faith Lapukeni, Financial Inclusion and the Impact of ICT: An Overview, American Journal of Economics, Vol. 5 No. 5, 2015, pp. 495-500. doi: 10.5923/j.economics.20150505.09.

Article Outline

1. Overview on Financial Inclusion

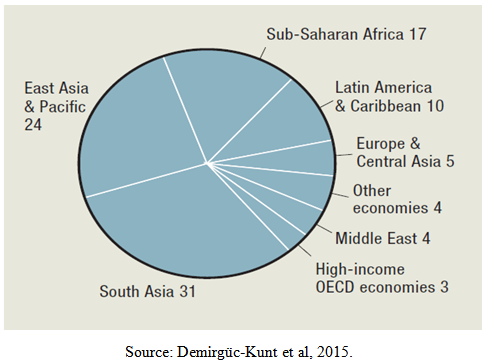

- Defining Financial InclusionFinancial inclusion is usually defined as the proportion of individuals and firms that have access to or use financial services (World Bank, 2014). Burkett and Sheehan (2009, Page v) define financial exclusion as: A process whereby a person, group or organisation lacks or is denied access to affordable, appropriate and fair financial products and services, with the result that their ability to participate fully in social and economic activities is reduced, financial hardship is increased, and poverty (measured by income, debt and assets) is exacerbated.Financial inclusion, therefore, is beyond access to finance, usage and quality are also important. Some people may have access to financial services at affordable prices, but choose not to use certain financial services for reasons such as religion or culture. Statistics show disparities due to factors such as income, age and gender (Demirgüc-Kunt et al, 2015). Others may lack access due to high costs of the services, unavailability of services due to regulatory barriers, or a variety of other market and cultural factors. Financial Inclusion is increasingly recognized as fundamental for development as it can help poor households improve their lives while also spurring economic activity. A greater access to financial services can contribute to: (i) poverty reduction, by decreasing vulnerability, (ii) an increase in the productivity of Micro, Small and Medium Enterprises (MSMEs), and (iii) greater formalization of firms. At the macro level, there is also evidence that an increase in access to financial services has positive effects on stability of the financial system, effectiveness of monetary policy, growth and inequality reduction. Policy makers and regulators globally have begun to make financial inclusion a priority and governments in both developing and developed economies are introducing measures to expand access to and the use of financial services. Financial Inclusion: Globally and In AfricaDespite these advantages, the financial exclusion worldwide is still prevalent. Recent studies have shown globally, 2 billion adults remain unbanked. South Asia and East Asia and the Pacific together account for more than half the world’s unbanked adult (Demirgüc-Kunt et al, 2015). Figure 1 below shows the share of the world’s unbanked by region. Sub-Saharan Africa ranks third highest with the unbanked population.

| Figure 1. The world’s unbanked adults by region Adults without an account (%), 2014 |

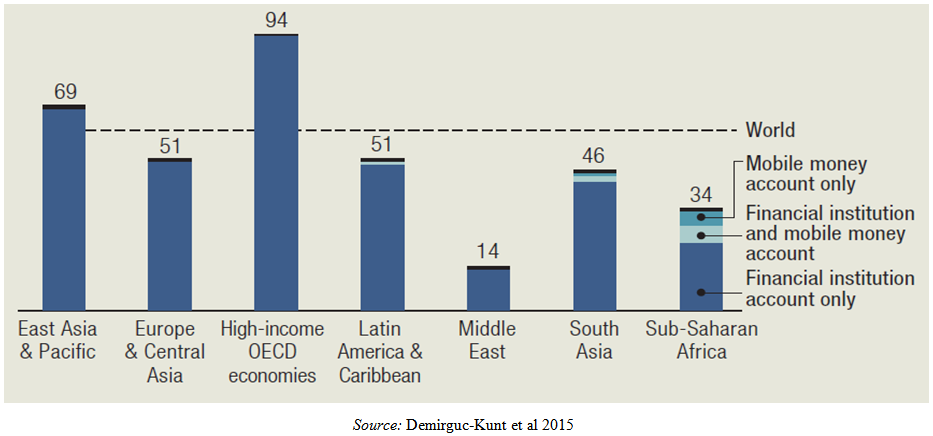

| Figure 2. Adults with an account at a formal financial institution as at 2014 (%) |

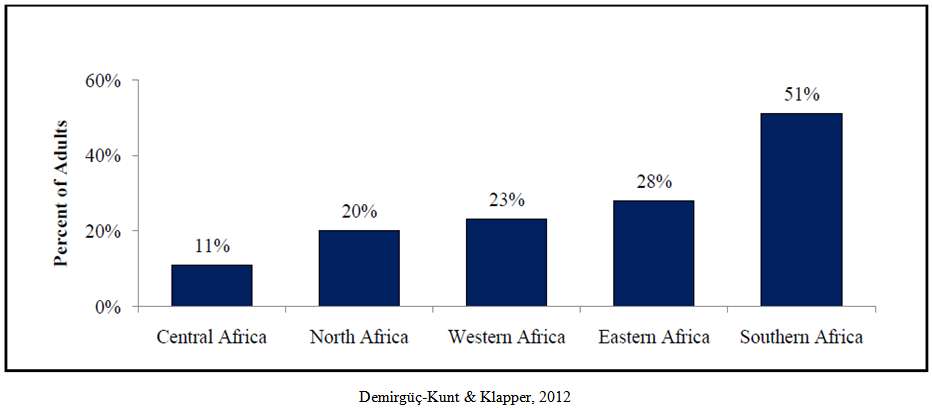

| Figure 3. Financial Inclusion in Africa as at 2011 |

2. The Developments of ICT in Recent Years

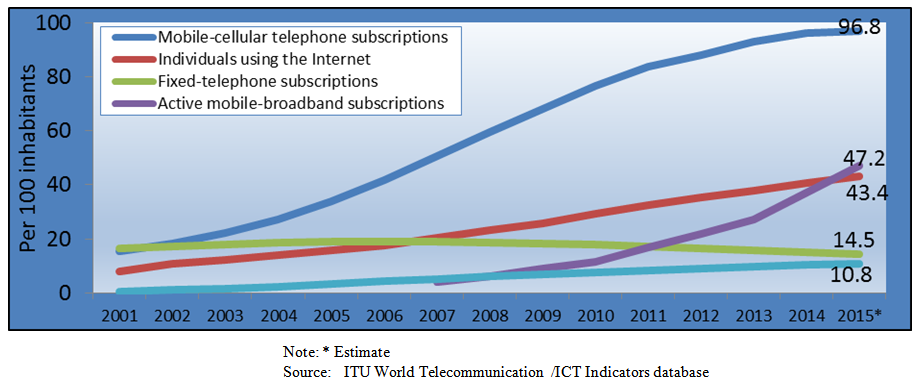

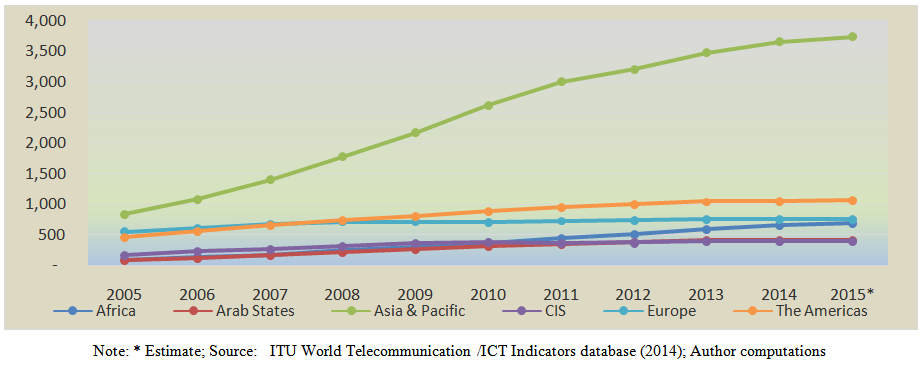

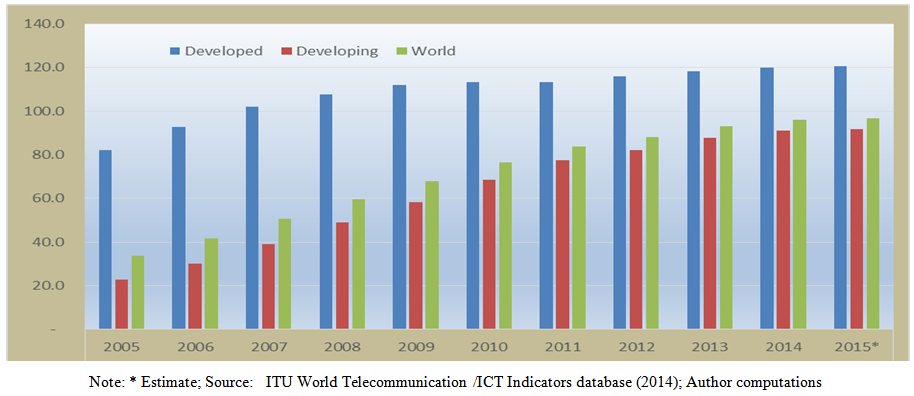

- There has been a speedy dissemination of information and communication technologies (ICT) in African countries, in line with similar patterns in other regions of the world (Figure 4). Some studies have observed that the economic and social return of ICT development is larger than the private return of the network provider (Andrianaivo and Kpodar, 2011).

| Figure 4. Global ICT developments, 2001-2015 |

| Figure 5. Mobile-cellular telephone subscriptions by Region (millions) |

| Figure 6. Mobile-cellular telephone subscriptions Per 100 inhabitants |

3. The Role of ICT

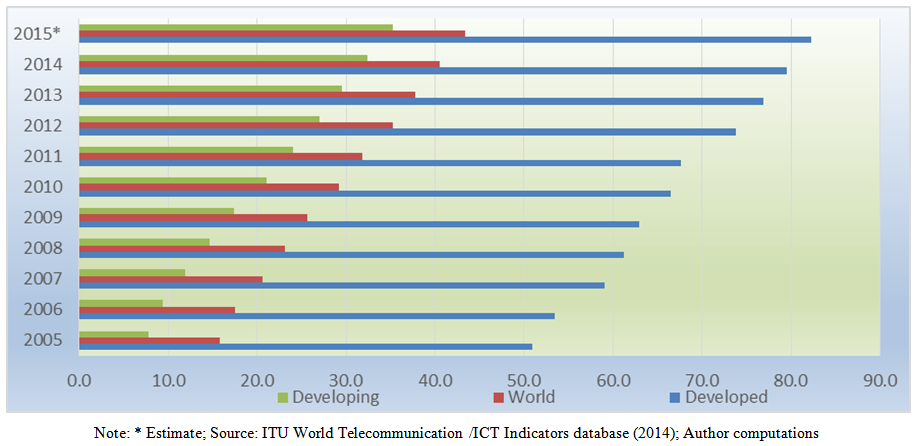

- The degree of financial inclusion is likely to increase in the next few years since, (i) the absolute income levels of those at the bottom of the pyramid are rising, (ii) new technologies such as mobile financial services reduce transaction costs and increase outreach, and (iii) financial inclusion has become a policy priority at high global levels. Financial inclusion is one of the channels through which ICT affects economic growth thus it will also contribute to growth of countries. Building on previous work by Beck and de la Torre (2006) and Beck et al. (2007), Kendall et al. (2010) investigate which factors that determine the outreach of the financial system. Their findings suggest that level of economic development, as well as population density and financial stability are of particularly importance for financial inclusion. They further conclude that electricity consumption and mobile phone diffusion have positive effects on financial access. ICTs allow for greater financial inclusion, and the financial services sector is a primary driver of communications and network technology. It is striking to see the role that ICT and innovative business models have played in the explosive growth of financial inclusion. In Sub-Saharan Africa the mobile phone is increasingly being used to extend financial services past the limits of bank branches. In Africa, the most visible case is Kenya, where active bank accounts have grown more than fourfold between 2007 and 2012. Innovative use of ICT has made management of large numbers of small transactions easier and the delivery of financial services in remote areas cheaper. Africa’s recent surge in mobile phone penetration looks promising for future progress towards greater financial inclusion (Faye and Triki, 2013). Technology developments such as telecommunication infrastructure and more advanced payment systems do not only reduce transaction costs but also expand reachable areas.The development of technological innovations can facilitate overcoming several of the obstacles that affect the supply and demand for financial services. By cutting costs even further, technology can make it feasible to reach an even broader population and can help expand operations in remote or sparsely populated rural areas. The delivery of financial services through digital channels, in particular through mobile, offer the greatest potential for reducing the costs of reaching a broader population and expanding operations in remote areas, while also enhancing the convenience of accessing the services, thereby tackling two of the main obstacles limiting financial inclusion. The experience of countries where digital payments are more widely available does suggest that this can be certainly a relevant and fast way of expanding access to financial services. In the medium and long term, the availability of smartphones and mobile broadband also offer an important potential for expanding different types of digital financial services. Figure 7 below shows the growth in the use of the internet worldwide. With almost universal access to the web, the range and quality of services could improve significantly. On the supply side, more data-rich services can help providers better assess risks using powerful analytical tools, as well as to develop more targeted and customer-centered service which would better fit the needs of customers.

| Figure 7. Individuals using the Internet per 100 inhabitants, 2005-2015 |

4. Conclusions and Policy Implications

- This paper is a preliminary overview on the impact of ICT development on financial inclusion. ICT development can lead to better financial inclusion and therefore facilitate financial development. Statistics show that financial development in Africa is slower than mobile phone subscriptions. The paper discussed potential benefits of financial inclusion for an economy. Further study is to be done to establish the empirical relationship between financial inclusion and ICT. It is important that governments pursuing financial inclusion consider the level of technology and ensuring its penetration in the various parts of the country. The increase in ICT development provides the much needed platform for financial inclusion to increase especially in Africa. Furthermore, ICT growth brings with it other macroeconomic benefits such as economic growth, employments and financial system stability through less information asymmetry. Further empirical analysis may be carried out to validate the statistical significance of the discussion herein.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML