Kemiki O. A., Odumosu J. O., Popoola N. I., Ogungbenro M. T., Falana F. F.

Department of Estate Management and Valuation, Federal University of Technology, Minna

Correspondence to: Kemiki O. A., Department of Estate Management and Valuation, Federal University of Technology, Minna.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

An empirical model for rental value prediction is herein presented considering the key factors that serve as its determinants. Using M.I. Wushishi Housing Estate in Minna, three (3) Linear models (with different number of parameters) and a polynomial model have been used in this research with the polynomial model adopted as the most suitable model. The study identified the major determinant factors of rental values within the study area.

Keywords:

Rental Value, Mathematical model, Determinant factors

Cite this paper: Kemiki O. A., Odumosu J. O., Popoola N. I., Ogungbenro M. T., Falana F. F., Empirical Model for Determination of Rent within M.I. Wushishi Housing Estate, Minna, Niger – State, American Journal of Economics, Vol. 5 No. 5, 2015, pp. 449-457. doi: 10.5923/j.economics.20150505.01.

1. Introduction

In recent times, determination of rent in Nigeria has often been left basically to the choice of the House owner who fixes prices based on his estimation of what the rent should be. Subsequently, as population increases, the rental values further continue to rise in response to demand and supply factors. This in most cases leaves the tenant as the person to bear the brunt of the (in most cases) unjustifiable flagrant house rent as the rents are increased with or without any further improvement on the building.Previous studies in real estate have examined the determinants of rents on industrial Properties [1], residential apartments [2] and shopping center rents [3] in the United States. In the Nigerian context, [4], [5], and [6] among other authors have carried out research on the determinants of rent on residential, industrial and commercial properties.[7] studies the relationship between house price and rent using the standard error correction model and the long horizon regression model since rent-price ratio is an indicator of valuation in the housing market.An empirical model for rents fixing is therefore here-in proposed which puts into consideration, the location of the property, Size of Land, type of house and other improvements (Services and Finishings) on the property using M.I Wushishi Housing Estate, Minna, Niger - State as case study.

2. Real Property Value Determinants

Generally, property refers to anything that can be owned or possessed; it can be tangible asset or an intangible asset. However, real estate means property [8]. Real estate differs from personal property in that the former is tangible while the later is intangible. Personal property refers to things that are movable and not permanently affixed to land [8], while real property means land or resources embodied in land of which neither is physically movable [9].Value is a subjective term and has many meaning depending on the context in which it is being used. A single property can therefore have different values such as sales value, rental value, and mortgage value amongst others. Estate values and economics usually express value in monetary terms and defined it as the power of a commodity to command other commodities in exchange [10]. The concern of land economists and appraisers is with the economic and market values. Valuer uses the word “value” to depict “market value” ([11]; [12]).Value of real estate is a function of physical, locational and legal characteristics of the property [8] and it is being influenced by; increase or decrease in population, change in age distribution of population, change in taste and fashion, change in technology, change in building methods, change in building cost, inflation and deflation, change in culture and planning control, Institutional factor, location and complementary uses ([12]; [10]).[10] identifies seven factors that affect property values. These factors are; population (increase or decrease), changes in fashion and taste, institutional factors (these are factors relating to people’s culture, religious belief and government action), technological factors, economic factors, location and complementary uses. [13] also identifies these factors under three major groups as external factors, internal factors and economic factors. The external factors include location and accessibility, internal factors include the individual features of the property such as number of bedrooms, plot size, garage, number of toilet, and so on, economic factors include individual’s purchasing power, the level of interest and inflation rates in the country. [14] maintained that prices of housing are subject to the influence of various neighborhood characteristics, such as the quality of nearby schools, the quality of the community environment, the development of neighbouring lands, and the status of public utilities and infrastructure.

3. Study Area

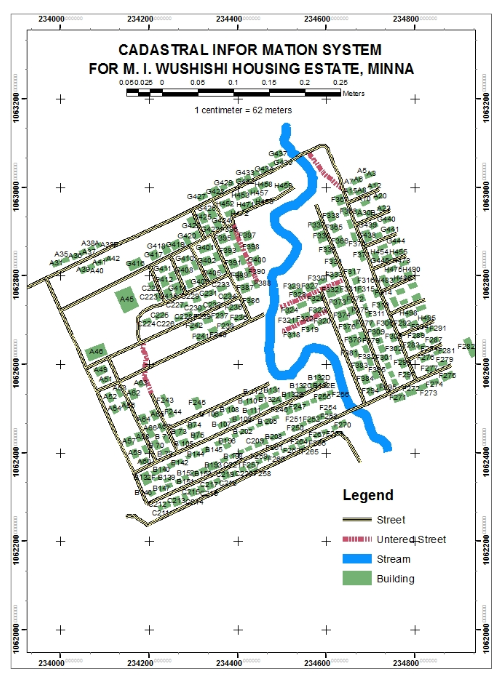

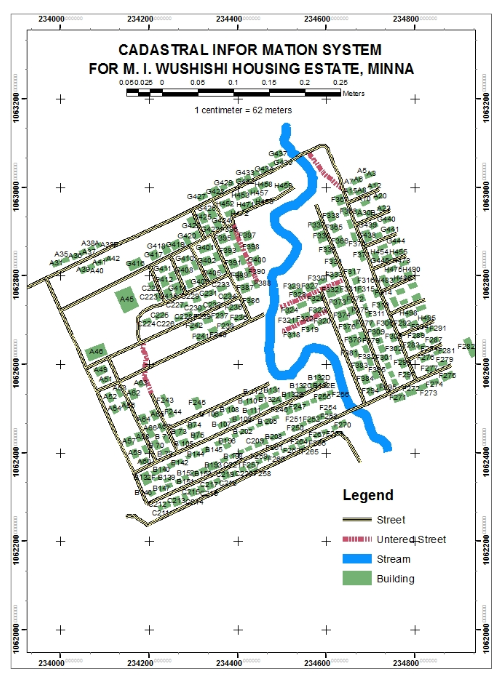

The study area used for this research are the flats located within M. I Wushishi Housing Estate, along the western Bye-Pass, Minna. The estate is a government residential estate built by the Niger State government to relief worker within the state capital of the pressure of getting decent accommodation within the estate. Although, the design within the blocks are homogeneous, the design (House Type and House finishing) vary across the blocks in-order to allow workers across all various income level to purchase within their means.Besides, as the residents move into the site, certain alterations (renovations, replacements and in few cases attachment structures) have been done haphazardly across the estate. Figure 1 shows a planimetric view of the study area. | Figure 1. Map showing the study area |

4. Data Used

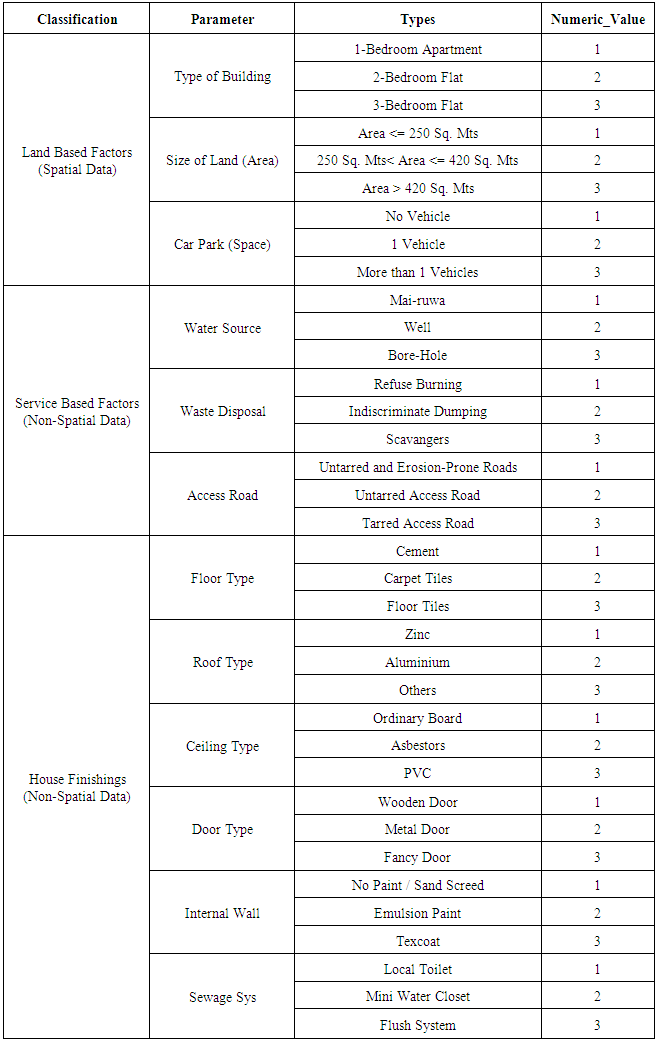

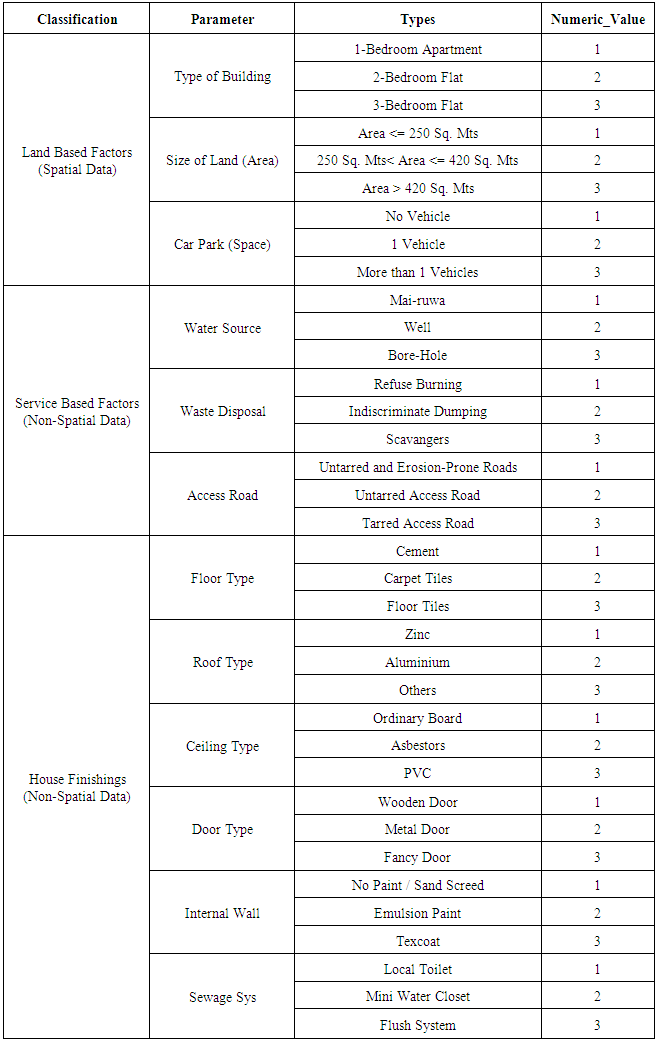

In this research, the parameters used are as shown in Table 1. For ease of data analysis, numerical weights were imposed on the various data thus converting them into numeric format as shown in the table. Table 1. The Data Used and their classification

|

| |

|

Since the data are basically of two (2) kinds (Table 1) i.e spatial (Land Based Factors) and non-spatial (Service based Factors and House Finishings); the non-spatial data and two of the spatial data (House Type and Car Park) were collected from the residents within the estate through questionnaires. The Size of the Land (Area) however was determined through chain survey method. Having measured the dimensions (and the diagonals where applicable) around each parcel of land, the Eular’s rule for area computation was then used as shown by equations 1(a) and (b). | (1a) |

| (1b) |

5. Methodology

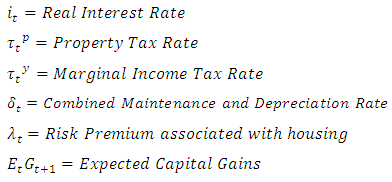

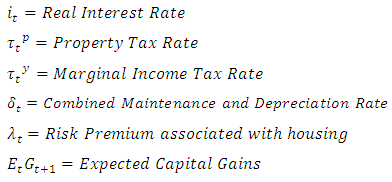

[15] gave a mathematical model of house prices and rents in a frictionless market (Equ. 1) such that rent should cover the user cost of housing: | (2) |

Where: Equation 1 mathematically describes the situation applicable to a new construction, however in an unstable economy where most of the economic indices required to satisfy equation 1 are seemingly uncertain, a simple regression model could be idealized as proposed in equation 2

Equation 1 mathematically describes the situation applicable to a new construction, however in an unstable economy where most of the economic indices required to satisfy equation 1 are seemingly uncertain, a simple regression model could be idealized as proposed in equation 2 | (3) |

Where:PR = Property RentThe measurable parameters include:Size of Property, Location of Property, Availability of Access Road, Water Source, Sewage System, Type of Ceiling e.t.cEquation 2 can then be re-written as equation 3 | (4) |

Equation 3 above describes a simple case of a linear regression model.Situations however arise occasionally where the outcome of events vary rapidly over time and as such cannot be described by a linear model and the use of a polynomial becomes inevitable. Since such polynomials are multivariate in nature, the expansion of such polynomial is given by conventional mathematics as equation 4: | (5) |

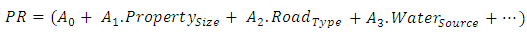

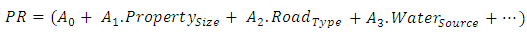

The methodology adopted for this study is presented in Figure 2. | Figure 2. Methodology Flow Chart |

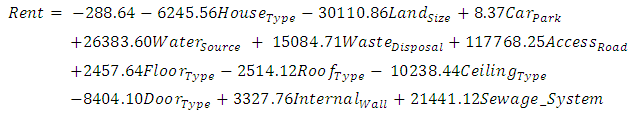

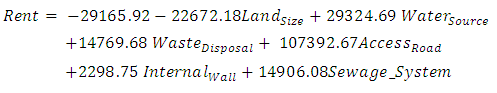

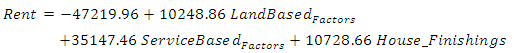

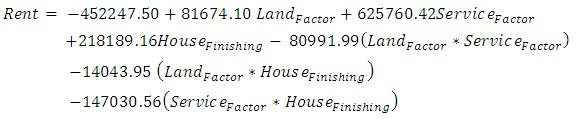

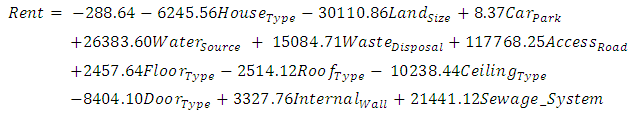

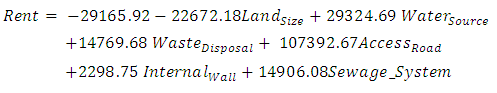

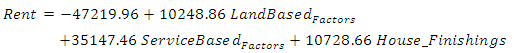

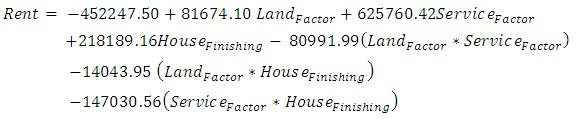

Based on the nomenclature stated in table 1, regression analysis was run to determine suitable linear models that can be used for predicting rental values within the study area. All twelve (12) parameters were first considered in linear model 1. Also a correlation test was performed between the rental values and the twelve (12) parameters. Results of the correlation test however shows that only six (6) out of the twelve initial parameters are significant in the rental value determination. A second iteration was thereafter done (called Regression analysis 2) in the methodology flow chart using the six (6) most significantly correlated parameters (i.e Size of Land, Water Source, Access Road, Waste Disposal, Sewage System and Internal Wall) and the obtained predictive model called linear model 2. Finally, the six (6) significant parameters were then concatenated into numerical values in their three (3) respective classes (i.e. Land Based Factors, Service Based Factors and House Finishing) while still ensuring that all classes have equal weight; reducing the parameters to three (3). A design matrix was then formulated from which the least squares technique was used to determine a linear model (called linear model 3 in the methodology flow chart) and a polynomial model for rental rate prediction within the study area.The linear predictive models developed are as shown in equations 6 (a – c) and the polynomial model in equ. 6(d) | (6a) |

| (6b) |

| (6c) |

| (6d) |

6. Results / Discussion of Results

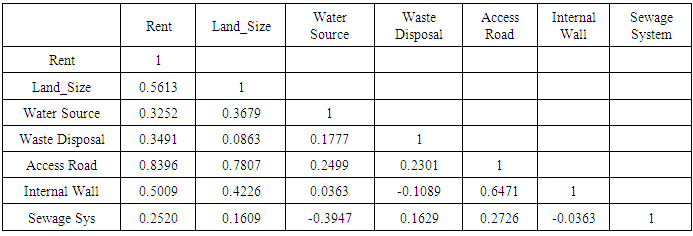

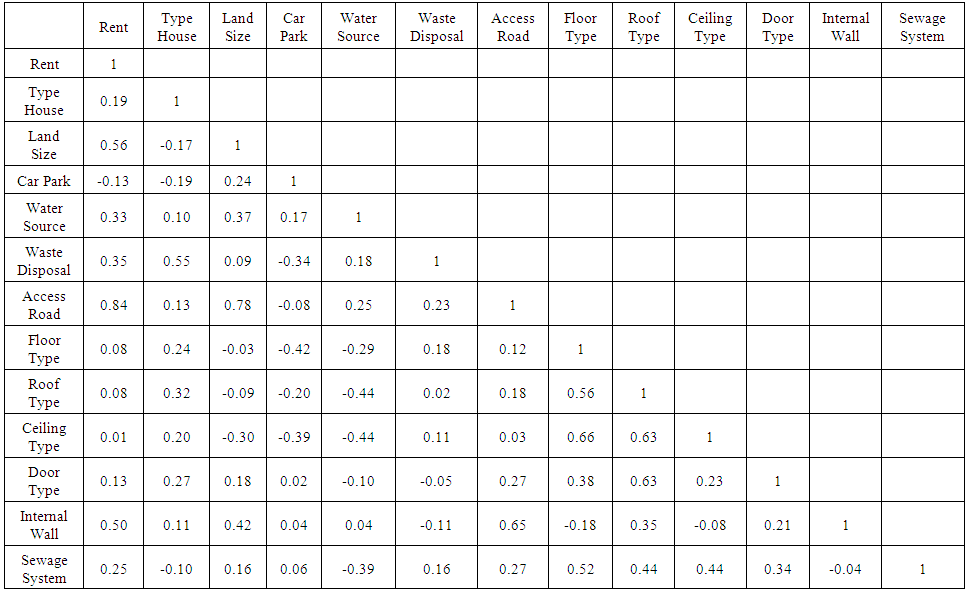

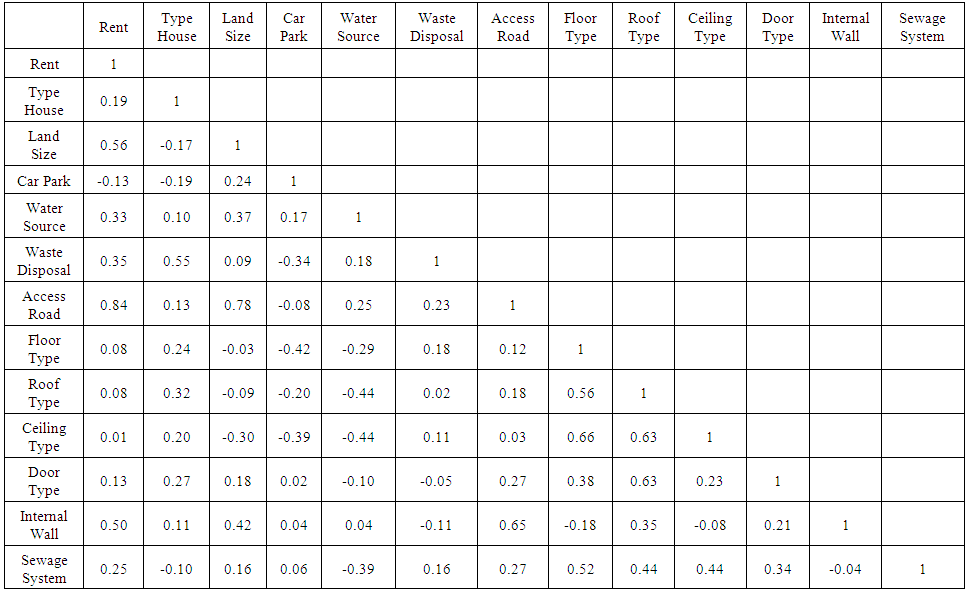

Shown in Tables 2(a – c) is the correlation table indicating the level of correlation between parameters and the rental value of properties within the study area.  | Table 2(a). Correlation Matrix of relationship between Rental Value and the parameters under study |

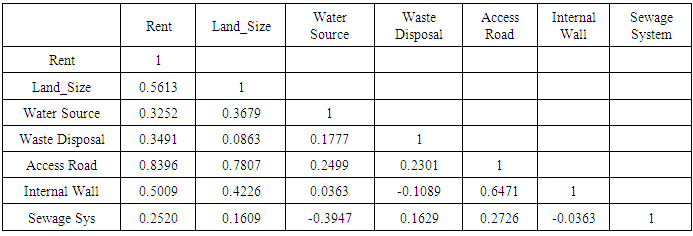

Table 2(b). Correlation Matrix of relationship between Rental Value and selected parameters

|

| |

|

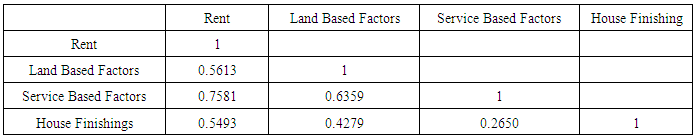

Table 2(c). Correlation Matrix of relationship between Rental Value and parameter categorization

|

| |

|

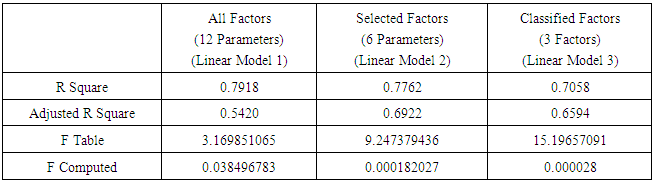

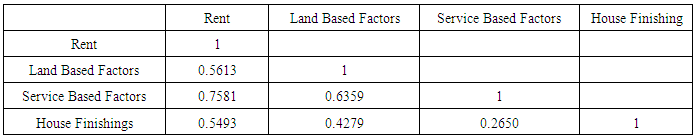

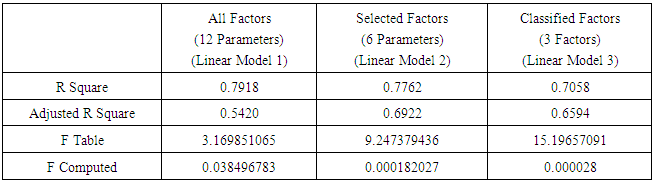

Consequent upon Table 2 (a), it is obvious that only six of the twelve parameters have much effect on rental values within the study area. This therefore means that the most critical determinants of rental value within the study area (listed in order of relevance) are:1. Available and well tarred Access Road (Location) – 0.842. The size of the Land upon which the property is situated (a probably reason for this could include the allowance of easement, convenience and recreation ground for the tenant) – 0.563. A well painted and decorated internal Wall – 0.504. A well planned means of waste disposal – 0.355. An hygienic and constant water source – 0.336. A good and decent Sewage System – 0.25Categorizing these parameters into three (3) convenient classes, table 2(c) shows us that tenants within the study area will pay more for service based factors that they can enjoy rather than the Land based factors or the House finishing. It is therefore advisable that property owners within the study area should rather spend more money on providing services (access road, good water and waste disposal facility) for tenants rather than choosing costly house finishing such as costly roofing material, expensive doors, floor tiles e.t.c. To scientifically justify the reduction in number of parameters used for building the linear models, and also determine the most suitable model for rental value prediction within the study area, the statistics of the regression analysis run in each of the three iterations were compared as shown in table 3.As shown from table 3, although, the goodness of fit of the first model seems to be more suitable, a look at the F-factor indicate that he smaller the number of parameters used, the more their significance on the resulting model. Therefore, Linear Model 3 is statistically the most suitable linear predictive model for rental value determination within the study area.Finally, the polynomial model was then compared with the linear model 3 to evaluate its suitability. Table 3 shows the residuals of predicted values using the linear model 3, polynomial model and the actual value at 23 sample properties. Table 3. Comparison of the performance of Linear regression model with different number of parameters

|

| |

|

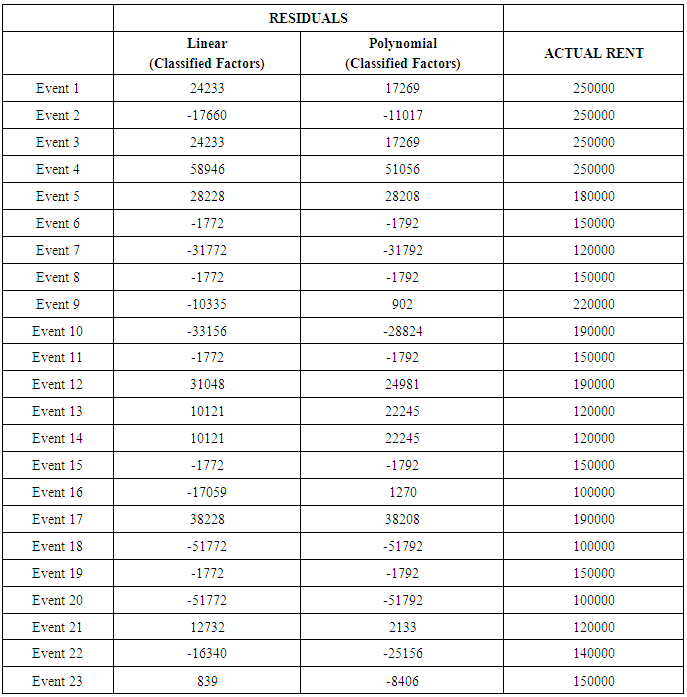

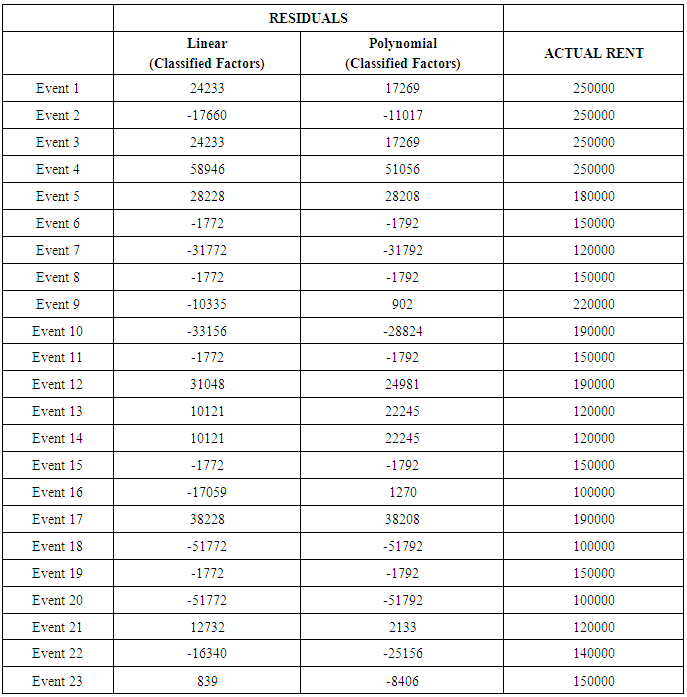

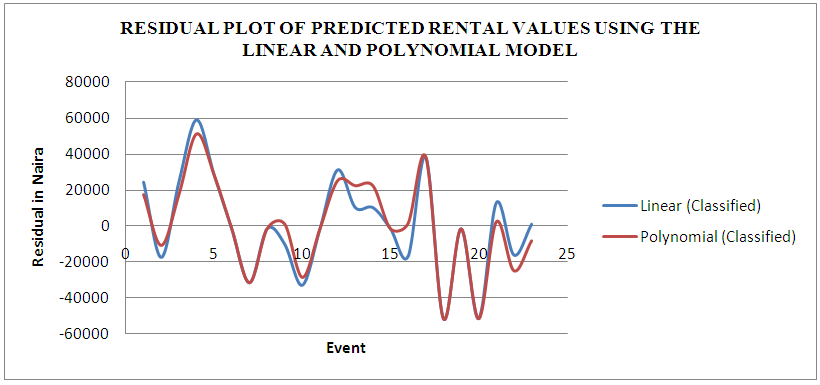

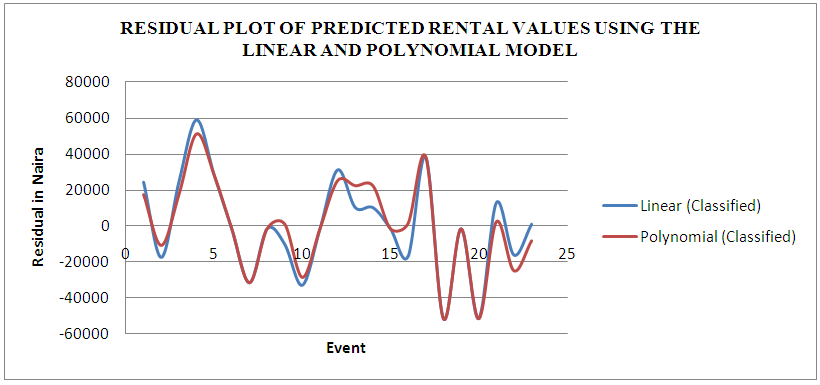

From Table 4, it is evident that the polynomial model gives a better fit at most of the sample properties as the residuals obtained from it are smaller compared to that of the linear model. However, anomalous behavior is observed at few locations such as event 13, event 14, event 22 and event 23. This probably suggests that the information provided by the resident at those locations is false.Table 4. Residual of Predicted Value (Linear Model 3 and Polynomial Model) with Actual Value

|

| |

|

Shown in Figure 2 is a graph of the prediction by the Linear and Polynomial model. | Figure 2. |

7. Conclusions

An empirical model for prediction of rental values within M. I. Wushishi housing estate has been developed. The polynomial model has proven better than the linear model within the study area and is therefore recommended.This study has also identified the key determinants of rental value within the study area as; Access Road, Land Size, Internal Wall, Waste disposal, Water source and Sewage System. Contrary to conventions, this research result shows that property owners should rather focus on service based factors and the internal wall if they desire increased rental income from their properties, rather than waste money on other house finishes like floor tiles, ceiling type, doors or roofing sheet.

References

| [1] | Thompson, B., and Tsolacos, (2000). Projections in the Industrial Property Market using a Simultaneous Equation System, Journal of Real Estate Research 19(1-2), 165-88. |

| [2] | Ge, X. J. and Du, Y. (2007), “Main Variables Influencing Residential Property Values Using the Entropy Method, the Case of Auckland”. Paper Presented at the Proceedings of the 5th International Structural Engineering and Construction Conference. Shunan, Japan. |

| [3] | McGough, T., Tsolacos, S., Olkkonen, O., (2000), “The Predictability of Office Property Returns in Helsinki, Journal of Property Investment & Finance”. |

| [4] | Udo, G.O., Egbenta I.R., (2007), “Effect of Domestic Waste Dumpsites on Rental Values of Residential Properties in Enugu”. The Nigerian Journal of Development Studies, 6(1): 79–98. |

| [5] | Bello, M.O and Bello V.A (2007), “The influence of consumer’s behaviour on the variables determining residential property values in Lagos, Nigeria”, American Journal of Applied Sciences 4(10): 774-778. |

| [6] | Udoekanem, N. B. (2012), “Effect of client pressure on market valuation of residential properties in Minna, Nigeria”. |

| [7] | Gallin, J, (2004) The Long-Run Relationship between House Prices and Rents. FEDS Working Paper No. 2004-50. |

| [8] | Ling, D. C. and Archer, W. R. (2006). Real Estate Principle: A Value Approach. New York: McGraw-Hill/Irwin Publisher. |

| [9] | Harvey, J. (2000). Urban Land Economics, Fifth edition. London: Macmillan Press Limited. |

| [10] | Oyebanji, A. O. (2003). Principles of Land Use Economics. Lagos: Sam-Otu Publishers |

| [11] | Adegoke, S.A.O. (2005). Fundamentals of Land Economics. Ibadan: Multi-firm Limited Publishers. |

| [12] | Millington, A. F. (1979). Introduction to Property Valuation. Great Britain: Pitman Press. |

| [13] | Olusegun, G. K. (2003) Principles and Practice of Property Valuation. (Volume One: General Principles). Climax Communications Limited, Lagos. |

| [14] | Chun-Chang, L and Hui-Yu, L (2014). The Impacts of The Quality of The Environment and Neighbourhood Affluence On Housing Prices: A Three-Level Hierarchical Linear Model Approach. Journal of Asian Economic and Financial, 4(5): 588-606. |

| [15] | Blackley, D. M. and Follain, J. R. (1996) In Search of Empirical Evidence that Links Rent and User Cost."Regional Science and Urban Economics 26:409-431. |

Equation 1 mathematically describes the situation applicable to a new construction, however in an unstable economy where most of the economic indices required to satisfy equation 1 are seemingly uncertain, a simple regression model could be idealized as proposed in equation 2

Equation 1 mathematically describes the situation applicable to a new construction, however in an unstable economy where most of the economic indices required to satisfy equation 1 are seemingly uncertain, a simple regression model could be idealized as proposed in equation 2

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML