-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(4): 417-422

doi:10.5923/j.economics.20150504.03

Cashless Policy and Economic Activities in Developing Countries (A Case Study of Nigeria)

Amire Comfort M.1, E. O. Omoare2

1Crawford University Igbesa, Ogun State, Nigeria

2Ogun State Institute of Technology (OGITECH) Igbesa, Ogun State, Nigeria

Correspondence to: Amire Comfort M., Crawford University Igbesa, Ogun State, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Economic activities can be described as legal activities that create and distribute utility from points of production to places of final consumption at a price. Economic activities have been classified into productive activities, commercial activities, distributive activities and service activities. Economic activities are embarked on by two separate economic agents identified as suppliers and buyers. The advent of money resulted into growth and development in economic activities. However, negative consequences associated with cash-based transactions necessitated the adoption of cashless policy. The cashless policy is a policy that encourages more electronic-based transactions. The aim of this study is to determine how some factors of cashless policy impact on economic activities. Some of these factors are availability of power, infrastructures and literacy level. Findings revealed that cashless policy has contributed to the promotion of technology enhanced businesses. In addition, constant and regular supply of electricity will aid cashless policy, thereby strengthening economic activities in Developing countries.

Keywords: Cashless policy, Economic activities., Cash-based economy, Electronic-based transactions

Cite this paper: Amire Comfort M., E. O. Omoare, Cashless Policy and Economic Activities in Developing Countries (A Case Study of Nigeria), American Journal of Economics, Vol. 5 No. 4, 2015, pp. 417-422. doi: 10.5923/j.economics.20150504.03.

Article Outline

1. Introduction

- Economic activities are legal activities that create and distribute utility from the points of production to places of final consumption usually with a price exchange. Economic activities involve incurring cost and making profit. Therefore, economic activities are all activities that are legal in form that generate revenue at a cost. Economic activities can be classified into productive activities, commercial activities distributive activities and service activities. Each activity is concerned with obtaining maximum satisfaction through efficient use of scarce resources (Mc Connel and Brue [1], 1999; Abiraj, 1998) [2]. Economic activities are embarked upon by two parties who relate with themselves through transactions that involve exchange of products for money. These two parties are referred to as economic agents and are separately identified as suppliers or producers and buyers or demanders. In the primitive economies, economic activities only took place through the barter system or trade by barter where goods were exchanged for goods and services for services. Therefore, the primitive economy is regarded as a barter economy. However, barter economies have faced problems such as double coincidence of wants, no common measurement of value, indivisibility of some goods etc. With a view to solving the problems encountered in a barter economy and to aid efficiency in economic activities, a number of commodities had served as money at different periods of history and in different communities (Miller, 1996) [3]. Adekanye (1983) [4] had noted that through the ages, different “things” have served different societies as money. These range from food items (e.g salt, corn or rice), implements (e.g hoes or cutlass), metals (e.g copper, iron or gold), paper money and book entries of commercial books. He opined that the only common factor about these terms was the general acceptability by a particular society of them as a means of payment. For example in Nigeria, cowries have served as money. The advent of money resulted into growth and development in economic activities. Subsistence production that featured in the primitive economies evolved into commercial production aided through technological development and population growth. Thus, the barter economies with the introduction and usage of money collapsed and the economy became what is regarded as money economy. However, money economies are characterized mostly with cash-based transactions (withdrawals and deposits) in banks. Also, in all money economies the amount of physical cash (coins and notes) circulating in the economy is enormous. This and other reasons made the Central Bank of Nigeria (CBN) introduced a new policy referred to as the cashless policy. The cashless policy is a policy on cash-based transactions, which stipulates a ‘cash handling charge’ on daily cash withdrawals or cash deposits that exceed N500,000 for individuals and N3,000,000 for corporate bodies. This policy encourages more electronic – based transactions (payments for goods, services, transfer etc). The new policy on cash-based transactions (withdrawals and deposits) in banks aims at reducing (NOT ELIMINATING) the amount of physical cash (coins and notes) circulating in the economy. This policy seeks to turn a money economy to what can be regarded as a cashless economy. A cashless economy is a shift from cash-based transactions to electronic-based transactions. The Central Bank of Nigeria (CBN) stated the following as key reasons why the cash policy was introduced. These include:- To drive development and modernization of our payment system in line with Nigeria’s vision 2020 goal of being amongst the top 20 economies by the year 2020. An efficient and modern payment system is positively correlated with economic development and is a key enabler for economic growth. - To reduce the cost of banking services (including cost of credit) and drive financial inclusion by providing more efficient transaction options and greater reach. - To improve the effectiveness of monetary policy in managing inflation and driving economic growth. [5] The pertinent problem of the study is to examine the negative consequences of non-availability of electricity, inadequacy of electronic-based infrastructures and the challenges non-literate economic agents face in the use of available technologies in a bid to comply with the cashless policy.

2. Objectives of the Study

- The general objective of the study is to determine the impact of cashless policy on economic activities in Nigeria. However, specific objectives of the study are to: - examine the effect of availability of supply of electricity on cashless policy. - assess the effect of availability of infrastructures on cashless policy. - assess the effect of literacy level on the cashless policy.

3. Review of Literature and Theoretical Framework

- Quantity Theory of Money (QTM) is a macro economic policy of government designed to control the level of economic activity in the country. QTM is the core a priori theory upon which this study is based. QTM claims that the level of prices in the economy is directly related to the quantity of money in the economy. Hetzel (1993) [6] stated that the QTM is one of the oldest and most useful ideas in economics which explains the determination of variables measured in dollars (or naira) such as the price level. He further stated that Milton Friedman and Anna Schwartz had given the quantity theory a specific form, known as monetarism, through their hypothesis that shifts in the money supply schedule have been large relative to shift in the money demand schedule. The quantity theory of money (QTM) is an economic idea that states that the supply of money in an economy determines the level of prices and changes in the money supply result in proportional changes in prices. According to Investopedia, the quantity theory of money in its simplest form can be outlined using the Irving Fisher’s equation as MV = PTThe above equation is interpreted as follows M = Money supply or stock of money in a given country. V = Velocity of circulation i.e the number of times the money supply circulates around the economy in a given period of time.P = Average price level of goods and services.T =Transactions total number of goods and services sold or added to stock in a given period of time. [7] MV is the money supply multiplied by the number of times it flows around the economy buying goods and services over a particular period of time. It is the same as the total expenditure, GNE, over that period of time. PT is the total of goods and services produced multiplied by the price at which they are on average sold. This is the same as total production GNP, over the particular period of time. GNE = GNPTherefore, MV = PTMoney spent on goods is necessarily the same as the value of which the goods were sold. The Central Bank of Nigeria (CBN) Cashless Project The Central Bank of Nigeria (CBN) introduced a new policy on cash-based transactions which stipulates a cash handling charge on daily cash withdrawals or cash deposits that exceed N150,000 for individuals and N3,000,000 for corporate bodies. The new policy on cash based transactions (withdrawals and deposits) in banks, aims at reducing (NOT ELIMINATING the amount of physical cash (coins and notes) circulating in the economy and encouraging more electronic-based transactions (payment for goods, services transfer etc). Financial System and the Cashless Policy Financial system is defined as the system that allows the transfer of money between savers / investors and borrowers to take place. It helps to allocate scarce resources in an economy. It helps in channeling household savings for utilization by the corporate sector. It also allocates investment funds among firms. One of the aims of the Central Bank of Nigeria (CBN) in embarking on the cashless policy is to reduce cash handling. The CBN further stated that an efficient and payment system is a feature of economic development and a key enabler of economic growth. In addition, a well organized payment system would cause to reduce the cost of banking services (including cost of credit), while driving financial inclusion by providing more efficient transaction options and greater reach (Folarin, 2014) [8].The cashless policy has helped as a tool to drive online and mobile-based transactions, using infrastructural facilities such as the internets, Point of Sale (POS) credit cards and the automated teller machine (ATM). Modernization of the financial system in Nigeria in line with the global trend will help corporate organizations enjoy faster access to capital, reduced revenue leakage and reduced cash handling costs. The introduction of the cashless policy has helped e-ecommerce to achieve greater penetration. Thus, a modern financial system backed up by the cashless policy helps to improve economic activities. Moreover, Oginni, El-Maude, Hambo, Abba and Onuh (2013) [9] asserted that several studies revealed that e-payment system is increasingly gaining users’ acceptance and there is gradual increase in the percentage of non-cash transactions in the last few years. Impact of Cashless Policy on Business in Nigeria One of the aims of the cashless policy is to work in line with Nigeria’s vision 2020 goal of being among the top 20 economies of the year 2020. This indicates that businesses and economic transactions cannot be underestimated. Since production and other economic activities such as buying and selling would have to be paid for, the cashless policy facilitates e-transactions and e-payment. Thus, cash-based transactions and physical handling of cash are deemphasized. This indicates that business people and businesses must open bank account in order to be financially inclusive. This further helps to strengthen CBN’s policy on financial inclusiveness. The cashless policy thrives better in the urban sector of the economy where literacy level is high and where majority of the economic activities take place. The cashless policy has developed a new form of businesses and employment opportunities for entrepreneurs, business people, professionals and job seekers. Infrastructures that facilitate the cashless policy need to be produced by some firms and distributed by other business concerns. Also, repairs and services need to be carried out by either the producers or other service related firms. Therefore, cashless policy has successfully brought about the development of integrated businesses. Economic Activities in the Nigerian Economy Economic activities involve the production, distribution and consumption of goods and services at all levels within a society. It is commonly measured by the Gross Domestic Product (GDP). The interaction between economic activities and the financial payment system is regarded as the economy. The Nigerian economy has been described as one of the most developed in Africa. The United Nations classified Nigeria as a middle income country with developed financial communication and transaction. It has the second largest stock exchange in the continent. The country practices a mixed economic system and is an emerging market.Nigeria recently changed its economic analysis to account for rapidly growing contributors to its GDP, such as telecommunication, banking and its film industry, as a result of this statistical revision, Nigeria has added 89% of its GDP, making it the largest African economy. Nigeria’s revealed re-based GDP figures for 2013 showed 89% jump in the estimated sized. The new re-based data shows that the size of the Nigerian economy is now estimated at N80.3trillion ($510 billion) for 2013. The new figures show that Nigeria has surpassed South Africa as the largest economy in Africa after overhauling its GDP data for the first time in two decades. Re basing of the national account series (which includes the GDP) is the process of replacing an old base year to compile volume measures of GDP with a new and more recent base year. [10]Economic activities are linked with economic agents. Productive activities of economic agents constitute economic activities. The interaction of these economic agents produces the national income. ThereforeGNP = C + I + G + (X – M)Consumption (C): This makes the largest part of the economy. A large domestic population forms a large market and consumes a large quantity of goods and services. Investment (I): This include: purchases of firms and organizations. Purchases of business organizations can be in form of fixed investment and inventories.Government (G): This is expenditures of government aimed at expanding the economy. It can either be current or capital.

4. Methodology

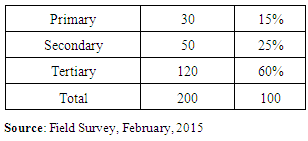

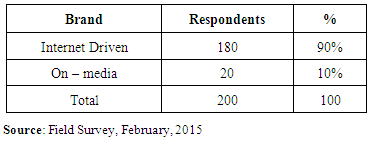

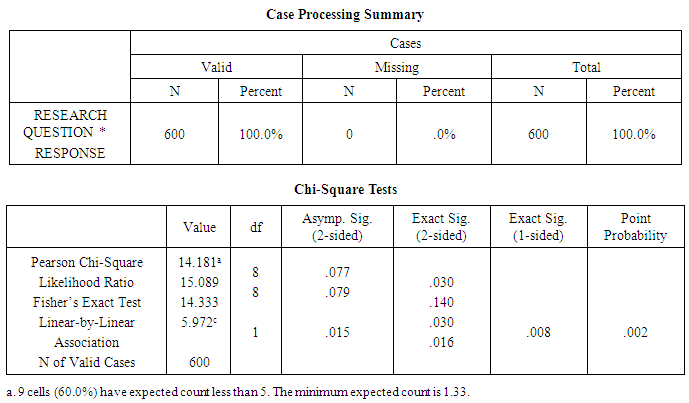

- The study was based on applied research where theoretical concepts are tested for actual problem solution. Population consists of all economic agents involved in economic activities. Area or cluster sampling technique was used in sample selection for the study. The chosen sample was Ado-Ode / Ota Local Government in Ogun State where the industrial estates of the state is mostly localized and a greater proportion of economic activities is transacted. The sample consists of two hundred respondents made up of one hundred and twenty demanders and eighty suppliers. Data Instrument, Analysis and Presentation

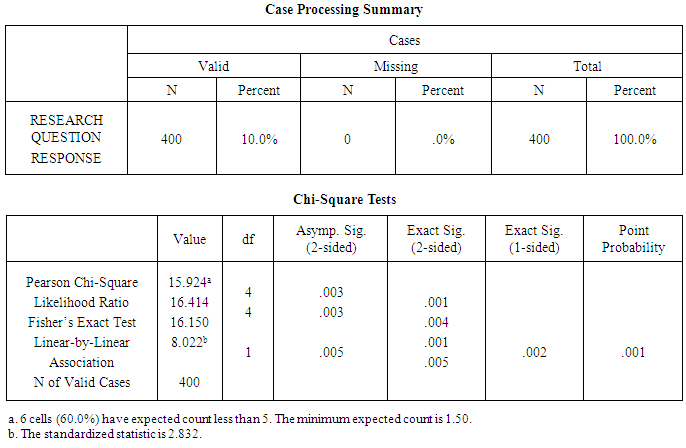

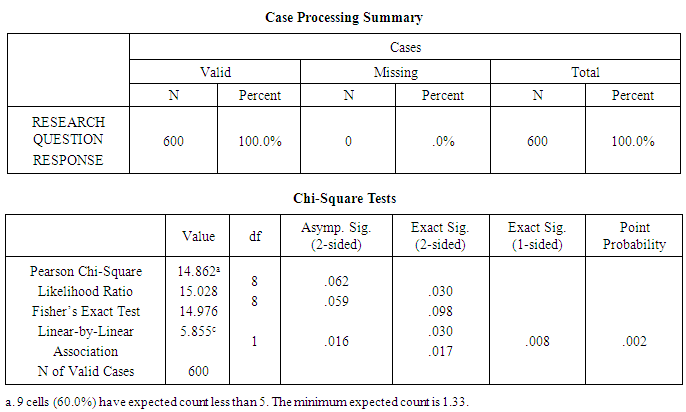

|

|

|

|

|

5. Summary, Conclusions and Recommendations

- Nigeria is primarily a cash economy but the CBN’s cashless policy on withdrawals and deposits in banks is aimed towards reducing the amount of physical each and encouraging more electronic-based transactions in payments for goods, services and fund transfers. In a cashless economy, little or very low cash flow is permitted. The cashless policy is a major global shift and / or a shift in policy paradigm which affects the payment system. The cashless policy has contributed to the promotion of technology enhanced businesses such as e-business and related web, internet and mobile phone/communication based businesses. Literates and technologically inclined people are favourably disposed towards the CBN cashless policy. Instructions and infrastructures utilization are in most cases stated in English Language. This suggests the need for increased literacy rate. Some vitally important infrastructures, needed for efficient cashless policy, need constant supply of power for efficient operations. The problem of epileptic power supply and low voltage is a challenge to the cashless policy. This negative situation will affect economic activities. The following recommendations are hereby stated: Government need to invest more on power and put in place policies that will make the power sector more effective and efficient. Enlightenment and educative programmes should be embarked on to orientate both literates and non-literates on infrastructures utilizations.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML