B. K. Obioma1, Eke Charles N.2

1Department of Economics, Imo State University, Owerri, Nigeria

2Department of Mathematics and Statistics, Federal Polytechnic Nekede, Owerri, Nigeria

Correspondence to: Eke Charles N., Department of Mathematics and Statistics, Federal Polytechnic Nekede, Owerri, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

This work investigated the interaction of Crude Oil Price, Consumer Price Level and Exchange Rate in Nigeria using the Vector Autoregressive (VAR) Model. A monthly data (January, 2007-February, 2015) obtained from the Central Bank of Nigeria was used for the analysis. The analysis showed that all the variables were integrated of order one I (1) and no long-run relationship existed among them. The work also revealed that a shock on crude oil price had a negative impact on exchange rate. More so, variation in exchange rate was substantially caused by crude oil price. Furthermore, a shock on exchange rate had a negative effect on consumer price level. Therefore, government was advised initiate policies that will diversify the income stream of Nigeria’s economy. Similarly, a policy that will promote an enabling environment for local investors to produce goods locally so as to conserve foreign exchange was equally encouraged.

Keywords:

Vector Autoregressive Model, Consumer Price Level, Impulse Response Function and Variance Decomposition

Cite this paper: B. K. Obioma, Eke Charles N., An Empirical Analysis of Crude Oil Price, Consumer Price Level and Exchange Rate Interaction in Nigeria: A Vector Autoregressive (VAR) Approach, American Journal of Economics, Vol. 5 No. 3, 2015, pp. 385-393. doi: 10.5923/j.economics.20150503.10.

1. Introduction

Nigeria discovered crude oil in 1956 and it became an export commodity in 1958. Prior to the discovery of crude oil, the export commodities were agricultural products. The production level of crude oil in the country has fluctuated over the years due to OPEC’s quota and socio-political instability. Following its discovery, crude oil has become major source income and foreign exchange for the country, thereby contributing to over 80% of the federal government’s revenue. Recently, the global price of crude oil dwindled in the international market; this led to a shock on the foreign exchange rate of the country and thereby affected consumer prices. Invariably, Exchange rate is the price for which the currency of a country can be exchange for another country’s currency [5]. Exchange rate is said to depreciate if the amount of domestic currency required to buy foreign currency increases, while the exchange rate appreciates if the amount of domestic currency required to buy a foreign currency reduces. An appreciation in the real exchange rate may create current account problems because it leads to overvaluation. Overvaluation in the turn makes imports artificially cheaper while export relatively expensive, thus reducing the international competitiveness of a country [12]. Exchange rate volatility refers to the swings of fluctuations in the deviations from a benchmark or equilibrium exchange rate [8]. Therefore, for an import dependent country like Nigeria, there is a need to understand the interaction existing among crude oil price, consumer price level and exchange rate. Thus, how does exchange rate react to a shock on crude price? To what extent does consumer price level reacts to a shock on exchange rate due to crude oil price jolt?

2. Literature Review

[9] studied the effect of oil price shock on aggregate economic activities in Nigeria using quarterly data from 1970 to 2003. Volatility was measured as the conditional variance of the percentage change of the normal oil price. The five variables used for the empirical study were gross domestic product (real GDP) as proxy for industrial production index, domestic money supply, the real effective exchange rate, the inflation rate, and real oil price. The findings showed that while oil price significantly influenced exchange rate, it did not have significant effect on output and inflation in Nigeria. He concluded that an increase in the price of oil results in wealth effects which appreciates the exchange rate.[6] employed a vector autoregressive model (VAR) to compare the effects of oil price and real effective exchange rate on the real economic activity in Russia, Japan and China. He first applied a lag Augmented VAR (LA-VAR) approach causality test to investigate whether the oil price shock and exchange rate volatility ganger-cause the economic growth in Russia, Japan and China. In addition, cointegration technique was used to examine how the real GDP of Russia, Japan and China are affected by changes in oil prices and the exchange rate in the long-run. To get the short-run of the model, a vector error correction model (VECM) was employed to analyze the short-run dynamics of the real GDP for the three countries. His findings indicated that oil price increases impact negatively on economic growth of Russia. [2] assessed the impact of oil price shock and real exchange rate volatility on the real gross domestic product in Nigeria using quarterly data that span the period 1986-2007. He used the Johansen VAR-based cointegration technique to examine the sensitivity of real GDP to change in oil prices and real exchange rate volatility in the long-run while the vector error correction model was used in the short-run. The result of the long-run analysis indicated that a 10.0 percent increase in crude oil prices increased the real GDP by 7.72 percent, similarly a 10.0 percent appreciation in exchange rate increased GDP by 0.35 percent. The short-run dynamics was found to be influenced by the long-run equilibrium condition. He recommended the diversification of the economy and infrastructural diversification.[7] employed basic data from OPEC countries for the period 1975 to 2005 to examine the determinants of equilibrium real exchange rates in some selected oil-dependent countries. The result indicated that oil price had significant effect on real exchange rates in the group of oil producing countries. It showed that higher oil price cause real exchange rate appreciation. [3] used a multivariate frame work to measure the short-run impact of oil shocks on economic growth, inflation, real wages and exchange rate. Short-run impacts were examined using linear and nonlinear oil price transformation. The generalized impulse responses and error variance decomposition results confirm there is a direct link between net oil price shock and growth and its indirect linkages through inflation and the real exchange rate. The paper thus concluded that oil prices exhibit substantial effects on inflation and exchange rate in New Zealand.[4] examined whether oil price had an impact on the real exchange rates of three oil-exporting countries namely; Norway, Russia and Saudi Arabia. The authors developed a measure of the real effective exchange rates for Norway and Saudi Arabia (1980-2006) and for Russia (1995-2006). They tested if real oil prices and productivity differentials against 15 OECD countries-influences exchange rate. The results showed that in Russia, there was a positive relationship rate in the long run. In case of Norway and Saudi Arabia, the results indicated that there were no significant impacts of real exchange rates. The results further indicated that different exchange rate regimes for these countries could not explain why the impact of oil prices differs across countries but adduce the development to other policy responses, such as the accumulation of net foreign assets and sterilization, as well as specific institutional characteristics.

3. Methodology

In order to understand the interaction among the three variables, the vector autoregressive model (VAR) was employed to assess the relationship. However, before estimating the model, the properties of the variables were verified in terms stationarity and long term relationship. The econometric tools that were used for these verifications are the Augmented Dickey-Fuller test for stationarity and Johansen co-integration test for long term relationship. In addition, the direction of causality among these variables was ascertained using the Granger Causality test. Nevertheless, impulse response function and variance decomposition were used to evaluate the effects of shocks and variations caused by variable itself and other variables respectively.The data for this research were obtained from the Central Bank of Nigeria. The scope was a monthly data from January, 2007 to February, 2015, while the variables are:1. Inflation Rate (INF) – proxy for consumer price level2. Exchange Rate (EXC)3. Crude Oil Price (CPR)

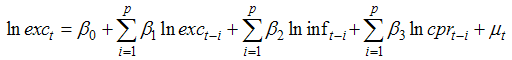

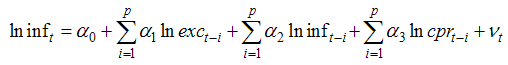

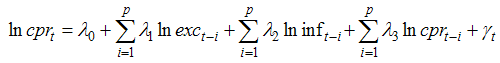

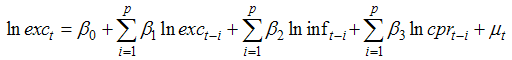

3.1. Model Specification

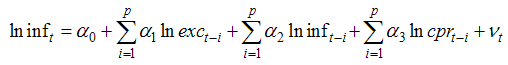

The VAR models to establish the interactions among these variables are: | (1) |

| (2) |

| (3) |

Where:lninf = natural logarithm inflation rate as a proxy for consumer price levellnexc = natural logarithm of nominal exchange ratelncpr = natural logarithm of crude oil pricet = current time  = parameters of the explanatory variables.

= parameters of the explanatory variables.

4. Results

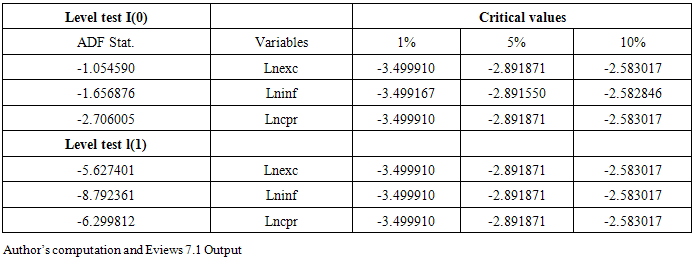

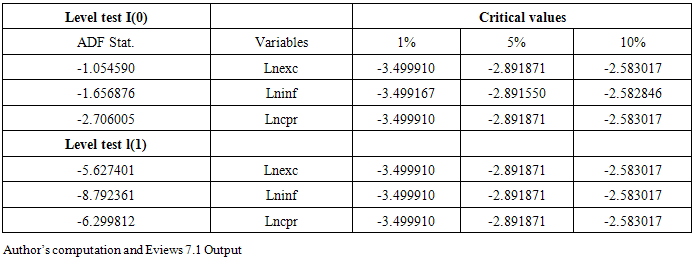

4.1. Unit Root Test

All the variables were tested for stationarity, from table 1 above it showed that they are all integrated of order one I(1) after the first differenced series showed stationarity.Table 1. Stationarity test of the variables

|

| |

|

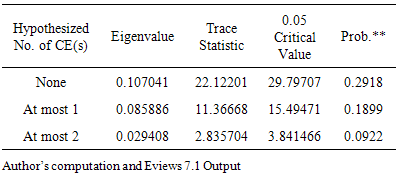

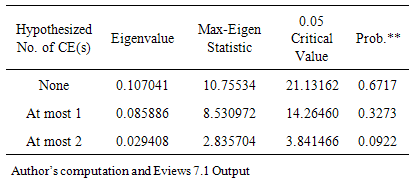

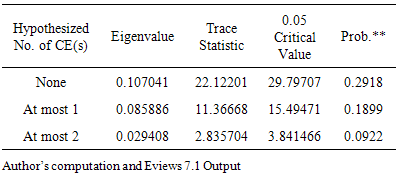

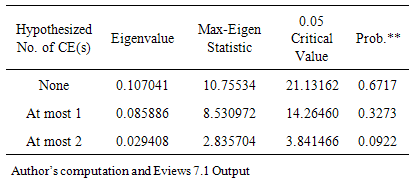

4.2. Cointegration Test

One of the conditions for the use of VAR model is that the stationary variables of order one I(1) must not be co-integrated. Therefore, to verify this condition, if there was a long term relationship existed among these variables, a co-integration test was carried out using the Johansen cointegration test.From tables 2 and 3 above showed that there was no co-integration among the three variables. Therefore, no long-run relationship existed among the variables within the period and this has confirmed the use of VAR model.Table 2. Test (Trace)

|

| |

|

Table 3. Test (Maximum Eigenvalue)

|

| |

|

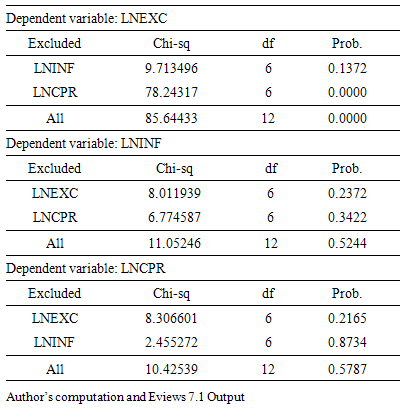

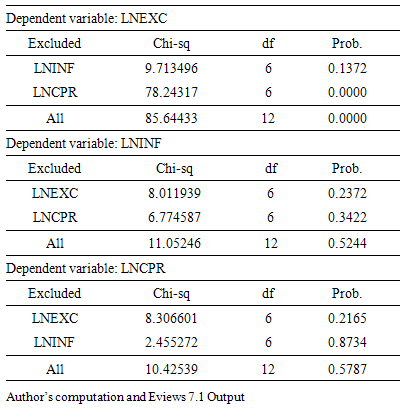

4.3. Granger Causality Test

The Granger causality analysis presented in table 4 showed that most of the variables did not cause each other. Nevertheless, there was a case of unidirectional causality from crude oil price to exchange rate at 5% significance level.Table 4. Granger Causality test of the variables

|

| |

|

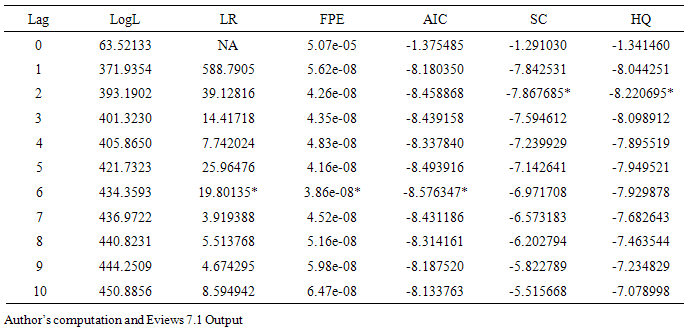

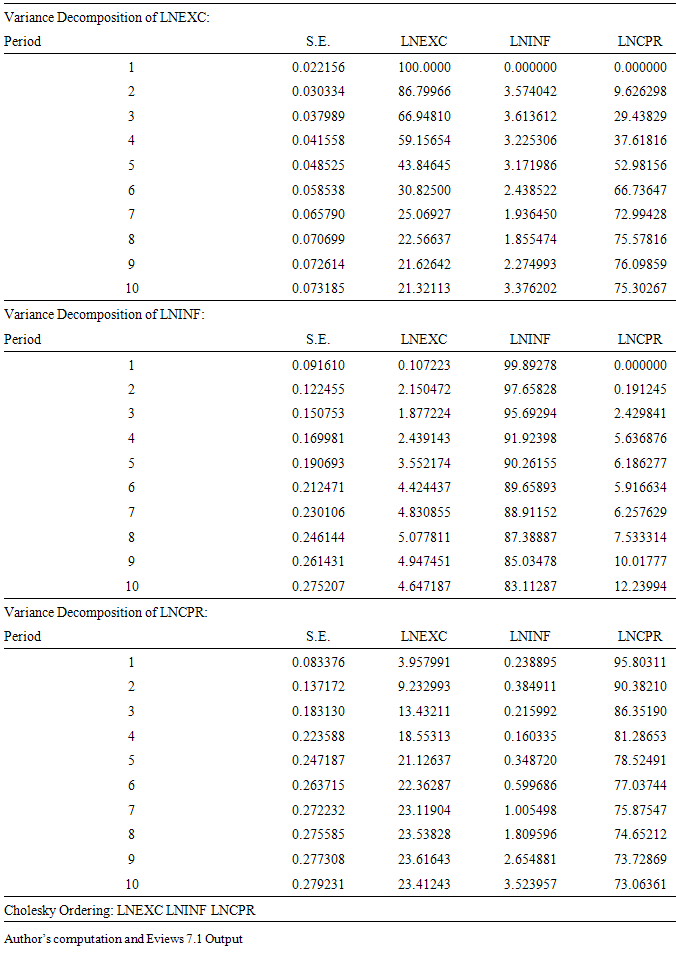

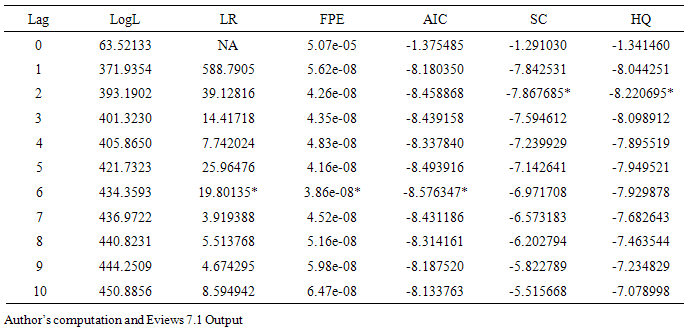

4.4. VAR Lag Order Selection Criteria

In VAR model estimation, the lag length is very important. Therefore, using the lag order selection criteria in table 5, it showed that most of the instruments selected lag length of 6. This lag length will be used in the model estimation and more so, to obtain the minimum values of the information criterion.Table 5. VAR Lag Order Selection Criteria

|

| |

|

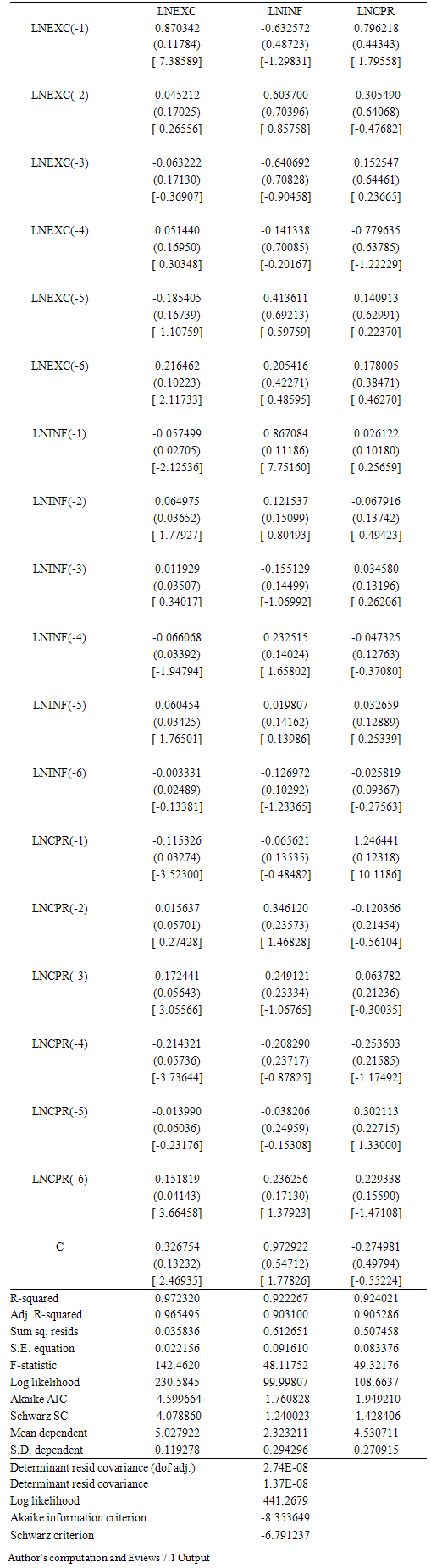

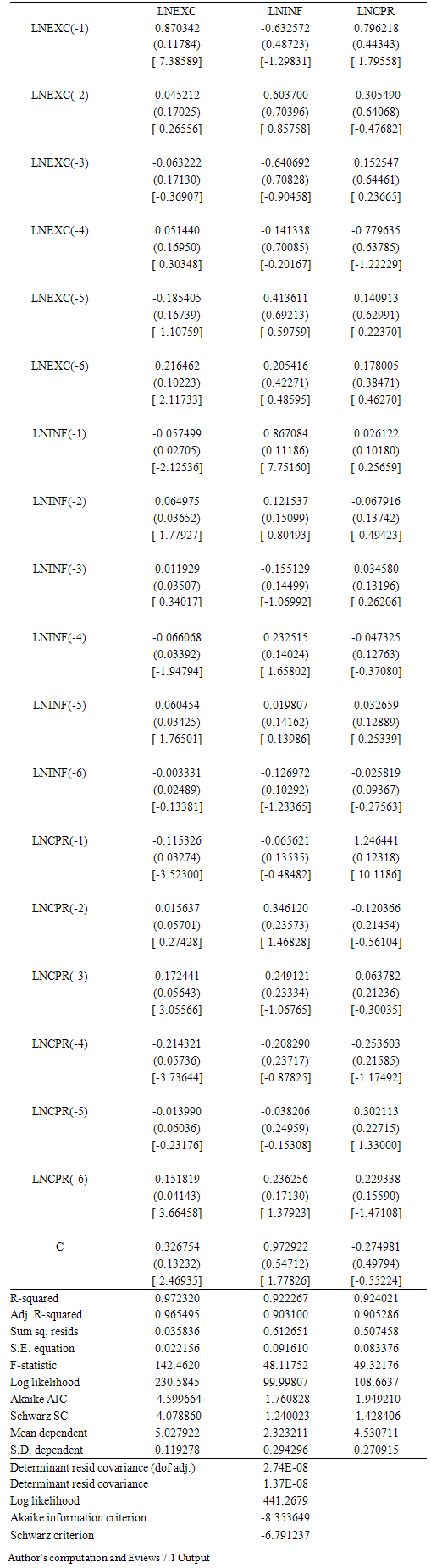

4.5. Model Estimation

The Vector Autoregressive (VAR) model was used to assess the interaction and shocks with respect to the three variables used for this research work using monthly data from January, 2007 to February 2015.The estimated result in table 6 showed that  of 0.9723 which indicated 97% of total variation in exchange rate can be explained by the explanatory variables. The adjusted

of 0.9723 which indicated 97% of total variation in exchange rate can be explained by the explanatory variables. The adjusted  of 0.9655 or 97%, showed that the explanatory variables were robust in explaining the variation in exchange rate. The

of 0.9655 or 97%, showed that the explanatory variables were robust in explaining the variation in exchange rate. The  for consumer price level and crude oil price were 0.9222 and 0.9240 respectively. While, the adjusted

for consumer price level and crude oil price were 0.9222 and 0.9240 respectively. While, the adjusted  of 90% and 91% respectively for consumer price level and crude oil price indicated that the level of variations explained by the explanatory variables. Nonetheless, the respective F-statistic was statistically significant at 5% and the model was a good fit. The individual parameters of the variables cannot be interpreted; therefore, a block-F test will be used to verify the collective impact of the explanatory variables.

of 90% and 91% respectively for consumer price level and crude oil price indicated that the level of variations explained by the explanatory variables. Nonetheless, the respective F-statistic was statistically significant at 5% and the model was a good fit. The individual parameters of the variables cannot be interpreted; therefore, a block-F test will be used to verify the collective impact of the explanatory variables.Table 6. Model Estimation Result

|

| |

|

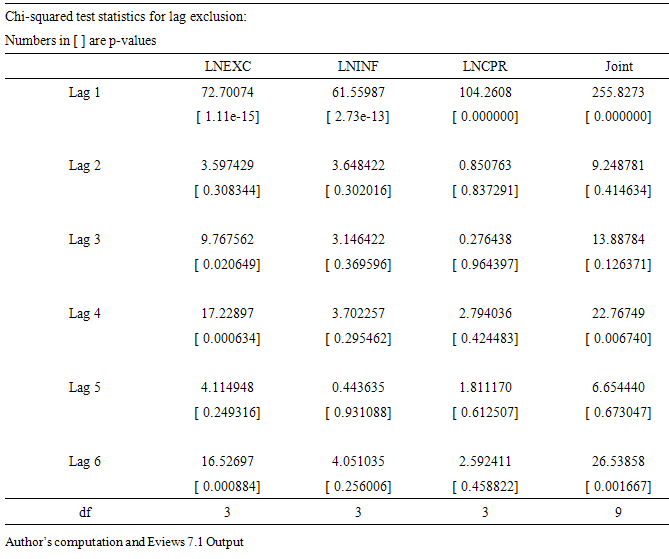

Table 7. VAR Lag Exclusion Wald Test

|

| |

|

4.6. Block-F Test

The exclusion test using the block-F test in table 7 above indicated that the parameters of all lag 1 variables were significant and jointly significant as well. Parameters of all lag 2 variables were both individually and jointly insignificant, and this is the same for parameters of lag 5 variables. The parameters of lag 3 variables were only significant in exchange rate model. The parameters of lag 4 and lag 6 displayed the same behavior. Nonetheless, there is no economic theory supporting the impact of these parameters. Therefore, the need for impulse response function (IRF) and variance decomposition for more understanding of the dynamic shock effects of these variables.

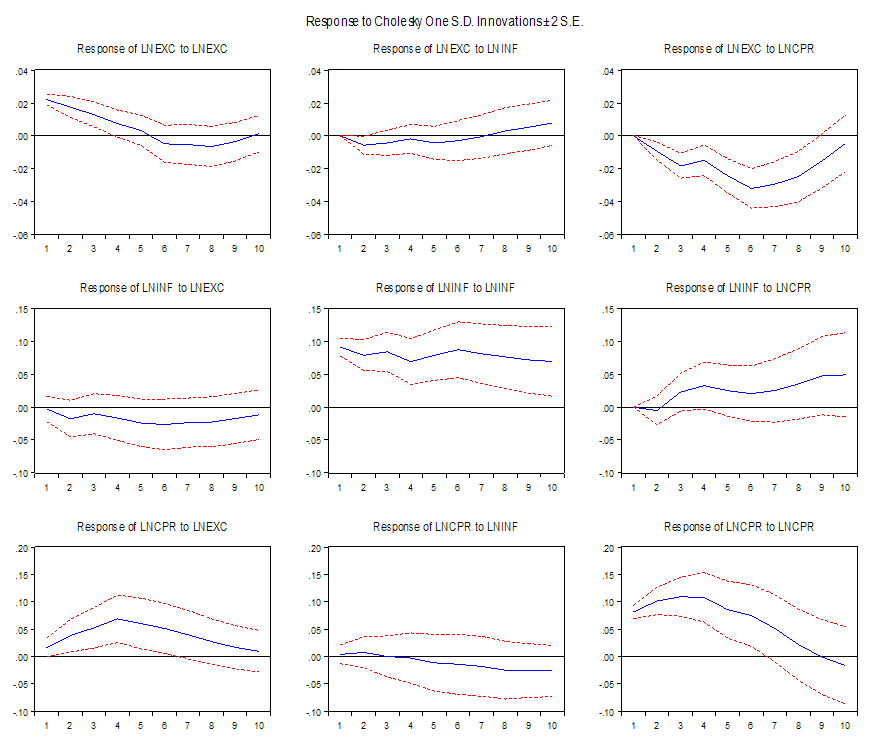

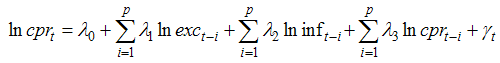

4.7. Impulse Response Function (IRF)

The graph of impulse response function in fig. 1 showed that consumer price level had initial negative impact on exchange rate but was able to find its way back to equilibrium path after 7 months. Also, crude oil price had a huge negative impact on exchange rate. In addition, exchange rate affected consumer price level negatively and the price level never returned to equilibrium path. Nevertheless, crude oil price had positive effect on consumer price level. All these effects were significant at 5%. | Figure 1. Graph of Impulse Response Function. (Author’s computation and Eviews 7.1 Output) |

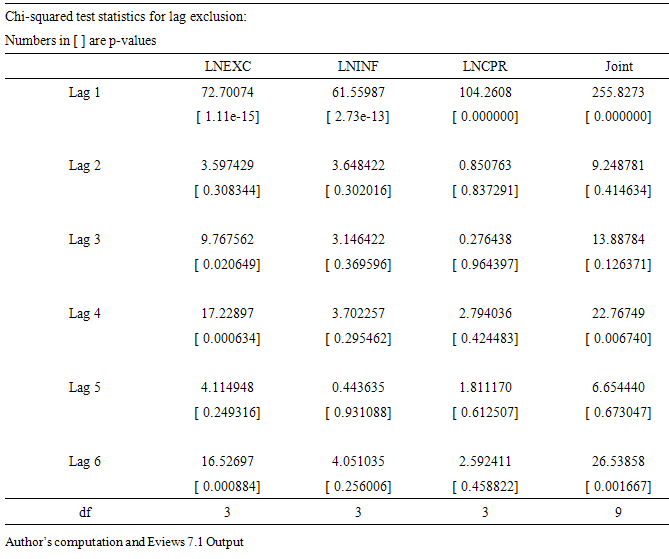

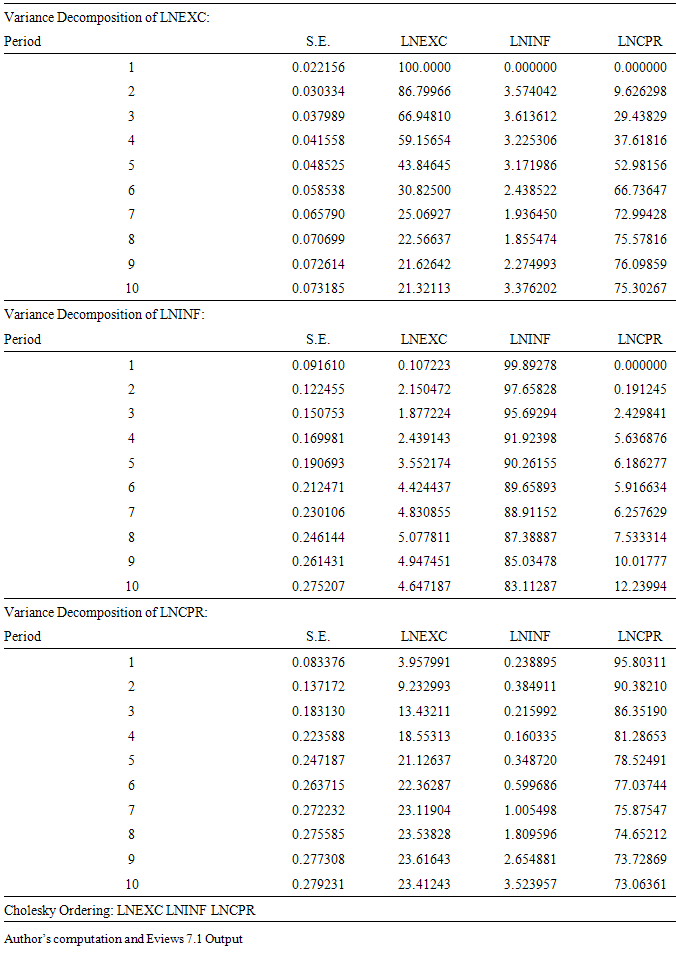

4.8. Variance Decomposition

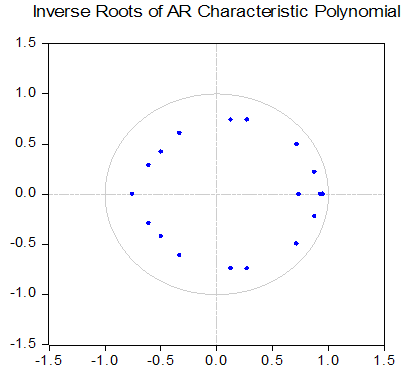

The forecast error variance of exchange rate showed that variation was mostly caused by crude oil price after 2 months. In the case of consumer price level, the variation was mostly caused by itself, while, exchange rate marginally caused variation in crude oil price after 4 months.  | Figure 2. Graph of AR Inverse Root |

Table 8. Variance Decomposition of Variables

|

| |

|

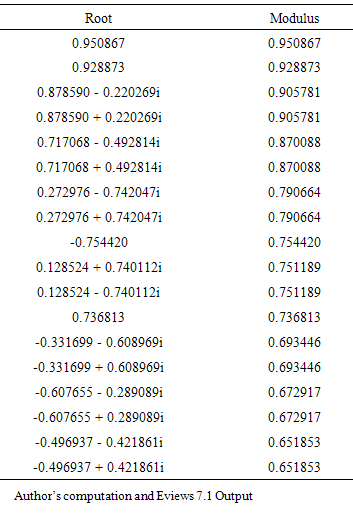

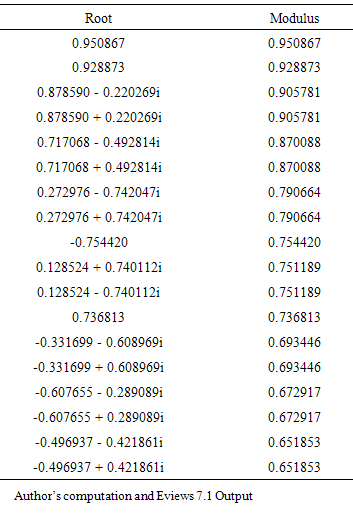

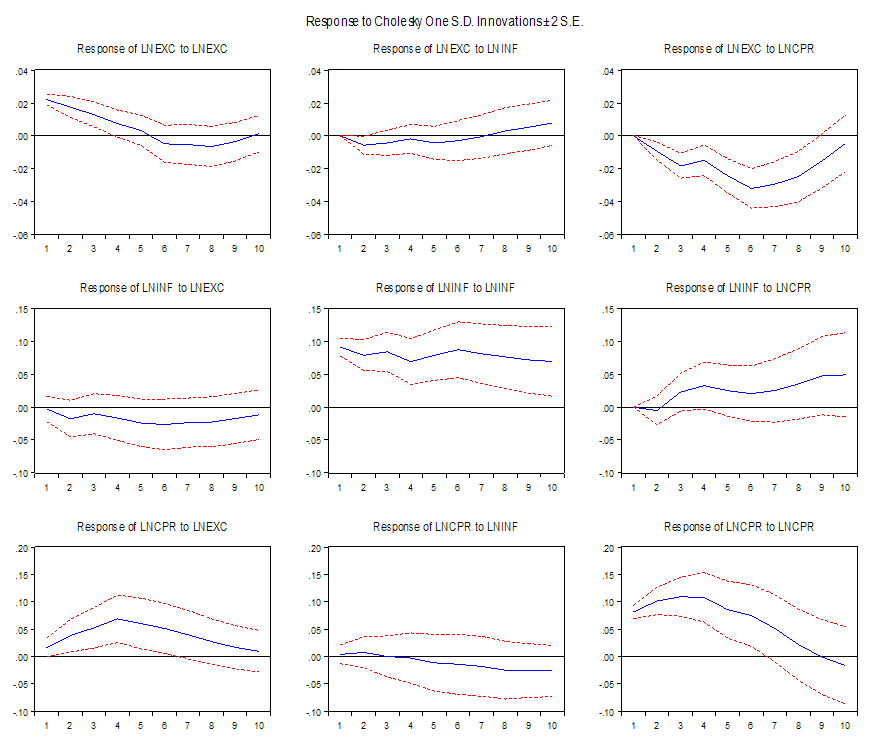

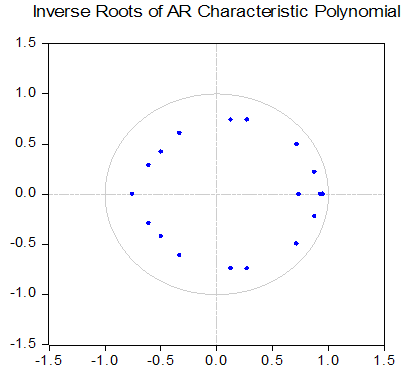

4.9. Model Stability

The autoregressive inverse root of the VAR indicated that all the polynomial roots were inside the unit circle, which showed that the VAR model is very stable and can be used for policy making.Table 9. Inverse Root of AR

|

| |

|

5. Conclusions

The recent global decline in crude oil prices necessitated the need to investigate the interaction of crude oil price, consumer price level and inflation in Nigeria. This work revealed that a shock on crude oil price had a negative impact on exchange rate. This negative impact could be as a result of Nigeria’s dependence on crude oil for both income and foreign exchange; this is line with the work of [9] and [2] in Nigeria. More so, variation in exchange rate was substantially caused by crude oil price. This shows a strong interaction existing between crude oil price and exchange rate in Nigeria. In addition, since the country is a highly import dependent, a shock on exchange rate had a negative effect on consumer price level. Therefore, government should initiate policies that will diversify the income stream of Nigeria’s economy instead of depending mainly on crude oil as source revenue. Equally, a policy that promotes an enabling environment that encourages local investors to produce goods for local consumption and export since this will help to conserve foreign exchange should be implemented.

References

| [1] | Ajao, M.G and Igbekoyi (2013) “The Determinants of Exchange Rate Volatility in Nigeria”. Academic Journal of Interdisciplinary Studies, vol. 2. No. 1. Pp. 459-471. |

| [2] | Aliyu, Shehu Usman Rano (2009): “Oil price Shocks and the Macro-Economy in Nigeria: A Non-Linear Approach, MPRA paper No. 18726. Retrieved 20th March, 2015 http://mpra.ub.uni-muenchen.de/18726/. |

| [3] | Gounder, Rukmani. and Bartleet, Matthew (2007): “Oil price Shocks and Economic Growth: Evidence of New Zealand, 1989-2006”. Papers presented at New Zealand Association of Economist Annual Conference, Christ church. Retrieved 20th March, 2015 https://editorialexpress.com/cgibin/conference/download.cgi?db_name=NZAE2007&paper_id=108. |

| [4] | Habib, Maurizio Michael and Kolamova, Margarita Manolova (2007): Are There oil currencies? The Real Excahnge rate of Oil Exporting countries” ECB Working Paper No. 839. Retrieved 20th Marc, 2015 https://ideas.repec.org/p/ecb/ecbwps/20070839.html. |

| [5] | Jhingan M.L (2003): International Economics 6th Edition, Vrida Publication (P) LTD. |

| [6] | Jin, G (2008)”The Impact of Oil price Shock and Exchange Rate Volatility on Economic Growth: A Comparative Analysis for Russia, Japan and China, Research Journal of International Studies Issue 8, PP.98-111. |

| [7] | Korhonen, Iikka and Juurikkala, Tuuli (2007): Equilibrium Exchange Rates in Oil-Dependent Countries BOFIT Discussion paper 8/2007, Bank of Finland Institute for economics in Transition. Retrieved 20th March, 2015 http://www.suomenpankki.fi/bofit/tutkimus/tutkimusjulkaisut/dp/Documents/dp0807.pdf. |

| [8] | Mordi P.N. (2006) “The Determinants exchange rate in Nigeria 1970-2007” An empirical analysis. Publisher: Indian Journals of economics and business. |

| [9] | Olomola A. (2006): “Oil Price Shock and Aggregate Economic Activity in Nigeria” African Economic and Business Review Vol. 4:2, ISSN 1109-56089. |

| [10] | Obi, B.W and Gobna, O.A.N (2010) “Determinants of Exchange Rate in Nigeria 1970-2010: An Empirical Analysis”. Indian Journal of Economics and Business, vol. 9. No. 1. |

| [11] | Oriavwote, V. E and Oyovwi, D.O (2012) “The Determinants of Real Exchange Rate in Nigeria”. International Journal of Economics and Finance, vol. 4. No. 8. P. 150. |

| [12] | Takaendesa, (2006): The Behaviour and Fundamental Determinant of the Real Exchange Rate in South Africa. Publisher: Rhodes University. |

= parameters of the explanatory variables.

= parameters of the explanatory variables. of 0.9723 which indicated 97% of total variation in exchange rate can be explained by the explanatory variables. The adjusted

of 0.9723 which indicated 97% of total variation in exchange rate can be explained by the explanatory variables. The adjusted  of 0.9655 or 97%, showed that the explanatory variables were robust in explaining the variation in exchange rate. The

of 0.9655 or 97%, showed that the explanatory variables were robust in explaining the variation in exchange rate. The  for consumer price level and crude oil price were 0.9222 and 0.9240 respectively. While, the adjusted

for consumer price level and crude oil price were 0.9222 and 0.9240 respectively. While, the adjusted  of 90% and 91% respectively for consumer price level and crude oil price indicated that the level of variations explained by the explanatory variables. Nonetheless, the respective F-statistic was statistically significant at 5% and the model was a good fit. The individual parameters of the variables cannot be interpreted; therefore, a block-F test will be used to verify the collective impact of the explanatory variables.

of 90% and 91% respectively for consumer price level and crude oil price indicated that the level of variations explained by the explanatory variables. Nonetheless, the respective F-statistic was statistically significant at 5% and the model was a good fit. The individual parameters of the variables cannot be interpreted; therefore, a block-F test will be used to verify the collective impact of the explanatory variables.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML