-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(3): 321-332

doi:10.5923/j.economics.20150503.03

Determinants of Debt Financing Structure and Debt Maturity - (Empirical Studies of Manufacturing Company on Indonesia Stock Exchange)

Ida Ayu Putri Widawati1, Made Sudarma2, Djumahir2, Mintarti Rahayu2

1Doctoral Program in Management Science, Faculty of Economics and Business, University of Brawijaya, Malang

2Gradute Program Faculty of Economics and Business, University of Brawijaya, Malang

Correspondence to: Ida Ayu Putri Widawati, Doctoral Program in Management Science, Faculty of Economics and Business, University of Brawijaya, Malang.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This study aims to predict and explain the determinants of debt financing structure and debt maturity from the perspective of contracting /agency cost theory and Signaling theory that explains that determines the structure of debt depends on the characteristics of companies that need funding as the company's growth opportunities, firm size , managerial ownership structure as well as the consideration of a change in environment or a desire to signal to the market about the quality of the company. Therefore, before determining the structure of corporate debt or debt maturity should be decided in advances that the financing of the debt taken, the study also examines the effect of leverage on the term structure of debt. The uniqueness of this study was to examine the effect of environmental change on the structure of funding and debt maturity, because previous research no one has studied the effect, although Thies and Clock (1992 in Simerly RL 2000) states that environmental changes increased the use of debt and long-term debt will decrease. The population of the research is the entire manufacturing companies listed in Indonesia Stock Exchange (IDX) of 145 companies with the observation period 2005-2011. Based on the criteria defined population, the number of samples analyzed was 32 companies. Methods of data analysis using Structural Equation Modeling (SEM) using AMOS Ver application program 21. The study findings suggest that contracting theoretical perspective that supports manufacturing companies that the larger companies use long-term debt, and the higher the dynamic changes in the environment will take a short-term debt, but the results of this study do not support the signaling theory, that the company is not trying to show the quality of the company in determining the maturity structure of the debt as well as managerial stock ownership and growth options has no effect on debt maturity. While the effect on the structure of the debt financing (leverage) is the size of the company and managerial stock ownership, while, corporate growth, corporate quality, and environmental changes found to have no effect on leverage. Leverage found to affect the maturity structure of the debt.

Keywords: Debt maturity, Environmental changes, Firm quality, Firm size, Growth opportunities, Leverage, Managerial stock ownership

Cite this paper: Ida Ayu Putri Widawati, Made Sudarma, Djumahir, Mintarti Rahayu, Determinants of Debt Financing Structure and Debt Maturity - (Empirical Studies of Manufacturing Company on Indonesia Stock Exchange), American Journal of Economics, Vol. 5 No. 3, 2015, pp. 321-332. doi: 10.5923/j.economics.20150503.03.

Article Outline

1. Introduction

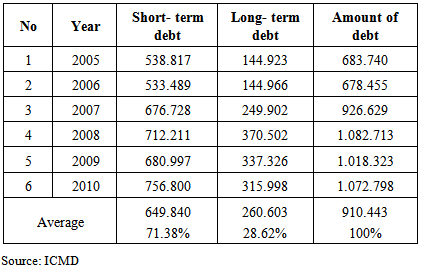

- Corporate funding decisions are made by considering two sources, such as own capital and foreign capital. Own capital or equity could be from stock issued or retained earnings, while foreign capital could be debt, both short-term debt and long-term. Capital structure theory of Modigliani and Miller [1] explains that the better funding decision of company is using debt rather than equity. It is due to tax savings as a result of increase in interest cost paid, thus it can increase the company value. In addition, if the funding conducted by adding equity (sold stock) it would cause a negative reaction in stock market because the dividend that is obtainable by shareholders will be smaller with the large number of shares outstanding.Funding decisions from the outside company in the form of debt is a strategic choice. Companies that rely on internal funding from income and accumulated depreciation would have difficulty making investments with large funds. However, this decision also carries risk, such as risk of liquidity difficulties, financial distress and bankruptcy risk when debt cost is greater than additional results obtained from the use of debt. Debt financing decisions can also cause market reaction due to the asymmetry information, known as a agency conflict. Conflicts can occur because the agent has more information about the company's internal condition opportunistic actions that benefit themselves. On the other hand, the principal who may have information that is relatively less than the agency expects to obtain a higher contribution. Agency conflict arises when some interests meet in a joint activity that would create a problem of agency (agency cost) so that each party will try to reduce this agency cost [2, 3]. Agency costs associated with financing through debt can be: (1) Opportunity prosperity loss caused by the influence of use of debt in investment decisions, (2) Cost of monitoring and cost of bonds issued by oblgasi owner and the owner/manager (the company), (3) The cost of bankruptcy and reorganization costs [4].Policy of company funding became a source of crisis in most Asian countries, except Indonesia. Several studies have shown that investments funded through debt has a high risk (mostly foreign debt-short term), such as causing weak macroeconomic and company financial condition (Pomerleano, Claessens et al., Booth et al. and Allayanis et al. as cited in Chevalier [5]). In Indonesia, characteristics of credit markets are more in touch with bank behavior to provide credit. A company can easily obtain short-term loans without collateral. Most group businesses prefer a commercial bank to serve needs of companies in this group. Therefore, relationship-based system, weak corporate governance, capital markets liberal with less financial supervision is a key characteristic of crisis on business environment in Indonesia. Bank-centered causes companies in Indonesia prefer to use short-term debt with negotiate interest rate and conduct roll over the loan every six months. Overview comparison of short-term and long-term debt used in manufacturing company on IDX (Indonesia Stock Exchange) is presented in Table 1.

|

|

2. Hypotheses

- Based on well understood relationships, the following hypotheses are proposed.Effect of growth options, firm size, firm quality, managerial ownership and environmental changes on leverageH1.1: Growth options provide negative effect on leverageH1.2: Firm size provide positive effect on leverageH1.3: Firm quality provide positive effect on leverageH1.4: Managerial ownership structure provide negative effect on leverageH1.5: Evironmental change provide negative effect on leverageEffect of growth options, firm size, firm quality, managerial ownership and environmental changes on debt maturityH2.1: Growth options provide negative effect on debt maturityH2.2: Firm size provide positive effect on debt maturityH2.3: Firm quality provide positive effect on debt maturityH2.4: Managerial ownership structure provide negative effect on debt maturityH2.5: Evironmental change provide negative effect on debt maturityEffect of leverage on debt maturityH3: Leverage provide positive effect on debt maturity

3. Data dan Variables

3.1. Population and Samples

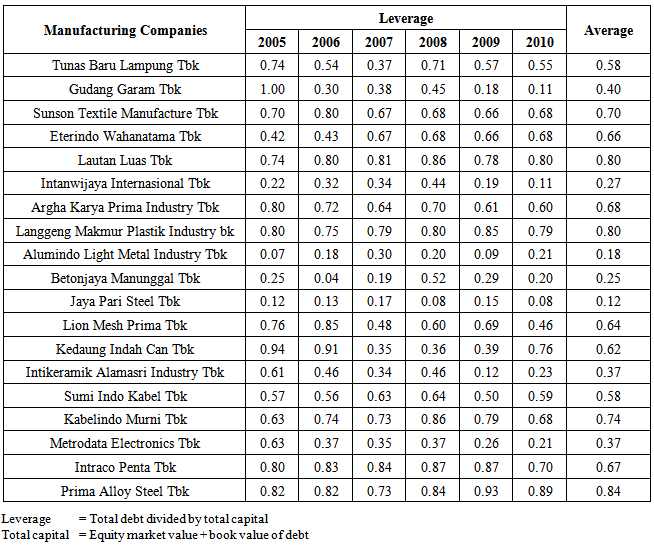

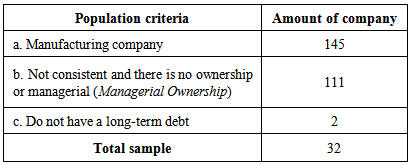

- Amount of companies manufacturing or population is 145 companies. From this population, only 32 companies used as sample with criteria as following: (1) Publish financial statements consistently in 2005-2011; (2) Report managerial ownership structure; and (3) Have a short-term debt and long-term debt.

|

3.2. Variables

3.2.1. Exogenous Variables

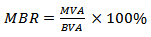

- a. Growth OptionsMesurement of growth options refers to Cai et al. [2]; Smith and Watts [10]; Barclay and Smith [11]; and Zheng et al. [12].

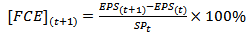

| (1) |

MVA = Market value of assets

MVA = Market value of assets BVA = Book value of assets

BVA = Book value of assets | (2) |

BVA = Book value of assets

BVA = Book value of assets BVE = Book value of equity

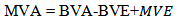

BVE = Book value of equity MVE = Market value of equityMarket value of equity is total outstanding stock multiplied by closing price. b. Firm SizeFirm size used in this study is size of company that proxied with firm value that measured by number of shares outstanding multiplied by share price added by book value debt. This measure will give a better description about firm size as it is associated with company's stock price position in stock market [2, 11].

MVE = Market value of equityMarket value of equity is total outstanding stock multiplied by closing price. b. Firm SizeFirm size used in this study is size of company that proxied with firm value that measured by number of shares outstanding multiplied by share price added by book value debt. This measure will give a better description about firm size as it is associated with company's stock price position in stock market [2, 11]. | (3) |

SP = Share price

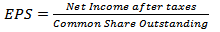

SP = Share price BVL = Book value of liabilitiesc. Firm QualityMesurement of firm quality refers to Cai et al. [2]; Stohs and Mauer [13].

BVL = Book value of liabilitiesc. Firm QualityMesurement of firm quality refers to Cai et al. [2]; Stohs and Mauer [13]. | (4) |

EPS = Earning per share

EPS = Earning per share SP = Share price

SP = Share price | (5) |

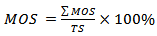

| (6) |

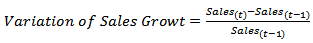

TS = Total Sharee. Environmental ChangesMeasurement of environment changes in this research is use of sales growth variation achieved by company. This formula is refers to Thies and Klock cited in Simerly and Li [8].

TS = Total Sharee. Environmental ChangesMeasurement of environment changes in this research is use of sales growth variation achieved by company. This formula is refers to Thies and Klock cited in Simerly and Li [8]. | (7) |

3.2.2. Endogenous Variables

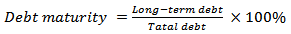

- a. Debt MaturityDebt maturity is percentage of long-term debt on total debt. This formula is refers to Cai et al. [2]; Barclay and Smith [11]; and Antonio et al. [14].

| (8) |

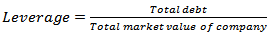

| (9) |

4. Result

4.1. Description of Research Variables

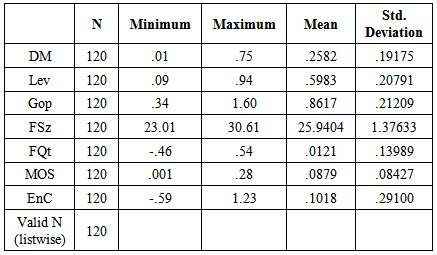

4.2. Hypothesis Testing Results

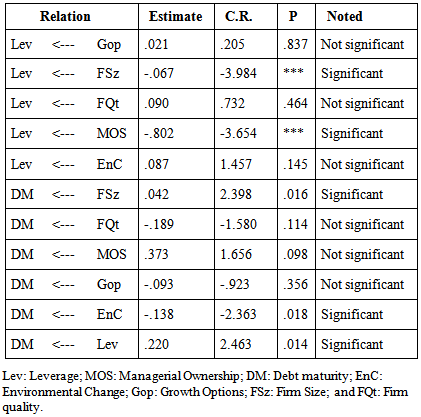

- Test of hypothesis was conducted by looking at estimated path coefficients value, critical point (CR*) value and p-values that significant at level 5% as shown in Table 5.

|

4.3. Discussion

4.3.1. Effect of Growth Options on the Leverage

- Firm growth options are measured based on ratio of market value of asset on book value of asset. The higher of ratio resulting in higher of firm growth option viewed from intrinsic value. Growth options are not caused increasing physical asset of firm but increasing firm intangible asset. Myers [16] views that if a firm wants to fund the growth options by asking debt, it will be difficult for its high risks. A developing firm is the firm that has high growth options since it has real asset value which is lower than its growth options. This condition causes the tendency of the neglecting growth options that can improve firm value (underinvestment problem) and cause conflict between shareholders and debt-holders. Shareholders view the risky debt will not only be paid by investment but also by cash budget and other main assets. If the investment is lower than capital or similar, it is the claim of debt-holder so there is no value that is taken by shareholders. The debt-holder is also less interested in funding the firm for its growth options because they will find difficulties in monitoring financial use of the investment toward the growth options. It is caused by investment on the growth options cannot increase material asset of the firm, otherwise it increases non physical asset where growth options is an investment on the firm value for example adaptation on the development of technology, product development, maintaining market demand, etc (non physical investment). Myers proposes some strategies to solve underinvestment problems such as using low debt by utilizing free cash flow which is obtained from the firm operation. The high firm development will earn high free cash flow so its debt is also low. Therefore, firms that have high underinvestment problems should use low debt. Thus, one of the strategies avoiding underinvestment problems is to decrease debt in the capital structure. The research finding shows that the development of firm does not influence the firm leverage. That growth option does not influence the debt shows the Indonesia manufacturing firms have relative low growth options. On the other hand, firms possessing high real asset in funding do not influence the debt amount they use. Funding over low growth option emphasizes on the investment coming from cash flow from operational production, retained earnings and previous operational production (internal cash flow). The low growth of manufacturing firms indicates that they have more physical asset than non-physical asset such as the low modern technology application, the low research, development and goodwill and high advertising. In conclusion, few under investments tend to occur in Indonesia because of low growth options with high real asset which does not influence the debt amount in the capital structure. On the other hand, a lot of overinvestment occurs in China, firms with low growth option have higher physical asset. Investor will control the manager actions by giving more debts so the manager will try harder in improving his performance [2]. This research funding does not support research by Gul [17] and Abdullah [18] who found market to book ratio as proxy from growth options giving positive significant effect on the leverage. On the other hand, Barclay et al. [19] and Chakraborty [20] found growth options influences leverage.

4.3.2. Effect of Firm Size on the Leverage

- In this research, the firm size is measured based on the market firm value which shows that firm size depends on the firm share value. Firm size will provide better description of firm size as it is view from firm condition in capital market. Big firms with low asymmetric information problem will fund their firms using debt easily so they will have high leverage. Big firms tend to have high liquidity level that indicates they will not get brankuptcy easily. Only big firms that are able to get high debts in the long-term credit market. They have high firm value according to assets in place, so they can get debts easily. In addition, they will get profit from economic scale when issuing bond, in which debt is higher and underwriting cost percentage is lower compared to small firms [21].The higher the debt use, the higher the leverage gain. Big firms use this opportunity, however if debt is too high, the agency cost and financial distress will be high when the amount is nowhere near to leverage gain. If related to firm value, using debts in certain limit will increase firm value because the tax savings is higher than financial distress and agency cost. Despite, in certain limit, using debts will decrease firm value because the tax savings is nowhere near to financial distress and agency cost. Trade-off model through Modigliani-Miller approach concerning with capital structure shows that debt fund and the fund of equity capital increase as the debt gets higher. The fund will get higher on the certain debt proportion because of financial distress and agency costs. However, big firms which are more diversified are able to take the debt and capital fund untill certain amount. This research finding shows that the bigger manufacturing firms listed in IDX, the lower the fund coming from debts in their capital structure or in other words the lower the leverage. Empirical result shows that there are many Indonesia big manufacturing firms having low leverage. It happens because of poor control from investor over the firm management so overinvestment tends to occur, where the firms are higher if they have high physical asset with limited growth options. Using high leverage is suppossed to increase firm valu through high control over free cash flow of the firms so overinvestment will not occur because investment on the firms commonly fails in diversification and acquisition. Compared to previous research, this research finding is not similar with Barclay et al. [19] who found that firm size gives positive effect on the leverage. Gul [17] also found that firm size gives positive effect on the leverage. Today, there is still no research that supports this research which finds firm size gives negative effect on the leverage.

4.3.3. Effect of Firm Quality on the Leverage

- Firm managers commonly do not realize that fund decision is able to give signal to capital market for example, stock price falls significantly when the firm offers new stock to public but the response is low if the firm uses debt for funding. Firms that know more about their prospect will try to deliver the information to capital market. Knowing the firm quality increases, managers will increase leverage amount so the market can see the signal that the firms are in good condition. The increasing leverage shows the firms are able to pay the debts from their firm profit [15].In this research, the measurement of firm quality uses the growth of firm EPS which is divided by stock price. Firms have motivation to send signal to capital market concerning with firm quality. The higher the firm quality which is seen from the increasing profit, the higher the debt or leverage use. It is caused by the increasing leverage shows the firm is in the undervalued condition or high-quality.Firm quality that is measured from the increasing of earnings per share which is divided by share price does not influence the leverage significantly in manufacturing firms listed in IDX. This research finding shows that firm quality does not give significant effect on the leverage which indicates the manufacturing firms whose increasing quality (indicated by the increasing profit) do not always increase their debt significantly. It means that Indonesia manufacturing firms do not try to give signal of firm quality through fund decision.This research is similar with research by Abdullah [18] who found that profitability does not give significant effect on the leverage. This research finding does not support research by Chacraborty [20] and Margaritis and Psillaki [22] who found that firm quality gives negative significant on the leverage.

4.3.4. Effect of Managerial Ownership on the Leverage

- Jensen and Meckling [4] develop a classic theory about ownership and managerial. The theory proposes that if some shares owned by managers, managerial incentive will make them rich, taking away shareholders welfare or involved in other sub optimal can be eliminated. Besides, it can help managers and shareholders similar interests/business so agency cost decreases. Myers [16] explains that managers decrease the debt ratio to protect their work and stabilize their personal welfare so the shareholders have strong incentive to increase debt amount that can decrease managers chance to make their personal welfare by creating management mechanism that can control management consumption over their authority. The higher the managerial ownership, the higher the shareholders interest and the lower the debt. It decreases authority abuse so that the shareholders get welfare with optimal profit. Besides, the low debt can decrease burden so shareholders profit gets higher. Firms tend to use retained earnings from the operational production in funding the investment. When the firm owner also becomes the manager, external shareholders do not need to over-control by giving high debt as control way to restrict manager actions. Managerial ownership phenomenon in Indonesia which is dominated by family tends to bear efficient management. It matches the research finding that firms are not supposed to be given much debt.This research finds that the higher the managerial ownership, the lower the debt amount in the firm capital structure. Therefore, the higher the managerial ownership in manufacturing firms listed in IDX, the lower the debt used according to theory proposed by Jensen and Meckling [4]. It is caused by the higher the managerial ownership the higher the manager and external shareholders interest in decreasing debt use because it burdens the firm and decrease the risks and no need tight control. The high amount of debt can be used as control way to restrict managers who want to make their personal welfare. It means, management tends to use internal funding to fund the investment. This research supports the hypothesis of Managerial Ownership Structure which gives negative effect on the leverage. The higher the managerial ownership, the lower the debt in the capital structure. In this research finding, share ownership which is more concentrated (the amount of share proportion owned by individual) will take lower debt because shareholders can strongly control over the cash flow by firm management, otherwise if individual share ownership is low, shareholders will control the managers tightly so the debt burdened to the firm is higher [23].

4.3.5. Effect of Environmental Change on the Leverage

- The environmental changes will cause uncertainty so the debt-holders will carefully give debt to avoid risks by controlling over the fund borrowed tightly. In that condition, it is difficult for the firms to get high debt in funding investment (based on the agency theory) by Jensen and Meckling [4] and Simerly and Li [8].In this research, the effect of environmental change does not give significant effect on the leverage. So, the environmental change which is indicated by the increasing sale growth does not influence the firm decision to take debt for funding. Furthermore, the debt-holder will not be influenced by the environmental change when giving debts. It happens because the firm will keep paying the credit and interest even though the sale growth decreases so the debt-holders do not concern with the change. The debt-holders concern with financial power more than earnings power. If the sale growth decreases, the firm does not decreases its debt because there is a facility from bank concerning with short-term capital, here the firm can pay the interest easily when it gets financial problem. The previous research finding about the effect of environmental changes on the leverage was conducted by Simerly [24] who said that the higher the environmental changes, the lower the debt (short-term debt) used.

4.3.6. Effect of Growth Options on the Debt Maturity

- Myers [16] explains that underinvestment incentive problem will increase if the investment over the growth options is funded by debt burdened to the firm with high risk. The high risk is caused by the debt that is not only supported by investment value but also cash and other assets. Investment on the growth options does not increase firm material asset otherwise non-physical asset. This kind of investment is called variable cost, if it is neglected, the firm condition will get worst in the future. Myers [16] explains that underinvestment incentive occurs if the firm growth options increase as it is funded by debt with high risk. The high risk is caused by fund used to improve the firm (non-physical) does not increase the firm real asset. In this case, shareholders want to neglect the profitable investment opportunity if the creditors get imbalance result over the value produced by the firm on the investment. As the result, the willingness of realization of project with positive NVP is more critical if the project gives high growth options. So, the project is completed before the maturity date (short term debt). Myers proposes some strategies to solve underinvestment problem such as using short-term debt with maturity date before the growth options occur, using less debt, using debt with restrictive covenants, negotiating debts and matching debt period with funded asset. Therefore, the firms with higher underinvestment problem should use more short-term debts. Based on the research finding, growth options do not give significant effect on the debt maturity. So, the height of growth options owned by manufacturing firms listed in IDX does not increase nor decrease the short term debt use. The low growth options are indicated by manufacturing firms in Indonesia which have low non physical asset, it can be seen from there is no optimal application of modern technology, product differentiation, increasing product quality to compete in the global market, etc do not give significant effect on the increasing of short term debt amount. This research finding is similar with the fact found in IDX during 2005-2010 which stated using short term debt average is higher (71.38%) than long term debt (28,62%) (Table 1). It can indicate that most Indonesia manufacturing firms use short term debt, it is not caused by having high growth options but its habit in using short term debt as it is more beneficial to corporate with bank which gives short term debt as funding source.This research finding does not support Myers [16] who found the higher the growth options of firm, the higher the short term debt. This research finds that there is no underinvestment problem in manufacturing firms in IDX. On the other hand, this research finding supports research finding by Stohs and Maure [13] and Cai et al. (1999) [25] who found the growth options do not give significant effect on the debt maturity.

4.3.7. Effect of Firm Size on the Debt Maturity

- Big firms can carry on the long term debt (bond) which has lower fixed cost (overall) because they have significantly higher economic scale. On the other hand, small firms are not quite able to take profit from the economic scale and tend to use short term debt which has lower transaction cost. Big firms can also issue the bonds easily while small firms only get short term debt from a bank [26]. The small firms choose to use short term debt because the lower flotation cost [11]. The investment opportunities in small firms are more guaranteed by their asset value [27]. Big firms are more transparent so the creditors get accurate information with cheap cost. Besides, big firms have low bankruptcy risk so it is easy for them in gaining external fund [28].The firm size by proxy of firm value which is equity capital added by debt book value are gives positive effect on the debt maturity. So, the bigger the size of manufacturing firms in IDX, the higher the long term debt they use.This research finding supports the hypothesis that firm size gives positive effect on the debt maturity. Compared to previous research finding, this research finding supports the empirical studies about firm size effect on the debt maturity by Barclay and Smith [11]; Barclay and Smith [15]; Barclay et al. [19]; and Ozkan [30, 31] who found the firm size gives positive effect on the debt maturity.

4.3.8. Effect of Firm Quality on the Debt Maturity

- Flannery [6] explains his research finding concerning with classic signaling model that managers coming from the strongest firms will take short term debt compared to managers leading weaker firms. The consequence of short term debt as the firms cannot get even the maturity debt, they can take a risk of rolling over after additional information is revealed. On the other hand, managers leading firms with not promising prospect tend to not take the risk so they decide to take long term debt which is not influenced over the mid-term renegotiation. Flannery [6] creates a model proposing that asymmetric information can cause the creditors cannot distinguish ‘good’ or ‘bad’ firm. The model shows that the creditors need higher risk premium for long-term debt because the longer time will increase the probability of decreasing credit quality. Furthermore, because of asymmetric information, long term debt is overpriced while short term debt is underpriced. Firms with low quality will select long term debt which is overpriced because it can postpone uncertain future environment of interest rate refinancing. On the other hand, firms with high quality will not concern with refinancing risk. The creditors understand this motivation and interpret that debt period selection is a signal of firm quality. This research finds that the firm quality by proxy with future changes in earnings does not give significant effect on the debt maturity. This finding does not support a hypothesis saying that firm quality gives negative effect on the debt maturity. The strong firms will predict the better profitability level or it will increase in the next year which is seen from the increasing value of earnings per share (EPS) so they should decide to take short term debt. Giving signal of good prospect firm to market reflects the issuers are able to take short term debt for funding their investment. This research finds that the strong manufacturing firms listed in IDX have good liquidity because they can predict their increasing profitability will not give positive signal to market by taking short term debt because taking short term debt shows low liquidity risk of the firms. In other words, this finding shows that either strong or weak firms do not give accurate information in the market (outsider) through selection of debt period. So, signaling theory related to debt period cannot be applied in manufacturing firms listed in IDX. This research finding is does not support the previous research by Barclay and Smith [11] who give poor support to fact that firms use debt maturity to give information signal to market. It shows the inconsistency of signaling hypotheses prediction in explaining its effect on the debt maturity. If the earning increases in the next year, firms will use few long term debt and more long term debt if the earning increases. Krishnaswami et al. [31] finds that abnormal earnings (firm quality) do not give effect on the debt structure. This research does not support research conducted by Ozkan [29] who finds quality does not influence debt maturity but taking all more than a year debts which is defined by debt maturity, the result of coefficient quality is significant. Ozkan [30] finds abnormal profit (firm quality) does not give significant effect. In fact, most manufacturing firms in IDX have higher short term debt. It is not caused by the increasing of neither profitability nor good quality. This research finding does not support a research by Stohs and Maurer [13] who finds that signaling hypotheses is tested by firm quality which is showed by future change in earnings (∆EPS), the difference between next year EPS which is divided by this year EPS. It is found that ∆EPS gives negative effect on the debt maturity, so the higher the EPS, the higher the profitability that will give effect on the higher short term debt use.

4.3.9. Effect of Managerial Ownership on the Debt Maturity

- Taking more short term debt is not only used to avoid underinvestment problem [17] but also to indicate that the firms can renew their debt which can get more control. Besides, taking short term debt can decrease agency cost over the action freedom of managers because underwriters, investors and rating agencies always control the firm based on the publication [32]. It occurs based on the firm liquidity. The firms with lower managerial ownership decide to take long term debt so that the control from external parties can be longer or low intensity. This research finding shows that managerial ownership does not give effect on the debt maturity. This finding does not support hypothesis stating that managerial ownership structure gives negative effect on the debt maturity. So, the higher the managerial ownership, the more the short term debt used. This finding shows that manufacturing firms in IDX which manage debt period selection is not in line with the shareholders who want the firms use more short term debt to facilitate good control from rating agencies. It happens because the managerial ownership in Indonesia is dominated by family or country, so the management can decide their own funding and higher incentive to take the risk so there is no need high control from rating agencies. This research finding supports a research by Cai et al. [2] who finds the managerial ownership does not give effect on the debt maturity in Chinese firms with regression technique.

4.3.10. Effect of Environmental Changes on the Debt Maturity

- The environmental changes (variation of sales growth) which are indicated by sales change caused by competition, government regulation change, technology change, etc will make the firms adapt to the changes. Based on the agency theories, high risk firms’ activities which are caused by the increasing of environmental change, will cause the firms get difficulties in gaining more debt and long term debt for its risk of uncertainty. Debt will be more expensive because the increasing of risk of the uncertain income. Debt holders will control tightly by restricting managers actions concerning with firm mapping. Debt holders will also refuse the investment if the agency cost problem can be eliminated effectively [4]. In this research, the finding shows that environmental changes give negative significant effect on the debt maturity. So, the firms consider the effect of environmental changes in deciding debt maturity by taking more short term debt. The debt holders in Indonesia consider the environmental changes in deciding debt maturity that is given. A fact that shows share ownership is dominated by family, so the firms will be careful in deciding debt maturity. If the environmental changes that are indicated by the increasing or decreasing of sale growth, issuers will use short term debt. This research supports the hypothesis stating that environmental changes give significantly negative effect on the debt maturity. It also supports the research finding by Thies and Klock as cited in Simerly and Li [8] that did longitudinal study on the manufacturing firms. They find that the increasing of sale growth (proxy from environmental changes), the increasing of environmental changes will decrease the long term debt use.

4.3.11. Effect of Leverage on the Debt Maturity

- The higher the debt proportion in the capital structure (the higher the leverage), there should be the higher the long term debt used to avoid bankruptcy. It is due to taking high short term debt can harm firm liquidity. This case is in line with Morris [33] who says that taking long term debt can help the firms in postponing bankruptcy, so the firms should use long term debt as taking the high debt. This research shows that leverage gives significant effect on the debt maturity. This finding supports the hypothesis stating that leverage gives positive effect on the debt maturity. The higher the debt, the more long term debt used. If the leverage level is not considered in funding investment by seeing debt maturity, liquidity risk, and financial distress cannot be avoided and bankruptcy occurs. That leverage gives significant effect on the debt maturity indicates that issuers consider the debt proportion in the capital structure to determine debt maturity. The higher the debt in the capital structure (leverage) the higher the long term debt used, for example taking bond from public market which is an efficient strategy since there is no tax. For the debt holders, funding process by using bond in public market is more secure because there are underwriters as the guarantee and there is regulator. That leverage height influences debt maturity can indicate that issuers increase their debt amount by increasing long term debt using public market. It aims to pay fixed asset. It gives information to regulator parties about the fact of firms have used capital market through bond funding. This research finding supports the previous research such Morris [33] who says that using long term debt can help the firms to delay bankruptcy because the firms should taking long term debt to get high debt.

4.4. Research Contribution

4.4.1. Theoretical Contribution

- This research findings can complete and improve social science in term of financial management, particularly the arrangement of selecting fund structure and debt maturity, it is developing capital structure theory from Modigliani and Miller (MM theory) [9]. This theory proposes that funding should consider debt more than equity because there is tax savings by considering the increasing of interest cost that can decrease firm income. MM theory prediction relates to how financial leverage is adjusted to return which is expected by investors. It also emphasizes on the perfect capital market, the firm value does not depend on the fund instrument, however in the reality, there are some factors confining the firm access toward external capital. This problem can be solved by selecting appropriate debt maturity. This research finding clarifies that fund decision is not only about how to create capital structure which is decision between debt or equity use, but also the fact saying that there are some considerations should be thought in taking debt. The considerations about whether using more debt or not and more short term debt or long term debt to avoid liquidity risk, financial distress, bankruptcy and the decreasing of firm value.There some considerations should be thought to decide funding structure and debt maturity. This research refers to theory of contracting/agency cost hypothesis, signaling and liquidity risk, considering the firm characteristics by adjusting the growth options and firm size. While firm quality relates to signaling and liquidity risk hypotheses, those variables from previous research finding are not consistent. Other than considering both theories, managerial ownership and environmental changes also give effect on the fund structure decision and debt maturity. Firm size supports contracting cost hypotheses, the bigger the firms, the higher the long term debt used however the firm quality does not support the signaling theory. So, manufacturing firms in IDX do not try to send signal through fund structure selection and debt maturity. Furthermore, managerial ownership does not give effect on the debt maturity, so the managerial ownership level does not give effect on the management decisions taken in determining the debt maturity. Then, environmental changes variable gives significant effect on the debt maturity. The economic condition which is not stabile will give effect on the decreasing of sale growth percentage, so the firms tend to use high short term debt. In this research finding, leverage gives effect on the debt maturity which indicates that the firms consider the debt amount in deciding debt maturity. Among variables that determine fund structure using debt are (growth options, firm size, firm quality, managerial ownership and environment changes), only firm size and managerial ownership that give significant effect on the leverage, it means that the bigger the firm size, the higher the debt used and the higher the managerial ownership, the better the suitability between manager and shareholders interest/business. Growth options, firm quality and environmental changes do not give significant effect; it means that growth options, managerial ownership and environmental changes do not give effect on the debt amount in the capital structure. This case supports the phenomena that the growth option of manufacturing firms which is seen from intangible assets such as technology development, research and development, managerial ownership by family, so the decision on the debt amount is not really considered because the owner can control the debt used. Furthermore, this research finding reveals that the issuers do not try to decrease the debt amount in the capital structure because of the environmental changing, but the firms tend to use short term debt if the sale growth decreases. It is caused by the environmental changes such as market segment change and tight competition.

4.4.2. Practical Contribution

- This research finding is expected to give information to Financial Managers in manufacturing firms in IDX for the basis of financial decision, particularly in determining fund structure and debt maturity in the future. They can consider fund structure and debt maturity that have been described to avoid underinvestment, liquidity risk, financial distress and firm value. This research finding gives information that firm size and environmental changes give significant effect on the debt maturity. That firm size gives significant effect to debt maturity indicates that big manufacturing firms in Indonesia tend to take long term debt because they have good economic scale in accordance with agency cost theory proposing that big firms have economic scale profitability so they can pay their long term debt which has high fixed cost. In addition, the environmental changes give effect on the debt maturity, it means that the firms will decrease uncertain risk and debt holder will be aware of deciding the debt maturity. The bigger the firm size, the higher the long term debt used in the public market. It is in the form of bond in the capital structure. For investor, this information shows that issuers have acted wisely because taking fund in public market will be more efficient and secure as there is underwriters’ control. As the environmental changes get higher, the firms tend to use short term debt. It indicates that issuers have been careful because the condition is uncertain so taking short term debt will not disturb the firm performance in the future. That leverage gives significant effect on the debt maturity indicates that issuers have considered the debt amount in deciding debt maturity. The higher the debt in the capital structure (leverage) the higher the long term debt used for example taking bond from public market which is more efficient way as there is no tax. By using bond in the public market for funding, it is more secure for debt holders because there are underwriters as guarantor and there are regulators. The leverage height giving effect on the debt maturity can indicate that issuers increase their debt amount by taking long term debt. It aims to pay fixed asset. This case should be considered by regulators that the firms which need more fund using debt have used capital market through bond for funding. The firm size and managerial ownership give effect on the leverage, but the firm size effect on the leverage is not in line. Its effect is the bigger the firm size, the lower the debt used for funding and the bigger the firm size, the lower the leverage. It can indicate the lack of control to firm management. In fact, there should be control over the free cash flow which comes from firms having high assets in place to restrict management freedom in the investment because the good growth cannot make the firms do diversification and acquisition so the increasing of leverage can increase the firm value. Furthermore, managerial ownership gives effect on the leverage. It gives information to issuers that the higher the managerial ownership, the lower the debt taken because the shareholders do not need to control and restrict the managers’ action by controlling the free cash flow so no need to increase leverage level. In funding investment, to avoid too high debt, the issuers can increase managerial ownership by giving bonus (share) to managers who have given many contributions in improving firm profit.

4.5. Research Delimitation

- 1. This research finding cannot summarize that most debt used by manufacturing firms in Indonesia is short term debt because capital need is higher and to pay fixed asset and this research does not examine firm liquidity. Another cause is the easy short term debt from bank that can be extended as the maturity date or it can also be called long term. 2. This research finding cannot be generalized to all issuers because the restriction in the sampling which is based on the population criteria, not random sampling.

5. Conclusion and Suggestion

5.1. Conclusion

- Based on the statistical test and hypothesis analysis, the finding of this research can be summarized as follow:1) Based on the firm characteristics in deciding debt maturity, this research finds the firm size and environmental changes give significant effect. The firm size gives significantly positive effect on the debt maturity, so the bigger the firm size, the higher the long term debt used. Environmental changes give significant effect on the debt maturity, so the higher the environmental changes, the higher the risk of uncertain condition that triggers issuers use more short term debt. On the other hand, firm size gives significantly negative affect on the leverage, so the bigger the firm size, the lower the debt used for the capital structure. This finding does not support the trade off theory which explains the big firms with more diversification can carry on the high debt so they have higher leverage. Managerial ownership gives significantly negative effect on the leverage, so the higher the managerial ownership, the lower the debt used. The high managerial ownership will be in line with shareholders’ business and firms will use less debt which decreases profit. Managers do not try to gain additional income by doing overinvestment. 2) Leverage gives effect on the debt maturity. The higher the debt amount, the higher the long term debt used by issuers. The policy can decrease bankruptcy risk because the high debt which is paid by short term debt can disturb the firm liquidity. 3) Growth options, firm quality, and managerial ownership do not give effect on the debt maturity. The firm quality does not give effect on the debt maturity, so this finding does not support signaling theory proposing that the firms can send signal to market through the selection of debt maturity. In addition, managerial ownership does not give effect on the debt maturity, so managers whose shares tend to not follow shareholders business. It happens because most managerial ownership is family so they can control the management directly. Growth options do not give effect on the debt maturity which indicates the low opportunity of manufacturing firms in Indonesia. Then, firm quality does not give effect on the leverage, so the high profit (high quality) of firms does not increase debt use to control free cash flow in improving firm value. Firms with good quality do not send signal to the market by increasing leverage that shows the firm prospect is getting better and are able to carry on the debt. Finally, environmental changes do not give effect on the leverage. The high uncertain condition triggers the firms to get difficulties in gaining high debt. So, environmental changes or competition level do not quite give effect on the leverage.

5.2. Suggestion

- According to the research finding, there are some suggestions to the next researchers: a. This research finds that some variables tested to measure their effect on the fund structure and debt maturity do not give significant effect. Therefore, other researchers are expected to conduct further research. b. Based on the development of science, variables affecting fund structure and debt maturity can develop. So, to enrich science of financial management, similar research can enlarge this research finding which can clarify the previous research.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML