-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(1): 21-28

doi:10.5923/j.economics.20150501.03

Market Power of Nigerian Deposit Money Market: Evidence from Bresnahan-Lau’s Approach

Folorunsho M. Ajide 1, Adetunji A. Aderemi 2

1School of Management and Business Studies(SM&BS), Lagos State Polytechnic, Lagos, Nigeria

2Faculty of Management Sciences, Osun State University, Osun, Nigeria

Correspondence to: Folorunsho M. Ajide , School of Management and Business Studies(SM&BS), Lagos State Polytechnic, Lagos, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Over the years, both structural and conduct regulations had been experienced in Nigerian deposit money market. Structural regulation focused on market structure, featured with the functional separation of firms into complementary activities (for example, caving out microfinance bank from the conventional commercial banking functions), restrictions on entry and rules regarding the operation of foreign banks. However, this structural regulation may tend to make entry difficult, and may tend to protect incumbent firms from competitive pressure. This arrangement might increase the level of market power of Nigerian deposit money market. By definition, market power specifies how firms in a market influence prices, and reveals the level of competition in the market. This study investigated the level of market power in Nigerian deposit money market using Bresnahan-Lau’s model. Annual data for the period of 1986-2012 were sourced from annual financial statements of Nigerian banks and Central Bank of Nigeria statistical bulletin. The model was estimated using Two-stage-Least Square (TSLS). The results revealed that Nigerian deposit money market maintained monopolistic competition. The study concluded that the banking reforms introduced had improve competitive condition of the industry, hence; the practice of monopolistic competition.

Keywords: Bank, Bresnahan-Lau’s model, Market power, Competition, Deposit market

Cite this paper: Folorunsho M. Ajide , Adetunji A. Aderemi , Market Power of Nigerian Deposit Money Market: Evidence from Bresnahan-Lau’s Approach, American Journal of Economics, Vol. 5 No. 1, 2015, pp. 21-28. doi: 10.5923/j.economics.20150501.03.

Article Outline

1. Introduction

- Bresahan (1982) [1] and Lau (1982) [2] developed a model of profit maximizing oligopoly banks in order to ascertain the degree of market power of the average bank. Market power specifies how firms in a market influence prices, and reveals the level of competition in the market. A competitive financial market has a positive impact not only on the well being of the stakeholders, but also on the country’s economy as a whole. Healthy competition in a financial system promotes the productivity of the real sector. There are a good reason why competition is very important in the deposit money market: the degree of competition in the financial sector can matter for the efficiency of the production of financial services, it can matter for the quality of financial products and the degree of innovation in the sector (see Claessens and Laeven, 2003 [3]; Ajide, 2014 [4]; Ajisafe and Akinlo 2014 [5]). The competitive conditions of deposit money market; as an arm of financial system; has major implications for the effectiveness of certain instruments of monetary policy such as discount rate and required reserve (Bikker, 2003) [6]. Hence, the impact of monetary policy on financial prices and quantities is conditioned on the degree of individual firms in the financial market to exploit credit demand and deposit supply functions. For the fact that competition is very important in a financial market, a limited number of work have been carried out in Nigeria to know the competitive conducts displayed in Nigerian deposit money market (See Ajisafe and Akinlo, 2013 [7]; Ajisafe and Akinlo, 2014 [5]; Asogwa, 2002 [8]). One of the empirical issues normally faced is the measurement problem because it is difficult to observe competition directly and lack of sufficient data deterred a clear view on deposit market structure. Hence, various measurements and approaches are necessary to further investigate the competitive conduct in Nigerian deposit market. Studies like Asogwa (2002) [8] used conjectural variation approach and; Ajisafe and Akinlo (2013) [7] used Panzar and Rosse (P-R) approach. The disadvantage of the P-R model is its assumption that firms in deposit money market provide one financial product or services only. It does not allow us to differentiate financial products or services because of insufficient data at firms’ level. This is precisely where Bresnahan-Lau’s model can play a supplementary role (Bikker, 2003) [6]. To the best of our knowledge; no study in Nigeria has used Bresnahan-Lau’s approach to investigate the competitive conditions. Most studies in Nigeria that focused on the test for banking competition failed to confirm the competitive conduct using Bresnahan – Lau’s model, enhance this necessitates further study. Therefore, the objective of this study is to invest the competitive conduct in Nigerian deposit money market.The rest of this paper is organized as follows. Section 2 provides both theoretical and empirical review of the literature; Section 3 is dedicated to the methodology and empirical model. Section 4 presents the results of the analysis, while the last section concludes the paper.

2. Literature Review

2.1. The Theoretical Structure

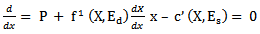

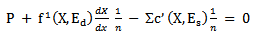

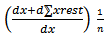

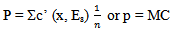

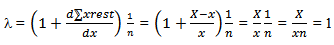

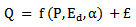

- In general, there are two main ways of analyzing the competitive features of the banking industry – structural and non-structural indicators. The structural approaches include the “Structure-Conduct-Performance Hypothesis” (SCP) and the “Efficient Structure Hypothesis” (ESH). Also, the market structure of an industry can be evaluated using market shares of individual firms, concentration ratios (CR), or a Hirschman–Herfindahl index (HHI).The SCP hypothesis measures the degree of competition in an industry from its structural features (Bain, 1951) [9]. It assumes that the concentration in the market can lead to market power, which makes banks to earn monopolistic or abnormal profits by offering lower deposit rates and charging higher loan rates. On the other hand, Demsetz (1973) [10] suggests Efficient Structure Hypothesis ( ESH) and states that the positive relationship between profitability and market concentration is not a consequence of market power but due to the greater efficiency of firms with larger market share.Alternatively, the “Contestable Market Theory (CMT)”, states that individual banks that make up an industry may behave differently depending on the market structure in which they operate. This theory was developed by Baumol (1982) [11] who declares that a concentrated industry can behave competitively when there are no (or low) barriers for new entrants to enter the market. These arrangements imply that a concentrated market can be competitive even if it is dominated by a few large banks. Therefore, policymakers should be relatively less concerned when the financial system is dominated by few financial intermediaries if the financial market is contestable.In literature, the non-structural measures of competition which is categorically called New Empirical Industrial Organization approach, in contrast, are based on the work of Lerner (1934) [12]. These include measures of competition of oligopolists such as Iwata (1974) [13] and those that test for competitive behavior in contestable markets by Bresnahan (1982) [1], Lau (1982) [2] and Panzar and Rosse (1987) [14]. These measures compare price mark-up over some competitive benchmark to gauge the market power in the market. Bresnahan (1982) [1] and Lau (1982) [2] approach requires a structural model of banking competition where a parameter representing the apparent market power of banks is included. This approach was first applied to the banking industry by Shaffer (1989 [15], 1993 [16]) using aggregate data for the U.S. loan market and the Canadian banking industry, respectively. Panzar and Rosse (1987) [14] formulated another approach known as "H-statistic", which is widely used to measure the overall market competitiveness. This approach suggests that banks employ different pricing strategies in response to change in input costs depending on the market structure in which they operate. The “H- statistic” is estimated as the sum of the elasticities of the reduced form revenue function with respect to input prices. If the market is featured as a monopoly, H- statistic value is less than or equal to zero. If the H- statistic is negative then the structure is a conjectural variations short-run oligopoly. The H statistic is equal to unity (one) when the market structure is perfectly competitive. The data required for the Bresnahan model as discussed are all macroeconomic (industry level) time series variables. Macroeconomic data is generally easier to obtain than microeconomic data. This is one of the benefits of using the Bresnahan model versus models that use bank specific data such as the Panzar and Rosse approach (Greenberg, et al , 2009) [17].The Bresnahan – Lau’s model is also known as mark –up test involves estimating a structural model. Incorporating demand and cost equations, together with the profit maximizing condition that marginal revenue (MR) equals marginal cost (MC). Given the profit function that belongs to a firm is as stated below:

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

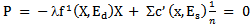

Then equation (5) can be written as:

Then equation (5) can be written as:  | (6) |

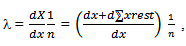

then

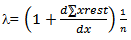

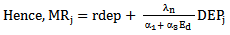

then  Where

Where  shows Conjectural Variation of the firm, it means a change in the overall output of other firms (d ∑x rest) that are anticipated by one firm as the result of changes in the firm’s output (dx). The numerical value of the parameter (λ) provides important information about the nature of competition that is perceived by the firm,• Under perfect competition, when a firm increases its output, it assumes there will be no impact on the market price. Because all firms are price takers. This means that λ = 0, so that equation (6) will be

shows Conjectural Variation of the firm, it means a change in the overall output of other firms (d ∑x rest) that are anticipated by one firm as the result of changes in the firm’s output (dx). The numerical value of the parameter (λ) provides important information about the nature of competition that is perceived by the firm,• Under perfect competition, when a firm increases its output, it assumes there will be no impact on the market price. Because all firms are price takers. This means that λ = 0, so that equation (6) will be • If firms are in perfect collusion, that is, under joint profit maximization. Then the increase in output of a firm would be followed by the increase in firms’ output.

• If firms are in perfect collusion, that is, under joint profit maximization. Then the increase in output of a firm would be followed by the increase in firms’ output. It means that λ = 1. • Between perfect competition and perfect collusion, the value of λ will range from o to 1 i.e. o < x < 1 that is a firm is in a monopolistic competition.However, taking the inverse of the demand function (2) and the price function (6) above, we have

It means that λ = 1. • Between perfect competition and perfect collusion, the value of λ will range from o to 1 i.e. o < x < 1 that is a firm is in a monopolistic competition.However, taking the inverse of the demand function (2) and the price function (6) above, we have  | (7) |

| (8) |

2.2. Previous Contributions

- A Standard industrial organization suggests that deviations from perfect competition introduce inefficiencies which, in turn, can deter firms’ access to funds and thus hinder economic growth. However, empirical studies provide contradictory evidence about the effect of competition and concentration on banking efficiencies. In addition, some studies investigate the competitive conditions in banking systems. The focus of these studies has been varied. Some try to document only the degree of competition or lack thereof, others try to identify the relationship between competition and efficiency. For instance, Lubis (2012) [18] examined the degree of market power of Indonesian commercial banking industry using Bresnahan-Lau model. The results indicate that the market power of credit market of the industry is relatively low. This means that the degree of competition is quite high.Vittas and Neal (1992) [19] examined the trends in competition and efficiency in Hungarian banking. They also assessed the performance of Hungarian bank and noted the tremendous progress that were made in expanding the number of competing banks, strengthening the legal and regulatory framework, increasing the banks’ managerial autonomy and promoting development of the private sector. Vittas and Neal noted that effective competition was constrained by the segmentation of the market. The entry of new banks – joint venture banks – has a clear impact on market shares, but competition appears to be more effective in increasing the range of services than in lowering bank.Molyneux et al. (1994) [20] employ the "H-statistic" on a sample of German, UK, French, Italian, and Spanish banks for each year of the period 1986 to 1989. On average, their results suggest existence of monopolistic competition in Germany, France, Spain and the UK, and monopoly in Italy. Molyneux et al. (1996) [21] also examine the competitiveness of Japanese banks and found monopoly for 1986 and monopolistic competition for 1988. De Bandt and Davis (2000) [22] found monopolistic competition for large banks and monopoly for small banks for Germany and France, and monopolistic competition for small and large banks in Italy over the period 1992-1996. Bikker and Groeneveld (2000) [23] found monopolistic competition of varying degrees for European Union countries for the period of 1989 to 1996.Bikker and Haaf (2002) [24] investigate the relationship between competition and market structure in the banking industry for all banks in their sample and estimate a regression model where the competition measure is tested against market structure (proxied by concentration indices and the log of the number of banks in the markets) and a dummy for EU/non-EU countries. Overall, they find support for the conventional view that concentration impairs competitiveness.Yildirim and Philippatos (2003) [25] analyzed the evolution of competitive conditions in the Banking industries of fourteen Central and Eastern European (CEE) transition economies using firm-level data. The results of the competition analysis suggest that the banking markets of CEE countries cannot be characterized by the bipolar cases of either perfect competition or monopoly over 1993-2000 except for FYR of Macedonia and Slovakia. That is, banks earned their revenues as if operating under conditions of monopolistic competition in that period. Furthermore, the cross-sectional analysis of competitive structure reveals initially a decreasing trend between 1993 and 1996 and a subsequent increasing trend in competitive conditions after 1996. Large banks in transition countries operate in a relatively more competitive environment compared to small banks, or in other words, competition is lower in local markets compared to national and international markets.Weill (2004) [26] investigates the relationship between competition and X-efficiency. Efficiency scores (estimated using a stochastic parametric method) are regressed on the competition measure and a set of independent variables including: macro factors (GDP per capita and density of demand); an intermediation ratio (loans/deposits) and finally a dummy that corresponds to the geographical location. The author finds evidence of a negative relationship between competition and efficiency in EU banking.Buchs and Mathisen (2005) [27] examined the degree of bank competition and efficiency with regard to banks’ financial intermediation in Ghana. In the study they applied panel data to variables derived from a theoretical model and find support for the presence of a noncompetitive market structure in the Ghanaian banking system, possibly hampering financial intermediation. The economic costs of the noncompetitive behaviour might have been exacerbated by the persisting domestic financing needs of the government, making it captive to the banks’ behaviour and fostering inefficiency in the banking system. Also, large deficit financing through the issuance of treasury bills has not only crowded out the private sector in capturing banks investments, but has also put pressure on interest rates, thereby making access to bank lending even more difficult for the private sector thus hampering private sector development. Therefore, further private sector development appears to be very much dependent upon sound fiscal adjustment, and the possible link between fiscal policy and the efficiency of the banking system should deserve further attention. The result of the study further indicated that consolidation of the Ghanaian banking sector is expected due to scale matters.Casu and Girardone (2005) [28] stated that the deregulation of financial services in the European Union, together with the establishment of the Economic and Monetary Union, was aimed at the creation of a level-playing-field in the provision of banking services across the EU. The plan was to remove entry barriers and to foster competition and efficiency in national banking markets. However, one of the effects of the regulatory changes was to spur a trend towards consolidation, resulting in the recent wave of mergers and acquisitions. To investigate the impact of increased consolidation on the competitive conditions of EU banking markets, they employ both structural (concentration ratios) and non-structural (Panzar-Rosse statistic) concentration measures. Using bank level balance sheet data for the major EU banking markets, in a period following the introduction of the Single Banking License (1997-2003), the study also investigates the factors that may influence the competitive conditions. Specifically, they control for differences in efficiency estimates, structural conditions and institutional characteristics. The results seem to suggest that the degree of concentration is not necessarily related to the degree of competition. They also find little evidence that more efficient banking systems are also more competitive. The relationship between competition and efficiency is not a straightforward one: increased competition has forced banks to become more efficient but increased efficiency is not resulting in more competitive EU banking systems.Greenberg, et al (2009) [17] investigated the level of competition in the South African banking sector. This is done by using two non-structural methods of measurement, namely the Panzar and Rosse approach and the Bresnahan model. The results of both of these non-structural models have shown that the South African banking sector faces a high level of monopolistic competition, even characteristics of perfect competition. This level of competition was tested during the period 1998 to 2007 for the Panzar and Rosse approach and from 1992 to 2008 for the Bresnahan model. This result supports other non-structural studies on the South African banking sector.Mirzaei, et al (2011) [29] investigated the effects of market power, banking and bank-environment activities on profitability and stability (risk and returns) for a total of 1929 banks in 40 emerging and advanced economies over the sample period of 1999-2008. The model developed incorporates the traditional structure-conduct-performance (SCP) and the relative market- power (RMP) hypotheses with the view to assessing the extent to which the bank performance can be attributed to non-competitive market conditions and pricing behaviour. The key findings are as follows; i) a greater market power leads to higher bank performance being biased toward the RMP hypothesis in advanced economies; ii) more concentrated banking systems in advanced economies may be more vulnerable to financial instability; iii) Neither of the hypotheses seems to be supported for the returns in the emerging banking sector; and iv) higher interest rate spreads increase profitability and stability for both types of economies, however, for emerging banks this seems to be one of the key elements to increase their profitability raising concerns on economies. Other interesting findings include that off balance- sheet activities appear to present banks with a trade-off between risk and returns in advanced economies, and the effects of bank age, bank ownership status and regulation on risk and returns, depend on market power.Erol, et al (2012) [30] carried out an empirical assessment of the market structure and the competitiveness of the Chinese banking sector particularly in the wake of China’s accession to the WTO by employing the Panzar-Rosse H-Statistic as a non-structural model over the period 2004-2007. The empirical findings indicate that the banking sector in China was monopolistically competitive for the specified period. They also find that the Chinese banks, which operate in more monopolistic environments, are less efficient. The findings reject the state of conjectural variation short run oligopoly or natural monopoly in the industry for the period under consideration.Al-jarrah, et al (2012) [31] evaluated the competition and pricing power in the banking sector of Jordan over the period 2001-2008. The most widely known structural and non-structural measures of competition are used and their results are reconciled with the aim of obtaining more consistent estimates for the overall state of competition of the banks under study. With regard to the traditional banking activities, the results suggest based mainly on the net interest margin measure that the banking sector of Jordan is not characterized by the so called "perfect competition". On the other hand, the more-inclusive non-structural competition measures that control for bank-specific and macro-economic variables show that the banking sector is a rather competitive sector, especially over the period 2005-2008. On this basis, they suggest that it is important for policy makers to consider the bank-specific and macroeconomic variables when assessing the overall state of banking sector competition. In addition, few studies in Nigeria have made attempt to examine the degree of bank competition in Nigeria. For instance, Asogwa (2002) [8] examined the banking competition in Nigeria using firm level balance sheet and income statement data for the period 1997 to 2001. He adopted the conjectural variation approach for the analyses of competition. In this perspective, estimation of a simultaneous equation model, formed by a cost equation and a supply equation, the latter containing a behavioral parameter to identify and assess the market conduct of banks. The finding was that the estimated degree of competition is usually lying between the perfectly competitive and perfectly collusive values, but above the Cournot values indicating a fairly competitive pattern of behaviour. Large banks have been characterized by more competitive conduct. He concluded that region-wide and Lagos/West regional banks exhibit stronger competitive conduct.Ajisafe and Akinlo (2013) [7] investigated the degree of competition in Nigerian banking sector between 1990 and 2009 using Panzar and Rosse (PR) methodology. The data for the study were obtained from the annual reports and statement of accounts of fifteen commercial banks in Nigeria which were purposively selected for the study. The data collected were analysed using dynamic panel generalised method of moment estimation technique with fixed effect. The results of the analysis showed that the Nigerian commercial banks were characterised by monopolistic competition with H-statistic significantly different from zero for all sample periods and sub-sample periods. The value of H-statistic ranged between 0.0925 and 0.1168. The study concluded that the banking industry in Nigeria exhibited monopolistic competition.Bashorun and Ojapinwa (2014) [32] investigated the effect of bank consolidation in Nigeria on the structural characteristics of the banking market. They established that there is substantial increase in concentration for the post consolidation period with very high tendency to gravitate towards becoming a moderately concentrated market according to the USA merger guideline. Also, there is the emergence in 2012, of eight top dominant banks controlling more than 75% of the Nigerian banking business especially in the total assets market. The implication of this finding is that there is the need to forestall collusive and anti-competitive practices by stepping up the oversight functions of the regulatory and supervisory agencies while reviewing periodically the hurdles for new entrants to the industry.Ayeni (2013) [33] investigated the level of competition in the Nigerian banking sector. Data were sourced from 18 banks for the period of 2006 -2010. The study employed the non-structural method of Panzar and Rosse to compute the competitive index. The results show that banks in Nigeria earned their income under an averagely monopolistic competitive market.In conclusion, most studies in Nigeria that focused on the test for banking competition have reached a consensus that the banking structure displayed monopolistic competition, but failed to confirm this assertion using Bresnahan – Lau’s model, enhance this necessitates further study.

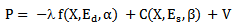

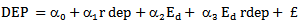

3. Methodology and the Emprical Model

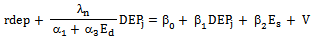

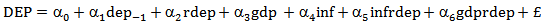

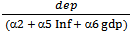

- This study depends on secondary data. Data were sourced from Central bank of Nigerian statistical bulletin, Securities and Exchange Commission (SEC) and annual report and accounts of Nigerian banks. The theoretical model described above has been interpreted by many authors in different ways. The equations (7) and (8) above serve as the basis from which the model of Bikker (2003) [6] and Green berg et. al (2009) [17] who have applied the Bresnahan – Lau’s model to bank competition in EU deposit loan market, and South African Banking sector respectively, were developed. They simultaneously solved for λ by equating demand and supply equation for deposit market: as stated below:Demand side function is

| (9) |

| (10) |

| (11) |

| (12) |

| (13) |

| (14) |

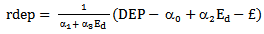

By making rdep be the subject of the formula and for average bank, we have

By making rdep be the subject of the formula and for average bank, we have | (15) |

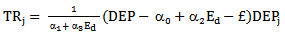

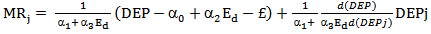

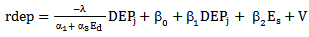

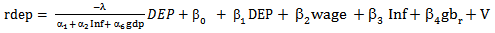

and; for Identification of λ requires that α1 ≠ 0 and α3 ≠ 0 must hold. However, for the purpose of this study, the model specified by Greenberg, et al (2009) [17] will be estimated with the following specifications:

and; for Identification of λ requires that α1 ≠ 0 and α3 ≠ 0 must hold. However, for the purpose of this study, the model specified by Greenberg, et al (2009) [17] will be estimated with the following specifications: | (16) |

| (17) |

= the conduct variable and its coefficient (λ) is the Parameter of interest. E and V = error terms.

= the conduct variable and its coefficient (λ) is the Parameter of interest. E and V = error terms. 3.1. Decision Rules

- λ is the parameter of interest, if λ = 1, it implies monopoly or colluding oligopoly. If λ is between 0 and 1, it implies monopolistic competition. And, if λ = 0, it implies perfect competition.

3.2. Apriori Expectations

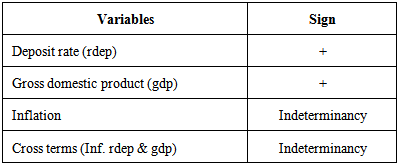

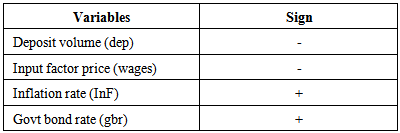

- Table 1 shows the expected sign of the various variables in the demand equation, while Table 2 shows the expected sign for the supply equation.

|

|

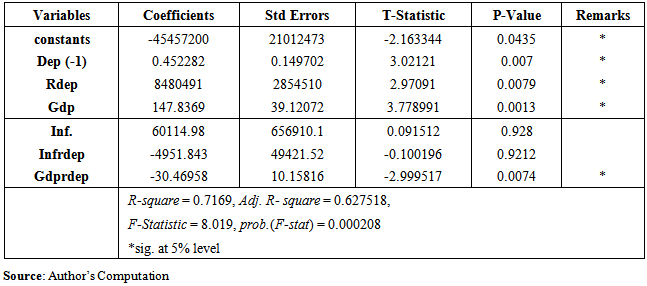

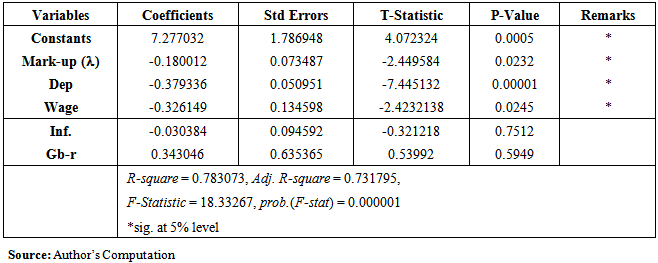

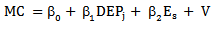

4. Results and Discussion

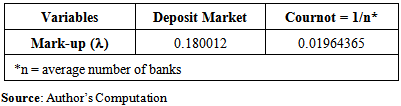

- The results of deposit demand model has been presented in Table 3 and the results of deposit supply have been presented in Table 4. The Table 5 shows that the mark-up value in the deposit markets is 0.180012 and Table 4 confirms its significant level at 5%. This shows that the market power is significantly different from zero. This implies that market power in the deposit market is not the same as the one in the perfectly competitive market; even when compared with the level of market power in the cournot competitive condition of 0.0196. The coefficient of the mark-up ranged between 0 and 1, this means that the deposit market displays monopolistic competition.

|

|

|

= 8480491.0 - 4951.843*inf - 30.469*gdp. The same thing applies to gdp and Inf variables, they both have direct and indirect effect on deposit volumes. The total effect of gdp is

= 8480491.0 - 4951.843*inf - 30.469*gdp. The same thing applies to gdp and Inf variables, they both have direct and indirect effect on deposit volumes. The total effect of gdp is  = 147.8369 -30.469*rdep while that of inflation (inf.) is

= 147.8369 -30.469*rdep while that of inflation (inf.) is  = 4951.843 -4951.843*rdep.The price equation called supply equation (16) explains the rate of deposit in terms of deposit volumes, labour prices and other exogenous variables like inflation etc. The deposit volume follows apriori expectation, banks pay lower deposit rate as more deposits are attracted. The wages coefficient has a negative sign, as input price (wages) increases the deposit rate would reduce. A unit increases in wages would make the deposit rate to reduce by 32.6%. The alternative interest rate (government bond rate, gb_r) cannot be ignored, our expectation is positive sign in which the coefficient confirms with. This is because if loan level increase abnormally, it will encourage banks to increase deposit rate (by 0.32%) for the purpose of increasing customers’ deposit by a unit, in turn, improves funding.

= 4951.843 -4951.843*rdep.The price equation called supply equation (16) explains the rate of deposit in terms of deposit volumes, labour prices and other exogenous variables like inflation etc. The deposit volume follows apriori expectation, banks pay lower deposit rate as more deposits are attracted. The wages coefficient has a negative sign, as input price (wages) increases the deposit rate would reduce. A unit increases in wages would make the deposit rate to reduce by 32.6%. The alternative interest rate (government bond rate, gb_r) cannot be ignored, our expectation is positive sign in which the coefficient confirms with. This is because if loan level increase abnormally, it will encourage banks to increase deposit rate (by 0.32%) for the purpose of increasing customers’ deposit by a unit, in turn, improves funding. 5. Conclusions

- The study examines the level of market power of Nigerian deposit money market using Bresnahan-Lau (BL) framework. The data required for the Bresnahan-Lau model are all macroeconomic (industry level) time series variables. By estimating the model, the results show that the level of competition in Nigerian deposit market is monopolistically competitive structure as the coefficient of the mark-up (λ) displays. This conclusion is consistent with the study of Ajisafe and Akinlo (2013) [7] and Ayeni (2013) [33] whose studies make use of Panzar and Rosse (PR) methodology and Asogwa(2002) [8] whose study uses conjecturer variation approach.

References

| [1] | Bresnaham, T.F. (1982). The oligopoly solution concept is identified. Economic Letters 10,87-92. |

| [2] | Lau, L.J. (1982). Identifying the degree of competitiveness from industry price and output data. Economic Letters 10,93-99. |

| [3] | Claessens, S. and Laeven, L. (2003). Competition in the financial sector and growth: A cross-country perspective. Being a paper presented at the Money, Finance and Growth workshop, organized by Charles Good hart, in Salford on September 8 and 9, year 2003. |

| [4] | Ajide, F.M. (2014). The effect of bank competition and stock market on economic growth in Nigeria. Unpublished M.Sc. Thesis: Department of Economics, Obafemi Awolowo University. |

| [5] | Ajisafe, R.A. and Akinlo, A.E. (2014). Competition and efficiency of commercial banks: empirical evidence from Nigeria. American Journal of Economics, 4(1), 18-22. |

| [6] | Bikker, J.A. (2003). Testing for imperfect competition on EU deposit and loan markets with Bresnahan’s market power model. De Netherlandsche Bank Research Series, Amsterdam. |

| [7] | Ajisafe, R.A. and Akinlo, A.E. (2013). Testing for competition in the Nigerian commercial banking sector. Modern Economy, 4(7), 501-511. |

| [8] | Asogwa, R.C. (2002). Testing for bank competition in Nigeria: A conjectural variation approach. African Journal of Economic Policy, 9(2), 21–50. |

| [9] | Bain, J.S. (1951). Relation of profit rate to industry concentration: American manufacturing, 1936-1940. Quarterly Journal of Economics, 65,293-324. |

| [10] | Demsetz, J. (1973). Industry structure, Market rivalry and public policy. Journal of Law and Economics 16:1-9. |

| [11] | Baumol, W.J. (1982). Contestable markets: An uprising in the theory of industry structure. American Economic Review 72, 1-15. |

| [12] | Lerner A. (1934). The concept of monopoly and the measurement of monopoly power. Review of Economic Studies 1: 157–175. |

| [13] | Iwata, G. (1974). Measurement of conjectural variations in oligopoly. Econometrica,42, 947-966. |

| [14] | Panzar, J. and Rosse J. (1987). Testing for Monopoly Equilibrium. Journal of Industrial Economics, 35(4), 443-456. |

| [15] | Shaffer, S. (1989). Competition in the US banking industry. Economic Letters 29,321-323. |

| [16] | Shaffer, S. (1993). A test of competition in Canadian banking. Journal of Money, Credit and Banking 25, 49-61. |

| [17] | Greenberg, J.B. and W. Simbanegavi (2009) Testing for competition in the South African banking Sector, Faculty of Commerce University of Cape Town, available at Simbanegavi Measuring competition in Banking sector.pdf. Accessed on June, 25th, 2013. |

| [18] | Lubis, A. F. (2012). Market power of Indonesian banking. Bulletin of Monetary Economics and Banking, Jan, 2012, 225-244. |

| [19] | Vittas, D. and Neal Craig (1992). Competition and Efficiency in Hungarian Banking. Policy Research Working Papers, Financial Policy and Systems. October. |

| [20] | Molyneux, P., Lloyd-Williams, D. and Thornton, J. (1994). Competitive conditions in European banking. Journal of Banking and Finance, 18, 445–459. |

| [21] | Molyneux, P., Thornton J. and D.M. Lloyd-Williams (1996). Competition and Market Contestability in Japanese Commercial Banking. Journal of Economics and Business, 48, 1, February, 33-45. |

| [22] | De Bandt O. and Davis E. P. (2000). Competition, contestability and market structure in European banking sectors on the Eve of EMU. Journal of Banking and Finance, 24,(2000), 1045-1066. |

| [23] | Bikker, J.A. and J.M.Groeneveld (2000) Competition and Concentration in the EU Banking Industry, Kredit und Kapital, 33, 62-98. |

| [24] | Bikker, J. and Haaf, K. (2002). Competition, concentration and their relationship: An empirical analysis of the banking industry. Journal of Banking & Finance, 26, 2191-2214. |

| [25] | Yildirim, H.S. and Philippatos, G.C. (2003). Competition and contestability in central and eastern European banking markets. A paper presented at 2003 FMA International meeting in Dublin, Island. |

| [26] | Weill, L., (2004) On the relationship between competition and efficiency in the EU banking sector, Kredit und Kapital, 37 (2004), 329-352. |

| [27] | Buchs T. and Mathisen J. (2005). Competition and efficiency in Banking: Behavioural and evidence from Ghana. International Monetary Fund, IMF Working paper, WP/05/17, January. |

| [28] | Casu, B. and Girardone, C. (2007). Does competition leads to efficiency? The case of EU commercial banks. Discussion Paper, Essex Finance Centre. No 07-01. |

| [29] | Mirzaei, A., Liu.G., and Moore, T. (2011). Does market structure matter on banks’ profitability and stability? Emerging versus advanced economies. Economics and Finance Working Paper Series Brunel University, Uxbridge, UK,. Available at http://www.brunel.ac.uk/economics, accessed on 25th October, 2013. |

| [30] | Erol C., Masood O., Aktan, B., and Sergi, B. (2002). Evaluation of competitive conditions in the PRC banking industry. Proc. Of 7th international conference on business and management, May 10th -12th, Vilnius, Lithuania. |

| [31] | Al-jarrah, I.M., Qasrawi, W., Obeidal, B.Y. and Sulyman, Y.H. (2012). Evaluating the competition and pricing power in the banking sector of Jordan. European Jouranl of Economics, Finance and Administrative sciences, 46 (2012), 41-53. |

| [32] | Bashorun, O.T. and Ojapinwa T. V.(2014). Bank consolidation and market structure in Nigeria: Application of the Herfindahl-Hirschman Index. International Journal of Economics and Finance,6(2),235-243. |

| [33] | Ayeni, R. K. (2013). Market structure: Investigating banking competition in Nigeria. Proc. of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013,pp.1-12. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML