-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2014; 4(4): 171-183

doi:10.5923/j.economics.20140404.02

The Effects of Uncertainty on Inflation and Output Growth in Four African Oil-Rich Countries: Evidence from an Asymmetric Multivariate GARCH-M Model

Arcade Ndoricimpa

Faculty of Economics and Management, University of Burundi, Bujumbura, Burundi

Correspondence to: Arcade Ndoricimpa, Faculty of Economics and Management, University of Burundi, Bujumbura, Burundi.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This study examines the impact of uncertainty on the levels of inflation and output growth for four African oil-rich countries, namely Algeria, Congo Republic, Gabon and Libya using an asymmetric multivariate GARCH-M model initiated by [21]. A number of important findings arise from this study. First, considering the impact of inflation uncertainty on inflation, Cukierman-Meltzer hypothesis is supported for Algeria and Gabon, while the stabilization hypothesis of [24] is supported for Congo Republic and Libya.Second, on the impact of output growth uncertainty on inflation, our findings support Devereux’ hypothesis of a positive impact of output growth uncertainty on the level of inflation for Congo Republic and a negative impact of output growth uncertainty on the level of inflation for the rest of the countries. Third, a closer look at the impact of inflation uncertainty on output growth shows that Friedman’s hypothesis of a negative impact of inflation uncertainty on output growth could not be supported for any country. In contrast, the hypothesis of a positive impact of inflation uncertainty on output growth suggested by [10] is supported for all the countries under study. Finally, concerning the impact of output growth uncertainty on output growth, Black hypothesis of a positive impact of output growth uncertainty on output growth is supported for Algeria, Gabon and Libya, while the views of [37] and [38] of a negative impact of output growth uncertainty on output growth are supported for Congo Republic. This is to the best of my knowledge the first attempt to examine the impact of uncertainty on inflation and output growth for these four African countries, namely Algeria, Congo Republic, Gabon and Libya. Further empirical investigations are therefore needed to shed more light on this issue.

Keywords: Inflation, Growth, Uncertainty, Asymmetric Multivariate GARCH-M model, African oil-rich countries

Cite this paper: Arcade Ndoricimpa, The Effects of Uncertainty on Inflation and Output Growth in Four African Oil-Rich Countries: Evidence from an Asymmetric Multivariate GARCH-M Model, American Journal of Economics, Vol. 4 No. 4, 2014, pp. 171-183. doi: 10.5923/j.economics.20140404.02.

Article Outline

1. Introduction

- Examining the real effects of inflation has gained much importance in the past decades following the claim of [18] that inflation uncertainty could be considered to be part of the welfare costs of inflation. He argued that rising inflation is associated with high inflation uncertainty and that inflation uncertainty is detrimental to growth by rendering market prices system less efficient for coordinating economic activity, therefore making it difficult for economic agents to decide how to use their resources.On the relationship between the level of inflation and inflation uncertainty, [1] supports [18] but [8] and [24] give contradicting views by suggesting existence of a reverse causality. [8] argue that an increase in inflation uncertainty leads to an increase in the level of inflation as policymakers create surprise inflation to stimulate output and [24] in his stabilization hypothesis points out that an increase in inflation uncertainty leads to a decrease in inflation as policymakers reduce the growth rate of money hence reducing inflation in order to reduce the effects of inflation uncertainty on the economy. While a number of scholars (see for instance, [15], [19], [6]) support [18] on the negative growth effects of inflation uncertainty, [10] suggest a different view of a positive impact of inflation uncertainty on output growth. They argue that an increase in the variability of monetary growth, and therefore inflation, makes the return to money balances more uncertain and leads to a fall in the demand for real money balances and consumption. Hence, agents increase precautionary savings leading to an increase in investments which in turn boost output growth.The impact of real uncertainty (output growth uncertainty) on output growth has also interested a number of scholars. While [17] argues that there is an independence relationship between the two, [2] and [3] suggest a positive impact of output growth uncertainty on output growth by arguing that high volatility will lead to increase in savings through precautionary motives which in turn cause an increase in investments. [37] and [38] on the other hand, suggest a negative impact of output growth uncertainty on output growth. According to them, large fluctuations in economic activity are more likely to increase the uncertainty regarding the long-run profitability of investments, making the returns to investments riskier and reducing hence the level of investments and therefore output growth.The impact of output growth uncertainty on inflation is also discussed in the literature. [9] developed a model which predicts a positive impact of output growth uncertainty on the level of inflation. According to [9], the central bank usually creates surprise inflation to raise output, but this will be effective when the degree of wage indexation is low. He shows that an increase in the variance of real shocks which lowers the degree of wage indexation raises output growth volatility (uncertainty) and causes the level of inflation to increase.A number of empirical studies have examined the effects of inflation uncertainty and output growth uncertainty on the levels of inflation and output growth, using either a simultaneous approach in GARCH-in-mean models (see, for instance [21], [22], [35], [34], [36], [23]) or two-step approach where uncertainty measures for inflation and output growth are initially generated using various types of GARCH models and then causality tests are conducted to examine the impact of uncertainty on inflation and output growth (see for instance, [16], [39], [27], [31], [33]).In addition, most of existing studies use univariate GARCH models (see, for instance, [16], [34], [23], [14], [32]) or restrictive models of the covariance process such as CCC and DCC-GARCH model1, diagonal VEC-GARCH model2 or diagonal BEKK model (see [26], [27], [31], [7]). As [21] note, univariate models do not permit the joint generation of the uncertainty measures for inflation and output growth nor do they permit one to simultaneously examine their impacts on the levels of inflation and output growth, while the restrictive models can lead to misspecification problem.[21] cautioned about using restrictive GARCH models that impose diagonality and symmetry restrictions on the conditional variance-covariance matrix. According to them, this might lead to misspecification problem hence wrong measures of inflation uncertainty and output growth uncertainty, and faulty conclusions regarding the impact of uncertainty on inflation and output growth. To address this problem, [21] proposed a model which allows testing for diagonality and symmetry in the conditional variance-covariance matrix instead of imposing them.This study therefore follows [21] and applies an asymmetric multivariate GARCH-M model to simultaneously examine the effects of inflation uncertainty and output growth uncertainty on the levels of inflation and output growth in four African Oil-rich countries, Algeria, Congo Republic, Gabon and Libya. While a number of empirical studies exist on this subject, this is to the best of my knowledge the first study to analyze the effects of uncertainty on inflation and output growth for those four African countries.The rest of the paper is organized as follows. Section 2 highlights the methodology used. Section 3 presents the estimation and diagnostic test results and section 4 concludes the study.

2. Methodology and Data

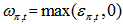

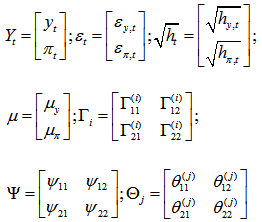

- To examine the impacts of inflation uncertainty and output growth uncertainty on the levels of inflation and output growth in Algeria, Congo Republic, Gabon and Libya, this study follows [21] and uses an asymmetric BEKK3 GARCH-M model in which the conditional means of inflation

and output growth

and output growth  are in form of VARMA (Vector Autoregressive Moving Average) GARCH-M model, where the conditional standard deviations of output growth and inflation are included as explanatory variables in each conditional mean equation. The specification of the conditional means of inflation

are in form of VARMA (Vector Autoregressive Moving Average) GARCH-M model, where the conditional standard deviations of output growth and inflation are included as explanatory variables in each conditional mean equation. The specification of the conditional means of inflation  and output growth

and output growth  is in equation (1), where,

is in equation (1), where,  is the conditional variance-covariance matrix,

is the conditional variance-covariance matrix,  is the conditional variance of output growth,

is the conditional variance of output growth,  is the conditional variance of inflation,

is the conditional variance of inflation,  are the conditional covariances between inflation and output growth,

are the conditional covariances between inflation and output growth,  is the vector of error terms,

is the vector of error terms,  is the matrix of constant terms,

is the matrix of constant terms,  is the matrix of Autoregressive coefficients,

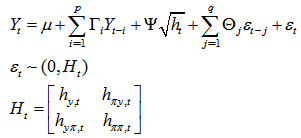

is the matrix of Autoregressive coefficients,  is the matrix of in-mean coefficients and

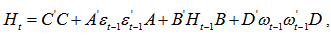

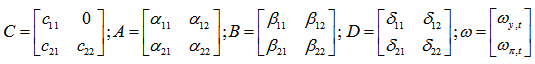

is the matrix of in-mean coefficients and  is the matrix of Moving Average coefficients. Important to note is that in GARCH models, uncertainty (volatility) is captured by the conditional variance which is just the variance of the one step ahead forecasting error.In equation (2), A is a matrix of ARCH coefficients which captures the ARCH effects and B is a matrix of GARCH coefficients capturing the GARCH effects. The diagonal elements in matrix A show the impact of own past shocks on the current conditional variance and the diagonal elements in Matrix B represent the impact of own past volatility on the current conditional variance, while the off-diagonal elements in matrices A and B represent the volatility spillovers’ effects ([40]). Asymmetries in the conditional variance-covariance matrix is captured by the matrix D which is the matrix of asymmetric coefficients with

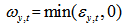

is the matrix of Moving Average coefficients. Important to note is that in GARCH models, uncertainty (volatility) is captured by the conditional variance which is just the variance of the one step ahead forecasting error.In equation (2), A is a matrix of ARCH coefficients which captures the ARCH effects and B is a matrix of GARCH coefficients capturing the GARCH effects. The diagonal elements in matrix A show the impact of own past shocks on the current conditional variance and the diagonal elements in Matrix B represent the impact of own past volatility on the current conditional variance, while the off-diagonal elements in matrices A and B represent the volatility spillovers’ effects ([40]). Asymmetries in the conditional variance-covariance matrix is captured by the matrix D which is the matrix of asymmetric coefficients with  and

and  . We note that the BEKK model becomes symmetric if asymmetric coefficients are statistically jointly equal to 0,

. We note that the BEKK model becomes symmetric if asymmetric coefficients are statistically jointly equal to 0,  . It should also be noted that BEKK model is preferred because it ensures the positive definiteness of the conditional variance-covariance matrix unlike the other variants of multivariate GARCH models.From the conditional mean equation (Equation 1), we can check how inflation uncertainty and output growth uncertainty affect the level of inflation and output growth. Assessing the impact of output growth uncertainty and inflation uncertainty on output growth is done by respectively testing the null hypotheses that

. It should also be noted that BEKK model is preferred because it ensures the positive definiteness of the conditional variance-covariance matrix unlike the other variants of multivariate GARCH models.From the conditional mean equation (Equation 1), we can check how inflation uncertainty and output growth uncertainty affect the level of inflation and output growth. Assessing the impact of output growth uncertainty and inflation uncertainty on output growth is done by respectively testing the null hypotheses that  and

and . A positive and significant

. A positive and significant  would mean a positive impact of output growth uncertainty on output growth, which is the Black hypothesis while a negative and significant

would mean a positive impact of output growth uncertainty on output growth, which is the Black hypothesis while a negative and significant  would imply a negative impact of output growth uncertainty on output growth, supporting the views of [37] and [38]. Similarly, a positive and significant

would imply a negative impact of output growth uncertainty on output growth, supporting the views of [37] and [38]. Similarly, a positive and significant  would mean a positive impact of inflation uncertainty on output growth which is Dotsey-Sarte hypothesis and a negative and significant

would mean a positive impact of inflation uncertainty on output growth which is Dotsey-Sarte hypothesis and a negative and significant  would mean a negative impact of inflation uncertainty on output growth which is Friedman hypothesis.Similarly, testing the impact of output growth uncertainty and inflation uncertainty on the level of inflation is done by respectively testing whether

would mean a negative impact of inflation uncertainty on output growth which is Friedman hypothesis.Similarly, testing the impact of output growth uncertainty and inflation uncertainty on the level of inflation is done by respectively testing whether  and

and  . A positive and significant

. A positive and significant  would mean a positive impact of output growth uncertainty on inflation which is Devereux hypothesis while a negative and significant

would mean a positive impact of output growth uncertainty on inflation which is Devereux hypothesis while a negative and significant  would imply a negative impact of output growth uncertainty on inflation. On the other hand, a positive and significant

would imply a negative impact of output growth uncertainty on inflation. On the other hand, a positive and significant  would mean a positive impact of inflation uncertainty on inflation, which would support Cukierman-Meltzer hypothesis while a negative and significant

would mean a positive impact of inflation uncertainty on inflation, which would support Cukierman-Meltzer hypothesis while a negative and significant  would mean a negative impact of inflation uncertainty on inflation, which is the stabilization hypothesis of [24].

would mean a negative impact of inflation uncertainty on inflation, which is the stabilization hypothesis of [24]. | (1) |

The conditional variance-covariance matrix of an asymmetric BEKK model is written as

The conditional variance-covariance matrix of an asymmetric BEKK model is written as | (2) |

3. Empirical Results and Discussion

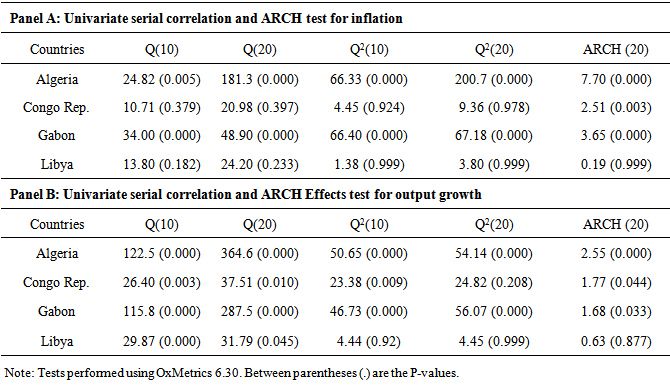

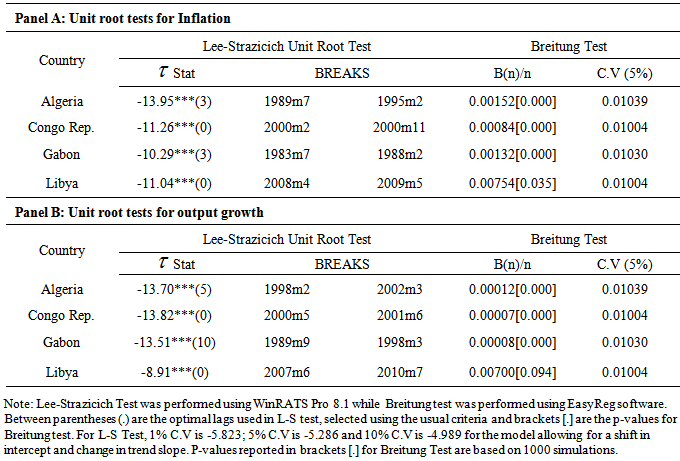

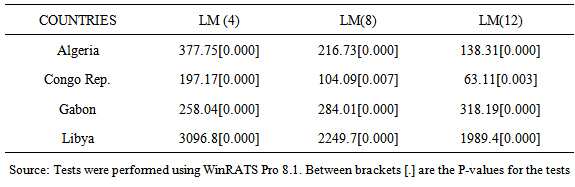

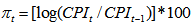

- Monthly data on price and output levels for Algeria, Congo Republic, Gabon and Libya are used for the period February 1974-May 2012, February 1998-July 2006, February 1978-February 2012 and February 2001-June 2011, respectively according to data availability. Data were retrieved from International Financial Statistics (IFS) of the International Monetary Fund (IMF). The price level is captured by Consumer Price Index (CPI) and output level is captured by Crude Petroleum Production Index. This is because high frequency data which are more appropriate with GARCH models are not available for GDP for most countries; a proxy for output level which can better capture the country’s economic activity is therefore used. We use Crude Petroleum Production Index since our selected countries are oil-rich countries; oil sector in these countries is the major contributor to Gross Domestic Product (GDP).Inflation rate is computed as the monthly difference of the logarithm of CPI,

and output growth is computed as the monthly difference of the logarithm of the production index

and output growth is computed as the monthly difference of the logarithm of the production index  ,

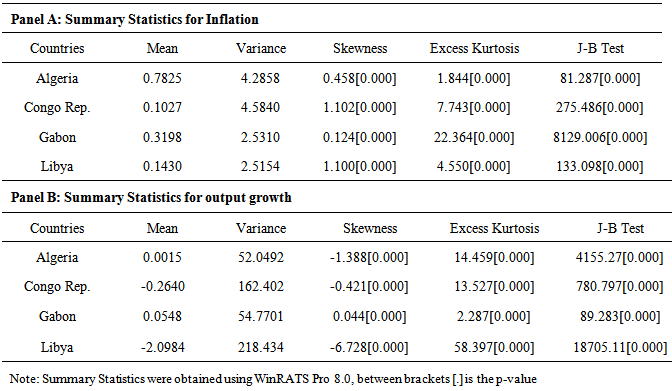

,  . Summary statistics in Table 1 show that both inflation,

. Summary statistics in Table 1 show that both inflation,  and output growth,

and output growth,  are positively skewed and display platikurtic behavior for all the selected countries. In addition, [25] test rejects the null hypothesis of normality in both inflation and output growth series.

are positively skewed and display platikurtic behavior for all the selected countries. In addition, [25] test rejects the null hypothesis of normality in both inflation and output growth series.

|

|

|

|

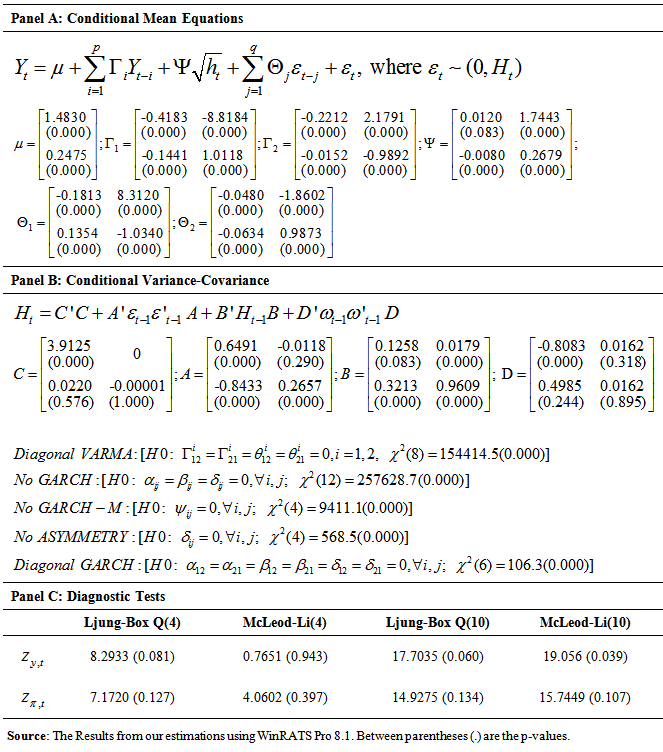

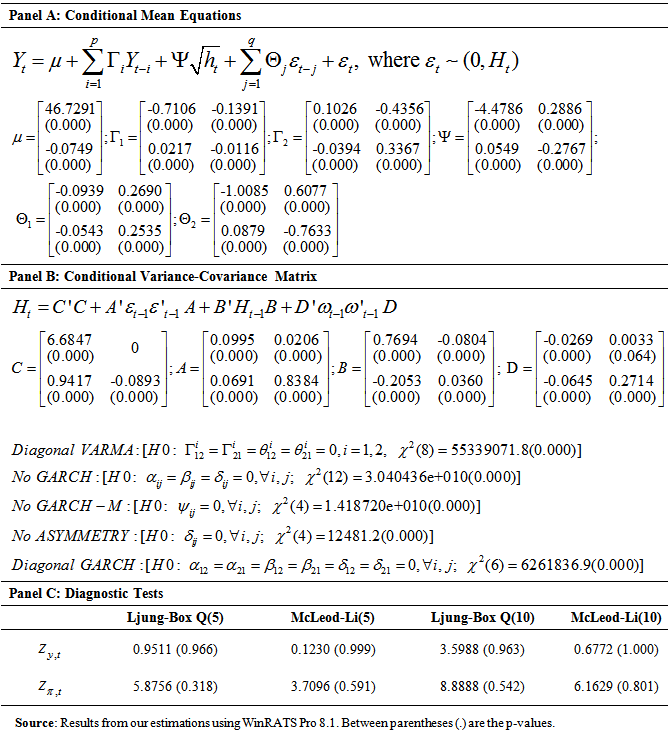

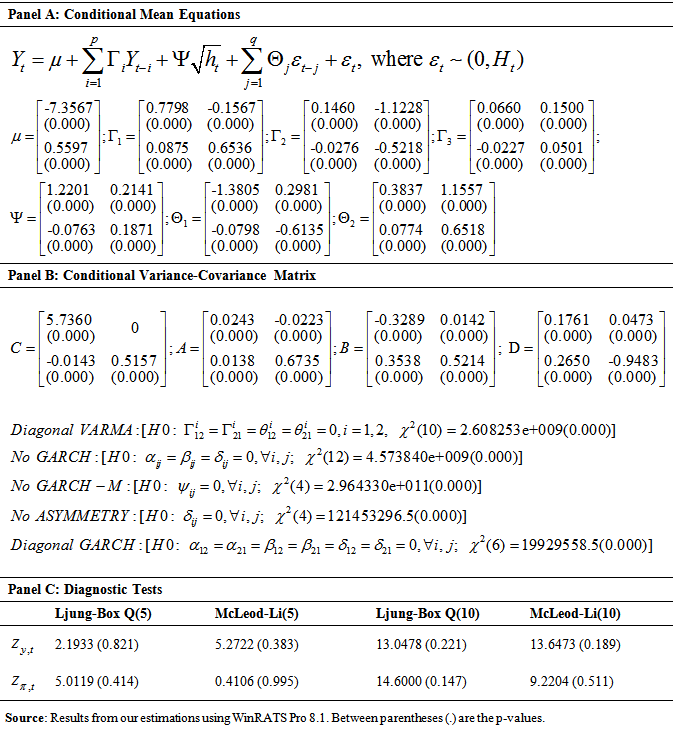

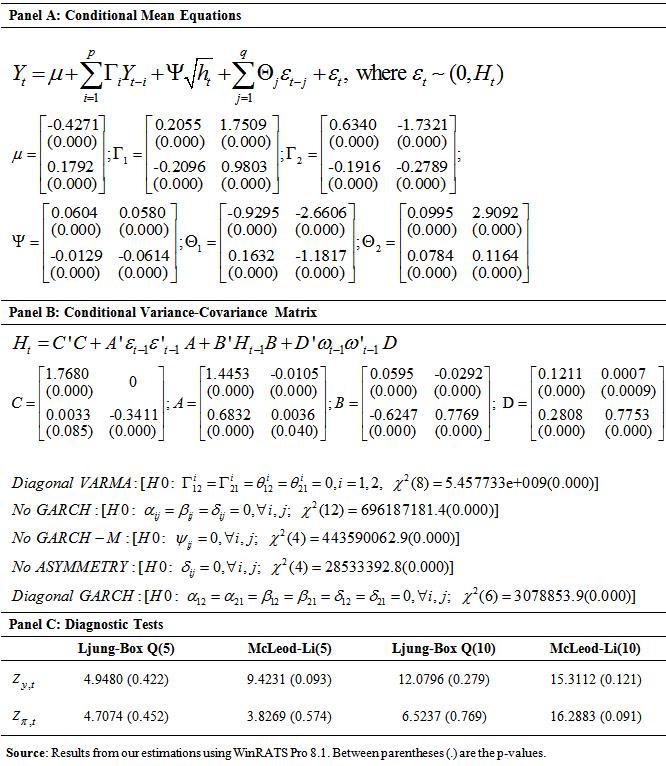

in equation 1. The estimation results indicate that

in equation 1. The estimation results indicate that  is statistically significant at 1% level (p-value = 0.000) for all the countries under study, positive for Algeria

is statistically significant at 1% level (p-value = 0.000) for all the countries under study, positive for Algeria  and Gabon

and Gabon  and negative for Congo Republic

and negative for Congo Republic  and Libya

and Libya  . The findings hence support Cukierman-Meltzer hypothesis (positive impact of inflation uncertainty on inflation) for Algeria and Gabon, and the stabilization hypothesis of [24] (negative impact of inflation uncertainty on inflation) for Congo Republic and Libya.Similarly, testing the impact of output growth uncertainty on the level of inflation is done by examining the sign and the significance of

. The findings hence support Cukierman-Meltzer hypothesis (positive impact of inflation uncertainty on inflation) for Algeria and Gabon, and the stabilization hypothesis of [24] (negative impact of inflation uncertainty on inflation) for Congo Republic and Libya.Similarly, testing the impact of output growth uncertainty on the level of inflation is done by examining the sign and the significance of  . The results indicate that

. The results indicate that  is statistically significant at 1% level (p-value = 0.000) for all the countries under study, positive for Congo Republic

is statistically significant at 1% level (p-value = 0.000) for all the countries under study, positive for Congo Republic  and negative for Algeria

and negative for Algeria  , Gabon

, Gabon  and Libya

and Libya , supporting [9] hypothesis (positive impact of output growth uncertainty on the level of inflation) for Congo Republic and a negative impact of output growth uncertainty on the level of inflation for the rest of the countries.In addition, examining the impact of output growth uncertainty and inflation uncertainty on output growth is done by respectively assessing the sign and the significance of

, supporting [9] hypothesis (positive impact of output growth uncertainty on the level of inflation) for Congo Republic and a negative impact of output growth uncertainty on the level of inflation for the rest of the countries.In addition, examining the impact of output growth uncertainty and inflation uncertainty on output growth is done by respectively assessing the sign and the significance of  and

and  . The results show that

. The results show that  is statistically significant at 10% level for Algeria and at 1% for Congo republic, Gabon and Libya.

is statistically significant at 10% level for Algeria and at 1% for Congo republic, Gabon and Libya.  is positive for Algeria

is positive for Algeria  , Gabon

, Gabon  and Libya

and Libya  , and negative for Congo republic

, and negative for Congo republic  , supporting Black hypothesis of a positive impact of output growth uncertainty on output growth for Algeria, Gabon and Libya, and for Congo Republic, the views of [37] and [38] of a negative impact of output growth uncertainty on output growth are supported.Finally with regard to the impact of inflation uncertainty on output growth, the results suggest that

, supporting Black hypothesis of a positive impact of output growth uncertainty on output growth for Algeria, Gabon and Libya, and for Congo Republic, the views of [37] and [38] of a negative impact of output growth uncertainty on output growth are supported.Finally with regard to the impact of inflation uncertainty on output growth, the results suggest that  is positive and statistically significant at 1% level for all the countries under study,

is positive and statistically significant at 1% level for all the countries under study,  for Algeria,

for Algeria,  for Congo republic,

for Congo republic,  for Gabon and

for Gabon and  for Libya. The results therefore support [10] hypothesis of a positive impact of inflation uncertainty on output growth for all the countries under study. [18] hypothesis of a negative impact of inflation uncertainty on output growth is not supported for any country.

for Libya. The results therefore support [10] hypothesis of a positive impact of inflation uncertainty on output growth for all the countries under study. [18] hypothesis of a negative impact of inflation uncertainty on output growth is not supported for any country.4. Conclusions

- This study examines the impacts of uncertainty about inflation and output growth on the levels of inflation and output growth for four oil-rich African countries, namely Algeria, Congo Republic, Gabon and Libya using a multivariate asymmetric GARCH-M model initiated by [21]. A number of important findings arise from this study. Concerning the impact of inflation uncertainty on inflation, Cukierman-Meltzer hypothesis (positive impact of inflation uncertainty on inflation) is supported for Algeria and Gabon, while the stabilization hypothesis of [24], that is, negative impact of inflation uncertainty on inflation, is supported for Congo Republic and Libya. In examining the impact of output growth uncertainty, our findings support [9] hypothesis (positive impact of output growth uncertainty on the level of inflation) for Congo Republic and a negative impact of output growth uncertainty on the level of inflation for the rest of the countries.Another result is that, in as far as the impact of inflation uncertainty on output growth is concerned, [18] hypothesis of a negative impact of inflation uncertainty on output growth could not be supported for any country. In contrast, [10] hypothesis of a positive impact of inflation uncertainty on output growth is supported for all the countries under study. Finally, a closer look at the impact of output growth uncertainty on output growth shows that Black hypothesis of a positive impact of output growth uncertainty on output growth is supported for Algeria, Gabon and Libya, while for Congo Republic, the views of [37] and [38] of a negative impact of output growth uncertainty on output growth are supported.This is to the best of our knowledge the first attempt to examine the impact of uncertainty on inflation and output growth for these four African countries, namely Algeria, Congo Republic, Gabon and Libya using a simultaneous approach. Further empirical studies are therefore needed to check the consistency of these findings by for instance applying the two-step approach.

Appendices

|

|

|

|

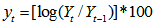

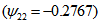

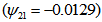

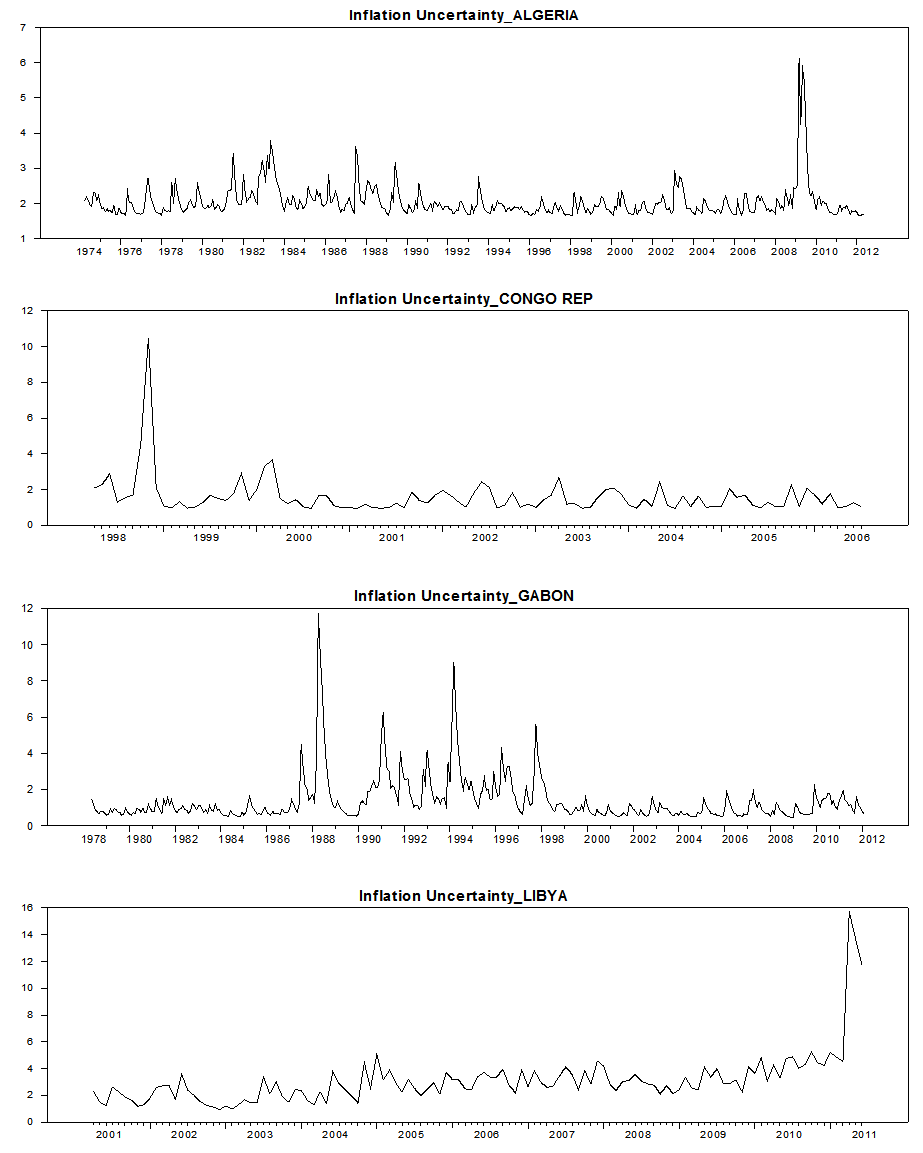

| Appendix 5. Inflation uncertainty |

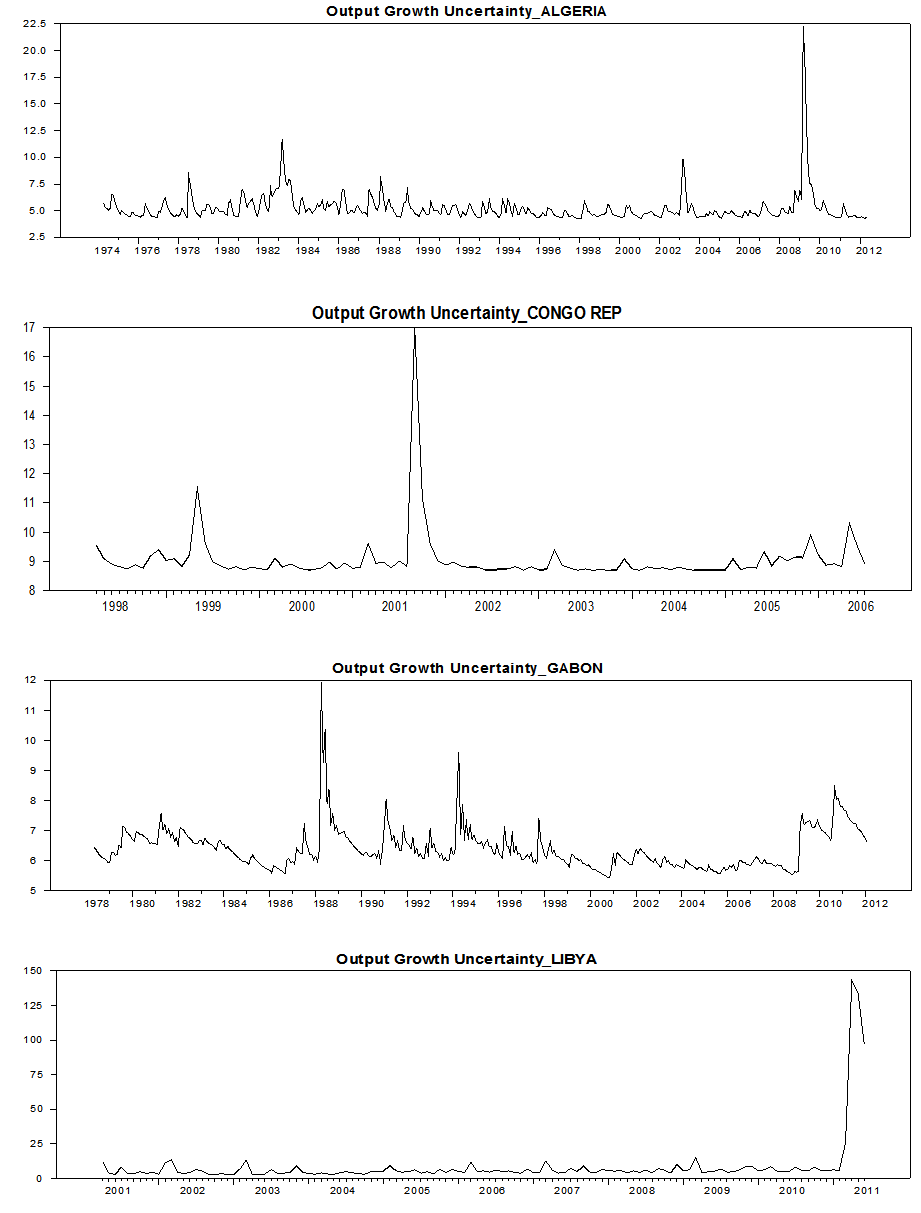

| Appendix 6. Output Growth Uncertainty |

Notes

- 1. CCC and DCC-GARCH models are respectively Constant and Dynamic Conditional Correlation GARCH model of [4] and [12]. They both assume that in the matrices of ARCH and GARCH terms are diagonal2. To simplify the VEC-GARCH model, Bollerslev, Engle and Wooldridge (1988) presented a GARCH model in which the matrices of ARCH and GARCH terms are diagonal3. BEKK model is a multivariate GARCH model developed by [13] and was named after Baba, Engle, Kraft and Kroner.4. In estimating the mean equation, we consider p = q =2 and the diagnostic tests confirm that the mean equation is well specified with that lag order.5. For convenience, the estimation results for the rest of the countries, Congo Republic, Gabon and Libya, are presented in the appendices.6. http://carnegieendowment.org/2009/04/13/lessons-from-algeria-s-2009-presidential-election/i8t7. http://blogs.reuters.com/global/2009/02/24/is-bouteflika-set-for-a-hollow-victory-in-algeria-election/8. http://www.infoplease.com/encyclopedia/world/gabon-history.html

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML