-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2014; 4(2): 124-129

doi:10.5923/j.economics.20140402.04

Budgetary Allocation Dynamics and Its Impact on Poverty Spread among the Geopolitical Zones of Nigeria

Saifullahi Sani Ibrahim, Hassan Ibrahim

Department of Economics and Development Studies, Faculty of Arts, Management and Social Sciences, Federal University, Dutsin-ma Katsina State, Nigeria

Correspondence to: Saifullahi Sani Ibrahim, Department of Economics and Development Studies, Faculty of Arts, Management and Social Sciences, Federal University, Dutsin-ma Katsina State, Nigeria.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

This study examines the budgetary allocation among the six geopolitical zones of Nigeria in connection to the level of poverty prevailing in each zone which is lopsided in nature. The study employed descriptive method of analysis with the aid of which we documented that inequality in the budgetary allocation attribute to the severity of poverty in the northern part of the country. We concluded that inequitable budgetary allocation could never be a solution to Nigerian’s problem of peaceful coexistence among the diverse tribes and could not holistically redress the country’s macroeconomic crisis. Therefore, going along this trend would no doubt subject unfavoured zones into serious socio-economic problem. For instance, scholars attributed the Boko Haram insurgent in the north-east geopolitical zone as a product of severity of poverty prevail in the zone and by this study we documented a strong nexus between low budgetary allocation and poverty situation in those zones. We therefore recommended that the need for realistic budgetary allocation formula becomes imminent. In such arrangement more weight should be accorded to the population size, internal revenue efforts and social development factors while equality to the states ought to be reduced.

Keywords: Budget, Poverty, Fiscal policy, Geopolitical zones, Nigeria

Cite this paper: Saifullahi Sani Ibrahim, Hassan Ibrahim, Budgetary Allocation Dynamics and Its Impact on Poverty Spread among the Geopolitical Zones of Nigeria, American Journal of Economics, Vol. 4 No. 2, 2014, pp. 124-129. doi: 10.5923/j.economics.20140402.04.

Article Outline

1. Introduction

- The superiority of utilizing fiscal policy to contain economic swing over other variants alternative measures was understood by the think-tank and policy ever since 1930s when Keynes unveil the economic miracles of budget and expenditure to prescribed effective solution to the disastrous great depression which paused the normal equilibrium of various macroeconomic variables. Therefore, effective budgetary allocation could be used among other things to eradicate any disequilibrium in the economy. However, if the budget is repressed the entire economy is bound to experience difficulties in the form of poverty, unemployment, jobless growth, crises among others [7, 16].The process of harmonizing revenue to tackle the expenditure is loosely called budget. This qualifies the budget to be robust instrument upon which is use in dictating the economy so as to achieve macroeconomics objectives such as price stability, non-jobless growth, poverty reduction, etc. If the however the budget is repressed and naively prepared, so many menaces witnessed during world depression could without doubt replicates as in the case of present Nigeria. Massive and pervasive poverty is fast approaching peak. For instance, available data from National Planning Commission (NPC) [11] shows that relative poverty and absolute poverty rates increased to 69.0% and 60.9% in 2010 respectively from 54.4% and 54.7% in 2004. Similarly, the rate of unemployment increased significantly from 9.1 million of the 61.1 million Nigeria’s available labour force was unemployed in 2008 to 2010 the 16 million in 2010. This translates to the rising national unemployment rate from 14.9% to 21% between 2008 and 2010. Before the discovery of crude oil and the time when agriculture was the mainstay of the Nigerian economy, contending issues relating to derivation principle is silent in the revenue allocation. However, after the discovery of oil and the subsequent oil boom of the 1970s made Nigeria solely dependent on oil sector as a source of foreign exchange and neglected the traditional sector with hitherto accommodates over 70 per cent of the productive youth, in addition of being the source funding to the public authority [8]. The repercussion of skewed revenue allocation among the federating states of Nigeria constitutes the perennial problems which have not only defied all past attempts at permanent solution, but also have a tendency for evoking high emotions on the part of all concerned [13]. The distribution of the problem is not equal. The magnitude of economic crisis within geo-political zone reflects the relative low budgetary allocation received from federal government. In a nutshell, the geo-political zone with the relative high budgetary allocation enjoys more welfare and economic stability. This study tends to investigate the relationship between budgetary allocation and poverty situation among the six geo-political zones of Nigeria. The paper is divided into four sections including this introduction. Section two contains the review of literature. Third section presents content analysis on budgetary allocation dynamics and poverty spread. The last section concludes the study.

2. Literature Review

- Ricardian Equivalence Hypothesis exhibits that dynamics in the budget allocation has a first order effect on savings in any society. Since, a reducing tax does not affect households’ lifetime wealth because future taxes will go up to offset current tax decrease. Therefore, current private saving rises when taxes fall, households save the income received from the tax cut in order to pay for the future tax increase. Consequently, a budget deficit would not cause a twin deficit of budget deficit and trade deficit; instead it would perpetuate dualism in the economy [2]. Meanwhile, a participatory budgetary process may not yield immediate victories for citizens but it may serve to enhance communication and trust between government officials and citizens [1, 5], leading to reinvigorated levels of popular participation. Such efforts may also serve the long-term goal of enhancing governmental accountability and responsiveness because public officials may begin to attribute more importance to citizen input [9].This is fundamental, given that Nigeria as a monolithic economy gets over 80% of its revenue from crude oil, by virtue of the constitutional provision, this revenue must be disbursed to the three tiers of government. It also explains why the formula for revenue allocation has continued to be at the heart of public debate and why public officeholders are hardly held accountable for the misuse of revenues derived from the national oil wealth. It is obvious that the nature and conditions of the financial relations in any federal system of government are crucial to the survival of such a system. A major source of inter-governmental disputes under a federal system centres on the problems of securing adequate financial resources on the part of the lower levels of government to discharge essential political and constitutional responsibilities [15]. The existence of a federal system with its accompanying political units necessitates a revenue sharing arrangement to enable its units to carry its constitutional assigned responsibilities [4].Every Federal Government budget covers all the various sectors of the economy irrespective of whether it is a servicing, manufacturing, or production outfit. However, much emphasis is usually laid on one or some sectors than others depending on the exigency of the situation at hand. Accordingly, Poor and Unrealistic capital budgeting has long been the bane of socio-economic development in Africa and of course, Nigeria [6]. The agitation for resource control is rooted in the desire to promote the practice of fiscal federalism as the most efficient means of freeing Nigerians from the hangover of military authoritarianism and misrule. He noted that it enunciates a competitive federal system in which every component is able to exploit its vast economic potentials towards rapid development and progress of every section of the country [17]. However for development to thrive, equitable budgetary allocation among the federating state must be met. When this necessary condition is violated, then development cannot be sustained and it may imbalances among states within a country [8].By and large, the poor budget performance is due to dwindling revenue flow from the federation account, low level of internally generated revenue and ill-timeliness of release of available funds quite apart from leakages and weak capacity in the Ministries Departments and Agencies (MDAs). Besides, the general pattern of fiscal management is of great concern. Both revenue and expenditure management in the states leaves much to be desired. The initiative and drive to generate more revenue and the capacity to allocate such revenues between categories of expenditure are specific areas that should be carefully managed to ensure that the state development objectives are achieved [16].

3. Budgetary Allocation Dynamics and Poverty Spread

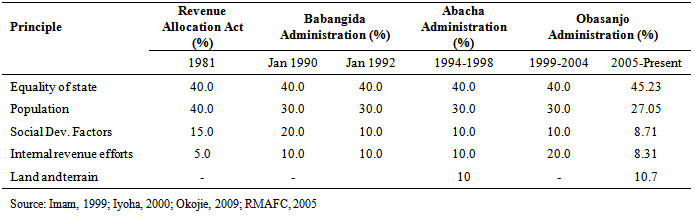

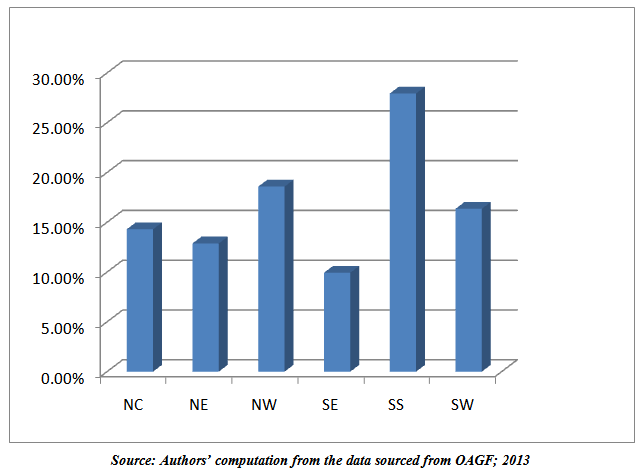

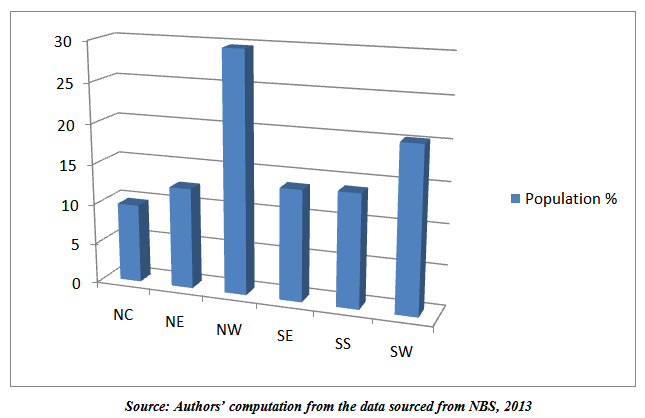

- In a country where its economy is dumped by foreign good as a result of absence of industrialization, the populace would always be concerned with how the national pie is derived and shared among effortless federating entities [8]. Accordingly, it will be an economic miracle to device an acceptable formula despite agitations here and there for an acceptable formula. In any federal system, the nature and conditions of the financial relations are crucial to the survival of the country; this led to credence for the fact that in most federal countries, the federating states always have some issues such as discourse, dispute and wrangling with the centre [18]. Meanwhile, it is imperative to note that Nigeria’s revenue sharing debates have revolved basically around three issues. Firstly, the relative proportions of federally collected revenues in the federation account that should be assigned to the centre, the states, the localities and the so-called ‘Special Funds’ (vertical revenue sharing); Secondly, the appropriate formulae for the distribution of centrally devolved revenues among the states and the localities (horizontal revenue sharing); Thirdly, the percentage of federally collected mineral revenue that should be returned to the oil-bearing states and communities on the account of the principle of derivation and compensation for the ecological risks of oil production [12].Horizontal revenue allocation deals with the distribution of funds within the same tier of government among states the federating state on the one hand, or within the local government in a state on the other hand. Several principles adopted in the country with the ultimate goal of finding more acceptable formula, however most of these principles have been contentious, since states usually prefer principles that favour their specific peculiarities, which often constitute the primary source of conflict and agitations [14]. The table below summarises the horizontal revenue allocation formula from 1980 – date.It is evident from the Table 1 above that variation in the equality of the state is relatively steady with the notable exception in the year 2005 when its rose from 40% to 45.23%. Meanwhile, the allocated revenue based on population of state decline from 40% in 1981 to 30% through 1980 down to 2004 and it further drops to 27.05% in 2005. In compliance with provision of the above revenue allocation formula, the allocation among the seven geopolitical zones was not far from unequal nor does contain any element of equity. For instance, in 2010 south-south received approximately 28% of budgetary allocation compared to tiny amount allocated to north-west which is approximately 13%. Moreover, north-central received 14%, north-east with 13%, 10% and 16% were allocated to south-east and south-west respectively.

|

| Figure 1. Budgetary Allocation by Geo-Political Zone (2010) |

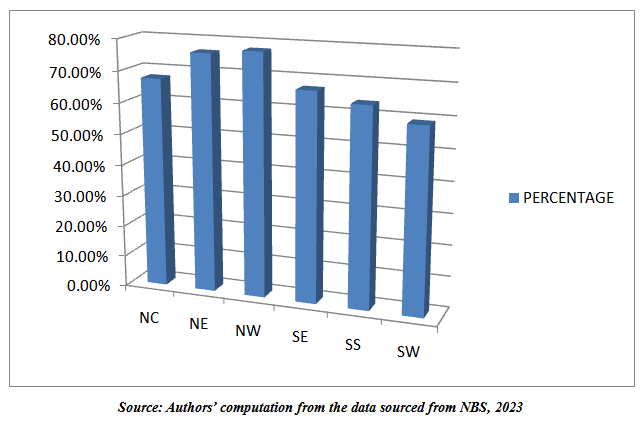

| Figure 2. Poverty level by geo-political zones (2010) |

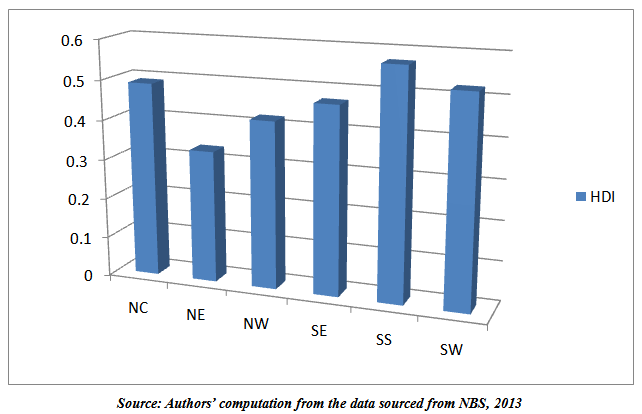

| Figure 3. Human development indicators by geo-political zones (2010) |

| Figure 4. Population by geo-political zones |

4. Conclusions

- This study reviews the budgetary allocation among the six geopolitical zones of Nigeria vis-à-vis the level of poverty prevailing in each zone which is lopsided in nature. Even though successive Nigerian government implemented several recommendations made by various committee saddled with the responsibility to fine tune the budgetary allocation among the federating state so as to ensure fair share among them. However, this perennial issue is far from settle albeit the current arrangement is ill-designed to silence the aggrieved state of south-south geopolitical zone who believed that they owned the country’s major source of foreign exchange (crude oil) and leaving very little to be shared among the other zones. We can rightfully conclude that inequitable budgetary allocation could never be a solution to Nigerian’s problem of peaceful coexistence among the diverse tribes and neither the issue could holistically redress the country’s macroeconomic crisis. Therefore, continuing along this trend would no doubt subject unfavoured zones into serious socio-economic problem. For instance, scholars attributed the Boko Haram insurgent in the north-east geopolitical zone as a product of severity of poverty prevail in the zone and by this study we documented a strong nexus between low budgetary allocation and poverty situation in those zones. We therefore recommended that the need for realistic budgetary allocation formula became imminent. In such arrangement more weight should be accorded to the population size, internal revenue efforts and social development factors while equality to the states ought to be reduced. It has been argued more populous society require huge amount of money for the maintenance of living standard than those with less. Furthermore, increasing allocation to the internal revenue effort will serve as a reward for hard work and thus motivate state to diversify their revenue source. Similarly, there is the need to empower Revenue Mobilisation, Allocation and Fiscal Commission (RMAFC) with an oversight function not only to monitor the implementation of budgetary allocated to each state but also to be publishing annual score-card for every state thereby paving the way for weeding-out rogue state and reduce their forthcoming allocation so as to serve as deterrent to others.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML