-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2014; 4(1): 52-61

doi:10.5923/j.economics.20140401.05

Assessment of Empirical Relationships among Remittances and Agricultural Productivity Indicators in Nigeria (1970-2012)

Sunday B. Akpan, Uwemedimo E. Okon, Samuel J. Udoka

Department of Agricultural Economics and Resources Management, Akwa Ibom state University, Ikot Akpaden, Mkpat-Enin L.G.A.

Correspondence to: Sunday B. Akpan, Department of Agricultural Economics and Resources Management, Akwa Ibom state University, Ikot Akpaden, Mkpat-Enin L.G.A..

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The study had established empirical relationships between remittances and indicators of agricultural productivity (agricultural GDP/total GDP, Agricultural productivity index and crop productivity index) in Nigeria. Augmented Dickey-Fuller unit root tests were conducted on the specified time series to ascertain the variables’ order of integration. The trend analysis revealed that, remittances, agricultural GDP, agricultural productivity index and crop productivity index have positive exponential growth rates, but remittances grew at a faster rate than others. It was discovered that, remittance has linear and symmetric relationships with agricultural productivity index and crop productivity index in Nigeria. However, there was no significant relationship among growth rates of remittances, agricultural GDP, agricultural productivity index and crop productivity index in Nigeria. The bilateral Granger causality test indicates unilateral relationship between nominal value of agricultural GDP and remittance inflow in the country. The result of the co-integration test revealed the presence of co-integration among specified variables. Agricultural productivity index and crop productivity index have significant relationships with remittance in the long run. Also, agricultural GDP and agricultural productivity index exhibited significant association with remittances in the short run.

Keywords: Remittances,Agricultural,Productivity, Crop, Relationship, Nigeria

Cite this paper: Sunday B. Akpan, Uwemedimo E. Okon, Samuel J. Udoka, Assessment of Empirical Relationships among Remittances and Agricultural Productivity Indicators in Nigeria (1970-2012), American Journal of Economics, Vol. 4 No. 1, 2014, pp. 52-61. doi: 10.5923/j.economics.20140401.05.

Article Outline

1. Introduction

- It is obvious that, the potential for remittances as a growth catalyst in both micro and macroeconomic environments seem presently unlimited in developing country like Nigeria. For instance, remittances affect poverty in Nigeria[26]. At households’ levels, remittances increase income and consumption smoothing[14]; it improves access to better nutrition[31] and to better education[8]. In China, a study has shown that, remittances affect crop production[25] and partially compensate for the outward movement of labour effect. It stimulates crop and possibly self-employment production in the rural areas[25]. On one hand, remittances enable rural households to invest locally in more risky activities including self-employment[22], and on the other hand, as a consequence crowd out farming activities. It is estimated that, about 100 million migrants from developing countries live and work outside the country of their birth. Remittances sent back home by these migrants are believed to have huge impact on the socio-economic conditions of families, left in the country of origin. Guptal et al,[10], reported that, the volume of remittances to developing countries has been growing significantly over the years. And that, in 2006, remittances flow to developing countries totaled US $ 221 billion, an amount that was twice the Official Development Assistance (ODA) to developing countries in that year. IFAD[13] asserted that in 2012, the cumulative remittances to developing countries exceeded US $1.5 trillion”. Available evidences show that, remittances to Sub-Sahara Africa (SSA) are relatively small compared to South Asia and Latin America. In Sub-Saharan Africa (SSA), Nigeria topped the list of remittance recipients’ nations in 2009, with US $10.0 billion followed by Sudan (US $3.2 billion), Kenya (US $ 1.8 billion), Senegal (US $1.2 billion) and South Africa (US $1.0 billion). This figure rose to US $ 11.0 billion or (N1.727 trillion) for Nigeria in 2010 and the highest for any African Country[29]. Notwithstanding the increasing growth of remittances, there are divergent scholarly opinions as regards their impact on economic growth and specifically on agricultural development. World Bank had reported that, remittance is uncorrelated with agricultural income[30]. Adams and Page[2]; Acosta et al,[1] and World Bank,[28] argued that migrant remittances impact positively on the balance of payments in many developing countries as well as enhanced economic growth, through their direct implications for savings and investments in human and physical capital and indirect effects through consumption. Additionally, in rural Mexico, migrant remittances have been found to have indirect short-term effects and long-term asset accumulation effects on the level and distribution of farm income, land and livestock holdings[23]. Remittances allow access to productive assets and complementary inputs[24]. Stark[21 and 22] and Kiriti and Clem,[15] opine that, remittance does not significantly improve agricultural productivity at the household level. Gwyer[12] remarked that, remittances result in farmers diverting funds, (which would normally have been used for farm improvements) into formal education for family members. Plath et al.,[19] in Lesotho discovered that remittances have been used to purchase agricultural equipment. According to Durand and Massey[7], under the right local economic circumstances, remittances and savings can be devoted to productive enterprises. According to research conducted by Taylor and his colleagues in 1996, in few Guatemalan communities, remittances has resulted in significant changes in land distribution, because they were used to buy forest land which were converted into cattle pasture or used to plant maize. Rath[20] concludes that remittance increases the consumption level of rural households, which might have substantial multiplier effects, because they are more likely to be spent on domestically produced goods. Lipton[16], Ahlburg[3] and Brown & Ahlburg[5], argued that remittances undermined productivity and growth in low-income countries because they are readily spent on consumption likely to be dominated by foreign goods than on productive investments. On the other hand, Nigeria is endowed with enormous agricultural potentials. During the pre-independence period, the agricultural sector contributed more than 50% of the GDP of Nigeria. Helleiner[37] opines that in 1929, agricultural export constituted about 80% of the 57% of total export revenue in Nigeria. Also during the first decade of the political independence (i.e. 1960 - 1970), Nigeria’s economy was still an agrarian based economy[38]. In this period, Nigeria was the world’s second largest producer of cocoa and largest exporter of palm oil. The country was the leading exporter of other major commodities such as cotton, groundnut, rubber, hides and skins[33]. Agricultural export crops like cocoa, groundnut, cotton, rubber, palm oil, palm kernel, etc. accounted for the bulk proportion of foreign exchange earnings and provided the most important source of revenue for the federal government[36]. However, because of the country civil war (1967 – 1970); and the discovery of crude oil in 1973, the agricultural sector suffered long term neglect in expense of petroleum sector[39]. According to the Central Bank of Nigeria report, “export-oriented agriculture declined from 42 per cent of the total export in 1970 to less than 3 per cent in 1985[39]. The liberalization of the agricultural sector in 1986 following the introduction of the Structural Adjustment Programme (SAP) gave the sector a new life. The federal government introduces several agricultural policies and programmes to help revitalized the sector. Currently, Nigeria is ranked sixth in the world and first in Africa in farm output[35]. Agriculture is still the mainstay of the country’s economy and about 70% of the population is involved in agricultural activities[35]. Nigeria is the world largest producer of cassava (Manihot esculenta) and yam (Dioscorea spp) of different varieties[34]. Other agricultural products popular among Nigerian include; corn, millet, peanuts, rice, sorghum, cowpeas, Sesame, cashew nuts and plantains among others. The agricultural production in Nigeria rose by 28% during the 1990s, while per capita output rose by only 8.5% during the same decade. In 2012, agricultural sector contributes about 30.90% of the country’s gross domestic product[34, 35].Despite dearth of literature on the relationships between remittances and agricultural productivity either at the household level or at the national level, there is no consensus or convergent point on the relationship between these variables, especially in the Sub Saharan region of Africa. Nigeria is an agrarian society, and is also the largest receiver of remittances in Africa, and remittances increase on annual basis in the country[27]. On the fact that, majority of families in the country are engaged in farming activities, one might be tempted to ask: do remittances affect agricultural activities at the household level in Nigeria? Alternatively, do remittances constitute a new financial inflow to agricultural sector in Nigeria? This research is built on the assumption that, if the household’s agricultural activities are significantly affected, the spillover effect will be detected at the national level. It is on this premise that, this research was designed to investigate the relationship between remittances and agricultural productivity indicators at the national level in Nigeria.

2. Research Methodology

2.1. Study Area and Data Source

- The study was conducted in Nigeria; the country is situated on the Gulf of Guinea, in the sub-Saharan Africa. Nigeria lies on latitude 100 00′ north of the Equator and on longitude 80 00′ east of Greenwich Meridian. Nigeria has a total land area of 923,768. 622 squared kilometers and a population of over 140 million [17]. Secondary data derived from publications of the Central Bank of Nigeria (CBN), Food and Agricultural Organization (FAO) and National Bureau of Statistics (NBS), were used in the analyses. Data covered the period, 1970 to 2012.

2.2. Analytical Techniques

- The study applied series of statistical and econometric techniques to test for the true relationship among remittances and agricultural productivity indicators in Nigeria. The tests applied, ranges from; the trend analysis, correlation analysis, Granger causality test and error correction model (ECM). Each of the tests is explained in both explicit and implicit forms as discussed below:

2.3. Trend Analyses of Remittance and Agricultural Productivity Indicators in Nigeria

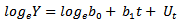

- To investigate the nature of growth rate in the remittances and indicators of agricultural productivity in Nigeria, we specified the exponential growth rate equation as thus:

| (1) |

| (2) |

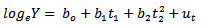

. To ascertain whether the exponential growth rate in the variables specified did increase at accelerated or decelerated rates over the period considered, the quadratic exponential trend equation was specified as thus:

. To ascertain whether the exponential growth rate in the variables specified did increase at accelerated or decelerated rates over the period considered, the quadratic exponential trend equation was specified as thus: | (3) |

> 0; the variable investigated had accelerated growth rate: when

> 0; the variable investigated had accelerated growth rate: when  < 0; the variable has decelerated growth rate over time. In this study, “Y” was represented by: remittance/ total GDP (REMt) expressed in percentage, agricultural GDP/total GDP (AGPt) expressed in percentage; agricultural productivity index (APRt) in percentage and crop productivity index (CRPt) expressed in percentage. The exponential growth rate equation was adopted in this study to investigate the growth in the specified variables because, several literature have supported increased inflow of remittances, and increased agricultural productivity for some years in Nigeria[4, 27].

< 0; the variable has decelerated growth rate over time. In this study, “Y” was represented by: remittance/ total GDP (REMt) expressed in percentage, agricultural GDP/total GDP (AGPt) expressed in percentage; agricultural productivity index (APRt) in percentage and crop productivity index (CRPt) expressed in percentage. The exponential growth rate equation was adopted in this study to investigate the growth in the specified variables because, several literature have supported increased inflow of remittances, and increased agricultural productivity for some years in Nigeria[4, 27]. 2.4. Pearson Correlation Matrix between Remittances and Agricultural Productivity Indicators in Nigeria

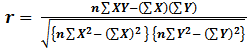

- To test for the symmetrical and linear relationship among remittances inflow and indicators of agricultural productivity in Nigeria, the Pearson correlation coefficients were estimated for the specified variables. The formula is as described below: “Note, since variables investigated were more than two, the correlation matrix was formed”

| (4) |

2.5. Bilateral Granger Causality Test on Remittances and Agricultural Productivity Indicators in Nigeria

- Granger causality test is one of the important econometric tools used to determine whether past change in time series variable say “X” has impact on the current variable “Y” or whether the relation works in the opposite directio[18]. The Granger causality test is a statistical hypothesis test for determining whether one time series is useful in forecasting another. A time series X is said to Granger-cause Y if it can be shown, usually through a series of t-tests and F- test on lagged values of X (and with lagged values of Y also included), that those X values provide statistically significant information about future values of Y [9]. If a time series is a stationary process, the test is performed using the level values of two (or more) variables. If the variables are non-stationary, then the test is done using first (or higher) differences. The number of lags to be included is usually chosen using information criteria, such as the Akaike information criterion or the Schwarz information criterion. This test assumes that the information relevant to the prediction of X and Y is contained solely in the time series data on these variables[11]. In this study, the bilateral Granger Causality tests were conducted for variables specified in growth rate, and nominal forms. The primary model in explicit form is expressed in growth rate as follows:

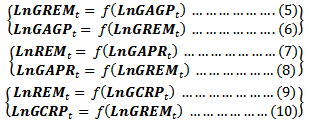

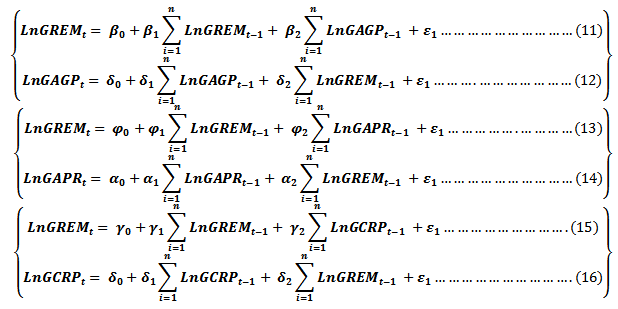

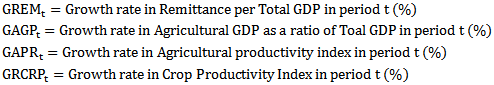

The following equations (i.e. 5, 6, 7, 8, 9 and 10) represent the explicit forms of above equations. The equations in Vector Autoregressive models are represented as thus[32]:

The following equations (i.e. 5, 6, 7, 8, 9 and 10) represent the explicit forms of above equations. The equations in Vector Autoregressive models are represented as thus[32]: Where:

Where:  In equations 11 and 12 for instance, there is bilateral Granger causality from growth rate of agricultural GDP to the growth rate of remittance if β2 ≠ 0 and

In equations 11 and 12 for instance, there is bilateral Granger causality from growth rate of agricultural GDP to the growth rate of remittance if β2 ≠ 0 and  = 0. Similarly, there is Granger causality from the growth rate of remittance (GREM) to the growth rate of Agricultural GDP ifβ2 = 0 and

= 0. Similarly, there is Granger causality from the growth rate of remittance (GREM) to the growth rate of Agricultural GDP ifβ2 = 0 and  ≠ 0. The causality is considered as mutual or bi-directional if β2 ≠ 0 and

≠ 0. The causality is considered as mutual or bi-directional if β2 ≠ 0 and  ≠ 0. Finally, there is no link between growth rate in remittance (GREMt) and growth rate in Agricultural GDP if β2 = 0 and

≠ 0. Finally, there is no link between growth rate in remittance (GREMt) and growth rate in Agricultural GDP if β2 = 0 and  = 0. The same interpretation follows for the rest of the equations.

= 0. The same interpretation follows for the rest of the equations. 2.6. Co-integration Test for Remittances Inflow and Indicators of Agricultural Productivity in Nigeria

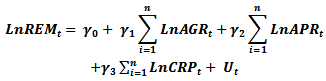

- The concept of cointegration as developed by Granger[9] involved the determination of the static or long-run associations among non-stationary time series. The pre-condition for applying the standard procedure of the cointegration tests to any series is that the variables in consideration must be integrated of the same order or non-stationary individually. The study applied the Engle and Granger two-step technique and Johansen cointegration approach to examine the co-integration relationship among the specified time series. “Note, the test was done on the assumption that, remittances influence agricultural productivity indicators in the country”. To avoid the simple regression specification of (Agricultural indicators=f (remittances)), the reverse specification was used in the study. Since, models were specified in either linear or log-linear forms, similar nature of relationship will be obtained if the variables are reversed. The study solely explores the empirical associations between remittances and indicators of agricultural productivity in Nigeria. Hence, the time dependent remittance equation used in the study, was specified as follows:

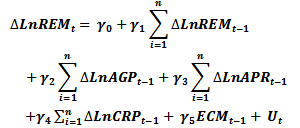

| (17) |

| (18) |

) of the ECMt-1 (-1<

) of the ECMt-1 (-1<  < 0) measures the deviations from the long-run equilibrium in period (t-1). In order to obtain a parsimonious dynamic ECM for the remittance equation, the study adopted Hendry’s (1995) approach in which an over parameterized model is initially estimated and then gradually reduced by eliminating insignificant lagged variables until a more interpretable and parsimonious model is obtained.

< 0) measures the deviations from the long-run equilibrium in period (t-1). In order to obtain a parsimonious dynamic ECM for the remittance equation, the study adopted Hendry’s (1995) approach in which an over parameterized model is initially estimated and then gradually reduced by eliminating insignificant lagged variables until a more interpretable and parsimonious model is obtained.3. Result and Discussion

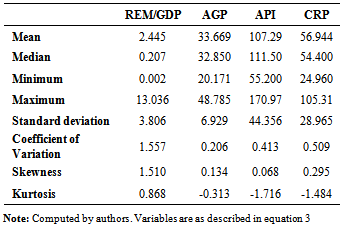

- Descriptive Analysis for remittances, Agricultural productivity, Agricultural GDP and Crop productivity index (1970 to 2012)

|

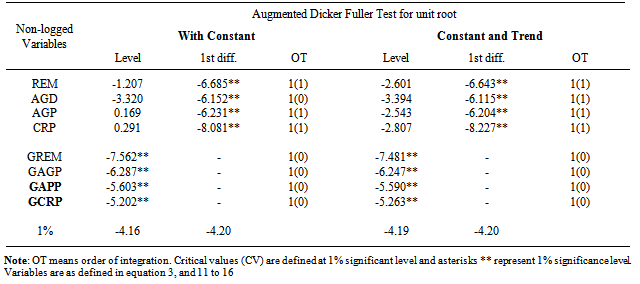

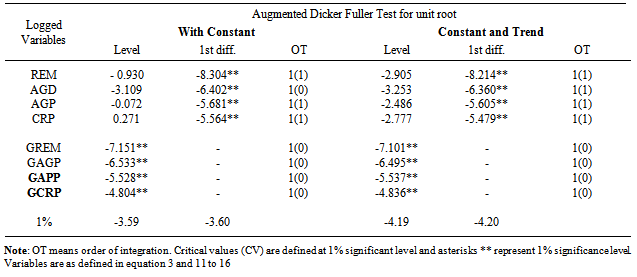

3.1. Augmented Dicker Fuller Unit Root Test

- In time series analysis, stationary of series is examined by the unit root tests. One of the most commonly used tests in the literature to ascertain the stationary level of series is ADF test developed by Dickey and Fuller in (6). The result of the ADF root tests as presented in Table 2 shows that, all specified non-logged variables were non-stationary at levels but stationary at the first difference. On the other hand, the growth rates of non-logged variables were stationary at levels. The result implies that, the specified variables at nominal values should be tested for the existence of co-integration (Johansen, 1988 and Johansen and Juselius, 1990); whereas growth rate variables can be specified at level provided the diagnostic tests do not show evidence of spurious regression (Johansen, 1988 and Johansen and Juselius, 1990). The same results were also obtained for logged variables shown in Table 3.

|

|

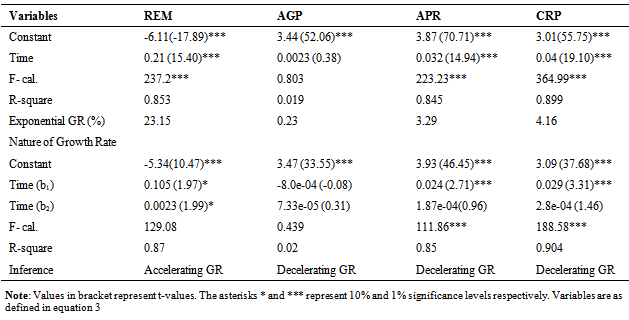

3.2. Exponential Trend Analysis of Remittances and Agricultural Productivity Indicators in Nigeria

- The exponential trend equation for each of the nominal value of variables specified in equations 3 is shown in Table 4. The result also contains the calculated exponential growth rate for each of the variables and the nature of such growth rate over time (i.e. from 1970 to 2012). The trend in remittances (REMt) shows that, the variable increases with time in Nigeria. In other words, remittances have direct relationship with time. The result further confirms that, remittance inflow had accelerated growth rate during the study period. This connotes that, remittances increase at increasing rate in the period 1970 to 2012 in Nigeria. This result is in consonance with the report of Ukeje and Michael[27] in Nigeria.

|

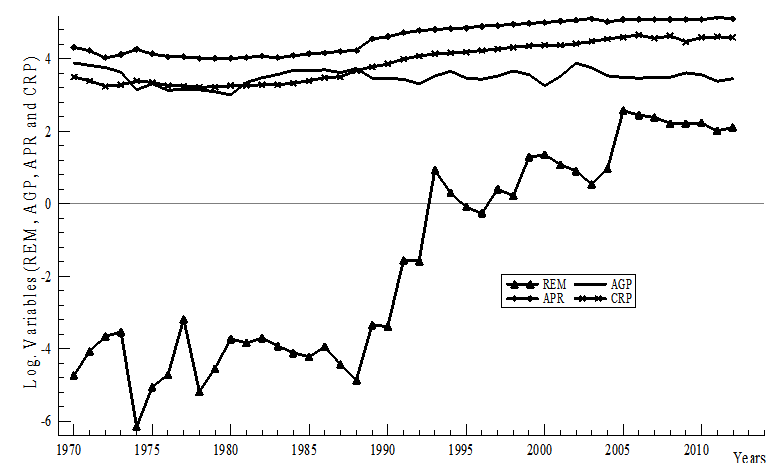

| Figure 1. Exponential Trends in REM, AGP, APR and CRP from 1970 to 2012 in Nigeria |

- The trend in agricultural GDP (AGPt), agricultural productivity index (APRt) and crop productivity index (CRPt) also exhibited positive relationship with time. However, the exponential growth rate in AGPt (0.23%); APRt (3.29%) and CRPt (4.16%) were far lower than that of the REMt (23.15%). The result revealed that, the exponential growth rates in AGPt; APRt and CRPt were not growing at increasing rate compared to remittance inflow. However, the crop productivity index (CRPt) grew faster than agricultural productivity index (APRt) and agricultural GDPt.“These results imply that, remittances and agricultural productivity indicators have positive relationship with time and positive exponential growth rates; but that the growth rate in remittances grew faster than those of indicators of agricultural productivity (agricultural GDP, agricultural productivity index and crop productivity index) in Nigeria” To further substantiate this result graphically, figure 1 shows the exponential trends in remittances (REMt), agricultural GDP (AGPt), agricultural productivity index (APRt), and crop productivity index (CRPt) from 1970 to 2012 in Nigeria. The exponential graph of remittance inflow shows a sharp rising trend from 1988 to 1993, thereafter it exhibits undulated upward trend till 2012. On the other hand, graphs of indicators of agricultural productivity (i.e. AGPt, APRt, and CRPt), showed an average but sluggish rising trend from 1986 to 2012.

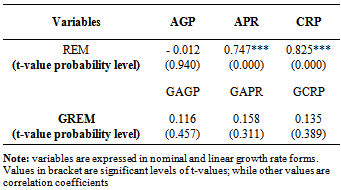

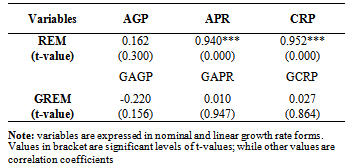

3.3. Pearson Correlation Matrix of Remittances and Indicators of Agricultural Productivity in Nigeria

- The linear and symmetric relationship between remittance and indicators of agricultural productivity (i.e. AGPt, APRt, and CRPt) was revealed by the use of Pearson correlation coefficients. Table 5 (contains non-logged variables) and Table 6 (contains logged variables), show the correlation matrix of remittances and indicators of agricultural productivity from 1970 to 2012 in Nigeria. The result for both logged and non-logged variables revealed that, remittance has a positive significant relationship with APRt and CRPt. This means that remittance has linear and symmetric associations with APRt and CRPt in Nigeria. This implies that, as REMt increases or decreases, the APRt and CRPt will also follow the respective pattern. However, there were no significant linear and symmetric relationships between growth rates in remittance and growth rates in indicators of agricultural productivity in Nigeria.

|

|

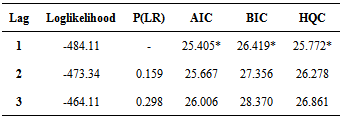

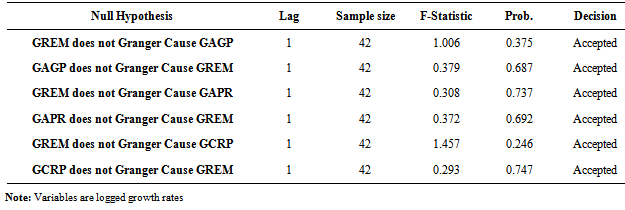

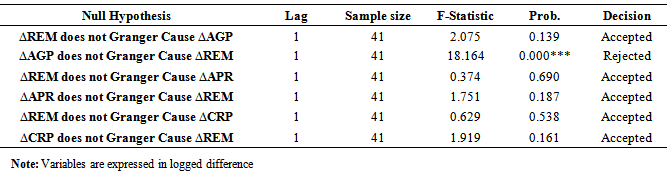

3.4. Bilateral Granger Causality Test on Remittance and Agricultural Productivity Indicators in Nigeria

- The long run causality relationship between remittance and indicators of agricultural productivity (i.e. AGPt, APRt, and CRPt) was investigated. The result of the analysis is shown in Table 8. The result in Table 7 shows the optimal lag period needed in the causality equation specified in equations 11 to 16. The asterisks below indicate the best (that is, minimized) values of the respective information criteria, AIC = Akaike criterion, BIC = Schwarz Bayesian criterion and HQC = Hannan-Quinn criterion.

|

|

|

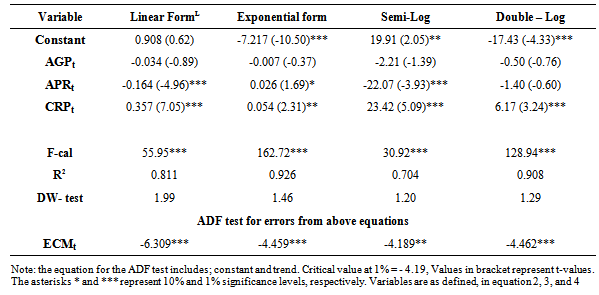

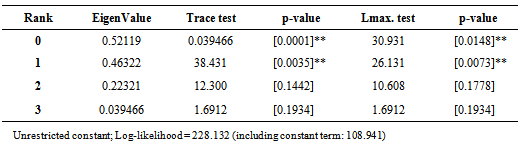

3.5. Co-integration Model

- The result of the Engle and Granger two-step technique of the co-integration regression tests for the residual (ECM) generated in the long run equation specified in equation 18 is presented in the lower portion of Table 10. The results show that at 1% probability level of significance, the Engle–Granger co-integration tests reject the null hypothesis of no co-integration. Hence, there exists a long run equilibrium relationship between the remittance and indicators of agricultural productivity in Nigeria. Also, the Johansen co-integration test result showed that, the trace and maximum eigenvalue values were significant at first rank level. The result as presented in Table 11 means that, the calculated trace test and maximum eigenvalue test statistics are greater than the critical values at 1% probability level. This further confirms the presence of co-integration relationship among the specified variables. The upper part of Table 10, presents the long run estimates of various functional forms for the remittance equation in Nigeria.

|

|

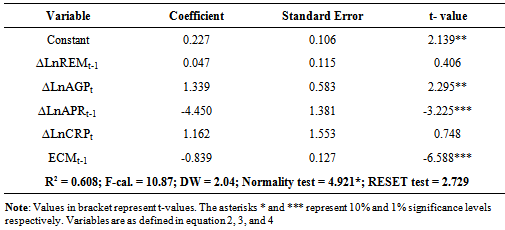

3.6. Error Correction Model for Remittance Inflow in Nigeria

|

4. Summary of Findings

- The study has employed statistical and econometric methodologies to investigate several relationships between remittances and indicators of agricultural productivity in Nigeria. Agricultural productivity indicators investigated were; agricultural GDP/total GDP, Agricultural productivity index and crop productivity index. The findings show that, remittance, agricultural GDP, agricultural productivity index and crop productivity index have positive exponential growth rates and positive relationships with time. Also, the Pearson correlation coefficients revealed that, remittance inflow has linear and symmetric relationships with agricultural productivity index and crop productivity index in Nigeria. However, there was no significant relationship between growth rate of remittances, and growth rates in agricultural GDP, agricultural productivity index and crop productivity index in Nigeria. The bilateral Granger causality test revealed a unilateral relationship between nominal value of agricultural GDP and remittance inflow in the country. The result of the co-integration test revealed the presence of co-integration among specified variables. Agricultural productivity index and crop productivity index have significant association with remittance inflow in the long run. Also, agricultural GDP and agricultural productivity index showed significant relationship with remittances in the short run.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML