-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2014; 4(1): 18-22

doi:10.5923/j.economics.20140401.02

Competition and Efficiency of Commercial Banks: An Empirical Evidence from Nigeria

R. A. Ajisafe, A. E. Akinlo

Department of Economics, Obafemi Awolowo University, Ile-Ife, 220005, Nigeria

Correspondence to: R. A. Ajisafe, Department of Economics, Obafemi Awolowo University, Ile-Ife, 220005, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The study examined the relationship between competition and efficiency of commercial banks in Nigerian for the period 1990 to 2009. Secondary data were sourced from the annual reports and statement of accounts of fifteen commercial banks in Nigeria which were purposively selected for the study. The data collected were analysed using pooled least square and dynamic panel generalised method of moment estimation technique with fixed effect. The results of the analysis showed that there was a positive and significant relationship between the degree of competition and the level of efficiency of commercial banks in Nigeria with a t-value of 2.45 and p-value < 0.05. The study concluded that the reforms introduced in the banking sector in the late 80’s, raised the degree of competition and improved the level of efficiency of the Nigerian commercial banks.

Keywords: Banking, Competition, Efficiency, Dynamic Panel GMM

Cite this paper: R. A. Ajisafe, A. E. Akinlo, Competition and Efficiency of Commercial Banks: An Empirical Evidence from Nigeria, American Journal of Economics, Vol. 4 No. 1, 2014, pp. 18-22. doi: 10.5923/j.economics.20140401.02.

1. Introduction

- The role of banks in the economic development of any nation has been discussed extensively in the literature. Schumpeter (1934) argues that financial institutions are necessary for economic development[1]. This view is supported by Goldsmith (1969)[2], Cameron et al. (1972)[3], Ikhide (1982)[4], Odedokun (1996)[5], to mention a few. Banks in both developed and developing countries assist in channeling resources from surplus to deficit economic units. They help in ensuring efficient payment systems and serves as conduit for the implementation of monetary policies[6]. The financial intermediation function of bank entails creation of money or deposit. This deposit creation has led to keener competition amongst commercial banks for funds particularly in the unbanked market. Asides, since early 1990s substantial reforms have been introduced into the banking sector to examine the impact of competition on efficiency. Competition and efficiency of commercial banks have been discussed extensively in the literature in the developed countries (U.S. and European nations), but there is dearth of literature on the relationship between them in the less developed countries particularly in Nigeria. Empirical studies from the European banking find mixed results. Fecher and Pestieau, 1993[7], Lang, 1996[8], Podpiera, Weill and Schobert, 2007[9], Weill, 2003[10] support negative relationship while Goldberg and Rai, 1996 [11], Punt and Van Rooij, 2003[12], Casu and Girardone, 2007[13], support positive relationship. Also the relationship between competition and efficiency of banks has not been ascertained in Nigeria; hence the need for this study.In the remaining part of this paper, Section 2 reviews the literature on competition and efficiency, Section 3 discusses the methodology while Section 4 contained the empirical results and Section 5 concludes the study.

2. Literature Review

- Theoretically, it is argued that competition and efficiency in the banking industry is based on the classical industrial organisation theory called the Structure-Conduct- Performance (SCP) paradigm. The theory assumes that, there is a causal relationship running from the structure of the market to the firm’s pricing behaviour, to the firm’s profit and the degree of market power. The theory predicts a positive relationship between concentration and profits.Empirically, Vittas and Neal (1992)[14], examined the trends in competition and efficiency in Hungarian banking. They also assessed the performance of Hungarian bank and noted the tremendous progress that were made in expanding the number of competing banks, strengthening the legal and regulatory framework, increasing the banks’ managerial autonomy and promoting development of the private sector. Vittas and Neal noted that effective competition was constrained by the segmentation of the market. The entry of new banks – joint venture banks – has a clear impact on market shares, but competition appears to be more effective in increasing the range of services than in lowering bank spreads. The impact of foreign banks would be greater if they were allowed to open branches or at least to establish fully owned subsidiaries. The drawback of this study is the use of operating ratios which provide a rough indication of bank efficiency. Casu and Girardone (2006)[15], examined recent developments in competition, concentration and bank efficiency levels in the single European market. Also, they investigated the relationship between competition and efficiency in banking markets using bank level balance sheet data for commercial banks in the major EU banking markets. Causality test between competition and efficiency was performed using dynamic panel data methods. The results of the analysis suggested that negative relationship (causation) exists between efficiency and competition, whereas, the causality running from competition to efficiency is weak though it is positive. In summary, the results suggested that the degree of concentration is not necessarily related to the degree of competition. Based on the above results, there is the need for further empirical analysis in this area. Podpiera (2007)[16], investigated the relationship between competition and efficiency in the Czech Republic between 1994 and 2005 using the Granger-causality test. The result of the study showed absence of increased competition in the Czech banking market between 1994 and 2005. The result seems surprising as one would have expected that the massive entry of foreign investor into the Czech banking industry would enhance the degree of banking competition. Furthermore, the result of the causality test showed that competition has negative effect on cost efficiency in the Czech banking sector. This finding supports part of the literature that increased competition leads to greater monitoring costs for banks and a reduction of the length of the customer relationship between the bank and the borrower which reduces efficiency.[9], argued that a higher degree of banking competition is a major issue for economic development and it is expected to provide welfare gains by reducing monopoly power of banks and cost inefficiencies, favoring the reduction of loan rates and investment. These expected gains are a major issue for transition countries in which bank credit represents the largest source of external finance for companies. The study used quarterly data for Czech banks, in order to provide evidence on the effects of banking competition on efficiency in the Czech Republic. On the empirical analysis, the study investigated the relationship and the causality between competition and efficiency. The result of the analysis provided a negative relationship between competition and efficiency. Also the causality test showed that causality runs from both directions. This has a major implication on the financial sector of the economy. This is because greater competition may hamper cost efficiency of banks which could result in higher rates and could lead to financial instability. In their conclusion, the results of the analysis rejected the intuitive ‘quiet life’ hypothesis and indicated a negative relationship between competition and efficiency in banking.[10], investigated the relationship between competition and efficiency in banking on a sample of 12 EU countries during the period 1994-1999 and measured competition by the Rosse-Panzar H-Statistic, while efficiency was estimated using stochastic frontier approach. The study concluded that a negative relationship existed between competition and efficiency in banking, thus failing to corroborate the intuitive positive effect of competition on efficiency. Carlson and Mitchener (2006)[17], studied branch banking, bank competition and financial stability and was of the opinion that the expansion of statewide branch banking induced greater competition in states where it was permitted and improved the stability of their banking systems by removing weak and inefficient banks. The results of their empirical findings were largely consistent with recent literature. Buchs and Mathisen (2005)[18], assessed the degree of bank competition and discussed efficiency with regard to banks’ financial intermediation in Ghana. In the study they applied panel data to variables derived from a theoretical model and find support for the presence of a noncompetitive market structure in the Ghanaian banking system, possibly hampering financial intermediation. The economic costs of the noncompetitive behaviour might have been exacerbated by the persisting domestic financing needs of the government, making it captive to the banks’ behaviour and fostering inefficiency in the banking system. Also, large deficit financing through the issuance of treasury bills has not only crowded out the private sector in capturing banks investments, but has also put pressure on interest rates, thereby making access to bank lending even more difficult for the private sector thus hampering private sector development. Therefore, further private sector development appears to be very much dependent upon sound fiscal adjustment, and the possible link between fiscal policy and the efficiency of the banking system should deserve further attention. The result of the study further indicated that consolidation of the Ghanaian banking sector is expected due to scale matters. Furthermore, barrier to competition on interest revenue is an indication that competition is stifled in the Ghanaian banking system. This could be as a result of the non transparent fee structure of the banks which help to shield the bank market structure from competition. Following from here, there is the need for further study in the area of competition and efficiency in the banking industry.Sunil and Binsheng (2011)[19], investigated the impact of financial reforms on competitiveness and production efficiency of the banking sector, as well as the short-term and long-term impact on economic growth, in Egypt during 1992–2007. The results of the study suggested that reforms have a positive and significant effect on competitiveness and production efficiency. Also, the evidence shows that state-owned banks are generally less competitive than private banks and foreign banks are less competitive than domestic banks. The average x-inefficiency of Egyptian banks is around 30 per cent, which is comparable to those reported for other African countries. Finally, there is evidence to suggest a significant relationship between financial bank productive efficiency and economic growth in the short run but not in the long run. Overall, the results support the argument for continuing the financial sector reform programme in Egypt.Simpasa (2011)[20], analysed the competitive nature of the Tanzanian banking industry from 2004 to 2008. Utilizing a rich bank level data set, the study employed the Panzar–Rosse methodology to compute the competitive index, taking into account risk, efficiency, regulatory and macroeconomic factors. The results showed that banks in Tanzania earned their income under conditions of oligopolistic conduct. Moreover, the competitive index derived from an interest revenue equation was not significantly different from that obtained using an aggregate revenue measure. This suggests that the degree of contestability from traditional intermediation activities approximates overall bank behaviour. The overall message is that greater market contestability can be achieved by adopting measures aimed at stimulating competitiveness in the banking sector, including consolidating gains on the macroeconomic front and allowing more foreign bank entry so as to increase the spread of banking services.Zhao and Murinde (2011)[21], investigated the interrelationships among bank competition, risk taking and efficiency during banking sector reforms in Nigeria (1993–2008). In the study, three stages were involved in the modeling procedure. In the first stage, the study measure bank productive efficiency, using data envelopment analysis, and the evolution of bank competition, using conjectural variations (CV) methods; the second stage involve using the CV estimates to test whether regulatory reforms influence bank competition; and the third stage investigated the impact of the reforms on bank behaviour. The evidence suggested that deregulation and prudential regulation influence bank risk taking and bank productive efficiency directly (direct impact) and via competition (indirect impact). Furthermore, it is found that as competition increases, excessive risk taking decreases and efficiency increases. Overall, the evidence on Nigeria affirms policies that foster bank competition.Somoye (2008)[22], examined the performances of government induced banks consolidation and macro- economic performance in Nigeria in a post-consolidation period. The paper analysed the data obtained from published audited accounts of twenty (20) out of twenty-five (25) banks that emerged from the consolidation exercise and data from the Central Banks of Nigeria (CBN). The analysis revealed that the consolidation programme has not improved the overall performances of banks significantly and also has contributed marginally to the growth of the real sector for sustainable development. The study concluded that banking sector is becoming competitive and market forces are creating an atmosphere where many banks simply cannot afford to have weak balance sheets and inadequate corporate governance. The study further posited that consolidation of banks may not necessarily be a sufficient tool for financial stability for sustainable development and this confirms the study by Megginson (2005) and Somoye (2006). It then recommended that bank consolidation in the financial market must be market driven to allow for efficiency in the sector. Also, the study recommended that researchers should begin to develop a new framework for financial market stability as opposed to banking consolidation policy.Brownbridge (1996)[23], studied the impact of public policy on the banking system in Nigeria. The study concentrated on the commercial and merchant banks which together accounted for 85 percent of the total assets of the financial institutions in Nigeria, excluding those held by the Central Bank of Nigeria (CBN). The study concluded that government controls on financial markets, public ownership of banks and the neglect of prudential regulation, had detrimental effects on the banking system, especially in terms of the quality of banks’ loan portfolios, efficiency and competition. Also, the efficacy of financial liberalisation and other financial sector reforms to enhance the efficiency of intermediation in the banking markets has been limited, which left large sections of the banking industry in financial distress. Some of the reforms introduced were inappropriately sequenced and others were not implemented in a consistent manner.

3. Methodology

- In order to examine the relationship between the degree of competition and the level of efficiency of commercial banks in Nigeria, the study employed the data for the period 1990 – 2009. The data were obtained from the annual report and statement of accounts of fifteen commercial banks in Nigeria. In analysing the model for the study, pooled least square estimate and Panel Generalised Method of Moment (GMM) were used. The model for the study is as specified:

| (1) |

4. Empirical Results

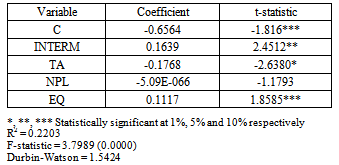

- The results obtained from the pooled least square estimate with fixed effect revealed that intermediation ratio is statistically significant with a value of 2.4512 at 5% level of significance (see table 1). This conforms to a priori expectation because, this ratio is expected to have a positive relationship on the level of efficiency as higher ratio will lower the quantity of deposits needed to produce loans. This in essence implies that banks with more deposit have the capacity to give out more loans to their customers which will increase the level of competition among the banks and invariably leads to increased efficiency. This result is in contrast with the negative relationship between competition and efficiency in the EU Banking Sector[10] though a priori, the expected relationship is positive. Also, the higher the deposit generated by the banking sector, the more loan that will be available to lend out to the customers.

|

|

5. Conclusions

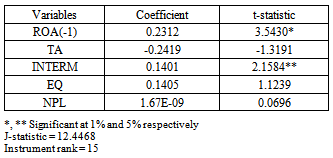

- The paper examined the relationship between competition and efficiency in the Nigerian banking sub sector for the period 1990 – 2009. Based on the data obtained from fifteen commercial banks in Nigeria, the specified model was estimated using both pooled least squares and Panel Generalised Method of Moments (GMM). The results revealed that competition in the Nigerian banking sector positively influenced the level of efficiency.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML