-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(6): 352-357

doi:10.5923/j.economics.20130306.16

An Analysis of Working Capital Management with Reference on Listed Companies in Bursa Malaysia

Nor Edi Azhar binti Mohamad

Department of Economics & Finance, University Tenaga Nasional

Correspondence to: Nor Edi Azhar binti Mohamad, Department of Economics & Finance, University Tenaga Nasional.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study investigates the relationships between working capital management policy with firm’s risk and return particularly in Malaysian public listed companies. As for this purpose, a study of 350 public listed companies from 6 different sectors that were listed in Bursa Malaysia Main Market covering the period of 2001-2011 was undertaken. The regression analysis was used to identify the effect of working capital policy towards the firm’s risk and return and the key independent variables for this research are working capital policy represent by Financing Policy (FP) and Investment Policy (IP). This study is not trying to identify the optimum level of current asset and current liability that a firm should have since the issues is unresolved in the financial literature however it’s expected to enhance the knowledge on working capital to shareholders, potential investors as well as the other stakeholders of a firm with the information on the management of short term financial decisions among securities listed in Bursa Malaysia.

Keywords: Working Capital Management, Financing Policy and Investment Policy

Cite this paper: Nor Edi Azhar binti Mohamad, An Analysis of Working Capital Management with Reference on Listed Companies in Bursa Malaysia, American Journal of Economics, Vol. 3 No. 6, 2013, pp. 352-357. doi: 10.5923/j.economics.20130306.16.

Article Outline

1. Introduction

- Working capital management gained less attention in corporate finance literature which traditionally focused more on the study of long-term financial decisions. However looking at the current economic ambiance, this short-term assets and liabilities managements necessitate vital consideration. Conclusively, one of the most important areas of finance is monitoring the firm’s working capital and its significance is due to the sensitivity of firm’s performance to the efficient management of working capital[1] as it’s represent the main share of items on a firm’s balance sheet[2]. It’s facts that the vital objective of a firms is to maximize the shareholders value and at the same time preserving the liquidity of the firms hence working capital is said to effect on liquidity as well as the firm’s performance[3] Referring towards the importance of working capital, the argument on the tradeoffs between risk and return instinctive in alternative working capital management usually become the starting point of working capital fragment in finance textbooks (see[4] and[5]). A part from that, the firm’s choices in working capital policies is said to have an influence on the firm’s liquidity and consequently on firms' profitability[6]. The policy of working capital is divided into two alternative namely aggressive and conservative strategies practiced by the firms. The aggressive strategies refer to high risk, high return working capital investment and financing strategies by financing part of its permanent asset base with short term debt thus is said to hold high level of current liabilities relative to total liabilities. In contrary, the conservative strategies refers to lower risk and return strategies where the firm’s non-current assets, permanent current assets and a part of the fluctuating current assets are financed with equity and long term debt. Extensive empirical research on working capital was carried out worldwide by the academia in order to hypothesize the firm performance (see example,[7];[3];[8];[9];[2] and[10]. Even so, the impact of various working capital mechanisms on firm’s performance from Malaysia perspective might be vaguely difference due to the divergence in business environment between other countries. Since recent study was built on western data and specific research studies exclusively from Malaysia perspective predominantly focus on risk and return for working capital policy are not available, thus this study was conducted with an attempt to bridge the gap in the literature by offering empirical evidence to the extent of which the result in Malaysia would be parallel to past studies. Considering the potential contribution of working capital policy to firm performance which eventually related to the economy of Malaysia, therefore, the objective of this study is to discover the relationships between working capital management policy with firm’s risk and return in a sample of Malaysian listed companies. This study is not try to identify the optimum level of current asset and current liability that a firm should have since the issues is unresolved in the financial literature however it’s expected to enhance the knowledge on working capital to shareholders, potential investors as well as the other stakeholders of a firm with the information on the management of short term financial decisions among securities listed in Bursa Malaysia.

2. Literature Review

- The importance of management in short term financing decisions also known as the management of working capital is not new to the finance literature. However, there are are no robust and widely accepted theories about working capital management[11] and as indicate by[12] the Pecking Order Theory[13] is the nearest pertinent theory which explain company’s optimal capital structure. This theory highlights the firm’s preference in financing their business using retained earnings as compared to debt, short-term debt over long-term debt and debt over equity. According to[11], the Agency Theory[14] is also one of the factor that has a significant influence towards firm’s decision making on working capital level considering conflict of interest between managers and shareholders.[15] analyze the working capital management efficiency of firms from telecommunication equipment industry. The variables used to represent the working capital are day’s sales outstanding, days inventory outstanding, days payable outstanding, days working capital, and current ratio while profitability and liquidity represent by cash conversion efficiency, income to total assets and income to sales. This study found evidence that even though “day’s working capital” is negatively related to the profitability, it is not significantly impacting the profitability of firms in telecommunication equipment industry. While,[16] found positive correlations between WCM with financial performance of the Pharmaceutical industry in Bangladesh. Whereas,[17] in his empirical study on Indian National Fertilizer Limited, for 1990-91 to 1999-2000 signify that working capital management and profitability of the company disclosed both negative and positive association. He also found evidence that increase in the profitability of a company was less than the proportion to decrease in working capital.[18] founds that high investment in inventories and receivables is associated with lower profitability. He used return on total assets as a measure of profitability for a sample of 58 small manufacturing firms in Mauritius for the period 1998–2003. The findings also reveal an increasing trend in the short-term component of working capital financing. Similar to study by[19] which focus on 14 corporate hospitals in India for the period 1996-97 to 2005-06. Their correlations and regression analysis signifying that working capital component namely current ratio, cash turnover ratio, current assets to operating income and leverage negatively influence profitability.[20] analyzed the effect of working capital management practices on the financial performance of Small scale enterprises (SSEs) in Kisii South District, Kenya using stratified random sampling technique on a sample of 113 SSEs comprising 72 trading and 41 manufacturing enterprises. Their study that employ both descriptive and inferential statistics revealed SSE financial performance was positively related to efficiency of cash management (ECM), efficiency of receivables management (ERM) and efficiency of inventory management (EIM) .As far as the working capital management policy is concerned, there is a limited literature discussed the working capital policies in specific. Earlier study was done by[21] which depicted the working capital management policies and practices of the private sector manufacturing companies in Sri Lanka. They used questionnaires and interviews with chief financial officers of a sample of manufacturing companies listed on the Colombo Stock Exchange. Their study revealed that most companies in Sri Lanka have informal working capital policy and company size has an influence on the overall working capital policy (formal or informal) and approach (conservative, moderate or aggressive). Moreover, company profitability has an influence on the methods of working capital planning and control.[7] which analyzed on the relationship between aggressive and conservative working capital practices for ten diverse industry groups of US firms indicates a significantly different current asset management policies practices across industry. Moreover, there is a stable relative industry ranking of the aggressive/conservative asset policies across industry over time. Their study also shows evident of high and significant negative correlation between industry asset and liability policies. Whilst,[8] through cross-sectional regression models on working capital policies and firms profitability based on sample of listed companies at Karachi Stock Exchange found a negative relationship between the profitability measures of firms and degree of aggressiveness on working capital investment and financing policies. Their result indicates that the firms yield negative profits if they follow an aggressive working capital policy .Recent study by[9] analyzed the working capital policy in on firms’ profitability and value for a sample of 57 industrial firms listed in Amman Stocks Market for the period of 2001 to 2009. The results show that conservative investment policy has a positive impact on a firm’s profitability and value whilst the aggressive financing policy has a negative impact. [10] examined the relationship between working capital aggressiveness and financial performance of manufacturing firms in Nigeria for 10 listed-manufacturing firms from the period 2006 to 2010. Their results indicate an increase in firm’s performance when total assets are financed by aggressive current assets but diminishing performance when financed by aggressive current liabilities. Turning to the empirical literature on working capital policy, we found no published study on the risks return tradeoff for working capital management policy from Malaysia perspectives. However there is a study on working capital concepts done by[22]. They explore the prevailing working capital management practices of some well-performed Malaysian public firms listed on Bursa Malaysia. They examine the correlation between profitability and the level of working capital of the sample firms and founds that profitability and working capital are linearly related positively to a certain extent.[23] investigate the relationship between working capital management and firm profitability using cash conversion cycle as measure of working capital management for panel data of 1628 firm-year for the period of 1996-2006 for six different economic sectors that listed in Bursa Malaysia . Their Pooled OLS regression analysis provide a strong negative significant relationship between cash conversion cycle and firm profitability.[2] on the other hand used Partial Least Square method to examine the validity of factors that determine the WC among 285 E50 firms in Malaysia based on accounting data of three years from 2006 to 2008.Their study used working capital as dependent variable, and growth of the firm, profitability, debt, size and industry as independent variables and validate that the convergent and discriminates validity of the constructs which the developed model represent the data adequately. They concluded that their identified latent variables are valid for testing.All the above studies provide a solid base in initiating the idea regarding working capital management and its components. They also provide the results and conclusions of those researches already conducted on the same area for different countries and environment from different aspect. However there are no reported studies on working capital management policy measures with reference to listed companies in Malaysia. Therefore on the basis of researches done in different countries, the established review of the literature had provides an ideal reference source of materials and research writings concerning return, risk and working capital profile of Malaysian listed firms in developing the hypotheses of research.H1: There is a significance relationship between firm return with working capital policyH2: There is a significance relationship between firm risk with working capital policy

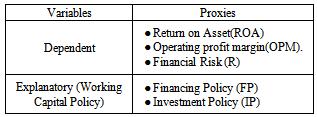

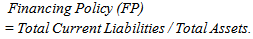

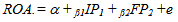

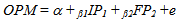

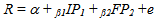

3. Data and Methodology

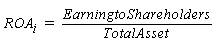

|

| (1) |

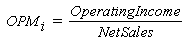

| (2) |

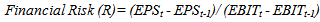

| (3) |

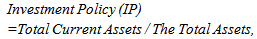

| (4) |

| (5) |

| (6) |

| (7) |

| (8) |

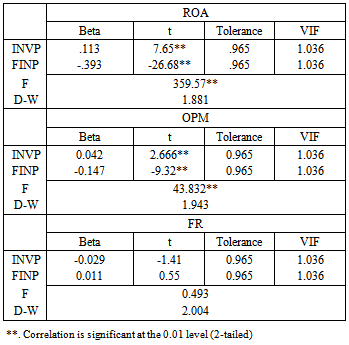

4. Results and Discussion

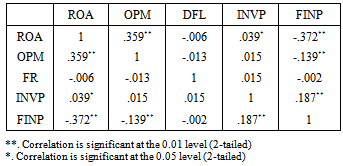

- The correlations between the variables were reported in Table 2. Results indicated no multicollinearity problems as the correlations were relatively low. According to[29], multicollinearity problems exist when the correlations value exceeded 0.80. The correlations results for ROA indicated a negative coefficient with FINP (-0.372) while positive significant with INVP(0.039) 1% and 5% significant level respectively. The result for OPM indicating also a negative significant correlations with FINP (-0.139) at 1% significant level. While the result for DFL both showing insignificant relations with INVP and FINP. Although results of the estimated correlation coefficient indicate negatively and positively correlated however it still considers low; therefore, it is not large enough to cause any concern in the regression model.

|

|

5. Conclusions

- This paper tries to find the influences of working capital management policy towards firm’s risk and return from Malaysian perspective. The study employed three model specifications in order to test the postulated hypotheses, using ROA and OPM, to represent return and FR to represent risk effect along with the working capital policy for 370 selected listed companies in Bursa Malaysian main Board for the period of 2001 until 2011. On the basis of findings of the research, it can be conclude that there are significant relations between Return factors with firm’s working capital management policy as our results suggest disclose both positive association with conservatives investment policy while negative association with conservative investment policy. In conclusions, applying correlations and multiple regression analysis, the result shows that there are significant associations between working capital policy towards firm’s returns performance. Nevertheless, it was hope that the result can contribute to the body of knowledge by identifying the conservatives and aggressive working capital management from Malaysia perspective. Although all the alternate hypotheses are support by the analysis, however the results of present study are in contradiction to some earlier studies on the issues which could compose an area of future research. It was recommended that the study is further improved with more sample size, different variables for risk and return performance and also other external variable which could confer with a strong relationship between the variables and help to uncover the efficient working capital management in Malaysia perspectives. Thus this study is left for future to be further explored.

ACKNOWLEDGEMENTS

- Special appreciation and deepest gratitude to our family and friends for their invaluable help of constructive comments and suggestions contributed to the success of this research.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML