-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(6): 336-340

doi:10.5923/j.economics.20130306.13

A Comparative Study of Gold ETF’s with Gold Spot Prices and Their Performance in India

1Quantitative Techniques & Operations, K.J. Somaiya Institute of Management Studies & Research Mumbai, India

2Finance, K.J. Somaiya Institute of Management Studies & Research Mumbai, India

Correspondence to: Kirti Arekar, Quantitative Techniques & Operations, K.J. Somaiya Institute of Management Studies & Research Mumbai, India.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The world economy was drastically affected by the financial crises since 2009. Large financial institutions suffered in the crisis. Banks were bailout by governments and stock markets reflected low level of Investor’s confidence. The collapse of Lehman Brothers made it the largest victim of the US subprime mortgage financial crisis. The Indian economy too was affected and the picture in India was not different. However during all these periods the prices of gold were not affected or rather they remained stable or increased. Gold Exchange Traded Fund is an instrument to invest in Gold in an E-form, which has various advantages of its own. However still many Indians prefer buying gold in physical form. Thus this paper aims to study the performance of Four NSE traded Gold ETF’s against Gold spot price.

Keywords: Gold, India, Gold ETF on NSE and Financial performance

Cite this paper: Kirti Arekar, Swati Godbole, A Comparative Study of Gold ETF’s with Gold Spot Prices and Their Performance in India, American Journal of Economics, Vol. 3 No. 6, 2013, pp. 336-340. doi: 10.5923/j.economics.20130306.13.

Article Outline

1. Introduction

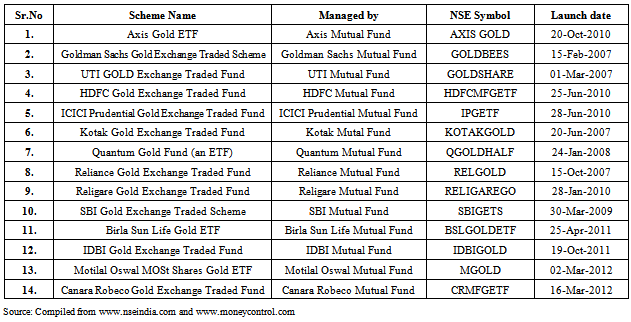

- The world economy was drastically affected by the financial crises since 2009. Large financial institutions suffered in the crisis. Banks were bailout by governments and stock markets reflected low level of Investor’s confidence. The collapse of Lehman Brothers made it the largest victim of the US subprime mortgage financial crisis. The Indian economy too was affected and the picture in India was not different.Going a little back in the past, the famous Harshad Mehta stock scam of 1992 and the Ketan Parekh stock scam of 2000-2001, adversely affected the market sentiments resulting into a big financial crises/loss for many. Even the unexpected/unimagined Satyam scam has further downgraded the sentiments/confidence level of the investors. However during all these periods the prices of gold were not affected or rather they remained stable or increased.Gold is one of the oldest precious metals known to man & for years it has been valued as a Global currency, an investment, a commodity and an object of beauty and India is not an exception to this Gold is used widely in various electrical industries, for dental filings and for jewellery. For many centuries gold served as the universally recognized form of money. Coins of the same weight bought the same amount of goods whether issued in Rome or China. It now has enormous emotional appeal. Gold is considered as form of money and is considered as one of the foundation assets for an Indian household and a means to accumulate wealth. There is no doubt that equity has the ability to outperform any asset class but is prone to huge volatility in the short or medium term, as against this gold, due to its weak correlation with equity provides for a good diversification in portfolio. Investment in gold is considered as an insurance of asset portfolio, since it gives good return, as was observed during the recent recession when the returns of stock and other assets were either negative or very low, the yellow metal continuously gave good returns. However, investment in precious metal requires special attention due to the problems associated with respect to its security, insurance, storage, moving, reselling, high price, purity and liquidity. To eliminate these issues and to provide a means to invest in gold the ETF were brought into the market.ETF-EXCHANGE TRADED FUND is security with group of stocks that tracks an index, a commodity, or a group of assets like an Index Fund, but trades like a share or stock on an exchange. The ETF are traded on net asset value- NAV of the underlying stocks they represent. Gold is held electronically in the Demat form and can be converted into physical gold. In India, E-Gold is offered by the National Stock Exchange Limited, which allows the investors the option to directly trade in or invest in gold online. Gold ETF is an exchange traded fund whose underlying asset is physical gold i.e. gold in physical form. In other words when a person buys or invests in gold ETF, he actually invest in gold but not in physical form but in the form of units or in electronic form and since in electronic form there is a need for Demat account. One unit of Gold ETF represents one gram of gold in Electronic form except for Quantum gold ETF and the investor can gets equivalent Gold on the sale of the units in the secondary market like the shares. The first Gold ETF was launched in March 2003 on the Australian Stock Exchange. In US the it was launched in 2004 on the New York Stock Exchange (NYSE), where as in India it was introduced in early 2007.Gold ETF is a very good option for retail investor as it gives them an option to invest in gold in small denomination; also it is free of taxes such as VAT and also being a Capital asset Gives the benefit of capital gain- either short term (holding for less than 12 months) or long term (holding for more than 12 months) as against a period of 3 years for physical gold. Also the quality of the gold is assured as the authorised custodians are from London Bullion Market Association and they guarantee for 99.5 percent purity i.e. 24 carat gold.However the growth of assets under gold exchange traded funds (ETF’s) in India slowed to 18% in the fiscal year ended 31st March 2013, compared with an average of more than 100% since its inception in 2007.Presently, there are 14 Mutual Fund Houses present in this segment managing gold assets worth nearly Rs. 12,000 crore and have together garnered a staggering amount of 40,000 kg of this precious bullion as per the data available with industry body AMFI. The following table shows the Fund Houses which are offering Gold Exchange Traded Funds.

|

2. Literature Review

- Dirk G. Baur (2013), in his study observed that ETF’s on indices provide access to diversified portfolio of assets at a low cost as against this a Gold ETF being based on a single commodity has a less advantage. On the observation of physical and synthetic gold ETFs (almost 80), concluded that it provides a low cost and more liquid alternative to physical investment in gold. Their study also provided new evidence on the financialization of commodities, the growth of Gold ETF and changes in the price of Gold.Monika Gulati and Shelly (2013), in their study on GOLD ETF as insurance for asset portfolio observed that, traditionally gold is extremely popular in India and at the same time it helps in countering the inflation, stock market volatility and the currency volatility. They also stated that Gold is less volatile commodity in comparison with the rest of the class of commodities. And finally concluded that Gold ETF have gained popularity in India.Swapan Sarkar (2012) in his article stated that Gold is the most important investment avenue due to the least risk, safe, most rewarding attributes. It is the most sought after investment as that was the only asset which gave positive returns during the financial crisis as well as during a period when the strongest economies were doubted for debt default. And as a result gold as well as products involving Gold as underlying asset has a bright future in India.Suganth Subramanian and Dr.K.Mohan (2012), in order to create awareness among the investor class and to keep the students aware and updated about the E-Gold, the authors discussed in their paper very highly and positively about Gold ETF. They also emphasized on the various innovation happening in the financial markets and how technological advancements are being utilized to benefit investors and students.Madhavi Lokhande and Shruti Manisha (2011), in their study of ETF in Indian Market, observed that though there has been significant increase in the ETF but it has not taken off well as ETF’s comprises of only 0.3% of total industry assets as against 9% in US and probably a low commission being one of the reason for the same. However with continuous reforms by SEBI, concluded that the future looks to be bright. Alok Goyal and Amit Joshi (2011), in their study of Gold ETF’s performance appraisal, stated that trading in Gold ETF’s is increasing over a time due to the continuous increase in the price of gold , less cost, no fear of theft , the tax benefit and less variation as compared to NSE Index.Dr. Sybila Pius Fernandez (2011), in her study on the prospects of Gold ETF in India, observed that Gold is a widely used metal, it is considered as one of the foundation assets for an Indian household and that there are good prospects for the growth of the ETF in India.Dr.Goyal Alok, Dr. Kaur Harvinder and Narang Praveen (2011), in their study observed that on one hand Gold ETF’s frees investors from the hassles of holding gold in physical form and at the same time gives them the exposure to gold and the fluctuations in the gold prices. Gold ETF’s are being used as a hedge against geopolitical instability; however the performance of the ETF’s depends upon the efficiency of the arbitrage mechanism. Wealth Noblett, Jackie (2010) suggested that Gold ETF’s witnessed a huge surge from all the corners since every class of investor looked at Gold to be the best alternative investment option due to its Hedge feature especially in case of a market volatility, geopolitical volatility and currency volatility. Lixia Wang and Iftikhar Hussain (2010) in their study of Gold ETF with reference to China, also observed that Gold ETF’s are a very good instruments for the small and medium-sized investors as well as it has a very positive significance for a country due to the currency fluctuations, as a financial safety. They also suggested that China needs Gold ETF as a national security strategy and for the small investors as they need to increase their profitability.

3. Objective of the Study

- 1. To Study the performance of the selected four NSE traded Gold ETF’s in comparison to Gold Spot prices.2. To Study the risk behavior and analysis the same.3. To understand the risk behavior of NSE traded Gold ETF’s, we had studied the Sharphe’s and Treynor’s ratio.

4. Research Methodology

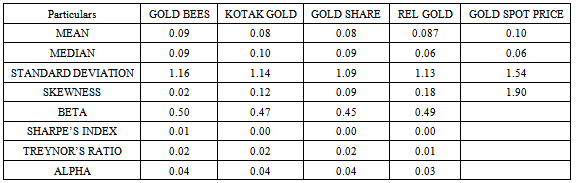

- The study is limited to only 4 Gold ETF that are currently traded on NSE. The data used for the study is secondary data. The period selected for observation is from June 2008 to May 2012. The four Gold ETF selected are Gold BEES, Kotak Gold, Gold Share and REL Gold, since all these four being in existence since June 2008. Quantum Gold fund has not been considered due to the difference in the unit size. The source for the Gold Spot Price has been MCX and that the daily price has been arrived at as an average. The period has been so considered since it has a pre and a post US financial recession feature. Various financial tools like Standard Deviation, Beta, Alpha, Sharpe’s Index, Treynor’s measure etc has been used to analyze the financial performance with reference to the Gold Spot Price.

5. Data Analysis and Interpretation

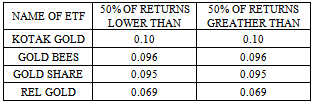

|

|

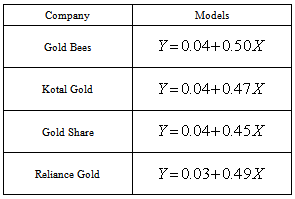

Where Y = individual company Gold ETF’s returnX = Gold Spot price Return

Where Y = individual company Gold ETF’s returnX = Gold Spot price Return

|

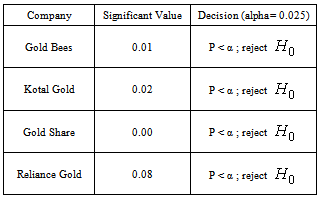

: Beta is not statistically significant

: Beta is not statistically significant : Beta is statistically significant

: Beta is statistically significant

|

6. Conclusions

- Thus it can be concluded that Gold ETF’s are indeed an alternate avenue of Gold investment available to the investors. Considering the benefits especially the Purity, No insurance, Tax benefits, ease in handling and returns almost matching the returns of Gold Spot Price, investors cannot ignore this avenue or need to add this instrument to their portfolio as a means of diversification. As the Gold prices are regularly touching a new height, more investors need to invest in these instruments so as to obtain the benefits of fair earning, low cost, sure profits, small ticket size investment, low taxes etc. Though the investments in ETF has increased over a period of time, the recent slow-down in the growth of the assets under Gold ETF hints that, there is a need to create more awareness among the general public, students and Investor class about the availability, advantages, ease in dealing due to the technology (E-GOLD). Consumers around the world bought 53% more bullion in physical form (either bar, coins etc) in the 2nd quarter of 2013 from the year ago, out of which India alone accounted for the biggest share at 310 M.T, which is 71% rise over the same period a year ago (Source: World Gold Council). So there is still lot of scope for GOLD ETF’s in India. Finally, we can say that as compared with the Gold spot prices all the gold ETF’s performance is good for the period of our study.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML