-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(6): 268-272

doi:10.5923/j.economics.20130306.04

The Impact of Fraud Management on Organizational Survival in Nigeria

1Department of Accountancy, Nnamdi Azikiwe University, Awka

2Department of Statistics, Nnamdi Azikiwe University, Awka

Correspondence to: Aronu C. O., Department of Statistics, Nnamdi Azikiwe University, Awka.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The impact of fraud management on organizational survival is about the contribution fraud has on the survival of difference organization. The objective of this study is to determine if business organization or companies adopt holistic approach to fraud management, to examine if the various stages of fraud management are effectively balance so as to reduce fraud losses and the extent to which the coordination of fraud management has reduced fraudulent activities. A sample size of forty-four (44) staff was used to evaluate the Chi-Square test statistic. From the result of the analysis it was observed that adoption of holistic approach to fraud management do not help companies in preventing fraud in Nigeria, also, the successful balancing of activities within and among the fraud management lifecycle do not result in improved fraud management performance in Nigeria. The effective coordination of fraud management activities was observed to help in reducing fraudulent activates in Nigeria.

Keywords: Business, Holistic, Companies, Determine, Sample Size, Successful, Coordination

Cite this paper: Ijeoma N., Aronu C. O., The Impact of Fraud Management on Organizational Survival in Nigeria, American Journal of Economics, Vol. 3 No. 6, 2013, pp. 268-272. doi: 10.5923/j.economics.20130306.04.

Article Outline

1. Introduction

- The costs of fraud are passed on to society in form of increased customer inconvenience, opportunity costs, unnecessary high prices of goods and services, and criminal activities funded by the fraudulent gains. But what managed effectively, with successfully balanced component, would significantly reduce the losses and societal costs associated with fraud. Fraud losses are frequently part of an economic externality. An economics externality is present when one business takes actions or refrains from acting and as a result, passes on, imposes or facilitates costs upon other business. An example from the internal fraud perspective would be when a financial institution decides not to facilitate law enforcement’s arrest and prosecution of a staff member who stole from them. As a result of their decisions, the ex-staff member may very well obtain employment at another financial institution and commit the same crime again. This situation is quite aptly described by the following “which fraud does exist in retail organizations, it is typically related to a particular loan officer and is more often than not quickly discovered. The employee is usually terminated from his or her position and mores on to a new company until the something happens all over”[1].[2], defined Fraud as encompassing any crime for gain that uses deception as its principal modus operandi. He identified three ways to illegally relieve a victim of his money: force, trickery or larceny. All offences that involve trickery are frauds. Deception is thus the lynchpin of fraud. Deception implies imposing a false idea or belief that causes ignorance, bewilderment or helplessness.[3], reported that fraud management embraces in its broadest sense, the awareness of the many components of fraud such as the human element, organizational behaviour, and knowledge of fraud theory, evidence and standards of proof, an awareness of the potentiality for fraud and an appreciation of the tell-tale signs or red flags of fraud. Fraud management has to do with all the controls, and policies developed by organization in order to reduce the risk of fraud and losses through better fraud control practices. Fraud risk management should be approached in a systematic manner. The basic strategy starts from prevention as prevention is better than detection. This is a proactive approach followed by detection and response. According to[4], fraud management lifecycle is a network lifecycle where each stage in the lifecycle is an aggregated entity that is made up of interrelated, interdependent and independent actions, functions and operations. These activities can but do not necessarily occur in a sequential or linear flow.[5], postulated a “Fraud deterrence cycle” as a regimen for fraud management. According to him no one can create an absolutely insurmountable barrier against fraud but many sensible precautionary steps can and should be taken by organizations to defer fraudsters and would be fraudsters. While fraud cannot be completely prevented, it can and should be deterred.[6], explained that the incidence of fraud in the Nigerian banking industry has assumed an alarming proportion of late. With the deregulation of the banking system in the early 1980s, the pace at which banks were established increased in an unprecedented manner. This development brought in its wake physical expansion and growth, both in structure and manpower. The Banking consolidation exercise which commenced in 2005 further accentuates rapid development and expansion of Nigerian Banks within and outside the country. Poaching of experienced and seasoned workers across all cadres to fill the ever increasing job openings in the banking sector became the order of the day. With this development, all manner of staff with questionable characters were employed into the banking industry. In their own contribution,[7], noted that though it appears the banking industry is one of the most profitable within the economy, higher performance could have been attained in terms of their performing a leading role in the reactivation of Nigerians economy, creation of wealth to her shareholders and rendition of social obligations to the larger society. The sub optimal performance of the Nigerian banking industry is due to an array of problems, of which fraud is a factor to contend with. Fraud has become one of the most intractable and monumental problems in recent times. As a matter of fact, banks have become the main target of conmen for survival. It is not an understatement that only well managed banks especially with respect to fraud prevention would survive in the coming years. It is on record that the spate of distress that ravaged the banking industry prior to the banking consolidation of 2006 was not entirely hinged on management’s ineptitude alone. The activities of fraudsters and the inability of banks to foil the frauds were their „‟Achilles heel‟‟. The high turnover of frauds, theft, defalcations and forgeries in the banking system is capable of undermining the growth, development and stability of banks which at the moment seems to be doggedly affecting the financial sector of the economy. The research interest of[8], were on fraudulent activities and forensic accounting. They called on banks to adopt more proactive measures such as the use of forensic accounting techniques. Also,[9] examined the impact of fraud on bank performance in Nigeria. Their study revealed that Nigerian banks recorded the highest cases of fraud in 2008. Result of their study revealed that, there was a significant relationship between banks profit and total amount of funds involved in fraud. To further buttress the argument in the present study,[10] cautioned that, the best forms of defence against the risk of fraud in any organization are proactive measures. For an organization to create a corporate environment that prevents, deters and timely detects frauds, it needs to understand why fraud occur, types and methods of perpetration as well as to identify its business areas that are at risk and implementing appropriate procedures to address them. It is a well established fact that before fraud can take place, there must be: an item worth stealing; a potential perpetrator willing to steal and an opportunity for crime to take place.[11], explained that accountants and auditors have often been exalted to be the leaders in fraud prevention by employing their skills in designing ‘tight’ control systems. This strategy however is at best a short-run solution to a large and pervasive problem. Business activities are built on the trust that people at all levels will do their jobs properly. Control systems limit trust, limit employee’s initiatives and in the extreme, can strangulate business organizations with bureaucracy. Managers and employees must have freedom to do business which may sometimes mean giving them freedom to commit fraud. Effective long-run prevention measures are complex and difficult, and involve the elimination of the causes of fraud by mitigating the effects of motive, opportunity and lack of integrity. The result of their study revealed that the commonest action against fraudsters had been disciplinary hearing and immediate dismissal from employment. This position has never helped matters because a man who has stolen colossal sums of money from an organization and is simply dismissed without punitive measures will go home as a king and a celebrity in a base society like that of Nigeria. Perhaps this is why fraud is on the increase in Nigerian firms, since wealth no matter how obtained is adored and worshipped. Most business organizations kept quiet in the face of fraud. Generally, since the costs of the decision are external to their business and are not illegal, it is accepted in the business community that there is limited reason to be concerned with the spill over or externality impacts of their fraud prevention actions or inaction upon other entities and society.Notably and regrettably absent from the interagency guidelines are any requirements to proactively monitor and profile employee activity with predictive statistical models in order to ensure the early detection and fast correction of these types of problem. also absent from the guidelines is a secondary and delayed form of this kind of monitoring known as foot print review foot print reviews compare accounts with confirmed fraud cases against those employee who reviewed or maintained the account information prior to the onset of the fraudulent activity. The guidelines correctly address deterrence and prevention stages of the fraud management lifecycle. But the clearly fall short of adequately addressing detection and mitigation activates. Previous employee’s dishonesty in the financial industry surely constitutes a reasonable anticipation of future employee dishonesty. In other words, financial institutions should be able to foresee the cases of employee dishonest will occur. Interestingly, many companies subscribe to the philosophy of fraud prevention as a competitive advantage where they gauge part of their success by how much fraud they can push off on their competitors. This can be described as a “Not in my backyard” approach. These companies typically are unwilling to discuss or share their fraud management methods with their competitors. The ability to quickly analyze fraud loses and implements prevention and detection policies increases the difficulty for the fraudsters, as they must defeat the new strategies put in place fast action can make fraudsters go elsewhere this forced migration is a core component for these compares which treat fraud management as a competitive advantage. Their focus is one of implementing strategies before their competitors, so the fraudsters will go to their competitors to commit the fraud, this approach to fraud management frequently results in isolation and a failure to maintain the required speed of adaptation. It’s however still present in a significant number of industries. As the internet began to emerge as a commercial delivery channel in the late 1999’s, many internet based merchants, thinking that they were unique, relied upon their own “proprietary heuristics”, these companies would not consider working with their peers or fraud management professionals from other industries because they were “unique”. This philosophy is by no means limited to a certain industries as well, and contributes to an overall increase in losses and missed opportunities. The costs of fraud across the insurance, telecommunications, backings, internet, and credit card industries in Nigeria are staggering. The successful management of the fraud management lifecycle such fraud deterrence, fraud prevention, fraud investigation and fraud prosecution, fraud analysis, fraud policy and fraud prosecution provides the promise of significantly reduced fraud losses and reduced societal impact. Hence, the need to determine if Nigeria companies adopt holistic approach to fraud management and determine the extent to which the coordination of fraud management has reduced fraudulent activities.

2. Research Methodology

2.1. Data Collection

- The data used in this study was collected using questionnaire distributed to a targeted sample of fourth four (44) out of fifty (50) small and medium scale business firms within Anambra state of Nigeria using Cochran’s formula for determining appropriate sample size (see[12]). Chi-Square test was used to analyze the data presented in this study and the level of confidence assumed was 95 % Confidence Interval (α=0.05). The test of hypothesis for the present study is stated as given;H01: The adoption of holistic approach to fraud management will not help the company in preventing fraudVsH11: The adoption of holistic approach to fraud management will help the company in preventing fraudH02: The successful balancing of activities within and among the fraud management lifecycle will not result in improved fraud management performanceVsH12: The successful balancing of activities within and among the fraud management lifecycle will result in improved fraud management performanceH03: The effective coordination of fraud management activities will not help in reducing fraudulent activatesVsH03: The effective coordination of fraud management activities will help in reducing fraudulent activates

2.2. Data Presentation

|

|

3. Analysis and Result

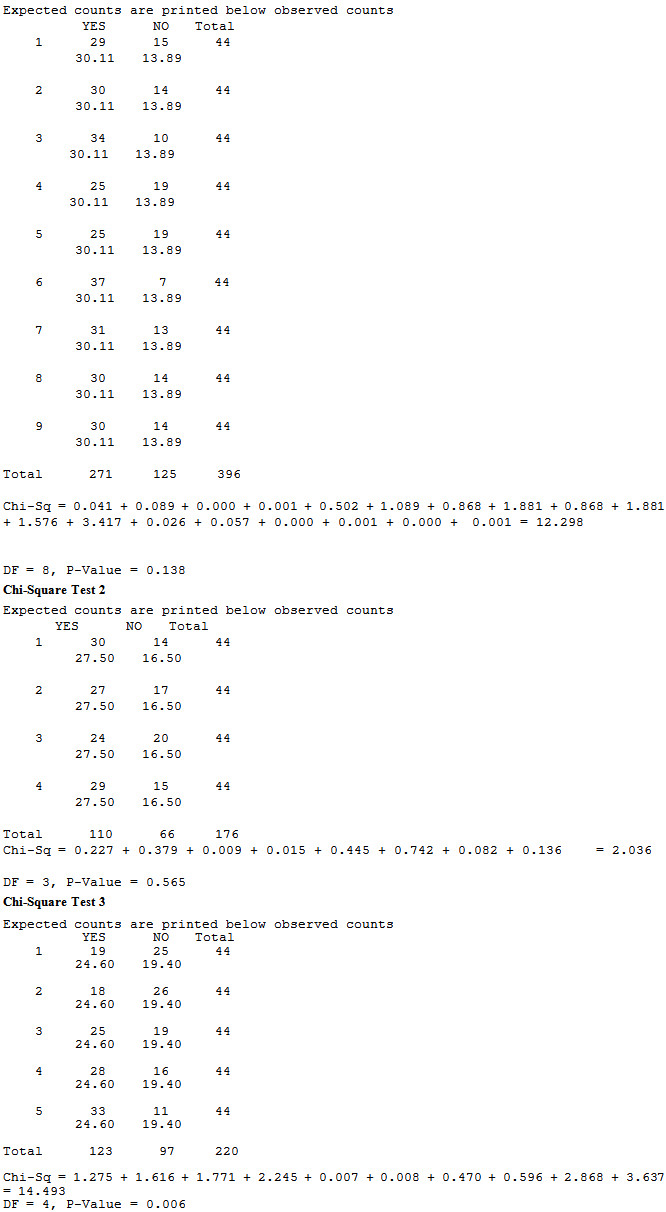

- Using the responses presented on Table 1, Table 2 and Table 3 the corresponding Chi-Square test result was obtained using MINITAB 11.0 statistical package was obtained as given;Chi-Square Test 1

4. Discussion

- From the Chi-Square 1 result it was observed that the Chi-Square value of 12.298 and a p-value of 0.138 which fall on the acceptance region of the null hypothesis since the p-value = 0.138 is greater than an alpha value of 0.05 assuming a 95% confidence interval. The result presented in Chi-Square 2 showed a Chi-Square value of 2.036 and a p-value of 0.565 which falls on the acceptance region of the null hypothesis since the p-value = 0.565 is greater than an alpha value of 0.05 assuming a 95% confidence interval. Also, Chi-Square 3 result showed Chi-Square value of 14.493 and a p-value of 0.006 which falls on the rejection of the null hypothesis since the p-value = 0.565 is greater than an alpha value of 0.05 assuming a 95% confidence interval.

5. Conclusions

- From the findings we observed that adoption of holistic approach to fraud management do not help companies in preventing fraud in Nigeria, also, the successful balancing of activities within and among the fraud management lifecycle do not result in improved fraud management performance in Nigeria. The effective coordination of fraud management activities was observed to help in reducing fraudulent activates in Nigeria. The effective coordination of fraud management activities and coherent approach to fraud management can be explained and understood by the rest of the functional disciplines in the business organization. Each area of a business from accounting to customer service and from sales to marketing will be better able to understand the needs and value provided by the fraud management. Their awareness and understanding is important to continue fraud reduction, because fraud prevention which is one of the stages of fraud management is never the core business focus. Business exists to provide goods and services, while fraud management plays a supporting role to the larger business objectives. Successful implementation of the fraud management lifecycle increases the likelihood of proactive fraud risk management and, therefore, the success of the business organization. We wish to stress that opportunity to implement the theory in practice and observe its applicability and performance through additional case studies would be a logical step in continued research of the fraud management lifecycle, and the opportunity to continue implementing the stages in practice will help to establish its relevance and validity in various industries.

References

| [1] | Prieston, A. J. and Dreyer, J. A. (2001). Mortgage fraud:The Impact of mortgage fraud on your company’s Bottom line, Mortgage Bankers Association of America. |

| [2] | Wells, .J.T. (2006). Corporate Fraud Handbook: Prevention and Detection, New Jersey John Wiley & Sons Inc. |

| [3] | Osisioma B.C (2006). Fraud Management and Forensic Accounting, Enugu El-Demak Inc. |

| [4] | Wilhelm K.W (2004) The Fraud Management Life Cycle Theory a Holistic Approach to Fraud Management. Journal of Economic Crime Management. |

| [5] | Singleton T.W, Singleton A.J, Bologna G.J & Lindquist R.J (2006). Fraud Auditing and Forensic Accounting, 3rd ed, New Jersy, John Wiley & Sons. |

| [6] | Nwaze, C., ‟Bank fraud exposed with cases and preventive measures”. Control & surveillance associates limited, Lagos, 2006. |

| [7] | Kanu, S. I., Okarafor, E. O., The Nature, Extent and Economic Impact of Fraud on bank deposits in Nigeria. Interdisciplinary Journal of Contemporary Research in Business, 4(9): 253-265, 2013. |

| [8] | Onuorah, Ebimobowei, Fraudulent activities and forensic accounting services of banks in Port Harcourt, Nigeria. Asian Journal of business management, 4(2), 2012. |

| [9] | Abdulrasheed, Babaitu, Yinusa, Fraud and its implications for bank performance in Nigeria” International Journal of Asian Social Science, 2(4), 2012. |

| [10] | Ogunleye.G.A (2010):Perspectives on the Nigerian Financial safety –Net Nigeria Deposit insurance corporation, Abuja. |

| [11] | Hamilton, D. I., Gabriel, J. M., Dimensions of Fraud in Nigeria Quoted Firms. American Journal of Social and Management Sciences, 3(3): 112-120, 2012. |

| [12] | Higgins, C. C., Kotrlik, J. W., Bartlett, J. E. (2001). Organizational Research: Determining Appropriate Sample Size in Survey Research. Information technology, learning, and Performance Journal, 19(1): 43-50. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML