-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(3): 159-163

doi:10.5923/j.economics.20130303.05

Comparative Analysis of Return on Sukuk and Conventional Bonds

Heri Fathurahman, Rachma Fitriati

Administrative Science Department, Social and Political Science, Universitas Indonesia M Building, Prof. Dr. Prayudi Atmosudirjo 2nd Floor UI Campus, Depok 16424, Indonesia

Correspondence to: Heri Fathurahman, Administrative Science Department, Social and Political Science, Universitas Indonesia M Building, Prof. Dr. Prayudi Atmosudirjo 2nd Floor UI Campus, Depok 16424, Indonesia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study aims to analyze the ratio between yields on sukuk and conventional bonds using model calculations Yield to Maturity (YTM) and portfolio optimization model (Markowitz Model and Single Index Model). Testing is done by using the average, standard deviation, coefficient of correlation, covariance of the portfolio, as well as the statistical test t. The samples used were sukuk and conventional bonds are actively traded and listed on the Indonesia Stock Exchange (IDX) and the Indonesia Bond Pricing Agents (IBPA) in October 2011. Of the total sample, the researchers divided into 10 groups of comparison so that comparisons can be done in a balanced and proportionate. The results showed that the average of the sukuk and conventional bonds differ significantly overall. From the tenth group comparisons, group 3, 6, and 10 had significant differences, namely sukuk average YTM is greater than conventional bonds. This study recommends that the following research more attention to the rules of sharia compliance.

Keywords: Sukuk, Bonds, Markowitz Optimal Portfolio Model, Markowitz Optimal Portfolio Model

Cite this paper: Heri Fathurahman, Rachma Fitriati, Comparative Analysis of Return on Sukuk and Conventional Bonds, American Journal of Economics, Vol. 3 No. 3, 2013, pp. 159-163. doi: 10.5923/j.economics.20130303.05.

Article Outline

1. Introduction

- Islamic bonds, or sukuk, are used to finance certificates that can be considered in the same Islamic bonds (Vishwanath and Azmi, 2009). According to the National Sharia Board Fatwa No: 32/DSN-19 MUI/IX/2002, "Islamic Bonds is a long-term securities sharia Issuer to the holders of bonds issued Shari'ah obliges issuers to pay income to the holders of Bonds Shariah in the form of profit sharing / margin/fee, and pay back the bond funds as they mature." Sukuk is not like other interest-based securities. Sukuk are bonds that the implementation based on the principles of sharia. Sukuk is composed of several types depending on the type of contract or agreement, including sukuk ijara, mudaraba, musharaka, and Istisna '. In issuing sukuk, there are things that must be met, namely the underlying asset. Underlying asset is an asset which is the object of the agreement. Underlying asset which is the difference in structure between sukuk bonds.In a conventional bond yields received one of them in the form of interest. While the principles of Shariah, is part of the usury rate. Riba (interest) is the return / reward or compensation is charged to the loan agreement and charged to the debt rescheduling (Tariq, 2004). Riba is prohibited in Islamic law. So, as a form of compensation for interest, then returns received from the investment sukuk is the reward and or profit.There are a number of studies relating to sukuk, Islamic investment returns and conventional. Wahdy (2007) analyzed the ratio of sukuk and conventional bonds on the secondary market. Sukuk or Islamic bonds, in principle, are securities as an investment instrument issued by a transaction or contract underlying sharia (underlying transaction), which can be ijara (lease), mudaraba (profit sharing), Musharaka or the other. Basic emergence of sukuk is due to incompatibility of conventional bonds are defined as bonds and give a coupon in the form of interest on the principal amount that is forbidden in Islamic law. The result is risk and sukuk yields no different from conventional bonds.Sukuk are growing quite rapidly judged to have more benefits when compared to conventional bonds. Bey (2007) states that menfaat sukuk include: a)sukuk been priced competitively parallel to conventional bonds, b) sukuk in general has a better risk, and c) the sukuk can be traded and in accordance with Islamic principles. Of the four benefits of sukuk, there is one benefit that is certainly interesting, the sukuk has a better risk. In line with Bey (2007), Renaissance (2005) in Wahdy (2007), Islamic bonds more competitive compared with conventional bonds. This is due to: (1) the possibility of obtaining higher revenue sharing than conventional bonds, (2) secure as Islamic bonds to fund prospective projects, (3) in the event of a loss (out of control) investors retain their assets, and (4) a breakthrough paradigm, not more debt but investment letters. Hesse et. al., (2008) Islamic sukuk securities similar to those in which through a loan or investment refers to the sharia-based trust in existing assets or future, transforming the bilateral risk sharing between borrowers and lenders in the finance market return based on the performance of assets . Borrowers and lenders mengkomoditaskan capital income from the transfer of assets in one of the three basic forms of Islamic finance. While Vishwanath and Azmi (2009), the sukuk market brings many benefits to issuers and investors. Publishers can benefit from the increased liquidity enormous in the Islamic world and can reduce sources of new lower cost. Sukuk based on the underlying transaction that creates a close relationship between financial flows and production. Finance should be channeled for productive purposes such as project finance rather than speculative activity. The exposure is a risk for the project and not to uncertainties or activities that have real economic benefits. It is much greater contribution to the stability of the financial system. Because of the principle of risk-sharing, there is an explicit risk sharing by financial providers and borrowers. Relationships with real investment risk generating enough welfare to compensate for the risk. Associated with risk, sukuk are exposed to variations in systematic risk as interest rate risk and exchange rate risk, and operational risk as the risk of currency and asset specific risk SPV (special purpose vehicle). Sukuk means balanced distribution of the prosperity that allows investors to benefit from the real profits that are the result of the company in a balanced division. Meanwhile, Cakir and Raei (2007) in his study of the Sukuk vs.. Eurobonds: Is There a Difference in Value-at-Risk? analyze whether the behavior of the secondary market Eurobonds and sukuk issued by the same issuer is significantly different to generate profits from diversification. Sukuk in many aspects similar to conventional eurobonds.Sukuk securities considered to serve the instruments that provide a predictable level of return (fixed or floating); sukuk and eurobonds traded in the secondary market even smaller than conventional bonds. Bonds representing the pure debt issuer, while the sukuk representing the ownership stake in the underlying asset. Sukuk create relationships lessee / lessor relationship in which different than the lender / borrower. Although International issues sukuk is similar to conventional bonds, sukuk when it appears like some of the features as grading, the procedures for issuing and redemption, coupon payment and default provisions, the relationship returns to the returns of conventional bonds, sukuk. Sukuk offer a lower return than bonds versus konvensioal. Sukuk also illiqud instrument than conventional bonds as evidenced lack of secondary market activity.Tariq (2004) in his research on Managing Financial Risk of Sukuk Strucure, explaining the risks of sukuk structures, which include (1) the market risk consisting of interest rate risk and exchange rate risk, (2) credit risk and the support, (3) the risk of shari'ah compliance, (4) operational risks, including the risk of default, the risk of coupon payment risk, currency risk asset specific risk SPV (special purpose vehicle), specific risk investors, as well as the risks associated with the asset yan. He also, sukuk certificates meayani replication functions of conventional bonds and securities that can be traded in the mobilization of resources from the market and liquidity injections into the company or government and in providing stable resources on income investors. Sukuk differ from conventional bonds and securities and other assets in some cases. First, conventional investors in corporate bonds and the government hopes to capitalize on the development of a better interest rate. Second, investment in trade financing involving the issuance of sukuk or production of intangible assets. Sukuk is directly related to the real sector activities. Third, invsetor sukuk have rights integral to information on the use of the investment, the nature of the underlying assets, and other things.Godlewski et. al., (2010) in his study entitled Sukuk Are Really Special: Evidence from the Malaysian Stock Exchange, citing Wilson (2008) which states that providers of funds called for special attention to the borrowers. Sukuk identical to conventional securities, for sukuk and other securities aimed at simplification of investor risk assessment on new investment

2. Method

- This study uses a quantitative approach to measure and compare the yield to maturity between sukuk and bonds. In this study, the data used is secondary data obtained from the Indonesian Bond Pricing Agent (IBPA) and the Indonesian Stock Exchange (IDX). Secondary data is the company that issued the bond issuer and the company that issued the sukuk issuers of any kind from them. The population used in this study consisted of 243 bonds well with a fixed interest rate (fixed rate) and the interest rate (floating rate). In addition, data sukuk totaling 31 either in the form of sukuk ijara and mudaraba. Secondary data is data that is listed in IDX and IBPA and still actively traded until the month October 2011In this study, the population is classified into ten groups of samples were randomly selected bonds using a computer. The selection of random bonds are intended to maintain the independence of each bond group. Each group consists of 31 bonds where the proficiency level equal to the amount of total sukuk. Ten groups of bonds compared to the yield to maturity with a group of sukuk by using an independent t test.

3. Result and Discussion

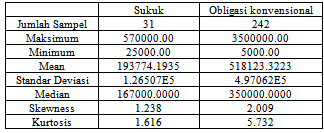

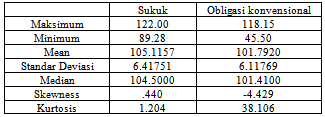

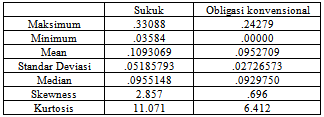

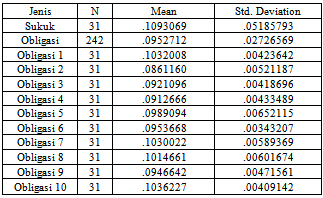

- The discussion begins with the analysis of this study show the descriptive statistical results of both the research object sukuk and bonds compared. Table 1. is a comparison table of the nominal value of sukuk and bonds. According to the table, the nominal value of sukuk have averaged less than conventional bonds.Next is a comparison of the trading price of sukuk and conventional bonds. Sukuk has the greatest maximum value when compared to conventional bonds. On the other hand, the minimum value of the smallest conventional bonds owned by the amount of 45.50.Based on the calculation of the yield to maturity between sukuk and bonds, the yield to maturity shown in the comparison chart below. In Table 3, the value of which yield the greatest maturity 0.33088 whereas conventional bonds valued at 0.24279. In addition, the average value of sukuk and bonds produced quite surprising. Sukuk instrument has a mean value which is equal to 0.1093069 highest whereas conventional bonds amounted to only 0.0952709.As previous research purpose, randomized study of conventional bonds into ten groups to be compared to the YTM YTM rate sukuk. Table 4 below displays comparison of the average and standard deviation of the ten groups of one group of bonds and sukuk. From the calculation, the average value of sukuk have the greatest value when compared with a group of ten bonds. Based on these calculations, the research hypothesis stating sukuk yields greater than bond yields acceptable.Independent Samples Test shows that the F count for the YTM with Equal variances assumed probability is 2379 with 0128. Since the probability of> 0.05, the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 4, t count for the YTM with Equal variances assumed probability is 0597 with 0553. For two-sided test, the probability of a 0553/2 = 0.2765. Since 0.2765> 0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows that the F count for the YTM with Equal variances assumed probability is 2191 with 0144. Since the probability of> 0.05 then the two variances are the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. Looks t count for YTM with Equal variances assumed was 2173 with probability 0034. For two-sided test, the probability of a 0034/2 = 0:17. Since 0017 <0025 then the average YTM of sukuk and bonds.Independent Samples Test shows that the F calculation for YTM with Equal variances assumed probability is 2813 with 0099. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 6, t count for the YTM with Equal variances assumed probability is 1684 with 0097. For two-sided test, the probability of a 0097/2 = 0.0485. Since 0.0485> 0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows that the F count for the YTM with Equal variances assumed probability is 2745 with 0102. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 7, t count for the YTM with Equal variances assumed probability is 1756 with 0097. For two-sided test, the probability of a 0084/2 = 0042. Since 0042> 0025 then the average YTM of sukuk and bonds are virtually identical. Independent Samples Test shows F count for the YTM with Equal variances assumed probability is 1221 with 0274. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 8, t count for the YTM with Equal variances assumed probability is 0914 with 0364. For two-sided test, the probability of a 0364/2 = 0182. Since 0182> 0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows F count for the YTM with Equal variances assumed is 5295 with a probability of 0.025. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 9, t count for the YTM with Equal variances assumed probability is 1404 with 0165. For two-sided test, the probability of a 0165/2 = 0.0825. Since 0.0825> 0025 then the average YTM of sukuk and bonds are virtually identicalIndependent Samples Test shows F calculation for YTM with Equal variances assumed probability is 0834 with 0365. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 10, t count for the YTM with Equal variances assumed probability is 0572 with 0569. For two-sided test, the probability of a 0569/2 = 0.2845. Since 0.2845> 0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows F calculation for YTM with Equal variances assumed probability is 1051 with 0309. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Table 11, t count for the YTM with Equal variances assumed probability is 0707 with 0482. For two-sided test, the probability of a 0482/2= 0241. Since 0241>0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows F calculation for YTM with Equal variances assumed probability is 2637 with 0110. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Independent Samples Test, t count for the YTM with Equal variances assumed probability is 1403 with 0166. For two-sided test, the probability of a 0166/2 = 0.83. Since 0.83> 0025 then the average YTM of sukuk and bonds are virtually identicalIndependent Samples Test shows F count for the YTM with Equal variances assumed probability is 2637 with 0110. Since the probability of> 0.05 then the second variance is the same YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Independent Samples Test, t count for the YTM with Equal variances assumed probability is 1403 with 0166. For two-sided test, the probability of a 0166/2 = 0.83. Since 0.83> 0025 then the average YTM of sukuk and bonds are virtually identical.Independent Samples Test shows F count for the YTM with Equal variances assumed is 8606 with a probability of 0.004. Since the probability of <0.05 was the second variance is different YTM. After testing equality of variance, subsequent analyzes using t tests to determine whether the average YTM differ significantly. In Independent Samples Test shows t count for the YTM with Equal variances assumed probability is -2376 to 0018. For two-sided test, the probability of a 0018/2 = 0009. Since 0009 <0025 then the average YTM of sukuk and bonds are not identical.

4. Conclusions

- Based on these results, it can be concluded that, overall, the results show that the average (mean) yield (Yield to Maturity / YTM) of sukuk greater than the average (mean) returns on conventional bonds. From the result of the formation of 10 (ten) groups between sukuk and bonds shows that the average (mean) rather than sukuk YTM is greater than the average (mean) of conventional bonds YTM. In the relative level of risk as measured by standard deviation for the sukuk is relatively larger than the standard deviation of conventional bonds. The level of risk as measured by standard deviation for the sukuk is greater than the risk of conventional bonds to ten randomly selected groups. Using a different test of significance on average there was a statistically significant difference in where the average (mean) YTM of sukuk compared with the average (mean) of conventional bonds YTM overall. There are significant differences in the average (mean) of conventional bonds, sukuk YTM on a group of 3, 6, and 10, and there is no significant difference from other groups (groups 1, 2, 4, 5, 7, 8, and 9).This study shows that investing in sukuk offering yield (yield) is higher for now. This mmerupakan right moment for investors to invest in sukuk. Investment sukuk yielding higher would be encouraged to issue sukuk issuers where the issue of those, many investors are interested.

ACKNOWLEDGEMENTS

- This paper is part of a research “Comparative Analysis of Return on Sukuk and Conventional Bonds: A Review of Knowledge-based Economy” Our deepest gratitude to the Directorate of Research and Community Outreach in Universitas Indonesia for funding this research in The Riset Awal Grant 2011.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML