-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(3): 149-152

doi:10.5923/j.economics.20130303.03

Determinants of the Internet Banking Intention in Malaysia

Hari Mohan, Norani Ahmad, Quah Chi Kong, Chiam Tzeh Yew, Jimmy Liew, Nik Kamariah Nik Mat

Othman Yeop Abdullah Graduate School of Business , Universiti Utara Malaysia

Correspondence to: Hari Mohan, Othman Yeop Abdullah Graduate School of Business , Universiti Utara Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The objective of this study is to determine factors that influence individual intention towards online banking In Malaysia. Specifically, the study examines the influence of Self Efficacy (6 item), Trust( 6 item), Perceived Ease of Use(5 item) and Media reference(4 item) on the intention towards Online banking. Each variable is measured using 7-point interval scale. To achieve a more balance findings among the internet banking users in Malaysia, a total of 250 questionnaires to online bank customers at 4 major banks in Klang Valley, Selangor, and across the major cities in Penang, Ipoh & Johor. 210 usable questionnaires were returned with a response rate of 84%. The data was analysed using SPSS. It was found that Self Efficiency; Trust; Perceived Ease of Use are significantly related to the intention to adopt internet banking among the users in Malaysia. Perceived Ease of Use was the main determinant towards the intention for online banking as compared to Self-Efficacy and Trust. Theoretically, our study suggests that there is a direct relationship between perceived ease of use and intention to adopt online bank In short, this study has provided a good understanding & established the factors that influence on the adoption of internet banking usage in Malaysia. This finding is paramount useful among the banks & on line banking vendors as it will assist on their various strategy resources allocation decision on their internet banking solutions to retain or acquire new market share which will benefit both the banks & the users as well.

Keywords: Internet Banking, Internet Banking Users, Technology Acceptance Model (TAM), Malaysia

Cite this paper: Hari Mohan, Norani Ahmad, Quah Chi Kong, Chiam Tzeh Yew, Jimmy Liew, Nik Kamariah Nik Mat, Determinants of the Internet Banking Intention in Malaysia, American Journal of Economics, Vol. 3 No. 3, 2013, pp. 149-152. doi: 10.5923/j.economics.20130303.03.

Article Outline

1. Introduction

- The internet banking has changed the way banking transaction being done. Today, internet banking is a web-based service which enables users to access to their accounts and enjoy range of banking services any time anywhere electronically with just a distance of a mouse click. (Sonja and Rita, 2008). The technology has brought a hassle free & swifter banking service to the users anytime. (Cheng, Lam & Yeung, 2006; Abu Shanab & Pearson, 2007).From the bank perspective, internet banking has been helping the banks to lower its operating costs (Sathye, 1999; Polsik and Wisniewski, 2009). Past study also established that banks that emphasize on internet banking solutions operate with a lower expense ratio, 15-20 % compared to 50-60% for the average non internet banks (Booz and Hamilton 1997). There were also studies suggesting that internet banking encourage commitment & loyalty among the customers and the loyalty of these customers will actually translate to a better profitability of the banking business. (ABA,2004). Thus, internet banking technology is actually a tool for customer retention, improve customer experience & improve the banks’ market share. (Lichtenstein and Willianson, 2006). Despite all the advantages of internet banking, study by Mozie, N.M et al (2012), suggests that general usage of internet banking is still not in line with the growth of the internet banking services in Malaysia. There have been not many scholarly research on the adoption of internet banking specifically in the Malaysian context other than Garry et. al., (2010), Lallahamood (2007), Ainin et al. (2005), Suganthi, Balachandler and Balachandran (2001), Ramayah et al (2003) and etc. On the other hand, Ndubisi and Sinti (2006) also suggested that the past research result is still inadequate and the internet banking usage in Malaysia remains at its early stages. Thus, we hope to close the gap here in this paper on the determinants (self-efficiency, trust, perceived ease of use; and media reference) of internet banking intention among the internet banking users in Malaysia. We will identify and rank the key factors of determinants which lead to the internet banking usage. This will benefit the banks or internet banking vendor by making strategy decision making on resources allocation on development & improvement of the internet banking solutions and also encourage the adoption of internet banking by the non-users. In this paper we will start with a brief overview of internet banking, followed by literature review, research methodology, findings of the study & lastly discussion, suggestion for future research and conclusion of the paper.

2. Literature Review

- Technology Acceptance Model (TAM) as proposed by Davis (1989) appear to be the most widely used model. An extension of the Theory of Reasoned Action (TRA) (Fishbein & Arjen, 1975) and the Theory of Planned Behaviour (TBA) (Arjen, 1991), TAM explained the relationship between beliefs (perceived usefulness and perceived ease of an information) and users’ attitude, intentions and actual usage of the system. TAM depicts that attitudes predict intentions and that intentions in turn predicts behaviour. The adoption behaviour is determined by the attitude, which in turn is determined by the perceived usefulness and perceived ease of use of the system (Davis, 1989). Several researchers have replicated Davis’s original study (Davis 1989) to provide empirical evidence on the relationships that exist between usefulness, ease of use and system use (Adams, Nelson & Todd 1992; Davis 1989; Hendrickson, Massey & Cronan 1993; Segars & Grovar 1993; Subramanian 1994; Szajna 1994).Trust is deemed as relevant given a user’s concern on computer security, computer hacking, computer viruses and identity theft wherein on-line banking involves the exchange of private and personal information. Under such on-line banking environments, trust remains a complex concept for which researchers are still trying to get a better Computer Self Efficacy(CSE), known to be an individual’s belief about his or her ability to successfully use a computer or a technological service to accomplish a specific task, has been cited as an important factor in determining an individual intention to use the IS. Efficient use cannot be realized in the absence or the lack of CSE of an individual (Compeau & Higgins, 1995; Hassan, 2006)

3. Methodology

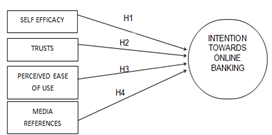

| Figure 1. Research Conceptual Framework with intention as a dependent and Self Efficacy, Trust, Perceived Ease Of Use & Media Reference as independent Variables |

Sampling Method and InstrumentThe respondents for this study were bank customers who had online internet banking account. By means of a convenience sampling a total of 250 questionnaires were distributed to bank customers of 4 major bank at Kuala Lumpur, Penang, Ipoh and Johor Baru. 50 Questionnaires were distributed at each town. Data was collected with the help of bank Staffs. The response rate was 84% with 210 completely filled questionnaires returned. The designed questionnaire consists of two sections. The First Section contain six demographic questions on gender, age, income, race, educational level and the variability of an online banking account. Part two of the questionnaire consists of multiple measures of each of the 4 independent variable and 1 independent variable. The items were derived from existing literature as shown in table 2 below. Each of this variable had 4- 6 items, hence a total of 25 questions were developed. The scale adopted was a 7-point Likert scale, ranging from 1 (strongly disagree) to 7 (strongly agree). There are many tools to measure behaviour, and many researchers prefer to use a Likert-type scale because it is very easy to analyze statistically.

Sampling Method and InstrumentThe respondents for this study were bank customers who had online internet banking account. By means of a convenience sampling a total of 250 questionnaires were distributed to bank customers of 4 major bank at Kuala Lumpur, Penang, Ipoh and Johor Baru. 50 Questionnaires were distributed at each town. Data was collected with the help of bank Staffs. The response rate was 84% with 210 completely filled questionnaires returned. The designed questionnaire consists of two sections. The First Section contain six demographic questions on gender, age, income, race, educational level and the variability of an online banking account. Part two of the questionnaire consists of multiple measures of each of the 4 independent variable and 1 independent variable. The items were derived from existing literature as shown in table 2 below. Each of this variable had 4- 6 items, hence a total of 25 questions were developed. The scale adopted was a 7-point Likert scale, ranging from 1 (strongly disagree) to 7 (strongly agree). There are many tools to measure behaviour, and many researchers prefer to use a Likert-type scale because it is very easy to analyze statistically. 4. Results

- Demographic Profile of the RespondentsThe respondents age range from 22 years old to 59 years. This indicates that most of the respondents who were into online banking were from the middle age group with an average age of 38 years. There were more female respondents (55.2%) as compare to males (44.8%). Chinese (49.0%) were the biggest group as compare with Malays (37.6%), whereas Indians (8.1%) and others (5.2%) made up less than 15% of the respondents. (see Table 3.0 Respondent Profile).The Monthly income ranged for Rm1000.00 to Rm12000.00 with an average income of Rm3774.00. This indicates that most of the online bank customers were middle upper income earners.

5. Reliability Analysis

- The Cronbach’s alpha coefficient was calculated to assess internal consistency reliabilities’ of the scales. All the alpha values were above the recommended value of 0.60 (Hair et al 1998; and Nunnally ,2000). This ensures the items grouping for the variables are reliable. The Alpha correlation coefficient was (SE: 0.75, Trust : 0.624. PEOU : 0.830; Media Reference : 0.667, Intention: 0.740). According to Cohen (1988) and Julie (2010) a result of more than 0.5 suggests a strong relationship between the constructs, whereas a range from 0.1 to 0.29 is considered weak and from 0.30 to 0.49 is considered medium. There was a strong positive correlation between Trust and Perceived Ease of Use( r=0.616) and between Trust and Self Efficacy. It also further suggests the possibility existence ofmulti-collinearity is absent. The relationship between determinants and intention towards online banking was tested using a multiple regression analysis. According to Hair, et al (1998), Multiple regression analysis is useful to analyse the relationship between a single dependent variable and several interdependent variables. The Summary of regression finding shows the result indicate that the model has no serious multicolinearity problem as the statistical value shows tolerance for all variables of more than 0.The coefficient of determination (R2) was 0.323. This indicate that 32.3 percent of intention towards online banking can be explained by the three independent variable. Based on Anova results the proposed model was also adequate ( F : 32.715, P=0.000)

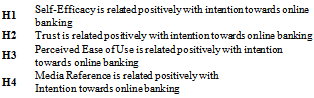

6. Hypothesis Testing

- Next the hypotheses in the study were analyzed using regression analysis. The result of the regression analysis suggest that Self Efficacy (t = 1.024, Sig = 0.307 B =0.70 ) and Trusts ( t =1.130, Sig = 0.260 B =0.085 ) are insignificant, as such H1 and H2 were not supported, whereas Perceived Ease Of Use ( t =6.398, Sig = 0.000 B = 0.474) was significant and H3 was supported.

7. Conclusions and Suggestion for Future Research

- This study was our initial attempt to extend our understanding of determinants towards the intention of online banking. Due to time constraint, a simple model comprising four independent variable (Self efficacy, Trust, Perceived Ease Of Use, and Media Reference) was developed based on TAM and TRP Models. In this study Perceived Ease of Use was the main determinant towards the intention for online banking as compare to Self-Efficacy and Trust. These results were consistent with other Malaysian studies regarding online banking intention (Amin H 2009 and Guriting and Ndubisi 2006). Theoretically, our study suggests that there is a direct relationship between perceived ease of use and intention to adopt online banking. When online banking is perceived as useful, customers’ intention to adopt it would be greater, thus influencing the bank customers to adopt online banking when it is easy to use. We acknowledge that there was limitation in our study. The first limitation was the adequacy of the items selected to measure the construct Media Reference Factor analysis results suggested that the items were not adequate to measure the construct. It is proposed that further extensive literature review is necessary when constructing the items for this construct. This study uses the same approach like other studies (Amin H 2009 and Guriting and Ndubisi 2006) whereby it is based on the determinants of intention towards online banking rather than on factors determining the actual usage of online banking. Nevertheless future research in this area should focus on actual usage of online banking, so that banks and financial institutions can better recognize what influences customer’s behaviour to use online banking and take necessary measures in enhancing the online banking useThe findings could be biasness for the whole of Malaysia because it was only conducted in the 4 region of Malaysia (Johor Bahru, Ipoh, Penang, Klang Valley). This model has shown some interesting findings which could be applied for utilization in research on a bigger scale to include the whole of Malaysia and Asian region. The study shows that self-efficiency and trust are not related positively with intention towards online banking. While perceived ease of use is influences the intention towards online banking.

ACKNOWLWDGEMENTS

- We would like to acknowledge all the kind people who contributed either directly or indirectly towards this paper.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML