-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(2): 119-126

doi:10.5923/j.economics.20130302.10

Analyzing Market Exploitation and Market Exploration Dyad for Marketing Strategy Implementation Effectiveness in Malaysian Fertilizer Industry: A Conceptual Paper

A. A. Norazlina 1, A. M. Izaidin 1, K. M. Hasfarizal 1, M. N. Shahrina 1, 2, F. W. Lai 2

1Universiti Teknikal Malaysia Melaka, Jalan Hang Tuah, Melaka, Malaysia

2Universiti Teknologi PETRONAS, Bandar Seri Iskandar, 31350 Tronoh, Perak, Malaysia

Correspondence to: A. A. Norazlina , Universiti Teknikal Malaysia Melaka, Jalan Hang Tuah, Melaka, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Analyzing the marketing strategy elements that influence the effectiveness of its implementation has been the subject of sizeable empirical research. The purpose of this paper is to address simultaneous management of market exploitation and market exploration in the marketing strategy on implementation effectiveness among the most relevant new product introduction success factors in Malaysian fertilizer industry. The proposed framework has theoretical significance in filling the gap in the body of knowledge in the implementation of marketing strategy in the Malaysian fertilizer industry. This paper discusses issues in relation to the role of marketing strategy which have profound impact on organizational implementation effectiveness.

Keywords: Market Exploitation, Market Exploration, Marketing Strategy, Effectiveness, New Product Introduction

Cite this paper: A. A. Norazlina , A. M. Izaidin , K. M. Hasfarizal , M. N. Shahrina , F. W. Lai , Analyzing Market Exploitation and Market Exploration Dyad for Marketing Strategy Implementation Effectiveness in Malaysian Fertilizer Industry: A Conceptual Paper, American Journal of Economics, Vol. 3 No. 2, 2013, pp. 119-126. doi: 10.5923/j.economics.20130302.10.

Article Outline

1. Introduction

- The study of marketing strategy-implementation effectiveness relationship is not new. In the marketing literature, a firm’s marketing strategy has a positive effect on its market effectiveness[1, 2]. Market exploitation and market exploration are two elements of marketing strategy that are arguably among the most relevant success factors in introducing new product[3]. Rapid growth in new technologies, increasingly diverse and demanding customers, intensifying market competition, and globalization has significantly enhanced the importance of innovation to the success of a firm[4]. Exploitation and exploration, two key organizational learning concepts, represent important capabilities in the innovation process[5]. Ref[3] indicate that the choice between exploitation and exploration depends on the goals of new product development. Furthermore, they found that both exploitation and exploration constitute important success factors when it comes to launching new products. Simultaneous investments in the exploitation of existing product innovation capabilities and the exploration of new ones may help create a competitive advantage[6]. The firm has to keep a balance between exploration and exploitation to survive and prosper[7]. In support of new product launch of high tech firms, the implementation of marketing strategy must be clear, uniform and in an integrated manner in order to link with performance[8]. The introduction of new products depends on the ability to transform organizational competence into reliable input to market innovation[9]. The main knowledge contribution of this paper is to address a conceptualization of marketing strategy by the simultaneous management of market exploitation and market exploration for the new product introduction in Malaysian fertilizer industry. Furthermore, for a company to survive and prosper there has to be a balance between exploration and exploitation.

2. Literature Review

2.1. Market Exploitation

- Exploitation pertains chiefly to refining and extending existing skills and capabilities. Exploitation represents a capability to refine existing competencies and resources to improve operational efficiency[10]. It is in particular through research and development processes that existing competencies are shared across firm boundaries to generate synergy[11]. Ref.[12] state that exploitation focuses on increasing the productivity and efficiency of capital and assets through standardization, systematic cost reductions, andimprovements to existing technologies, skills, and capabilities. According to ref.[13], they defined the exploitation fit as the extent to which task and partner-related characteristics pertaining to the ability to effectively market products align with explicit alliance formation motives to leverage existing products and sell them in new markets. Thus, exploitation is less tacit and more explicit than exploration[10]. The exploitation reinforce current institutionalized learning and are intended to respond to the current environmental conditions by adapting existing technologies and further meeting the needs of existing customers[14]. Exploitation involves the development of new knowledge about the firm's existing markets, products, and abilities, while exploration entails the challenge of existing ideas and the development of new knowledge about new markets, products, technologies, and skills[7, 15]. Exploitation is based on intensive search, which means experimentation along an existing knowledge dimension[16]. Ref.[17] suggest that exploitation has two distinct phases, which are use and development of things that already know or exist. They define development as the expansion of the firm’s current stock of knowledge while the term use as the appropriation of economic returns of the current stock of knowledge. Exploitation provides efficient solutions and supports current organizational viability through near and clear returns[18].A typical example of exploitation entails the use of economies of scale; to benefit from such exploitation, firms must employ modernization and automatic production processes, along with efficient capacity utilization[19]. Therefore, exploitation relies on cumulative learning, and future behaviour does not deviate much from the firm's past trajectory[10].

2.2. Market Exploration

- Exploration is defined as the experimentation which is using new alternatives having returns that are uncertain, distant and often negative[7]. The exploration involves investing resources with the aim of acquiring entirely new knowledge, skills and processes[20]. It is also related to the ground breaking improvisation, emerging markets and technologies. It is motivated by a desire to discover something new[5]. The capability of an organization to learn through questioning, pushing the knowledge frontier, and engaging in proactivity and risk taking can be represented by the market exploration. For instance, the activities such as concept testing, discovery, creative deconstruction and research and development (R&D) are consistent with exploration[21, 22]. Exploratory invention requires distant search and a departure from the firm’s store of current skills and capabilities[23]. According to ref.[24], exploratory innovative competence represents the ability to perform extensive searches that result in novel methods or materialstechnologically distant from existing innovations. Exploitation provides efficient solutions and supports current organizational viability through near and clear returns[18].Exploration enables new product development (NPD) teams to continually uncover new markets and develop technology and ideas that challenge the existing cause–effect relationships, thereby resulting in innovative products with unique benefits[9]. By providing new insights into the design of new features and benefits in a product, exploration ensures that the new product will contain emergent ideas. These may differentiate the product from what competitors offer and thus be judged superior by customers[25].

2.3. Combination between Exploitation and Exploration

- From the generation of new ideas through to the launch of a new product, exploration and exploitation play a vital role in product innovation. the capabilities needed for exploration and exploitation are closely connected[26] even at different organizational levels[27]. Ref.[28] have investigated the balance betweenexploration and exploitation and the impact on organizational performance and conclude that it depends on whether the two concepts are viewed as mutually opposing or complementary.To take advantage of their exploratory and exploitative competences in new product inroduction, companies should carefully examine the differences between these two competences and the particular situation under which each can be more or less effective to develop a successful new product[3]. The challenge confronting an organization is ‘‘to engage in sufficient exploitation to ensure its current viability and, at the same time, to devote enough energy to exploration to ensure its future viability’’[29]. The returns of exploitation tend to be more certain and proximate, whereas those of exploration are more variable and distant in time. External industry forces also generally give rise to one or the other or perhaps both[30-32]. Ref.[13] study maintains that exploration and exploitation are separate (though not necessarily antithetical) strategies with different antecedents and performance consequences. However, certain combinations of task- and partner-related characteristics likely fit an exploitation or exploration motive better[33]. For example, a partner with complementary technological skills and experience in their application can effectively explore the potential for new innovations and learning, which should produce upstream performance outcomes such as product enhancements[26].Prior research has documented the role of exploitative and explorative capabilities in firm success[9, 34]. Product development and market-related exploitative and explorative capabilities are viewed as the value creating mechanisms through which entrepreneurial orientation (EO) affects performance in export markets[35]. Exploration and exploitation imply specific decision and adoption processes that involve different levels of risk and ambiguity[16]. Exploitation provides efficient solutions and supports current organizational viability through near and clear returns. However, exploration improves the ability to adapt to a changing environment because it increases the variance of organizational activities[18].Exploitation and exploration theory was explicitly discussed by ref.[7]. A tension between exploration and exploitation exists because the exploitation generates clearer, earlier and closer feedback than exploration. The exploitation drives out exploration due to clearer, more temporally proximate, and greater financial feedback, the same argument may apply for development and use[36].

2.4. Market Strategy

- Nowadays, marketing strategy has been directly identified as a strategic capability of the organization in order to create unique differential advantage[37]. In an increasingly competitive market, it is imperative to recognize the importance of strategic marketing for long-term success of the firm. One element of strategic marketing is target marketing strategy. In order to execute target marketing, we have to perform market segmentation analysis[38]. Intelligence on market segmentation offers a wide range of potential and relevant benefits to the organization in terms of market leadership, strategic positioning and advancement.In one breath the literature counts segmentation, targeting, differentiation, and positioning as marketing strategies and in the same breath recounts the marketing mix elements/4 P’s, which are product, pricing, promotion and place (distribution), as strategies[39]. He defined the marketing strategy as the total sum of the integration of segmentation, targeting, differentiation, and positioning strategies designed to create, communicate, and deliver an offer to a target market. Marketing strategy contributes to enhancing firm effectiveness through targeting.According to ref.[40], marketing strategies are the means by which objectives will be achieved. They reflect the company’s best opinion as to how it can most profitably apply its skills and resources in the marketplace and they are inevitably broad in scope.Looking at the fertilizer industry, major fertilizer companies have tried to use strategic market focus either through creating new brands, targeting specific groups or through purchasing existing brands[41]. Such market segmentation strategies have brought competitive strength to fertilizer companies. Also, market segmentation leads to emphasis on delivering value to the customers[42]. Market segmentation arises because it is necessary to balance diverse customer needs with the capabilities and resources of competing organizations in the marketplace. In most markets the breadth of customer requirements is too extreme to allow single organizations to satisfy all customer products and service needs at all times. Companies are more likely to achieve a match between their particular assets and the diversity of needs by concentrating efforts on customer groups with fairly homogeneous requirements[43, 44]. Today’s consumer marketers look to market segmentation systems in order to identify their key consumer segments, recognize the varying importance of those segments to their business, understand individual consumers by identifying the group to which they belong, thus bridging the gulf between mass marketing and a “one-tone” emphasis, use that newly-gained understanding to predict how consumers will react to new products, alter brand loyalties, respond to diverse media, target new prospects more effectively, and communicate with both customers and prospects in order to establish and enhance relationships[45]. Segmentation can lead to more efficient resource allocation as companies strive to assess the relative attractiveness and future potential of particular markets and segments within them. For companies which operate across a wide range of markets, such analysis plays a vital role in ensuring that the balance of marketing activities continues to contribute to market share and profitability. Low market share companies with limited resources can use segmentation to focus on marketing assets by identifying, developing and sustaining activity in lower risk market segments[46]. Used effectively, market segmentation should help also to develop and maintain an edge over rival companies[47].In marketing, initial thinking focused on determining target market desires and catering to them better than competitors did. However, time and the competitive saturation of markets have caused subtle changes. For instance, the search for competitive advantage has necessitated increasingly more sophisticated marketing research tools[37].The marketing strategy is formulated as an interactive and iterative process involving a number of steps which are customer behavior, segments the market, select target segments, design the offer to fit target market needs, differentiate the offer and position it in the customers mind[39]. If marketing strategy is to be implemented effectively, it must be thought of in a total organization, systemic way, with plentiful inputs from various levels of operating management. Only with such a collaborative approach can the priorities of the marketing plan be fully supported by the operating plan[48].Evidence from ref.[39], once marketing strategy is formulated, a process for its implementation must be set in force. The process of strategy implementation is what we traditionally label as marketing management.

2.5. Implementation and Effectiveness

- Implementation is the realization of an application, or execution of a plan, idea, model, design, specification, standard, algorithm, or policy. According to ref.[49], the six key criteria determining implementation success are clear and consistent objectives, accurate causal linkages between objectives and actions, use of a sympathetic agency with adequate resources and authority to implement the plan, skilled and committed implementation managers, public and stakeholder support; and, a supportive socioeconomic and policy environment.The study which is done by researchers[50, 51] show that implementation on particular strategy is important for few reasons. The failure to carry out the strategic plan can cause lost opportunities, duplicated efforts, incompatible systems, and wasted resources[52]. Next, the lack of implementation will leaves firms dissatisfied with, and reluctant to continue their strategic planning[53]. The implementation process influences the effectiveness, and involves processes that are highly complex, being affected by internal as well as external factors[54].The concept of effectiveness may be divided broadly into substantive effectiveness, whether it achieves its purposes and procedural effectiveness, whether it is undertaken according to the established expectation[55, 56]. The overall neglect of strategy implementation leads to poor performance both in the current execution and in future strategy formulation processes[57]. Organizational effectiveness (OE) has been one of the most extensively researched issues since the earlydevelopment of organizational theory. In essence, organizational effectiveness represents the outcome of organizational activities[58]. The explanation of effectiveness variation and the search for its true causal structure represent one of the most enduring themes in the study of organizations[59]. For example, ref.[60] identifies different conceptions of effectiveness including profitability, financial-market, multi-stakeholder satisfaction, and quality of firms’ transformations.According to[61], they used powerful terminology to describe the importance of implementation. They refer to the word of conquering the gap between strategy and performance, and offer tactical specificity for conquering the formulation-implementation- performance process which are including keep it simple/make it concrete, debate assumptions/not forecasts, use a rigorous framework/speak a common language, discuss resource deployment early, clearly identify priorities, continuously monitor performance, and reward/develop execution capabilities. The researchers[62] suggest the structures and managerial as the two main variables of implementation. The structures provide the framework or configuration in which companies operate effectively while managerial skills are the behavioral activities that managers engage in within the structures developed by the organization. Structure levers of implementation are actions, programs, systems and policies. Based on the researchers[63] structural variables offer an implementation toolkit for identifying key levers that affect the formulation-implementation process and ensuring formulation-implementation-performance cycle.Managerial skills are discretionary in nature and vary with individual perceptions and behavior. Skill relatedimplementation levers in the capable organizations framework are interacting, allocating, monitoring and organizing[63]. The marketing strategies are implemented through the structure, with managerial skills as key indicators of the successful or unsuccessful accomplishment of the implementation effort.

2.6. New Product Introduction

- The timing of the launch of a new product critically affects the success of its market entry[64]. Prior studies have shown the benefits of speedy and early market entry[65, 66]. In the environment where the product cycle is short, the pace of technological innovation will be rapid and the product competition will be intense. The company that brings new products to the market quickly can typically command a premium on the product price with higher margin as well as garner larger market share[67]. Thus, it is imperative to pay close attention towards marketing strategies that follow a new product development and its commercialization. The most common reason cited for the failure of a new product introduction is that the market segment in which the product is selling is not profitable owing to its relatively small size. In other words, a new product, albeit well designed and meets the needs of its target customers, is doomed to fail if the size of its targeted market segment is not large enough to satisfy a critical mass[68]. In this light, sales forecasts become critically important to project the profitability of a new product’s entry into the market. Producers need to ensure that the market entry of new products can generate enough revenue in excess of cost.Ref[69] found that in the markets which saw firms with more positively correlated cost structures may attract fewer new product introductions and have fewer new product failures. Such cost correlations can arise, for example, if firms choose to cooperate on R&D, have common labor unions, or use the same suppliers.

2.7. Malaysian Fertilizer Industry

- Malaysian has a total land area of 329,733 km2. The soils are highly leached infertile acid tropical soils. As such, fertilizer application is essential in the agriculture sector. Large tracts of land are cultivated with perennial tree crops such as palm oil where large quantities of fertilizers are required annually to sustain high crop yields and ultimately profitability. Besides oil palm, the other cultivations are rubber, cocoa and paddy[70].In retrospect, the credit restrictions due to the global financial crisis have reduced the ability of the Malaysian Smallholders, Planters, and the Malaysian Fertilizers Importers, to purchase fertilizers internationally. The drop of commodity prices such as Crude Palm Oil (CPO) has necessitated the reduction of purchases of high priced fertilizers. For instance, the price of Malaysian CPO has gone down by about 66% from as high as RM 4,486 per ton in March 2008 to as low as RM 1,510 per ton in February 2009. As a result, the major Malaysian Planters were trying to penetrate new markets for survival. For example, the major Malaysian Planters have sought the Government’s assistance to enable CPO to be used as an energy source in the form of 5% palm methyl ester blend with diesel, as biodiesel. The Government has allocated RM 200 million of the total RM 500 million in chess for palm oil to support the biodiesel initiative. 2009 was a challenging year for the fertilizer industry in Malaysia[71].The impact of fertilizer market reform on small-scale farmers could be better understood if fertilizer consumption data were disaggregated between the small scale and large-scale/estate sectors, and between concessional vs. commercial sales. Analysis by[72] indicates that the technology package of improved maize seed, fertilizer, and management practices was highly profitable for most farmers in the three regions where farm budget information was analyzed.There appears to be substantial scope to reduce fertilizer marketing costs such as policies to coordinate port clearing with inland transport, facilitating the transparency of government programs, reassess levies on fertilizer and transportation, policies affecting market structure and competition, investments in transportation infrastructure, potential effects of banking and foreign exchange system performance on fertilizer prices[73]. An analysis of production by region indicates that the global production of fertilizers is characterized by a high and increasing level of concentration and consolidation. As indicated by[74] this trend is basically explained by the fertilizer industry being a capital-intensive industry which requires economies of scale in production and a high requirement of raw materials, such as natural gas, phosphate rock, and potassium salts, which constitute 70–90 percent of cash production costs.At the global level, it is clear that the fertilizer industry is a highly concentrated market with high and increasing levels of trade. A small number of countries control most of the production capacity for the main nitrogen, phosphate, and potash fertilizers. Production is concentrated among few countries within each region and among few firms within each major producing country. All regions have also increased their imports of fertilizer in recent years. Whereas South Asia is both a major global fertilizer producer and consumer (though most of its production is oriented toward satisfying its high and increasing local demand), sub-Saharan Africa is by far the smallest producer and consumer in the world. Latin America is an important (and increasing) consumer, though still a small-sized producer[75]. Except for ammonium nitrate (AN), the top five countries control more than half of the world’s production capacity for all major fertilizer products. Similarly, except for China, the industry shows a high level of concentration among firms within each main producing country. In most cases, the top four firms control more than 50 percent of the country’s production capacity. Although the availability of raw materials explains the geographical pattern of global production, economies of scale in production might explain the industry structure at the country level. The importance of trade in the industry is evident from the increasing dependence of several regions on imported fertilizers. Fertilizer prices in major international markets have, in turn, shown an upward trend in recent years. Despite the different levels of production and consumption across the regions, the market situation in each region shows high concentration levels in production, as well as a significant or increasing dependence on external markets for the provision of fertilizer.

3. Conceptual Framework

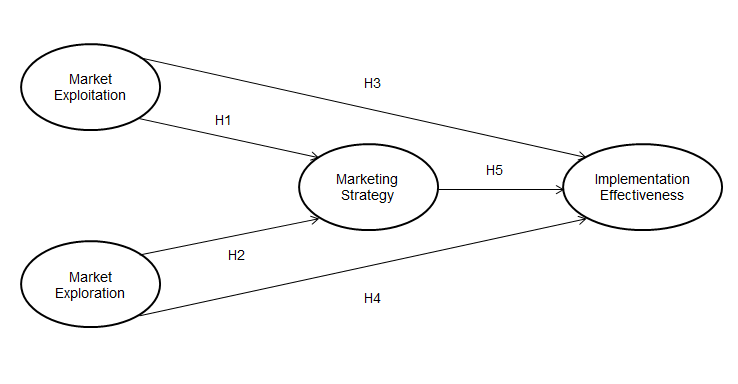

- We propose a conceptual framework linking market exploitation and market exploration on new products introduction to corporate marketing strategy implementation effectiveness for fertilizer industry in Malaysia. Fig. 1 depicts that there are four endogenous constructs in the proposed framework namely, market exploitation, market exploration, marketing strategy and implementation effectiveness. The measurement model for the four endogenous construct, implementation effectiveness, can be established by drawing and using two main variables which are structures and managerial skills[63].A few areas can be the focus for further research in relation to the proposed conceptual framework. For instance, empirical exploratory investigation can be conducted onto the measurement scales of all the variables presented in the proposed framework especially those of exogenous factors. This can be done apart from further examination for additional exogenous factors that are pertinent to measuring up each endogenous construct.

| Figure 1. Proposed model of market exploitation and market exploration dyad for marketing strategy implementation effectiveness |

4. Conclusions and Future Direction

- This paper presents a conceptual framework linking market exploitation and market exploration on new products introduction to corporate marketing strategy implementation effectiveness for fertilizer industry in Malaysia. We believe that with appropriate quantification and measurement of the exogenous factors in the framework, it will become a robust model for empirical testing. The testing and analytic model can be established by employing regression analysis for forecasting or structural equation modeling for causal analysis.Findings from such robust analytic modeling mentioned above shall augur well for insights into developing and implementing effective marketing strategy for specific new product offerings in the Malaysian fertilizer industry.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML