M. A. Loto , Nkaogu Chinweike V.

Department of Economics, University of Lagos Akoka, Yaba, Lagos, Nigeria

Correspondence to: M. A. Loto , Department of Economics, University of Lagos Akoka, Yaba, Lagos, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The study focused on the Lekki-Epe Expressway concession project. The objective here is to analyse the cost-benefit effect of the project on the people that ply the road. This is a way of analysing whether the welfare of the people increases or decreases with the project. To carry out the analysis, several assumptions were made. The cost of the project by the executors has been stated. The benefits to them will come from the tolls, for the period of thirty years (30 years). This paper studied the impact of this project on the people by way of assigning values to the benefits and costs. The vehicles were categorized based on tolls to be paid. The study summarized that the project has value in the sense that the benefits from it, outweigh the costs, based on cost benefit analysis procedure, which is centered on NPV; Cost-Benefit ratio. On the whole, the NPV was positive i.e. > 0 and benefit/cost ratio is > 1. Apart from the primary benefits that projects normally takes into consideration, other benefits were also detected. These benefits are called secondary benefits. These include: saving on petrol, on car maintenance, on time to destinations, among others. This shows that the Lekki-Epe Expressway concession project is a viable project, and that it will increase the welfare of the people, and directly or indirectly improve the standard of living of the people.

Keywords:

Infrastructure, Ppps, Sustainable Development, Cost-Benefit Analysis, NPV Procedure

Cite this paper: M. A. Loto , Nkaogu Chinweike V. , Infrastructural Development in Nigeria: A Study of the Lekki Epe Expressway: (The Cost-Benefit Analysis Between 2010 - 2040). A 30 Year Period Analysis, American Journal of Economics, Vol. 3 No. 1, 2013, pp. 32-42. doi: 10.5923/j.economics.20130301.07.

1. Introduction

The economic growth of a nation is no doubt dependent on the availability of functional infrastructures such as energy, roads, railways, water supply, education and a host of other amenities that converge to provide the conducive environment for the free flow of goods and services across the length and breadth of the country. The high cost of doing business in Nigeria due to poor infrastructure has impacted negatively on the nation’s economy as investors seeking greener pastures have been relocating to neighbouring countries even as mortality rate for industries, especially Small and Medium-Scale Enterprises, has been on the increase in the last few years.The huge gap in infrastructure is easily noticed in critical sectors of the nation’s economy. The deplorable condition of Nigeria’s infrastructure requires that the Federal Government must spend  2.25tn ($15bn) annually to improve it to an acceptable level according to a report on the state of infrastructure by ICRC (2011). Poor infrastructure is one of the major constraints to economic development through its debilitating impact on productivity, investment in-flows, competitiveness, cost of doing business and people’s confidence in the government and the economy.Infrastructure is the key element in diversifying the opportunities which can bring about shared growth. That is growth that enables not just the private sector to come in but also have positive impact on the lives of the people. . Evidently, there is a high correlation between availability of infrastructural services and the income levels of most economies. The concept of Public private partnerships (PPPs) is now becoming an interesting debate in the world, especially in developing countries as a means of reducing infrastructural development problem for sustainable growth. It is now becoming very glaring that public sector alone cannot provide adequate infrastructure for sustainable development. The PPPs is more or less a new phenomenon in the developing countries. As a result of this, people are resisting it, because they believed that the cost of the good and service will be too much for the public to bear. The importance of PPPs is not really very open to the people of the third world. As a result of this they need awareness.This study presents the assessment of the recent PPP initiative in the road infrastructure in Nigeria (a case study of the LekkI-Epe expressway concession (Cost- Benefits analysis Approach). A fast growing development corridor such as that served by the Lekki-Epe Expressway, with over 85,000 vehicles using the Expressway daily, needs good road infrastructure to support its continued development and growth, according to LCC publication on the internet. The government believed that a first-class road facility, such as is being currently delivered, will both stimulate further economic growth and provide sustainable livelihoods for people living along the axis.The objective here is to analyse critically the benefits and costs of this project. The outcome of the study will be able to shed more light on the importance of the project; and how people may benefit or otherwise from the project whether it will add value to their standard of living (i.e. their welfare) or not. Although, according to[1], the private sector participation is increasingly involved in the conduct of developing countries but the success or failure of PPP projects has not been systematically assessed. In order words, the cost and benefits have not been properly analysed.In line with his argument, this present study is focused on the true analysis of the costs and benefits of Lekki-Epe express road concession in Nigeria between 2010-2040.

2.25tn ($15bn) annually to improve it to an acceptable level according to a report on the state of infrastructure by ICRC (2011). Poor infrastructure is one of the major constraints to economic development through its debilitating impact on productivity, investment in-flows, competitiveness, cost of doing business and people’s confidence in the government and the economy.Infrastructure is the key element in diversifying the opportunities which can bring about shared growth. That is growth that enables not just the private sector to come in but also have positive impact on the lives of the people. . Evidently, there is a high correlation between availability of infrastructural services and the income levels of most economies. The concept of Public private partnerships (PPPs) is now becoming an interesting debate in the world, especially in developing countries as a means of reducing infrastructural development problem for sustainable growth. It is now becoming very glaring that public sector alone cannot provide adequate infrastructure for sustainable development. The PPPs is more or less a new phenomenon in the developing countries. As a result of this, people are resisting it, because they believed that the cost of the good and service will be too much for the public to bear. The importance of PPPs is not really very open to the people of the third world. As a result of this they need awareness.This study presents the assessment of the recent PPP initiative in the road infrastructure in Nigeria (a case study of the LekkI-Epe expressway concession (Cost- Benefits analysis Approach). A fast growing development corridor such as that served by the Lekki-Epe Expressway, with over 85,000 vehicles using the Expressway daily, needs good road infrastructure to support its continued development and growth, according to LCC publication on the internet. The government believed that a first-class road facility, such as is being currently delivered, will both stimulate further economic growth and provide sustainable livelihoods for people living along the axis.The objective here is to analyse critically the benefits and costs of this project. The outcome of the study will be able to shed more light on the importance of the project; and how people may benefit or otherwise from the project whether it will add value to their standard of living (i.e. their welfare) or not. Although, according to[1], the private sector participation is increasingly involved in the conduct of developing countries but the success or failure of PPP projects has not been systematically assessed. In order words, the cost and benefits have not been properly analysed.In line with his argument, this present study is focused on the true analysis of the costs and benefits of Lekki-Epe express road concession in Nigeria between 2010-2040.

2. Literature Review, Theoretical Framework and Methodology

2.1. Literature Review

Interest in the PPPs is on the increase all over the third world countries. Several factors help to account for the increased interest and popularity of PPPs. According to[2], he pointed out that the promise of efficiency saving and a reduced burden on strained public resources has certainly struck a positive chord `in countries operating under tight budgets. He went further to clarify the beauty of PPPs in terms of benefits that will accrue from it such as access to provide finance for expanding services, cleaner objective, new ideas, flexibility, better planning, improve incentives for competitive tendering and greater value for money for public projects.[3] also believed that infrastructure development is as central in terms of its importance as an ingredient of social and economic stability. He clarified this issue further by looking at how valuable an infrastructure is that the World Bank estimates that every 1% spent on infrastructure will lead to an equivalent 1% increase in GDP which gives a positive correlation between infrastructure and GDP.Most roads in Nigeria are not in good condition. To this extent[4] stressed that the provision of roads and transportation facilities are fundamentally important to the development of Nigeria as well as the welfare of the people. Good infrastructure is a requirement for economic growth and development.[5]pointed out that several factors are responsible for the increase in the interest and popularity of PPP. These he categorized as:(a)→Efficiency(b)→Saving(c)→Reduced burden on strained public resources.(d)→Access to provide finance(e)→Cleaner objectives(f)→New ideas(g)→Better planning(h)→Flexibility etc .For PPPs to be accepted by the people, it needs a lot of awareness, educating the people about the benefits associated with it. These benefits could be primary or secondary.According to[6], the key fundamental requirements of effective PPPs include:Commitment symmetryCommon goals symmetryIntensive communicationAlignment of cooperation learning capabilityConverging working cultureFurthermore, author such as[7], added more to the ingredients of collaborations of PPP as:Individual excellenceInvestmentInformationIntegrationIntegrity[8], pointed out that PPPs must be seen as a mechanism that has the capability of providing the atmosphere for state functions and municipal goods and services on a cost effective and sustainable basis.To make the Lekki-Epe Expressway concession to be acceptable to the people, a thorough analysis needs to be undertaken. The objective of this study is to analyse this through Cost-Benefit analysis.

2.2. Theoretical Framework

It has been established in development theory that the use of PPPs in the production and distribution of some goods and services cannot be thrown away if the attainment of sustainable development is to be achieve. It is very important to encourage the provision of and the delivering of some goods by the private sector, for efficient, effective sustainable, dynamic and very vibrant economy.Public private partnerships (PPPs) are conceptually collaborative efforts between the public and the private sector to deliver public goods and services,[9],,[10] stressed that, the role of the private sector in the pursuit of sustainable economic development in most economies have been on the increase and is being recognized. It is assumed that for efficiency and effectiveness of production and distribution of goods and services, the best bet is the joint efforts of PPPs. Commonwealth (2003) saw Public Private Partnerships (PPPs) as the collaboration between public and private sector organization to deliver public goods and services.Efficiency theory postulates that the private sector led economic and development is more efficient in terms of allocative, efficiencies and effective. In as much as the private sector is more dynamic and efficient, it is a profit oriented in nature and there is the interplay of the market for us to determine the production and the distribution of goods and service of demand and supply through the forces of demand and supply.The private sector has been described as the current predominant global ideology and a viable engine of growth and to a sustainable development. As rightly pointed out in[8], that the private sector being a profit oriented organization would not embark in providing and distributing goods and services where there is no direct economic/peculiarly profitability. Infact, it might not be possible for private sector to invest in goods and services such as infrastructure even if, it is desirable by the community, except if the net peculiarly gain is positive. In as much as in most countries (especially in Africa of which Nigeria is one), it is very likely that there will be shortage of adequate experience, skills, knowledge and exposure that is planned to provide and also expand the high standard goods and services that are required for sustainable growth.A way out of the above is to embrace the role of both public and private sectors to collaborate in owing financing and management of the operation of the production and the distribution of goods and services. Hence PPP’s should be encouraged.The theory behind this is the cost/benefit analysis which is in the domain of welfare economics.

2.2.1. Cost-Benefit Analysis

Welfare economics is concerned with the evaluation of alternative economic situation from the point of view of the society’s well-being that if for example, the present position of the society stood at P, if a new policy is propounded in the form of new project. If the outcome of the policy can improve on P to P* whereby P*>P, then it is socially desirable. To evaluate this point, Cost-Benefit analysis could be used adequately. That is, by subjecting the whole situations into costs and benefits and to see whether benefits outweigh the costs. This type of evaluation is precisely the subject matter of welfare economics. The objective of welfare economics is the evaluation of the social desirability of alternative economic state. Where benefits out-weigh costs, will be that point of B>C which will be the preferred state, and will have that ability to give satisfaction or utility. Thus, this means that gains could also be defined as utility or welfare. The objective of a nation is to move the society to a state of the economy that promises the maximum utility or welfare[11] provided the analytical tool. This was analysed through the consumer’s equilibrium. The equations are specified below The consumer’s equilibrium is achieved at that point where: | (1) |

Or MUx = λ Px.Where, MUx = marginal utility of good X, MUy = marginal utility of good Y, λ = marginal utility of income,Px and Py are respectively the prices of good X and good Y, If the marginal utility of income is equal to 1, then Mux = Px. Thus, price reflects the value of the satisfaction or utility to the individual, of the commodity (or state) X, and similarly for all other commodities. Therefore, if an individual wants the commodity, he must be willing to pay Px. It is exactly this willingness to pay which defines the value of a benefit. Thus, the following important equivalence is obtained:Marginal Utility = Benefit = willingness = PriceThe relationship may be generalized as follows:Let:M = Total number of individuals in the society,i = The ith individual; i = 1, 2, 3,……,mn = Total number of goods and services:j = the jth goods and services, that is j = 1, 2, 3,……..nX = Vector of goods and services, that is  | (2) |

Therefore Xij = commodity j purchased by individual i.If Ui = Ui (Xi1, Xi2, Xi3, Xij,…………..Xin), Generalizing the equilibrium condition shown above, we have: Where,MUij= marginal utility of good j to individual iλ = marginal utility of money income to individual i P = price of good j Any change in money income individual I will result into changes in goods and services Xij, purchased by individual i. Therefore, an increase, (ΔXj) in the amount of Xj, will raise utility (Ui) for individual i byI

Where,MUij= marginal utility of good j to individual iλ = marginal utility of money income to individual i P = price of good j Any change in money income individual I will result into changes in goods and services Xij, purchased by individual i. Therefore, an increase, (ΔXj) in the amount of Xj, will raise utility (Ui) for individual i byI | (3) |

that is, addition to total utility as a result of increasing consumption of Xj by one unit (MUijj) multiplied by the increase in the consumption of Xjthat is ΔXij.Therefore  | (4) |

Substituting for δUi we have: | (5) |

n | (6) |

j=1if it is assumed that a change in the social welfare (DSW) resulting from a change in the national income is the sum of changes in the utilities of individuals in the society, then: | (7) |

Substituting for ΔUi, we have: | (8) |

Some of the goods and services (Xij) are outputs and some are inputs. Treating the outputs as physical benefits (ba) and the inputs as physical cost (cj), then: | (9) |

If λ is the same for all individuals, and the change in the national product is distributed across the community rather than individuals, then: | (10) |

Since the absolute magnitude of the social welfare (SW) in this analysis is not relevant, and the social welfare function is an aggregate of individual utility functions, which are defined only up to a monotonic transformation, then the above may be written as: | (11) |

| (12) |

where: b and c are the values of the benefits and costs respectively.Thus, the changes in social welfare would be equal to the money value of benefits less the money value of costs. Therefore, in order to take a decision about the effect of a project on the social welfare, it is necessary to compare the benefits with the costs. In the case of Lekki concession tolls, the costs and benefits of the project could be analysed using Cost-Benefit analysis. This is to test whether the social well being of the people increases with the project or deceases. If it increases, it shows that the welfare of the people have increased thereby bringing about increase in economic growth which is a measure of welfare. If otherwise then the project should be rejected.

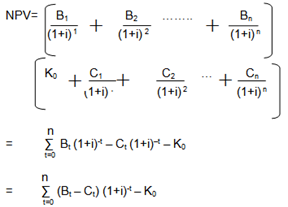

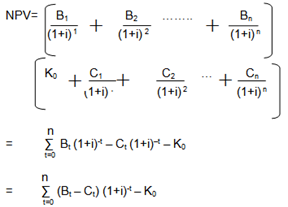

2.3. Analytical Framework

This study is focused on the Lekki-Epe Expressway concession road in Lagos Sate, Nigeria. The aim is to analyse the cost and the benefit of the project using the project evaluation technique that is appropriate. The appropriate project evaluation technique in this case is the NPV evaluation technique and the Benefit-Cost ratio.A project is characterized by an initial fixed expenditure of, say, XK in machinery equipment, trucks etc, an operating expenditure of, say, XC, every year. Also streams of revenues or benefits, XBt, over the life of the project.The annual costs incurred is refers to as a cash outflow, and the revenue received as the cash inflow. The present value is either the present value of revenues (or benefits) less the present value of costs, or the present value of net benefits (that is, benefits net of costs). Thus: .Where:K0= the initial cost which will not be discounted. ( such costs include: cost of preparation and signing of contract, feasibility preparation costs.). Bt= stream of benefitsCt = stream of Costsi = discount ratet = time in yearsThe, decision rule here is that if the NPV > 0 then accept the project.( It shows that the project is worthwhile) . In the case of Benefit-Cost ratio, there are two variants. The gross Benefit-Cost ratio and the net benefit-cost ratio.The gross benefit-cost ratio is given as:

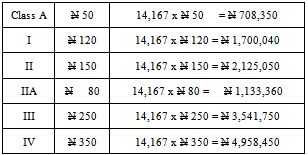

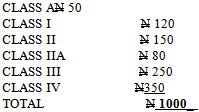

.Where:K0= the initial cost which will not be discounted. ( such costs include: cost of preparation and signing of contract, feasibility preparation costs.). Bt= stream of benefitsCt = stream of Costsi = discount ratet = time in yearsThe, decision rule here is that if the NPV > 0 then accept the project.( It shows that the project is worthwhile) . In the case of Benefit-Cost ratio, there are two variants. The gross Benefit-Cost ratio and the net benefit-cost ratio.The gross benefit-cost ratio is given as: The net Benefit-Cost ratio is given as:

The net Benefit-Cost ratio is given as:  Where:Bt = streams of benefitsCt = streams of operating costsKt = replacement costsKio = initial Costsi = discount ratet = time in yearsOn both ratios, the decision rule is that, the project is worthwhile if the outcome of the two equations are each greater than one that is, if RG>1RN> 1

Where:Bt = streams of benefitsCt = streams of operating costsKt = replacement costsKio = initial Costsi = discount ratet = time in yearsOn both ratios, the decision rule is that, the project is worthwhile if the outcome of the two equations are each greater than one that is, if RG>1RN> 1

2.4. Methodology.

The study is focused on the Lekki–Epe Express way concession in terms of the benefits and the costs between now and 30 years.The study will make use of secondary data.The sources of data will be:1. LCC websites (www, lcccom.ng) 2. Guardian Newspaper (December 21, 2010)3. Published data by the LCC through seminars and conferences.

2.4.1. Data used and their Calculations

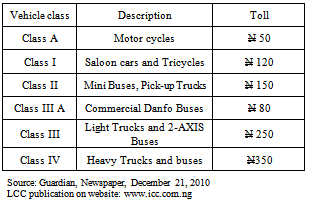

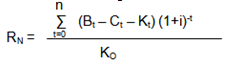

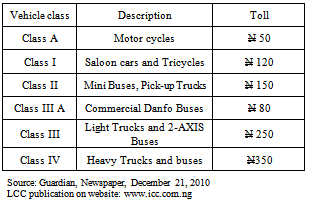

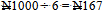

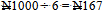

The type of tariffs to be charged, are as clarified by the project executors.Table (1) presents the vehicle class, the description of the vehicle and the standard toll.There are six categories of vehicles. The total number of vehicles that are likely to ply the route everyday is given as 85,000 on the average. If we assumed that the distribution is equally distributed among the six classes of vehicles, then we will have 85000 ÷ 6 = 14,167On the basis of the above, each of the vehicle class will be charged tariff.Table 1. Classes of vehicles and the toll tariff

|

| |

|

Table 2. Vehicle tariff total amt paid

|

| |

|

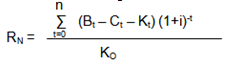

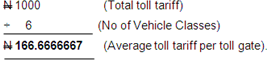

The above analysis is based on the assumption that all vehicle class will move from the first toll to the last toll. Supposing this assumption is relaxed and we assumed that not all vehicles will go as far as the last toll. Then, certain assumption could be made:Supposing the whole 85,000 Vehicles pay the first toll only.70% of 85000 that is 59500 vehicles will pay 1st and 2nd tolls 40% of 85000 that is 34000 vehicles will pay 1st, 2nd and 3rd tollsTo obtain average toll tariff per toll gate per car is obtain by

TO OBTAIN THE AVERAGE TOLL TARIFF PER TOLL GATE

TO OBTAIN THE AVERAGE TOLL TARIFF PER TOLL GATE This means that:85, 000 vehicles will pay

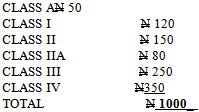

This means that:85, 000 vehicles will pay  167 each 70% of 85000, i.e. 59,500 will pay twice for two toll gates 40% of 85000, i.e. 34000 will pay three times for the three toll gatesThese estimates can now be projected to one week, one month, one year, and 30 yrs.TO OBTAIN THE TOTAL REVENUE OR INCOME PER DAY 85,000 x

167 each 70% of 85000, i.e. 59,500 will pay twice for two toll gates 40% of 85000, i.e. 34000 will pay three times for the three toll gatesThese estimates can now be projected to one week, one month, one year, and 30 yrs.TO OBTAIN THE TOTAL REVENUE OR INCOME PER DAY 85,000 x  167 =

167 =  14,195,000 59,500 x

14,195,000 59,500 x  334 =

334 =  19,873,000 34,000 x

19,873,000 34,000 x  500 =

500 =  17,000,000

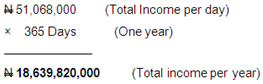

17,000,000 51,068,000 (Total Revenue per day)TO OBTAIN THE TOTAL INCOME IN 7 DAYS (ONE WEEK)

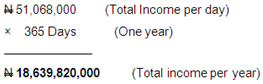

51,068,000 (Total Revenue per day)TO OBTAIN THE TOTAL INCOME IN 7 DAYS (ONE WEEK) TO OBTAIN THE TOTAL INCOME IN ONE YEAR (365 Days)

TO OBTAIN THE TOTAL INCOME IN ONE YEAR (365 Days) Total income per day will be

Total income per day will be  51, 068,000 per day

51, 068,000 per day  357,476,000 per week

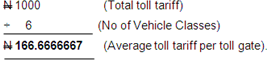

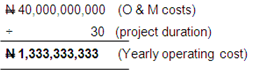

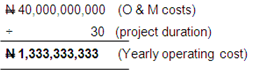

357,476,000 per week 18, 639,820,000 per year The cost of the project is N50 billion. If for examples, out of the total cost of the project,20% = Initial Cost (which will not be discounted).80% = Operating and maintenance costsInitial Cost =N10 BillionOperating and maintenance Costs = N40 BillionIf we assumed that the operating cost includes maintenance cost for the period of 30 years are N40 billion then, to obtain the yearly cost of operating and maintenance will be

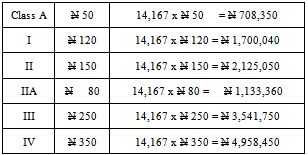

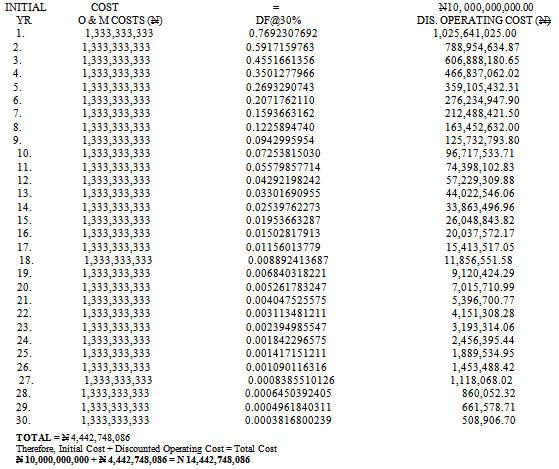

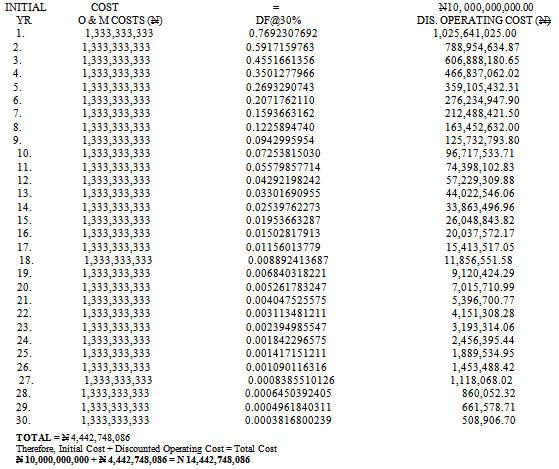

18, 639,820,000 per year The cost of the project is N50 billion. If for examples, out of the total cost of the project,20% = Initial Cost (which will not be discounted).80% = Operating and maintenance costsInitial Cost =N10 BillionOperating and maintenance Costs = N40 BillionIf we assumed that the operating cost includes maintenance cost for the period of 30 years are N40 billion then, to obtain the yearly cost of operating and maintenance will be On the basis of the above, the data in tables 3 and 4 were generated. TOTAL =

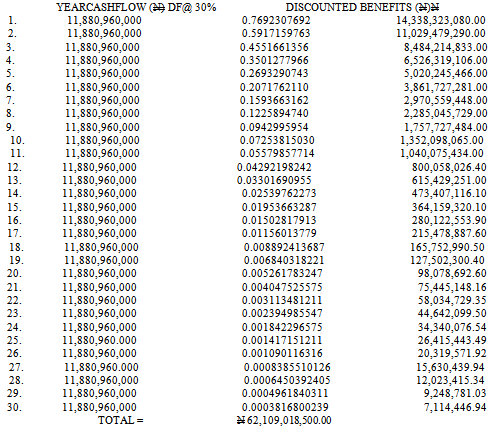

On the basis of the above, the data in tables 3 and 4 were generated. TOTAL =  62,109,018,500.00

62,109,018,500.00  14,442,748,086.00Benefit-Cost Ratio=

14,442,748,086.00Benefit-Cost Ratio= 62,109,018,500 = 4.300360162 > 1 positive

62,109,018,500 = 4.300360162 > 1 positive 14,442,748,086NPV =

14,442,748,086NPV =  62,109,018,500 -

62,109,018,500 -  14,442,748,086 =

14,442,748,086 =  47,666,270,414 > 0NOTE: The 30 percent interest rate used in this estimation and analysis is the rate charged on loans obtained by LCC for the project. Also, the toll tariff used for the analysis is based on the assumption that there will be no discount and the tariffs remain the same for the period of 30 years

47,666,270,414 > 0NOTE: The 30 percent interest rate used in this estimation and analysis is the rate charged on loans obtained by LCC for the project. Also, the toll tariff used for the analysis is based on the assumption that there will be no discount and the tariffs remain the same for the period of 30 yearsTable 3. Discounted operating cost

|

| |

|

Table 4. Discounted streams of benefits

|

| |

|

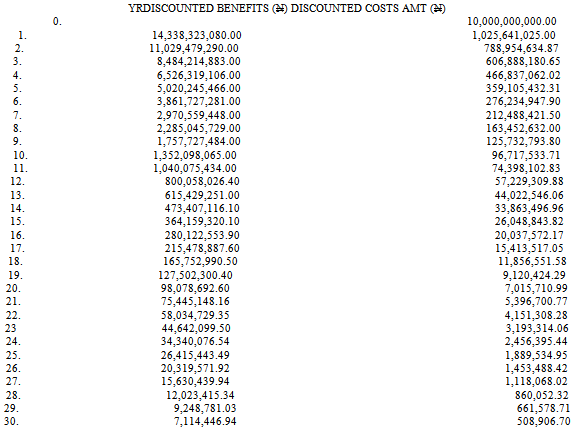

Table 5. Discounted streams of benefits and costs discounted at 30%

|

| |

|

3. Empirical Findings

This study investigated the potential benefits and the costs of the Lekki-Epe concession road network and its impact in terms of benefits/costs to the people. Data has been collected from the document of the project executors, based on the assumptions made by them. The Costs and the likely benefits have been dictated. The benefits were based on revenue from tolls as stated in the documents and the dailies. The figures were worked upon to arrive at benefit - Cost ratio and NPV. The analysis was also extended to include the secondary benefit of the project. The true evaluation of the project was being carried out on the basis of both primary and secondary benefits and also the costs, the true Benefits-Cost ratio, and the NPV.

3.1. Interpretation and Discussion of Results

Interpretation of result of the benefit-cost ratio on Lekki-Epe expressway concession project.Data were collected for thirty years (30 years) which is the period of analysis. The extracted figures were subjected to the discounting methods of findings the present value of money that extends into the future today. The discount rate used in this study is the cost of borrowing of the project executors i.e. 30%. This 30% was used to discount streams of benefits and costs for the thirty years. Decisions were taken based on the outcome of the discounted benefits and costs.Tables 3 and 4 shows the results of the discounted benefits and costs.Discounted streams of benefits= N62, 109, 018, 500.00Discounted streams of costs = N4, 442,748,086.00Plus the undiscounted initial cost=N 4,442,748,086 + N10, 000,000,000= N14, 442, 748, 0856.00To arrive at benefits/cost ratio, we divide the total streams of discounted benefits with the total stream of discounted costs i.e.: To arrive at the Net Present Value of the project (NPV), we take away the discounted cost plus the initial cost from the discounted streams of benefits. When the outcome is greater than zero, it shows that the project is worthwhile.In the case of Lekki-Epe expressway concession project, the NPV turned out to be greater than zero (

To arrive at the Net Present Value of the project (NPV), we take away the discounted cost plus the initial cost from the discounted streams of benefits. When the outcome is greater than zero, it shows that the project is worthwhile.In the case of Lekki-Epe expressway concession project, the NPV turned out to be greater than zero ( 47, 666,270,414). This shows that from the point of view of the contractor, the project is a lucrative one.In as much the Lekki-Epe expressway focused on the primary benefits that the road will have on the people. Benefits come in different ways. Apart from the primary benefits that projects normally takes into consideration, other benefits are also associated with a project like this. These other benefits are called secondary benefits.The secondary benefits, which could be evaluated in monetary terms, are classified below:

47, 666,270,414). This shows that from the point of view of the contractor, the project is a lucrative one.In as much the Lekki-Epe expressway focused on the primary benefits that the road will have on the people. Benefits come in different ways. Apart from the primary benefits that projects normally takes into consideration, other benefits are also associated with a project like this. These other benefits are called secondary benefits.The secondary benefits, which could be evaluated in monetary terms, are classified below:

3.1.1. The benefit to the people (Secondary benefits)

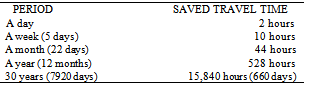

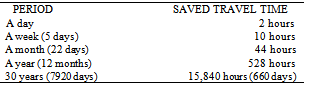

There are other benefits associated with the project that are not captured by the primary objective of the project or the primary benefits of the project. These other benefits to the users of the project are what we called secondary benefits. A secondary benefit is defined as the indirect contributions of a project to each of the various objectives that the project is designed to fulfil, that are not entirely captured by the direct or primary measures. These secondary benefits of the LCC are categorized as: Table 6. Time saving benefit

|

| |

|

3.1.2. Time Saving Benefits

Time is a valuable non renewable resource. Travel time is often worth more than monetary costs Since, travel time is a high ranking cost, it could be argued that projects that increase travel speeds offer significant potential benefits. Time spent in discomfort (waiting in the rain at the side of a busy roadway or on traffics) has higher unit costs than time spent in comfort (in a comfortable seat).In other to estimate the time saving in 30 years of the concession, let assume that the road user apply along this axis for 2 trips per day (to and fro). Let us assume that the road user will save one hour going to this axis and one hour coming from the axis making it 2 hours per day as a result of the smoothness and less congestion of the road. Also assuming he/she is to ply the road for 5 working days a week. The time saving benefits could be calculated as shown in the table below:That is, 2 trip per day; saves 2 hours per dayIn 5 working days, saves 10 hours per weekIn one month (22 days), saves 44 hoursIn 12 months, saves 528 hours per yearIn 30 years, saves 15,840 hours (660 days) in 30 years.This will be the time saving benefits of the Lekki-Epe expressway road construction assuming the road user ply the road for the next 30 years (Ceteris Paribus).

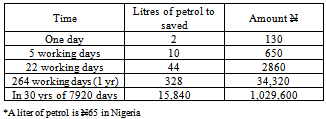

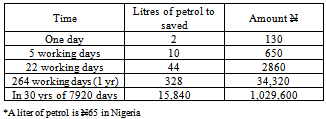

3.1.3. Petrol Saving Benefit

Also, to estimate the petrol saving as a result of the construction of the road, the assumption is that, if a motorist is able to save 2 liter of petrol per day, how much will het saved in 30 yrs? The estimation is shown in the table below: Table 7. Petrol Saving

|

| |

|

Assuming a road user that plies this axis, twice a day (to and fro), 5 days a week and in 30 years period. The estimate is thus:In a day, he/she will save N 130 (2 litres of petrol)In a week, he/she saves N 650 (10 litres of petrol)In a month (22 days), he/she saves N 2860 (44 litres of petrol)In 264 working days (1 year), he/she saves N 34,320 (328 litres of petrol)In 7920 days (30 years), he/she saves  1,029,600 (15,840 litres of petrol).This will be the saving on petrol assuming the price and other thing remain the same (Ceteris Paribus).

1,029,600 (15,840 litres of petrol).This will be the saving on petrol assuming the price and other thing remain the same (Ceteris Paribus).

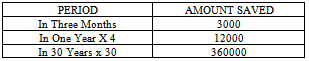

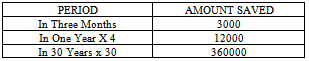

3.1.4. Saving on Car Maintenance

Due to the newness and smoothness of the new road, cars will avoid running into pot-holes, craggy roads and also less traffic congestions will be experienced. These could also be monetized in terms of naira saved/gained.Assuming a situation where a road user who apply on this axis carry’s out repairs and maintenance of his/her vehicle twice in three month due to heavy traffic and congestion on this axis before the construction of the road. With the construction of the Lekki-Epe expressway, road user now experience less congestion, traffic and vehicle costs.Assuming a road user repairs and maintains his/her vehicle twice in three months with #3000 per repair/maintenance cost before the construction. Now, with the road construction, he/she carry’s-out repair and maintenance of his/her vehicle once in three months with  3000 per repair/maintenance.If on the average, the road user saved a minimum of

3000 per repair/maintenance.If on the average, the road user saved a minimum of  3000 every three months. How much would have been saved in 30 years. The table below depicts the results

3000 every three months. How much would have been saved in 30 years. The table below depicts the results Table 8. Saving on car maintenance

|

| |

|

In three month he/she will save N 3,000 In one year, saves N12, 000The road user will save N12000 in one year as a result of the road construction, assuming all things remain equal (Ceteris Paribus).Commercial user will save three times more than the owner car users.

3.1.5. Benefit to a commercial road user (A transporter)

The above analysis applies to a private road user. Now, assuming a commercial road user (transporter) with Danfo bus, who applies the axis ten times daily (5 times going and 5 times coming) for his daily commercial activities?In a day, he will save 10 hours, 5 litres of petrol (N 325)In a week (6 days per week), he will save 60 hours and 30 litres of petrol (# 1,950).In a month (25 days per month), he will save 250 hours and 125 litres of petrol (#8,125).In a year (300 days per year), he will save 3,000 hours and 1,500 litres of petrol (#97,500).In 30 years (9,000 days), he will save 90,000 hours and 45,000 litres of petrol (#2,925,000). Assuming he apply this axis for 30 years and all things remain the same (ceteris Paribus). NOTE: These analyses on secondary benefits are based on assumptions and projections.Other benefits include reduction in traffic congestion, crash costs, noise and air pollution costs. The construction of a good road will reduce these risks and improve the health and well-being of the people.Table 9. Benefit of a transporter

|

| |

|

4. Summary, Recommendation, and Conclusions

4.1. Summary

The paper investigates the costs and the benefits associated with the Lekki–Epe Expressway concession project after completion.The method of analysis was based on the NPV assessment of the project and the Benefit-Cost ratio. The analysis covered the 49.4 kilometer length of the road project. The objective was to analysis critically the Benefits-Costs of the project. Also, apart from the primary benefit which is the goal of the project itself, secondary benefits were detected, which can further decrease the price paid and improve the standard of living of the people. The results have so far shown that the concession project will impact positively on the social-economic growth and development of the state and Nigeria in particular. The union between the private and public enterprises in the provision of social amenities and infrastructures has been shown to be capable of creating several opportunities for investors to realize a reasonable return on investment while the people of Lagos state receive reliable and efficient services. Subsequently, the PPPs in Nigeria are capable of producing abundant immediate and future benefits internally and externally. On the whole the benefits outweigh the costs in the long-run. This shows that the project is viable and beneficial to the people and to the developmental goals of the nation.

4.2. Recommendation

The appeal of Public-Private Partnerships (PPPs) as a new policy alternative in the context of developing countries is growing. However, not only PPPs have become mired in a stream of conceptual ambiguity, but also the logistics and policy requirements for successful PPP implementation have not been systematically explored. This study has attempted to shed light on this relatively new and complex policy, both from a conceptual and practical implementation perspective.The following policy recommendations are offered and they are mostly based on the empirical findings and other observations made by previous researchers.Generally, trust, openness and fairness are basic foundational underpinnings of successful PPPs. Partnering should be mutually viewed as representing an opportunity rather than a threat and loss of control. In this context, while recognizing the immense complexities in working across sectors with different strategic and operational realities, the focus should be on identifying common goals, delineating responsibilities, negotiating expectations and building bridges including common working practices and specific reporting and record keeping requirements.Attention needs to be accorded to developing mechanisms –structures, processes and skills – for bridging organizational/interpersonal differences and nurturing communication and coordination. Deploying adequate time and staff helps ensure that both partners’ resources are tapped and that both have their goals and needs adequately represented.[12] suggested that PPPs must begin with careful groundwork and preparation, including a comprehensive feasibility study and economic evaluation for each potential partnership project. In this respect, developing country governments need to build their legal and regulatory capacity to effectively foster and participate in PPPs. The concept of partnership is indeed founded on the assumptions of interdependence and individual excellence (i.e. complementary assets and skills). These pre-requisites cannot be compromised in the pursuit of quick fixes and efficiency gains. Unequal qualifications and contributions of expertise are recipes for failing PPPs.Hence, while PPPs can bring added value to the public and private sector partners, a sound legal and regulatory framework and complete transparency particularly with regards to financial accountability are essential elements. Also, important is the presence of strong structure at the level of central administration to steer and guide policy implementation. PPPs indeed often falter because of hastily prepared tender documents and contracts and the negotiations taking place between unequally qualified and experienced professionals, mainly to the disadvantage of the representative from the public sector[13].[14] States that what emerges from the observation of currently adopted schemes is that each PPP arrangement should be designed and adapted to the specific characteristics of the asset at stake, as well as to the peculiar abilities of all partners involved in the project. In order to guarantee value for money (VFM), the relative strengths and weaknesses of each PPP scheme should be considered. Depending on the sector of application, some models are better suited than others in delivering targeted outputs and in ensuring accurate risk management. Choosing the wrong model or inaccurately evaluating the risk management capacities of each party may have extremely costly consequences and a negative impact on public accounts.Finally, while PPPs may offer opportunities for exploiting the comparative advantages of both the private sector – dynamism, access to finance, knowledge of technologies, managerial efficiency, and entrepreneurial spirit, with the social responsibility, environmental awareness, and job generation concerns of the public sector – they should not be treated as a panacea. PPPs projects should be evaluated on their merits, on a case-by-case basis, and contemplated when the ingredients of effective collaboration (e.g. commitment, interdependence, individual excellence, communication and integrity) are found or can be safely nurtured along the way.

4.3. Conclusions

The objective of this study was to shed more light on the importance of PPPs, infrastructure and sustainable economic growth. The provision of adequate infrastructure cannot be left in the hand of government of the nation. In Nigeria and other developing countries, sustainable access to road infrastructure and other socio-economic services and products can be accomplished through public-private partnerships, where the government delivers the minimum standard of services, products and or care, the private sector brings skills and core competencies, while donors and business bring funding and other resources. Such collaborations will be especially productive in promoting poverty alleviation through micro-finance, enhancing development through partnerships as has been the case with the developed countries.[8] Stated that given the changing role of the public and private sectors in the bid to bring about sustainable development in most countries, it is no longer sustainable for the public sector to bring about sustainable development in most countries. Efficient and effective production and distribution of public goods and services should be part of the social contribution of the private sector to sustainable economic development. It has been seriously proven by[8] that private sector led economic growth and development, is generally more efficient (both productive and allocative efficiencies) and effective. The private sector is more dynamic resilient, creative, innovative and vibrant that the public sector. But because private sector is more profit-oriented, the provision of infrastructures cannot be left alone in the hands of private sector. Since there will still be some elements of market imperfection, the advocation of public, private partnership is in order. The main problem associated with the Lekki- Epe-Express way is not the problem of money perse, but the problem of acceptability by the people living along the axis. This is based on the amount of tolls they will be asked to pay. The solution then will be to educate the people on the benefits associated with such project. They should also consider the secondary benefits associated with the it.In the efforts to achieve sustainable PPP, the objectives would be to highlight perspectives on development from leaders in civil society, government, business and the media, share information on development alternatives, provide forums for informed debate on related issues, seek to accomplish better understanding of the nature of relationships between government and non-governmental organizations, and introduce conceptual frameworks for understanding such relationships. PPPs objectives would also include bridging the information gap between the public and private sector organizations, analysing their capacities and opportunities, and suggesting mechanisms for improving the relationships between the government and the governed/citizenry. Therefore, the ball is in government court to providing an enabling environment for private participation and in provision of required infrastructure for growth and development. The study concluded that the use of public-private partnerships (PPPs) in the provision and distribution of some goods especially infrastructure is good and rewarding. This will bring about the attainment of sustainable development. Infrastructure is key to sustainable development.

References

| [1] | KOpuiyo O. “The Lekki Toll Road User Guild”, v1.0. LCC Publication, Lagos. |

| [2] | Roseneau, P. (1999), “The Strengths and Weaknesses of Public Private Policy Partnerships”, Behavioral Scientist, Vol. 43 No. 1, pp. |

| [3] | Spackman, M. (2002), “Public-private partnerships: lessons from the British approach”, Economic Systems, Vol. 26, pp. 283-301. |

| [4] | Saidu N (2008), “PPP in Nigeria, How Far? www.fppn.org |

| [5] | Nijkamp, P., Van der Burch, M. and Vidigni, G. (2002), “A Comparative Institutional Evaluation of Public Private Partnerships in Dutch urban land-use and revitalization projects”, Urban Studies, Vol. 39 No. 10, pp. 1865-80 |

| [6] | Samii, R., Van Wassenhove, L.N. and Bhattacharya, S. (2002), “An innovative public private partnership: new approach to development”, World Development, Vol. 30 No. 6, pp. 991-1008. |

| [7] | Kanther, R.M. (1994), “Collaborative advantage: the art of alliances”, Harvard Business Review, July-August, pp. 96-108 |

| [8] | Ngowi, H. P. (2007), “Public-Private Partnership (PPPs) in the Management of Municipalities in Tanzania – Issues and Lessons of Experience”: Economics Department, Mzumbe University |

| [9] | Dasgupte, A. K and Peace D. W (1972), Cost –Benefit Analysis: Theory and Practice. Harper & Row Publishers Inc |

| [10] | Obozuwa, D. (2010), “PPP as a Tool for Infrastructure Development in Nigeria Part. 2”, www.businessdayonline.com |

| [11] | Olutayo O. and Margaret A. Loto (2008), “Project Analysis and Evaluation: Principles and Techniques”, Third Edition, Concept Publications, Lagos |

| [12] | Sohail, M., Plummer, J., Slater, R., and Heymans,C., (2003), “Local Government Service Partnerships: A Background”. Commonwealth Local Government Conference. Pretoria, South Africa. |

| [13] | Zouggari, M. (2003), “Public Private Partnerships: Major Hindrances to the Private Sector’s Participation in the Financing and Management of Public Infrastructures”, Water Resources Development, Vol. 19 No. 2, pp. 123-9 |

| [14] | Buse, K and Walt, G (2000b).The World Health Organisation and Global Public Private Partnerships. In Search of Good Global Health Governance. WHO, in Dime Jamali (2004), “Success and Failure Mechanisms of Public-Private Partnership (PPPs) in developing Countries: insights from the Lebanese Context”. Emerald group Publication limited. International Journal for Public sector Management, No5, 2004. |

| [15] | Commonwealth (2003). “Public – Private Partnerships: A Review with Special Reference to Local Government” inCommonwealth Local Government Handbook.KPL. Rochester, in Dime Jamali (2004), “Success and Failure Mechanisms of Public-Private Partnership (PPPs) in developing Countries: insights from the Lebanese Context”. Emerald group Publication limited. International Journal for Public sector Management, Vol: 17 No5, 2004, |

| [16] | Guardian Newspaper (December 21, 2010). |

| [17] | Hagen, R. (2002), “Globalization, university transformation and economic regeneration: a UK case study of public/private sector partnership”, The International Journal of Public Sector Management, Vol. 15 No. 3, pp. 204-18 |

| [18] | LCC Publications. http://www.lcc.com.ng |

| [19] | Ohio U. (2008), “Infrastructure Concession in Nigeria as Panacea” www.nigeriamuse.com |

2.25tn ($15bn) annually to improve it to an acceptable level according to a report on the state of infrastructure by ICRC (2011). Poor infrastructure is one of the major constraints to economic development through its debilitating impact on productivity, investment in-flows, competitiveness, cost of doing business and people’s confidence in the government and the economy.Infrastructure is the key element in diversifying the opportunities which can bring about shared growth. That is growth that enables not just the private sector to come in but also have positive impact on the lives of the people. . Evidently, there is a high correlation between availability of infrastructural services and the income levels of most economies. The concept of Public private partnerships (PPPs) is now becoming an interesting debate in the world, especially in developing countries as a means of reducing infrastructural development problem for sustainable growth. It is now becoming very glaring that public sector alone cannot provide adequate infrastructure for sustainable development. The PPPs is more or less a new phenomenon in the developing countries. As a result of this, people are resisting it, because they believed that the cost of the good and service will be too much for the public to bear. The importance of PPPs is not really very open to the people of the third world. As a result of this they need awareness.This study presents the assessment of the recent PPP initiative in the road infrastructure in Nigeria (a case study of the LekkI-Epe expressway concession (Cost- Benefits analysis Approach). A fast growing development corridor such as that served by the Lekki-Epe Expressway, with over 85,000 vehicles using the Expressway daily, needs good road infrastructure to support its continued development and growth, according to LCC publication on the internet. The government believed that a first-class road facility, such as is being currently delivered, will both stimulate further economic growth and provide sustainable livelihoods for people living along the axis.The objective here is to analyse critically the benefits and costs of this project. The outcome of the study will be able to shed more light on the importance of the project; and how people may benefit or otherwise from the project whether it will add value to their standard of living (i.e. their welfare) or not. Although, according to[1], the private sector participation is increasingly involved in the conduct of developing countries but the success or failure of PPP projects has not been systematically assessed. In order words, the cost and benefits have not been properly analysed.In line with his argument, this present study is focused on the true analysis of the costs and benefits of Lekki-Epe express road concession in Nigeria between 2010-2040.

2.25tn ($15bn) annually to improve it to an acceptable level according to a report on the state of infrastructure by ICRC (2011). Poor infrastructure is one of the major constraints to economic development through its debilitating impact on productivity, investment in-flows, competitiveness, cost of doing business and people’s confidence in the government and the economy.Infrastructure is the key element in diversifying the opportunities which can bring about shared growth. That is growth that enables not just the private sector to come in but also have positive impact on the lives of the people. . Evidently, there is a high correlation between availability of infrastructural services and the income levels of most economies. The concept of Public private partnerships (PPPs) is now becoming an interesting debate in the world, especially in developing countries as a means of reducing infrastructural development problem for sustainable growth. It is now becoming very glaring that public sector alone cannot provide adequate infrastructure for sustainable development. The PPPs is more or less a new phenomenon in the developing countries. As a result of this, people are resisting it, because they believed that the cost of the good and service will be too much for the public to bear. The importance of PPPs is not really very open to the people of the third world. As a result of this they need awareness.This study presents the assessment of the recent PPP initiative in the road infrastructure in Nigeria (a case study of the LekkI-Epe expressway concession (Cost- Benefits analysis Approach). A fast growing development corridor such as that served by the Lekki-Epe Expressway, with over 85,000 vehicles using the Expressway daily, needs good road infrastructure to support its continued development and growth, according to LCC publication on the internet. The government believed that a first-class road facility, such as is being currently delivered, will both stimulate further economic growth and provide sustainable livelihoods for people living along the axis.The objective here is to analyse critically the benefits and costs of this project. The outcome of the study will be able to shed more light on the importance of the project; and how people may benefit or otherwise from the project whether it will add value to their standard of living (i.e. their welfare) or not. Although, according to[1], the private sector participation is increasingly involved in the conduct of developing countries but the success or failure of PPP projects has not been systematically assessed. In order words, the cost and benefits have not been properly analysed.In line with his argument, this present study is focused on the true analysis of the costs and benefits of Lekki-Epe express road concession in Nigeria between 2010-2040.

Where,MUij= marginal utility of good j to individual iλ = marginal utility of money income to individual i P = price of good j Any change in money income individual I will result into changes in goods and services Xij, purchased by individual i. Therefore, an increase, (ΔXj) in the amount of Xj, will raise utility (Ui) for individual i byI

Where,MUij= marginal utility of good j to individual iλ = marginal utility of money income to individual i P = price of good j Any change in money income individual I will result into changes in goods and services Xij, purchased by individual i. Therefore, an increase, (ΔXj) in the amount of Xj, will raise utility (Ui) for individual i byI

.Where:K0= the initial cost which will not be discounted. ( such costs include: cost of preparation and signing of contract, feasibility preparation costs.). Bt= stream of benefitsCt = stream of Costsi = discount ratet = time in yearsThe, decision rule here is that if the NPV > 0 then accept the project.( It shows that the project is worthwhile) . In the case of Benefit-Cost ratio, there are two variants. The gross Benefit-Cost ratio and the net benefit-cost ratio.The gross benefit-cost ratio is given as:

.Where:K0= the initial cost which will not be discounted. ( such costs include: cost of preparation and signing of contract, feasibility preparation costs.). Bt= stream of benefitsCt = stream of Costsi = discount ratet = time in yearsThe, decision rule here is that if the NPV > 0 then accept the project.( It shows that the project is worthwhile) . In the case of Benefit-Cost ratio, there are two variants. The gross Benefit-Cost ratio and the net benefit-cost ratio.The gross benefit-cost ratio is given as: The net Benefit-Cost ratio is given as:

The net Benefit-Cost ratio is given as:  Where:Bt = streams of benefitsCt = streams of operating costsKt = replacement costsKio = initial Costsi = discount ratet = time in yearsOn both ratios, the decision rule is that, the project is worthwhile if the outcome of the two equations are each greater than one that is, if RG>1RN> 1

Where:Bt = streams of benefitsCt = streams of operating costsKt = replacement costsKio = initial Costsi = discount ratet = time in yearsOn both ratios, the decision rule is that, the project is worthwhile if the outcome of the two equations are each greater than one that is, if RG>1RN> 1

TO OBTAIN THE AVERAGE TOLL TARIFF PER TOLL GATE

TO OBTAIN THE AVERAGE TOLL TARIFF PER TOLL GATE This means that:85, 000 vehicles will pay

This means that:85, 000 vehicles will pay  167 each 70% of 85000, i.e. 59,500 will pay twice for two toll gates 40% of 85000, i.e. 34000 will pay three times for the three toll gatesThese estimates can now be projected to one week, one month, one year, and 30 yrs.TO OBTAIN THE TOTAL REVENUE OR INCOME PER DAY 85,000 x

167 each 70% of 85000, i.e. 59,500 will pay twice for two toll gates 40% of 85000, i.e. 34000 will pay three times for the three toll gatesThese estimates can now be projected to one week, one month, one year, and 30 yrs.TO OBTAIN THE TOTAL REVENUE OR INCOME PER DAY 85,000 x  167 =

167 =  14,195,000 59,500 x

14,195,000 59,500 x  334 =

334 =  19,873,000 34,000 x

19,873,000 34,000 x  500 =

500 =  17,000,000

17,000,000 51,068,000 (Total Revenue per day)TO OBTAIN THE TOTAL INCOME IN 7 DAYS (ONE WEEK)

51,068,000 (Total Revenue per day)TO OBTAIN THE TOTAL INCOME IN 7 DAYS (ONE WEEK) TO OBTAIN THE TOTAL INCOME IN ONE YEAR (365 Days)

TO OBTAIN THE TOTAL INCOME IN ONE YEAR (365 Days) Total income per day will be

Total income per day will be  51, 068,000 per day

51, 068,000 per day  357,476,000 per week

357,476,000 per week 18, 639,820,000 per year The cost of the project is N50 billion. If for examples, out of the total cost of the project,20% = Initial Cost (which will not be discounted).80% = Operating and maintenance costsInitial Cost =N10 BillionOperating and maintenance Costs = N40 BillionIf we assumed that the operating cost includes maintenance cost for the period of 30 years are N40 billion then, to obtain the yearly cost of operating and maintenance will be

18, 639,820,000 per year The cost of the project is N50 billion. If for examples, out of the total cost of the project,20% = Initial Cost (which will not be discounted).80% = Operating and maintenance costsInitial Cost =N10 BillionOperating and maintenance Costs = N40 BillionIf we assumed that the operating cost includes maintenance cost for the period of 30 years are N40 billion then, to obtain the yearly cost of operating and maintenance will be On the basis of the above, the data in tables 3 and 4 were generated. TOTAL =

On the basis of the above, the data in tables 3 and 4 were generated. TOTAL =  62,109,018,500.00

62,109,018,500.00  14,442,748,086.00Benefit-Cost Ratio=

14,442,748,086.00Benefit-Cost Ratio= 62,109,018,500 = 4.300360162 > 1 positive

62,109,018,500 = 4.300360162 > 1 positive 14,442,748,086NPV =

14,442,748,086NPV =  62,109,018,500 -

62,109,018,500 -  14,442,748,086 =

14,442,748,086 =  47,666,270,414 > 0NOTE: The 30 percent interest rate used in this estimation and analysis is the rate charged on loans obtained by LCC for the project. Also, the toll tariff used for the analysis is based on the assumption that there will be no discount and the tariffs remain the same for the period of 30 years

47,666,270,414 > 0NOTE: The 30 percent interest rate used in this estimation and analysis is the rate charged on loans obtained by LCC for the project. Also, the toll tariff used for the analysis is based on the assumption that there will be no discount and the tariffs remain the same for the period of 30 years To arrive at the Net Present Value of the project (NPV), we take away the discounted cost plus the initial cost from the discounted streams of benefits. When the outcome is greater than zero, it shows that the project is worthwhile.In the case of Lekki-Epe expressway concession project, the NPV turned out to be greater than zero (

To arrive at the Net Present Value of the project (NPV), we take away the discounted cost plus the initial cost from the discounted streams of benefits. When the outcome is greater than zero, it shows that the project is worthwhile.In the case of Lekki-Epe expressway concession project, the NPV turned out to be greater than zero ( 47, 666,270,414). This shows that from the point of view of the contractor, the project is a lucrative one.In as much the Lekki-Epe expressway focused on the primary benefits that the road will have on the people. Benefits come in different ways. Apart from the primary benefits that projects normally takes into consideration, other benefits are also associated with a project like this. These other benefits are called secondary benefits.The secondary benefits, which could be evaluated in monetary terms, are classified below:

47, 666,270,414). This shows that from the point of view of the contractor, the project is a lucrative one.In as much the Lekki-Epe expressway focused on the primary benefits that the road will have on the people. Benefits come in different ways. Apart from the primary benefits that projects normally takes into consideration, other benefits are also associated with a project like this. These other benefits are called secondary benefits.The secondary benefits, which could be evaluated in monetary terms, are classified below: 1,029,600 (15,840 litres of petrol).This will be the saving on petrol assuming the price and other thing remain the same (Ceteris Paribus).

1,029,600 (15,840 litres of petrol).This will be the saving on petrol assuming the price and other thing remain the same (Ceteris Paribus).  3000 per repair/maintenance.If on the average, the road user saved a minimum of

3000 per repair/maintenance.If on the average, the road user saved a minimum of  3000 every three months. How much would have been saved in 30 years. The table below depicts the results

3000 every three months. How much would have been saved in 30 years. The table below depicts the results  Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML