-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(1): 23-26

doi:10.5923/j.economics.20130301.05

An Assessment of the Direct Welfare Impact of Fuel Subsidy Reform in Nigeria

Habibu Mohammed Umar 1, Musa Sulaiman Umar 2

1School of Economics, Finance and Banking, University Utara Malaysia, sintok, 06010, Kedah Darul Aman

2Department of Accounting, Faculty of Management Sciences, Kaduna state university, Nigeria

Correspondence to: Habibu Mohammed Umar , School of Economics, Finance and Banking, University Utara Malaysia, sintok, 06010, Kedah Darul Aman.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Using the Household Expenditure Survey of 2010, this paper measures the direct welfare impact of higher fuel prices on different socio-economic groups in Nigeria. The analysis is carried out by segregating households into 3 different income groups and the welfare impact due to subsidy cut is measured. The results show that the reduction in welfare due to higher price is larger for the middle 40% compared to the top and the bottom 20%. This is due to the fact that the middle income group has a larger budget share on fuel. Fuel subsidies are found to be costly in protecting poor households due to substantial leakage of benefits to higher income group but the welfare loss for the lower income group due to subsidy cut is somewhat higher due to the smaller size of their income. Thus, while subsidy reform is undeniably necessary, our findings suggest that it must be carried out cautiously. Contrary to commonly held views, our study suggests that the reform must be accompanied with strategies and programs to mitigate the welfare loss, not only for the lower income but also the middle income group.

Keywords: Fuel, Subsidy, Reform, Welfare

Cite this paper: Habibu Mohammed Umar , Musa Sulaiman Umar , An Assessment of the Direct Welfare Impact of Fuel Subsidy Reform in Nigeria, American Journal of Economics, Vol. 3 No. 1, 2013, pp. 23-26. doi: 10.5923/j.economics.20130301.05.

1. Introduction

- Fuel subsidies are used in both developed and developing countries to encourage the production of goods and services through lowering the cost of production and in certain cases to lighten the burden of rising prices on consumers. As in other countries, the Nigerian government has been subsidizing fuel products, particular petrol and kerosene, where these products are sold below their market prices. Evidently, fuel subsidy has made a hole in the country’s budget, contributing to the fiscal deficit, which stood at about 3.0% of gross domestic product (GDP) in this fiscal year (2012). The subsidy will soak up 888 billion naira ($5.61 billion) out of the 2012 budget alone. Due to high cost of subsidies, fuel subsidy reform is on the top agendas of many countries all over the world. Nigeria is among the countries that are implementing such a policy reform. In theory, it is thus proved that, rationalizing fuel subsidies could remove market distortions, improve efficiency in the oil market and relieve the government from its financial burden and fiscal problems.Nigeria also found it necessary to embark on subsidy reform in order for the country to overcome its fiscal challenges and substantiate its support for environmental policies. Gasoline subsidies in Nigeria account for about a quarter of government spending. According to the government, the reform will free up funds for building infrastructure such as power plants and roads. The official estimates from the government shows that, ending the fuel subsidies will help save 1.2 trillion naira ($7.5 billion) this year, or about 25 percent of the government’s 4.8 trillion naira spending plan. The reform, if carried out, will raise the price of a litre of petrol by 53.6% (i.e. from 65 naira (40 U.S. cents) per litre to 140 naira (88 U.S cents). The move undertaken by the government to rationalize fuel subsidy has sparked mixed reactions from various segments of the society. Basically the reactions fall under two opposing views. The proponents of fuel subsidy reduction basically argue on the premise of efficiency, i.e. fuel subsidy removal will remove market distortions and thus consumption and investment decisions will be made based on true price signal. They further argued that, in the case of Nigeria, the reform will address the perennial corruption that has taking over the subsidy business for long. On the other hand, the opponents of fuel subsidy removal basically argue on the basis of equity, i.e. the removal of subsidy may adversely affect the lower income groups. Both arguments have their own merits. Nevertheless the appropriate action to be taken entails an in-depth investigation on the impact of phasing out fuel subsidy on the overall welfare of the society. The aim of this paper, unlike the ongoing polemical commentaries on this topical issue, is to provide empirical evidence on the impact the reform has produced on the lives of people in the country. Accordingly, the paper investigates the distributional welfare impact through the direct measure of welfare impact on household resulting from the intended subsidy rationalization. Following the introduction in the first section, section two will look at the empirical evidences on fuel subsidy reform. Section three will discuss the method and data used in the study followed by analysis of the welfare impact in section 4. Section 5 concludes the study and provides some policy recommendations.

2. Related Literature

- There are economic arguments for removing fuel subsidies. Some said fuel subsidies are not efficient as they result to distortions in the economy; and also inequitable as the rich people receive more of the benefits than the poor. Studies have shown that fuel subsidies are ineffective in fuelling economic growth or in ensuring equitable distribution of income. In fact, most of the studies suggest that fuel subsidies hamper economic growth and undermine the principle of equity, therefore should be reduced if not wash out completely. A study on Gabon, by El Said Leigh, (2006) revealed that, the richest 10% of the individuals receive about one-third of the total subsidy. Meanwhile, the poorest 30% of individuals receive only 13% of all the subsidies. This shows that the benefit of maintaining low prices is captured mostly by higher income groups, reflecting their large share in total income and consumption. Therefore, fuel subsidy becomes an inefficient instrument for protecting the poor households and ascertaining equity.Experiences from the countries that implemented the reform have shown a remarkable improvement in social services delivery. For example, Beers and Moor (2001) based on simulation analysis, reported an increase in global welfare of $35 billion if consumer subsidies in non-OECD countries are removed. Real income for the world as a whole would increase by 0.7% annually while the terms of trade would improve by 0.5% per year. Furthermore, in most countries where energy price reform had taken place, such as in Colombia, Ghana, Indonesia, Turkey and Zimbabwe, GDP growth has been higher than before the reform.Removing consumer subsidies in eight large non-OECD countries produces efficiency gains and economic growth of 0.7% GDP. In 1998, Russia experienced efficiency gain of 1.5% in GDP and 17% of CO2 emissions as a result of 33% reduction in fuel subsidies. Similarly, Indonesia had experienced 0.2% efficiency gain in real GDP and 11% reduction in CO2 emissions due to 28% increase in fuel prices. Venezuela reduced fuel subsidies by 58% and recorded 1.2% efficiency gain in GDP and 26% fall in CO2 emissions, (Beers and Moor, (2001)).A number of studies confirmed that benefits of fuel subsidies are regressively distributed. Coady, et al. (2010) discovered that over 80% of the total benefits on gasoline subsidies go to the richest 40% of households. For diesel and liquefied petroleum gas, respectively, over 65% and 70% of benefits go to these income groups. Evidence has shown that, subsidies, particularly fuel subsidies, are costly when compared to other alternative policies. A recent study on developing countries, conducted by Granado, Coady and Gillingham, (2010), shows that, the cost of transferring one dollar to the 20% poorest households via gasoline subsidy is around 33 dollars. They further argued that, if 15 dollars out of every 100 dollars which is allocated to a safety net program is absorbed by administrative costs and 80% of the remaining 85 dollars in beneficiary transfers reaches the poor (or 68% of the total budget), then the cost-benefit ratio for such a program is 1.5 dollars (i.e., $1/0.68). This shows that the opportunity cost of subsidizing fuel is high and costly.On the other hand, recent experiences in Colombia, Ghana, Indonesia, Turkey and Zimbabwe have shown that, rich households spend a lower proportion of their income on energy than poor income households do. The maximum loss in income for the rich was very small, ranging from 1% to slightly over 3%. In all cases, the biggest losers were poor urban households – the largest users of commercial fuels. Oktaviani et al. (2007) use a CGE model to analyze the elimination of fuel subsidies in Indonesia, for the increased prices of 12% in 2000, 30% in 2001 and 29% in 2005. They concluded that the short to medium-term macroeconomic performance of the economy was impaired by the removal of the subsidies, due to a reduction in household incomes and increase in domestic prices. Furthermore, the reduction of fuel subsidies increased the overall incidence of poverty in the Indonesian economy from 8.9% to 12.9% of the population, with rural areas worst affected. On the other hand, the authors note that there is little difference in terms of inequality over the period; declines in household incomes were fairly uniform across income groups, (IEA, OPEC, OECD & World Bank, 2010).Abouleinein et al. (2009) studied the impact of phasing out fuel subsidies in Egypt over a five-year period. Using a CGE model, it shows that the elimination of energy subsidies, without any offsetting policy actions, would reduce average annual GDP growth by 1.4 percentage points over the reference period and depress the welfare levels of households at all levels of the income distribution. However in terms of income inequality, the study also revealed a reduction in the level of inequality among the income groups. This reflects the larger welfare impact on households in the richest quintile of the distribution. (World Bank, 2010).

3. Data and Methodology

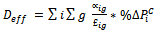

- This study evaluates only the direct welfare effect using partial equilibrium approaches on the assumption that consumers do not shift their demand from fuel despite the price change. This assumption is important because in reality, the fuel price elasticity of demand is very low (inelastic). To determine the welfare effect, households are divided into different income groups and their (groups) shares of expenditure on fuel consumption to their total expenditure are obtained. For each group, the budget share is calculated by dividing the group’s fuel expenditure by total group expenditure. Multiplying budget shares by the percentage increase in fuel price gives a first-order estimate of the real income effect of the reform (for the details of this technique see Coady, et al, 2006). Thus, the equation for calculating the direct effect is given as:

for the ith refined petroleum product and gth income group.Where:∝ = household expenditure on fuel ε = total household expenditure

for the ith refined petroleum product and gth income group.Where:∝ = household expenditure on fuel ε = total household expenditure  = percentage change in price The distribution of the welfare impact from a price increase is classified as progressive, regressive or neutral. Thus, this can be analyzed by calculating the average percentage real income loss for each income group. If the percentage real income loss is higher for low income households, then the incidence is said to be regressive. This method was used by Coady, El-Said, Gillingham, Kpodar, Medas and Newhouse (2006).This study uses the Nigeria living standard measurement survey of 2010 (LSMS Data) obtained from Nigeria Office of Statistics (NBS, 2011). A sample of 4992 households was considered as the representative of the larger population (i.e. all households in Nigeria). The relevant demographic information of this sample was used for the analysis. However, the data was from a survey of 2010/2011 which is used to evaluate the welfare impact of the present fuel subsidy reform. The sample used in this study (i.e. 4992 households) is divided into three groups based on the size of their annual income (using annual total expenditure as a proxy); i.e. Top 20 percent, Middle 40 percent, and the Bottom 40 percent.

= percentage change in price The distribution of the welfare impact from a price increase is classified as progressive, regressive or neutral. Thus, this can be analyzed by calculating the average percentage real income loss for each income group. If the percentage real income loss is higher for low income households, then the incidence is said to be regressive. This method was used by Coady, El-Said, Gillingham, Kpodar, Medas and Newhouse (2006).This study uses the Nigeria living standard measurement survey of 2010 (LSMS Data) obtained from Nigeria Office of Statistics (NBS, 2011). A sample of 4992 households was considered as the representative of the larger population (i.e. all households in Nigeria). The relevant demographic information of this sample was used for the analysis. However, the data was from a survey of 2010/2011 which is used to evaluate the welfare impact of the present fuel subsidy reform. The sample used in this study (i.e. 4992 households) is divided into three groups based on the size of their annual income (using annual total expenditure as a proxy); i.e. Top 20 percent, Middle 40 percent, and the Bottom 40 percent.4. Conclusions

- Overall, we found that a 53 percent increase in fuel price per litre in Nigeria, will decrease households’ welfare directly by about 3.8 percent on average. Our study reveals that the highest proportion of fuel subsidies’ benefits goes to the highest top 20% of the income group. It is also found that the highest income group (top 20%) receives more than four times higher in terms of the benefit from fuel subsidy than the poor income group (bottom 20%), this is due to their higher share of average monthly consumption of fuel.While our study appears to provide justification for the removal of existing fuel subsidies based on the benefits received from subsidy (where the top 20% benefits more), it thus however shows that the distributional welfare impact on the different segments of the society needs to be tackled accordingly. Our study reveals that the removal of fuel subsidy will hurt the middle income group the most, compared to the lower or the upper income groups. This implies that, while it is important to provide the poorest (or the lower income group) with various types of support to help them maintain a decent standard of living, equally important is for the policy makers to consider strategies and programs to ease the likely burden facing the middle class (middle income group). Hence, our study provides the evidence that the removal of fuel subsidy would likely accelerate the “middle class squeeze” in Nigeria.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML