-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(1): 18-22

doi:10.5923/j.economics.20130301.04

Antecedents of Firm’S Performance. Empirical Evidence from Yemeni Sme’S

Rubina Jabeen 1, Jamal Mohammed Esmail Alekam 2, Khaldoun Ahmed Mohammed Aldaoud 1, Nik Kamariah Nik Mat 1, Bilal Nayef Ibrahim Zureigat 1, Alharbi Khalid Nahi 1, Alaa Muhammad Fadel al Junaidi 1, Hassan 1

1Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia Sintok, 06010, Malaysia

2Candidate and GTA School of Business management Universiti Utara Malaysia Sintok, 06010, Malaysia

Correspondence to: Jamal Mohammed Esmail Alekam , Candidate and GTA School of Business management Universiti Utara Malaysia Sintok, 06010, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The purpose of this study is to examine the relationship between market orientation and firm’s performance in the context of SMEs of Yemen. Though lot of attention is given to study the relationship between market orientation and firm’s performance but still there is a considerable confusion about how this relationship is developed and where it is directed. It has been previously studied that market orientation and performance are directly related, but this paper will empirically analyze the relationship of other factors, learning orientation, risk taking orientation and innovation with the performance. Each of the construct was measured on 7-point likert scale ranging from 1 strongly disagree to 7 strongly agree, where market orientation has 15 items, learning orientation has 7 items, risk taking orientation has 5 items, innovation has 5 items and firm’s performance has 5 items. Four hundred self administered questionnaires were distributed to target respondents of SME’s in Aden, Ibb and Sanaa, Yemen. 249 questionnaires were completed and returned, so the response rate was 63%. The data was analyzed using Structural Equation Modeling (SEM) through AMOS 16. The goodness of fit indices of the revised structural model indicate adequate fit (GFI: 0.952, RMSEA: 0.028, Ratio: 1.19, P-value: 0.119). The regression parameter estimates show four significant relationships between innovation and market orientation (β=0.31 ,P-value>0.002 and C.R=3.148),innovation and learning orientation ((β=0.716, P-value=0.001 and C.R=3.671), learning orientation and firm’s performance (β=0.44,P -value=0.03 and C.R=2.168), firm’s performance and innovation (β=0.327,P-value=0.013 and C.R=2.482)

Keywords: Market Orientation, Learning Orientation, Risk Taking Orientation, Innovation, Performance

Cite this paper: Rubina Jabeen , Jamal Mohammed Esmail Alekam , Khaldoun Ahmed Mohammed Aldaoud , Nik Kamariah Nik Mat , Bilal Nayef Ibrahim Zureigat , Alharbi Khalid Nahi , Alaa Muhammad Fadel al Junaidi , Hassan , Antecedents of Firm’S Performance. Empirical Evidence from Yemeni Sme’S, American Journal of Economics, Vol. 3 No. 1, 2013, pp. 18-22. doi: 10.5923/j.economics.20130301.04.

Article Outline

1. Introduction

- Firm performance is a function of market structure and the behavior of firms within the competitive and ever changing business world. As indicated in many previous studies, better performance in companies when they focus on market orientation with particular focus on flexibility and speed of response (Noble et al.,[1];Lee & Tsai,[2];Keskin,[3]; Lin et al.,[4] Market orientation is the first step to response the business changing environment. Market orientation is a group of behaviors and process or culture to create superior value for its product and services amongst the customers. Similarly research conducted by Narver, Slater, & Tietje,[5] suggested that market oriented firms are in a better state to define their own value discipline, which allows them to allocate resources more efficiently and to focus on appropriate consumer segments. Many previous literatures suggests that market orientation’s primary goal is to deliver superior customer value, which is based on knowledge derived from customer and competitor analyses and then through integrated process this knowledge is disseminated throughout the organization (Felton 1,[6]; Narver and Slater, [7] Empirical studies provides evidence that market orientation is very important factor affecting firm’s performance (Kumar & Venkatesan, Leone, [8]; Lafferty and Hult,[9]; Eris & Ozmen,[10].According to the study conducted by Slater and Narver,[11] stated market orientation will give more impact on the performance when it is combined with learning orientation. Recently, studies also found that extreme level of market orientation, along with organizational learning and innovation, led to increase value discipline. Several of researchers have shown interest in the concept of learning orientation and its importance. For example, Kaya and Patton,[12] defines learning orientation as "a process of information acquisition, informationdissemination and shared interpretation that increases both individual and organizational effectiveness due to the direct impact on the outcomes."As stated by different researchers such as Han et al.,[13]; Slater and Narver,[14]; Slater and Narver,[15]; Va´zquez-Casielles et al.,[16]Learning orientation and market orientation in organizations increasingly have been considered as a key element for increased performance. Both market orientation and learning orientation involves knowledge about markets, products, process and structures and use of this knowledge are very important to innovativeness thus attaining competitive edge in performance. It is also found that small entrepreneurial firms tend to take more risks. In other words, small entrepreneurial firms often take more risk in terms of innovating their processes and technologies than larger companies. However evidences show that most of the studies have been done on developed countries, particularly in the United States and European countries. There are different factors contributing to organizational performance between developed and developing countries, due to differences in relations to the economic structure, regulation aspect, competitive environment, cultural and the people elements, which is unique to a particular country. There is dearth of research that has been conducted in developing countries especially in the context of SMEs. Small and medium enterprises (SMEs) demanded to develop market orientation concept in their organizations in order to cope with the challenges of changing business environment. This study is conducted in the context of Yemeni SMEs. As mentioned by Khalid [17], Yemeni SME’s have been facing many problems regarding marketing, investors and getting various funding resources, marketing their products and services at local and external level that has led to weak competition position in the local market and especially in-front of the competing imported products. Study in management and marketing support the relations among market orientations, learning organization, innovativeness and performance. However, that relation in SMEs is still low. This study aims to reveal the relations between market orientation, learning orientation, risk taking orientation and innovation for the improvement of SMEs performance in Yemen.

2. Literature Review

- Firms can create superior value by being the low-cost producer of an undifferentiated product or by providing differentiated products more efficiently Porter[18]. Marketing orientation is a valuable resource for a firm in challenging market environment, in exploring opportunities based on unexpressed needs or the failure of competitors to meet expressed needs, or both. Jaworski & Kohli[19] defined market orientation in behavioral context, as several activities that are present within market oriented cultures, such as intelligence generation, intelligence dissemination, and finally the response to new information. Market orientation according to [5], is the culture of the firm which emphasis on the creation of value for customers. Therefore it is suggested that firms with a highly developed market orientation may be able to discover opportunities before rivals and thus establish customer loyalty and market share which may improve firm’s performance. According to Kumar & Venkatesan, Leone,[20] market orientation has a more prominent effect on a company’s profit than sales because market orientation concentrate efforts on customer retention rather than on the acquisition. Suliyanto and Rahab,[21] argue that small and medium enterprises (SMEs) emphasize to develop market orientation concepts in their organizations in order to improve business environment. Basically market orientation is the first step to response on changing business environment. In consistent with the above discussion Ottesen and Gronhaug,[22] studied that along with market orientation, learning orientation aspect, particularly learning from customers is essential. Slater and Narver, [23] said that market orientation only gave impact on business performance when it was combined with learning orientation within the company. According to Baker and Sinkula,[24] argument there is a synergy between market orientation and learning orientation. They argue that a company with lower learning capability is supposed to be less adaptive and weak in market flexibility. Hardley and Mavondo,[25] viewed that learning orientation has significant and positive impact on customers and competitors orientation. Based on his findings, it is revealed that learning orientation influence the relation between market orientation and business performance. Market oriented firms are more capable to gather information related to customer's current and future needs, but firm’s can only transform market information to innovate products to meet customers’ needs, when it has the capacity to innovate. Innovation is conceptualizes as the willingness to use new ideas to improve the efficiency through a technological innovation or by improving the products offering though an externally focused innovation. According to Eris and Ozmen,[26] show that the companies that are market oriented, learning oriented, and innovative are effective on firm’s performance enhancement.

3. Theoretical Underpinning of Study

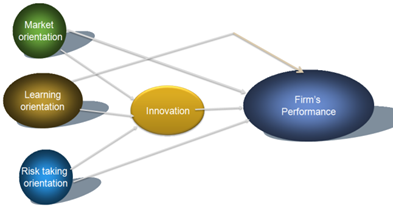

- In this study, RBV theory is used as an underlying framework for understanding the antecedents of firm’s performance. The RBV theory postulates that, marketorientation, innovation and organizational learning altogether bear a unique source for firms Hult and Ketchen,[27]. Based on the studies carried out by Narver and Slater and Kohli and Jaworski,[28] the market orientation concept was linked to various variables and today, the impacts of concepts such as market orientation, learning orientation, risk taking orientation and innovativeness on each other and on the performance of enterprises has been studied.

| Figure 1. Theoretical Framework |

4. Methodology

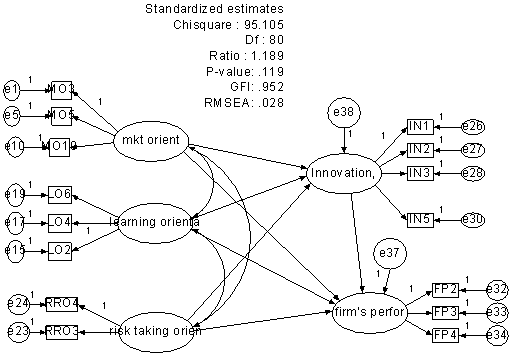

- The sample is taken from 249 SMEs of Aden, Ibb and Sanaa in Yemen. The study identifies four antecedents of firm’s performance i.e.(i) market orientation (ii) learning orientation (iii) risk taking orientation and (iv) innovation. Each of the antecedents is measured using a 7-point likert scale, where, (1 represent strongly disagree and 7 represent strongly agree) to measure the construct. Data was gathered by simple random sampling. The primary data is collected through a survey using questionnaire. 400 questionnaires were sent out to the owners of SMEs, of which 253 were returned representing 63 % response rate. Past validated instruments are used to measure the variables specified namely, market orientation (13 items), learning orientation (7 items), risk taking orientation (5 items), innovation (5 items) and firm’s performance (5 items). In order to ensure accuracy of data entry, adequacy of sample size, missing values, detection of multivariate outliers, prior to all analyses, the data was entered and analyzed using the SPSS 18. First, in the course of data screening for outliers, four outliers were detected and subsequently deleted,leaving a final 249 dataset to be analyzed by using Structural Equation Modeling and AMOS 16..The revised structural model achieves model fit as shown in Figure 2.The goodness of fit indices of the revised model indicate adequate fit as (GFI: 0.952: >0.90; RMSEA: 0.028: <0.08; Ratio cmindf: 1.189: <2 , p-value: 0.119; >0.05). Thus, the hypothesized findings could be generalized to the population. From the 7 direct hypothesized relationships, four are supported.The regression parameter estimates show four significant relationships between innovation and market orientation (β=0.31 ,P-value>0.002 and C.R=3.148),innovation and learning orientation ((β=0.716, P-value=0.001 and C.R=3.671), learning orientation and firm’s performance (β=0.44, P -value=0.03 and C.R=2.168), firm’s performance and innovation (β=0.327,P-value=0.013 and C.R=2.482). while, insignificant relationship are found between innovation and risk takingorientation(β=-0.166,P-value=-0.296 and C.R=-1.046), firm’s performance and risk taking orientation(β=0.086, P-value=0.53 and C.R=0.628) and firm’s performance and market orientation (β=-0.144 P-value=0.099 and C.R=1.649)

| Figure 2. Revised model and standardized estimates |

5. Limitations and Suggestions for Future Research

- The current study has several limitations. The sample size is small and taken from one merging economy, Yemen. Thus the results may not be generalized to other developing countries, so there is a need to expand the geographic scope of this study to further increase external validity. Future studies can be conducted on SMEs with same type of industry, should consider the possibility of increasing the sample size by including more respondents. In addition, as this study is quantitative in nature case study can be employed; interviews can be conducted to account for more detailed results.

6. Conclusions

- The paper discusses the importance of strategic orientation of SMEs to face the competition within and outside country to acquire the opportunities for profit generation. Based on the study, the paper visualizes, that policy makers of Yemen should look at strategic resource enhancement and orientation factors in combination with innovation to fit into a period of sustained economic growth through industrial development. In this study, seven direct causal effects have been proposed: (1) Innovation and market orientation (2) Innovation and learning orientation (3) Innovation and risk taking orientation (4) firm's performance and learning orientation (5) firm's performance and risk taking orientation (6) firm's performance and market orientation (7) firm's performance and Innovation. Interestingly, this study reveals that four causal relationships showed a significant positive effect.

7. Discussions

- It can be seen from analysis results for goodness-of-fit that four hypotheses are supported. Furthermore, the result shows three insignificant relationships between Innovation and risk taking orientation, firm’s performance and risk taking orientation and Firm’s performance and market orientation. This is consistent with previous studies that suggest the positive association between market orientation and performance does not necessarily hold true in developing countries (Appiah-Adu,[29]; Bhuian, [30]. As examined by Yoon & Lee,[31] that there could be differences in term of economic structure, regulation aspect, competitive environment and the people elements, which are unique to a particular country. However, there is a need to conduct more studies to be carried out in other developing countries taking into account the cultural elements of the country.

ACKNOWLEDGEMENTS

- The authors gratefully acknowledge the valuable guidance , patience and support of Prof.Dr. Nik Kamariah Nik Mat and contribution of Jamal Mohammed Esmail Alekam PhD. Candidate, Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML