-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2012; 2(7): 195-205

doi: 10.5923/j.economics.20120207.05

External Debt Relief and Economic Growth in Nigeria

M. C. Ekperiware 1, S. I. Oladeji 2

1Technology, Innovation and Enterprise Studies (TIES) department, National Centre for Technology management (NACETEM) Ile-Ife, PMB 012, Nigeria

2Department of Economics, Obafemi Awolowo University (OAU), Ile-Ife, Osun State Nigeria

Correspondence to: M. C. Ekperiware , Technology, Innovation and Enterprise Studies (TIES) department, National Centre for Technology management (NACETEM) Ile-Ife, PMB 012, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study examined the structural break relationship between external debt and economic growth from 1980 to 2009 with a view to examine the effect of external debt relief on economic growth in Nigeria. The effect of huge external debt of less developed countries is believed to impede investment resources. This has resulted in debt restructuring of various kinds in Nigeria with some concessional loans, as well as the external debt relief in 2005. A decade after the debt relief critical sectors of the economy such as education, health, electricity, transport and exchange rate etc. suppose to show evidence or sources of such debt relief. Some studies found the effect of external debt relief to be doubtful especially on economic growth. Hence, a scientific study of the debt relief granted Nigeria by the Paris club in 2005 is here evaluated in respect of the effect on economic growth in the country. The study used quarterly time series of external debt, external debt service and real gross domestic product to determine the structural break effect of external debt on economic growth in the Nigeria as a result of the debt relief. The result of the chow test showed that the 2005 external debt relief caused a structural break in economic growth relationship with external debt in Nigeria. The study further showed that beside the reduction in aids, resources were freed for economic growth projects in health and education sectors. Conclusively, the external debt relief did make available resources for economic growth in Nigeria. Countries are therefore recommended toward discretional concessional borrowing and see external debt relief as a good option for poor unsustainable indebted countries as a way of making resources available for economic growth. The real sector should be the focal point where value is created rather than impeding it with mismanagement and servicing debt.

Keywords: External Debt Relief, Structural Break, Dummy Structural Break, Aids , Economic Growth

Cite this paper: M. C. Ekperiware , S. I. Oladeji , "External Debt Relief and Economic Growth in Nigeria", American Journal of Economics, Vol. 2 No. 7, 2012, pp. 195-205. doi: 10.5923/j.economics.20120207.05.

Article Outline

1. Introduction

- Nigeria like other developing countries had faced domestic financial constraint. This constraint has made external debt an essential complement to domestic resources for promoting sustainable economic growth among these developing countries. This is possible if the economic benefits from such projects are larger than the interest paid on the debt (1). However, excessive external debt more often than not impedes economic growth. The burden of debt on indebted countries has resulted in channelling of funds to debt servicing, instead of allocating resources to crucial developmental projects (2 and 3).Huge debt of less developed countries has led to debt, constituting impeding factor to economic development of these countries. This has resulted to debt restructuring of various kinds. Debt restructuring is the renegotiation of existing debt to new terms that are accepted by both the creditor and debtor. Restructured debt can be in three ways: rescheduling of debt, debt relief and conversion of debt.Rescheduled debt is change in the terms of agreement and conditions surrounding the amount of debt owed. Debt relief or cancellation is the reduction in outstanding debt obligation. Nigeria has been involved in one form of debt restructuring or the other (4; 5 and 6). Creditor nations introduced debt relief in 1996 and 1999 to Heavily Indebted Poor Countries (HIPC) as a way of removing the impeding effect of debt burden on economic growth, such as debt overhang. Debt overhang occurs when the stock of external debt in a country exceeds her repayment ability (7). Thus, external debt forgiveness will encourage investment, economic growth and probably improve foreign exchange rate in indebted countries (8 and 2). However, external debt relief contributing to economic growth is possible if such countries are able to engage in viable economic projects with their new external debt status without falling back to debt crisis (9). In essence, external debt relief is not automatic but, domestic government good governance and resource utilization are crucial in making such debt relief to boost economic growth (8 and 10).Nigeria achieved the long sought external debt relief from the Paris Club in 2005 that agreed to cancel 60% (18 billion US dollar) of the US$30.85 billion owed to it. This debt relief eventually spared the country from the yearly US$2.3 billion (N345 billion) debt service burden. And expectations are that the deduction of 30 billion US dollar (N4.5 trillion) from Nigerian external debt profile is potent to induce economic growth. The expectations are that the resources required previously to pay and service such external debt should now be channelled to investment and other viable projects to boost economic growth. Despite the debt forgiveness received by Nigeria from Paris club, the evidence of accelerated economic growth looks sketchy (11). The performance in the education, health, exchange rate, external debt stock and servicing should show evidence or sources of the impacts of such debt relief, if not, where is all those resources previously used in servicing these debts gone into or what of the promise of reduction in poverty the government gave if the debt is relief. It is therefore, instructive to find out the direction and the extent of the effectiveness of the debt relief granted to Nigeria. This forms the motivation to examine the trend of macroeconomic variables to illustrate how these variables performed before, during and after the external debt relief and establish a structural break in the relationship of external debt, external debt service and economic growth in Nigeria. This debate of external debt relief has established two schools of thought; the argument for and against external debt relief as a tool for economic growth. Some authors are of the view that debt relief significantly will improve economic growth (12; 13 and 14) while other authors are of the view that debt relief have no potential of improving economic performance on its own (15 and 16). This controversy prompts a country case study of external debt relief examination. These conflicting positions have given rise to the need for an examination of external debt relief using Nigeria as a case study. This research would go a long way to bring to light the external debt relief impact on economic growth by establishing the structural break in the relationship between external debt and economic growth in Nigeria.

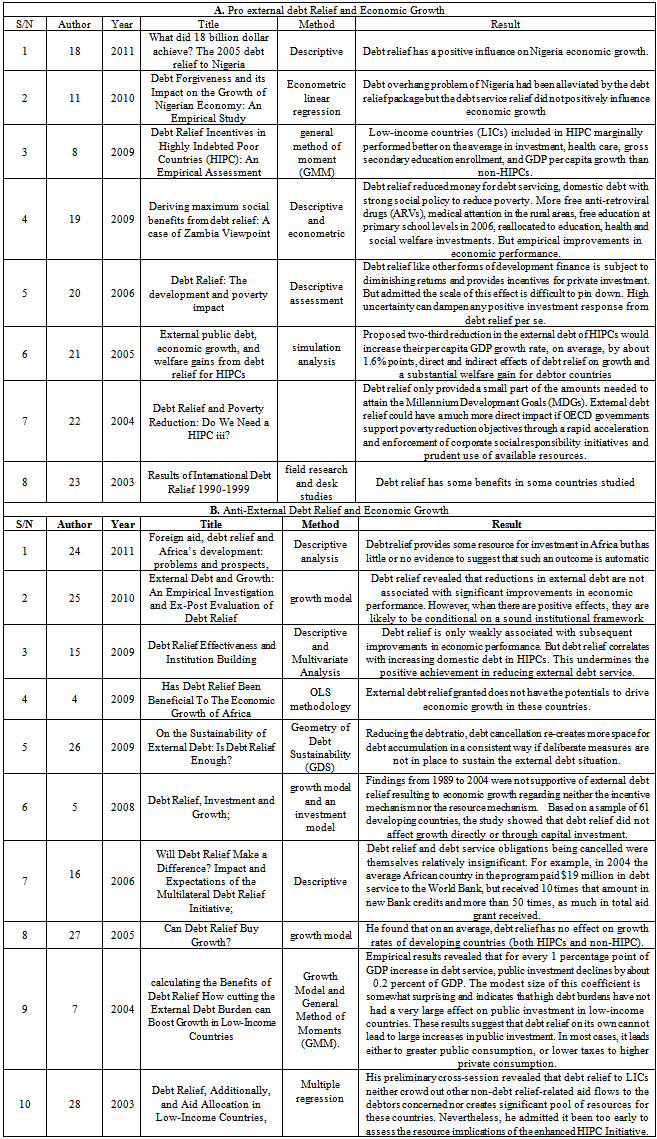

2. Empirical Literature Review

- Debt relief is an agreement by a creditor of an indebted firm or country to accept reduced or postponed interest and redemption payments from the debtor (17). In different country studies since the external debt relief initiative, some studies have shown the effect of external debt cancelation/relief on economic growth. Some empirical studies found positive effect of external debt relief on economic growth while others did not found any significant effect of external debt relief on economic growth. Both positive and negative findings are presented below.From the literature review, debt relief in some case is evident in economic indicators, while in some other studies, it has no effect on economic performance because of several reasons and conditions. This prompts this study toexamine the effect of the $30billion relief in 2005 on economic growth in Nigeria.

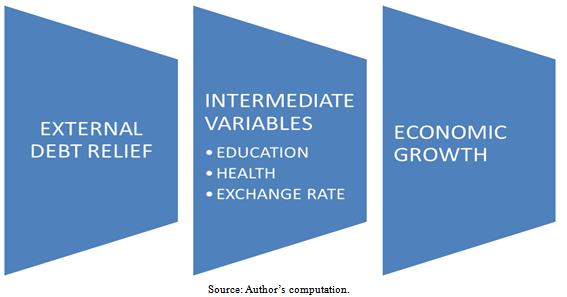

3. Theoretical Perspective of External Debt Relief and Economic Growth

- The position of economic theory on the relationship between external debt relief and economic growth is vital to this study. The literature presents both positive and negative effect of debt relief on economic growth. External debt relief lowers the debt service in the future of the debtor country. Proponents focus on two different channels: the incentive mechanisms and the resource mechanism (28). On the other hand, opponents question the existence of both the incentive and resource mechanism, particularly in low-income countries.

3.1. The Incentive Mechanism Theory (Debt Overhang Theory)

|

3.2. The Resource Mechanism Theory

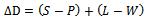

- The resource mechanism theory emphasizes the crowding-out effect theory (30 and 31). In the case of a high debt burden, debt service payments crowd out investment and thereby impede economic growth. In this setting, debt relief can affect investment and growth through an expansion in public spending by easing the government’s budget constraints. (28) provided an accounting identity to show how debt relief can actually generate resources and ease the government budget constraint. Some premises for resource mechanism are established. Resources are only freed if the country has actually been servicing its debt (P) and if the revenue collection in the country is not reduced (T). Moreover, debt relief has to be in addition to granted aid (A) (28). (32) looked at two accounting identities: the evolution of indebtedness and the fiscal constraint on a debtor.

| (1) |

| (2) |

4. The Trend of Some Macroeconomic Variablesin Nigeria

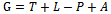

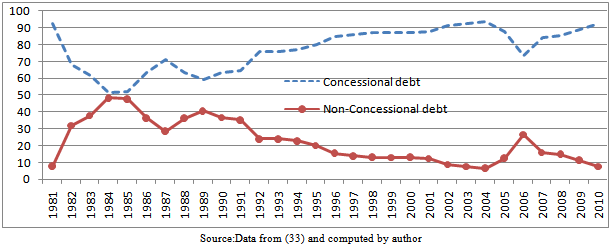

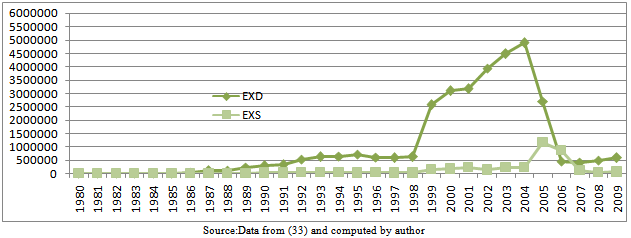

- This section examines the trend of external debt, external debt service, financial aid, education, health, exchange rate and economic growth of Nigeria before and after the external debt relief to illustrate the behaviour of the variables of interest. The Nigeria external debt profile was both concessional and non-concessional borrowing but from the early 1990s, concessional borrowings were sought more in bridging the savings gap in the country as shown below.As shown in figure 2, the value of external debt rose significantly above the value of aids from abroad. Before the external debt relief, aids from abroad increased between 2004 and 2005 but soon after the debt relief, the value of aids decreased significantly. More disturbing to the gains from the Paris Club debt relief was that the value of aid from the UK dropped sharply to the zero line. The need for investigating the aid flow from abroad was informed by the fact that aid was like debt relief, and aid from abroad may drop on the account that the country just benefited from debt relief. Indeed, aid from UK and other countries did drop and this may impede the gains from external debt relief. (28) asserted that if debt relief would improve economic growth, aid inflow must not drop, but if not, debt relief would just be an accounting exercise.

| Figure 1. Trend of Nigeria Concessional and Non-concessional External Debt (%) |

| Figure 2. Trend of Nigeria External Debt and Financial Aid Composition (1980-2009) |

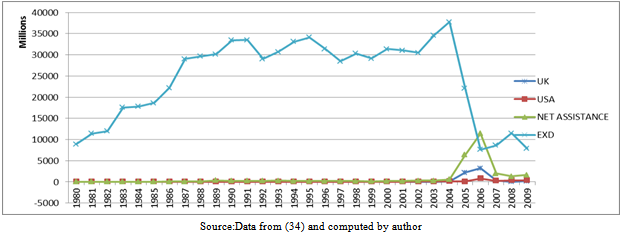

| Figure 3. Trend of Total Debt Service in Nigeria (2005-2010) |

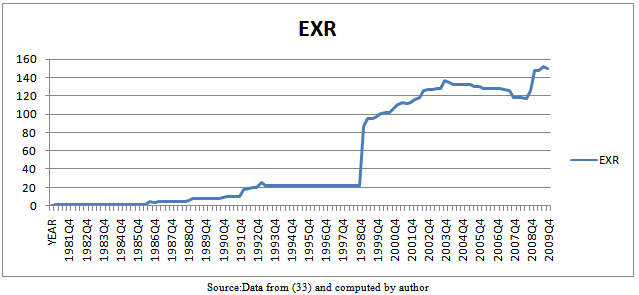

| Figure 4. Trend of Nigeria Exchange Rate (1982:1-2009:3) |

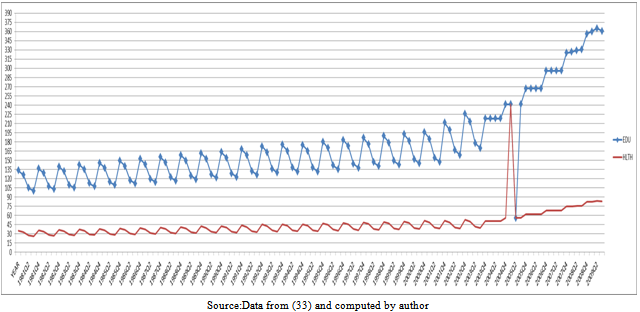

| Figure 5. Trend of Nigeria Health and Education Output (1982:2-2009:3) |

5. Method and Materials

- The method used here would show if the external debt relief had caused any difference in the economic performance of Nigeria. Chow-test is a regression technique that shows if there is a structural break in the relationship between the regress (Yt) and the regressor(s) (Xit). By structural change, the parameters of the model do not remain the same through the entire period (36). The period covered by this study is from 1980-2009. The choice of this period is because Nigerian external debt really began to mount within this period and the 1999 struggle for debt relief that finally came in 2005 (6).

| Figure 6. Trend of Nigeria External Debt and External Debt Service (1980-2009) |

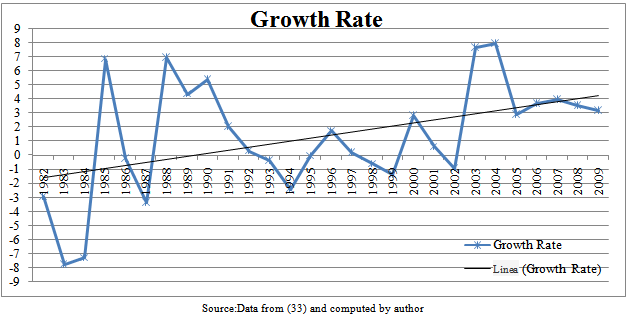

| Figure 7. Trend of Nigeria GDP Growth Rate (1980-2009) |

| Figure 8. Transmission Mechanism of External Debt Relief Effect on Economic Growth |

5.1. Identification of Structural Break Test

- This section underscores the structural chow test with a view to establishing the structural relationship between external debt, external debt service and economic growth before and after the external debt relief in Nigeria. That is, if the Nigeria GDP significantly changed under the reviewed period (1980 to 2009) because of the external debt relief granted to Nigeria in the first quarter of 2005.

5.2. Model Specification

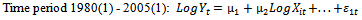

- Two periods were observed: pre- and post-2005 external debt relief periods. Thus, we have three possible regression specifications:

| (5.1a) |

| (5.2a) |

| (5.3a) |

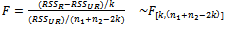

| (5.4) |

5.3. Chow Test Estimation

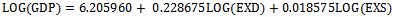

- From our specification in subsection 5.2, regression 5.3a assumed that there was no difference in economic growth between the two time period; that is, no structural break over the entire period (1980-2009) caused by external debt relief. Hence, the regression estimates thus:BETWEEN 1980:1-2005:1

| (5.1b) |

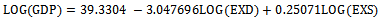

| (5.2b) |

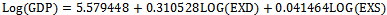

| (5.3b) |

Where * Shows statistical significant at 5% and RSS3 or RSSR is the restricted or pooled RSSThe estimated regressions suggested that the relationship between external debt (EXD), external debt service (EXS) and gross domestic product (GDP) were not the same in the two subperiods. The partial slope coefficients in the first regression 5.1b showed that EXD contributed 0.23 units to one unit change in GDP. External debt service contributed 0.02 units to one unit change in GDP. The result showed that external debt positively contributed to economic growth in the country between 1980:1 and 2005:1 with a significant F statistics and positive autocorrelation among the variables. Between 2005:2 and 2009:4 in the second regression, EXD negatively contributed to GDP (though with a weak t statistical proof) while EXS presented a positive coefficient of 0.25 units. This result also have high explanatory power (R2=60%) with the required Durbin Watson (DW=2.28) regression correlation but significant F statistics only at 25%. This can be attributed to the small degree of freedom. The third regression (5.3b), where we assumed no structural break (pooled regression), showed R2=52 (52% explanatory power) and no serial autocorrelation of DW=2.5 among the variables with a significant F statistics. The result showed that EXD positively contributed 0.31 to a unit change in GDP significantly at 5% and EXS contributed 0.04 to a unit change in GDP.The mechanism of Chow test depends less on individual coefficients and regressions significances but rather, the result of the overall F statistic of the model. But it would be useful to have a formal test of the reliability of the Chow test result before it becomes our deciding tool if external debt relief indeed has a structural break in the relation between external debt and GDP. This is where the test for similarity of error variance test comes in handy (37).

Where * Shows statistical significant at 5% and RSS3 or RSSR is the restricted or pooled RSSThe estimated regressions suggested that the relationship between external debt (EXD), external debt service (EXS) and gross domestic product (GDP) were not the same in the two subperiods. The partial slope coefficients in the first regression 5.1b showed that EXD contributed 0.23 units to one unit change in GDP. External debt service contributed 0.02 units to one unit change in GDP. The result showed that external debt positively contributed to economic growth in the country between 1980:1 and 2005:1 with a significant F statistics and positive autocorrelation among the variables. Between 2005:2 and 2009:4 in the second regression, EXD negatively contributed to GDP (though with a weak t statistical proof) while EXS presented a positive coefficient of 0.25 units. This result also have high explanatory power (R2=60%) with the required Durbin Watson (DW=2.28) regression correlation but significant F statistics only at 25%. This can be attributed to the small degree of freedom. The third regression (5.3b), where we assumed no structural break (pooled regression), showed R2=52 (52% explanatory power) and no serial autocorrelation of DW=2.5 among the variables with a significant F statistics. The result showed that EXD positively contributed 0.31 to a unit change in GDP significantly at 5% and EXS contributed 0.04 to a unit change in GDP.The mechanism of Chow test depends less on individual coefficients and regressions significances but rather, the result of the overall F statistic of the model. But it would be useful to have a formal test of the reliability of the Chow test result before it becomes our deciding tool if external debt relief indeed has a structural break in the relation between external debt and GDP. This is where the test for similarity of error variance test comes in handy (37).5.4. Testing the Similarity of Error Variances

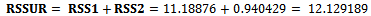

- A crucial requirement underlying the usage of chow test and to rely on the result was that the error variances in the regressions in (5.1b and 5.2b) were the same (36). Since we cannot observe the true error variances of regression (5.1a) and (5.2a), we can observe their estimates from the RSS given in regression (5.1b) and (5.2b).

Since the F calculated (1.58) is not greater than the critical F value (from the F table, for 3 and 114 df, at 5 percent-critical F value is 2.68)

Since the F calculated (1.58) is not greater than the critical F value (from the F table, for 3 and 114 df, at 5 percent-critical F value is 2.68)  , the null hypothesis of similarity of error variances is not to be rejected. This means that the error variances of the two subperiod are statistically the same (i.e. the sub regressions are from the same sampled population) and the chow test is to be validly used.

, the null hypothesis of similarity of error variances is not to be rejected. This means that the error variances of the two subperiod are statistically the same (i.e. the sub regressions are from the same sampled population) and the chow test is to be validly used. 5.5. Discussion of Chow Test Result

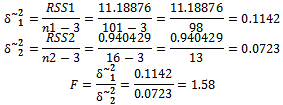

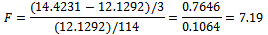

- The computed F value is obtained as (from equation 4.1, 4.2 and 4.3)

5% critical F value

5% critical F value  Since the computed F value 7.19 is greater than the critical F value 2.68, the 2005 external debt relief did significantly caused a change in how external debt, external debt service relations with economic growth in Nigeria. The null hypothesis of no structural break between 1980 and 2009 is rejected. The Chow test therefore seems to support our earlier hunch that the external debt–economic growth relation has undergone a structural change in Nigeria over the period 1980–2009 because of the 2005 external debt relief granted to Nigeria. It shows that the present external debt of Nigeria because of the debt relief has reduced the amount allotted for external debt servicing in the country. This has provided resources to growth enhancing investments in the country. The current stable economic growth trend could be a pointer to our result (33).

Since the computed F value 7.19 is greater than the critical F value 2.68, the 2005 external debt relief did significantly caused a change in how external debt, external debt service relations with economic growth in Nigeria. The null hypothesis of no structural break between 1980 and 2009 is rejected. The Chow test therefore seems to support our earlier hunch that the external debt–economic growth relation has undergone a structural change in Nigeria over the period 1980–2009 because of the 2005 external debt relief granted to Nigeria. It shows that the present external debt of Nigeria because of the debt relief has reduced the amount allotted for external debt servicing in the country. This has provided resources to growth enhancing investments in the country. The current stable economic growth trend could be a pointer to our result (33).5.6. Dummy Structural Break Estimate and Result

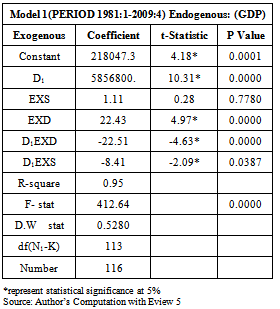

- The Chow test method did not tell us the source of such break, whether in intercept or slope coefficient. A popular tool that guided this work to further affirm and identify any structural break sources is the dummy structural break test (dummy Chow Test method). We quantify the effect of the 2005 external debt relief on economic growth by constructing a nominal artificial variable (dummy variable). Here, the dummy variable (called the differential intercept) assumed 0 in period before the external debt relief (1981:1-2005:1) and the period after the debt relief was assigned 1 (2005:2-2009:4) in a single regression and slope drifters to capture the effect of the external debt cancellation granted to Nigeria by the Paris Club of London in 2005 on Nigerian economic growth. The regression estimates are presented bellow;

|

6. Discussion of Basic Findings

- Here the major findings from the study based on the set objectives are highlighted.

6.1. Sources of External Debt and Trend

- (i)The study revealed that Nigeria external debt was more from concessional official source (87.5% in 2005 and 92.7% in 2010) than non-concessional private source (12.5% in 2005 and 7.3% in 2010). Specifically, Paris Club before the external debt relief constituted larger portion (75.3%) of the Nigerian external debt but after the debt relief, multilateral external debt became the major source (92.7%). (ii)External debt (EXD) and external debt service (EXS) graphs showed that the external debt relief brought a significant fall in EXD and EXS in the country. However, the graph of aid from the UK and other developed countries dropped significantly. Specifically, aid from the UK before the debt relief trend upward but dropped to the zero line soon after the debt relief.(iii)Economic growth rate, health and education output graphs showed significant upward trend during the 2005 external debt relief. Also, the Nigerian exchange rate (EXR) improved during the period.

6.2. Debt Relief and Economic Growth: Structural Break

- (i)A pooled sample test of external debt, external debt service and GDP before and after the external debt relief of 2005 revealed that the different samples are significantly from the same populations. This significant finding is crucial in applying a structural break test among the different period samples to validly investigate the effect of the 2005 external debt relief in the Nigerian economy.(ii)The null hypothesis of no structural break between 1980 and 2009 is rejected. The Chow test therefore support our earlier hunch that the external debt–economic growth relation has undergone a structural change in Nigeria over the period 1980–2009 because of the 2005 external debt relief granted to Nigeria. A further verification of the sources of the break through dummy chow test confirmed both intercept and slope coefficient structural break relationship of external debt and economic growth in Nigeria(iii)The present external debt of Nigeria because of the debt relief has reduced the amount allotted for external debt servicing in the country. This has provided resources to growth enhancing investments in the country. (iv)the study revealed that the impact of debt relief on economic growth is not in the act of the debt cancellation but the venture resources previously used in servicing the debt is been put into that would reflect on the economic output of such recipient organisation or country.(v)Hence, from the study, the 2005 debt relief released resources for investment in human capital and this has paid up in the stable economic growth observed in the study.

7. Conclusions

- The general observation from the study revealed that Nigeria external debt constitute more of concessional than non-concessional debt. The external debt and external debt service significantly reduced because of the external debt relief in the country. However, financial aid from the UK and other developed countries dropped significantly. Specifically, aid from the UK before the debt relief trend upward but dropped to the zero line soon after the debt relief. Economic growth rate, health, Nigerian exchange rate and education outputs significantly improved during the 2005 debt relief. A structural break in the relationship between external debt and economic growth in Nigeria was identifies as a result of the external debt relief from both the intercept and slope coefficient, including a significant over all F statistic at 5% level of significant. The study therefore concludes that because of the 2005 external debt relief, the Nigerian economy has undergone a structural change in external debt – economic growth relation through investment in human capital in the country

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML