-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Computer Science and Engineering

p-ISSN: 2163-1484 e-ISSN: 2163-1492

2025; 15(5): 107-113

doi:10.5923/j.computer.20251505.01

Received: May 28, 2025; Accepted: Jun. 19, 2025; Published: Jul. 4, 2025

Revolutionizing Hedge Management: The SAP S/4HANA Hedging Cockpit Advantage

Narinder Pal Verma

Capgemini America Inc, Valencia, California, USA

Correspondence to: Narinder Pal Verma, Capgemini America Inc, Valencia, California, USA.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Given the financial markets' volatility, it is essential to employ a hedge strategy to reduce risk exposure and stabilize revenues. Additionally, integrating hedge management with accurate General Ledger entries ensures hedging transactions are accurately recorded and presented in financial reports. SAP S/4HANA Treasury meets these requirements with its Hedging Cockpit and user-friendly SAP Fiori App for hedge management. This article covers the fundamentals of hedge strategy and hedge accounting concepts, as well as the generation of automated GL postings, including the deferral of recognition and subsequent reclassification. A process flow using the Fiori App demonstrates optimized end-to-end hedge management for enhanced transparency, efficiency, and regulatory compliance.

Keywords: Hedge Strategy, Hedge Accounting, General Ledger Accounting, Hedging Cockpit, SAP Fiori App, SAP S/4HANA Treasury, IFRS 9, Risk Management, Financial Derivatives, Cash Flow Hedge, Fair Value Hedge

Cite this paper: Narinder Pal Verma, Revolutionizing Hedge Management: The SAP S/4HANA Hedging Cockpit Advantage, Computer Science and Engineering, Vol. 15 No. 5, 2025, pp. 107-113. doi: 10.5923/j.computer.20251505.01.

Article Outline

1. Introduction

- Treasury and Risk Managers face challenges related to fluctuations in foreign currency exposures and interest rates. To address these issues, the team engages in hedging activities. Hedging is a financial strategy used to reduce or mitigate the risk of adverse price movements in assets, liabilities, or cash flows. It involves taking an offsetting position in a financial instrument, typically a derivative such as a forward contract, futures, options, or swaps, to protect against uncertainties like currency fluctuations, interest rate changes, or commodity price volatility. Think of hedging as an insurance policy: it doesn’t eliminate risk but limits potential losses while allowing businesses to focus on their core operations.For example, a company expecting revenue in a foreign currency might use a forward contract to lock in an exchange rate, shielding itself from unfavourable currency movement.SAP S/4HANA Treasury and Risk Management (TRM) offers a robust platform to manage these hedging activities, with the Hedge Management Cockpit serving as a central tool for streamlining processes. This article explores the concept of hedging, its strategies, accounting treatment, and how the SAP S/4HANA Hedge Management Cockpit enhances hedge management.

2. Understanding Hedging and Its Strategies

- Hedging involves taking an offsetting position in a financial instrument to reduce the risk of adverse price movements in an asset or liability. It’s akin to an insurance policy, designed to protect against unfavorable market shifts while allowing companies to focus on their core operations. Common hedging strategies include:1. Cash Flow Hedging: This strategy mitigates risks associated with future cash flows, such as expected foreign currency sales or variable interest rate payments. For example, a company expecting USD revenue from exports can use a forward contract to lock in an exchange rate, reducing exposure to currency fluctuations.2. Fair Value Hedging: This Strategy is used to protect against changes in the fair value of assets, liabilities, or firm commitments. This strategy aligns the accounting treatment of the hedged item and the hedging instrument to minimize volatility in financial statements. For instance, a company might hedge a fixed-rate bond against interest rate changes using an interest rate swap.3. Net Investment Hedging: Multinational corporations often hedge the currency risk of foreign subsidiaries’ net assets. This involves using derivatives to offset exchange rate impacts on the parent company’s consolidated financial statements.4. Base Currency Hedging: In centralized FX risk management, companies hedge all exposures against a single base currency (e.g., USD) to simplify processes and leverage natural offsets from netting exposures across subsidiaries.Each strategy requires careful planning, documentation, and effectiveness testing to ensure compliance with accounting standards like IFRS 9 or ASC 815, which govern hedge accounting. Hedge accounting aligns the timing of gains or losses from the hedged item and hedging instrument, reducing earnings volatility.

3. Importance of Hedge Strategy

- Hedge strategy is the cornerstone of mitigating financial risk and stabilizing earnings by aligning financial instruments with the underlying exposures. Key elements include:1. Clear Documentation: Establishing a formal hedge relationship by defining the hedged item, the hedging instrument, and the nature of the risk exposure is essential for both internal control and regulatory compliance.2. Effectiveness Testing: Regular assessments verify that the hedging instrument’s performance sufficiently offsets the inherent risk, ensuring that gains and losses are recorded appropriately.3. Regulatory Alignment: Adopting hedge accounting principles under IFRS 9 ensures that the timing of recognition for gains and losses on both the hedging instrument and the hedged item is synchronized.By following these processes, organizations ensure that the economic impact of hedging is accurately captured in financial statements.

4. What is Hedge Effectiveness, and Why is It Important?

- Hedge effectiveness is a measure to assess how efficiently your hedging instruments cover the risk of Hedge items like future payments.To qualify for Hedge Accounting, the hedge relationship should be effective. Example:- You are about to receive 600M EUR after 6 Months and to currency risk, you entered into a forward contract to sell 600 M EUR after 6 months, which means the maturity date & the amount of the Forward Contract should match with the Inflow to make it effective. In case of 400 Mill, you are left under the hedge & in case of 800 Mill, you make it over the hedge, and increase the risk.

5. Fundamentals of Hedge Accounting

- Hedge accounting synchronizes the financial impacts of the hedging instrument and its related hedged item, thereby reducing reported earnings volatility. The key principles include:1. Matching Principle: Gains and losses incurred by the hedging instrument are initially deferred on the balance sheet and later reclassified into profit and loss as the hedged item impacts earnings.2. Formal Documentation & Qualification: Detailed documentation at the inception of a hedge—specifying the risk, the hedging instrument, and the method of effectiveness testing—is mandatory.3. Ongoing Effectiveness Evaluation: Periodic testing confirms that hedge relationships remain highly effective. Should effectiveness decline, adjustments to the accounting treatment are made.Adhering to these principles ensures that only the effective portion of the hedge’s gains and losses is recognized, thereby enhancing reporting accuracy.

6. The Role of the Hedging Cockpit in SAP S/4HANA Treasury

- The SAP S/4HANA Treasury Hedging Cockpit centralizes the management of hedge relationships by consolidating documentation, real-time monitoring, and automated accounting integrations in a single platform.

6.1. Centralized Hedge Relationship Setup

- • Data Capture and Formal Designation: Users configure hedge relationships by selecting the hedged item, the hedging instrument, and capturing key risk exposure details. This creates a fully auditable record that meets IFRS 9 requirements.

6.2. Automated Real-Time Effectiveness Monitoring

- • Integrated Algorithms and Dashboards: The cockpit uses automated calculations to continuously measure hedge effectiveness against real-time market data. Dynamic dashboards provide treasury professionals with KPIs and automated alerts to trigger timely interventions.SAP uses a combination of quantitative and qualitative methods to assess hedge effectiveness, depending on the configuration and accounting standards (like IFRS or US GAAP). Here’s a breakdown of the key algorithms and approaches:a) Critical Terms Match (CTM) – A qualitative method where the key terms of the hedging instrument and the hedged item (e.g., notional amount, maturity, underlying) are compared. If they align closely, the hedge is presumed effective.b) Dollar Offset Method – A retrospective quantitative test that compares the change in fair value or cash flows of the hedging instrument to that of the hedged item. The ratio must typically fall within 80–125% to be considered effective.c) Regression Analysis – A statistical method used in prospective testing to predict the relationship between the hedged item and the hedging instrument. A high R-squared value (typically above 0.8) indicates strong effectiveness.d) Hypothetical Derivative Method – Often used in cash flow hedges, this method involves constructing a hypothetical derivative that perfectly offsets the hedged risk, then comparing it to the actual hedge.SAP-Specific Configuration (FS-BA-PM-HP) – In SAP’s Hedge Management component, the effectiveness test rule allows users to define how the system evaluates hedge relationships. This includes setting thresholds, choosing offset methods, and determining whether to run prospective or retrospective tests.

6.3. Seamless Accounting Integration

- • Automated GL Postings: When a hedge is declared effective, the system automatically posts deferred entries reflecting gains or losses on the hedging instrument. As the hedged item impacts earnings, these amounts are reclassified from a dedicated hedging reserve on the balance sheet into the profit and loss statement.

7. General Ledger Accounting Entries for Hedging

- A critical achievement of the Hedging Cockpit is the automation of GL accounting entries associated with hedge transactions. The key processes include:

7.1. Deferred Recognition of Hedge Gains/Losses

- When a hedging instrument (for example, a forward forex) is designated, its fair value changes are recorded without an immediate impact on profit or loss. Instead, the effective portion is deferred as follows:• Initial Entry Upon Hedge Inception:Description: The value change of the hedging instrument is recorded, with the effective gain or loss moved to a dedicated hedging reserve account on the balance sheet.

7.2. Reclassification to Profit and Loss

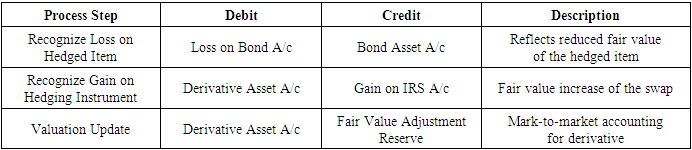

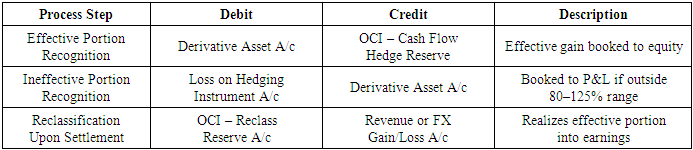

- As the hedged item impacts earnings, deferred gains or losses are reclassified to the income statement:• Reclassification Entry:Description: The effective portion held in the hedging reserve is transferred into profit and loss, matching the timing of the underlying transaction’s effect on earnings.Example:-1. Fair Value HedgeProcess: Interest Rate Risk Hedging using Interest Rate Swap

|

|

7.3. Continuous GL Integration

- All journal entries are automatically propagated across parallel ledgers and integrated within the overall SAP financial reporting framework. This integration ensures:• Consistent updates across the financial system.• Accurate, real-time reporting.• Reduced manual intervention and an auditable trail of hedge accounting transactions.

8. S/4HANA Fiori App for Hedge Management Process Flow

- An integral component of SAP S/4HANA is its suite of Fiori applications that provide an intuitive, role-based user interface for managing hedge processes. The Fiori App for Hedge Management simplifies the end-to-end flow—from hedge initiation through effective monitoring to automated accounting integration.

8.1. Overview of the Process Flow

- The SAP Fiori App for Hedge Management guides treasury professionals through a structured process that includes:1. Hedge Initiation & Documentationa) Functionality: The Fiori App provides a wizard-based interface where users capture all necessary data—selecting hedged items, defining hedging instruments, and specifying risk exposures.b) Outcome: A formal hedge relationship is established with all relevant documentation integrated with master data.2. Hedge Effectiveness Testing & Monitoringa) Functionality: Real-time dashboards display effectiveness metrics via integrated algorithms that compare changes in the hedging instrument's fair value with that of the hedged item.b) Outcome: Continuous monitoring with automated alerts enables proactive management should effectiveness fall below a set threshold.3. General Ledger Accounting Integrationa) Functionality: Once the hedge is effective, the Fiori App triggers automated GL entries. The deferred recognition is recorded and, when appropriate, reclassified into profit and loss following preset schedules.b) Outcome: Automated and accurate recording of hedge-related GL entries minimizes manual intervention and errors.4. Reporting & Analysisa) Functionality: The app offers detailed drill-down reports and trend analyses that provide insights into hedge performance and the impact on financial statements.b) Outcome: Enhanced transparency for management review and regulatory reporting.

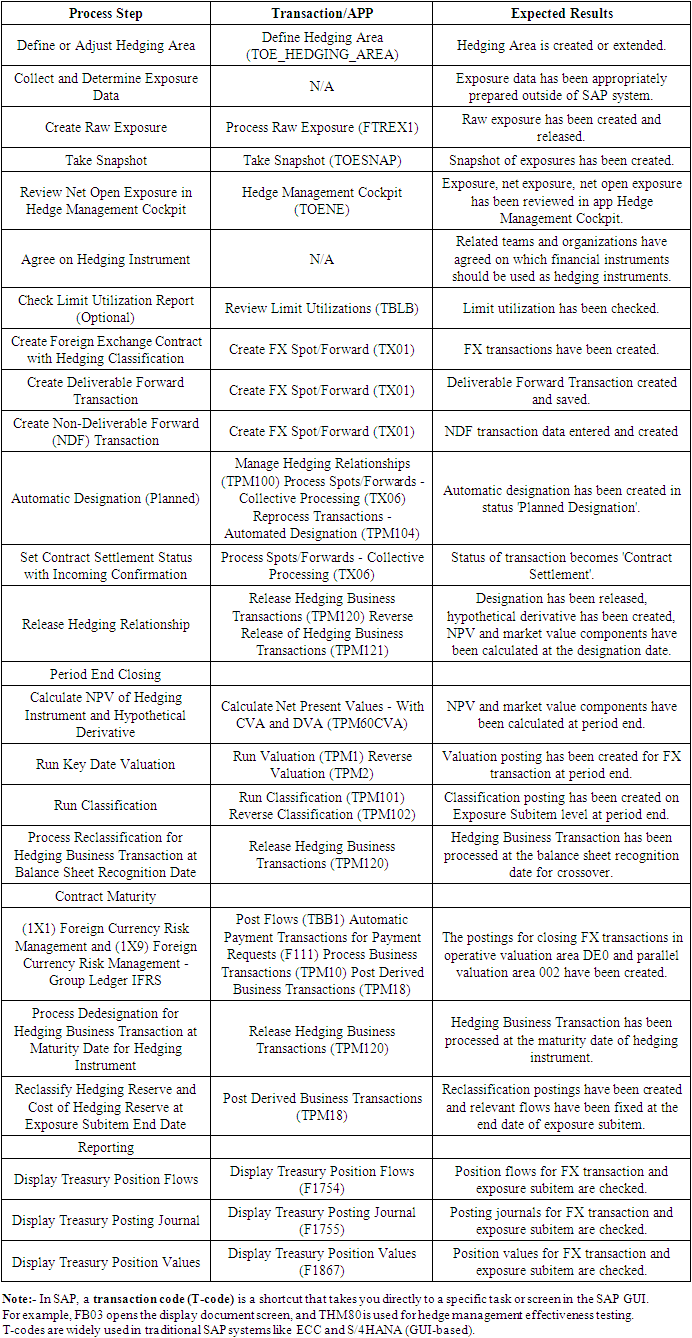

8.2. Process Flow

- A simplified representation of the end-to-end process flow is illustrated in the table below with the Fiori App’s:

|

8.3. Benefits of the Fiori App

- • Enhanced User Experience: The intuitive, role-based design significantly cuts training time and improves productivity.• Reduced Manual Intervention: Automation throughout the process flow minimizes errors and expedites financial closings.• Improved Decision Making: Real-time data and integrated analytics empower treasury teams to react swiftly to market shifts.

9. Benefits, Challenges, and Best Practices

9.1. Benefits

- • Comprehensive Risk Overview: The cockpit aggregates exposure data from various sources to provide a holistic view of FX risk. For example, if a multinational company holds transactions in different currencies, the system can consolidate these positions to calculate the net open exposure—the amount of risk that isn’t yet hedged. This overview enables the CFO and risk managers to identify vulnerabilities quickly and decide on additional hedging measures if an imbalance is detected. This consolidation and clarity support strategic financial planning and efficient risk management.• Real-Time Insights and Monitoring: Access to up-to-date market data is a key strength. Imagine a scenario where sudden geopolitical events cause currency volatility; the cockpit continuously recalculates key figures, such as net exposures and potential risk scenarios, in near real-time. This rapid feedback loop means that portfolio managers can immediately assess the impact of market shifts on current hedges and respond before losses accumulate. Such real-time monitoring is essential for mitigating unexpected FX risks, ensuring the business stays agile in turbulent markets.• Automated Hedge Requests and Adjustments: A standout feature is the automated handling of hedge requests. Consider a situation where the system identifies an overhedge—a scenario where hedging positions exceed actual exposures. Instead of manually performing time-consuming reconciliations, the system offers automated functions to initiate FX hedge, swap, dedesignation, or termination requests with just a few clicks. This automation reduces the potential for human error and significantly speeds up the process of realigning the hedging strategy. It’s like having a smart assistant that alerts you when adjustments are needed and helps execute them promptly.• Enhanced Compliance and Accounting Integration: For organizations bound by rigorous accounting standards such as IFRS 9 and U.S. GAAP, the cockpit provides integrated hedge accounting features. For instance, by automating the designation, classification, and reclassification of hedging instruments, the tool not only streamlines daily operations but also ensures that the company’s records are in perfect alignment with accounting norms. This reduces the risk of compliance issues and simplifies the audit process, giving both management and external auditors a reliable, transparent view of the hedging activities.Streamlined Treasury Operations Finally, the Hedge Management Cockpit supports a more agile treasury function. By automating labor-intensive processes and consolidating information on various FX instruments (spots, forwards, swaps, options), the system frees up treasury teams to focus on strategic decision-making rather than routine administrative tasks. For example, a treasury department that typically spends hours verifying each instrument’s hedge status can instead use that time to analyze market trends and refine overall FX risk strategies—directly impacting the company’s competitive edge.

9.2. Challenges

- • System Integration Complexity: Coordinating hedge accounting processes with the overall GL architecture requires careful configuration and regular audits.• Dynamic Reevaluation: Frequent adjustments may be required in volatile markets, challenging the flexibility of pre-configured automated processes.• User Expertise: Adequate training is essential for treasury and accounting teams to fully leverage the integrated system.

9.3. Best Practices

- • Regular Training and Auditing: Continuous education and periodic reviews of generated GL postings help ensure compliance and uphold system integrity.• Proactive Monitoring: Leverage real-time analytics offered by the Fiori App to adjust hedge relationships and corresponding GL entries promptly.• Integrated Financial Reporting: Ensure reconciliation of hedge entries with broader financial reporting to provide a comprehensive view of overall risk management.

10. Conclusions

- Integrating hedge strategy with rigorous hedge accounting and precise General Ledger entries is imperative for effective risk management and accurate financial reporting. The SAP S/4HANA Treasury Hedging Cockpit, in conjunction with an intuitive SAP Fiori App, streamlines the entire hedge management process—from initiation and effectiveness testing to automated GL postings and detailed reporting. By automating deferred recognition and subsequent reclassification, these integrated tools minimize manual processing, reduce errors, and ensure compliance with IFRS 9. Organizations that adopt these best practices are better equipped to mitigate financial uncertainty, stabilize earnings, and sustain long-term financial stability.

11. Glossary: SAP Hedging Cockpit

- • Hedge Management Cockpit (TOENE): A centralized SAP interface for managing and monitoring hedging activities, including exposure analysis, hedge requests, and effectiveness testing.• Exposure Item: A financial position (e.g., forecasted transaction or firm commitment) subject to market risk, which can be hedged.• Hedge Request: A formalized instruction within SAP to initiate a hedge for a specific exposure. It can be created manually or automatically based on predefined rules.• Net Open Exposure (NOE): The unhedged portion of risk exposure after considering existing hedges. SAP allows users to manage NOE through the cockpit.• Hedging Instrument: A derivative (e.g., forward, option, swap) used to offset the risk of an exposure item.• Effectiveness Test: A quantitative or qualitative assessment to determine whether a hedge relationship meets accounting standards (e.g., IFRS 9 or ASC 815).• Snapshot (TOESNAP): A record of exposure and hedge positions at a specific point in time, used for audit and analysis.• Hedge Accounting: The process of aligning the accounting treatment of hedging instruments and hedged items to reduce volatility in financial statements.• Critical Terms Match (CTM): A qualitative method for hedge effectiveness testing where key terms of the hedge and exposure are compared.• Dollar Offset Method: A retrospective test comparing changes in fair value or cash flows between the hedged item and the hedging instrument.• Regression Analysis: A statistical method used in prospective effectiveness testing to evaluate the correlation between the hedged item and the hedging instrument.• Hypothetical Derivative: A theoretical instrument used to model the perfect hedge for comparison in effectiveness testing.• Termination Request: A process to unwind or discontinue a hedge relationship, often triggered by changes in exposure or strategy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML