-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Computer Science and Engineering

p-ISSN: 2163-1484 e-ISSN: 2163-1492

2024; 4(5): 108-119

doi:10.5923/j.computer.20241405.03

Received: Aug. 23, 2024; Accepted: Sep. 11, 2024; Published: Sep. 14, 2024

Financial Close Automation with SAP S4 HANA Advanced Financial Close Technology

Shoukathali Jambagi

MBA – Finance, SAP Finance Solution Architect, Los Angeles, California, United States of America

Correspondence to: Shoukathali Jambagi, MBA – Finance, SAP Finance Solution Architect, Los Angeles, California, United States of America.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

SAP Advanced Financial Closing (SAP AFC) is a cloud-based solution aimed at optimizing, automating, and orchestrating the financial closing process. By integrating seamlessly with SAP S/4HANA and other ERP systems, SAP AFC helps organizations streamline complex tasks involved in period-end financial close. Its core features include automation of repetitive activities, task and workflow management, real-time tracking of closing processes, and enhanced collaboration tools. These capabilities contribute to increased efficiency, reduced errors, and improved compliance with regulatory requirements. SAP AFC enables organizations to accelerate their financial closing cycles while ensuring accuracy, transparency, and governance across financial processes. This document organized into 8 unites and it covered all end to end financial close processes.

Keywords: AFC – Advanced Financial Close, SAP – system application and products, ERP, API, Integration, Cloud and On-premises, MED, QED and YED, Reports, Dashboard, Security, Workflows

Cite this paper: Shoukathali Jambagi, Financial Close Automation with SAP S4 HANA Advanced Financial Close Technology, Computer Science and Engineering, Vol. 4 No. 5, 2024, pp. 108-119. doi: 10.5923/j.computer.20241405.03.

Article Outline

1. Introduction

1.1. Background

- SAP S/4HANA Advanced Financial Closing is built to help organizations achieve faster, more accurate, and more transparent financial closes. The solution supports the end-to-end closing process, ensuring compliance and enhancing the reliability of financial reporting. SAP S/4HANA Advanced Financial Closing (AFC) is a modern solution within the SAP S/4HANA suite designed to streamline and automate the financial closing process. In today's business landscape, organizations encounter various economic obstacles such as inflation, high labor expenses, production insufficiencies, shortages of skilled resources, and supply chain complications. Moreover, they must adhere to ever-increasing regulatory demands, stricter compliance rules, and extensive audit and analytical requirements by the regulatory watchdogs. For CFOs, balancing these challenges while facilitating critical accounting processes like the month-end close is highly complex. There is immense pressure to provide accurate and timely financial data to both internal and external stakeholders for decision-making purposes. Although the finance close process is a recurring task, it is not always completed on time. To streamline financial operations and achieve business objectives, organizations must understand and tackle the significant hurdles encountered during the finance close process. This necessitates a combination of process improvements, technology investments, and effective collaboration among various teams and departments involved in the finance close process.

1.2. Problem Statement

- The finance close process is a complex and critical process that requires a high level of expertise, attention to detail and coordination across different departments and systems. It enables organizations to make informed decisions and ensure the accuracy and reliability of their financial statements on time. Financial closing processes often involve repetitive and labor-intensive tasks, such as manual reconciliations, posting of journal entries and generation of reports. These processes can be prone to human error, leading to delays and inaccuracies. Solution Provided by SAP AFC and SAP AFC automates many of these manual tasks, reducing the time and effort required to complete the financial close, thereby minimizing errors and enhancing process efficiency.Financial closing tasks are often scattered across departments with limited transparency into the status of individual tasks and their dependencies. This can result in bottlenecks, missed deadlines, and poor coordination among teams. Solution Provided by SAP AFC offers real-time tracking of all closing tasks through a centralized dashboard, providing visibility into progress, task dependencies and potential delays. This transparency helps ensure that deadlines are met and issues are quickly addressed.The financial close process often involves multiple departments (e.g., accounting, finance, IT), leading to communication gaps and delays in the completion of tasks due to a lack of coordination. SAP AFC provides solutions with integrated collaboration and communication tools, SAP AFC allows team members from different departments to interact seamlessly, ensuring smoother workflows and quicker resolution of issues during the financial close.Organizations are required to comply with various accounting standards and regulations during the financial close process. Manual handling of these tasks may lead to inconsistencies in applying controls, risking non-compliance or audit challenges. Solution Provided by SAP AFC, The system has built-in regulatory controls, standardized templates, and audit trails that help ensure compliance with financial regulations and internal policies. It also supports audit readiness by documenting the process and ensuring consistency in how tasks are performed.Organizations with multiple subsidiaries or business units often face challenges in consolidating financial results and ensuring consistent accounting practices across entities. This complexity can delay financial close and introduce errors. SAP AFC centralizes and standardizes the closing processes for multiple entities, allowing for easier consolidation and reducing the likelihood of errors. It also supports the alignment of accounting practices across different units or regions.Many companies rely on outdated ERP systems, custom tools or spreadsheets to manage closing processes. These legacy systems are not only inefficient but can also lead to data silos, complicating the financial close. SAP AFC integrates directly with modern ERP systems like SAP S/4HANA and consolidates closing tasks within one platform. This eliminates the need for spreadsheets or disconnected systems, enabling more efficient and accurate closing cycles.Long and drawn-out closing cycles delay financial reporting, negatively affecting business decision-making, compliance with regulatory timelines and stakeholder communications. SAP AFC automating and orchestrating key financial closing tasks, SAP AFC shortens the close cycle, allowing organizations to meet reporting deadlines more consistently and deliver timely financial insights to stakeholders.Financial regulations and accounting standards continuously evolve, making it difficult for companies to keep up with the changes and adjust their financial close processes accordingly. SAP AFC is built to be flexible, allowing organizations to quickly adapt to new accounting standards and regulatory requirements by configuring workflows and controls to meet changing demands.The integrity of financial data is critical for generating reliable reports and ensuring compliance. Disparate systems and manual interventions can compromise data accuracy during the financial close. SAP AFC provides automated data validation and control checks, ensuring that the financial data processed during the close is accurate and free from inconsistencies.Organizations operating globally often struggle with financial consolidation across various currencies, regions, and regulatory environments, leading to delays and errors in the financial close. SAP AFC supports global organizations by handling multiple currencies, complex intercompany transactions, and regional regulatory requirements, enabling more accurate and timely financial consolidation.

2. Key Challenges

- The finance close process is a critical task for organizations as it ensures the accuracy and compliance of financial data and generates accurate financial statements. However, conducting the finance close process comes with a range of challenges that can make it difficult to complete the task effectively and efficiently. Organizations face multiple obstacles during the finance close process, including time constraints, collaboration, and technology. Especially with the COVID-19 effect and the new remote and hybrid work culture continuing to have teams working remotely, the orchestrating and coordination of closing steps and tasks have become even more challenging.

2.1. Time Constraints

- The finance close process often has tight deadlines, which can make it difficult for finance teams to complete all necessary tasks on time. According to a leading survey, 61% of finance professionals reported that they have less than five days to complete the finance close process. However, 93% of finance professionals believe that their organization's finance close process could be completed faster, and 51% believe that their organization has too many manual processes that slow down the process.One of the most significant challenges organizations face during the financial closing process is meeting tight deadlines. The financial close must be completed within a defined timeframe to comply with external reporting requirements, satisfy internal stakeholders, and provide timely insights for decision-making. However, the closing process often involves numerous interdependent tasks across various departments, such as accounting, finance, IT, and operations. Managing these tasks manually can result in delays due to bottlenecks, human errors, and coordination issues. Time pressures can also increase the risk of mistakes, negatively impacting the quality and accuracy of the financial statements. As a result, finance teams may feel overwhelmed, which can lead to overtime work, stress, and decreased productivity.Consequences of Time Constraints:Delayed Financial Reporting: Extended closing cycles delay the submission of financial reports to stakeholders, which can affect decision-making and regulatory compliance.Increased Risk of Errors: Time pressure can lead to rushed work, resulting in mistakes, such as data entry errors or overlooked reconciliations.Inconsistent Process Execution: Limited time often means tasks are completed differently across departments, leading to inefficiencies and inconsistent results.Lack of Time for Review: When closing processes take too long, there may not be enough time left for thorough reviews, quality control, or adjustments before finalizing reports.SAP AFC’s Role in Overcoming Time Constraints:Automation of Financial Close Repetitive Tasks: SAP AFC automates time-consuming manual tasks like journal entries, reconciliations, and report generation. This significantly reduces the amount of manual effort required, freeing up time for finance teams to focus on higher-value activities.Task Orchestration and Workflow Management: AFC provides a centralized platform to track and manage all closing tasks. This visibility ensures that bottlenecks are identified early and critical tasks are prioritized to keep the closing process on schedule.Real-Time Monitoring: The ability to monitor progress in real-time helps ensure that deadlines are met. Managers can see which tasks are completed, in progress, or delayed, allowing for timely interventions and reassignments if necessary.Streamlined Collaboration: By improving collaboration between departments, SAP AFC eliminates delays caused by miscommunication or coordination issues. Teams can work together more efficiently to resolve issues, reducing the likelihood of last-minute problems that could extend the close.Standardized Closing Processes: SAP AFC enforces standardized workflows, reducing variations in how tasks are executed. This consistency improves efficiency and ensures that the closing process can be completed more quickly, without compromising on quality.Advanced Analytics and Reporting: The solution also provides advanced reporting capabilities, which allow teams to quickly generate financial statements and reports. This minimizes the time required to produce critical financial data at the end of the close.

2.2. Complex Landscape

- Organizations often use various systems and data sources to manage their financial information, such as ERP systems, general ledger systems, and other financial applications. Research shows that the average industry uses more than 5 different systems to complete the finance close process. The complexity arises when these systems are not fully integrated, or when data is stored in different formats, making it challenging to reconcile and consolidate financial information.Organizations with large, complex business structures often face significant challenges in managing the financial closing process due to a complex IT landscape and diverse business operations. This includes organizations operating across multiple entities, business units, and geographical regions, as well as those using disparate ERP systems, non-standardized processes, and multiple currencies. These complexities create substantial difficulties in ensuring consistency, accuracy, and efficiency during the financial close.Consequences of a Complex Landscape:Extended Closing Cycles: Complex landscapes lead to longer financial close processes due to the time required to gather, reconcile, and consolidate data across multiple systems and entities.Increased Risk of Errors: Data inconsistencies and manual reconciliations across different systems and processes increase the risk of reporting errors, impacting the accuracy of financial statements.Higher Resource Requirements: Managing a complex close process often requires additional resources and personnel to oversee data collection, reconciliations, and reporting activities across the organization.Difficulty in Achieving Compliance: Ensuring compliance with various local and global regulations becomes more difficult, particularly when different regions or business units follow different accounting practices.SAP AFC’s Role in Addressing the Challenges of a Complex Landscape:Centralized Task Management and Orchestration: SAP AFC provides a single platform for orchestrating the entire financial close across multiple entities, systems, and geographies. It consolidates tasks and processes, providing a holistic view of all activities, enabling efficient management of even the most complex closing operations.Integration Across Multiple ERP Systems: SAP AFC integrates seamlessly with SAP S/4HANA and other ERP systems, enabling data consolidation from disparate sources. By automating data collection and consolidation, the solution eliminates the need for manual data transfers between systems, ensuring that data from different systems can be processed accurately and consistently.Standardized Closing Processes: SAP AFC enforces standardized closing workflows across all entities, ensuring consistency in task execution regardless of business unit or geographical location. This standardization helps ensure that financial controls are applied uniformly across the organization, reducing the risk of discrepancies.Multi-Entity and Multi-Currency Management: AFC handles complex corporate structures by allowing organizations to manage multiple entities, regions, and currencies with ease. The platform automates intercompany reconciliations and ensures that currency conversions and exchange rates are properly accounted for during financial close, reducing the risk of errors and speeding up the process.Compliance with Global and Local Regulations: SAP AFC supports compliance with diverse regulatory standards (e.g., IFRS, GAAP, and local tax laws) by providing configurable templates and workflows that ensure adherence to both local and global reporting requirements. This helps organizations remain compliant across regions, reducing the risk of regulatory penalties.Automated Data Reconciliation and Validation: The platform automates reconciliations and validation processes, reducing the time and effort required to reconcile financial data from different systems and entities. This ensures that the data used for reporting is accurate, complete, and compliant with regulatory requirements.Real-Time Monitoring and Reporting: SAP AFC offers real-time visibility into the financial close process across all business units and regions. This visibility helps management identify potential bottlenecks or discrepancies early in the process and take corrective action to ensure a smooth close.

2.3. Global Operations

- Organizations that operate globally often have to deal with multiple currencies, tax jurisdictions, and regulatory requirements which need a high level of expertise and knowledge of local regulations, as well as the ability to accurately translate and consolidate financial information across different languages, access to the local systems etc. Managing this level of coordination across different geography can make the finance close process more complex. The problem gets even further challenging if some of the processes are outsourced and managed via a shared service center and often needs. Organizations with global operations face numerous challenges during the financial closing process due to the complexity of managing different regulatory requirements, multiple currencies, varied accounting standards, and diverse business practices across regions. These challenges can lead to delays, inconsistencies, and inefficiencies, making it difficult for multinational companies to close their books accurately and on time.Consequences of Global Operational Challenges:Longer Closing Cycles: Managing the financial close across multiple regions and business units lengthens the time required to gather, reconcile, and consolidate financial data, delaying the close process and reporting timelines.Higher Risk of Errors and Non-Compliance: The complexity of dealing with different regulations, currencies, and local practices increases the risk of errors in financial reporting and the likelihood of regulatory non-compliance.Increased Administrative Burden: Finance teams must manually handle the intricacies of global financial operations, adding to their workload and creating stress during the close process.SAP AFC’s Role in Addressing Global Operation Challenges:Compliance with Multiple Regulatory Frameworks: SAP AFC is designed to handle various accounting standards (e.g., IFRS, GAAP) and country-specific regulatory requirements. It offers configurable templates and workflows that ensure compliance with local and global regulations, allowing organizations to adhere to reporting requirements in every region where they operate. This reduces the risk of non-compliance and ensures consistent reporting across regions.Multi-Currency Management: SAP AFC automates handling multiple currencies and exchange rate fluctuations, streamlining currency conversions and ensuring accurate financial consolidation. The platform automatically applies real-time exchange rates, reconciles exchange rate differences, and provides visibility into how currency fluctuations impact financial results, reducing the risk of errors in multi-currency transactions.Intercompany Transaction Reconciliation: AFC automates the reconciliation of complex intercompany transactions, simplifying the process for cross-border transactions and ensuring that they are accurately reflected in financial statements. This reduces the time spent on manual reconciliations and improves the accuracy of intercompany reporting.Standardization of Global Financial Processes: SAP AFC standardizes financial close workflows across different regions, ensuring that all entities follow a consistent and unified process. This standardization reduces variability, mitigates errors, and ensures that financial controls are applied uniformly across all business units and geographies.Integration Across Global Systems: AFC integrates with SAP S/4HANA and other ERP systems, enabling data from various regions and business units to be consolidated into a single platform. This allows global organizations to manage data consistently across multiple systems, eliminating data silos and ensuring accurate, real-time reporting.Collaboration Tools for Dispersed Teams: AFC provides collaboration and communication tools that enhance coordination among global finance teams, regardless of location or time zone. Real-time task tracking and notifications ensure that dispersed teams remain aligned and can collaborate efficiently, reducing delays and bottlenecks caused by time zone differences.Real-Time Monitoring and Consolidation, AFC offers real-time visibility into the progress of financial closing activities across all global entities. This allows finance leaders to monitor the status of closing tasks across different regions, identify potential issues, and take action to keep the closing process on track. The platform's automated data consolidation also ensures that global results are aggregated accurately and quickly.

2.4. Data Accuracy

- Ensuring the accuracy of financial data can be challenging, as there may be discrepancies or errors in the data that need to be identified and corrected. Research shows that more than 50% of finance professionals believe that accuracy and completeness are top challenges in their financial close process, resulting in delays in the close process.Data accuracy is one of the most critical challenges during the financial closing process. Organizations often rely on vast amounts of data sourced from various systems, departments, and business units, making it difficult to maintain a high level of accuracy throughout the close. Inaccurate or incomplete financial data can lead to incorrect financial statements, compliance issues, and poor decision-making, which can damage an organization’s reputation and lead to financial penalties.Consequences of Inaccurate Data:Erroneous Financial Statements: Inaccurate data leads to incorrect financial results, which can misrepresent an organization’s financial health and affect decisions by management, investors, and regulators.Compliance and Audit Issues: Inaccurate financial data can result in non-compliance with regulatory standards and internal controls, leading to audit findings, fines, or penalties.Rework and Delays: Incorrect data often requires extensive rework to correct, which can delay the closing process and increase pressure on finance teams to meet reporting deadlines.Loss of Trust: Repeated instances of inaccurate data can undermine the trust of stakeholders, including shareholders, regulatory authorities, and business partners.SAP AFC’s Role in Addressing Data Accuracy Challenges:Automated Data Validation and Reconciliation: SAP AFC automates data validation and reconciliation processes, ensuring that discrepancies are identified and corrected early in the closing cycle. Automated reconciliations reduce reliance on manual tasks and minimize the potential for human error, leading to more accurate financial data.Centralized Data Integration: AFC integrates with SAP S/4HANA and other ERP systems, creating a single, unified source of truth for financial data. This centralized integration reduces data silos, ensuring that information is consistent across departments and business units, thus improving overall data accuracy.Real-Time Data Monitoring: SAP AFC enables real-time tracking and monitoring of financial data throughout the closing process. This real-time visibility ensures that any inconsistencies or anomalies in the data can be detected and resolved immediately, improving the accuracy of financial reporting.Standardized Financial Processes: AFC enforces standardized workflows and processes for financial close activities across all entities and departments, ensuring consistency in how data is handled and reported. Standardization reduces the risk of errors caused by variations in processes or systems.Accurate Intercompany Reconciliation: AFC automates the reconciliation of complex intercompany transactions, ensuring that these transactions are accurately recorded and reflected in financial statements. This eliminates discrepancies between entities and improves data consistency in consolidated reporting.Audit Trail and Controls: SAP AFC provides a complete audit trail for all financial close activities, ensuring that every data adjustment, journal entry, and reconciliation is tracked and documented. This enhances data transparency and ensures compliance with internal controls and external regulatory requirements.Data Quality Control and Error Prevention: The platform includes built-in quality control mechanisms, such as validation checks and approval workflows, that prevent erroneous data from entering the financial reporting process. These checks ensure that only accurate, complete data is included in the final close.

2.5. High Volume of Transactions

- Large organizations with high transaction volumes face more complex finance close processes, as there are more transactions to reconcile and account for. This can be especially challenging when there are manual processes involved or when there is coordination and data review required between different departments, systems, or data sources. Managing some of these issues due required effective coordination and accessibility of information on a real-time basis. Often, this is done offline and delays the closing process.Organizations that deal with a high volume of financial transactions face significant challenges during the financial closing process. As businesses grow in scale or expand operations, they often see an increase in transactional data across various business units, departments, and global entities. Managing and reconciling this large volume of transactions especially in a manual or semi-automated environment can lead to inefficiencies, errors and delays in closing.Consequences of High Transaction Volume:Extended Closing Cycles: High volumes of transactions slow down the financial close, requiring more time to process, reconcile, and validate data before final reports can be generated.Increased Risk of Errors: With more transactions to process, the likelihood of errors during data entry, reconciliation and reporting increases. Even minor errors in transactional data can compound, leading to inaccurate financial statements.Resource Strain and Burnout: High transaction volumes put pressure on finance teams, requiring additional resources or overtime work to meet reporting deadlines. This can result in burnout and decreased productivity.Reduced Decision-Making Speed: Delays in the financial close caused by high transaction volumes can prevent management from accessing timely financial insights, negatively impacting decision-making and strategy formulation.SAP AFC’s Role in Addressing High Transaction Volume Challenges:Automation of Repetitive Tasks: SAP AFC automates key closing tasks, such as journal entries, reconciliations and transaction matching, allowing organizations to process high volumes of transactions without manual intervention. By automating these processes, AFC reduces the time and effort required to manage large datasets and ensures that transactions are processed accurately.Mass Data Processing and Reconciliation, SAP AFC is designed to handle large datasets and high transaction volumes efficiently. It automates the reconciliation of thousands or millions of transactions across multiple accounts, systems, and entities. This capability enables finance teams to perform reconciliations at scale, without the need for manual matching, significantly speeding up the process.Integration with Multiple ERP Systems: AFC integrates with multiple ERP systems, including SAP S/4HANA and third-party solutions, ensuring that data from various systems and business units can be consolidated quickly and accurately. This seamless integration helps eliminate data silos and enables centralized processing of high-volume transactions.Real-Time Data Processing: SAP AFC offers real-time processing of financial data, allowing organizations to track and manage transactions as they occur. This reduces the end-of-period workload and ensures that transactions are captured and reconciled in real time, minimizing backlogs.Batch Processing Capabilities: AFC supports batch processing of large volumes of transactions, allowing finance teams to automate and process multiple transactions simultaneously. This helps to reduce the strain on resources and improves efficiency during the financial close.Task Prioritization and Workflow Automation: SAP AFC includes workflow automation tools that prioritize high-volume tasks, such as transaction processing and reconciliation, ensuring that critical activities are completed on time. Automated workflows reduce the need for manual task management, enabling finance teams to focus on more strategic activities.Advanced Analytics and Reporting: AFC provides advanced analytics and reporting capabilities that help finance teams monitor high-volume transactions and detect potential issues early in the process. This real-time insight allows organizations to identify bottlenecks, discrepancies, or anomalies in their data and address them before they impact the financial close.

2.6. Audit and Compliance Requirements

- Organizations are subject to various audit and compliance requirements, which can add complexity to the finance close process. This includes ensuring that financial statements are accurate and comply with accounting standards, as well as meeting regulatory requirements such as SOX, IFRS, and GAAP.Organizations face significant pressure to meet audit and compliance requirements during the financial closing process. These requirements are critical to ensuring that financial statements are accurate, complete, and in line with local and global regulations, such as IFRS, GAAP, SOX, and other industry-specific standards. The financial close must not only be timely and accurate but also fully auditable, with transparent processes and documentation that regulators and auditors can easily review. Failure to meet compliance or audit standards can result in fines, regulatory penalties, reputational damage, and even legal consequences. However, managing these requirements is complicated by the complexity of the close process, the number of transactions, the need for consistency across different entities and regions, and the ever-evolving nature of regulatory standards.Consequences of Poor Audit and Compliance Management:Non-Compliance Penalties: Failing to meet regulatory requirements can result in penalties, fines, or other legal consequences. This is especially critical for organizations subject to stringent regulations like Sarbanes-Oxley (SOX) in the U.S.Audit Findings and Remediation Costs: Inefficient or inconsistent processes can lead to negative audit findings, requiring costly remediation efforts and damaging the organization’s reputation.Extended Closing and Reporting Timelines, Manual efforts to meet compliance requirements and provide adequate documentation for audits can extend the financial close timeline, causing delays in reporting.Risk to Financial Integrity: Inadequate compliance controls can lead to inaccuracies in financial reporting, undermining the integrity of financial statements and leading to stakeholder mistrust.SAP AFC’s Role in Addressing Audit and Compliance Challenges:Automated Compliance and Controls Management: SAP AFC helps automate the enforcement of financial controls during the closing process. Organizations can define and standardize workflows that ensure compliance with internal controls, regulatory requirements, and external audit standards across the entire organization. This consistency reduces the risk of non-compliance due to human error or deviations from established processes.Built-in Regulatory Compliance Features: SAP AFC is designed to comply with various global regulations, including IFRS, GAAP, SOX, and other reporting standards. The platform provides built-in templates and processes that align with these regulatory frameworks, helping organizations meet their legal and reporting obligations.Complete Audit Trail and Documentation: SAP AFC automatically creates a comprehensive audit trail that tracks all financial transactions, adjustments, and reconciliations throughout the close process. This audit trail ensures that all changes are logged, with full visibility into who made what changes, when, and why, enabling auditors to review the entire process easily and efficiently.Real-Time Monitoring and Validation: SAP AFC provides real-time monitoring of the closing process and enables automatic data validation at key stages of the workflow. This reduces the risk of errors and ensures that all transactions and financial records meet the required standards before they are finalized, improving the accuracy of financial statements.Automated Task Assignments and Approvals: The platform includes automated workflows for task assignments, approvals, and sign-offs, ensuring that the appropriate people review and approve key closing activities. This reduces the likelihood of manual oversight errors and ensures that all compliance-related tasks are completed on time.Continuous Adaptation to Regulatory Changes: SAP AFC is continuously updated to align with new and evolving regulatory standards. Organizations can configure the system to meet specific compliance needs as they arise, ensuring ongoing compliance with changing laws and accounting standards.

3. Key Features

3.1. Automation of Financial Close Activities

- Automates repetitive and manual tasks, such as accrual postings, reconciliations, and balance sheet reviews, reducing the risk of errors and speeding up the closing process.

3.2. Standardized Processes

- Provides predefined templates and best practices for closing activities, which can be customized to suit specific organizational needs. This standardization ensures consistency across different business units.

3.3. Integration with Other SAP Modules

- Seamlessly integrates with other SAP modules, such as Finance (FI), Controlling (CO), and Treasury (TR), ensuring that data flows smoothly across the organization and that financial statements are accurate.

3.4. Real-Time Insights and Reporting

- Offers real-time monitoring and reporting capabilities, allowing finance teams to track the progress of the closing process and identify bottlenecks or issues as they arise.

3.5. Compliance and Auditability

- Ensures that all closing activities are documented and traceable, supporting compliance with internal controls and external regulatory requirements. It also facilitates audits by providing a clear audit trail.

3.6. User Friendly Interface

- Features an intuitive and user-friendly interface, with role-based dashboards and workflows that guide users through the closing process, ensuring that tasks are completed in the correct sequence.

4. Benefits of SAP S4 Advanced Financial Closing (AFC)

- Addressing these challenges requires a combination of process improvements, technology investments, and effective collaboration between different teams and departments involved in the finance close process. Although CFOs and finance leaders understand the advantages of technology investments and automation, they often hesitate to adopt it due to concerns that their current processes are too intricate and unique for automation solutions. Nevertheless, adopting a gradual and systematic approach to automation using tools such as the SAP AFC on S/4 HANA Could is possible. These can help organizations improve coordination, transparency, and enhance the accuracy and efficiency of their close process by introducing a new level of discipline.

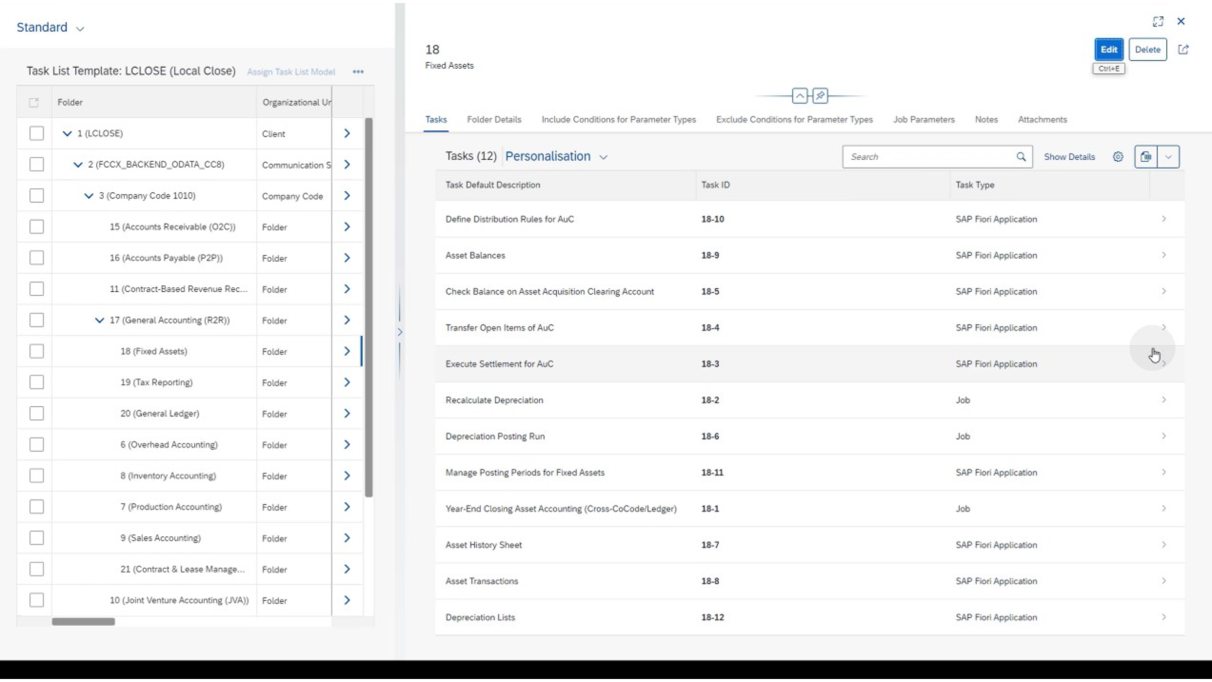

4.1. Global Template and Workflow Approval

- SAPs new technology tool Advance Finance Close for S/4HANA releases offers flexibility to configure templates that contain all the closing tasks, outlining standard closing steps between various sub-processes across geography, This will improve collaboration and provide a unified workspace for all stakeholders to work together, reducing the risk of miscommunication or conflicting objectives.SAP AFC template we can configure Financial close task as Jobs which will trigger batch jobs based on the day and time specified with parameters, Fiori app task SAP AFC will support us to run the task from AFC template and once its complete task can mark with status as complete, completed with Error or failed based on situation. Last one SAP AFC will support to add task as Note that would be a manual task to track Financial close related in template as you can see in figure 1. Additionally, organizations can also add manual steps to the templates and set up approval to improve controls and compliance. The Finance Closing Template provides transparency into the finance close process by clearly outlining the required tasks and procedures, enabling stakeholders to track progress and ensuring that all necessary tasks are completed accurately and in a timely manner. Overall, AFC's pre-configured templates and Finance Closing Template help organizations streamline their finance close process, improve accuracy, and reduce the risk of errors or discrepancies in financial reporting.

| Figure 1. Financial close tasks |

| Figure 2. Workflow configuration |

4.2. Automation

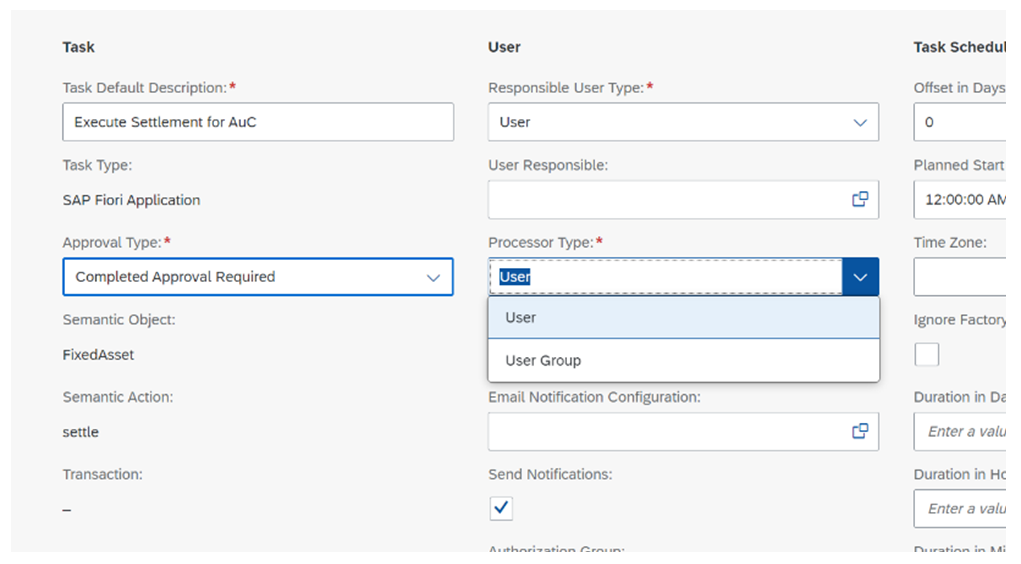

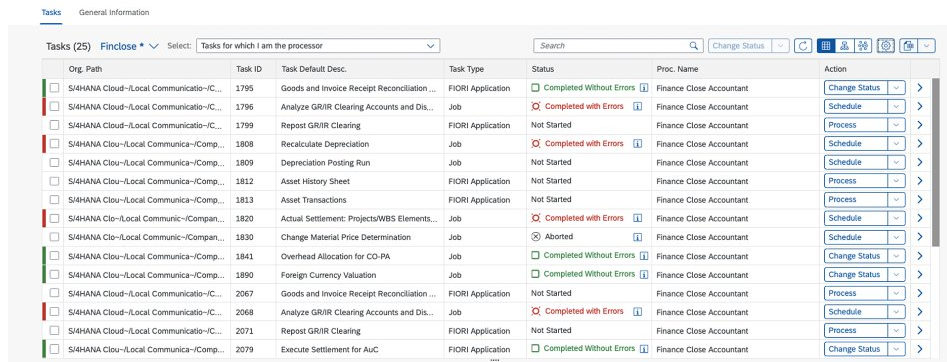

- A Finance Closing Template can improve the efficiency of the finance close process by eliminating the need for manual processes and reducing the time and effort required for each task. By automating repetitive tasks by clearly defining the dependency and successor path organizations can complete the financial close process more quickly and efficiently, Financial close task we can automate while scheduling starts immediately in figure 3 which SAP AFC will trigger batch jobs based on specific parameters and time during the Financial close window.

| Figure 3. Define and automate tasks on specific day and time |

| Figure 4. Financial close task status |

4.3. Connect Multiple Applications

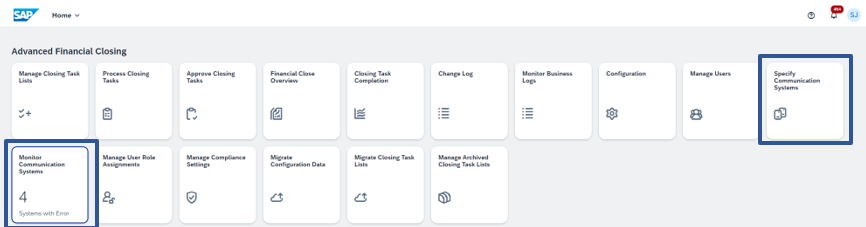

- One of the key advantages of SAP Advance Finance Close Process is its ability to connect multiple financial systems and applications. It provides seamless integration with SAP's financial management software as well as other third-party systems, allowing organizations to streamline their finance close process and ensure that all financial data is accurate and up-to-date. This capability helps to eliminate the need for manual data entry and reduces the risk of errors or discrepancies in financial reporting. With the ability to connect multiple systems, SAP Advance Finance Close Process enables organizations to centralize their financial data, simplify their finance close process, and make more informed decisions based on accurate and timely financial information.In the context of SAP AFC, communication systems play a crucial role in facilitating seamless interaction between various stakeholders involved in the financial closing process. Effective communication systems ensure that tasks, issues, approvals, and other important closing activities are communicated clearly and efficiently across different departments, entities, and regions. This minimizes delays, reduces errors, and improves coordination throughout the financial close figure 5 shows the communication between different SAP GUI clients with SAP AFC and it will be real-time integration and communications between different SAP and other systems.

| Figure 5. Communication system and status |

4.4. Reduce IT Dependency

- AFC's cloud-based architecture allows finance professionals to access the platform from anywhere, at any time. The AFC offers a user-friendly interface that allows finance professionals to manage many business functions like closing, template, Closing tasks, user roles, etc., without extensive IT knowledge. This reduces the need for IT assistance or support, enabling finance professionals to manage their closing tasks independently and efficiently.

4.5. Efficiency, Accuracy and Transparency

- Automating and streamlining the closing process significantly reduces the time required to close the books, allowing finance teams to focus on value-added activities and by minimizing manual intervention, SAP S/4HANA AFC reduces the risk of errors and ensures that financial data is accurate and reliable. Real-time insights into the closing process provide visibility into where the organization stands at any given time, making it easier to identify and address issues.

4.6. Compliance

- The solution supports compliance with accounting standards and regulations, ensuring that financial reporting meets legal and organizational requirements, SAP Advanced Financial Closing is designed to streamline the financial close process while ensuring that organizations meet various regulatory and internal compliance requirements. Compliance is a critical aspect of financial closing, especially for large, multinational companies that need to adhere to various local, national, and international accounting standards, such as IFRS, GAAP, and SOX (Sarbanes-Oxley Act), among others. SAP AFC helps finance teams ensure accuracy, transparency, and control across the closing process to meet these requirements.

5. Technical Design

5.1. Prerequisite

- Implementing SAP S/4HANA Advanced Financial Closing (AFC) requires certain prerequisites to ensure a successful deployment and effective use of the solution. Below are the key prerequisites that organizations need to consider.SAP S/4HANA: The SAP system must have a compatible version of SAP S/4HANA (on-premises or cloud) installed. AFC is tightly integrated with the SAP S/4HANA suite, leveraging its capabilities for financial processes. Ensure that you are on a version of SAP S/4HANA that supports AFC (usually S/4HANA 1909 or later).SAP Fiori Launchpad: SAP Fiori is used for the user interface of AFC, providing an intuitive experience. You need to have SAP Fiori configured and set up to enable access to the AFC applications.HANA Database: As AFC is built on the SAP HANA platform, an operational HANA database is essential for the solution. The database should be sized appropriately to handle the volume of data and processes involved in the financial close.

5.2. Different Financial Closes Templates

- SAP S/4HANA Advanced Financial Closing (AFC) provides several predefined templates to streamline various financial close processes. These templates help automate tasks and ensure that the closing processes are executed efficiently and consistently across different periods. Here are some of the common financial close templates available in AFC:

5.2.1. Month-End Close Template

- Facilitates the standard month-end close process, which includes recurring tasks that need to be completed at the end of each month, examples - - Accruals and deferrals postings- Foreign currency valuation- Bank reconciliations- Fixed assets depreciation posting- Open item clearing (AR/AP)- Inventory valuation and adjustments- Internal order and cost center assessments- Posting period open and close

5.2.2. Quarter-End Close Template

- Manages the quarterly closing activities, including additional tasks that may not be performed on a monthly basis but are required at the end of each quarter, examples - - Quarterly financial statement preparation- Tax provision and calculation adjustments- Comprehensive intercompany reconciliations- Segment reporting and profit center close activities- Regulatory reporting requirements

5.2.3. Year-End Close Template

- Handles the comprehensive year-end closing process, which involves a greater number of tasks, including final adjustments, reconciliations, and reporting for regulatory and auditing purposes, examples - - Final depreciation runs and asset disposals- Final closing of open items in AR and AP- Fiscal year changeover and opening balance carry forward- Adjustments for tax reporting- Financial statement consolidation and reporting- Provisioning for future liabilities- Adjustments for shareholder equity and dividends- Asset Fiscal Year close

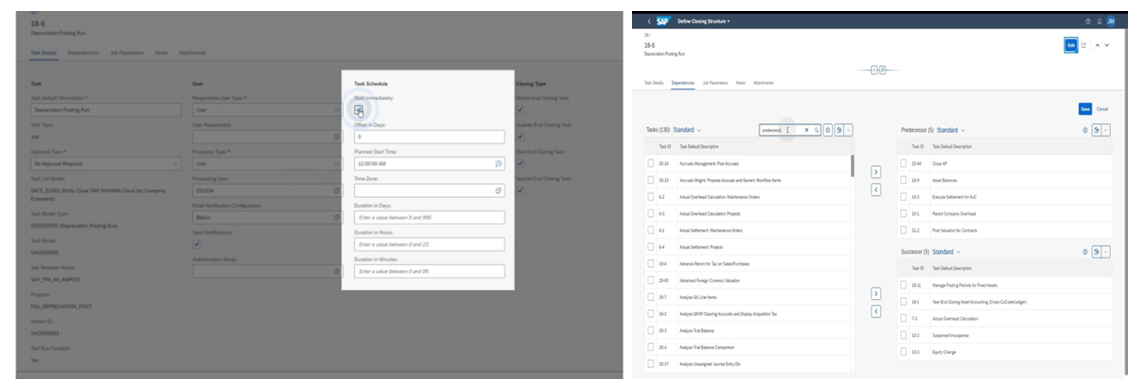

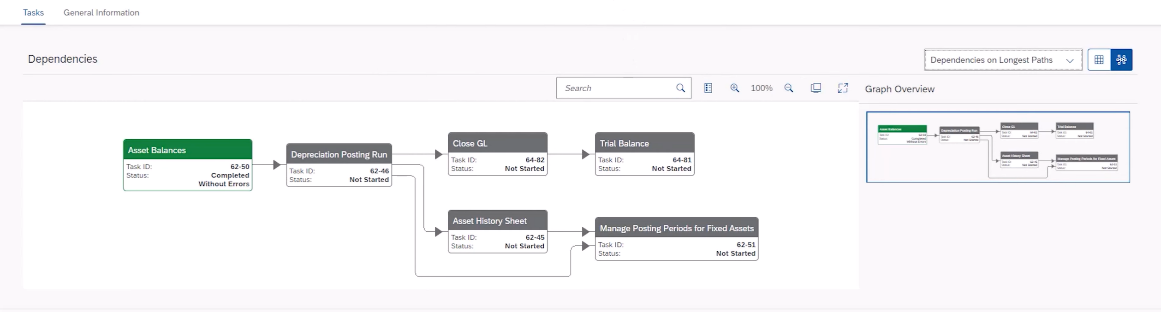

5.3. Configuration and Integration with SAP Core Modules

- Core SAP FI (Financial Accounting) modules, including General Ledger (GL), Accounts Receivable (AR), and Accounts Payable (AP), should be fully configured and operational. AFC works closely with these modules for closing activities. If organization is already using SAP Financial Closing Cockpit, some configurations and processes may need to be migrated or aligned with the AFC solution. AFC offers more advanced features but draws on some foundational concepts from the Financial Closing Cockpit.In case multiple systems organization uses third-party systems for certain financial processes (e.g., external reporting, payroll, or treasury systems), integration points between those systems and SAP S/4HANA AFC need to be planned and established.Task DefinitionPredefined Templates: Use the predefined templates provided by SAP for closing tasks, such as accrual postings, balance sheet reconciliations, intercompany eliminations, and fixed asset depreciation. These templates can be customized based on the specific needs of the organization.Custom Tasks: Define any custom closing tasks that are specific to your organization. This may include additional reconciliations, manual journal entries, or data validation steps.Task Dependencies: Establish dependencies between tasks, ensuring that certain activities are completed before others can begin. Additionally, the new release empowers you to identify the most critical and time-consuming tasks in the closing process, allowing you to take proactive measures to mitigate potential delays and stay on track to meet the closing deadline. This feature provides valuable insights to the organization, allowing it to focus on areas of improvement that have the greatest impact on the overall efficiency of the closing process, leading to better performance and increased productivity.Task dependency in SAP Advanced Financial Closing (SAP AFC) is a critical feature that ensures the smooth and sequential execution of tasks during the financial closing process as shown in figure 6. In complex financial environments, multiple tasks are interdependent, meaning some tasks can only start after others have been completed. Task dependency management ensures that tasks follow a defined order, reducing the risk of delays, errors, and missed steps in the closing process.

| Figure 6. Financial Close task dependency assignation |

5.4. Role-based and User Authorization

- Role-Based Access Controls: Define and configure role-based access controls (RBAC) for users who will be involved in the closing process. Users must have the appropriate authorizations to access and execute closing tasks within the AFC module.Segregation of Duties (SoD): Ensure that proper segregation of duties is in place for financial closing activities to prevent conflicts of interest and meet internal control and compliance requirements.

6. Management and Controller Reports

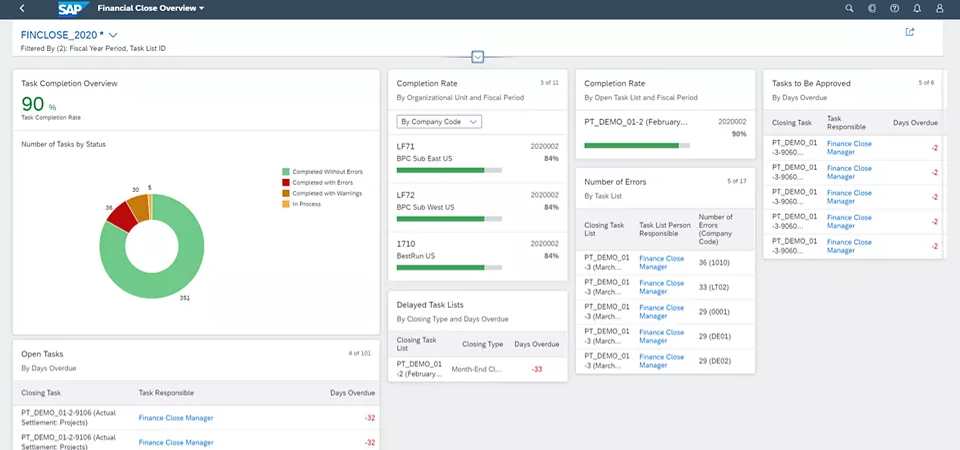

6.1. Real-Time Monitoring and Analytics

- Real-Time Monitoring and Analytics take finance close process management to the next level. It enables you to monitor your closing activities in real-time through an intuitive Fiori dashboard, providing instant visibility into the progress of the financial close process. Enabling them to monitor, identify bottlenecks, and take corrective actions where required.The SAP Advanced Financial Closing Overview Dashboard (Figure 7) is a powerful tool that provides real-time visibility into the entire financial closing process. It centralizes critical financial close information, giving finance teams and executives an at-a-glance view of key metrics, task statuses, bottlenecks, and dependencies, ensuring a more efficient and transparent close.

| Figure 7. Financial Close Dashboard |

7. Use Cases

- SAP S/4HANA Advanced Financial Closing is particularly beneficial for companies operating in industries with stringent reporting requirements or those undergoing digital transformation initiatives aimed at improving financial management.- Large enterprises with complex financial structures that require frequent and detailed financial closes.- Organizations looking to standardize and optimize their financial closing processes across multiple business units or geographies.- Companies seeking to improve the accuracy and timeliness of their financial reporting.

8. Conclusions

- SAP S/4 HANA Advance Finance Closing (AFC) is a comprehensive and efficient solution that addresses the challenges faced by organizations in their finance close process. Its range of functionalities, including process orchestration, task management, and performance analytics, enable organizations to optimize their financial close process. By combining process improvements, technology investments, and effective collaboration organizations can streamline their finance close process, improve accuracy, and reduce the risk of errors or discrepancies in financial reporting.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML