-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Arts

2012; 2(4): 26-30

doi: 10.5923/j.arts.20120204.02

The Portuguese Contemporary Art Auction Market Between 2008 and 2011

Pedro David Ribeiro Simões

Art History Institute, Faculty of Letters of University of Lisbon, Lisbon, 1600-214, Portugal

Correspondence to: Pedro David Ribeiro Simões , Art History Institute, Faculty of Letters of University of Lisbon, Lisbon, 1600-214, Portugal.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The purpose of this study is to understand how the Portuguese auction market for contemporary art reacted to the global crisis following the collapse of Lehman Brothers investment bank in September 2008. By studying the records from some major auction houses in the country it is possible to understand the movement of this market between 2008 and 2011, and to compare it with the international auction market. This study shows that the Portuguese auction market for contemporary art followed a different path from the international market, facing a longer period of recovering.

Keywords: Contemporary Art, Auction, Art Market, Portugal

1. Introduction

- Artists and society are much more interconnected and dependent today than they were in the aftermath of the crisis of figurative art in the early 20th century.1 From a dangerous pariah and marginal bohemian the artist has become the provider of a world that revolves around him: art galleries, museums, auction houses, collectors, art historians, among many others[1]. Today there is a constant search for the next big artist and their professional status has become much more respected and stable. Nevertheless, only a minority of the society follows, enjoys and, particularly, purchases art[2]. Therefore, it must be kept in mind that the art world does not move as a unified whole, and this is the main reason why new art movements have rarely been accepted by all[1]. Obtaining public recognition is somewhat contradictory, as artists who deny and wish to change the status quo are tolerated and sometimes even preferred to the ones that accept it[3]. Eric Hobsbawm considers, for example, that abstract paintings had only reached such high prices and esteem in the market due to the hostility that Hitler and Stalin had shown for them, making the style a sort of official art of the "free world" against "totalitarianism"[4]. Hobsbawm even criticizes the fact that paintings could not be easily reproduced, which in his opinion, is inadequate to a global market where the demand was not from one or two people, but from millions. Even if artists tend to officially deny the market, with some of them trying to create unsellable art, the vast majority of them ends up by accepting it in their current practice. At least, they accept the idea of selling certificates which legitimized their art - whether it is a performance, an idea, or simply a public discussion[6],[11].It is this very idea of an art market that, as Paulo Filipe Monteiro recalls, generally has a pejorative sense: that the arts have fallen in the mire of bourgeois conventions and financial speculation[5]. It is a common belief that people relate to the arts only for reasons of bourgeois convention, prestige or economic investment and that it destroys the very meaning of art. But Monteiro has another option: instead of seeing this artworld as something that destroys the meaning of art itself, should we not just see it as something that actually multiplies it? "The loss of the collective sharing of a meaning given to a work will not be replaced by the act, collectively shared, of giving it a meaning, though more or less individual[5]?” The author concludes, citing Marx: "consumption completes production".In reality, an economic view of art does not replace aesthetics, criticism or art history. Rather, it complements them[6].The art market has undergone major changes between 2008 and 2011, similarly to what happened in the financial markets. The crisis that has hit the markets forced an adjustment in the sales figures of art, namely in the most speculative area of the art market - contemporary art.Although there was already some feeling of deterioration in the global economic climate during the first half of 2008, it was in this period that the auction market for contemporary art reached one of the highest points in sales. During the second half of that year the repercussions of the collapse of Lehman Brothers bank[7],[8] were already reaching the world and the crisis that followed led to a sharp drop in revenue the next year. From 2001 onwards the credit and housing bubble in the United States provided a high profit for investors all around the world. Around the year 2007 the decline of the United States housing market started to seriously impact the financial system setting a negative trend that created widespread fear about the existence of even bigger hidden losses linked to all subprime mortgage-related bonds and to the institutions suspected of owning them[9]. As one of the largest private investment banks in the United States and the biggest producer of securities based on subprime mortgages, Lehman Brothers Holdings Inc. was directly affected by these losses and in 2008 had to file for bankruptcy, following the refusal of bailout from the government and the failure in selling the bank. This became the largest bankruptcy ever in the United States involving around $613 billion and nearly 80 Lehman subsidiaries around the world that had close ties with the parent company[9]. Thousands in the financial market were affected and with the confidence of the investors at a low all entities linked directly or indirectly to the bank suffered losses. The size and the dynamic of the global financial system had made it much more volatile and prone to a worldwide crisis than the more stable national markets would have allowed[9]. Contemporary art was at the front end of the expansion phase of the auction market of art: from 92 million in 2002 it grew to 915 million euros in 2008, but this sector of the art market was also the most affected by the global financial crisis. Late in 2009, the sector had fallen almost 60% both in number of lots sold and in prices, with the crisis affecting all market participants – from the vendors to the art collectors[10]. The increasing globalization of the international art market was one of the factors that prevented its further downfall, because although the art market was not immune to recession it managed to control the problem more easily than other sectors of the market[10] and the services provided by online sales databases like Artnet and Artprice managed to improve the “transparency of the art market information as well as the speed and scope with which these data are presented to the public”[11]. The auction market reacted quickly to the loss of revenue and confidence on the part of buyers, showing signs of recovery as early as 2010. This positive trend was maintained throughout the year 2011 highlighting the agility of the art market and the idea that the worst had already passed[12]. Our first research question, thus, is to know if the auction market for contemporary art reacted in the same way in Portugal.

2. Methodology

- In order to answer the question above, we have considered data from three auction houses: Cabral Moncada Leilões, Palácio do Correio Velho and Sala Branca. These three companies represented nearly 60% of the turnover of the Portuguese auction market during the period under study. All auctions conducted by Cabral Moncada Auctions and Sala Branca are included in the study, as well as 68% of the ones from Palácio do Correio Velho. The data presented considers only the hammer prices and the values were not updated for inflation. Fees or commissions from auction houses, and other forms of services they provide were not considered (appraisal services and advertising in catalogues for example). One of the initial difficulties of such a study was the definition of works considered to be contemporary art. This is a controversial question, particularly in art history forums. However, we have decided to follow a strictly commercial definition, due to the nature of this study. Therefore, we have started this enquiry by following the criteria established by the major international auctions houses, which considers contemporary art works produced by artists who were born after 1945 (criteria used, for example, by the service Artprice in http://web.artprice.com). However, we soon realize that the differences between the Portuguese and the international auction market became increasingly visible. It was necessary to adapt the criteria to the national market and to classify as contemporary art all the works done by artists born after the year 1920, making no distinctions between styles or the aesthetic journey of each artist. This choice was made due to the conservative attitude reflected in the national art market. To some extent this tendency can be attributable to the past history of Portugal in the art world. During the regime of the Estado Novo (a authoritarian regime installed in the country from the 30’s until the 70’s when an armed revolution done by the military overthrew the regime and reinstated the democratic Republic in Portugal[13-15]), the country was almost always isolated from the art that was made around the world. The official art was disconnected from the European avant-garde and the few Portuguese artists who wanted to stay up to date with the rest of the art world were forced to leave the country or look for other livelihoods, such as education or advertising[16].It was only with the change of regime in the 70’s that a dying art scene received a new impetus. The local artists access to international trends and cutting edge performances, like Land Art or Art Povera, were greatly facilitated and they participated in aesthetic currents from different countries such as Italy, France or the U.S., among others. This new national art scene included art galleries and biennials that had managed to set[17]. Gradually this change of the national art scene started to also change – albeit slowly - the habits of the collectors of art, from mostly buying ancient art to starting to buy art of their own time. But, as it will be shown in the next chapters, even with all those changes the national buyers of art still keep a conservative stance. Another difficulty was realizing that studies on this subject are scarce in Portugal[18],[19], were made some time ago[20],[21] or do not use an effective quantitative analysis[22],[23]. Hopefully this study will help remedy the lack of information on the subject.

3. The Market

- The auction market for contemporary art in Portugal is mainly domestic. Looking at the origin of the sold lots (Figure 1), there are more than 90% of lots from national origin. The remaining lots are split between those without a defined place of origin (5.31%), those with Africa as origin (1.28%), other locations with little representation (not even reaching 1%) and those lots with an unspecified country which are of European origin and that, together, reach only 0.79% of the total. In order to simplify the graph, we chose to cluster in "Others" all countries whose origin is poorly represented at auction (countries such as Russia, Brazil or the United States for example).

| Figure 1. Origin of lots sold between 2008 and 2011 |

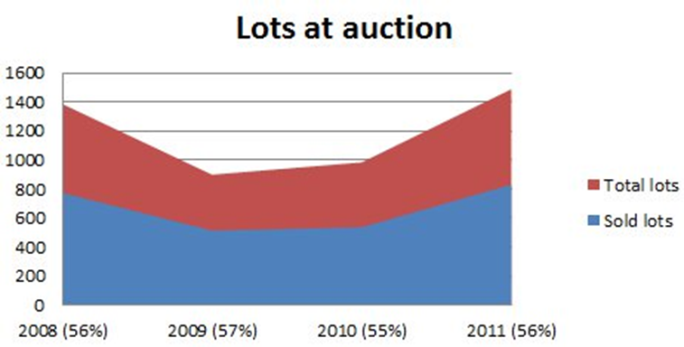

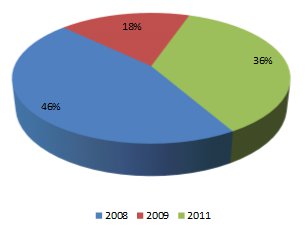

| Figure 2. Lots at auction between 2008 and 2011 |

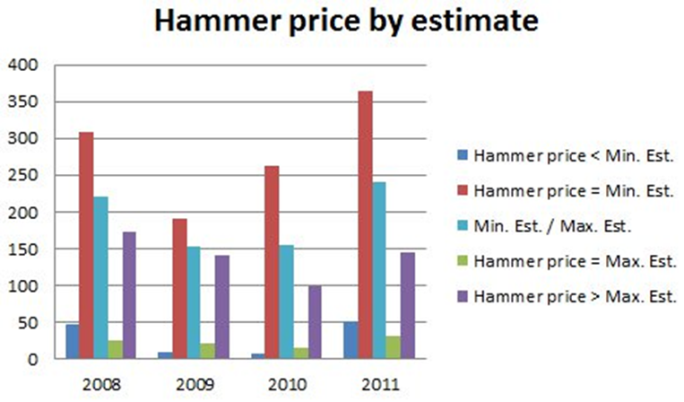

| Figure 3. Hammer price by estimate |

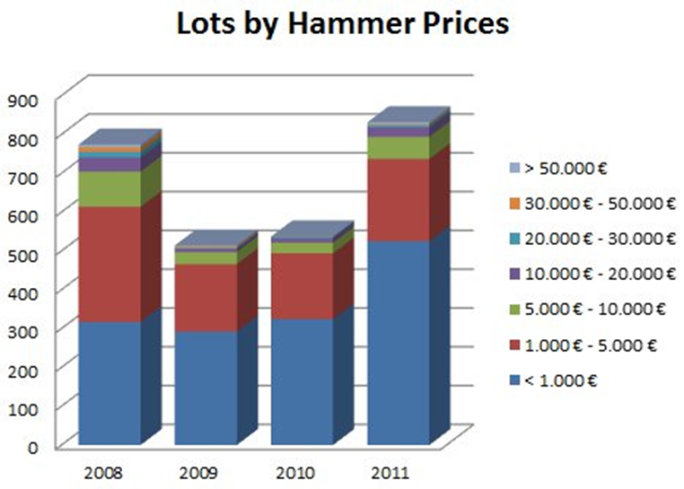

| Figure 4. Lots by hammer prices |

| Figure 5. Average sales price |

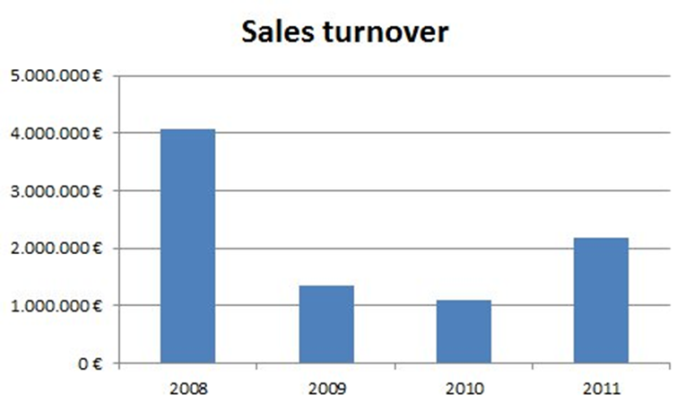

| Figure 6. Sales turnover by year |

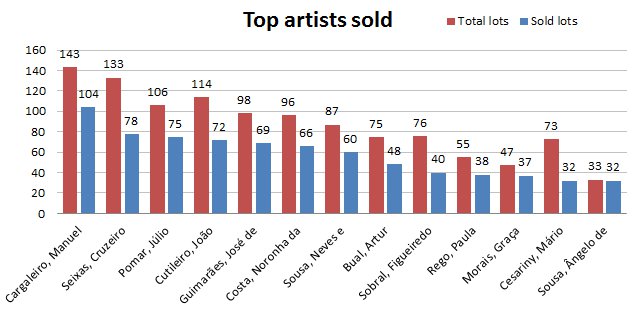

| Figure 7. Top artists sold between 2008 and 2011 |

| Figure 8. Lots sold over €80,000 between 2008 and 2011 |

4. Conclusions

- We can verify that the peak of the market was achieved in 2008, then it fell sharply in 2009 and continued to decline in 2010. It only showed signs of recovery during 2011, presenting a distinct pattern from the international market. Indeed, while 2010 was the worst year for auctions of contemporary art in Portugal, the international market was already showing signs of recovery.In 2009, there was also a decrease in the number of lots of contemporary art at auction, compared to 2008. This situation was reversed in the following year, with an increase in the number of lots, a trend that continued in 2011. During 2011 the auctions not only presented a greater number of lots, but these lots were also offered on sale with lower estimates.To sum up, during the four years under study most of the works were purchased by the minimum estimate given by the auction house. The most common category sold was paintings, mostly by Portuguese artists. Far from the existing speculation on contemporary art in the international market, buyers participating in the auction market in Portugal seem to give preference to works by renowned authors, in the latter years of their career who represent a low investment risk.

Notes

- 1. This study is an outcome of the research project entitled The antique and contemporary art auction market in Lisbon (2005-2011), funded by the Fundação para a Ciência e Tecnologia (reference PTDC/EAT-HAT/103690/2008).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML