-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Architecture Research

p-ISSN: 2168-507X e-ISSN: 2168-5088

2020; 10(1): 21-26

doi:10.5923/j.arch.20201001.03

Assessing the Effect of Building Obsolescence on Property Values in Uyo, Nigeria

Okey Francis Nwanekezie1, Robert Walpole Nwanguma2

1Department of Estate Management, University of Uyo, AkwaIbom State, Nigeria

2Department of Architecture, University of Uyo, AkwaIbom State, Nigeria

Correspondence to: Okey Francis Nwanekezie, Department of Estate Management, University of Uyo, AkwaIbom State, Nigeria.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study investigated the effect of building obsolescence on rental values of property in Uyo Metropolis. Total enumeration survey of thirty-six (36) estate surveying firms in Uyo was conducted, and twenty-four (24) of them responded positively. Relative importance Index (RII) and linear regression analysis were used to analyze the gathered data. The study showed that the age of buildings, construction faults, level of deterioration, poor level and standard of services, poor accessibility and over-supplied market significantly impacted on the level of building obsolescence. It also concluded that the rental value is directly related to and affected by the degree of obsolescence. The study advocated for effective and efficient property management to help check the rate of obsolescence on buildings.

Keywords: Obsolescence, Rental value, Depreciation, Age, Facilities, Accessibility

Cite this paper: Okey Francis Nwanekezie, Robert Walpole Nwanguma, Assessing the Effect of Building Obsolescence on Property Values in Uyo, Nigeria, Architecture Research, Vol. 0 No. 1, 2020, pp. 21-26. doi: 10.5923/j.arch.20201001.03.

Article Outline

1. Introduction

- An observation of building structures in the city center of Uyo will expose an array of physically aging and dilapidated structures. Many of the structures are being used for purposes not originally designed. Such is the situation along Ibom Plaza, Ikpa road, Ibiam street areas, etc., where residential buildings have been converted to commercial. Moreover, the rate at which structures within this area of the central business district (CBD) are being demolished and new buildings erected and also some of the old buildings being refurbished or renovated is high. This is encouraged by the high demand for new buildings and modern fixtures and fittings. The above scenario lends credence to the fact that the old buildings have become obsolete or that their utility (usefulness) is low and at times non-existent. Hence, the need for rehabilitation or demolition to give way to the highest and best use of land.The idea of obsolescence is often interwoven with depreciation by many professionals and scholars of the built environment. However, the two concepts are different. Depreciation is often merely seen as an object diminishing in value over a period, while obsolescence means the property or item is no longer produced or used, or is out of date or has fallen into disuse. Ogbuefi (2002) has defined depreciation as the gradual wearing down of capital asset and its implied deterioration in value. Also, according to the Accounting Standard Committee (1987) cited in Cheong (2010), measuring the wearing out, consumption, or other reduction in the useful economic life of a fixed asset whether arising from use, the passage of time or obsolescence through technological or market changes is depreciation. Reed and Myers (2010) define obsolescence as a loss in value due to a decrease in the usefulness of property caused by decay, changes in technology, people's behavioral patterns, and tastes, or environmental changes. Cheony (2010) describes obsolescence as a decline in utility that results directly from physical usage, the action of the elements or the passage of time. From the above definitions, the utility is central to the idea of obsolescence. Thus, if something is not felt to be providing utility, it will be considered obsolete, and depreciation which has to with diminishing usage can be said to occur as a result of that building becoming obsolete. Obsolescence has been variously classified and identified, but there are three core forms traditionally recognized, that affects all buildings – physical, functional and economic (Cheong, 2010, Reed and Myers 2010). Other types of obsolescence identified in the literature include technological, locational, social, market, legal, building, historical and professional (Mansfield and Pinder 2008, Reed and Mayer 2010 and Thomsen and Flier, 2011). Physical obsolescence is seen by Ogbuefi (2002) as the degeneration in the value of the physical condition of an asset due to wear and tear occasioned by use, age, and impacts of natural elements. Physical obsolescence is more than a little deterioration of the building. Functional obsolescence is described by Reed and Myer (2010) as relating to the problem of the building, materials, or design of the improvement when compared with the highest land best use and the most useful functional design requirement; whereas economic obsolescence is a loss in value caused by factors outside a property and is often incurable (Cheong 2010). The worth of the structure is related directly to the degree of obsolescence evident in the structure (Reed and Myers 2010). The impact of obsolescence whether, physical, functional or economical on real property cannot be overstated. For example, in Uyo property market, a two bedroom flat with one toilet is no longer in demand, and such accommodations have had a reduced rental value compared to those with en-suite bedrooms. Therefore, the concern of this paper is to investigate the effect of obsolescence on property values in Uyo metropolis.

2. Literature Review

- This section reviews some of the related literature on obsolescence in the property. Baum (1991) in the UK through a cross-section of 125 office buildings demonstrated the uses of classification of building quality with particular reference to occupier utility. The author reasoned that age is related to quality and that buildings deteriorate and become obsolete as they age. Through measuring of building depreciation and developing a classification of building qualities, the author related attributes to depreciation and proved that a healthy relationship exists between quality and depreciation than that which exists between age and depreciation. And that obsolescence factors, especially configuration and internal specification, are more critical than deterioration factors. The study also found that external appearance was an unimportant factor for London office occupiers. Further analysis of the four qualities reveals the predominance of layout over the floor to ceiling height in the configuration factor and the importance of services in the internal specification. This study treated obsolescence as the cause of depreciation and was limited to London. It studied only the quality of the physical structure as other forms of obsolescence were not considered. Moreover, the selection of sample size of 125 office buildings did not follow any sampling procedure.In an update of the earlier study of 125 office buildings in London by Baum (1991) in 1986, Baum and McElhinney (1997) examined the rate at which office buildings in the city of London have depreciated from 1986 to 1996. They also sought to explain rental values and rate of depreciation as a function of a set of quality variables and changes in those quality variables. The study surveyed a cross-section of 128 office buildings out of which 82 office buildings were in the 1986 survey. The primary instrument of data collection was questionnaires, where the qualities were ranked. The study found that for all city office in the sample, rent fell from an average of $31.21 for properties with an average age of I year to the average of $15.19 for properties with an average age of 34 years. Level (annual) rate of depreciation in rental value the first 34 years of life averaged 2.2%, doubling of 1986 value by 1.1%. The period of greatest depreciation in rental values, previously years 17 to 26, was now much earlier (years 7 to 12). The study also found that the annual rate of depreciation in capital values averaged 2.9% as compared to 1986's 1.6%. The period of greatest depreciation in capital values was again 7 to 12 years when compared to 1986 of years 20 to 29. The authors concluded that variation in subsequent performance regarding rental and the capital value was not explained by age, as all properties were ten years older. Here, again, the authors fail to give a clear distinction between depreciation and obsolescence. The study was not based on any probability sampling. Therefore it cannot be said to be representative of the total population.In another UK study, Mansfield and Pinder (2002) examined the characteristics and impact of economic and functional obsolescence on valuation practice. The study highlighted the practical difficulties in pricing obsolescence using inflexible methodologies in a marketplace that is subject to evolving criteria. The authors adopted an exploratory approach in the design without any empirical analysis but based the study on a review of literature and advice from international professional bodies. The authors concluded that despite the need to be more explicit in valuations, current methods are unable to address such detail. They advocated for a thorough revision of the guidance and advice offered by professional bodies in the valuation approach and hoped that the progress being made in methodology will be incorporated in directed guidance to practitioners. The study findings and conclusions are without any empirical survey or case study; therefore its conclusion should be considered as the authors’ opinion.Cheong (2010) studied building obsolescence in standard design terrace houses in Perale, Malaysia through a case study of double story terrace houses. The definition and differences between obsolescence and depreciation, as well as an explanation for all different types of obsolescence, are highlighted in the study. The author opined that depreciation occurs as the result of the building becoming obsolete. Hence, that depreciation should be considered as the effect of obsolescence and obsolescence is the cause of depreciation. The study found that not all types of obsolescence cause depreciation of rental on office building u that legal obsolescence will not affect the service life of the building. The paper identified types of obsolescence to include, economic, functional, aesthetic, environmental, legal, social, technological, locational and physical. The author classified the impact of obsolescence into curable and incurable, reasoning that incurable obsolescence is more crucial than curable obsolescence as it is more difficult to control. The study is based on a few case study of double terrace houses without any further survey of the tenants nor the professionals and as such its findings cannot be generalized.Reed and Myers (2010) in an exploratory study, examined whether sustainable obsolescence is a new form of obsolescence. The authors submitted that while there have been many forms of obsolescence, there are three core forms of obsolescence that affect all buildings. These include physical, functional and economic obsolescence. Other types of obsolescence identified by the paper include technological, locational, social, market, legal, building, historical and professional. The authors argued that the concept of sustainability has evolved from a basic sector (green), to being acceptable to all segments of the society. The authors submitted that there had been distinct lack of market evidence to allow a detailed analysis of obsolescence and depreciation over time. They concluded that the relationship between obsolescence and property values need to be carefully monitored and then further examined when more data become available. The study found that sustainability cannot be considered as the new form of obsolescence until more studies are conducted, since the sample size of sustainable buildings is too small to draw a meaningful inference. The study is without location and needs further investigations into this emerging area as suggested by the authors. In Amsterdam, Netherlands, Thomsen, and Flier (2011) explore the characteristics and causes of obsolescence resulting in a conceptual model of causes of obsolescence and effects. The paper is mainly inventory and theoretical without empirical survey. The article describes obsolescence as a process as the growing divergence between the declining performance of buildings and the rising expectation of users and proprietors. The authors distinguished between physical and behavioral factors affecting obsolescence and showed the different relationship between the increase of complexity of types of obsolescence and the decrease of possibilities to manage it. The study regard obsolescence as a severe threat to built property and as the start of the end-of-life phase of buildings. It observed that obsolescence is not an inevitable natural phenomenon but a function of human action and decision making. It concluded that obsolescence does not necessarily lead to demolition as obsolescence does not always precede demolition. The authors advocated minimizing obsolescence to preserve the physical, economic and societal investments involved given that these investments are immobile, long lasting and capital intensive. This study like Mansfield and Pinder (2008) is without survey or case study and its findings and conclusions cannot be generalized but taken as the author’s opinion. Bokhari and Geltner (2014) examined empirical evidence on the nature and magnitude of real depreciation in commercial and multi-family investment properties in the United States. The authors argued that depreciation is measured as a fraction of total property value, not just structure value, and it is oriented towards cash flow and market valuation metrics of investment performance such as IRR, and it includes physical, functional, and economic obsolescence of the building structure. The study is based on analysis of 107,805 transaction prices. It found an overall average depreciation rate of 1.5% per year for all the transactions, 1.82% per year for properties with new buildings and 1.12% per year for properties with 50-year-old buildings. It also found that apartment properties depreciate slightly faster than non-residential commercial properties and that depreciation rates vary considerably across metropolitan areas, with areas characterized by space market supply constraints exhibiting notably less depreciation. The study area is too broad as it tried to cover the whole of the United States which can lead to unlimited generalization. The above reviews reflect the non-availability of Nigerian literature in the subject area which bolsters the need for the present study. The next sector treats the methodology adopted to reach its findings and conclusions.

3. Research Methods

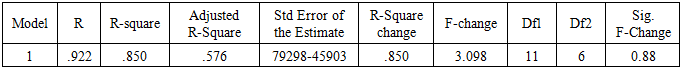

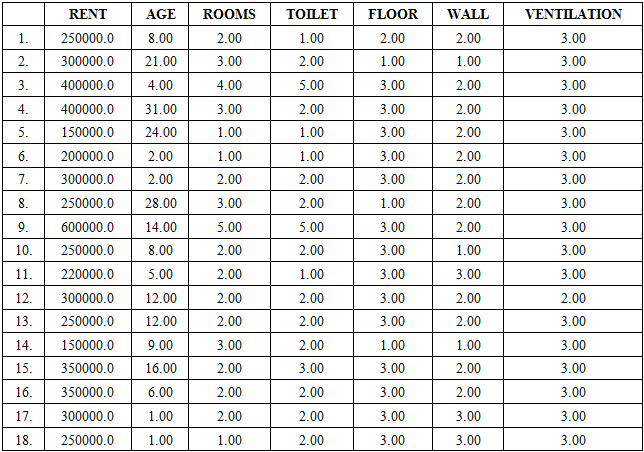

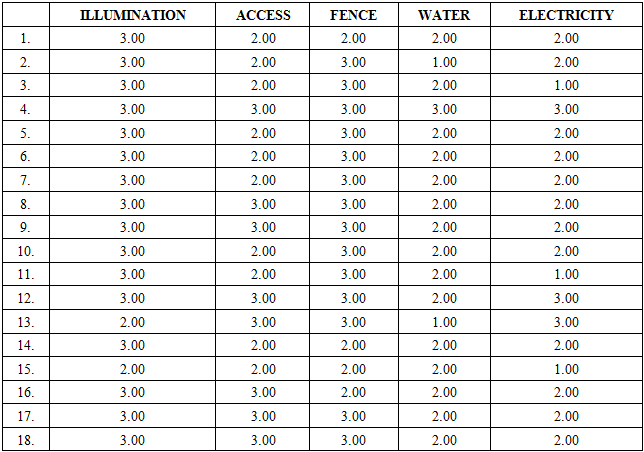

- Assessing the effect of obsolescence on property value is the object of this work, and estate surveyors are the most appropriate professionals to provide such technical and professional opinion. They are trained in the management of real property. From the records of the Nigerian Institution of Estate Surveyors and valuers, Akwa Ibom State branch, there are thirty-six estate surveying firms in Uyo. Therefore, the total enumeration of 36 firms was conducted since the sample size was small. Twenty-four (24) responded positively, which gave a response rate of 66.67. Primary instrument of data collection was questionnaire. The firms were also required to provide data on at least one property in their portfolio considered to be affected by obsolescence, and only eighteen (18) of them gave one (1) property each thus providing a sample size of 18 for analyses of the effect of obsolescence. The resulting data was analyzed using relative importance index and linear regression analysis. Rent was the dependent variable, while eleven (11) variables of age of the building (x1), number of rooms (x2), number of toilets (x3), floor finish (x4), wall finish (x5), ventilation (x6), illumination (x7), accessibility to the property (x8), fence (x9), availability of water (x10), and electricity (x11) were independent variables. The floor finish was measured with the tiled floor as 3, partly tiled floored apartment as 2 and cement screed floor as 1. Acrylic wall finish is ranked 3, emulsion/texcote 2; and unpainted as 1. Tarred access was considered as 3; untarred but motorable 2 and not motorable access 1. A fenced compound was graded 3, partly fenced premises 2 and unfenced premises 1, building with both public water supply and private borehole was ranked 3, the only private borehole was given 2 and non-availability of water was 1. Ventilation, illumination, and electricity were graded as good 3, Fair 2 and poor as 1.

4. Discussion of Result

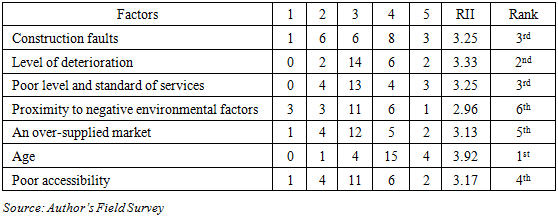

- Ranking the factors that impact and cause obsolescence in the building which they are managing was asked of the respondents. Their responses and analysis are presented in table 1 below.

|

|

5. Conclusions and Recommendations

- This study provided significant data and information on the effect of obsolescence on property value in Uyo. It concluded that age, level of deterioration, construction faults, poor level and standard of services, poor accessibility, and over-supplied market do significantly impact obsolescence of building. It also concluded that rental value is directly related to and affected by the degree of obsolescence seen or observed in a building. Thoughtful design with flexibility will help to avoid functional obsolescence in the early life of the building. Also, efficient management and maintenance will improve the lifespan of the building thereby reducing the effect of aging and level of deterioration. It is further recommended that proper feasibility and viability studies will help in not developing a building that is already oversupplied in the property market.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML