-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Applied Mathematics

p-ISSN: 2163-1409 e-ISSN: 2163-1425

2022; 12(2): 32-39

doi:10.5923/j.am.20221202.02

Received: Jun. 10, 2022; Accepted: Jun. 23, 2022; Published: Jun. 29, 2022

An Optimal Loans Model for a Bank in Upper West Region of Ghana Using Linear Programming

Sebastian Mbugri Akudugu, Douglas Kwasi Boah

Department of Mathematics, C. K. Tedam University of Technology and Applied Sciences, Navrongo, Ghana

Correspondence to: Douglas Kwasi Boah, Department of Mathematics, C. K. Tedam University of Technology and Applied Sciences, Navrongo, Ghana.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Some banks in Ghana suffer low returns and sometimes incur losses when they give out loans. In this study, the concept of linear programming has been successfully used to examine the loan policy of a bank in Upper West Region of Ghana. Based on collected data and information from the bank, an optimal loans model has been developed for the bank using linear programming to help maximize its profits or returns accrued from giving out loans. Also, the effects of variations of some selected key parameters on the developed model has been performed by means of sensitivity analysis. Moreover, duality analysis has been performed on the developed model to know the effect of an increase or decrease in an available resource on the optimal solution or profit. The study recommends that, the bank under consideration should use the developed model as a guide when giving out loans in order to maximize its profits or returns. Also, other banks and financial institutions should take a cue from the developed model when giving out loans in order to maximize their profits or returns.

Keywords: Optimal Loans Model, Linear Programming, Simplex Method, Sensitivity Analysis, Duality Analysis

Cite this paper: Sebastian Mbugri Akudugu, Douglas Kwasi Boah, An Optimal Loans Model for a Bank in Upper West Region of Ghana Using Linear Programming, Applied Mathematics, Vol. 12 No. 2, 2022, pp. 32-39. doi: 10.5923/j.am.20221202.02.

Article Outline

1. Introduction

- According to Prabhavathi and Dinesh [1], a bank is a financial institution which deals with cash in-flows, outflows, credits etc. It lends money to the needy, accepts the deposits, acts as intermediary between the lenders and the borrowers. Banking on the other hand is a business activity of accepting and safeguarding money owned by other individuals or institutions and then lending them to other entities as loans, in order that economic motive such attaining profit or covering back the operating capital is met. In finance and banking, a loan is the lending of a sum of money as stated by World Bank [2]. In simple terms, a loan is anything that is borrowed and will be paid back with interest, especially money. Loans are very essential to both the lender and the borrower. It is a as source of funding to the borrower to solve his immediate problems. To the lender, it serves as a form of investment which generates profit. Banks or financial institutions would always assess the current economic situation at every time which may include but not limited to; the current rate of depreciation of the said currency, the rate of inflation at time t, the possibility of no or very low bad-debt occurrence, the interest rate levels that will be favourable to both the lender and the borrower etc. Some banks in Ghana suffer low returns and sometimes incur losses when they give out loans. Due to the fairly less effective allocation that some banks adopt, the banks are unable to attain the maximum returns that they need to grow bigger. This is primarily because monies that could have been used for more services go into bad-debts which are not recoverable. The general objective of the study therefore was to examine the loan policy of a bank in Upper West Region of Ghana. Specifically, the study sought to develop an optimal loans model for the bank using linear programming. Also, it sought to investigate the effects of variations of some selected key parameters on the developed model by means of sensitivity analysis. Finally, the study sought to perform duality analysis on the developed model. The bank required anonymity.

2. Literature Review

- Linear programming was developed as a discipline in the 1940s, initially motivated by the need to solve complex planning problems in wartime operations. Its development accelerated rapidly in the post-war period as many industries found valuable uses for linear programming. According to Obi [3], the origin of Linear Programming has been traced to the period of the Second World War which prevailed between 1939 and 1945. “The war required a lot of logistics in view of its complexity and magnificent nature in terms of materials management, equipment, personnel and area of coverage”. “This led to innovative efforts of the protagonist war nation of England in studying the problems of the war particularly the problems of armed forces, civil defence, air force and their associated logistics”. “The efforts made in these studies gave birth to the concept of Linear Programming. Furtherance to that, during the 2nd World War, Marshall K. Wood worked on the allocation of the resources for the United States of America, while George B. Dantzig who was a member of the United States Air Force devised a method of allocating resources through the minimization and maximization of the desired object of the problem in 1947”. Globally, linear programming has become the most popular mathematical technique applied in the allocation of scarce resources. Linear programming has attracted the attention of mathematicians and researchers in various fields of study ranging from engineering, finance, production sector, business, banking and the likes. Conner [4] demonstrated in his research in a navy shore on a facility maintenance problem using linear programming. According to him, “a powerful tool of the management science discipline is that of linear programming”. That technique was described and its several benefits discussed. Possible applications of the device were explored and a simple least-cost model developed. Kottke [5] applied linear programming to estimate the economic impact of tourism development. In his study, he constructed an LP problem model which could be used to obtain a benchmark situation in terms of the income generated by the tourist industry as against the quantity of resources that it used. The model generated was further used to specify some expected tourism growth levels and the impact on land use, income and employment. Delson and Shahidehpour [6] applied linear programming to power system economics, its planning and operations. The results of their review presented some recommendations that power system planning should incorporate in its financial flows. Erenstein and Schipper [7] applied linear programming to land use planning by using Matara District in Sri Lanka as a case study. They stated emphatically that when one intends to optimize one’s land use, an LP problem model could be used to achieve such objective. Suslawati and Parsaulian [8] applied Linear Programming to dormitory development plan at Petra Christian University. Linear Programming was applied to calculate and ascertain the number of rooms and area of each facility that could satisfy the available constraints and produce the maximum profit or returns. Fagoyinbo and Ajibode [9] applied linear programming techniques to effective use of resources for staff training. In their study, they were of the view that the success of any business venture or organization depends largely on how it is able to use its scarce and limited resources to train its human resource to be equipped with more skills for a rise in productivity. A Linear Programming model was developed out of the data available which could help the business to effectively utilize its limited resources for the staff training. Anieting et al [10] applied linear programming technique in the determination of an optimum production capacity. They were concerned with applying linear programming technique to determine optimum production of Usmer Water Company, Uyo. They performed sensitivity analysis of the LP problem to ascertain the contribution of each variable of the model. Agarana et al [11] applied linear programming to unsecured loans and bad debt risk control in a bank. In their paper, they suggested management of credit risk as it affects loan portfolio management and prudence in terms of strategies to seek out relative value of opportunities. Maurya et al [12] used linear programming for profit maximization using an Ethiopian Chemical Company as a case study. An LP model was developed which was very effective and could be used to calculate the profit margin given the various parameters. Olayinka et al [13] applied linear programming technique to an entrepreneur decision making process and examined its impact using the model to maximize profit with the limited resources available. Akpan and Iwok [14] employed linear programming for optimal use of raw materials in a bakery. In their study, they sought to investigate how an LP problem could be used to allocate the limited resources of the bakery effectively to the competing variables such as small loaf, big loaf and giant loaf in order to achieve a maximum profit for the bakery. Altan et al [15] carried out a research with the primary aim of maximizing the national income of turkey by employing linear programming as a tool as well as input-output analysis. Obi [3] presented linear programming technique as a major method for water resource management. With the empirical data, they demonstrated the uniqueness of linear programming in water resources utilizations, modeling and optimization by means of maximizing benefits, gains and profits and the minimization of losses, expenditure and labour. Woubante [16] applied linear programming technique to apparel industry. The data available was used to estimate the parameters of the model whose results realized a major finding that profit of the company could be improved by as much as 59.84%. Aboelmagd [17] applied linear programming to some construction sites. Linear programming model was formulated to solve various cost and time problems at those sites. Lechuga [18] demonstrated in his research that linear programming problem could be applied as an optimal logistic strategy to distribute medicines to clinics and hospitals. The study presented a methodology for the optimal selection of vehicles that could be used to distribute their drugs from one delivery point to the other by employing a mixed integer linear programming that provided the various quantities and characteristics of each of the transports. Al-Nassr [19] presented Al-Rasheed crop farm as a linear programming problem. He investigated the optimal agricultural plan that could achieve the best crop combination that could produce the maximum returns or profit at a least cost from farm inputs and to ensure that efficient utilization of available resources was achieved. Al-Rawi and Mukherjee [20] applied linear programming to optimize labour scheduling. Their research focused on a constructive method for solving labour scheduling problem encountered in a construction company, suggesting an estimated labour cost over a week and the requirement of part-time labourers in each shift using linear programming techniques. Oladejo et al [21] optimized landmark university bakery production using linear programming. The formulated LP model provided an optimized profit of a production industry. Mallick et al [22] applied linear programming technique to find an optimal poultry feed cost. According to them, “demand for poultry meat and eggs was increasing at a faster rate due to their good quality, nutritive values, and reasonable prices”. Alotaibi and Nadeem [23] reviewed some applications of linear programming in agricultural practices. They presented the various LP applications that included feed mix, crop pattern and rotation plan, irrigation water, and the likes that have the main role to improve the various segments of the agricultural sector.From the reviewed literature and to the best of our knowledge, application of the concept of linear programming in the manner presented in this paper appears non-existent. The study was therefore intended to fill that knowledge or research gap.

3. Materials and Methods

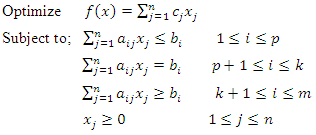

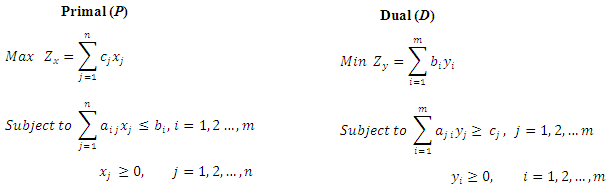

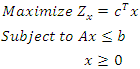

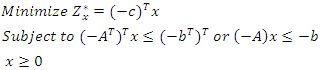

- The concepts of Linear Programming, Sensitivity Analysis and Duality Theory are the main theoretical framework of this study. • Linear Programming (LP)Linear programming (LP), also called linear optimization, is a method used to achieve the best outcome for an objective (such as maximum profit or minimum cost or other measures of effectiveness (Williams [24]) in a mathematical model whose requirements are represented by linear relationships. Linear programming is a special case of mathematical programming (mathematical optimization). More formally, linear programming is a technique for the optimization of a linear objective function, subject to linear equality or linear inequality constraints. Linear programming is concerned with finding an efficient way to utilize scarce resources. The general form of the LP model is stated as:

| (1) |

is the objective function,

is the objective function,  is the

is the  decision variable,

decision variable,  is the

is the  cost coefficient,

cost coefficient,  is the

is the  technological coefficient in the

technological coefficient in the  constraint,

constraint,  is the

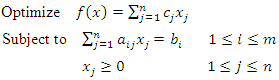

is the  right-hand-side parameter (resource availability) and p, k, m, and n are integers. The general form LP (1) can be transformed into the standard form as:

right-hand-side parameter (resource availability) and p, k, m, and n are integers. The general form LP (1) can be transformed into the standard form as: | (2) |

Minimize

Minimize  or • Minimize

or • Minimize  Maximize

Maximize  .There are four main assumptions inherent in a LP model that must be taken into account in any application. They are proportionality, additivity, divisibility, and certainty (Hillier and Lieberman [25]). Some of the existing mathematical optimisation methods generally used to solve LP problems are the simplex method, revised simplex method and interior-point methods. • Sensitivity AnalysisFormally, sensitivity analysis is the study of how the uncertainty in the output of a mathematical model or system (numerical or otherwise) can be apportioned to different sources of uncertainty in its inputs (Saltelli et al [26]). In LP, sensitivity analysis is concerned with how changes in an LP’s parameters affect the LP’s optimal solution. Changes in the problem which are usually studied can be classified into the following six categories:(a) Changes in the profit or cost coefficient

.There are four main assumptions inherent in a LP model that must be taken into account in any application. They are proportionality, additivity, divisibility, and certainty (Hillier and Lieberman [25]). Some of the existing mathematical optimisation methods generally used to solve LP problems are the simplex method, revised simplex method and interior-point methods. • Sensitivity AnalysisFormally, sensitivity analysis is the study of how the uncertainty in the output of a mathematical model or system (numerical or otherwise) can be apportioned to different sources of uncertainty in its inputs (Saltelli et al [26]). In LP, sensitivity analysis is concerned with how changes in an LP’s parameters affect the LP’s optimal solution. Changes in the problem which are usually studied can be classified into the following six categories:(a) Changes in the profit or cost coefficient  (b) Changes in the availability of a resource

(b) Changes in the availability of a resource  (c) Changes in the technological coefficient

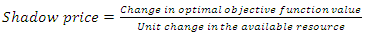

(c) Changes in the technological coefficient  (d) Addition/Deletion of a constraint(e) Addition/Deletion of a variable(f) Combinations of (a) to (e)The interested reader is referred to Sharma [27], Sinha [28] and Hillier & Lieberman [29] for detailed discussions of sensitivity analysis.• Duality in LPIn the context of linear programming, duality implies that a linear programming problem can be analyzed in two different ways but they would have equivalent solutions. Any LP problem (either maximization or minimization) can be stated in another equivalent form based on the same data. The new LP problem is called the dual problem or in short, the dual. If the optimal solution to any one is known, the optimal solution to the other can readily be obtained. In fact, it is immaterial which problem is designated the primal since the dual of a dual is the primal. Because of these properties, the solution of a linear programming problem can be obtained by solving either the primal or the dual, whichever is easier (Rao [30]). The main aim of a dual problem is to find for each resource its best marginal value (also called shadow price). This value reflects the scarcity of the resource; that is the maximum additional price to be paid to obtain one additional unit of the resource (Sharma [27]).The shadow price is also defined as the rate of change in the optimal objective function value with respect to a unit change in the available resource. To be more precise for any constraint, we have

(d) Addition/Deletion of a constraint(e) Addition/Deletion of a variable(f) Combinations of (a) to (e)The interested reader is referred to Sharma [27], Sinha [28] and Hillier & Lieberman [29] for detailed discussions of sensitivity analysis.• Duality in LPIn the context of linear programming, duality implies that a linear programming problem can be analyzed in two different ways but they would have equivalent solutions. Any LP problem (either maximization or minimization) can be stated in another equivalent form based on the same data. The new LP problem is called the dual problem or in short, the dual. If the optimal solution to any one is known, the optimal solution to the other can readily be obtained. In fact, it is immaterial which problem is designated the primal since the dual of a dual is the primal. Because of these properties, the solution of a linear programming problem can be obtained by solving either the primal or the dual, whichever is easier (Rao [30]). The main aim of a dual problem is to find for each resource its best marginal value (also called shadow price). This value reflects the scarcity of the resource; that is the maximum additional price to be paid to obtain one additional unit of the resource (Sharma [27]).The shadow price is also defined as the rate of change in the optimal objective function value with respect to a unit change in the available resource. To be more precise for any constraint, we have The interpretation of rate of change (increase or decrease) in the value of an objective function depends on whether we are solving a maximization or minimization LP problem. The shadow price for a less than or equal to

The interpretation of rate of change (increase or decrease) in the value of an objective function depends on whether we are solving a maximization or minimization LP problem. The shadow price for a less than or equal to  type constraint will always be greater than or equal to zero. This is because increasing the right-hand side resource value cannot make the value of the objective function worse. Similarly, the shadow price for a greater than or equal to

type constraint will always be greater than or equal to zero. This is because increasing the right-hand side resource value cannot make the value of the objective function worse. Similarly, the shadow price for a greater than or equal to  type constraint will always be less than or equal to zero because increasing the right-hand side value cannot improve the value of the objective function (Sharma [27]).In general, the primal-dual relationship between a pair of unsymmetrical LP problems can be expressed as follows:

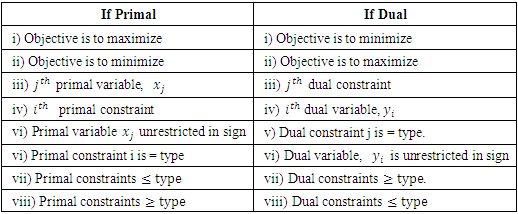

type constraint will always be less than or equal to zero because increasing the right-hand side value cannot improve the value of the objective function (Sharma [27]).In general, the primal-dual relationship between a pair of unsymmetrical LP problems can be expressed as follows: Table 1 gives a summary of the primal-dual relationships between a pair of unsymmetrical LP problems.

Table 1 gives a summary of the primal-dual relationships between a pair of unsymmetrical LP problems.

|

| (3) |

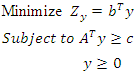

The dual of this problem is

The dual of this problem is  | (4) |

| (5) |

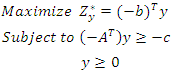

If we consider LP problem [5] as primal, then its dual can be constructed by considering x as the dual variable. Thus we have,

If we consider LP problem [5] as primal, then its dual can be constructed by considering x as the dual variable. Thus we have, | (6) |

is an optimal solution for the primal problem (3) and

is an optimal solution for the primal problem (3) and  is an optimal solution for its corresponding dual problem (4), then

is an optimal solution for its corresponding dual problem (4), then  ProofIf

ProofIf  are feasible solutions of the primal and dual problems (3) and (4) respectively and

are feasible solutions of the primal and dual problems (3) and (4) respectively and  , then

, then  must be optimal solutions to the primal and dual problems respectively (Certificate of Optimality Theorem).It follows that if

must be optimal solutions to the primal and dual problems respectively (Certificate of Optimality Theorem).It follows that if  is an optimal solution for the primal problem (3) and

is an optimal solution for the primal problem (3) and  is an optimal solution for the dual (4), then

is an optimal solution for the dual (4), then

4. Results and Discussions

4.1. Collected Data and Information from the Bank

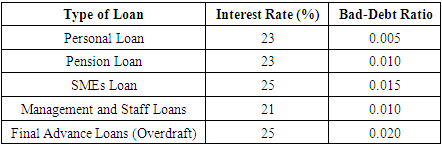

- Table 2 presents the various types of loans offered by the bank in 2022 and their corresponding interest rates and bad-debt ratios.

|

4.2. Formulation of the Loans Model

- Based on the collected data and information from the bank in January, 2022, an optimal loans model was developed for the bank as follows.

4.2.1. Decision Variables of the Model

- Let

= Amount of cedis to be invested in Personal Loans

= Amount of cedis to be invested in Personal Loans = Amount of cedis to be invested in Pension Loans

= Amount of cedis to be invested in Pension Loans = Amount of cedis to be invested in SMEs loans

= Amount of cedis to be invested in SMEs loans = Amount of cedis to be invested in Management and Staff Loans

= Amount of cedis to be invested in Management and Staff Loans = Amount of cedis to be invested in Final Advanced Loans (Overdraft)

= Amount of cedis to be invested in Final Advanced Loans (Overdraft)  and

and  are the decision variables of the model.

are the decision variables of the model.4.2.2. Objective Function of the Model

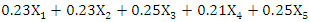

- Total Interest =

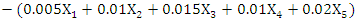

Bad Debt =

Bad Debt =  Net Returns = Total interest - Bad Debt

Net Returns = Total interest - Bad Debt

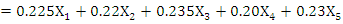

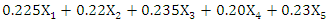

The objective function is therefore given asMaximize P =

The objective function is therefore given asMaximize P =  where P is the Total Profit to be accrued from the various investments.

where P is the Total Profit to be accrued from the various investments.4.2.3. Constraints of the Model

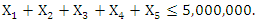

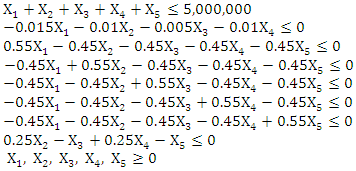

- i. A maximum of GH¢5 million to be invested implies that

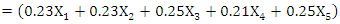

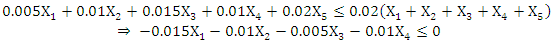

ii. Bad debts should not exceed 2% of all loans implies that

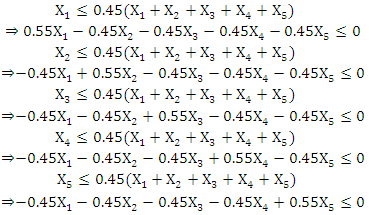

ii. Bad debts should not exceed 2% of all loans implies that iii. None of the loan investments should receive more than 45% of the total investment implies that

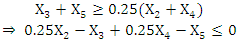

iii. None of the loan investments should receive more than 45% of the total investment implies that iv. Investment in SMEs and Final Advanced loans (overdraft) should receive at least 25% of the funds invested in Pension and Management and Staff loans implies:

iv. Investment in SMEs and Final Advanced loans (overdraft) should receive at least 25% of the funds invested in Pension and Management and Staff loans implies:

4.2.4. The Developed Loans Model

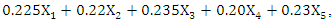

- The developed loans model for the bank is therefore given as:Maximize P =

Subject to

Subject to | (7) |

4.3. Optimal Solution of the Model

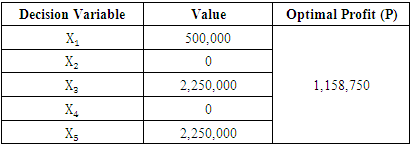

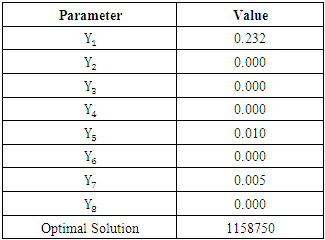

- The developed model was solved using Management Scientist Version 5 Software based on the Simplex Method and developed by Anderson et al [31]. Table 3 presents the optimal solution of the developed model.

|

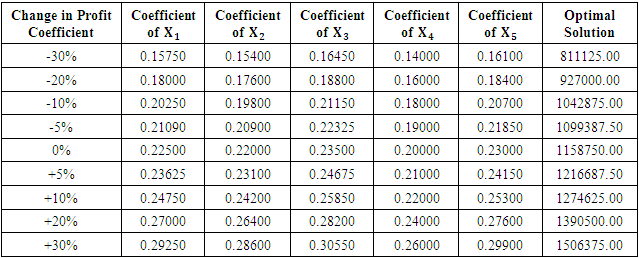

4.4. Sensitivity Analysis of the Developed Model

- Here the effects of variations of selected key parameters on the model are presented. Specifically, the effects of variations of the profit coefficients of the model was done as presented in Table 4.

|

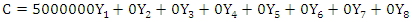

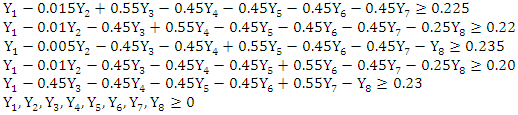

4.5. Duality Analysis

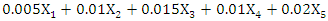

- The Dual of the developed LP model (7) was formulated as:Minimize

Subject to

Subject to | (8) |

|

means that if the right hand side value of the first constraint in the Primal Model is increased or decreased by GH¢1.00, the optimal solution/profit will respectively increase or decrease by GH¢0.232. Similarly,

means that if the right hand side value of the first constraint in the Primal Model is increased or decreased by GH¢1.00, the optimal solution/profit will respectively increase or decrease by GH¢0.232. Similarly,  means that if the right hand side value of the fifth constraint in the Primal Model is increased by GH¢1.00, the optimal solution/profit will increase by GH¢0.010.

means that if the right hand side value of the fifth constraint in the Primal Model is increased by GH¢1.00, the optimal solution/profit will increase by GH¢0.010.  can also be interpreted in a similar fashion or way. Finally,

can also be interpreted in a similar fashion or way. Finally,  means that increasing the right hand side value of the second constraint in the Primal Model will not have any effect on the optimal solution/profit.

means that increasing the right hand side value of the second constraint in the Primal Model will not have any effect on the optimal solution/profit.

and

and  can be interpreted in a similar way.

can be interpreted in a similar way.4.6. Discussions of Results

- The developed loans model will go a long way to help the bank because it will as a guide when giving out loans in order to maximize profit. Other banks and financial institutions can benefit from the developed model as they can take a cue from it. It can be recalled from the results of the sensitivity analysis performed on the developed model that, as the profit coefficients of the model decrease, the optimal profits decrease and as the profit coefficients increase, the optimal profits increase. This naturally makes sense and affirms the fact that the model has been well formulated or developed. It can also be recalled that the optimal solution for both the Primal Model and the Dual Model are the same and for that matter agreeing with strong Duality Theorem discussed in Chapter Three. This in one way or the other affirms that both the Primal Model and the Dual Model have well formulated. Finally, from the results of the duality analysis performed, one will not have to necessarily run the developed loans model to know the effect of an increase or decrease in an available resource on the optimal solution/profit.

5. Conclusions

- The concept of linear programming has been successfully used to examine the loan policy of a bank in Upper West Region of Ghana. Specifically, an optimal loans model has been developed for the bank using linear programming to help maximize its profits or returns accrued from giving out loans. Also, the effects of variations of some selected key parameters on the developed model has been performed by means of sensitivity analysis. Moreover, duality analysis has been performed on the developed model to know the effect of an increase or decrease in an available resource on the optimal solution/profit.The study recommends that the bank under consideration should use the developed model as a guide when giving out loans in order to maximize its profit or returns. Also, other banks and financial institutions should take a cue from the developed model when giving out loans in order to maximize their profits or returns.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML