-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Applied Mathematics

p-ISSN: 2163-1409 e-ISSN: 2163-1425

2018; 8(1): 1-4

doi:10.5923/j.am.20180801.01

On a Problem of Maximization in the Discrete Time Models of Economic Dynamics

S. I. Hamidov

Baku State University, Department of Mathematic Cybernetics, Baku, Azerbaijan

Correspondence to: S. I. Hamidov, Baku State University, Department of Mathematic Cybernetics, Baku, Azerbaijan.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

We consider the two-sector model of the economic dynamics. The problem of the distribution of labor between sectors is considered under the condition that the total consumption is maximized. As a production function is taken a function with constant elasticity of the substitution (CES). Potential opportunity of the sectors is analyzed.

Keywords: Problem of maximization, Consumption, Production function

Cite this paper: S. I. Hamidov, On a Problem of Maximization in the Discrete Time Models of Economic Dynamics, Applied Mathematics, Vol. 8 No. 1, 2018, pp. 1-4. doi: 10.5923/j.am.20180801.01.

1. Introduction

- Consider Neumann type two-sector model

[1] that is denoted as

[1] that is denoted as  . Let’s introduce the denotations:

. Let’s introduce the denotations: base funds of the

base funds of the  sector;

sector; number of the labor in the

number of the labor in the  sector;

sector; consumption fund of the

consumption fund of the  sector;

sector; specific consumption (wage rate) in the

specific consumption (wage rate) in the  sector;

sector; national income in the

national income in the  sector;

sector; capital-labor force ratio in the

capital-labor force ratio in the  sector,

sector,

ratio of fixed assets disposals in the

ratio of fixed assets disposals in the  sector;

sector; production function of the

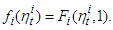

production function of the  sector. Sometimes instead of the function

sector. Sometimes instead of the function  we’ll consider the function

we’ll consider the function  It is expected that the total labor force is

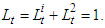

It is expected that the total labor force is  In paper [2] the dependence of the consumption volume on the labor force is investigated. In this paper the following problem is set: to distribute the labor between the sectors such that to maximize the total consumption. At the same time as a production function the function with constant elasticity of substitution (CES) is considered [1, 3, 4, 6, 8].

In paper [2] the dependence of the consumption volume on the labor force is investigated. In this paper the following problem is set: to distribute the labor between the sectors such that to maximize the total consumption. At the same time as a production function the function with constant elasticity of substitution (CES) is considered [1, 3, 4, 6, 8].2. Main Part

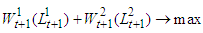

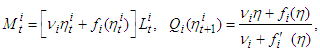

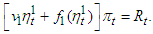

- So, consider the problem of maximizing the total consumption

| (1) |

| (2) |

is a consumption fund in the

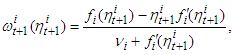

is a consumption fund in the  sector, under the assumption that the special consumption

sector, under the assumption that the special consumption  is chosen by the formula

is chosen by the formula  | (3) |

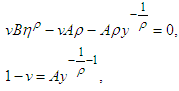

is the unique root of the equation

is the unique root of the equation  | (4) |

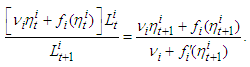

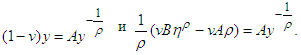

may be expressed as function of

may be expressed as function of

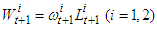

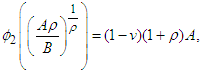

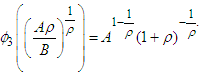

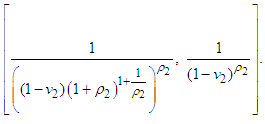

| (5) |

and

and  are defined by the equalities

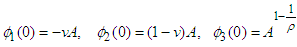

are defined by the equalities then the following relations are valid

then the following relations are valid | (6) |

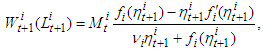

is an inverse to function defined by the formula (5).Now suppose that as a production function will be considered the function with a constant elasticity of substitution (CES)

is an inverse to function defined by the formula (5).Now suppose that as a production function will be considered the function with a constant elasticity of substitution (CES)  | (7) |

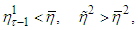

It is proved that [2] in the case when

It is proved that [2] in the case when  is a production function with a constant elasticity of substitution (CES) the consumption computed by the formula (6), reaches its maximum in some point

is a production function with a constant elasticity of substitution (CES) the consumption computed by the formula (6), reaches its maximum in some point  and

and  is a unique local extremum point, the function

is a unique local extremum point, the function  has the only inflection point

has the only inflection point  which changes the concavity to the convexity while

which changes the concavity to the convexity while  Note that capital-labor ratio

Note that capital-labor ratio  in which the maximum of the consumption function of the defined by the formula (6) is reached is the same at all times. Therefore, the point

in which the maximum of the consumption function of the defined by the formula (6) is reached is the same at all times. Therefore, the point  depends only on the national wealth

depends only on the national wealth

| (8) |

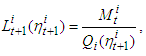

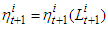

Suppose that (3) has a unique solution

Suppose that (3) has a unique solution  and

and  is a point in which the function

is a point in which the function  reaches its maximum. As above

reaches its maximum. As above  and

and  are found from the conditions

are found from the conditions Here we give Lemma 1. Let the following conditions be fulfilled а)

Here we give Lemma 1. Let the following conditions be fulfilled а)  b)

b)  for some moment

for some moment  .Then

.Then  Proof. Let

Proof. Let  and

and  . Since

. Since  and

and  are increasing functions and

are increasing functions and  then

then  and therefore

and therefore  Since

Since  we have

we have Considering (8) we get

Considering (8) we get  Lemma is proved. Note. It is easy to check that the condition

Lemma is proved. Note. It is easy to check that the condition  is satisfied if

is satisfied if  Let’s show this. The points

Let’s show this. The points  and

and  are solutions of the equations

are solutions of the equations  where

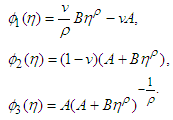

where  Then

Then Let

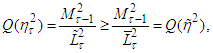

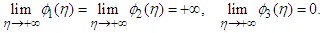

Let Note that the functions

Note that the functions  and

and  are increasing and

are increasing and  - decreasing and moreover

- decreasing and moreover and

and It follows from the last that the equation

It follows from the last that the equation  has a unique solution

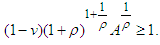

has a unique solution  if and only if, when

if and only if, when  that is equivalent to the inequality

that is equivalent to the inequality  Then

Then  if and only if when

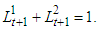

if and only if when  Due to the properties of

Due to the properties of  and

and  we have

we have  (Fig.1).

(Fig.1). | Figure 1 |

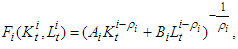

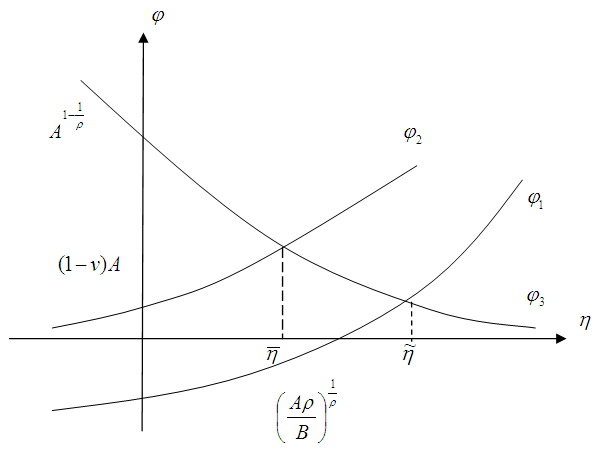

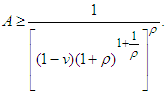

is satisfied if

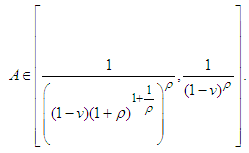

is satisfied if | (9) |

and

and

As follows from (9)

As follows from (9) From this we obtain

From this we obtain Consequently, for the fulfillment of the condition а) of Lemma 1 it is enough to take

Consequently, for the fulfillment of the condition а) of Lemma 1 it is enough to take  from the interval

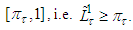

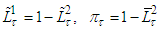

from the interval  Let

Let  and

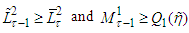

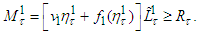

and  It is validTheorem 1. Let the conditions а)

It is validTheorem 1. Let the conditions а)  b)

b)  be satisfied. Then

be satisfied. Then  for all

for all  and moreover

and moreover  decreases.Proof. First we show that

decreases.Proof. First we show that  Actually, from the condition

Actually, from the condition  and (8) follows that

and (8) follows that  Since the total number of the labor is equal to unit, the function

Since the total number of the labor is equal to unit, the function  is increasing and concave on the interval

is increasing and concave on the interval  . Considering that

. Considering that  we obtain from the last that

we obtain from the last that  increases on the interval

increases on the interval  and decreases on

and decreases on  . Therefore the solution

. Therefore the solution  of problem (1) lies on the interval

of problem (1) lies on the interval  It gives

It gives Suppose that

Suppose that  Then from the second condition of b) follows that

Then from the second condition of b) follows that  This means that

This means that  If

If  then

then  and then

and then  From

From  we get

we get  Thus

Thus  Besides in the proof was shown that

Besides in the proof was shown that  and so considering

and so considering  we get

we get  Now using Lemma 1 we obtain

Now using Lemma 1 we obtain From this considering

From this considering  after the similar considerations may be shown that

after the similar considerations may be shown that  and

and  Continuing this process we arrive at the proof of the theorem.

Continuing this process we arrive at the proof of the theorem. 3. Consequence

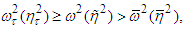

- If the conditions of Theorem 1 are satisfied then

and total consumption

and total consumption tends to

tends to  .Assume that the potential of the second sector is higher than the first sector. Then Theorem 1 is an example of the fact that under certain assumptions in the problem of maximization of the total consumption in contrast to the problems with the same wage rates we do not observe the replacement of the labor force to the second, more "better" production [2]. Moreover, in fact, the labor force in the second sector is upper bounded by the decreasing sequence. Also limit the total consumption is less than the similar limit in the problem with the same wages.

.Assume that the potential of the second sector is higher than the first sector. Then Theorem 1 is an example of the fact that under certain assumptions in the problem of maximization of the total consumption in contrast to the problems with the same wage rates we do not observe the replacement of the labor force to the second, more "better" production [2]. Moreover, in fact, the labor force in the second sector is upper bounded by the decreasing sequence. Also limit the total consumption is less than the similar limit in the problem with the same wages. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML