Quang Phung Duy

Department of Mathematics, Foreign Trade University, Ha noi, Viet Nam

Correspondence to: Quang Phung Duy , Department of Mathematics, Foreign Trade University, Ha noi, Viet Nam.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The aim of this paper is to give recursive and integral equations for ruin probabilities of generalized risk processes under assumption that both sequences of claims and rates of interest are homogenous Markov chains. Generalized Lundberg inequalities for ruin probabilities of these processes are derived by using recursive technique. Firstly, we give a recursive equations for finite – time probability and ultimate ruin probability. By using these equations, we can derive probability inequalities for finite – time probability and ultimate ruin probability. The above results give upper bounds for finite – time probability and ultimate ruin probability. A numerical example is given to illustrate results.

Keywords:

Integral equation, Recursive equation, Ruin probability, Homogeneous Markov chain

Cite this paper: Quang Phung Duy , Ruin Probability in a Generalized Risk Process under Rates of Interest with Homogenous Markov Chain Claims and Homogenous Markov Chain Interests, Applied Mathematics, Vol. 3 No. 5, 2013, pp. 185-197. doi: 10.5923/j.am.20130305.05.

1. Introduction

For over a century, there has been a major interest in actuarial science. Since a large portion of the surplus of insurance business from investment income, actuaries have been studying ruin problems under risk models with rates of interest. For example, Teugels and Sundt[10],[11] studied the effects of constant rate on the ruin probability under the compound Poisson risk model. Yang[13] established both exponential and non – exponential upper bounds for ruin probabilities in a risk model with constant interest force and independent premiums and claims. Cai[3],[4] investigated the ruin probabilities in two risk models, with independent premiums and claims and used a first – order autoregressive process to model the rates of in interest. Cai and Dickson[5] obtained Lundberg inequalities for ruin probabilities in two discrete- time risk process with a Markov chain interest model and independent premiums and claims. In this paper, we study the models considered by Cai and Dickson[5] to the case homogenous Markov chain claims and homogenous Markov chain rates of interest and independent premiums. The main difference between the model in our paper and the one in Cai and Dickson[5] is that claims and rates of interest in our model are assumed to follow homogeneous Markov chains. We let  be premiums,

be premiums,  be claims,

be claims,  be interests and they define on probability space

be interests and they define on probability space  To establish probability inequalities for ruin probabilities of these models, we study two styles of premium collections. On the one hand of the premiums are collected at the beginning of each period then the surplus process

To establish probability inequalities for ruin probabilities of these models, we study two styles of premium collections. On the one hand of the premiums are collected at the beginning of each period then the surplus process  with initial surplus

with initial surplus  can be written as

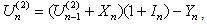

can be written as | (1.1) |

which can be rearranged as | (1.2) |

On the other hand, if the premiums are collected at the end of each period, then the surplus process  with initial surplus

with initial surplus  can be written as

can be written as | (1.3) |

which is equivalent to | (1.4) |

where throughout this paper, we denote  and

and  if

if  .We assume that:Assumption 1.1.

.We assume that:Assumption 1.1.  Assumption 1.2.

Assumption 1.2.  is a sequence of independent and identically distributed non – negative continuous random variables with the same distributive function

is a sequence of independent and identically distributed non – negative continuous random variables with the same distributive function  .Assumption 1.3.

.Assumption 1.3.  is a homogeneous Markov chain,

is a homogeneous Markov chain,  take values in a finite set of non - negative numbers

take values in a finite set of non - negative numbers  with

with  and

and  where

where  Assumption 1.4.

Assumption 1.4.  is homogeneous Markov chain,

is homogeneous Markov chain,  take values in a finite set of non - negative numbers

take values in a finite set of non - negative numbers  with

with  and

and  where

where  Assumption 1.5.

Assumption 1.5.  and

and  are assumed to be independent.We define the finite time and ultimate ruin probabilities of model (1.1) with assumption 1.1 to assumption 1.5, respectively, by

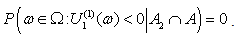

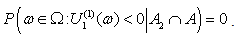

are assumed to be independent.We define the finite time and ultimate ruin probabilities of model (1.1) with assumption 1.1 to assumption 1.5, respectively, by | (1.5) |

| (1.6) |

Similarly, we define the finite time and ultimate ruin probabilities of model (1.3) with assumption 1.1 to assumption 1.5, respectively, by | (1.7) |

| (1.8) |

In this paper, we derive probability inequalities for  and

and  . The paper is organized as follows; in Section 2, we give recursive and integral equations for

. The paper is organized as follows; in Section 2, we give recursive and integral equations for  and

and  . In Section 3 we derive probability inequalities for

. In Section 3 we derive probability inequalities for  and

and  by an inductive approach. A numerical example is given to illustrate these results in Section 4. Finally, we conclude our paper in Section 5.

by an inductive approach. A numerical example is given to illustrate these results in Section 4. Finally, we conclude our paper in Section 5.

2. Integral Equation for Ruin Probabilities

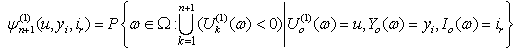

We first give recursive equations for  and an integral equation for

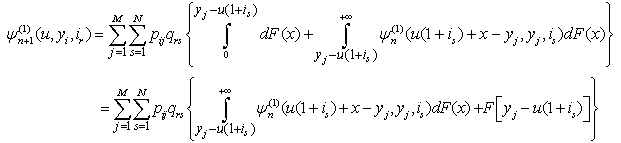

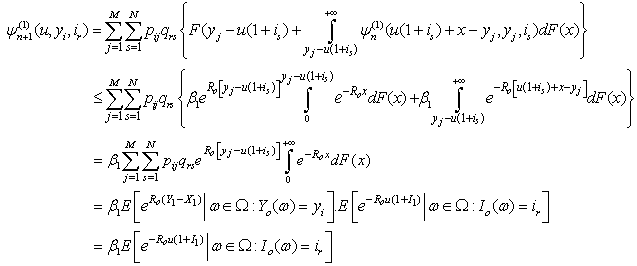

and an integral equation for  .Theorem 2.1. If model (1.1) satisfies the assumptions 1.1 to 1.5 then for n = 1, 2, …

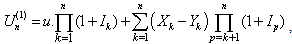

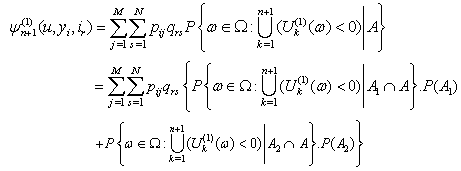

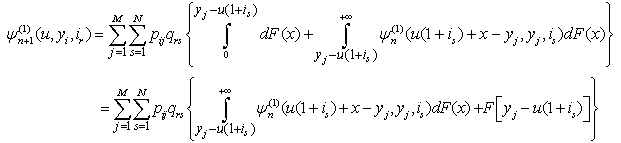

.Theorem 2.1. If model (1.1) satisfies the assumptions 1.1 to 1.5 then for n = 1, 2, …  | (2.1) |

and | (2.2) |

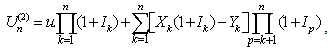

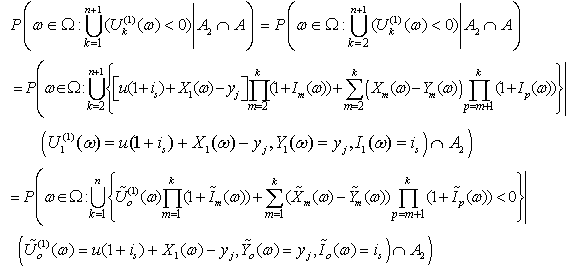

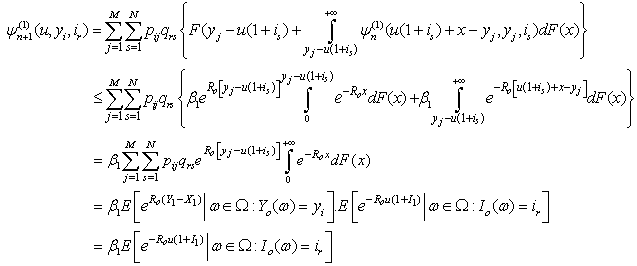

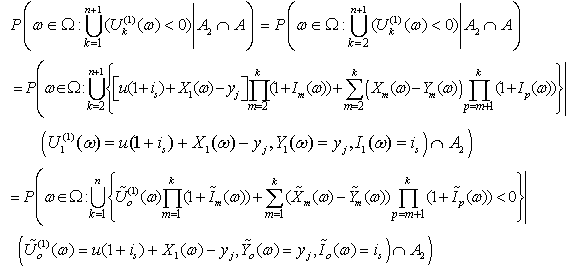

Proof.Give  Let

Let

,

, .From (1.1), we have

.From (1.1), we have  and

and | (2.3) |

In addition, | (2.4) |

Let  be independent copies of

be independent copies of  ,

,  ,

,  respectively with

respectively with  Thus, (2.4) and (1.2) imply that

Thus, (2.4) and (1.2) imply that | (2.5) |

On the other hand, (1.5) implies Thus, we have

Thus, we have | (2.6) |

From (2.3), we have .From (2.5), we have

.From (2.5), we have Therefore, (2.6) is written as

Therefore, (2.6) is written as | (2.7) |

Thus, the integaral equation for  in Theorem 2.1 follows immediately from the dominated convergence theorem by letting

in Theorem 2.1 follows immediately from the dominated convergence theorem by letting  in (2.7).This completes the proof Similarly, the following recursive equation for

in (2.7).This completes the proof Similarly, the following recursive equation for  and integral equation for

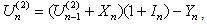

and integral equation for  are hold.Theorem 2.2. If model (1.3) satisfies assumptions 1.1 to 1.5 then, for n = 1, 2, …

are hold.Theorem 2.2. If model (1.3) satisfies assumptions 1.1 to 1.5 then, for n = 1, 2, … | (2.8) |

and | (2.9) |

Next, we establish probability inequalities for ruin probabilities of model (1.1) and model (1.3).

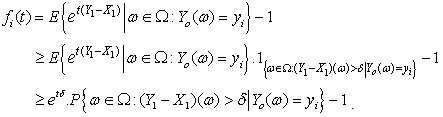

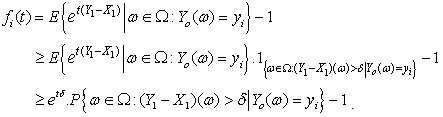

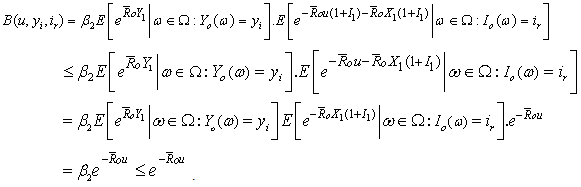

3. Probability Inequalities for Ruin Probabilities

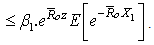

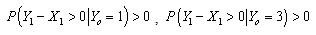

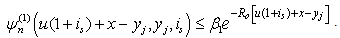

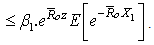

To establish probability inequalities for ruin probabilities of model (1.1), we first proof the following Lemma.Lemma 3.1. Let model (1.1) satisfy assumptions 1.1 to 1.5 and  . If, any

. If, any ,

, and

and | (3.1) |

then there exists a unique positive constant  satisfying:

satisfying: | (3.2) |

Proof.Define  We have

We have From

From  is discrete random variables and it takes values in

is discrete random variables and it takes values in  then

then  has

has  -th derivative function on

-th derivative function on  (any

(any  ).In addition,

).In addition,  with

with  satisfying :

satisfying : and

and  .This implies that

.This implies that  has

has  -th derivative function on

-th derivative function on  with

with  . Thus,

. Thus,  has

has  -th derivative function on

-th derivative function on  with

with  and

and

.This implies that

.This implies that | (3.3) |

and | (3.4) |

By  , we can find some constant

, we can find some constant  such that

such that Then, we can get that

Then, we can get that Imply

Imply | (3.5) |

From (3.3), (3.4) and (3.5) there exists a unique positive constant  satisfying (3.2).This completes the proof .Let:

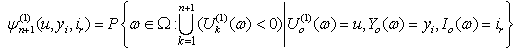

satisfying (3.2).This completes the proof .Let:  Using Lemma 3.1 and Theorem 2.1, we obtain a probability inequality for

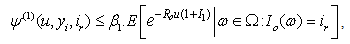

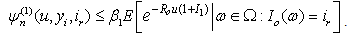

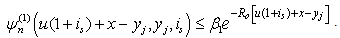

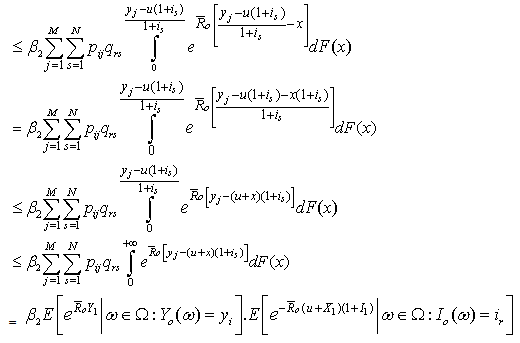

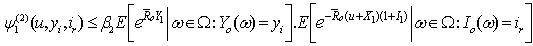

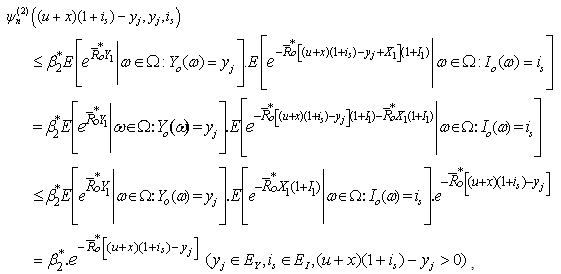

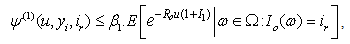

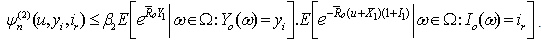

Using Lemma 3.1 and Theorem 2.1, we obtain a probability inequality for  by an inductive approach.Theorem 3.1. If model (1.1) satisfies assumptions 1.1 to 1.5,

by an inductive approach.Theorem 3.1. If model (1.1) satisfies assumptions 1.1 to 1.5,  and (3.1) thenfor any

and (3.1) thenfor any  ,

, and

and

| (3.6) |

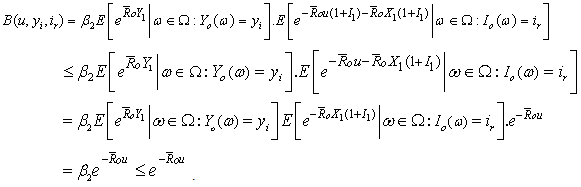

where Proof.Firstly, we have

Proof.Firstly, we have .For any

.For any  , we have

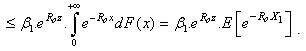

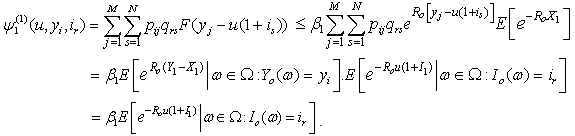

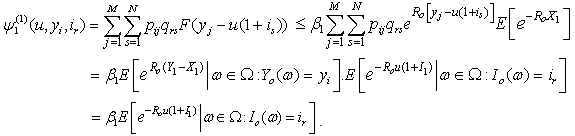

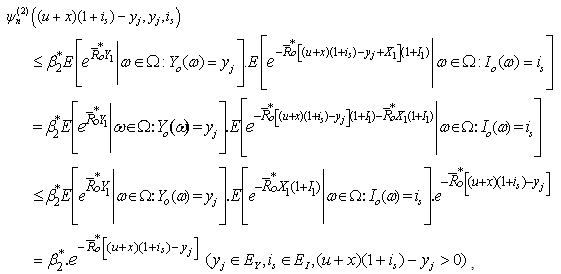

, we have | (3.7) |

| (3.8) |

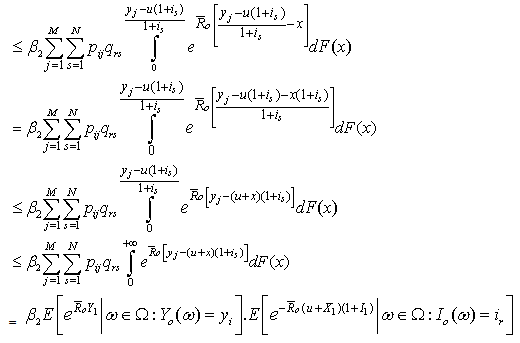

Then, for any  ,

, and

and  , we can write

, we can write  | (3.9) |

Thus, combining (3.8) and (3.9), we have | (3.10) |

Applying an inductive hypothesis, we assume for any  ,

, and

and  ,

, | (3.11) |

Then (3.10) implies that (3.11) holds with n = 1. For  ,

,  and

and  , we have

, we have where

where  ,

, and

and  For any

For any

then

then

.That

.That  then

then | (3.12) |

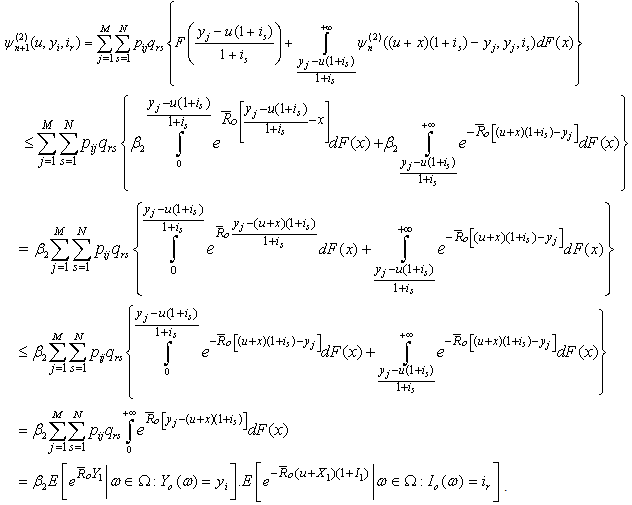

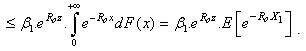

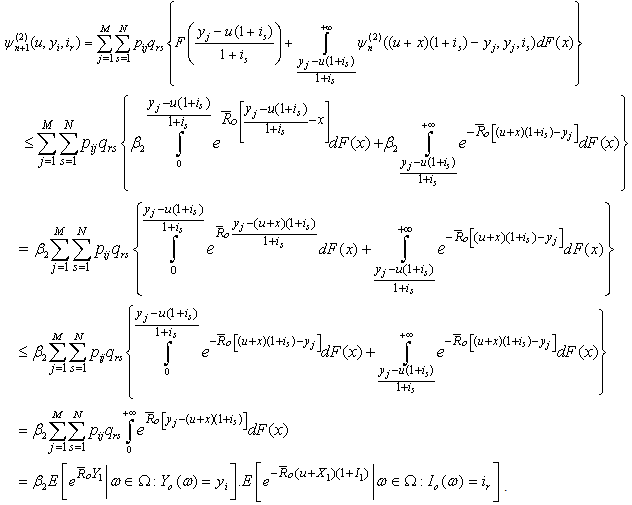

Therefore, by Lemma 3.1, (2.1), (3.7) and (3.12), we get Thus

Thus Consequently, for any

Consequently, for any  (3.11) holds. Therefore, (3.6) follows by letting

(3.11) holds. Therefore, (3.6) follows by letting  in (3.11).This completes the proof Remark 3.1. Let

in (3.11).This completes the proof Remark 3.1. Let  . From

. From  and

and  , we have

, we have Therefore, upper bound for ruin probability in (3.6) is better than

Therefore, upper bound for ruin probability in (3.6) is better than  .Similar to Lemma 3.1, we have Lemma 3.2.Lemma 3.2. Assume that model (1.3) satisfies assumptions 1.1 to 1.5 and

.Similar to Lemma 3.1, we have Lemma 3.2.Lemma 3.2. Assume that model (1.3) satisfies assumptions 1.1 to 1.5 and  . If any

. If any  and

and  ,

,  and

and  | (3.13) |

then there exists a unique positive constant  satisfying:

satisfying: Let

Let  Next, we use Lemma 3.2 and Theorem 2.2 to give a probability inequality for

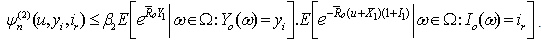

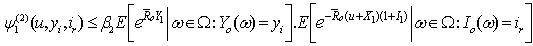

Next, we use Lemma 3.2 and Theorem 2.2 to give a probability inequality for  by an inductive approach.Theorem 3.2. If model (1.3) satisfies assumptions 1.1 to 1.5,

by an inductive approach.Theorem 3.2. If model (1.3) satisfies assumptions 1.1 to 1.5,  and (3.13) then, for any

and (3.13) then, for any  and

and

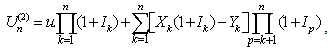

| (3.14) |

where Proof.Similarly with Theorem 3.1, we have

Proof.Similarly with Theorem 3.1, we have  and any

and any

| (3.15) |

| (3.16) |

Then, for any  ,

,  and

and

Hence

Hence | (3.17) |

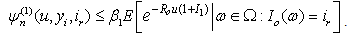

Under an inductive hypothesis, we assume that  | (3.18) |

Then, (3.17) implies that (3.18) holds with n = 1. For  ,

,  and

and  , we have

, we have where

where  ,

, and

and  For any

For any

then

then

We get

We get  then

then | (3.19) |

Therefore, by Lemma 3.2, (2.8), (3.15) and (3.19), we get Thus

Thus Consequently, for any n =1, 2, … (3.18) holds. Therefore, (3.14) follows by letting

Consequently, for any n =1, 2, … (3.18) holds. Therefore, (3.14) follows by letting  in (3.18). Remark 3.2.Let

in (3.18). Remark 3.2.Let From

From  and

and  , we have

, we have  Hence, upper bound for ruin probability in (3.14) is better than

Hence, upper bound for ruin probability in (3.14) is better than  .

.

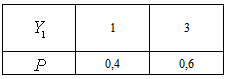

4. A Numerical Illustration

In this section we give a numerical example to illustrate the bounds of  derived in Section 3. Let

derived in Section 3. Let  be a sequence of independent and identically distributed non-negative continuous random variables with the same distributive function

be a sequence of independent and identically distributed non-negative continuous random variables with the same distributive function  .Let

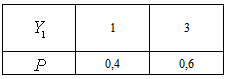

.Let  be a homogeneous Markov chain such that for any

be a homogeneous Markov chain such that for any  ,

,  take values in

take values in  with

with  having a distribution:

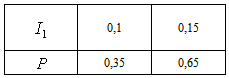

having a distribution: and matrix

and matrix  is given by

is given by Let

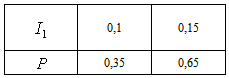

Let  be a homogeneous Markov chain such that for any

be a homogeneous Markov chain such that for any  ,

,  take value in

take value in  with

with  having a distribution:

having a distribution: and matrix

and matrix  is given by

is given by Then, we have

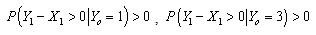

Then, we have  Therefore

Therefore | (4.1) |

In the other hand, | (4.2) |

and  | (4.3) |

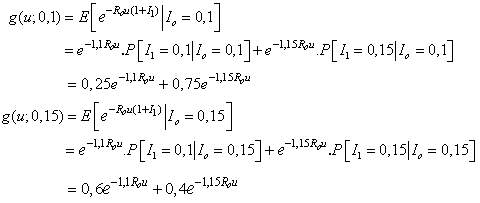

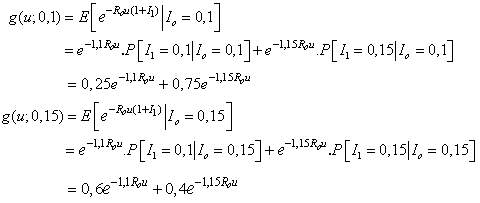

Combining (4.1), (4.2) and (4.3) imply that Lemma 3.1 holds.Next, we solve equation (3.2). Firstly, we have where

where (

( )and

)and

Respective equation (3.2) for

Respective equation (3.2) for  , by

, by | (4.4) |

| (4.5) |

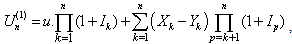

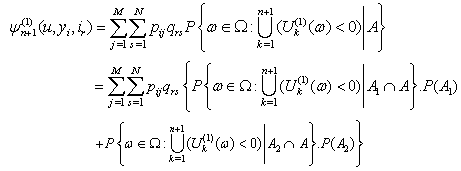

Using Maple, we find respective root of (3.2) for  , by

, by Hence,

Hence,  .We can apply the result of Theorem 3.1 for

.We can apply the result of Theorem 3.1 for

| (4.6) |

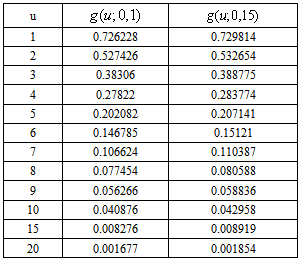

where Table 1 shows values upper bounds

Table 1 shows values upper bounds  of

of  for a range of value of u

for a range of value of u

5. Conclusions

Our main results in this paper are Theorem 2.1 and Theorem 2.2 giving recursive equations for  and

and  and integral equations for

and integral equations for  and

and  ; Theorem 3.1 and Theorem 3.2 giving probability inequalities for

; Theorem 3.1 and Theorem 3.2 giving probability inequalities for  and

and  by an inductive approach. In addition, a numerical example is given illustrating Theorem 3.1.

by an inductive approach. In addition, a numerical example is given illustrating Theorem 3.1.

ACKNOWLEDGMENTS

The author is thankful to the referee for providing valuable suggestions to improve the quality of the paper.In addition, the author would like to express his sincere gratitude to Professor Bui Khoi Dam for many scientific suggestions during the preparation of this paper.

References

| [1] | Albrecher, H. (1998) Dependent risks and ruin probabilities in insurance. IIASA Interim Report, IR-98-072 . |

| [2] | Asmussen, S. (2000) Ruin probabilities, World Scientific, Singapore. |

| [3] | Cai, J. (2002) Discrete time risk models under rates of interest. Probability in the Engineering and Informational Sciences, 16, 309-324. |

| [4] | Cai, J. (2002) Ruin probabilities wwith dependent rates of interest, Journal of Applied Probability, 39, 312-323. |

| [5] | Cai, J. and Dickson, D. CM (2004) Ruin Probabilities with a Markov chain interest model. Insurance: Mathematics and Economics, 35, 513-525. |

| [6] | Nyrhinen, H. (1998) Rough descriptions of ruin for a general class of surplus processes. Adv. Appl. Prob., 30 , 1008-1026. |

| [7] | Promislow, S. D. (1991) The probability of ruin in a process with dependent increments. Insurance: Mathematics and Economics, 10, 99-107. |

| [8] | Rolski, T., Schmidli, H., Schmidt, V. and Teugels, J. L.(1999) Stochastic Processes for Insuarance and Finance. John Wiley, Chichester. |

| [9] | Shaked, M. and Shanthikumar, J. (1994), Stochastic Orders and their Applications. Academic Press, San Diego. |

| [10] | Sundt, B. and Teugels, J. L (1995) Ruin estimates under interest force, Insurance: Mathematics and Economics, 16, 7-22. |

| [11] | Sundt, B. and Teugels, J. L. (1997) The adjustment function in ruin estimates under interest force. Insurance: Mathematics and Economics, 19, 85-94. |

| [12] | Xu, L. and Wang, R. (2006) Upper bounds for ruin probabilities in an autoregressive risk model with Markov chain interest rate, Journal of Industrial and Management optimization, Vol.2 No.2,165- 175. |

| [13] | Yang, H. (1999) Non – exponetial bounds for ruin probability with interest effect included, Scandinavian Actuarial Journal, 2, 66-79. |

| [14] | Willmost, G. E, Cai, J. and Lin, X.S. (2001) Lundberg Approximations for Compound Distribution with Insurance Applications. Springer – Verlag, New York. |

be premiums,

be premiums,  be claims,

be claims,  be interests and they define on probability space

be interests and they define on probability space  To establish probability inequalities for ruin probabilities of these models, we study two styles of premium collections. On the one hand of the premiums are collected at the beginning of each period then the surplus process

To establish probability inequalities for ruin probabilities of these models, we study two styles of premium collections. On the one hand of the premiums are collected at the beginning of each period then the surplus process  with initial surplus

with initial surplus  can be written as

can be written as

with initial surplus

with initial surplus  can be written as

can be written as

and

and  if

if  .We assume that:Assumption 1.1.

.We assume that:Assumption 1.1.  Assumption 1.2.

Assumption 1.2.  is a sequence of independent and identically distributed non – negative continuous random variables with the same distributive function

is a sequence of independent and identically distributed non – negative continuous random variables with the same distributive function  .Assumption 1.3.

.Assumption 1.3.  is a homogeneous Markov chain,

is a homogeneous Markov chain,  take values in a finite set of non - negative numbers

take values in a finite set of non - negative numbers  with

with  and

and  where

where  Assumption 1.4.

Assumption 1.4.  is homogeneous Markov chain,

is homogeneous Markov chain,  take values in a finite set of non - negative numbers

take values in a finite set of non - negative numbers  with

with  and

and  where

where  Assumption 1.5.

Assumption 1.5.  and

and  are assumed to be independent.We define the finite time and ultimate ruin probabilities of model (1.1) with assumption 1.1 to assumption 1.5, respectively, by

are assumed to be independent.We define the finite time and ultimate ruin probabilities of model (1.1) with assumption 1.1 to assumption 1.5, respectively, by

and

and  . The paper is organized as follows; in Section 2, we give recursive and integral equations for

. The paper is organized as follows; in Section 2, we give recursive and integral equations for  and

and  . In Section 3 we derive probability inequalities for

. In Section 3 we derive probability inequalities for  and

and  by an inductive approach. A numerical example is given to illustrate these results in Section 4. Finally, we conclude our paper in Section 5.

by an inductive approach. A numerical example is given to illustrate these results in Section 4. Finally, we conclude our paper in Section 5. and an integral equation for

and an integral equation for  .Theorem 2.1. If model (1.1) satisfies the assumptions 1.1 to 1.5 then for n = 1, 2, …

.Theorem 2.1. If model (1.1) satisfies the assumptions 1.1 to 1.5 then for n = 1, 2, …

Let

Let

,

, .From (1.1), we have

.From (1.1), we have  and

and

be independent copies of

be independent copies of  ,

,  ,

,  respectively with

respectively with  Thus, (2.4) and (1.2) imply that

Thus, (2.4) and (1.2) imply that

Thus, we have

Thus, we have

.From (2.5), we have

.From (2.5), we have Therefore, (2.6) is written as

Therefore, (2.6) is written as

in Theorem 2.1 follows immediately from the dominated convergence theorem by letting

in Theorem 2.1 follows immediately from the dominated convergence theorem by letting  in (2.7).This completes the proof Similarly, the following recursive equation for

in (2.7).This completes the proof Similarly, the following recursive equation for  and integral equation for

and integral equation for  are hold.Theorem 2.2. If model (1.3) satisfies assumptions 1.1 to 1.5 then, for n = 1, 2, …

are hold.Theorem 2.2. If model (1.3) satisfies assumptions 1.1 to 1.5 then, for n = 1, 2, …

. If, any

. If, any ,

, and

and

satisfying:

satisfying:

We have

We have From

From  is discrete random variables and it takes values in

is discrete random variables and it takes values in  then

then  has

has  -th derivative function on

-th derivative function on  (any

(any  ).In addition,

).In addition,  with

with  satisfying :

satisfying : and

and  .This implies that

.This implies that  has

has  -th derivative function on

-th derivative function on  with

with  . Thus,

. Thus,  has

has  -th derivative function on

-th derivative function on  with

with  and

and

.This implies that

.This implies that

, we can find some constant

, we can find some constant  such that

such that Then, we can get that

Then, we can get that Imply

Imply

satisfying (3.2).This completes the proof .Let:

satisfying (3.2).This completes the proof .Let:  Using Lemma 3.1 and Theorem 2.1, we obtain a probability inequality for

Using Lemma 3.1 and Theorem 2.1, we obtain a probability inequality for  by an inductive approach.Theorem 3.1. If model (1.1) satisfies assumptions 1.1 to 1.5,

by an inductive approach.Theorem 3.1. If model (1.1) satisfies assumptions 1.1 to 1.5,  and (3.1) thenfor any

and (3.1) thenfor any  ,

, and

and

Proof.Firstly, we have

Proof.Firstly, we have .For any

.For any  , we have

, we have

,

, and

and  , we can write

, we can write

,

, and

and  ,

,

,

,  and

and  , we have

, we have where

where  ,

, and

and  For any

For any

then

then

.That

.That  then

then

Thus

Thus Consequently, for any

Consequently, for any  (3.11) holds. Therefore, (3.6) follows by letting

(3.11) holds. Therefore, (3.6) follows by letting  in (3.11).This completes the proof Remark 3.1. Let

in (3.11).This completes the proof Remark 3.1. Let  . From

. From  and

and  , we have

, we have Therefore, upper bound for ruin probability in (3.6) is better than

Therefore, upper bound for ruin probability in (3.6) is better than  .Similar to Lemma 3.1, we have Lemma 3.2.Lemma 3.2. Assume that model (1.3) satisfies assumptions 1.1 to 1.5 and

.Similar to Lemma 3.1, we have Lemma 3.2.Lemma 3.2. Assume that model (1.3) satisfies assumptions 1.1 to 1.5 and  . If any

. If any  and

and  ,

,  and

and

satisfying:

satisfying: Let

Let  Next, we use Lemma 3.2 and Theorem 2.2 to give a probability inequality for

Next, we use Lemma 3.2 and Theorem 2.2 to give a probability inequality for  by an inductive approach.Theorem 3.2. If model (1.3) satisfies assumptions 1.1 to 1.5,

by an inductive approach.Theorem 3.2. If model (1.3) satisfies assumptions 1.1 to 1.5,  and (3.13) then, for any

and (3.13) then, for any  and

and

Proof.Similarly with Theorem 3.1, we have

Proof.Similarly with Theorem 3.1, we have  and any

and any

,

,  and

and

Hence

Hence

,

,  and

and  , we have

, we have where

where  ,

, and

and  For any

For any

then

then

We get

We get  then

then

Thus

Thus Consequently, for any n =1, 2, … (3.18) holds. Therefore, (3.14) follows by letting

Consequently, for any n =1, 2, … (3.18) holds. Therefore, (3.14) follows by letting  in (3.18). Remark 3.2.Let

in (3.18). Remark 3.2.Let From

From  and

and  , we have

, we have  Hence, upper bound for ruin probability in (3.14) is better than

Hence, upper bound for ruin probability in (3.14) is better than  .

. derived in Section 3. Let

derived in Section 3. Let  be a sequence of independent and identically distributed non-negative continuous random variables with the same distributive function

be a sequence of independent and identically distributed non-negative continuous random variables with the same distributive function  .Let

.Let  be a homogeneous Markov chain such that for any

be a homogeneous Markov chain such that for any  ,

,  take values in

take values in  with

with  having a distribution:

having a distribution: and matrix

and matrix  is given by

is given by Let

Let  be a homogeneous Markov chain such that for any

be a homogeneous Markov chain such that for any  ,

,  take value in

take value in  with

with  having a distribution:

having a distribution: and matrix

and matrix  is given by

is given by Then, we have

Then, we have  Therefore

Therefore

where

where (

( )and

)and

Respective equation (3.2) for

Respective equation (3.2) for  , by

, by

, by

, by Hence,

Hence,  .We can apply the result of Theorem 3.1 for

.We can apply the result of Theorem 3.1 for

Table 1 shows values upper bounds

Table 1 shows values upper bounds  of

of  for a range of value of u

for a range of value of u and

and  and integral equations for

and integral equations for  and

and  ; Theorem 3.1 and Theorem 3.2 giving probability inequalities for

; Theorem 3.1 and Theorem 3.2 giving probability inequalities for  and

and  by an inductive approach. In addition, a numerical example is given illustrating Theorem 3.1.

by an inductive approach. In addition, a numerical example is given illustrating Theorem 3.1. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML of

of