Muhammad Alamgir Islam, Md. Shahidul Hoque, Sanjib Ghosh

Department of Statistics, University of Chittagong, Chattogram, Bangladesh

Correspondence to: Muhammad Alamgir Islam, Department of Statistics, University of Chittagong, Chattogram, Bangladesh.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

Mode choice is an essential and important step in investment planning. The idea of this study focusing on identifying an application of multinomial logistic regression (MLR) model, that we believe it is important and useful methods for categorical data analysis. This paper presents the process of derivation and estimation of a MLR for mode of investment in Bangladesh. This study aims to identify the factors that influence the choice of mode of investment in Bangladesh. We only have considered three choices of investments such as saving or time deposit, gold and stock market. To identify the model by practical way, we used real data. In this study a well-designed and pre-tested questionnaire have been used to collect data. Finally used 766 respondents with consistent and valid information for analysis. The variables of the model have been predicted based on maximum likelihood method. So, our maximum likelihood parameter estimates, diagnostic and goodness of fit statistics and odds ratios were obtained from the final fitted logistic regression model. From this study it has been found most of the respondents prefer saving or time deposit as mode of investment. We also observed that males are 0.705 times less likely than females to prefer investment of saving over stock market.

Keywords:

Mode of investment, Multinomial logit model, Maximum likelihood estimation, LR Test, Odds ratio

Cite this paper: Muhammad Alamgir Islam, Md. Shahidul Hoque, Sanjib Ghosh, Investment Mode Choice Behavior with Multinomial Logit Model, American Journal of Mathematics and Statistics, Vol. 14 No. 1, 2024, pp. 1-8. doi: 10.5923/j.ajms.20241401.01.

1. Introduction

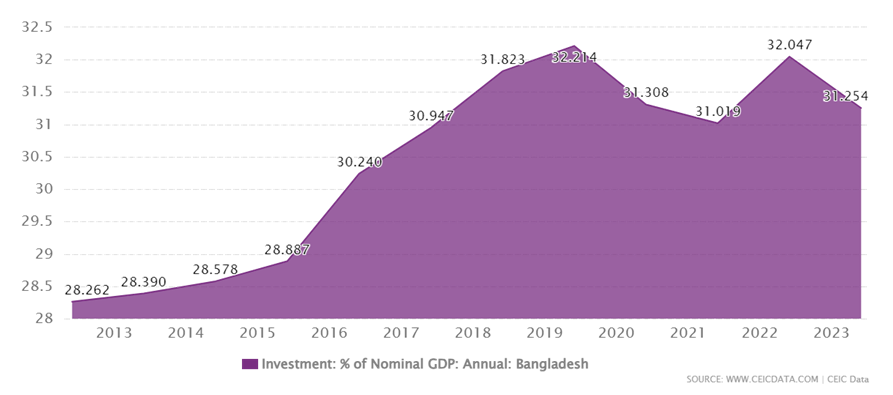

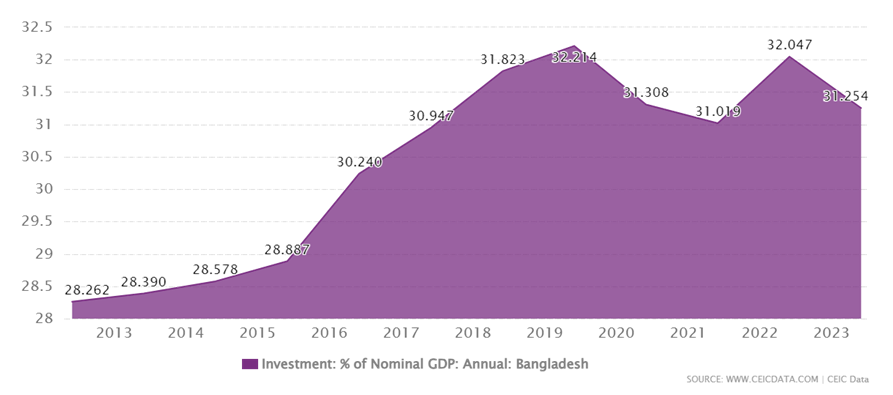

In an economy, investments provide the most important economic link between the past, the present, and the future. This also play a critical role in the growth process. Economic history shows that countries that flourished in accruing high levels of national investment largely financed by national savings, achieved faster rates of economic growth and progress. Bangladesh investment accounted for 31.3% of its nominal GDP in Jun 2023, compared with a ratio of 32.0% in the previous year. Bangladesh has political stability under a democratic system. Inflation is steady because of good monetary and fiscal management. Bangladesh is a winning combination with its high connectivity, competitive market, business-friendly environment, and competitive cost structure that can give you the best returns. Bangladesh offers generous and attractive packages of incentives to investors. It is now considered as the most liberal and business friendly economy in South Asia and an attractive destination for foreign private business and investments. The government of Bangladesh has given highest priority to augmenting private investment in Bangladesh. The incentives offered are considered as the most competitive in South Asia.Bangladesh financial market has developed through time. As a result of this development, financially knowledgeable investors in the country now have a variety of short- and long-term modes of investment to explore. Most investors want to make investments that will yield significant returns as quickly as possible while avoiding the risk of losing their money. It is why so many people are on the search for effective forms of investment that will allow them to grow their money in a matter of months or years while posturing little or no risk. By investing wisely, investor can ensure that their hard-earned money is parked in investments that help the investor reach their short- and long-term financial goals. Investment planning is an excellent way to prepare for retirement so that the investor can finally do the things that the investor has always done. If the investors are wondering how to invest a small amount of money in Bangladesh, here are three investment categories that you can consider, namely, savings or time deposit, stock market and gold.

1.1. Time Deposit / Savings

A time deposit is a bank account that takes in an amount of cash that will bear interest with a pre-set maturity date. The most common type of time deposit account is a certificate of deposit or CD, which requires you to commit your savings for a specific term of months or years. It pays a higher interest rate compared to a regular savings account. At the same time, there is no limitation as to when one can withdraw money from a regular savings account, the time deposit locks in the money within a certain time. The longer the bank keeps the money, the higher the interest payment it offers to the depositor. The interest payment is an amount earned by having the money in the bank for the term or period. Time deposits are also called term deposits.

1.2. Stock Market

Investments in stock markets can achieve long-term wealth creation. However, finding the appropriate stocks to invest in requires a lot of research and caution. You must also carefully time your entrance and exit points, as well as maintain constant investment monitoring. Bangladesh has two Stock exchanges which include the Dhaka Stock exchange and the Chittagong stock exchange. Dhaka Stock exchange (generally known as DSE) is the main stock exchange of Bangladesh. It is located in Motijheel at the heart of the Dhaka city. It was incorporated in 1954. Dhaka stock exchange is the first stock exchange of the country. There are a total of 651 Securities [18] and 356 companies [13] listed on this Stock exchange. The listing provides an exclusive privilege to securities in the stock exchange. Only listed shares are quoted on the stock exchange. A stock exchange facilitates transparency in transactions of listed securities in perfect equality and competitive conditions. Listing is beneficial to the company, to the investor, and to the public at large. The Chittagong Stock Exchange is a stock exchange based in the port city Chattogram, Bangladesh. It is one of the twin financial hubs of the country, alongside the Dhaka Stock Exchange. Established in 1995, the exchange is located in the Agrabad business district in downtown Chittagong. [9] It has a combined market capitalization of over US$ 38 billion as of 2020. [4]

1.3. Gold Investment

Individuals can also invest in solid gold by purchasing biscuits, bars, or coins. The making charges here are very low, and you get good returns while selling. There is a plethora of precious metals, but gold is placed in high regard as an investment. Due to some influencing factors such as high liquidity and inflation-beating capacity, gold is one of the most preferred investments in Bangladesh. Gold investment can be done in many forms like buying jewelry, coins, bars, gold exchange-traded funds, gold funds, sovereign gold bond scheme, etc. Gold stocks generally rise and fall with the price of gold, but there are well-managed mining companies that are profitable even when the price of gold is down. The main reason to invest in gold is because of the safety it provides. So, for anyone looking to play safe on their investment, gold can be an ideal choice.Bangladesh investment: % GDP from 2012 to 2023 | Figure 1 |

1.4. Related Work

Multinomial logit model has been applied in data analysis in many areas, for example health, social, behavioral, investment and educational. Many studies have been conducted previously on the multinomial logit model in different research field. The MLR model allows the simultaneous comparison of more than one contrast, that is, the log odds of three or more contrasts are estimated simultaneously, Garson (2009) [10].David P. Baron (1982) [16] identified that the model demonstrates a positive demand for investment banking advising and distribution services and provides an explanation of the underpricing of new issues. Ewa Szafraniec-Silutaet et. al., (2022) [1] they established that financial factors have a greater impact on the development of tangible investments in agricultural enterprises in Central Pomerania than non-financial factors. Syed Shahan Ali et al., (2018) [6] they show that Logistic regression model can be used by investors, individual as well as institutions or fund managers to enhance their ability to predict “good or poor” stock. Isfenti Sadalia et al., (2020) [2] they use binary logistic regression on the designed model and found that there is one predictor variable that significantly affects the non-real asset investment decision is the variable availability of financial advisors. Evangelia Karasmanaki et al., (2019) [5] they tried to identify the most important factors that affect environmental students’ willingness to invest in renewable energy (RE) by developing a logistic regression model. According to their analysis, the participants in their majority expressed their willingness to invest, while environmental values, the low risk and profitability of renewable investments, as well as preferences for certain energy types were significant factors determining this willingness. A study conducted by Shaibu Osmanet et. al., (2016) [7] used multinomial logit model and they found that the significant association between drug driving and educational status, Distance traveled, Time (hours) used in driving by commercial drivers in Ghana.M.A. Islam et al. (2020) [3] found that the likelihood of male respondents would choose plane as mood of transportation more than female respondent in Bangladesh by using the multinomial logistic model. In research conducted by Shahidul Hoque et al. (2015) [8] on the multinomial logistic model for mode of occupational choices in Bangladesh, the result indicated that the likelihood of male respondents would choose business as occupation is 5.930 times more than female respondents.From the above studies we may conclude that very few empirical studies have done on mode of investment choice. The present study is designed for derivation and estimation of a multinomial logistic model and its application to the modes of investment in Bangladesh. We strongly believe that, this research will exploit the awareness and behavior of investors, towards existing modes of investment. The developed model might help the investors, to present satisfactory investment and the scheme to fulfill the needs.The core objectives of this study by using real data to apply a new statistical method (multinomial logistic regression model) for analyzing categorical data, to identify the factors that influence the choice of mode of investment in Bangladesh.And to find the likelihood of choosing different types of mode of investment under different types of socio-economic and demographic backgrounds.

2. Materials and Methods

2.1. Study Setting

Bangladesh is situated in eastern South Asia and is bordered by the Bay of Bengal in the south, India, and Myanmar to the east, and just India to the west. Its general area is 148460 square kilometers, including waterways. Bangladesh has a huge population. This little country is populated by around 170 million people. Here, the population density is high. About 1329 people reside in a square kilometer. Bangladesh is predominantly an agricultural nation, with the majority of its population being farmers. The administrative structure of Bangladesh currently comprises eight divisions, namely Chattogram, Dhaka, Khulna, Rajshahi, Barishal, Rangpur, Mymensingh and Sylhet.

2.2. Survey Design and Population

The survey was conducted from April to July 2023. All the earning capability men and women from the eight divisions in Bangladesh, namely Chattogram, Dhaka, Khulna, Rajshahi, Barishal, Rangpur, Mymensingh and Sylhet were considered as the population.

2.3. Data Collection and Sampling Technique

Primary data is used in this study. Here, sampling units are the individuals of the different divisions of Bangladesh. In this study a three-stage unequal cluster sampling has been adopted and the reason for three-stage sampling is administrative convenience [15]. When the clusters are varying in their sizes, the procedure of drawing of sample is known as unequal cluster sampling or cluster sampling for unequal cluster size. Multistage cluster sampling is where the investigator divides the population into clusters, samples the clusters, and then resample, repeating the process until the final sampling units are selected at the last of the hierarchical levels [19]. For a three-stage sampling, at first, we divide the entire population into different clusters (divisions), where the number of districts in each division are not same. In the first stage, we have selected four divisions such as Dhaka, Chattogram, Rajshahi and Sylhet, out of mentioned eight divisions through simple random sampling (SRS). Secondly, from the selected divisions in the first stage we draw a sample of eight districts through SRS. In the final stage, we choose one thana within each district using SRS and those men and women were considered for the study. A well designed and pre-tested questionnaire was used to collect data by skilled data accumulators under constant supervision. Total of 790 respondents were completed the questionnaire and after scrutiny the questionnaire 766 respondents included in the study. Remaining 24 questionnaire were excluded due to not answering the desired questions.

2.4. Study Variables

We only have considered three choices of investments such as saving or time deposit, gold and stock market. The possible factors that influencing the choice of investment, we have considered the factors that is likely to influence sex of the respondents, age of the respondents, level of education and type of jobs as a response variable.

2.5. Method of Data Analysis

Raw data were coded, entered, and analyzed using SPSS statistical software package version 26.0. The logistic regression is the major tool used in this paper. Specifically, the logit version of the multinomial logistic model is used. The parameters of our postulated multinomial logistic models have been estimated by using maximum likelihood method. The technique of chi-square test has been applied to test the goodness of fit of the model. The likelihood ratio test has been used to test the significance of the different factors. Multinomial logistic regression analysis was done to identify the different factors associated with the choice of investment. Odds ratio with 95%confidence interval (CI) were used to determine the significance association and a p-value < 0.05 were considered as a statistical significance.

3. Model Derivation

Multinomial logistic model [11,12,17] used to model a relationship between polytomous response variables and a set of regressor variables. Logistic regression model has an outcome which is categorical and usually binary (dichotomous) [14]. Therefore, for derivation of multinomial logistic model for choice of mode of investment, we have considered the factor that is likely to influence choosing mode of investment as a response variable and four factors such as, sex, age level of education and types of jobs considered as determinants of the mode of investment choice as regressor variables.

3.1. Model Assumptions

Logistic regression does not assume a linear association between the response and explanatory variables, the response variables do not need to be normally distributed, there is no homogeneity of variance assumption, in other words, the variances do not have to be the same within categories, normally distributed error terms are not assumed.

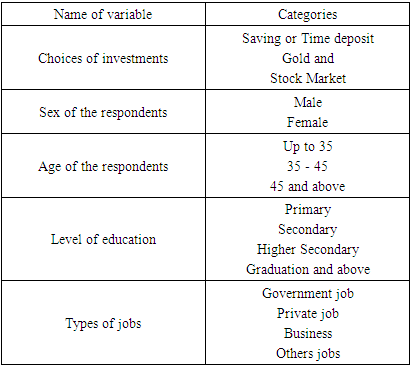

3.2. Categorized Variables

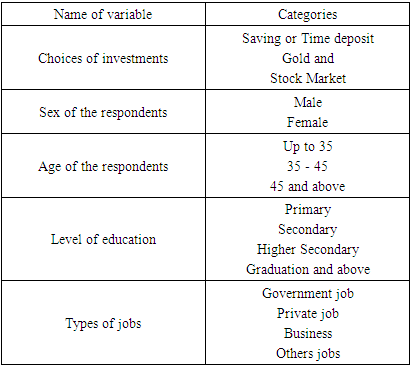

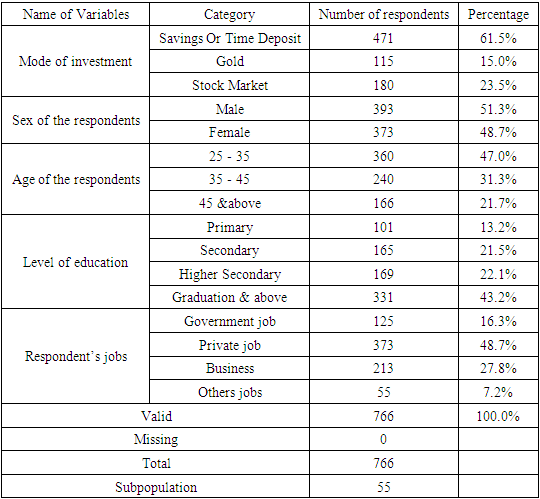

Study VariablesChoice of mode of investments: we only have considered three choices of investments: 1) Saving or Time deposit2) Gold and3) Stock MarketResponse VariablesThe possible factors that influence the choices of investment: Here we have considered only four such factors.1) Sex of the respondents2) Age of the respondents3) Level of education and4) Type of jobs Table 1. Categories of variables

|

| |

|

| Figure 2. Pie chart for mode of investment |

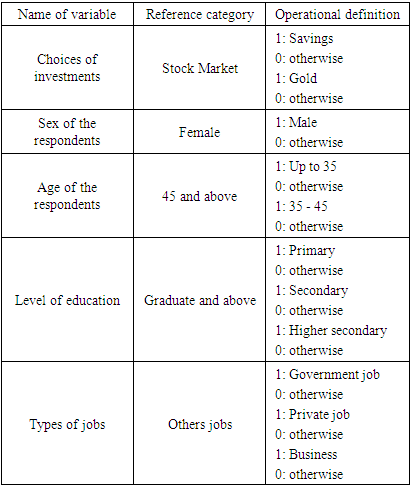

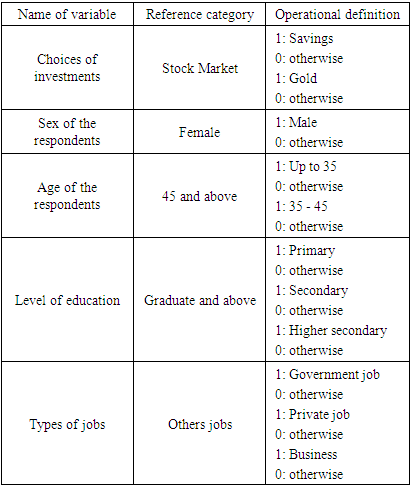

Table 2. Operational Definition

|

| |

|

3.3. Derived Model for Mode of Investment

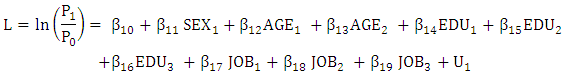

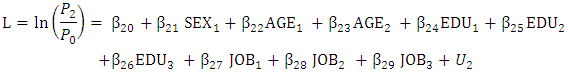

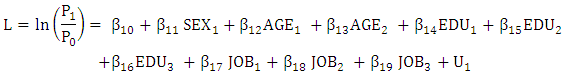

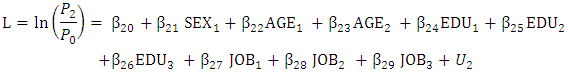

The postulated multinomial logistic model for choices of investment in Bangladesh given below:Equation-I (Saving relative to Stock market) And Equation-II (Gold relative to Stock market)

And Equation-II (Gold relative to Stock market) Here Equation-I is defined for Saving relative to Stock market and Equation-II is defined for gold relative to Stock market. Where β10 and β20 denotes the constant terms for all reference categories of respondents, such as female, age 45 & above, level of education is graduation & above and have others service.SEX1 is a dummy variable denoting the two categories for sex of the respondents: male and female.AGE1 and AGE2 are set of two categories representing the dummy variable age of the respondents, such as up to 35 and 34 to 45 respectively, where age 45 and above as reference category. EDU1, EDU2 and EDU3 are set of three categories representing the dummy variable level of education of the respondents, such as primary, secondary and higher secondary respectively, where graduation and above considered as reference category. JOB1, JOB2 and JOB3 are set of three categories representing the dummy variable types of jobs of the respondents, government service, private service and business respectively, where others jobs are considered as reference category.

Here Equation-I is defined for Saving relative to Stock market and Equation-II is defined for gold relative to Stock market. Where β10 and β20 denotes the constant terms for all reference categories of respondents, such as female, age 45 & above, level of education is graduation & above and have others service.SEX1 is a dummy variable denoting the two categories for sex of the respondents: male and female.AGE1 and AGE2 are set of two categories representing the dummy variable age of the respondents, such as up to 35 and 34 to 45 respectively, where age 45 and above as reference category. EDU1, EDU2 and EDU3 are set of three categories representing the dummy variable level of education of the respondents, such as primary, secondary and higher secondary respectively, where graduation and above considered as reference category. JOB1, JOB2 and JOB3 are set of three categories representing the dummy variable types of jobs of the respondents, government service, private service and business respectively, where others jobs are considered as reference category.

4. Estimation and Results Discussion

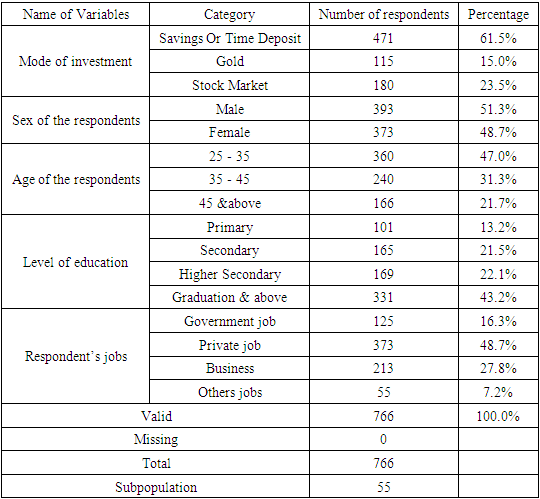

Table 3. General Information on sample data

|

| |

|

A subpopulation of the data consists of one combination of the predictor variables specified for the model. It indicates how many of these combinations of the predictor variables consist of records that all have the same value in the outcome variable.

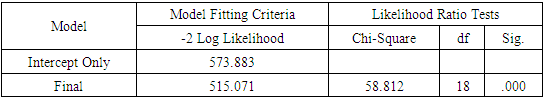

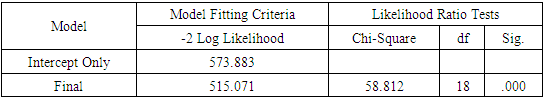

4.1. Test of Fitness of the Fitted Model

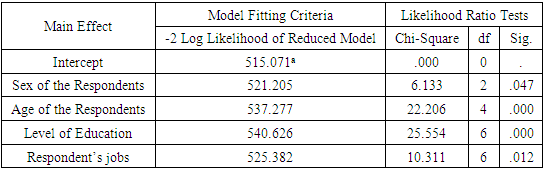

Likelihood Ratio Test (Overall fitness test):We test for whether our model with predictors fits significantly better than our model with just an intercept (null model).Hypothesis:H0: All parameters of that effect are zero.H1: At least one of the predictors regression coefficients is not equal to zero in the model.Table 4. Model Fitting Information

|

| |

|

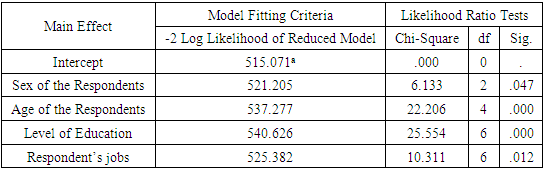

Table 5. Likelihood Ratio Tests of the model

|

| |

|

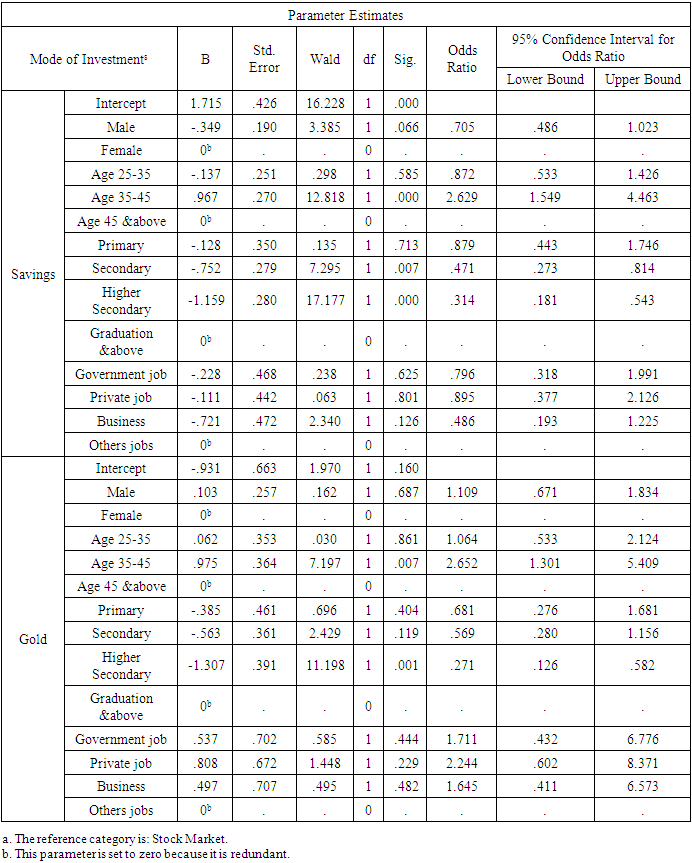

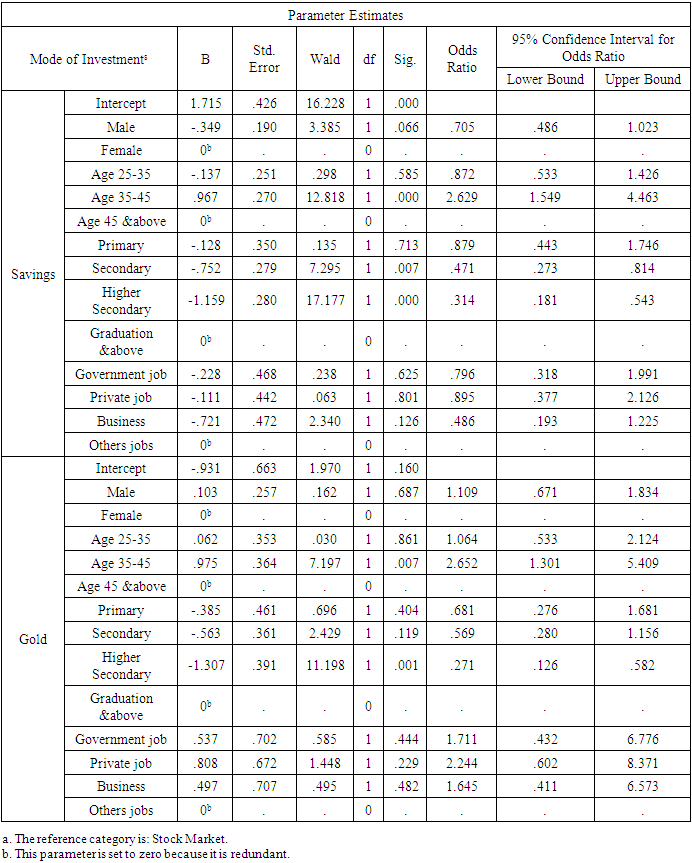

The Chi-Square statistic is the Likelihood Ratio (LR) Chi-Square test that at least one of the regression coefficients is not equal to zero in the model. The LR Chi-Square statistic can be calculated by -2*L (null model) – (-2*L (fitted model)) = 573.883– 515.071= 58.812, where L (null model) is from the log likelihood with just the response variable in the model (Intercept Only) and L (fitted model) is the log likelihood from the final iteration (assuming the model converged) with all the parameters.a. This reduced (null model) model is equivalent to the final model because omitting the effect does not increase the degrees of freedom.RemarksOn the basis of likelihood ratio test, it has been seen that all the parameters of our derived model are statistically highly significant.Table 6. Maximum Likelihood Estimate

|

| |

|

4.2. Interpretation on Estimated Model

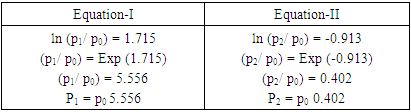

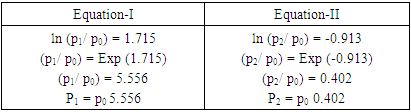

Wald test This is the Wald chi-square test that tests the null hypothesis that the estimate equals 0. For Saving relative to Stock market, the Wald test statistic for the predictor age 35-45 is 12.818 with an associated p-value of 0.000. If we set our alpha level to 0.01, we would reject the null hypothesis and conclude that the regression coefficient for Age 35-45 has been found to be statistically different from zero. Again, for Saving relative to gold, the Wald test statistic for the predictor higher secondary is 11.198 with an associated p-value of 0.001. If we set our alpha level to 0.01, we would reject the null hypothesis and conclude that the regression coefficient for higher secondary has been found to be statistically different from zero. Interpretation of the InterceptsFor those respondents who are female, age 45 & above, level of education is graduation & above and have other services all the regressors will have zero values.Table 7. Estimated values of intercept terms

|

| |

|

For those respondents who are female, age 45 & above, level of education is graduation & above and have other services, the probability of investing in saving is 5.556 times the probability of investing in stock market in equation-I and the probability of investing in gold is 0.402 times the probability of investing in stock market in equation-II. Interpretation of the Slope CoefficientsInterpretation on the slope coefficients of our estimated model can be made in terms of odds ratio as follows:Equation-I (Saving relative to Stock market)For the Age 35-45, the odds ratio 2.629, indicates that respondents age 35-45 are 2.629 times more likely than age 45 &above to prefer investment of saving over stock market.For the male, the odds ratio 0.705, indicates that males are 0.705 times less likely than females to prefer investment of saving over stock market.For the education level secondary, the odds ratio 0.471, indicates that secondary level of education respondents are 0.471 times less likely than the respondent’s graduation &above to prefer investment of saving over stock market and so on.Equation-II (Gold relative to Stock market)For the male, the odds ratio 1.109, indicates that males are 1.109 times more likely than female respondents to prefer investment of gold over stock market.For the Age 35-45, the odds ratio 2.652, indicates that respondents age 35-45 are 2.652 times more likely than age 45 & above to prefer investment of gold over stock market.For the occupation of private job, the odds ratio 2.244, suggest that respondents who have private job would prefer investment of gold 2.244 times more likely than respondents have other services and so on.

5. Concluding Remarks

This study used a multinomial logistic model to examine how socioeconomic and demographics variables influence investment mode choice among resident people in Bangladesh. The variables of the model have been predicted based on maximum likelihood method. The results obtained from the table-3 revealed that respondents would choose 61.5% saving or time deposit, 15% gold and 23.5% stock market as a mode of investment in Bangladesh. Therefore, most of the respondents prefer saving or time deposit as mode of investment. On the basis of likelihood ratio test, our study finds that all the parameters of our derived model are statistically highly significant. However, Wald test indicates that there are some parameters are significant. For those respondents who are female, age 45 & above, level of education is graduation & above and have other services, the probability of investing in saving is 5.556 times the probability of investing in stock market in equation-I and the probability of investing in gold is 0.402 times the probability of investing in stock market in equation-II. The respondents who are female, age 45 & above, level of education is graduation & above and have other services, the probability of investing in saving is 5.556 times the probability of investing in stock market in equation-I and the probability of investing in gold is 0.402 times the probability of investing in stock market in equation-II. The respondents who have private job would prefer investment of gold 2.244 times more likely than respondents have other services. Therefore, we may conclude that this type of respondents would like better saving or time deposit as a mode of investment in Bangladesh. Future studies should be conducted to compare and analyze the investment behavior in Bangladesh with foreign investment.

6. Limitations

In any research study, the limitations are important to acknowledge. Some limitations cannot be controlled by the researcher, some can be minimized, and some occur when the researcher tries to balance scientific accuracy with realism. During the time of conducting the research, many complexities were faced in the field. Some of the respondents were not so cooperative and they were not interested in answering any questions and that was very challenging to the researcher to collect data. Time was very limited to collect data from huge number of populations at eight divisions in Bangladesh and it was a new area of research in Bangladesh, so it was hard for researchers to include whole country.

7. Recommendations

We have suggested prospective areas of researches: future studies can focus on other factors of choosing mode of investment need, such as income and expenditure. The outcome of the study may also make the government aware of the investment sectors. The government should also take necessary steps for creating a business-friendly environment for the investors. For similar study in the future, it is suggested that, database with more comprehensive information about choice of other investment modes (bonds, savings letter) can be considered. Therefore, we suggest that, a similar study can be conducted including interactions effects in this model.

References

| [1] | Ewa Szafraniec-Siluta et al., (2022), Application of the logistic regression model to assess the likelihood of making tangible investments by agricultural enterprises. Procedia Computer Science Volume 207, pages 3894–3903. |

| [2] | Isfenti Sadalia et al., (2020), logistic regression analysis to know the factors affecting the financial knowledge in decision of investment non real assets at university investment gallery. International Journal of Management (IJM) Volume 11, Issue 2, pp. 147–162. |

| [3] | Muhammad Alamgir Islam et al., (2020), Mode of Transportation Choices in Bangladesh: An Application of Multinomial Logistic Model. International Journal of Probability and Statistics, 9(3): 45-53, DOI: 10.5923/j.ijps.20200903.01. |

| [4] | "Historical Market Summary". CSE. 27 October 2020. |

| [5] | Evangelia Karasmanaki et al., (2019), An Investigation of Factors Affecting the Willingness to Invest in Renewables among Environmental Students: A Logistic Regression Approach. Sustainability, 11(18), 5012; https://doi.org/10.3390/su11185012. |

| [6] | Syed Shahan Ali et al., (2018), Prediction of stock performance by using logistic regression model: evidence from Pakistan Stock Exchange (PSX). Asian Journal of Empirical Research Volume 8, Issue 7: 247-258. |

| [7] | Shaibu Osman et al (2016), Logit Model for the Determinants of Drug Driving in Ghana. International Journal of Statistics and Applications 2016, 6(6): 339-346. |

| [8] | Md. Shahidul Hoque et al., (2015), Multinomial logistic model for mode of occupational choices. International Journal of Multidisciplinary Research and Development; 2(3): 20-26. |

| [9] | Muhammad Abdul Mazid (2012). "Chittagong Stock Exchange". In Sirajul Islam; Miah, Sajahan; Khanam, Mahfuza; Ahmed, Sabbir (eds.). Banglapedia: The National Encyclopedia of Bangladesh (Online ed.). Dhaka, Bangladesh: Banglapedia Trust, Asiatic Society of Bangladesh. ISBN 984-32-0576-6. OCLC 52727562. OL 30677644M Retrieved 7 January 2024. |

| [10] | Garson, D. (2009). Logistic Regression with SPSS. North Carolina State University, Public administration Program. |

| [11] | Logit Model (MNL), Traffic Engineering and Control (TEC), October 2008 issue. |

| [12] | Ying So, Warren F. Kuhfeld: Multinomial Logit Models, MR-2010G. |

| [13] | https://www.ceicdata.com/en/bangladesh/dhaka-stock-exchange-number-of-listed-companies-and-shares. |

| [14] | Chatterjee, Samprit, Ali, S., Hadi, and Price, B. (2000). Regression Analysis by Example. New York: John Wiley and Sons. |

| [15] | Kalton, G., Introduction to Survey Sampling, Sage Publications, Thousand Oaks, C.A., 1983. |

| [16] | David P. Baron (1982), A Model of the Demand for Investment Banking Advising and Distribution Services for New Issues. The Journal of Finance Vol. 37, No. 4, pp. 955-976. |

| [17] | Multinomial Logit Models – Overview (This is adapted heavily from Menard’s Applied Logistic Regression analysis). |

| [18] | https://dsebd.org/company_listing.php. |

| [19] | Goldstein, H., Multilevel Statistical Models, Halstead Press, New York, 1995. |

And Equation-II (Gold relative to Stock market)

And Equation-II (Gold relative to Stock market) Here Equation-I is defined for Saving relative to Stock market and Equation-II is defined for gold relative to Stock market. Where β10 and β20 denotes the constant terms for all reference categories of respondents, such as female, age 45 & above, level of education is graduation & above and have others service.SEX1 is a dummy variable denoting the two categories for sex of the respondents: male and female.AGE1 and AGE2 are set of two categories representing the dummy variable age of the respondents, such as up to 35 and 34 to 45 respectively, where age 45 and above as reference category. EDU1, EDU2 and EDU3 are set of three categories representing the dummy variable level of education of the respondents, such as primary, secondary and higher secondary respectively, where graduation and above considered as reference category. JOB1, JOB2 and JOB3 are set of three categories representing the dummy variable types of jobs of the respondents, government service, private service and business respectively, where others jobs are considered as reference category.

Here Equation-I is defined for Saving relative to Stock market and Equation-II is defined for gold relative to Stock market. Where β10 and β20 denotes the constant terms for all reference categories of respondents, such as female, age 45 & above, level of education is graduation & above and have others service.SEX1 is a dummy variable denoting the two categories for sex of the respondents: male and female.AGE1 and AGE2 are set of two categories representing the dummy variable age of the respondents, such as up to 35 and 34 to 45 respectively, where age 45 and above as reference category. EDU1, EDU2 and EDU3 are set of three categories representing the dummy variable level of education of the respondents, such as primary, secondary and higher secondary respectively, where graduation and above considered as reference category. JOB1, JOB2 and JOB3 are set of three categories representing the dummy variable types of jobs of the respondents, government service, private service and business respectively, where others jobs are considered as reference category.  Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML