-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Mathematics and Statistics

p-ISSN: 2162-948X e-ISSN: 2162-8475

2022; 12(2): 15-21

doi:10.5923/j.ajms.20221202.01

Received: Mar. 7, 2022; Accepted: Mar. 25, 2022; Published: Aug. 15, 2022

Markov Switching Autoregressive Modelling of the COVID-19 Daily Cases and Deaths in Nigeria

Benson T. I.1, Biu E. O.2, Nwakuya M. T.2

1Department of Mathematics Statistics, Ignatius Ajuru University of Education, Rivers State Nigeria

2Department of Mathematics and Statistics, University of Port Harcourt, Nigeria

Correspondence to: Nwakuya M. T., Department of Mathematics and Statistics, University of Port Harcourt, Nigeria.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article modeled the daily COVID-19 infected cases and deaths of Nigeria using a Markov switching model. Structural breaks and Stationarity of the daily COVID-19 cases and deaths series were investigated. Unit root and unit root structural break tests were applied where evidence of breaks exists. The results show that each of the series was found to be a nonlinear and nonstationary series with evidence of a structural break. The results of the unit root tests in the presence of structural breaks indicated that each of the series was two significant wave changes. Consequently, a Markov switching AR (MSM(2)-AR(1)) model with two regimes was fitted to the data having established its suitability in modelling the series. Finally, a transition probability matrix between the expected number of COVID-19 infected cases and death cases was obtained.

Keywords: Markov Switching AR Model, Structural Breaks, COVID-19, Nonstationary Series, Volatility, Nonlinear Series

Cite this paper: Benson T. I., Biu E. O., Nwakuya M. T., Markov Switching Autoregressive Modelling of the COVID-19 Daily Cases and Deaths in Nigeria, American Journal of Mathematics and Statistics, Vol. 12 No. 2, 2022, pp. 15-21. doi: 10.5923/j.ajms.20221202.01.

Article Outline

1. Introduction

- There is a need to carry out statistical analysis on the new coronavirus in the world and as well as in Nigeria. Since the epidemic breakouts, a large number of enterprises have faced closures, employment has become more difficult, and people's lives have been greatly affected. Focusing only on the statistical analysis, however, does not solve the problem. But the government needs to adopt the statistical results and interpretation in putting the measures to control the spread of the coronavirus. Since the outbreak of the epidemic, there have been several studies to understand the trend of the virus and predict or forecast the next possible behavior of the virus in order to help in policy making to combat the virus. Some of the studies on COVID-19 include the work of Ogundokun et al., (2020) who in their study showed that the government of Nigeria made the right decision in enforcing travel restrictions because it was discovered that people's travel history and contacts increased their chances of contracting COVID-19. Maleki et al., (2020) proposed an effective technique in predicting confirmed and recovered COVID-19 infections all over the world. Roy et al., (2021) in their study of the epidemiologic pattern in the prevalence and incidence of COVID-2019 in India, showed that west and south of the Indian district are highly vulnerable for COVID-2019. These studies proposed different models for the virus which varies from time series models to growth models. Adedeji et al (2021) in their paper examined the dynamic effect of COVID-19 on four major oil prices concerning China and Nigeria using the structural vector autoregressive method. Zhao et al (2020) predicted Covid-19 spread in African countries using the Maximum-Hasting (MH) parameter estimation method and the modified Susceptible Exposed Infectious Recovered (SEIR) model. Kartikasari et al (2020) evaluate the temporal COVID-19 infection behavior among HCW-D, HCW-A, and non-HCW using ARFIMA Model while Balah and Djeddou (2020) used Autoregressive fractionally integrated moving average Models (ARFIMA) to forecast Covid-19 daily new cases in Algeria. Lahmiri and Bekiros (2021) employed ARFIMA and FIGARCH models to examine long memory (self-similarity) in digital currencies and international stock exchanges before and during the COVID-19 pandemic. Tatar et al (2021) Analyzed excess deaths during the COVID-19 pandemic in the state of Florida using seasonal autoregressive integrated moving average time-series modeling and historical mortality trends. Although these models provide results, there is a risk that these models may not actually reflect the actual properties of the data which might lead to either underestimation or overestimation of the data. Hence, it is important to properly examine the properties of the data to determine its nature and based on that determine the appropriate models that can be associated with such dataset and then proceed to obtain the best model that fits the data for proper and adequate modelling and forecasting for optimal policy making. From the foregoing, it is obvious that the total number of COVID-19 infected cases and deaths in Nigeria have not been studied using a regime-based model. Testing for nonlinearity and structural break is an important step in time series analysis since it helps researchers to determine whether to use each of the linear and nonlinear time series models. In this paper, we demonstrate the usefulness of the regime-switching Markov switching autoregressive (MS-AR) approach in examining the COVID-19 total infected cases and total deaths in Nigeria. We seek to establish evidence of nonlinearity in the total number of COVID-19 infected cases and deaths due to common regime switching behavior occasioned by structural breaks. The remainder of the paper is organized as follows: Section 2 introduces other methodologies and the Markov switching vector autoregressive specifications. Section 3 presents the data analysis and results while Section 4 concludes the paper.

2. Methodology

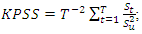

2.1. Unit Roots and Stationarity Tests: (Kwiatkowski-Phillips-Schmidt-Shin (KPSS) Test)

- The KPSS test is a Unit root test that tests for the stationarity of a given series around a deterministic trend. It is used to test whether we have a deterministic trend or stochastic trend: KPSS test is conducted under the following hypothesis:H0: Yt ~ I(0) trend stationaryH1: Yt ~ I(1) stochastic trendIf the null hypothesis is not rejected, it means that there is evidence that the series is trend stationary. The process is as follows:Ø Regress yt on a constant and time trend. Get Ordinary Least Square residuals

Ø Calculate the partial sum of the residuals:

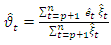

Ø Calculate the partial sum of the residuals: | (1) |

| (2) |

is the estimate of the long-run variance of the residuals.Ø Reject H0 when KPSS is large

is the estimate of the long-run variance of the residuals.Ø Reject H0 when KPSS is large2.2. Nonlinearity and Structural Break Tests

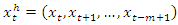

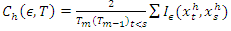

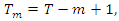

- The BDS and Tsay tests were adopted for testing nonlinearity in the series. The test of Brock et al. (1996) known as the BDS test, takes the concept of the correlation integral and transforms it into a formal test statistic which is asymptotically distributed as a standard normal variable under the null hypothesis of independent and identical distribution against an unspecified alternative Brooks C. (1996). Considering a time series xt with h histories,

, The correlation integral at embedding dimension h can be estimated by;

, The correlation integral at embedding dimension h can be estimated by; | (3) |

is the maximum number of overlapping vectors that we can form with a sample of size T,

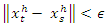

is the maximum number of overlapping vectors that we can form with a sample of size T,  is an indicator function that is equal to one if

is an indicator function that is equal to one if  and equal to zero otherwise. A pair of vectors

and equal to zero otherwise. A pair of vectors  is said to be

is said to be  apart, if the maximum-norm

apart, if the maximum-norm  is greater or equal to

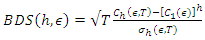

is greater or equal to  . Using this relation the BDS test statistic is defined as;

. Using this relation the BDS test statistic is defined as; | (4) |

is the standard deviation of

is the standard deviation of  The Tsay test of Tsay (1989), tests for evidence of threshold nonlinearity under the null hypothesis of linearity in the dataset. This test is an improvement of Keenan’s test for nonlinearity. Keenan (1985) proposes a nonlinearity test for time series that uses

The Tsay test of Tsay (1989), tests for evidence of threshold nonlinearity under the null hypothesis of linearity in the dataset. This test is an improvement of Keenan’s test for nonlinearity. Keenan (1985) proposes a nonlinearity test for time series that uses  only and modifies the second step of the reset test to avoid multicollinearity between

only and modifies the second step of the reset test to avoid multicollinearity between  and

and  . Tsay test improved on the Keenan’s test by allowing disaggregated nonlinear variables, that is all cross products of

. Tsay test improved on the Keenan’s test by allowing disaggregated nonlinear variables, that is all cross products of  . Hence generalizing Keenan test by explicitly looking for quadratic serial dependence in the data. The procedure is as follows;Firstly, using any selection criterion, select the value p of the number of lags involved in the regression, then fit

. Hence generalizing Keenan test by explicitly looking for quadratic serial dependence in the data. The procedure is as follows;Firstly, using any selection criterion, select the value p of the number of lags involved in the regression, then fit  on

on  to obtain the fitted values

to obtain the fitted values  the residuals set

the residuals set  and the residual sum of squares SSR. Then regress the product

and the residual sum of squares SSR. Then regress the product  on

on  to obtain the residual set

to obtain the residual set  The calculate;

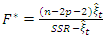

The calculate; | (5) |

| (6) |

where

where  . Once there is evidence of nonlinearity, we proceed to check for the presence of structural break.

. Once there is evidence of nonlinearity, we proceed to check for the presence of structural break.2.3. Unit Roots and Stationarity Tests

- Kim and Perron, (2006) stated that in testing for unit root, it is necessary to consider the effects of structural breaks during unit root testing. Structural breaks play significant roles in that it can lead to misspecification of deterministic function of the auxiliary regression that is used for either testing for unit root or variance stationarity. In this study, we consider the structural break unit root test of Zivot and Andrews (1992) and Perron (1989). Perron uses a modified Dickey-Fuller (DF) unit root tests that includes dummy variables to account for one known, or exogenous structural break. The break point of the trend function is fixed (exogenous) and chosen independently of the data. Perron’s (1989) unit root tests allows for a break under both the null and alternative hypothesis. These tests have less power than the standard DF type test when there is no break. However, Perron (1989) points out that they have a correct size asymptotically and is consistent whether there is a break or not. Moreover, they are invariant to the break parameters and thus their performance does not depend on the magnitude of the break. Zivot and Andrews (1992) endogenous structural break test is a sequential test which utilizes the full sample and uses a different dummy variable for each possible break date. The break date is selected where the t-statistic from the ADF test of unit root is at a minimum (most negative). Consequently, a break date will be chosen where the evidence is least favorable for the unit root null.

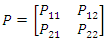

2.4. Markov Switching Vector Autoregressive Model Specification

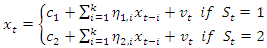

- The Markov Switching Model of Hamilton (1989), also known as the Regime Switching Model, is one of the most popular nonlinear time series models in the literature. This model involves multiple structures that can characterize the time series behaviors in different regimes or states or episodes. A novel feature of the Markov switching model is its Markovian property, which states that the probability of transitioning to any particular state is dependent solely on the current state, and not on the sequence of state that preceded it.In this work we considered modeling the Markov Switching Autoregressive (MS-AR) process. We specifically consider a two regime-switching. We intend to model the regime St as the outcome of an unobserved 2-state Markov chain with St independent of vt for all t. The MS-AR model for two regimes with autoregressive (AR) process of order k is as follows:

| (7) |

The intercept and parameters of AR part are dependent of

The intercept and parameters of AR part are dependent of  at time t. Given that we considered two regimes, we label regime 1 as

at time t. Given that we considered two regimes, we label regime 1 as  representing the period of first wave of COVID-19 and we label regime 2 as

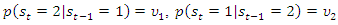

representing the period of first wave of COVID-19 and we label regime 2 as  representing the 2nd wave of COVID-19. The transitions of the St are presumed to be ergodic and intricate 1st order Markov-process with transition probabilities

representing the 2nd wave of COVID-19. The transitions of the St are presumed to be ergodic and intricate 1st order Markov-process with transition probabilities | (8) |

The nearer the probability

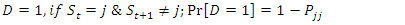

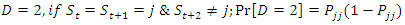

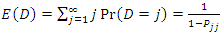

The nearer the probability  is to one the longer it takes to shift to the next regime. The diagonal element of the matrix of the transition probabilities contains important information on the expected duration on the state of the regime. Let D be defined as the duration of state j; we have:

is to one the longer it takes to shift to the next regime. The diagonal element of the matrix of the transition probabilities contains important information on the expected duration on the state of the regime. Let D be defined as the duration of state j; we have: | (9) |

| (10) |

| (11) |

3. Results and Discussion

- In this section, we present the results and discussion on the daily total infected cases and total deaths of COVID-19 data for Nigeria from 28th February 2020 to 30th September 2021.

3.1. Time Plot of the Series

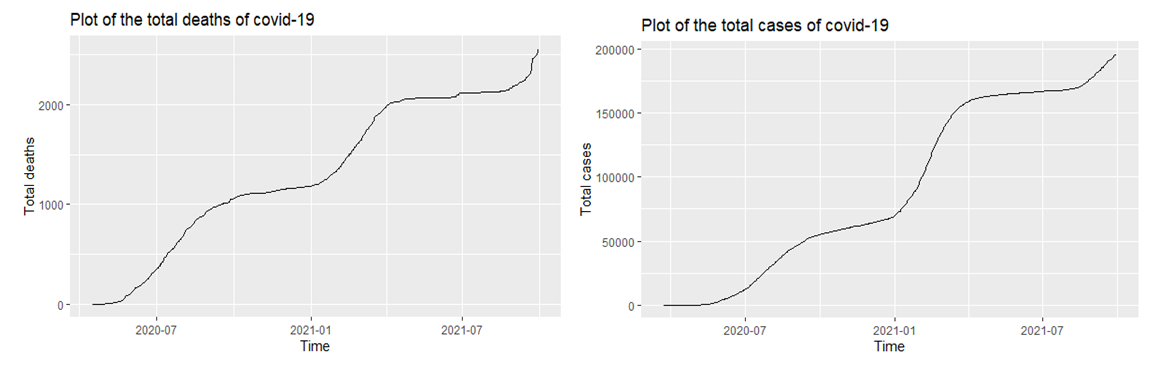

- A look at the time series plot of the total COVID-19 cases and deaths in Figure 1 shows that the total COVID-19 Cases and Deaths of Nigeria respectively has an upwards trend and is non-stationary.

| Figure 1. Time series plot of the total COVID-19 cases and deaths of Nigeria |

|

|

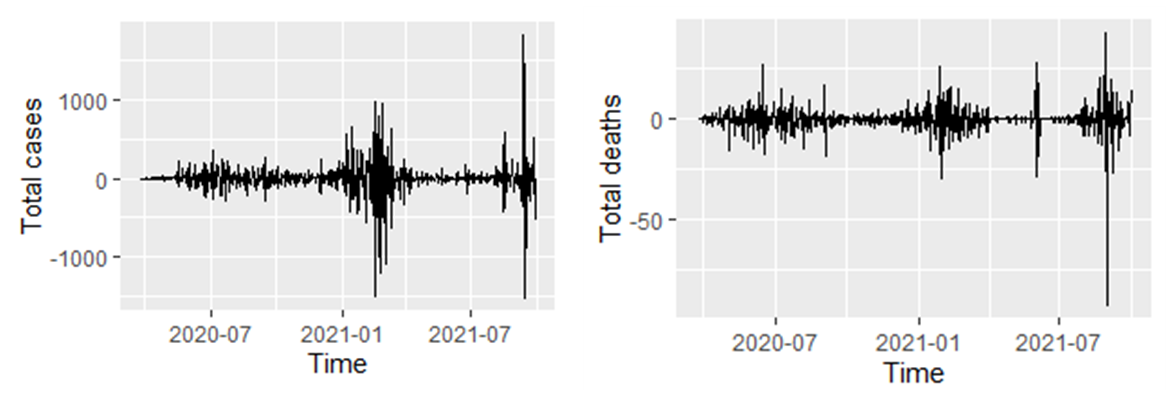

| Figure 2. Time series plot of the 2nd difference of the two series |

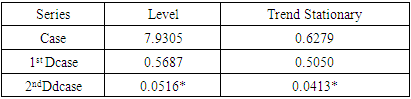

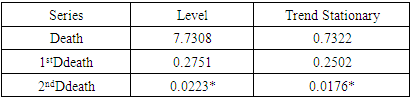

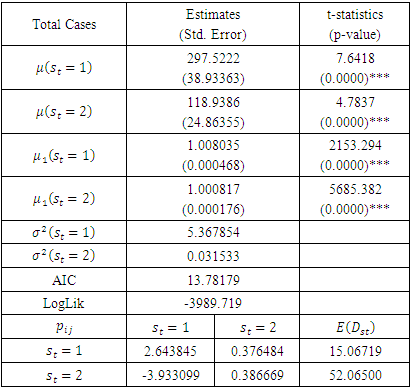

3.2. Nonlinearity and Structural Break Tests for the Returns

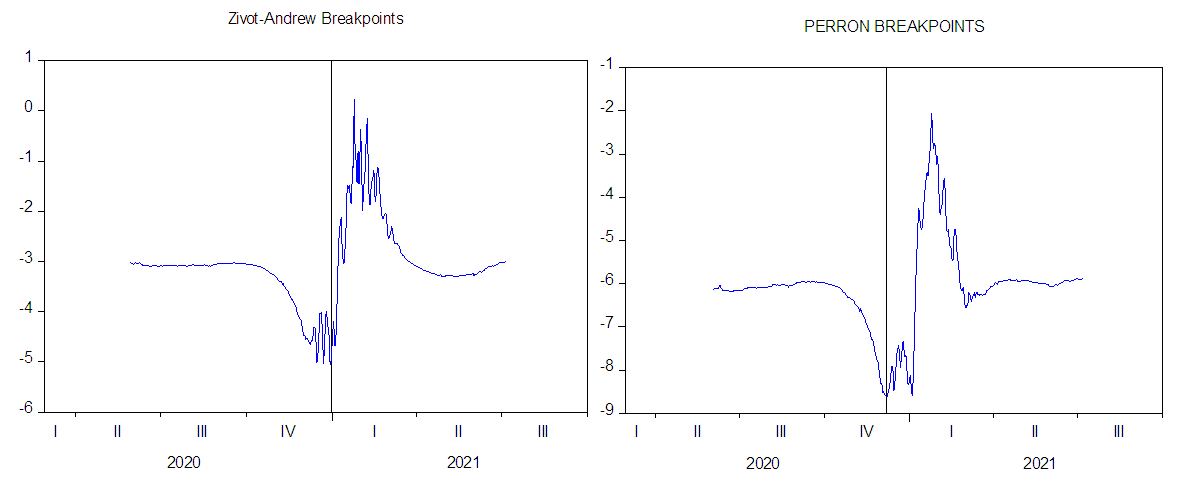

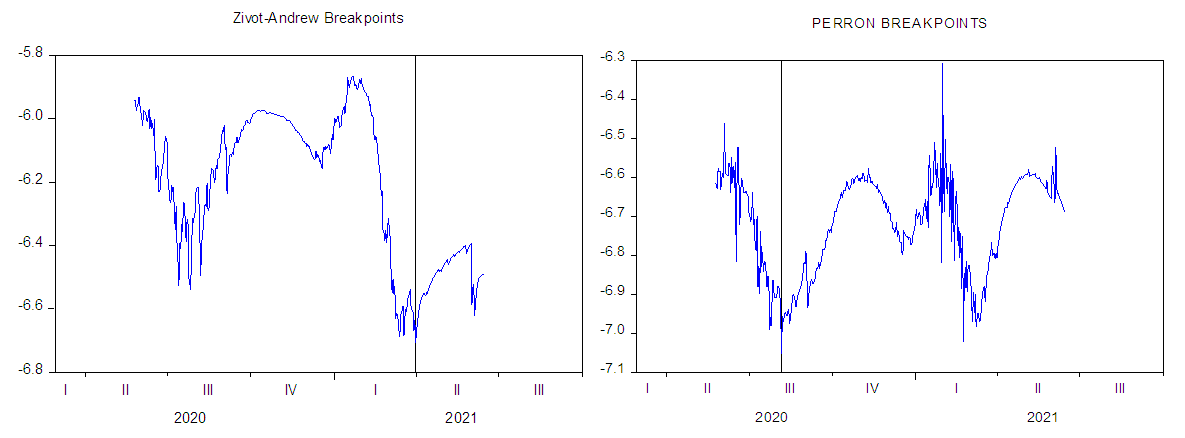

- In this subsection, we present the results of the two nonlinearity tests. From Table 3, the results corresponding to the BDS and Tsay tests show that there is evidence of nonlinearity in both series. Furthermore, the Zivot-Andrew and the Perron breakpoint tests in Figure 3 and Figure 4 showed evidence of one structural break. The identified break dates are 30th December, 2020 for Zivot-Andrew test, 6th December, 2020 for Perron test each for the total COVID cases and for the total COVID deaths, 31th March, 2021 and 5th August, 2020 were the identified break dates from the Zivot-Andrew and Perron tests respectively.

|

| Figure 3. Plot based on Zivot-Andrew and Perron test for the Total COVID-19 Cases |

| Figure 4. Plot based on Zivot-Andrew and Perron test for the Total COVID-19 Deaths |

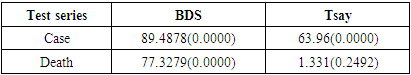

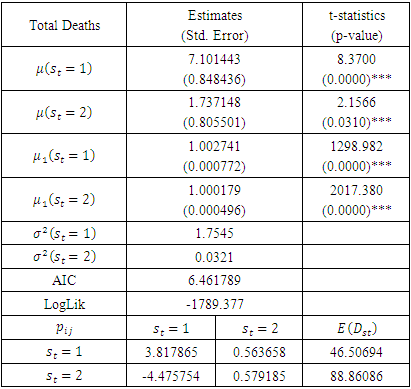

3.3. Model Estimation

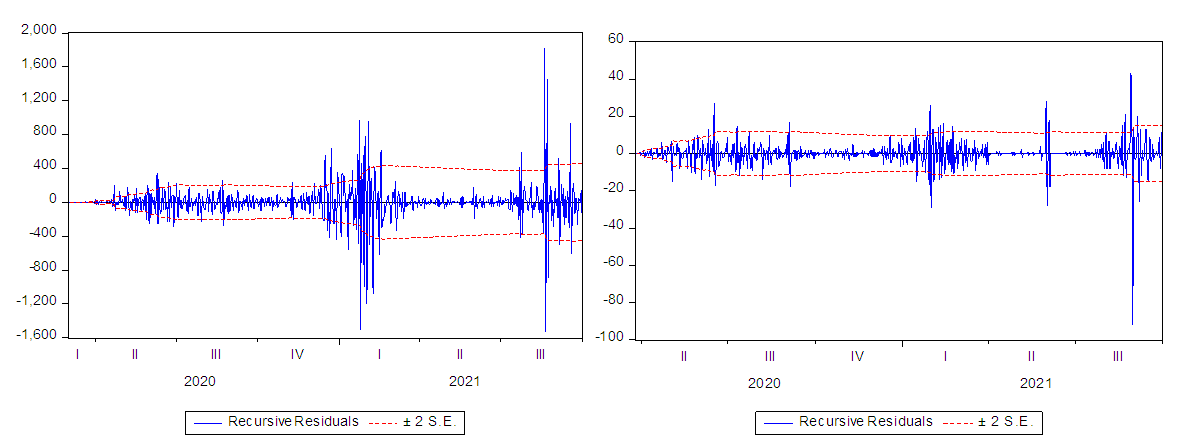

- The possible number of Covid-19 waves to be considered in the MSM model is determined on the basis of recursive local fitting as suggested in Gharleghi et al. (2014). The plot of the recursive residuals about the zero point, plus and minus two standard errors is shown in Figure 5.

| Figure 5. Recursive Residual Plot for total infected cases and total death cases |

|

|

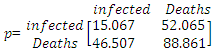

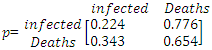

And the transition probability matrix between the Expected numbers of COVID-19 infected Cases and Death cases, is;

And the transition probability matrix between the Expected numbers of COVID-19 infected Cases and Death cases, is; This transition probability matrix can be used to predict the first, second, third periods etc. between the two waves for the number of COVID-19 infected and death cases.

This transition probability matrix can be used to predict the first, second, third periods etc. between the two waves for the number of COVID-19 infected and death cases.4. Conclusions

- This paper examined the nonlinear modelling of COVID-19 daily infected cases and deaths in Nigeria using the MS-AR model. The model estimates that the expected number of infected cases rises by 297% daily during the first wave of COVID-19 while it rises by 118% daily during the second wave of the pandemic. Also, the volatility of the two waves show that the COVID-19 infected cases in the first wave was more volatile than that of the second wave of the pandemic. The transition probabilities showed that in the first wave, the COVID-19 infected cases expected duration is around 15 days and 52 days in the second wave. For the COVID-19 deaths, the model estimates that the expected number of infected cases rises by 7.1% daily during the first wave of COVID-19 while it rises by 1.7% daily during the second wave of the pandemic. Also, the volatility of the two waves show that the COVID-19 infected cases in the first wave was more volatile than that in the second wave of the pandemic.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML