-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Mathematics and Statistics

p-ISSN: 2162-948X e-ISSN: 2162-8475

2022; 12(1): 9-14

doi:10.5923/j.ajms.20221201.03

Received: May 23, 2022; Accepted: Jun. 9, 2022; Published: Jun. 23, 2022

Mover-Stayer Analysis of the Movement Pattern of Nigeria’s External Reserves

Yusuf J. Adams, Mohammed Bapparu, Emmanuel J. Waya

Authors are Staff of Statistics Office, Central Bank of Nigeria, Yola

Correspondence to: Yusuf J. Adams, Authors are Staff of Statistics Office, Central Bank of Nigeria, Yola.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

External Reserve is a major monetary indicator, as it enables the Central Banks to intervene in the foreign exchange market and helps cushion the economy from external shocks. A lot of work had been done, in terms of analyzing the effect or otherwise of External Reserves on various economic indicators in Nigeria. However, attention has not been given to the pattern of movement of this important indicator over the years. This paper analyzed the movement pattern of this important monetary indicator using the Mover-Stayer technique advanced by Adams and Abdulkadir (2018), using data collected from the Central Bank of Nigeria Database over the period 2001 – 2020. The data was classified and coded into four (4) groups based on the amount that gives three months import cover. The proportions of stayers to various coded groups as well as the individual-level transition matrix were estimated.

Keywords: External Reserves, Polya-Aeppli, Mover-Stayer, Transition matrix, Baseline

Cite this paper: Yusuf J. Adams, Mohammed Bapparu, Emmanuel J. Waya, Mover-Stayer Analysis of the Movement Pattern of Nigeria’s External Reserves, American Journal of Mathematics and Statistics, Vol. 12 No. 1, 2022, pp. 9-14. doi: 10.5923/j.ajms.20221201.03.

Article Outline

1. Introduction

- Different definitions exist for External Reserves (EXTRS), often known as international reserves, foreign reserves, or foreign exchange reserves. The definition of foreign reserves established by the IMF (2009) in its 5th edition of the balance of payments is, nevertheless, the most frequently recognized. External reserves are defined as external assets that are readily available to and controlled by monetary authorities for meeting balance of payments financing needs, intervening in foreign exchange markets to affect the currency exchange rate, and other related purposes like maintaining confidence in the currency and the economy, as well as serving as a basis for foreign borrowing.The accumulation of international reserves is a method of self-defense against financial crises: they let central banks to interfere in the foreign exchange market, allowing the economy to be protected from external shocks (Ifeoluwa and Ajayi, 2018). International reserves are a mechanism of crisis prevention by the International Monetary Fund (IMF), which has proposed new measures to assess their adequacy. Fischer (2001) comments in his opening remarks at an IMF/World Bank International Reserves-Policy Issues Forum: “Reserves matter because they are the key determinant of acountry’s ability to avoid economic and financial crisis. This istrue of all countries, but especially of emerging markets open tovolatile international capital flows. The availability of capitalflows to offset current account should, on the face of it, reduce the amount of reserves a country needs. But access to private capital is often uncertain, and inflows are subject to rapid reversals, as we have seen all too often in recent years. We have also seen in the recent crises that countries that had big reserves, by and large, did better in withstanding contagion than those with smaller reserves- to an extent that is hard to account for through our usual analyses of the need for reserves”.It's worth noting that managing a country's external reserves is the duty of that country's central bank. The Central Bank of Nigeria (CBN) Act 1991 entrusts the CBN with the custody and management of the country's external reserves. Reserves were retained by countries primarily to control foreign exchange demand and supply emerging from current account operations prior to financial globalization (Doguwa and Alade, 2015). Virtually, every country of the world for one reason or the other hold external reserves. Nigeria hold hers to: (i) Finance government spending abroad like importation of goods and services, (ii) Service liabilities and pay debts of foreign currencies (iii) Have defence against emergencies, (iv) Provide a buffer against external shocks, (v) Serve as wealth accumulation etc. (Okeregwu and Etuk, 2017).When the balance of payment table of a country’s transaction with the rest of the world is prepared at the end of the year, any surplus thereof is set aside for future use. The surplus of the balance of payments of past periods are referred to as the External Reserves or the external assets of the country that earned them (Onoh, 2007). External reserves consist of foreign currencies and other approved near liquid foreign assets. The monetary authorities of each country determine from time to time the types of foreign currencies or foreign liquid assets and near liquid assets, which may be held as foreign reserves (Osadume and Okene, 2019).The challenges of funding for developing countries are known to policy makers, academics as well as researchers. It is widely believed that developing nations suffer inadequate funds to build basic infrastructure that would ginger capital formation and long-term expansion (Ayadi and Ayadi, 2008; Saheed et al., 2015). As a result, tax revenue, crude oil revenues, and other natural endowments, which make up most of government revenue in emerging countries, are insufficient to encourage long-term growth. This is due to their inability to develop effective collection procedures, a tax base, and highly volatile commodity prices. Hence, Nigeria has been participating in deficit spending as a pillar of capital formation and long-term production growth. (Ayunku and Markjackson, 2020).Oputa, (1997), discussed the determinants of the currency composition of external reserves in Nigeria. The authors analysis revealed that, the main factors influencing the currency composition of external reserves in Nigeria are international trade transactions and currency composition of external debt, while reserve adequacy aided the diversification into more currencies.The influence of changes in Nigeria's foreign reserve holdings on domestic investment, inflation, and exchange rate was researched by Abdullateef and Waheed (2010). Using a mix of ordinary least square (OLS) and vector error correction (VEC) approaches, it was discovered that changes in the country's external reserves have only a minor impact on FDI and exchange rates, with no effect on domestic investment or inflation rates.The increase or decline of a country's external reserves, according to Iwueze et al. (2013), is an essential feature of its economy. They then created a statistical model that could be used to keep track of the rise of Nigeria's external reserves, which is crucial for the creation, execution, and monitoring of economic policies. The study (i) assessed external reserve data for the assumptions of the autoregressive integrated moving average (ARIMA) model, (ii) established the right model for the study data, and (iii) built a statistical model to anticipate Nigeria's future external reserve condition.Bentum-Ennin, I. (2014) studied the effect of international reserves accumulation on economic growth and whether there is a threshold effect in the international reserves-economic growth nexus. The static panel regression analysis and the panel cointegration tests results confirm that international reserves accumulation promotes economic growth, and indicated the existence of the threshold effects in the economic growth-international reserves nexus.Onwuka and Igweze, (2014) examined the effect of foreign reserve and external debt on USD/Naira exchange rate. Their models have consistently shown that external reserve and foreign debt have significant contributions to the USD/Naira exchange rate. A direct relationship exists between USD/Naira exchange rate and external reserve and foreign debt respectively. Doguwa and Alade, (2015) used seasonal autoregressive integrated moving average (SARIMA), seasonal autoregressive integrated moving average with an exogenous input (SARIMA-X), and an autoregressive distributed lag (ARDL) processes to create three short-term forecasting models for adjusted external reserves. Over the period of July 2013 to May 2014, the suggested models were compared to an existing model created using an autoregressive integrated moving average (ARIMA) method and the pseudo-out-of-sample forecasting procedure. The results reveal that the SARIMA model outperforms the other models over a three-to-six-month forecast horizon, while the ARDL model outperforms the other models over a one-to-two-month forecast horizon.Nwachukwu et al., (2016) in a Threshold Vector Error Correction Model (TVECM) framework, modelled the long-run connection between the Bureau De Change currency rate and external reserves in Nigeria using daily data from January 1, 2014 to July 31, 2015. The result indicates that there is a non-linear long-run relationship between the series, providing empirical support in favor of a TVECM specification. Senibi et al., (2016) opined that Nigeria was Faced with a scarcity of capital and forced to rely on foreign debt to supplement domestic savings, balance of payment deficits, and income shortfalls, whereas the debt stock continues to rise at an alarming rate. In light of this, their research looked at the influence of Nigeria's public debt on the country's external reserves. The study's goals include assessing the patterns and relationship between Nigeria's public debt and external reserve utilizing secondary data from 1981 to 2013 and the Johansen cointegration and Fully Modified Ordinary Least Square (FMOLS) technique. The findings revealed that, in the long run, public debt has a positive and significant effect on external reserve stock, implying that the country's debt crisis can be attributed to both exogenous and endogenous factors such as the economy's nature, economic policies, high reliance on oil, and swindling foreign exchange receipt.Okeregwu and Etuk (2017) try to find and design an appropriate and reliable Box-Jenkins model for estimating Nigeria's foreign reserves. E-views used data from Nigeria's external reserves for 34 years, from January 1981 to December 2014. The ARIMA (4,1,0) model outperformed the ARIMA (4,1,1) model with the smallest AIC and BIC values. As a result, the ARIMA (4,1,0) model is proposed for projecting Nigeria's external reserves in this study horizon.Ifeoluwa and Ajayi, (2018), for the years 2005 to 2014, looked at the relationship between international reserve and its factors in west African countries. The study used the Panel ARDL technique to estimate the buffer stock model. Osadume and Okene, (2019) examined the effect of External Reserves (EXTRS) and External Debt (EXTDT) on economic development of Nigeria between 1980 and 2018. The study covered a 38-year period from 1980 to 2018 and used secondary data sourced from the CBN and the World Bank. The effect of the independent variables (EXTRS and EXTDT) on the dependent variable, economic development proxied by Human Development index (HDI) were tested at the 5% level of significance using econometric techniques. The findings revealed that EXTRS had negative and significant effect on HDI in the short-run with a positive and significant effect in the long-run while EXTDT showed a positive but insignificant effect on HDI in both periods. The study concludes that while EXTRS have significant effect, EXTDT show insignificant effect on economic development. Ayunku and Markjackson, (2020) examined if external debt and debt servicing have an impact on Nigeria's international reserves. The study's theoretical foundations were dual gap theory and the self-insurance hypothesis of external reserves. To assess the study's components in retrospect, the after-effect research design was used. Historical data from the World Development Indicators was compiled and analyzed using the error correction mechanism as the unit of analysis, with the least square technique used to estimate the results. External debt stock has a negative and statistically significant impact on Nigeria's foreign exchange reserve portfolios, according to the empirical data. It was also shown that Nigeria's foreign debt service payments have a favorable but statistically insignificant impact on the country's international reserves. According to the findings, Nigeria's external debt stock and external debt service payments have no meaningful impact on the country's international reserve portfolios.Even though, a lot of work had been done, in terms of analyzing the effect or otherwise of External Reserves on various economic indicators in Nigeria, interest has not been focused on the pattern of movement of Nigeria’s External Reserves over the years. Consequently, this paper set out to analyze the movement pattern of this important monetary indicator using the Mover-Stayer technique advanced by Adams and Abdulkadir (2018).

2. Methodology

2.1. Model Description

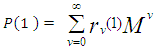

- The fraction of the population moving in (0, t) will satisfy a Polya-Aeppli distribution if individual (External Reserves) transitions follow a Poisson process, with individual rates of mobility described by a negative binomial density (Adams and Abdulkadir, 2018).The one-step probability matrix for persons with a common rate of movement equal to λ at time t would be given by

| (1) |

is given by;

is given by; | (2) |

, and M is the transition matrix for mobile individuals.

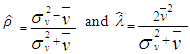

, and M is the transition matrix for mobile individuals. | (3) |

is the Poisson distribution (Spilerman, 1972).Consequently, using (2) in (1), the value of M can be obtained as;

is the Poisson distribution (Spilerman, 1972).Consequently, using (2) in (1), the value of M can be obtained as; | (4) |

2.2. The Stayer Population

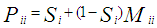

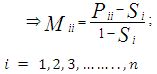

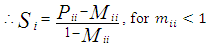

- Goodman (1961) and Morgan et al (1983), specified

with

with  diagonal elements (proportion of stayers in the

diagonal elements (proportion of stayers in the  state), where I is an identity matrix. Hence,

state), where I is an identity matrix. Hence, | (5) |

| (6) |

values are obtained as follows;

values are obtained as follows; | (7) |

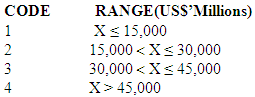

2.3. Data Source and Coding

- Secondary data (External Reserves) was collected from the Central Bank of Nigeria Database. The data collected on External Reserves was coded as follows;

X represents External Reserve value in Million US Dollars.This gives four (4) classes (External Reserves range) defined as states of the process. External Reserves were collected quarterly, and were recorded over the period 2001 through 2020. This classification was based on import cover by the country. Import cover measures the number of months of imports that can be covered with foreign exchange reserves available with the central bank of the country. Eight to ten months of import cover is essential for the stability of a currency but a common rule of thumb is that reserves that can cover three months' worth of imports are adequate. It is an important indicator of the stability of a currency. Therefore, groups of $15,000 Million range, that is the amount that gives three months import cover (average monthly import cover for the period, computed as $4,472.82 Million) were created.Polya-Aeppli distribution, defined clusters as number of moves (υ), whereas repeated independent trials resulting in either success with probability ρ or failure with probability 1-ρ, represents the distribution of rate of movement. Consequently, the distribution of the number of moves (υ), with the kth success on a given number of trials, follows the negative binomial distribution. To put it another way, the distribution of the number of successes in a series of trials prior to a predetermined number of failures. (see Adams, Abdulkadir and Jibasen, 2019).

X represents External Reserve value in Million US Dollars.This gives four (4) classes (External Reserves range) defined as states of the process. External Reserves were collected quarterly, and were recorded over the period 2001 through 2020. This classification was based on import cover by the country. Import cover measures the number of months of imports that can be covered with foreign exchange reserves available with the central bank of the country. Eight to ten months of import cover is essential for the stability of a currency but a common rule of thumb is that reserves that can cover three months' worth of imports are adequate. It is an important indicator of the stability of a currency. Therefore, groups of $15,000 Million range, that is the amount that gives three months import cover (average monthly import cover for the period, computed as $4,472.82 Million) were created.Polya-Aeppli distribution, defined clusters as number of moves (υ), whereas repeated independent trials resulting in either success with probability ρ or failure with probability 1-ρ, represents the distribution of rate of movement. Consequently, the distribution of the number of moves (υ), with the kth success on a given number of trials, follows the negative binomial distribution. To put it another way, the distribution of the number of successes in a series of trials prior to a predetermined number of failures. (see Adams, Abdulkadir and Jibasen, 2019). 3. Findings

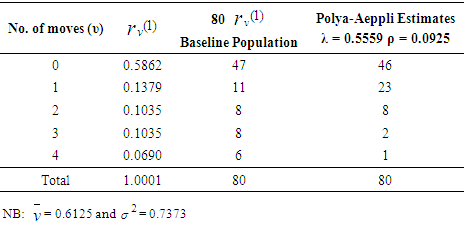

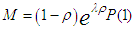

- The number of moves (υ) distributed into four (4) states (External Reserves Range) is given in Table 1.

|

| (8) |

| (9) |

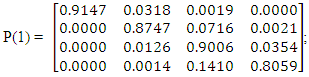

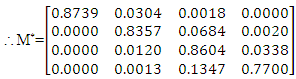

3.1. Individual-Level (Expected) Transition Matrix

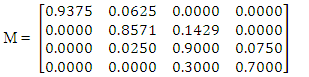

- The expected transition matrix (M), can be evaluated using P(1) matrix obtained in (9), as well as values of λ and ρ as computed above.

| (10) |

3.2. Evaluation of Stayer Population on External Reserves

- The proportions of stayers per range of External Reserves (class) computed from equation 7, using equations 9 and 10 above as advanced by Goodman (1961) and Morgan et al. (1983) follows;

| (11) |

4. Discussion and Conclusions

- External Reserves data was collected on quarterly basis, from the Central Bank of Nigeria Database over the period 2001 – 2020. The data was classified and coded into four (4) groups of $15,000 Million range, the amount that gives three months import cover, that is $5,000 Million per month (average monthly import cover for the period, computed as $4,472.82 Million). The proportions of stayers to various coded groups were also estimated. Similarly, the individual-level transition matrix was estimated, where it was observed that, X ≤ $15,000 Million is the most successful group in retaining the Country’s External Reserves when they move. This was followed closely by $30,000 Million < X ≤ $45,000 Million, during the entire study period. This implied that, for the most part of the period covered, Nigeria’s external reserves revolve around $15,000 Million and below. The results obtained were like that of Adams et al., (2019), who researched the movement of students within and around the various classes of degrees at Yola, Nigeria's Modibbo Adama University of Technology. In that study, a transition matrix was created for the five degree classes based on movement patterns during 10 semesters (2011–2016). The probability of moving between the five classes were calculated. A fundamental matrix was also obtained in order to predict the expected number of students who remained in each class (stayers). Furthermore, the result is similar to that of Adams et al., (2022) who provided a method of estimating the transition matrix M, and obtained an estimate of the stayer population using simulated data adopted from Spilerman (1972).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML