Meshal Harbi Odah1, Ali Sadig Mohommed Bager1, Bahr Kadhim Mohammed2

1The Bucharest University of Economic Studies, Department of Statistics and Econometrics, Muthanna University, Iraq

2The Bucharest University of Economic Studies, Department of Statistics and Econometrics, University of AL-Qadisiyah, Iraq

Correspondence to: Ali Sadig Mohommed Bager, The Bucharest University of Economic Studies, Department of Statistics and Econometrics, Muthanna University, Iraq.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

It occurs quite often in economic data to find variables describing a specific phenomenon which are censored from right side or left side. When the data has to be censored from left side at censored point equal to zero, the Tobit regression model represents the most appropriate model to use. In this paper, we study the determinants of bank loans value, which is one of the main banking services provided by banks in any country. They are considered the most important banking activity, allowing the bank to achieve an appropriate profit with small risks. These loans aim to finance short term needs for covering expenses, or financing investment projects that allow the development of institutions. The study aimed to apply Tobit regression model and Ordinary least squares method in order to reveal the most important factors affecting loans provided by Iraqi banks and the best method to estimate data .It was found that liquidity and loan repayment affect the Iraqi Bank Loans, while the effects of interest rate and borrowers were not statistically significant. The results from Tobit and OLS estimations shows that bias can result when estimating Iraqi bank loans using OLS if bank loans are restricted.

Keywords:

Tobit regression model, Bank loans, Iraqi banks policy

Cite this paper: Meshal Harbi Odah, Ali Sadig Mohommed Bager, Bahr Kadhim Mohammed, Tobit Regression Analysis Applied on Iraqi Bank Loans, American Journal of Mathematics and Statistics, Vol. 7 No. 4, 2017, pp. 179-182. doi: 10.5923/j.ajms.20170704.06.

1. Introduction

Many types of regression models are applied in economic and social research and their use is dependent, among other factors, upon the nature of data. The Tobit model is the most suitable statistical model to solve in the case in which a dependent variable is binary. Since the work of James Tobin (1958) [13], Tobit regression has been the subject of great theoretical interest and various practical applications have been developed using it in fields such as econometrics, biological sciences, finance, and medicine. Tobit regression (TR) can be viewed as a linear regression model where only the data on the response variable is incompletely observed and the response variable is censored at zero Greene. W (2007) [8]. To inquire the policy in granting loans and credit facilities provided by the bank to the customer and the banks, 10 banks have been chosen in the study. The banking services are affected by the economic situations of the each country and the banking sector plays an important role in the national economy through deposits (Liabilities) and loans (assets). The banks usually functions as an intermediary by making money available for the economic growth of the country. According to some authors such Belaish (2001) [4] or Roman (2003) [12] a developing country cannot acquire economic progress without emphasizing credit mechanisms, and developing the credit policy, which is why the bank loans are considered highly important since they represent a part of the bank’s assets.The loans are one of the most important aspects of in vesting in the financial resources of the bank, they represent the bulk of the assets, also the yield generated by the bulk of revenues. It has become necessary that the officials at the bank give special attention to loans through the development of an appropriate policy to ensure their safety and to identify the nature of the loans. The main policies control the loan request in the different phases down to the analysis of such requests (Lozano and Pastor, 2006) [11].In the study conducted in 2008 by Bollou, et al [6], the Tobit regression model was chosen for an analysis of six West African Countries data from 1995 to 2002 and the empirical findings showed that ICT use was not contribuing to economic freedom in the countries chosen for the study Also in 2010, Karim et al [10] investigated the relationship between nonperforming loans and bank efficiency in Malaysia and Singapore using also the Tobit regression model on data from 1995 to 2000 for banks of those countries, and the results indicated the fact that higher nonperforming loan reduces cost efficiency and lower cost efficiency increases nonperforming loans.Iraqi banks policies Banking sector contributes significantly to Iraqi economic development and influence the national economy by providing the necessary liquidity for financing investment projects or current activities of other banking institutions. Through fiscal and monetary transactions, particularly in the field of internal and external credit, banking sector affects various institutions directly involved in the financial and monetary policy of any country. The structure of the banking system in Iraq consists of three types of banks in addition to the central Bank of Iraq, namely public and private banks, alongside with foreign banks. The public banking sector consists of seven banks, while the private sector consists of nine bank and there are also four foreign banks; it is important to notice that there are six Islamic banks with back ownership to the private sector (CIB, 2016) [7].For the purpose of this research, the current analysis relies on a sample of ten banks, covering public sector, private and foreign banks, as follows: (Agricultural cooperative Bank of Iraq, Babylon Bank, Basrah International Bank for Investment, Dar Es Salaam Investment Bank, Gulf Commercial Bank, Industrial Bank of Iraq, Rafidain Bank, Rasheed Bank, Real Estate Bank of Iraq and Iraqi Middle East investment Bank. The private banks in Iraq have a major role in financing investment projects, while public banks have other activities pertaining to the state, such as the foreign trade of the state and the processes that belong to the treasury and transactions of government departments and the salaries of retirees. The activity of private banks is to attract deposits and used to finance investment projects in addition to the credit facilities.After 2003, the banking system in Iraq adopted the principles of the market economy. The interest rate was liberalized, the credit plans were cancelled, and the work of foreign banks was opened, whether through participation in local banks, without setting limits on the participation rate, or opening branches in Iraq, without specifying the capital limits. In addition it was released to the possibility of opening representative offices, the freedom of foreign transfer and the abolition of restrictions on the transfer of money, except for those in relation to the requirements of the law against money laundering and financing terrorism. Since mid 2014, Iraq is experiencing a severe economic and financial crisis that began to escalate and exacerbate for objective and subjective reasons, including: financial mismanagement and financial and administrative corruption in the state's economic institutions, in the context of the severe fall of oil prices in the world market by 65% of its prices. It should be noticed that Iraq relies completely on oil resources and not on developing plans and programs to diversify resources and encourage other economic sectors such as agriculture, industry, tourism and other sectors.Also in 2016 Ata, H. Ali, and Mehmet Fatih Buğan [1] collected financial statement data from 2006–2014, for a study on the factors that impact efficiency of conventional and participation banks within the Turkish Banking system. Factors that affect bank efficiency were determined by using the Tobit regression model, which was applied for determining the factors that affect banks, concluding that the factors affecting the efficiency of banks are asset size and net interest margin.This study is focused on the Bank loans of the Iraqi banks for the period 2013-2015, its contribution being to help banks and the mentioned departments to create the appropriate environment and promote positive results, trying to mitigate the negative in order to ensure continuity of the banks and its success in achieving its objectives and achieve the desired economic development. This paper is organized as follows: In Section 2, we explain Tobit regression model, in Section 3, we illustrate the Results and Discussions and finally, in section 4, we present a conclusion of the study.

2. Tobit Regression Model

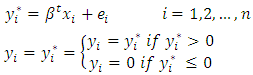

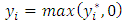

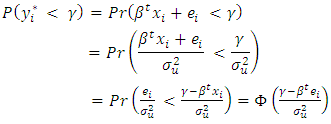

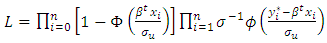

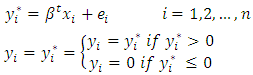

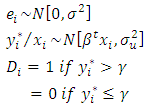

The Tobit model is a statistical model proposed by James Tobin in 1958, used in order to explain the relationship between a non negative dependent variable and an independent one assuming that there is a latent variable which linearly depends on the independent one trough a parameter (beta) that determines the relationship between the independent and latent variables. According to Verbeek (2004) [14] Tobit regression is usually the best model when the dependent variable is continuous and has a constrained rage, represents a positive variable. This statistical model has previously been used in studies such as Trabelsi et al. (2008) [6], Hussainey and Al Najjar (2011) [9], but also the pseudo R squared can be computed by Efron, McFadden, Cox and Snell, and Count. R Software also provides pseudo R squared based on McFadden’s formula, like in this paper when applying the Tobit model estimates. | (1) |

Where: Random error, the set represents all the variables is non observed influencing in the dependent variable

Random error, the set represents all the variables is non observed influencing in the dependent variable  distributed

distributed  which i.i.d

which i.i.d Represents (Latent variable) It is generated through traditional linear regression model according to the formula

Represents (Latent variable) It is generated through traditional linear regression model according to the formula  it is non observer when

it is non observer when  .

. Is the independent variable and the dependent variable known each

Is the independent variable and the dependent variable known each  . Generally, it can be defined as follows:

. Generally, it can be defined as follows: | (2) |

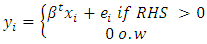

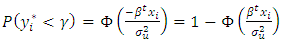

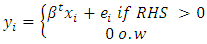

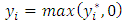

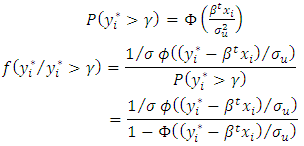

While (Herman and Bierens, 2004) knew (Tobit Regression Model) and supposed the dependent variable observer  for observers

for observers  is achieved as follows:

is achieved as follows:  | (3) |

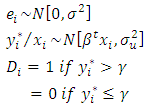

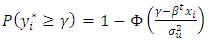

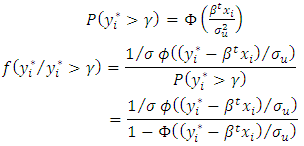

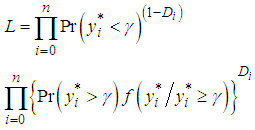

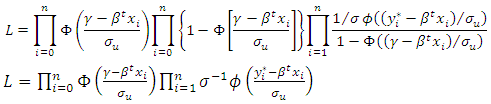

For the purposes of estimate suppose that: Then the Maximum Likelihood Function:

Then the Maximum Likelihood Function: | (4) |

The function (4) can be simplified as follows: | (5) |

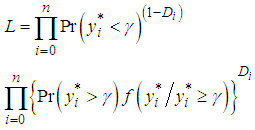

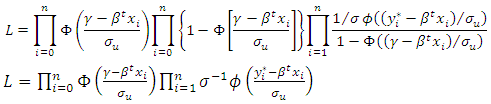

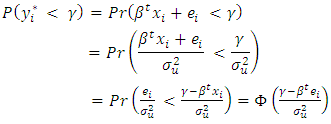

When  , that:

, that: | (6) |

| (7) |

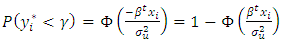

When  , that:

, that: | (8) |

Therefore: | (9) |

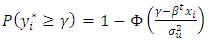

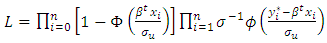

When  that:

that: | (10) |

Where  &

&  represents the probability distribution function, the probability density function, respectively for normal distribution, the Tobit Regression Model, described in the above to know the limited regression model.If

represents the probability distribution function, the probability density function, respectively for normal distribution, the Tobit Regression Model, described in the above to know the limited regression model.If  &

&  are not observed when

are not observed when  then the model is known as truncated regression model, in other words the data

then the model is known as truncated regression model, in other words the data  &

&  are observed only when

are observed only when  . We used R packages ("censReg") Arne. H (2013) [2] for analysing data.

. We used R packages ("censReg") Arne. H (2013) [2] for analysing data.

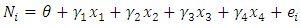

2.1. The Empirical Model

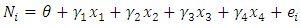

An equation for Iraqi Bank loans is specified as: | (11) |

Where  Number of bank loans;

Number of bank loans;  Liquidity The ability of a bank or business to meet its current obligations;

Liquidity The ability of a bank or business to meet its current obligations;  Loan repayment if it will be a payment at once or in the form of periodic payments;

Loan repayment if it will be a payment at once or in the form of periodic payments;  Interest rate the assessed for the use of borrowed funds;

Interest rate the assessed for the use of borrowed funds;  Borrowers that can be considered are: personal, capital of the borrower, and last

Borrowers that can be considered are: personal, capital of the borrower, and last  is the random error.θ is a constant and γ are the parameters to be estimated, while

is the random error.θ is a constant and γ are the parameters to be estimated, while  is assumed to be independently normally distributed. All right hand side variables of equation (11) are exogenous, justifying the use of a single equation model. A double logarithmic functional form was chosen because it has been shown to be an appropriate functional form for the phenomenon studied equation in general, and also because the estimation results are easy to interpret.Private Bank loans data was collected at the following ten banks in Iraq: Agricultural Cooperative Bank of Iraq, Babylon Bank, Basrah International Bank for Investment, Dar Es Salaam Investment Bank, Gulf Commercial Bank, Industrial Bank of Iraq, Rafidain Bank, Rasheed Bank, Real Estate Bank of Iraq and Iraqi Middle East investment Bank. For the years 2013-2015. The data required for the preparation of this study was gathered from the annual reports and financial statements for data collection Phenomenon under study, as well as annual reports and periodicals issued by the Central Bank of Iraq and the Association of Iraqi bank.

is assumed to be independently normally distributed. All right hand side variables of equation (11) are exogenous, justifying the use of a single equation model. A double logarithmic functional form was chosen because it has been shown to be an appropriate functional form for the phenomenon studied equation in general, and also because the estimation results are easy to interpret.Private Bank loans data was collected at the following ten banks in Iraq: Agricultural Cooperative Bank of Iraq, Babylon Bank, Basrah International Bank for Investment, Dar Es Salaam Investment Bank, Gulf Commercial Bank, Industrial Bank of Iraq, Rafidain Bank, Rasheed Bank, Real Estate Bank of Iraq and Iraqi Middle East investment Bank. For the years 2013-2015. The data required for the preparation of this study was gathered from the annual reports and financial statements for data collection Phenomenon under study, as well as annual reports and periodicals issued by the Central Bank of Iraq and the Association of Iraqi bank.

3. Results and Discussion

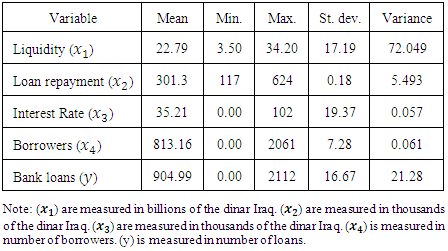

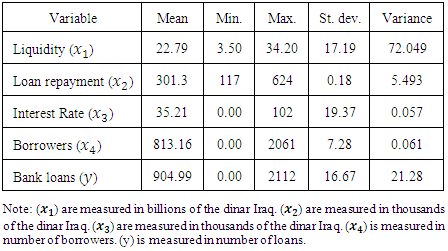

The first step in analysis is to descriptive statistics for the dependent and independent variables. Table 1. Descriptive Statistics for the Dependent and Independent Variables

|

| |

|

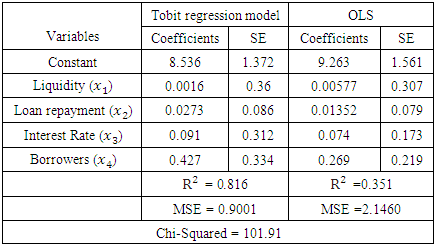

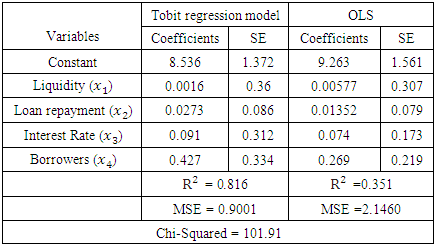

Both Tobit regression model and OLS estimation were applied in order to test the hypothesis that conventional methods lead to biased estimates. The results are shown in Table 2.Table 2. Results of Tobit Regression Model and OLS Estimates of Iraqi Bank Loans

|

| |

|

The coefficients of Liquidity and Loan repayment are significant in both the Tobit regression model and OLS estimations. Loan repayment in the Tobit regression model estimation is almost significant at the 5% level. Interest rate and borrowers do not seem to have a significant influence on the Iraqi Bank Loans. Interest rate does not have a significant impact because it is a ratio between 6% and 12%, the interest rate of the loan granted is also fixed. If the number of borrowers increaseas or decreases, it does not affect bank loans. Tobit estimation is demonstrated by the Wald statistic, following a chi squared distribution with 5 degrees of freedom (Amemiya, 1985, p. 142). As shown by the R square values (0.816 and 0.351, the OLS regression has a good fit and the significant variables indicate that Iraqi Bank Loans decrease if liquidity or loan repayment decreases.According to the results from Tobit regression model estimation, a one unit increase in liquidity increases Iraqi Bank Loans by 0.0016; and a one unit increase in loan repayment increases Iraqi Bank Loans by 0.0273.The pseudo R square was calculated for both estimations R2 = 0.816 for Tobit regression model and R2 = 0.351 for OLS. The OLS (MSE) Mean Square Errors is almost one third larger than that for the Tobit regression model estimation, indicating the superiority of the Tobit analysis.

4. Conclusions

In this work, Iraqi Bank Loans were estimated, and due to the fact that they are restricted, both Tobit regression model and OLS analyses were used. The recommending solutions can be a source of help to the bankers. When studying Bank loans as dependent variables, we find that variable data is censored at zero and this means the Tobit model is the appropriate model to use.It was found that liquidity and loan repayment affect the Iraqi Bank Loans, while the effects of interest rate and borrowers were not statistically significant. The comparison of the results from Tobit and OLS estimations shows that bias can result when estimating Iraqi bank loans using OLS if bank loans are restricted by because the banks do not grant loans throughout the year, but granted intermittent times in any specific months of the year. In this case, the coefficient of loan repayment was biased by more than one third, implying that care should be taken in building bank loans models, and that alternative estimating methods such as Tobit estimation should be considered.

References

| [1] | Ata, H. Ali, and Mehmet Fatih Buğan. (2016), Factors Affecting the Efficiency of Islamic and Conventional Banks in Turkey. |

| [2] | Arne. H (2013). Estimating Censored Regression Models in R using the censReg Package. R package version 5.05. University of Copenhagen. |

| [3] | Amemiya, T. (1984). Tobit models: A survey. Journal of econometrics, 24(1-2), 3-61. |

| [4] | Belaish A. (2001). Euro Area Banking at the Crossroads. IMF Working Paper, n.28. |

| [5] | Bierens, H. J. (2004). Introduction to the mathematical and statistical foundations of econometrics. Cambridge University Press. |

| [6] | Bollou, F., Tesunbi, S. and Nwokoma, A. (2008). “Are Investments in ICT Impacting Economic Freedom in Africa? A Tobit Regression Analysis of Five African Countries from 1995-2002." GlobDev. |

| [7] | Central Bank of Iraq, (2016), the Directorate General of Statistics and Research, Annual Bulletin. |

| [8] | Greene, W. (2007). Econometric analysis. Book. New York University. Seven edition. |

| [9] | Hussainey, K. & Al-Najjar, B. (2011). Futureoriented narrative reporting: determinants and use. Journal of Applied Accounting Research, 12, pp.123 - 138. |

| [10] | Karim, M. Z. A., Chan, S. G., & Hassan, S. (2010). Bank efficiency and non-performing loans: Evidence from Malaysia and Singapore. Prague Economic Papers, 2(2010), 118-132. |

| [11] | Lozano. A, and Pastor. J (2006). "Relating Macroeconomic Efficiency: A comparison of Fifteen OECD Countries over a Eighteen Year Period". In Journal of Productivity Analysis, Vol. 25: pp.67-78. |

| [12] | Roman, M. (2003) Statistica financiar bancara si bursiera, Editura ASE, Bucuresti. |

| [13] | Tobin, J. (1958). "Estimation of Relationships for limited dependent Variables", in Econometrica, January 26, pp. 24-36. |

| [14] | Verbeek, M. (2004). A Guide to Modern Econometrics, England, John Wily and SonsLtd. |

Random error, the set represents all the variables is non observed influencing in the dependent variable

Random error, the set represents all the variables is non observed influencing in the dependent variable  distributed

distributed  which i.i.d

which i.i.d Represents (Latent variable) It is generated through traditional linear regression model according to the formula

Represents (Latent variable) It is generated through traditional linear regression model according to the formula  it is non observer when

it is non observer when  .

. Is the independent variable and the dependent variable known each

Is the independent variable and the dependent variable known each  . Generally, it can be defined as follows:

. Generally, it can be defined as follows:

for observers

for observers  is achieved as follows:

is achieved as follows:

Then the Maximum Likelihood Function:

Then the Maximum Likelihood Function:

, that:

, that:

, that:

, that:

that:

that:

&

&  represents the probability distribution function, the probability density function, respectively for normal distribution, the Tobit Regression Model, described in the above to know the limited regression model.If

represents the probability distribution function, the probability density function, respectively for normal distribution, the Tobit Regression Model, described in the above to know the limited regression model.If  &

&  are not observed when

are not observed when  then the model is known as truncated regression model, in other words the data

then the model is known as truncated regression model, in other words the data  &

&  are observed only when

are observed only when  . We used R packages ("censReg") Arne. H (2013) [2] for analysing data.

. We used R packages ("censReg") Arne. H (2013) [2] for analysing data.

Number of bank loans;

Number of bank loans;  Liquidity The ability of a bank or business to meet its current obligations;

Liquidity The ability of a bank or business to meet its current obligations;  Loan repayment if it will be a payment at once or in the form of periodic payments;

Loan repayment if it will be a payment at once or in the form of periodic payments;  Interest rate the assessed for the use of borrowed funds;

Interest rate the assessed for the use of borrowed funds;  Borrowers that can be considered are: personal, capital of the borrower, and last

Borrowers that can be considered are: personal, capital of the borrower, and last  is the random error.θ is a constant and γ are the parameters to be estimated, while

is the random error.θ is a constant and γ are the parameters to be estimated, while  is assumed to be independently normally distributed. All right hand side variables of equation (11) are exogenous, justifying the use of a single equation model. A double logarithmic functional form was chosen because it has been shown to be an appropriate functional form for the phenomenon studied equation in general, and also because the estimation results are easy to interpret.Private Bank loans data was collected at the following ten banks in Iraq: Agricultural Cooperative Bank of Iraq, Babylon Bank, Basrah International Bank for Investment, Dar Es Salaam Investment Bank, Gulf Commercial Bank, Industrial Bank of Iraq, Rafidain Bank, Rasheed Bank, Real Estate Bank of Iraq and Iraqi Middle East investment Bank. For the years 2013-2015. The data required for the preparation of this study was gathered from the annual reports and financial statements for data collection Phenomenon under study, as well as annual reports and periodicals issued by the Central Bank of Iraq and the Association of Iraqi bank.

is assumed to be independently normally distributed. All right hand side variables of equation (11) are exogenous, justifying the use of a single equation model. A double logarithmic functional form was chosen because it has been shown to be an appropriate functional form for the phenomenon studied equation in general, and also because the estimation results are easy to interpret.Private Bank loans data was collected at the following ten banks in Iraq: Agricultural Cooperative Bank of Iraq, Babylon Bank, Basrah International Bank for Investment, Dar Es Salaam Investment Bank, Gulf Commercial Bank, Industrial Bank of Iraq, Rafidain Bank, Rasheed Bank, Real Estate Bank of Iraq and Iraqi Middle East investment Bank. For the years 2013-2015. The data required for the preparation of this study was gathered from the annual reports and financial statements for data collection Phenomenon under study, as well as annual reports and periodicals issued by the Central Bank of Iraq and the Association of Iraqi bank. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML