-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Mathematics and Statistics

p-ISSN: 2162-948X e-ISSN: 2162-8475

2016; 6(6): 233-237

doi:10.5923/j.ajms.20160606.02

Modeling of Exchange Rate Risk

El Hachloufi Mostafa, El Haddad Mohammed

Faculty of Law, Economics and Social Sciences, University of Mohamed IV, Rabat, Morocco

Correspondence to: El Hachloufi Mostafa, Faculty of Law, Economics and Social Sciences, University of Mohamed IV, Rabat, Morocco.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this work we present a mathematical modeling approach to exchange rate risk using the stochastic model of Vasicek. The risk measure used in this modeling approach is the conditional value at risk CVaR. The objective of this approach is to provide a tool of decision for the exchange market managers.

Keywords: Exchange rates, Risk, CVaR, Vasicek Stochastic model

Cite this paper: El Hachloufi Mostafa, El Haddad Mohammed, Modeling of Exchange Rate Risk, American Journal of Mathematics and Statistics, Vol. 6 No. 6, 2016, pp. 233-237. doi: 10.5923/j.ajms.20160606.02.

Article Outline

1. Introduction

- The exchange rate is very important macroeconomic variable that plays a crucial role in international trade. Indeed, the change of the exchange rate affects the terms of trade, it allows modification and adjustment of prices in the different sectors of tradables and non-tradables.Thus, exchange rate fluctuations constitute an area of research that requires considerable effort at modeling. It aims to establish a model to study the convergence of the exchange rate towards equilibrium.In another, the modeling and the evaluation of exchange rate risk is a very important task for managers in the field of foreign trade.The organization of this work is as follows: In Section 1 we present the stochastic model Vasick. Then, value at risk conditional of exchange rate is presented in section 3.

2. Stochastic Model of Exchange Rate Vasicek

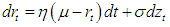

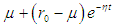

- The exchange rate can be modeled by several stochastic models, among them there are stochastic processes that tend to return to a moderate level in more or less long term that are used to model the exchange rates of some currencies.In this context fits the stochastic process Vasick or the process of returning to the mean.Thereby, more the fluctuations of

is around to its mean of long term is low, more the volatility of

is around to its mean of long term is low, more the volatility of  is low.The model of exchange rate of Vasicek is given by the following equation:

is low.The model of exchange rate of Vasicek is given by the following equation: | (1) |

is the speed of exchange rate of return to the mean;Ø

is the speed of exchange rate of return to the mean;Ø  is the average exchange rate.Ø

is the average exchange rate.Ø  is the exchange rate volatility which is assumed independentØ

is the exchange rate volatility which is assumed independentØ  is a Brownian motion as

is a Brownian motion as  with

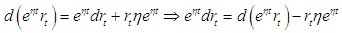

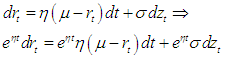

with  Thus we can develop this model as follows:

Thus we can develop this model as follows: In other,

In other,  So we get:

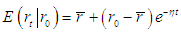

So we get: So the exchange rate

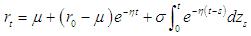

So the exchange rate  according to this model can be expressed as follows:

according to this model can be expressed as follows: | (2) |

is a Brownian motion as

is a Brownian motion as  with

with  then

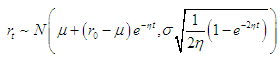

then  follows the normal law and thereafter variable

follows the normal law and thereafter variable  also follows the normal law.As the term

also follows the normal law.As the term  is not a random term then

is not a random term then  is a random variable that follows the normal law.By using Iso isometry [2] it is found that:

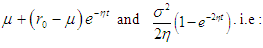

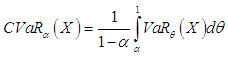

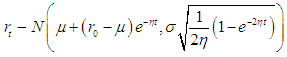

is a random variable that follows the normal law.By using Iso isometry [2] it is found that: Then the mean and variance are respectively:Ø

Then the mean and variance are respectively:Ø  Ø

Ø  Thus the random variable follows the normal distribution with mean and variance respectively:

Thus the random variable follows the normal distribution with mean and variance respectively:

| (3) |

3. Modeling of Exchange Rate Risk

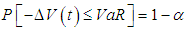

- Value at risk VaR is a risk measure proposed by JP Morgan in 1994. It represents the maximum loss that may arise in a portfolio over

for a given level of probability

for a given level of probability  i.e :

i.e : | (4) |

with:Ø

with:Ø  : Portfolio value at beginning of the period.Ø

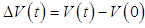

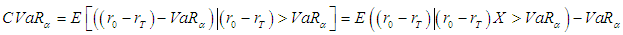

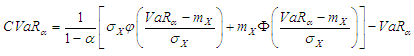

: Portfolio value at beginning of the period.Ø  : Portfolio value by the end of the period.Value at Risk depends on three parameters:Ø The distribution of the change in portfolio valueØ The probability that the losses are less than the VaRØ The horizon for which VaR is calculated.VaR offers several advantages such as ease of comparison and interpretation.However, studies such as Szergõ [9] showed that VaR does not take into account the amount of losses exceeding the VaR. Thus VaR is not sub-additive, it means that diversification does not imply a reduced risk.To overcome the limitations of VaR, a new risk measure called the conditional VaR (CVaR), defined as the expected loss exceeding the VaR can be adopted.This is the average value of losses that exceed VaR. CVaR is expressed as follows:

: Portfolio value by the end of the period.Value at Risk depends on three parameters:Ø The distribution of the change in portfolio valueØ The probability that the losses are less than the VaRØ The horizon for which VaR is calculated.VaR offers several advantages such as ease of comparison and interpretation.However, studies such as Szergõ [9] showed that VaR does not take into account the amount of losses exceeding the VaR. Thus VaR is not sub-additive, it means that diversification does not imply a reduced risk.To overcome the limitations of VaR, a new risk measure called the conditional VaR (CVaR), defined as the expected loss exceeding the VaR can be adopted.This is the average value of losses that exceed VaR. CVaR is expressed as follows: | (5) |

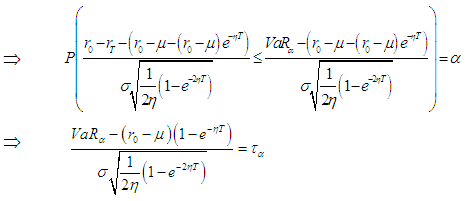

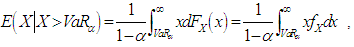

as

as  Then

Then  Then

Then  | (6) |

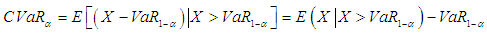

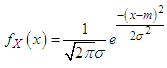

Put

Put  then

then Gold

Gold  where

where  with

with  and

and  are the mean and variance respectively

are the mean and variance respectively  Let

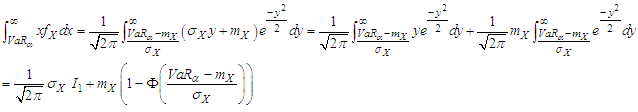

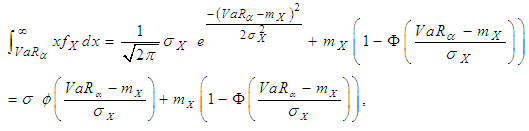

Let  it comes :

it comes : where

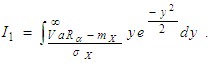

where  For calculating

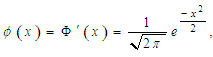

For calculating  we know successively:

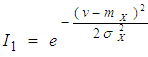

we know successively:  It follows

It follows  then

then  where

where  hence the following result:

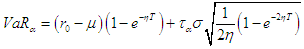

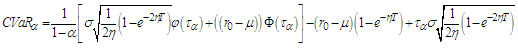

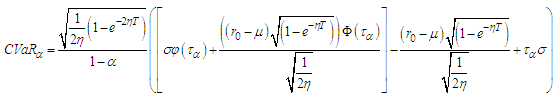

hence the following result: Replace

Replace  and

and  expressions in formula previous. So we get:

expressions in formula previous. So we get: Thus

Thus  | (7) |

4. Numerical Application

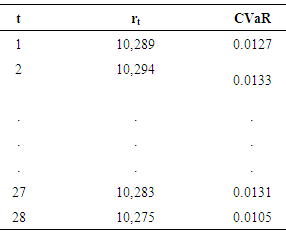

- In this part we will present an example of a numerical application of the previous formula of CVaR.

Consider a sample of 28 exchange rate DH / EUR of February month 2015 from which we calculate the CVaR The results obtained are given in the following table:

Consider a sample of 28 exchange rate DH / EUR of February month 2015 from which we calculate the CVaR The results obtained are given in the following table:5. Conclusions

- In this paper, we developed a mathematical formula to express the conditional value at risk CVaR exchange rate using the Vasick stochastic model.This formula allows to assess the risk of exchange rate, thereby providing a tool for decision support to the exchange market managers.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML