-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Intelligent Systems

p-ISSN: 2165-8978 e-ISSN: 2165-8994

2016; 6(1): 22-29

doi:10.5923/j.ajis.20160601.03

A Hybrid High Order Fuzzy Time Series Forecasting Approach Based on PSO and ANNs Methods

Erol Eğrioglu1, Cagdas Hakan Aladag2, Ufuk Yolcu3, Ali Zafer Dalar1

1Department of Statistics, Giresun University, Giresun, Turkey

2Department of Statistics, Hacettepe University, Ankara, Turkey

3Department of Statistics, Ankara University, Ankara, Turkey

Correspondence to: Erol Eğrioglu, Department of Statistics, Giresun University, Giresun, Turkey.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Fuzzy time series approaches usually consist of three phases such as fuzzification, defining fuzzy relationships, and defuzzification. Depending on the forecasting model order, the method used to define fuzzy relation changes. Using methods such as genetic algorithms, fuzzy c-means or particle swarm optimization in the fuzzification step improves the forecasting performance. In recent studies, it has been observed that utilizing feed forward neural networks simplifies calculations and increases the forecasting accuracy. A new fuzzy time series approach is proposed to analyze high order fuzzy time series forecasting models in this paper. The proposed method is a hybrid method in which particle swarm optimization and feed forward neural networks are employed in the fuzzification and in the defining fuzzy relationships steps, respectively. To investigate the performance of the proposed hybrid fuzzy time series forecasting method, the method was applied to a real-world time series which is the data of index 100 in Istanbul Stock Exchange (ISE). In order to study the usefulness of the proposed method, its forecasting accuracy is compared with that of some other fuzzy time series approaches available in the literature. The application results accentuate the superiority of the proposed method over the other approaches for ISE data.

Keywords: Feed forward neural networks, Forecasting, Fuzzy time series, High order model, Hybrid approach, Particle swarm optimization, Stock prices

Cite this paper: Erol Eğrioglu, Cagdas Hakan Aladag, Ufuk Yolcu, Ali Zafer Dalar, A Hybrid High Order Fuzzy Time Series Forecasting Approach Based on PSO and ANNs Methods, American Journal of Intelligent Systems, Vol. 6 No. 1, 2016, pp. 22-29. doi: 10.5923/j.ajis.20160601.03.

Article Outline

1. Introduction

- Time series forecasting is a classic prediction problem which is getting more and more attention from both academic and industry communities. In the literature, various techniques have been utilized to solve this problem. Forecasting approaches can be divided into four groups which are probability theory-based conventional methods [1], computational methods such as neural networks [2], fuzzy theory-based methods such as fuzzy time series [3] and hybrid forecasting techniques [4]. It is well-known fact that using a hybrid forecasting approach can produce better forecasts since a hybrid approach includes advantages of different methods used in this hybrid approach. Therefore, there have been many studies in which hybrid approaches are proposed for time series forecasting in order to reach high accuracy level [5-13].Fuzzy time series approach based on fuzzy set theory was introduced as an alternative method for conventional forecasting time series models [3]. In recent years, fuzzy time series approaches for forecasting problems have drawn a great amount of attention [7]. Fuzzy time series forecasting models can be categorized into two subclasses which are the first order and the high order models [14]. Although it is easy to use the first order models, this type of models is inadequate to analyze real world time series since relations between high order fuzzy lagged variables are not included in a first order model. Despite of the fact that modeling capability of the high order models is better than this of the first order models, the main drawback of using the high order model is that defining fuzzy relations becomes very hard when this type of models are being used. To analyze the high order models Chen [15] proposed a method which utilizes fuzzy logic group relation tables to determine the fuzzy relations. The method proposed by Chen [15] is also the improved version of the method suggested by Chen [16]. Afterwards, Aladag et al. [17] proposed a high order fuzzy time series model in which artificial neural networks are employed to establish fuzzy relations.Fuzzy time series method is composed of three main stages; these are fuzzification, determining fuzzy relations between observation, and defuzzification. Like other phases, fuzzification stage also plays an important role in forecasting performance of fuzzy time series. Decomposition of universe of discourse according to a specified length of interval is a favorite method for the fuzzification step. The length of interval which is required for partitioning the universe of discourse has an important impact on the forecasting results [18]. Huarng [18] suggested mean based and distribution based methods to determine the length of interval. Egrioglu et al. [19, 20] calculated length of intervals in first order and high order models by using single variable constrained optimization. Huarng and Yu [21] proposed a method in which the length of the interval is not fixed and is exponentially increased with a ratio. That is, they partitioned the universe of discourse by using dynamic length of interval instead of fixed one. Yolcu et al. [22] improved the method proposed by Huarng and Yu [21]. They determined the ratio used in Huarng and Yu’s [21] method by using optimization. Afterwards, some studies were inspired by the idea of using dynamic interval length. Davari et al. [23], Kuo et al. [24, 25], and Park et al. [26] utilized particle swarm optimization (PSO) to determine dynamic interval lengths. Bas et al. [27] utilized differential evolution algorithm to determine dynamic interval lengths. Uslu et al. [28] and Bas et al. [29] proposed two approaches based on weights using the number of recurrences of fuzzy relations. And also Uslu et al. [30] proposed an approach based on weights determined chronologically. It has been observed that using PSO method improves forecasting accuracy. Moreover, in fuzzification stage, there are some studies in the literature that have used fuzzy clustering techniques [31, 11].In this study, a new hybrid high order fuzzy time series forecasting approach is proposed. In the proposed hybrid method, PSO method is used for fuzzification and artificial neural networks (ANNs) are utilized to define fuzzy relations. In the literature, the proposed method is the first fuzzy time series method in which PSO and ANNs are used together. Also, the proposed hybrid method provides some advantages given below.● In the fuzzification step, determination on length of interval is not subjective since PSO is employed to calculate interval lengths. It prevents arbitrarily determination of the interval length so that the proposed method works in a systematic way.● Instead of using a fixed length of interval, dynamic interval lengths are employed. Therefore, the data can be modeled better.● The proposed method does not require constructing complex fuzzy logic group relation tables to define fuzzy relations since ANNs method is utilized to determine these relations. This substantially reduces the computational complexity of the method since it is easy to use ANNs approach.● The proposed hybrid method can benefit from capabilities of methods PSO and ANNs to analyze high order fuzzy time series forecasting models. For example, the proposed method has the ability of flexible modeling which is also included by ANNs.● By virtue of the advantages mentioned above, it is expected that the proposed hybrid high order fuzzy time series forecasting method has high forecasting accuracy.The basic definitions on fuzzy time series are given in the next section. The method proposed in this paper is introduced step by step in Section 3. Section 4 covers the comparative applications of all methods mentioned in this paper. The final section is about a conclusion driven from the whole study.

2. Basic Fuzzy Time Series Definitions

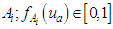

- Fuzzy time series was firstly put forward by Song and Chissom [32-34]. Fuzzy time series can be shortly defined as time series whose observations are fuzzy sets. General definitions of fuzzy time series are given as follows:Let U be the universe of discourse, where

. A fuzzy set Ai of U is defined as

. A fuzzy set Ai of U is defined as  where

where  is the membership function of the fuzzy set

is the membership function of the fuzzy set  ua is a generic element of fuzzy set

ua is a generic element of fuzzy set  is the degree of belongingness of ua to

is the degree of belongingness of ua to  and

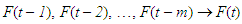

and  Definition 1. Fuzzy time series Let Y(t) (t=0, 1, 2, …) a subset of real numbers, be the universe of discourse by which fuzzy sets fj(t) are defined. If F(t) is a collection of f1(t), f2(t), … then F(t)is called a fuzzy time series defined on Y(t).Definition 2. Let F(t) be a fuzzy time series. If F(t) is a caused by F(t – 1), then this fuzzy logical relationship is represented by

Definition 1. Fuzzy time series Let Y(t) (t=0, 1, 2, …) a subset of real numbers, be the universe of discourse by which fuzzy sets fj(t) are defined. If F(t) is a collection of f1(t), f2(t), … then F(t)is called a fuzzy time series defined on Y(t).Definition 2. Let F(t) be a fuzzy time series. If F(t) is a caused by F(t – 1), then this fuzzy logical relationship is represented by | (1) |

| (2) |

3. The Proposed Hybrid Forecasting Method

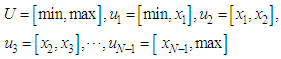

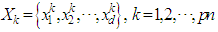

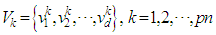

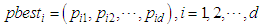

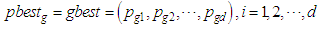

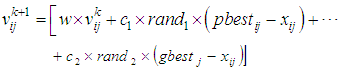

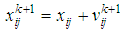

- In the literature, it has been seen that utilizing artificial intelligent techniques in various steps of fuzzy time series approach can provide three important advantages. First of all, the approach can work more systematically since arbitrary decisions are avoided. Secondly, using artificial intelligent methods makes the usage of fuzzy time series approach easier since computational complexity of the method is reduced. Finally, in many applications, it was observed that utilizing artificial intelligent techniques considerably increase the forecasting performance of fuzzy time series. Therefore, using hybrid methods combine fuzzy time series and artificial intelligent techniques have been preferred in recent studies. For example, Chen and Chung [35] and Lee et al. [36] utilized genetic algorithms in fuzzification step. Davari et al. [23], Kuo et al. [24, 25], and Park et al. [26] employed PSO method to fuzzify observations. Cheng et al. [37] and Li et al. [38] used fuzzy c-means method in fuzzification step.Particle swarm optimization, which is a population based heuristic algorithm, was firstly proposed by Kennedy & Eberhart [39]. Distinguishing feature of this heuristic algorithm is that it simultaneously examines different points in different regions of the solution space to obtain the global optimum solution. Local optimum traps can be avoided because of this feature of the method [40]. In the fuzzy time series literature, there are some studies in which PSO method was used for fuzzification. Davari et al. [23] employed PSO method for fuzzification step of first order fuzzy time series. Kuo et al. [24] utilized this method for both first and high order fuzzy time series. PSO method was used by Kuo et al. [25] to fuzzify observations in high order models. Park et al. [26] exploited PSO method for fuzzification in two factor high order fuzzy time series. In the proposed hybrid approach, the modified particle swarm optimization (MPSO) method is used for fuzzification. The detailed information about MPSO method can be found in Aladag et al. [6]. The MPSO algorithm has time varying inertia weight like in Shi and Eberhart [41]. In a similar way, this algorithm also has time varying acceleration coefficient like in Ma et al. [42]. In the proposed hybrid forecasting technique, MPSO optimization method is utilized to fuzzify the observations.ANNs method is an effective inference method which can learn complex relationships between the observations. An important kind of ANNs is feed forward neural networks. In fuzzy time series literature, feed forward neural networks were firstly used by Huarng and Yu [43] for defining fuzzy relations stage in fuzzy time series. Aladag et al. [17] employed feed forward neural networks for this stage in high order fuzzy time series. In Egrioglu et al. [8], feed forward neural networks were utilized to define fuzzy relations in bivariate fuzzy time series. Egrioglu et al. [44] also used this type of neural networks to determine fuzzy relations in multi variable fuzzy time series. Yu and Huarng [45] and Yolcu et al. [46] utilized feed forward neural networks which include more than one neuron in the output layer for determining fuzzy relations. In the proposed approach, feed forward neural networks are used to define fuzzy relations. And also the fuzzy lagged variable selection in fuzzy time series with genetic algorithm was proposed by [47].As mentioned above, in the proposed hybrid fuzzy time series forecasting method, MPSO and feed forward neural networks methods are used for fuzzification and establishing fuzzy relations, respectively. The proposed hybrid fuzzy time series method is the first fuzzy time series method uses PSO and ANNs approaches together. The algorithm of the proposed approach is given below.Algorithm 2: The proposed methodStep 1. Boundaries of universe of discourse min and max, parameters of PSO method such as w1, w2, c1i, c2i, c1f, and c2f . The number of particles pn, and maximum number of iterations tmax are specified.Step 2. For variables, which will be optimized with PSO, starting positions and velocities are determined. Positions and velocities of particles are given in formula (3) and (4).Universe of discourse and its partition according to variables

which will be optimized with PSO are as follows

which will be optimized with PSO are as follows where U is the universe of discourse, min and max are maximum and minimum values of time series, respectively,

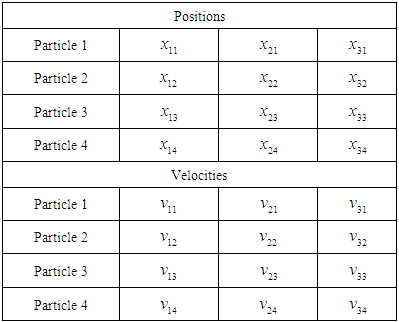

where U is the universe of discourse, min and max are maximum and minimum values of time series, respectively,  are positions of particles, and N represents the number of sub intervals. For instance, let N = 4, and the number of particles m equals to 4. In this case, particles and velocities are like in Table 1.

are positions of particles, and N represents the number of sub intervals. For instance, let N = 4, and the number of particles m equals to 4. In this case, particles and velocities are like in Table 1.

|

| (3) |

| (4) |

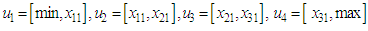

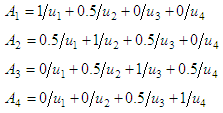

According to this, fuzzy sets can be defined as follows:

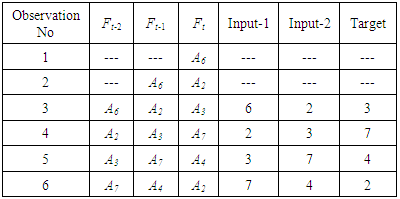

According to this, fuzzy sets can be defined as follows: Fuzzy time series is obtained by mapping each observation of time series into a fuzzy set which has the maximum membership degree for the interval including this observation.Step 3.2 Fuzzy relationships are established with feed forward neural networks.An example will be given to explain this step more clearly for the second order fuzzy time series. Because of dealing with second order fuzzy time series, two inputs are employed in neural network model, so that lagged variables Ft-2 and Ft-1 are obtained from fuzzy time series Ft. These series are given in Table 2. The index numbers (i) of Ai of Ft-2 and Ft-1 series are taken as input values whose titles are Input-1 and Input-2 in Table 2 for the neural network model. Also, the index numbers of Ai of Ft series are taken as target values whose title is Target in Table 2 for the neural network model. When the third observation is taken as an example, inputs values for the learning sample [A6, A2] are 6 and 2. Then, target value for this learning sample is 3.

Fuzzy time series is obtained by mapping each observation of time series into a fuzzy set which has the maximum membership degree for the interval including this observation.Step 3.2 Fuzzy relationships are established with feed forward neural networks.An example will be given to explain this step more clearly for the second order fuzzy time series. Because of dealing with second order fuzzy time series, two inputs are employed in neural network model, so that lagged variables Ft-2 and Ft-1 are obtained from fuzzy time series Ft. These series are given in Table 2. The index numbers (i) of Ai of Ft-2 and Ft-1 series are taken as input values whose titles are Input-1 and Input-2 in Table 2 for the neural network model. Also, the index numbers of Ai of Ft series are taken as target values whose title is Target in Table 2 for the neural network model. When the third observation is taken as an example, inputs values for the learning sample [A6, A2] are 6 and 2. Then, target value for this learning sample is 3.

|

| (5) |

| (6) |

| (7) |

| (8) |

| (9) |

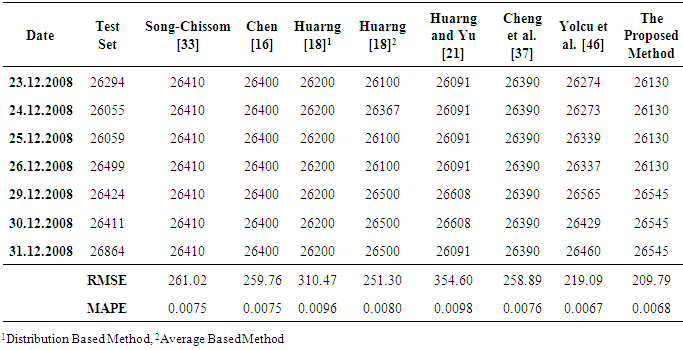

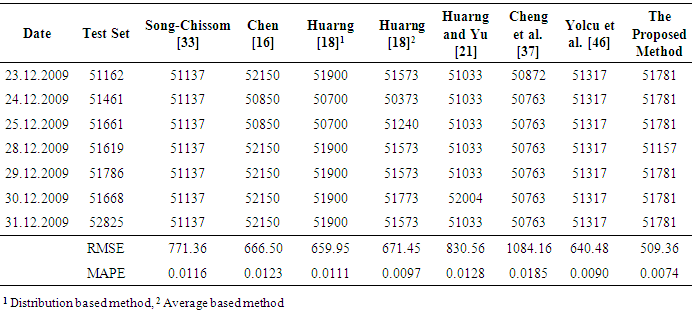

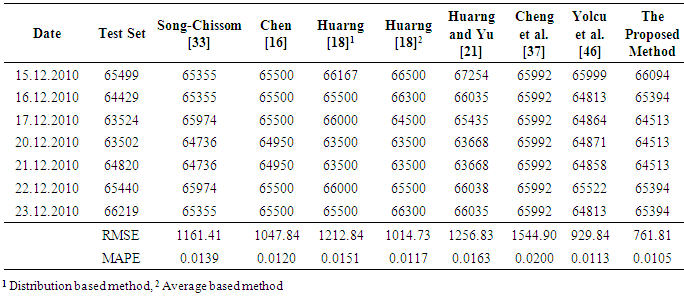

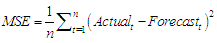

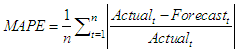

4. The Application

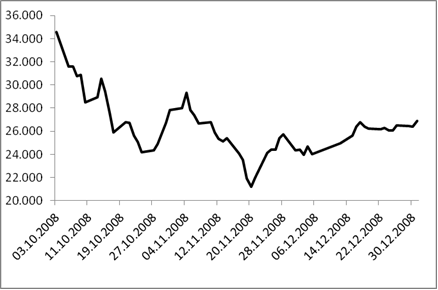

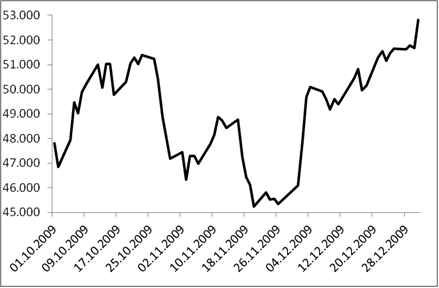

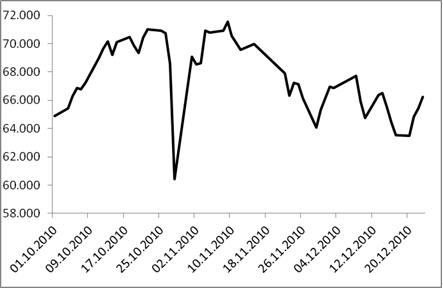

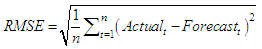

- In order to evaluate the performance of the proposed hybrid fuzzy time series forecasting method, the method was applied to the data of index 100 in Istanbul Stock Exchange (ISE). ISE data includes daily observations was divided into three data sets. Each data set belongs to a different year. The periods, 03/10/2008 - 31/12/2008, 01/10/2009 - 31/12/2009 and 01/10/2010 - 23/12/2010 of ISE were referred as Series 1, 2, and 3, respectively. The proposed method and the other fuzzy time series approaches available in the literature were applied to all three data sets. All the other fuzzy time series approaches are codded in MATLAB package program.Then, all obtained forecasting results were compared to each other. The graphs of these time series are given in Fig. 1, 2, and 3, respectively.

| Figure 1. The graph of Series 1, the period between 03/10/2008 and 31/12/2008 |

| Figure 2. The graph of Series 2, the period between 01/10/2009 and 31/12/2009 |

| Figure 3. The graph of Series 3, the period between 01/10/2010 and 23/12/2009 |

| (10) |

| (11) |

|

|

|

5. Conclusions and Discussion

- The most proper approach to analyze time series whose observations include uncertainty is fuzzy time series. During the last ten years, there has been a substantial increase in the interest on fuzzy time series. Specifically, they are good for tasks involving data sets have uncertainty. However, there have been some problems with using this approach. The main drawbacks of this approach are some arbitrary decisions that directly affect the performance of the approach, and complex computations. In this study, to overcome these issues, a novel hybrid high order fuzzy time series approach utilizes artificial intelligent techniques is firstly introduced. In the fuzzification step of the proposed method, PSO is employed to determine the length of interval instead of determining it by an arbitrary decision. Also, in the suggested method, feed forward neural networks are utilized to define fuzzy relations between observations of time series so the method does not require complex fuzzy group relation tables operations. In the literature, the proposed hybrid approach is the first fuzzy time series method in which PSO and ANNs methods are exploited together. In order to show the applicability of the proposed method, it was applied to a real-world time series which is index 100 in stocks and bonds exchange market of İstanbul. Some other fuzzy time series approaches were also applied to the data for the aim of comparison. As a result of the implementation, it was observed that the proposed hybrid forecasting approach produces very promising results. Therefore, the suggested method can be used as a good alternative method to forecast fuzzy time series.

ACKNOWLEDGEMENTS

- This work was in supported by “The Scientific and Technological Research Council of Turkey (TUBITAK)”, Turkey, under project number 210T150.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML