-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Computer Architecture

2023; 10(1): 1-8

doi:10.5923/j.ajca.20231001.01

Received: Mar. 5, 2022; Accepted: Mar. 15, 2022; Published: Mar. 17, 2023

Revolutionizing Finance: The Power of Cloud-Based ERP Solutions

Mohd Iqbal Ashraf1, Ghausiya Ashraf2

1Architect, Giant Eagle Inc, Pittsburgh, PA, USA

2ERP Consultant, Pittsburgh, PA, USA

Correspondence to: Mohd Iqbal Ashraf, Architect, Giant Eagle Inc, Pittsburgh, PA, USA.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The focus of this paper is to explore the potential transformation of various business domains, especially finance, through the use of cloud technologies and machine learning. The adoption of cloud technology has already revolutionized the business landscape, providing novel capabilities while augmenting existing ones. The paper delves into the benefits and use cases of cloud-based applications in finance and assesses the factors that should be considered when transitioning finance operations to the cloud. By leveraging these technologies, businesses can unlock significant advantages and sustain a competitive advantage in the dynamic modern marketplace. The discussion will center on Oracle Financial Cloud as a SaaS ERP solution.

Keywords: Cloud technologies, Machine learning, Transformative potential, Business domains, Finance, Oracle Cloud ERP, Frameworks, Cost savings, Efficiency, AI

Cite this paper: Mohd Iqbal Ashraf, Ghausiya Ashraf, Revolutionizing Finance: The Power of Cloud-Based ERP Solutions, American Journal of Computer Architecture, Vol. 10 No. 1, 2023, pp. 1-8. doi: 10.5923/j.ajca.20231001.01.

Article Outline

1. Introduction

- Oracle Fusion Cloud Financials is a powerful platform that enables finance to be modern and adaptable, enhancing productivity and enabling improved business decisions. This comprehensive solution offers robust support for global companies across a wide range of industries and provides continuous innovation in critical areas such as machine learning, intelligent automation, and analytics, all while being deployed in the cloud.By leveraging Oracle Financials, businesses can benefit from increased speed and agility, enabling them to do more with less. The platform's intelligent automation capabilities help streamline finance operations, reducing the risk of errors and freeing up time for more strategic tasks. Furthermore, the use of advanced analytics and machine learning technologies enables companies to gain deeper insights into their financial data, unlocking new opportunities for growth and efficiency.Oracle's cloud-based solution is designed with the future in mind, with continuous innovation and updates ensuring that businesses always have access to the latest features and technologies. This means that companies can remain at the forefront of their industries and stay competitive, no matter how rapidly their sector is changing.

2. Why Cloud

- Software-as-a-Service (SaaS) based cloud applications offer numerous benefits to businesses, including:• Scalability: SaaS applications can be easily scaled up or down to meet changing business needs. This flexibility means that businesses can quickly respond to market changes and adjust their software usage as needed.• Lower Costs: SaaS applications typically have lower upfront costs than traditional software deployments. Additionally, maintenance and upgrades are handled by the provider, reducing the burden on businesses.• Accessibility: SaaS applications are accessible from any location with an internet connection, making it easier for remote workers and distributed teams to collaborate.• Improved Security: SaaS providers typically have robust security measures in place to protect their customers' data. This can help businesses avoid costly data breaches and other security incidents.• Faster Deployment: SaaS applications can be deployed much more quickly than traditional software deployments. This means that businesses can start using their new software sooner and start reaping the benefits sooner as well.• Automatic Updates: SaaS providers handle updates and patches automatically, ensuring that businesses are always using the latest and most secure version of the software.• Predictive Analytics: By using machine learning algorithms to analyze large datasets, SaaS providers can offer businesses predictive analytics capabilities that can help them make more informed decisions.Overall, SaaS-based cloud applications offer a cost-effective, flexible, and scalable solution for businesses of all sizes. They provide businesses with the tools they need to be more productive, efficient, and competitive in today's fast-paced business environment.

3. Prerequisites for Finance Application on Cloud

- There are several prerequisites that businesses should consider before migrating their finance applications to the cloud. Some of these include:• Security: The security of financial data is of utmost importance, and businesses must ensure that their cloud provider has robust security measures in place to protect their sensitive data.• Compliance: Many industries have strict compliance requirements around financial data, such as HIPAA in healthcare or PCI DSS in payments. Businesses must ensure that their cloud provider is compliant with all relevant regulations.• Integration: Businesses must ensure that their cloud-based finance applications can integrate with their other systems, such as CRM, ERP, or HR systems, to ensure a seamless flow of data across their organization.• Customization: Finance applications often require customization to meet the unique needs of each business. Businesses must ensure that their cloud provider offers the flexibility to customize their applications as needed.• Support: Businesses must ensure that their cloud provider offers adequate support, such as technical support or training, to ensure that their finance applications are properly configured and used.• Performance: Financial applications require high levels of performance to handle the large volumes of data that are typically involved. Businesses must ensure that their cloud provider offers the necessary performance and reliability to meet their needs.Overall, businesses must carefully evaluate their cloud provider and ensure that they meet all these prerequisites before migrating their finance applications to the cloud. By doing so, businesses can ensure that their financial data is secure and compliant, that their applications integrate seamlessly with their other systems, and that they have the necessary support and performance to meet their needs.

4. Benefits of Finance Application on Cloud

4.1. Exceptional Processing Speeds

- Oracle Fusion ERP is known for its exceptional processing speed, which is one of its key features. With its cloud-based architecture and advanced technology, Oracle Fusion ERP is designed to process large amounts of data quickly and efficiently. This enables businesses to manage their financial operations and other business processes faster and more effectively than with traditional on-premises systems.One of the main advantages of the exceptional processing speed of Oracle Fusion ERP is that it enables businesses to perform complex tasks quickly and efficiently. This includes tasks such as financial reporting, cash management, revenue recognition, and risk management. With faster processing speeds, businesses can complete these tasks in real-time or near real-time, allowing them to make informed decisions based on up-to-date information. Another advantage of the exceptional processing speed of Oracle Fusion ERP is that it enables businesses to scale their operations quickly and efficiently. As a cloud-based system, Oracle Fusion ERP is designed to handle large amounts of data and transactions, making it well-suited for businesses of all sizes, from small startups to large enterprises. Overall, the exceptional processing speed of Oracle Fusion ERP is a key factor in its ability to transform finance and other business processes. By enabling businesses to process data quickly and efficiently, Oracle Fusion ERP helps businesses to optimize their operations, reduce costs, and stay competitive in today's fast-paced business environment.

| Figure 1. Cloud Processing Speed |

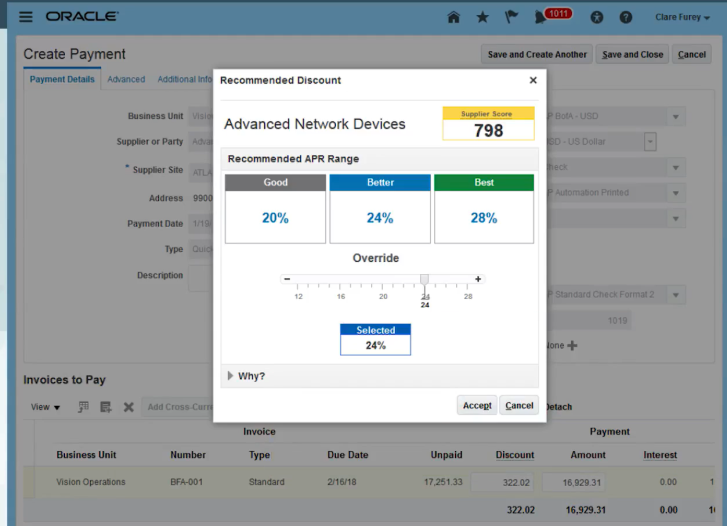

4.2. Oracle Financials Includes Embedded Oracle Artificial Intelligence Apps

- Oracle Cloud Financials includes AI-powered features tailored to finance tasks, enabling improved performance, optimized working capital, and increased automation across payables and receivables. To name a few, Oracle Financials includes the following embedded AI Apps:• Dynamic Discounting• Intelligent Account Combination Defaulting.

| Figure 2. AI Embedded |

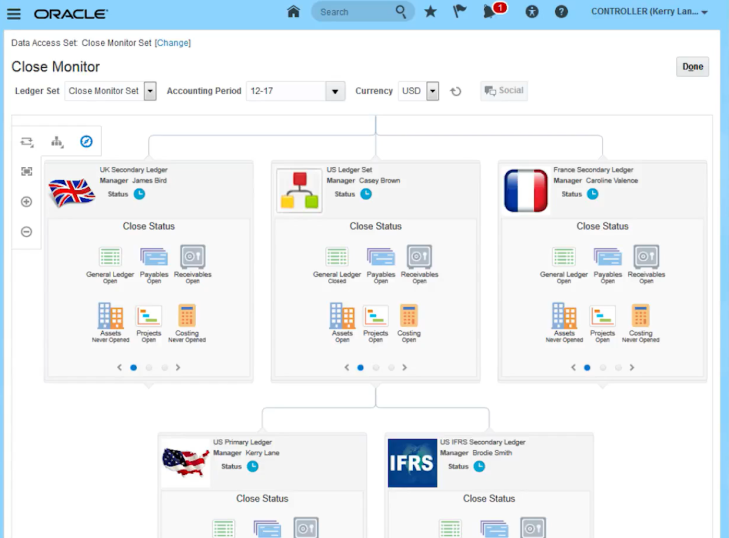

4.3. Accelerate Your Book Closing Process

- When facing pressure to close books faster and complete financial reporting sooner, having a comprehensive close management system is crucial. By utilizing centralized accounting and integrated subledgers, intuitive dashboards, and a collaborative close process, businesses can ensure they know where they stand in the close process. The close manager automatically identifies any subledgers that have not yet closed, offering complete visibility and centralized control through a visual representation of the close process across the entire organization, including a hierarchy viewer that illustrates the close's dependency on related subsidiaries. Accounting automation streamlines end-to-end accounting and transaction processes without user intervention, such as daily rates import, accounting creation, journal import, and journal posting. Users are notified of any exceptions and given the information necessary to resolve them. Intelligent real-time monitoring indicates changes in account balances, comparing current information against a target or baseline, such as budget or prior period results, to identify and manage anomalies.

| Figure 3. Fast Book Closing |

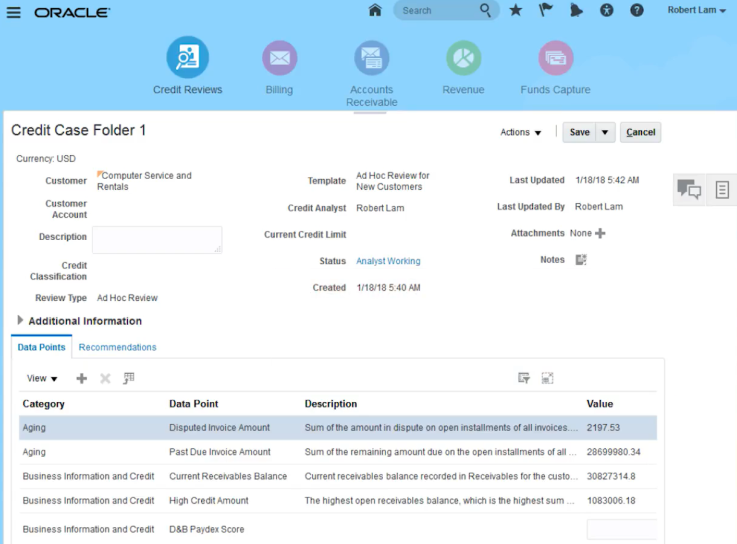

4.4. Accelerate Payment and Minimize Bad Debt

- Automated collection strategies based on customer scoring can apply a series of customized tasks to ensure timely collections from overdue customers, resulting in higher recovery rates of outstanding receivables. Collections metrics such as DSO and broken promise count evaluate the collections process using industry standard formulas, providing a better understanding of the health of outstanding receivables, collections organization efficiency, and potential problem areas that may require more resources or altered collection strategies. This ultimately improves the collection experience for both customers and collections agents.

| Figure 4. Customer Credit |

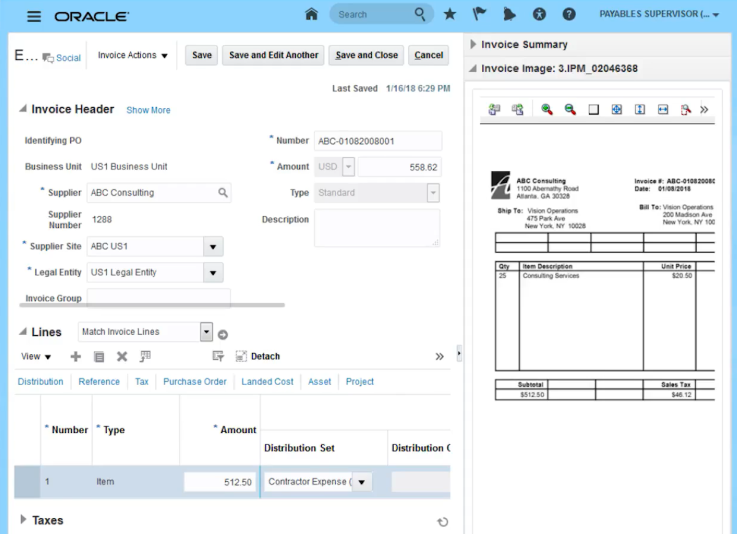

4.5. Automated Processing for Supplier Invoices with no Human Intervention Required

- Incorporating imaging capabilities can speed up invoice entry, reduce errors, and minimize processing costs, eliminating the need for expensive third-party solutions. Supplier invoices can be scanned with intelligent document recognition and automatically completed, validated, approved, and paid with no user intervention. An interactive viewer allows for issue resolution and machine learning algorithm training. Real-time alerts are integrated into the invoice work area to proactively monitor processes, track transaction status, and alert users to issues or exceptions that require attention. Relevant transactions are displayed on the same page for immediate action, with single-click actions such as approve or release hold increasing productivity for simple tasks. Overall, utilizing integrated imaging capabilities for invoice processing can significantly streamline the process, reduce errors, and minimize costs while providing real-time alerts and increased productivity for simple tasks.

| Figure 5. Supplier Invoices |

4.6. Enhance Cash Flow

- Cash management provides a solution for managing bank account activity and controlling cash positions. It enables quick analysis of cash positions and accurate forecasting of cash requirements through configurable dashboards, work areas, and reports, ensuring optimal utilization of cash resources and maintaining liquidity.

| Figure 6. Cash Flow |

4.7. Manage Revenue and Take Charge of Customer Billing

- Improve daily customer activities by identifying billing or accounts receivable issues and highlighting transactions that require attention directly in the work area, streamlining processes. An electronic bill presentment solution extends the reach of Oracle Financials to customers, reducing billing and collection costs while improving overall customer service through a self-service solution for managing accounts. Credit management provides the necessary information and tools to monitor and evaluate customer creditworthiness and make informed credit decisions by tailoring credit policies to business needs and market conditions. Ensure compliance with the ASC 606 and IFRS 15 accounting standard for Revenue from Contracts with Customers by utilizing a centralized, automated solution for revenue management. This solution provides a configurable framework for automating customer contract and performance obligation identification and creation, valuations, resulting accounting entries, and revenue recognition over time or at a point in time. Automating ASC 606 and IFRS 15 processes improves productivity and reduces the risk of errors.

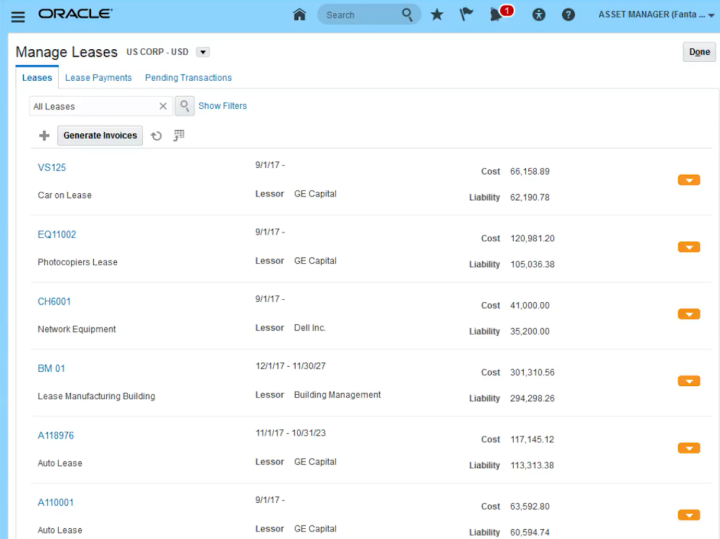

4.8. Efficiently Manage Assets and Leases

- The assets work area streamlines asset lifecycle operations, managing transaction and period close activities for asset books. It also addresses accounting standards such as IFRS 16 and ASC 842 for lease accounting through a comprehensive offering that standardizes corporate lease policies, improves internal controls, and ensures compliance with lease obligations.

| Figure 7. Managing Leases |

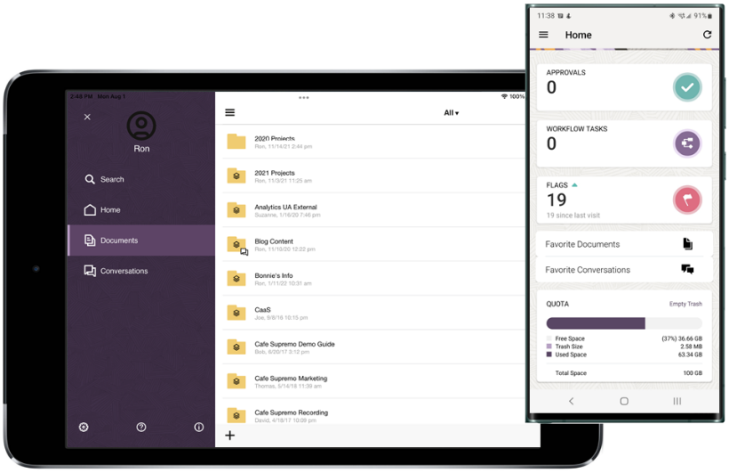

4.9. Mobility

- One of the primary benefits of using SaaS ERP is accessibility on touch screen devices. With touch screen devices such as smartphones and tablets, users can access their ERP systems from anywhere, at any time. This makes it easier for employees to perform their tasks and stay productive, even when they are on the go.

| Figure 8. SAAS ERP on Mobile devices |

5. Cloud ERP Selection

- Choosing the right cloud ERP (Enterprise Resource Planning) solution for your business can be a challenging task, given the plethora of options available in the market. Here are some key factors you should consider when evaluating which cloud ERP to select:• Business requirements: The first step is to identify your business requirements and objectives. This will help you understand what functionalities and features you need in an ERP solution to meet your specific business needs.• Scalability: Your ERP solution should be scalable to accommodate future business growth and expansion. Make sure the ERP can handle a higher volume of transactions and users without causing any downtime or performance issues.• Customization: The cloud ERP solution should be customizable to meet your unique business processes and workflows. The system should allow you to modify fields, forms, reports, and other aspects of the system to fit your specific needs.• Integration: Your cloud ERP solution should integrate seamlessly with other software and applications you use to manage your business operations, such as CRM, inventory management, e-commerce, and accounting software.• Security: Cloud ERP solutions store sensitive data such as financial information, customer data, and employee data. Ensure that the solution you choose has robust security features such as data encryption, firewalls, and access controls.• Support and Training: Evaluate the level of customer support and training provided by the vendor. Ensure that the vendor offers adequate training and support to help you get up and running and address any issues or questions that may arise.• Total Cost of Ownership: Consider the total cost of ownership, which includes not only the subscription cost but also implementation costs, training costs, and ongoing maintenance and support costs.• Vendor Reputation: Finally, research the vendor's reputation and track record in the market. Read customer reviews, case studies, and other sources of information to evaluate the vendor's performance and reliability.By considering these factors, you can choose a cloud ERP solution that aligns with your business needs and helps you achieve your goals efficiently and effectively. For example, Oracle Finance Cloud and SAP S/4HANA Finance are both cloud-based ERP solutions designed to manage financial operations and improve financial performance for businesses. Here are some key differences between the two:1. Technology: Oracle Finance Cloud uses Oracle’s own technology stack, while SAP S/4HANA Finance is built on SAP's HANA in-memory database. HANA provides real-time data processing capabilities and helps organizations to reduce data redundancy and improve data analytics.2. User interface: Oracle Finance Cloud has a modern and intuitive user interface that is designed for ease of use and customization. SAP S/4HANA Finance has a user interface that is familiar to SAP users but may be more complex to use for those who are not already familiar with the SAP ecosystem.3. Functionality: Both solutions offer robust financial management capabilities, including general ledger, accounts payable, accounts receivable, and cash management. However, SAP S/4HANA Finance offers additional functionality, such as predictive accounting, financial planning, and analysis.4. Deployment options: Oracle Finance Cloud offers deployment options for private, public, and hybrid cloud environments. SAP S/4HANA Finance is designed to run on the SAP HANA Cloud Platform, and also offers on-premises deployment options.5. Integration: Both solutions offer integration with other software applications and platforms. Oracle Finance Cloud offers pre-built integrations with Oracle's other cloud-based applications, while SAP S/4HANA Finance offers integrations with other SAP solutions as well as third-party applications.6. Support: Oracle and SAP both offer comprehensive support services for their respective solutions, including training, consulting, and technical support. However, the level of support and expertise may vary depending on the vendor and the specific solution.7. Pricing: The cost of both solutions can vary depending on factors such as deployment type, functionality, and level of customization. SAP S/4HANA Finance may be more expensive initially, but it can provide significant cost savings over time due to its real-time data processing capabilities.

6. Use-Cases

- Oracle Fusion Finance Cloud ERP offers a wide range of use cases for businesses, including:• Financial Management: Oracle Fusion Financials Cloud enables businesses to manage their financial operations efficiently and effectively, with features for general ledger, accounts payable, accounts receivable, and fixed assets.• Procurement: Oracle Fusion Procurement Cloud helps businesses streamline their procurement processes, with features for requisitioning, purchasing, and supplier management.• Project Management: Oracle Fusion Project Management Cloud enables businesses to manage their projects from start to finish, with features for project planning, resource management, and project financials.• Revenue Management: Oracle Fusion Revenue Management Cloud enables businesses to comply with revenue recognition standards such as ASC 606 and IFRS 15, with features for contract management, performance obligations, and revenue recognition.• Risk Management: Oracle Fusion Risk Management Cloud helps businesses manage risk across their organization, with features for risk identification, assessment, and mitigation.• Financial Reporting and Analytics: Oracle Fusion Financial Reporting and Analytics Cloud provides businesses with real-time financial reporting and analytics, enabling them to make informed decisions based on up-to-date financial data.• Cash Management: Oracle Fusion Cash Management Cloud enables businesses to manage their cash positions and forecast cash requirements through configurable dashboards, work areas, and reports.• Accounting Hub: Oracle Fusion Accounting Hub Cloud enables businesses to consolidate financial information from multiple sources, manage accounting for multiple entities, and enforce accounting policies across the organization.• Order Management: Oracle Fusion Order Management Cloud enables businesses to manage their order-to-cash processes, with features for order fulfillment, billing, and revenue recognition.Overall, Oracle Fusion Finance Cloud ERP offers businesses a comprehensive suite of applications to manage their financial operations, procurement, projects, revenue, risk, reporting, cash, accounting, and order management. With its advanced features and capabilities, businesses can optimize their operations, reduce costs, and stay competitive in today's fast-paced business environment.

7. Conclusions

- Cloud-based applications have the potential to transform the finance industry by providing cost savings, scalability, and increased efficiency. However, the migration to the cloud requires careful planning and execution to ensure that data security and compliance requirements are met. Additionally, finance companies need to carefully select the cloud computing platform and SaaS applications that best meet their needs. With the right strategy and tools, finance companies can leverage cloud-based applications to stay competitive in the rapidly changing financial landscape.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML