-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Advances in Computing

p-ISSN: 2163-2944 e-ISSN: 2163-2979

2022; 12(1): 1-6

doi:10.5923/j.ac.20221201.01

Received: Jul. 30, 2022; Accepted: Aug. 23, 2022; Published: Sep. 15, 2022

The Acceptability of Cryptocurrency as an Alternate Currency in Jamaica

Damith Wickramanayake, Danae Reid, Jovaughn Bennett, Matthew Tingling, Roshaun Walker

School of Information Technology, University of Technology, Kingston, Jamaica

Correspondence to: Damith Wickramanayake, School of Information Technology, University of Technology, Kingston, Jamaica.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study’s purpose was to use quantitative methodology to investigate and study the willingness of Jamaican citizens to accept cryptocurrency as a major alternate currency, using a quantitative methodology. The Unified Theory of Acceptance and Use of Technology (UTAUT) theoretical framework was used to identify the factors that would prevent the adoption of cryptocurrency as an alternative currency. Key findings revealed that 58.8% of respondents are willing to use cryptocurrency as an alternative currency and 40.1% of respondents were educated about cryptocurrency. This study also revealed a significant correlation between performance, effort, social influence, and the behavioural intention of Jamaicans to use cryptocurrency as an alternate currency. Also, there is a significant correlation between behavioural intention, facilitating conditions and the use behaviour of Jamaicans to use cryptocurrencies. Further there is a significant correlation between sociodemographic factors, and the level of interest in cryptocurrency among Jamaican citizens. The researchers concentrated on user opinions rather than the economics of cryptocurrency and also highlighted their technological and technical characteristics. We found that not all participants are very well educated about the technology and that is one of the biggest factors affecting adoption so that is the stage which the researchers think is the next step into full adoption - education and awareness.

Keywords: Cryptocurrency, Unified Theory of Acceptance and Use of Technology, Behavioural Intention

Cite this paper: Damith Wickramanayake, Danae Reid, Jovaughn Bennett, Matthew Tingling, Roshaun Walker, The Acceptability of Cryptocurrency as an Alternate Currency in Jamaica, Advances in Computing, Vol. 12 No. 1, 2022, pp. 1-6. doi: 10.5923/j.ac.20221201.01.

Article Outline

1. Introduction

- Cryptocurrencies were first introduced in 2009 when the world’s first decentralized currency, Bitcoin, was created. Cavendish [4] stated that the main idea behind cryptocurrency was the creation of a secure and anonymous method of transferring currency from one person to another.Cavendish goes on further to mention the currency as a means of enabling the instantaneous and direct transfer of money between parties, and adds that any type of currency can be exchanged, from fiat currency to gold, to even airline miles.While seeking a definition for cryptocurrency, the literature revealed several descriptions. For example, Milutinović [11] described cryptocurrency as “a digital asset, whose main purpose is to be a medium in exchange, and while doing that, it uses cryptography so that all the transactions are secured, everything new that appears is controlled by its own system." Most cryptocurrencies are decentralized networks that run on blockchain technology and possess the defining feature of not being issued by any central authority, rendering them theoretically immune to government interference or manipulation. Singh et al. [16] defined cryptocurrency as an advanced resource, whose purpose is to function as a technique for the exchange of money with the help of cryptography in an effort to control the production of additional units of the money. Furthermore, Arora [3] posits that cryptocurrencies seek to offer a multitude of benefits. For example, it is accompanied by transaction fees that are next to nothing compared to fees that exist when utilizing a bank. Arora also highlights the fact that transactions can be made at any time of the day or night, without limits on purchases and withdrawals.Alaklabi & Kang [2] described cryptocurrency as “a challenging area in finance that requires additional attention from the academic community as it can have a potentially large impact on society and the economy.” With everything around us becoming more digitized and technology-based, the cryptocurrency market has evolved unpredictably and at a very fast pace over the course of its lifespan. Since the release of Bitcoin to the public in January 2009, more than 6,500 cryptocurrencies are in existence as of September 2021. With the accelerated use of cryptocurrencies and its acceptance within major businesses, we must explore the possibility and potential of cryptos becoming an accepted currency in Jamaica.The study’s purpose is to use quantitative methodology to investigate and study the willingness of Jamaican citizens to accept cryptocurrency as a major alternate currency. Then, based on the findings, determine appropriate measures that will guide the government on how to achieve cryptocurrency adoption successfully.This study will utilize the Unified Theory of Acceptance and Use Model (UTAUT) theoretical framework to identify the factors that would influence the acceptability of cryptocurrencies. Six different hypotheses were derived.

2. Related Work

2.1. Literature Review

- Humans have been bartering for thousands of years in the early years using objects such as shells or stones, nowadays we are used to doing transactions using fiat currencies such as the Jamaican Dollar. And with these means of transactions the actors generally trust that these currencies are valuable and useful. “The inception of Bitcoin has taken a further step, as it is a virtual currency that claims to be tradable in exactly the same fashion as sovereign currencies, yet without a sovereign” [10]. From its implementation in 2009, bitcoin currency and its blockchain technology have steered increasing research interest predominantly in the areas of cryptography, security, and peer to peer computing [15].The backbone of a cryptocurrency is the blockchain that it is built upon. Blockchains are tamper evident and tamper resistant digital ledgers implemented in a distributed fashion (i.e., without a central repository) and usually without a central authority (i.e., a bank, company or government). At their basic level, they enable a community of users to record transactions in a shared ledger within that community, such that under normal operation of the blockchain network no transaction can be changed once published [19].Blockchain is a widely used, non-controversial technology in the cryptocurrency industry that functions perfectly and securely, and is the second most valuable technology after the Internet. A distributed system is used to convey digital information that represents electronic currency. Bitcoin users may authenticate and transfer their rights to that data to another user, and the Bitcoin blockchain publicly records this transfer, allowing all network members to independently verify the transactions' legitimacy. To avoid falsified entries, the ownership of blocks in the blockchain are checked. It is difficult to erase or reverse a transaction after it has been recorded in a blockchain. The adoption of cryptocurrency may be motivated by a various number of features, including transparency [10]. Bitcoin's anonymity is also a source of concern for the market. Despite its reputation for claimed secrecy, every transaction is available to the public. Unlike private bank accounts, anyone can see another user's Bitcoin balance without knowing their identity. Dasgupta, D. et al. [8] stated, “Blockchains run on a decentralized, peer-to-peer network in which all entities adhere to the same protocols, preventing any single entity from controlling the underlying infrastructure.” in addition “this open, decentralized, permission-less architecture prevents any entity from exerting regulatory pressures or otherwise interfering with blockchain operations.” Decentralization allows the blockchain technology to have better security, and faster settlement [5].Trust has long been regarded as a catalyst for buyer-seller transactions that can provide consumers with high expectations of satisfying exchange relationships [13]. In the view of Nakamoto [12], privacy and trust is top priority while making transactions. By definition, trust is necessary only in situations of vulnerability and risk. Risk arises from interactions of the user, the system and the environment [6]. Dissemination of information would really impact the adoption of cryptocurrency as an alternative to fiat currencies.In a research conducted by Craggs, B et al. [7], it was observed that information distributed in the form of news was crucial to Bitcoin’s adoption and pricing. In similar research done by Gibbs, T., & Yordchim, S. [9] on Litecoin, they focused on user perception about its acceptance and use, and they came to the conclusion that people must become knowledge seekers regarding cryptocurrency and discover the benefits presented in their ownership. Additionally, in their discussions they implied that the perception of this technology is what really affects its adoption, being that some people place value on the use of things using their internal feelings but not the actual knowledge of said thing, in this case being crypto.Polasik, M et al. [14] also stated a key factor in adoption was customers’ knowledge about the technology. They also stated that the more they knew, the more likely they were to use the technology. Additionally, they found that crypto like Bitcoin already interacts with other payment methods used in e-commerce. This also would affect the adoption as that falls under facilitating conditions having bitcoin linked with already popular payment systems it should be easier for people to transition into its use as an alternate currency. Polasik, M et al. [14] stated, “Bitcoin provides only limited benefits but, if the vendor is looking to sell in developing countries with larger shadow economies, then accepting the cryptocurrency is a sensible option.” and also, “If vendors want low transaction costs and no chargeback, they should avoid credit cards, PayPal, and cash on delivery.”Appropriate incentives, particularly financial, may be necessary to attain critical mass/mainstream adoption for crypto payment system advancements. Two sets of users in the network, namely customers making payments and merchants accepting them, require simultaneous adoption for such a system to work [14].

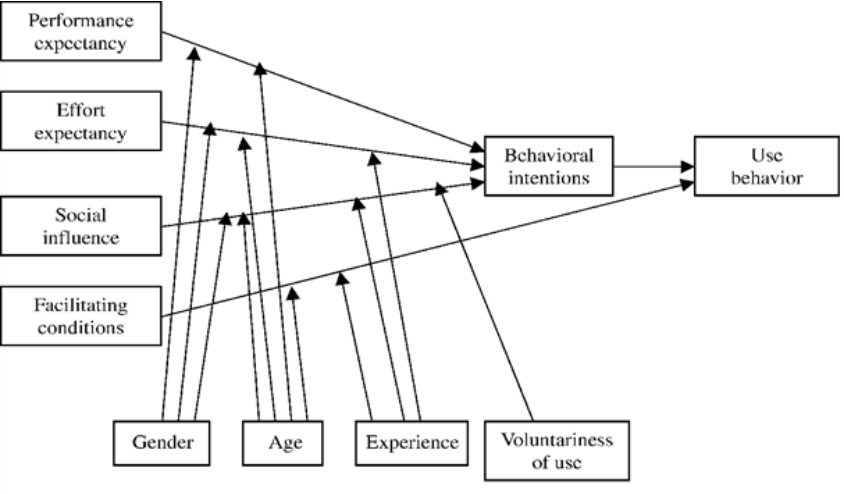

2.2. Theoretical Frameworks

- Several theoretical frameworks were examined, namely Theory of Reasoned Action (TRA), Technology Acceptance Model (TAM), and Unified Theory of Acceptance and Use of Technology (UTAUT), to identify an appropriate theoretical framework for this study. Out of these frameworks, the Unified Theory of Acceptance and Use of Technology was selected as the preferred theoretical framework.The UTAUT model uses four core determinants to determine a user's behavioural intention (BI) to use a technology: performance expectancy (PE), effort expectancy (EE), social influence (SI), and facilitating conditions (FC) [18]. The first three are direct determinants of usage intention and behaviour, and the fourth is a direct determinant of user behaviour. Gender, age, experience, and voluntariness of use are posited to moderate the impact of the four key constructs on usage intention and behaviour. The theory was developed through a review and consolidation of the constructs of eight models that earlier research had employed to explain information systems usage behaviour (theory of reasoned action, technology acceptance model, motivational model, theory of planned behaviour, a combined theory of planned behaviour/technology acceptance model, and model of personal computer use, diffusion of innovations theory, and social cognitive theory). Subsequent validation by Venkatesh et al. [18] of UTAUT in a longitudinal study found it to account for 70% of the variance in behavioural intention to use (BI) and about 50% of actual use.

| Figure 1. Proposed Model |

3. Methodology

- This study was conducted with the purpose of determining the willingness of Jamaican citizens to utilize or adopt cryptocurrency as an alternate currency. This paper utilized the Unified Theory of Acceptance and Use Model (UTAUT) to identify the factors that would prevent the adoption of cryptocurrencies. A quantitative approach was employed to answer the five research questions. The study is guided by six hypotheses based on the Unified Theory of Acceptance and Use of Technology (UTAUT) theoretical framework. The instrument used to conduct the survey is a questionnaire which was created after reviewing similar questionnaires used in other studies. The study was an island-wide cross-sectional study of Jamaican citizens over the age of 18, with a sample size of eighty (80) people in an effort to increase the variance of responses. The convenience sampling method was utilized with the aid of people in our contact list as consideration is given to external factors such as resources and the COVID-19 pandemic restrictions that we are currently experiencing. The information obtained from the instrument was then appropriately analyzed by IBM SPSS.

4. Results

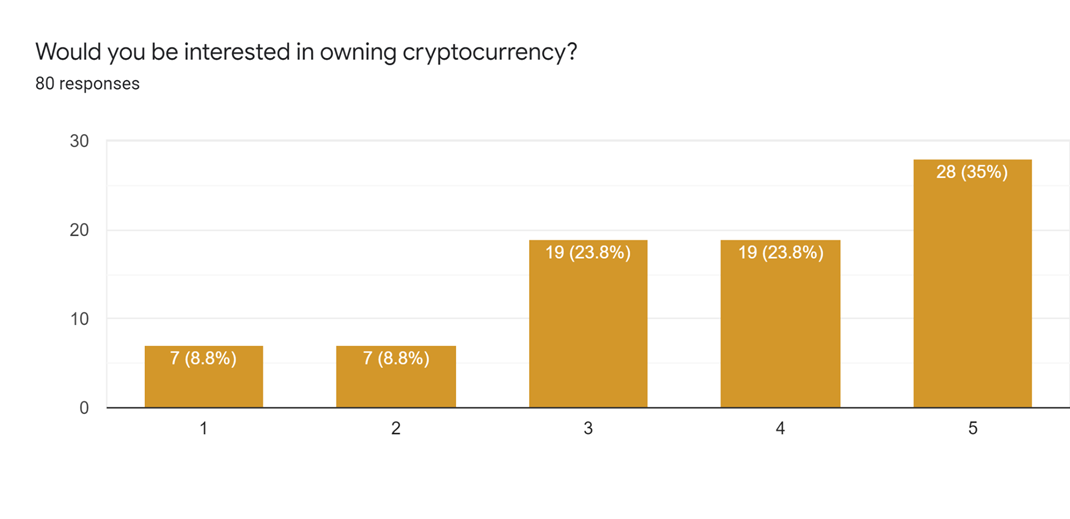

- The first research question is, “To what extent are Jamaicans interested in using cryptocurrency?". Using the Likert 5-point scale, 1 being “definitely not” and 5 being “absolutely”, the respondents were asked to rate their willingness to use or interest in owning cryptocurrency. As shown in the figure below, 35% of respondents would absolutely be interested in owning cryptos, rating it a 5, and both the 3-point and 4-point ratings had been selected by 23.8% of respondents. Additionally, 8.8% of respondents would definitely not be interested in owning cryptos, rating it a 1. The 2-point rating was also selected by 8.8% of respondents.

| Figure 2. Willingness to use cryptocurrency |

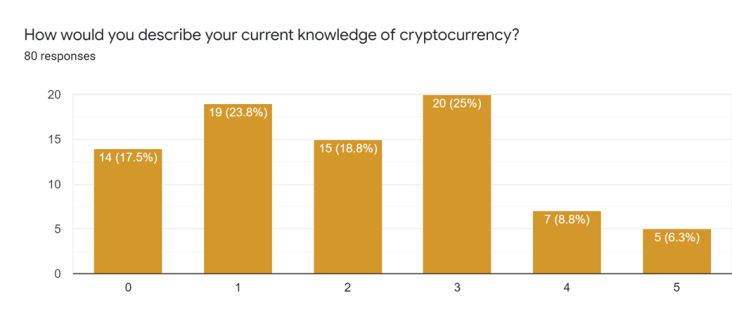

| Figure 3. Current knowledge of cryptocurrency |

5. Conclusions

- In this research we investigated factors affecting the adoption of cryptocurrency as an alternate currency, through means of a questionnaire and also reviewing literature related to technology acceptance and the acceptance of crypto as a whole. Additionally, the study aimed to answer the following research questions:● RQ 1: To what extent are Jamaicans interested in using cryptocurrency?● RQ 2: How educated are Jamaicans about cryptocurrency?● RQ 3: What is the association between performance, effort, social influence, and Jamaicans’ behavioural intention to use cryptocurrency?● RQ 4: What is the association between behavioural intention, facilitating conditions, and Jamaicans’ use behaviour to use cryptocurrency?● RQ 5: Is there an association between sociodemographic factors and the level of interest in cryptocurrency among Jamaican citizens?One of our contributions to this study is that, unlike earlier research on cryptocurrencies, we concentrated on user opinions rather than the economics of cryptocurrency and also highlight their technological and technical characteristics. After analyzing the results, we made the observation that most of the participants are males, and these participants are between the ages of 18-25 and are students. As for the adoption of cryptocurrency, a person's income is likely to impact their behavioural intention in using the technology. Furthermore, a majority of the participants in this study would be interested in owning and using cryptocurrencies as an alternate currency. After examining the hypotheses, we found that all 6 hypotheses were found to be statistically significant in some case, which would confirm the finding of the research to be true.

5.1. Limitations

- Due to the constraints of the COVID-19 pandemic, selecting a suitable population size and providing participants with enough time to answer the questions was one of the main limitations we found. This led us to limit our population size. Accordingly, we wanted to give respondents enough time and, equally important, have the results back in a timely manner for analysis.

5.2. Recommendations

- The researchers found that not all participants are very well educated about the technology, and that is one of the biggest factors affecting adoption so that is the stage which the researchers think is the next step into full adoption - education and awareness.Our research was limited to using the Jamaican population to test our theories but we believe that not enough studies on the adoption of cryptocurrencies in developing countries exists. We encourage more researchers to study this topic.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML