Faridah Pardi1, Arifin Md. Salleh2, Abdol Samad Nawi3

1Faculty of Business Management, Universiti Teknologi MARA (Shah Alam)

2Faculty of Business Management, Universiti Teknologi MARA (Melaka)

3Faculty of Business Management, Universiti Teknologi MARA (Terengganu)

Correspondence to: Faridah Pardi, Faculty of Business Management, Universiti Teknologi MARA (Shah Alam).

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

Measuring sustainability has become an important issue since traditional concept of Gross Domestic Product (GDP) as indicator for measuring growth is no longer adequate to reflect sustainable development path of an economy. Adjusted Net Saving (ANS) rate has been introduced by the World Bank during 1990s as an alternative indicator to measure sustainable development. ANS measures true rate of saving in a nation by making some adjustments from GDP and net national saving, by including public expenditure on education with deducting minerals depletion and environmental degradation. It is normally expressed as a fraction from Gross National Income (GNI). This paper assesses several factors that might have effect on sustainable development, as proxied by ANS rate in Malaysia. The annual data used for time-serial analysis in this study is selected from 1971 to 2011. Inflation Rate (INF), Financial Development (FIN), Per Capita Income (INC) and Minerals Exports Share (MNR) are the selected independent variables that were hypothesized to have effects on ANS. Unit-root testing, optimum lag selection, Johansen Test of Cointegration and VECM were conducted in this study to develop the short-run and long-run relationship among the selected variables. The result findings showed the existence of a short run and long run relationship between the independent variables with ANS. Diagnostic checking on the models has further indicate that there is no serial correlation, heteroscedasticity and the data were normally distributed.

Keywords:

Adjusted Net Saving (ANS), Sustainable Development, VECM, Malaysia

Cite this paper: Faridah Pardi, Arifin Md. Salleh, Abdol Samad Nawi, Determinants of Sustainable Development in Malaysia: A VECM Approach of Short-Run and Long-Run Relationships, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 269-277. doi: 10.5923/c.economics.201501.35.

1. Introduction

Traditional focus on economic growth has now moved to a new concept and dimension - the concept of sustainability. Sustainability or sustainable development extends on what have been achieved after economic growth, the essentiality of ‘greening’ the national income accounts. The interesting features are the depreciation or depletion of natural capital is included in the aggregate indicators of net national output. Since its conception, most governments around the world have adopted sustainable development as their national objective. For a developing country like Malaysia, the national goal to achieve sustainability has indeed becoming the key element. The New Economic Model (NEM) launched by Prime Minister in 2010; had overriding objective to become a high income advanced nation through inclusiveness and sustainability by year 2020. The sustainability component of the NEM is to ensure that all of the proposed measures be sustainable in both economic and environmental terms.

2. Background to the Study

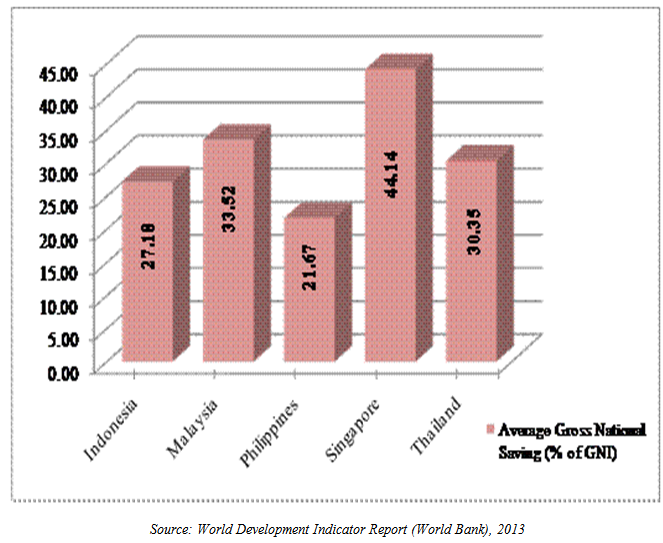

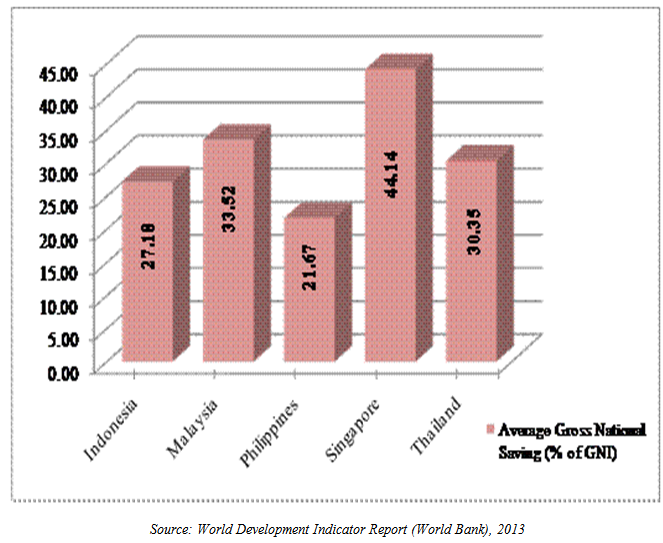

Malaysia gained its independence in 1957 and has since never looked back to stop growing in term of economic, political and social qualities. The country’s impressive performance was mostly represented by its high GDP growth. Along with this remarkable performance, Malaysia has also performed well in national saving rates record as compared to its counterparts. This high level of national saving rate has led the country to become a good example among Asian countries. During the period of 1980 to 2010, Malaysia marked as among the top for high national saving rate. This impressive performance is undoubtedly seen as the outcome from success administration and development plans designed by the government. National saving is an essential element that needs to be taken into consideration in order to ensure the solid economic functioning of a nation’s economy. Conventional economic wisdom maintains that higher saving leads to greater capital formation which in turn leads to greater economic growth [1]. In a world in which a large segment of mankind is living on low levels of income per capita, anything that can be done to increase knowledge of the growth process, and, with the acquired knowledge, to increase economic growth, is a laudable goal.Saving has been prominently addressed in the economic growth models. It is one of the key elements found in the traditional Keynes's economic model’s circular flow of income. Saving is said to be a core aspect of development and is often being regarded as an important input of investment in order to promote long run economic growth. Greater saving in an economy means large funds available for investment opportunities that lead to an increase in gross domestic product. The high rates of national saving in the East Asian countries over the past few decades had contributed towards their rapid growth and successful development. Gross (national) saving rate (expressed as percentage of gross national income) within ASEAN countries are found to be significantly high during 1980 to 2010 periods. According to World Bank Report (2013), high rates of saving and investment in these countries have been the reasons for rapid economic growth in the region. Economic reforms in Malaysia, have drastically changed the pattern of saving and investment.In Figure 1, gross national saving rate for the selected ASEAN countries (namely ASEAN-5 according to IMF – International Monetary Fund classification) is seen to be more than 20% of their national income. Malaysia outperformed Thailand, Indonesia, and Philippines in terms of high national saving rate. In Malaysia, substantial growth has been related with positive saving that has brought the country to become an outstanding example of success in East Asia. The rapid growth of Malaysian economy in the context of macroeconomic stability has attracted international attention. | Figure 1. Average Gross Saving for Selected ASEAN countries (1980-2010) |

It is now clear that issues on national saving have become a primary importance in Malaysia as the adequacy of saving has far reaching economic and social implications. From an economic point of view, the national saving rate directly reflects to the level of national consumption, the level of investments, the nation's current account, capital account, interest rates, exchange rate, and ultimately to the long-term growth rate. From a social perspective, everyone deserves to sustain their current standards of living after retirement or in old age, but this would not be attainable given the current levels of saving. As a result, a large proportion of the population requires government assistance via a safety net, which places a burden on future generations. Therefore, the saving problem has been reaching economic and social implications (i.e. inter-generational issues) that affect each and every individual, even if we have saved a sufficient amount for future or meeting old age needs.

2.1. From Growth to Sustainable Development

After sixty years of predominance in the western countries, both the objective of economic growth and its core measure, the GDP, have been questioned. It no longer seems consistent to maintain growth as a societal goal and to keep gross domestic product as the major reference for socioeconomic policies. Both the potential pitfalls of macro-economic policies focused on stimulating economic growth and the problems involved in using gross domestic product as a measure of well-being or economic welfare have been recognized by economists and researchers from other social sciences. Therefore, it is no surprise that alternative measures for policy-making have been developed and promoted since the early 1970s. [1] has debated the difficulties to perceive GDP as a social welfare or genuine progress indicator. The use and calculation of the GDP indicator is inconsistent with two principles of good bookkeeping - to divide clearly between costs and benefits; and to correct for changes in stocks and supplies. GDP does represents an estimate of the costs instead of the benefits of all market-related economic activities in a country; however it fail to reflect social costs as it omits external costs. GDP as a measure of social welfare was not being an agreed notation in economics. Quite the contrary, optimal growth theory proposes models that explicitly use a theoretical (usually intertemporal) notion of social welfare that is not identical to a GDP type of criterion. Subjective well-being studies further show that absolute individual income is not a suitable proxy of individual welfare. Relative income and various income-independent factors also would be affecting individual welfare or happiness.

2.2. The Concept of Sustainable Development

The term 'sustainability' is originally developed from the concept of 'conservation' which was mentioned in IUCN's report on World Conservation Strategy [2]. Sustainable utilization is a means that species and ecosystems should be utilized at levels and renewable for all practical purposes indefinitely. A society's dependence on resources would rise importance to ensure sustainable utilization of the ecosystem and species. The greater the diversity and flexibility of an economy, the less need for it to utilize certain resources sustainably. Therefore, sustainable development means a development that likely to achieve lasting satisfaction of human needs and improvement of the quality of human life. The report's definition of conservation relating to sustainability has received notable critics from social scientists, due to neglecting address on the social science aspect of conservation; especially in the aspect of economics. The Brundlant Report, prepared by the committee of World Commission on Environment and Development (United Nations) in 1987 corrected the term by signifying social science input into the definition of sustainable development. The report suggested that new development path is required, which sustained human progress not just in a few places for a few years, but for the entire planet into the distant future. Thus, it outlined the famous and widely accepted meaning of sustainable development - development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

2.3. Adjusted Net Saving Rate as the Indicator to Measure Sustainable Development

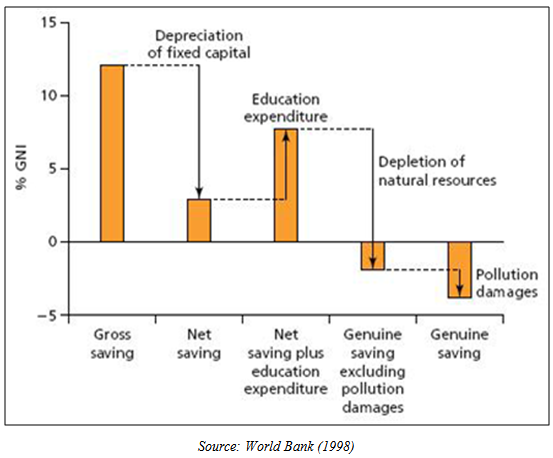

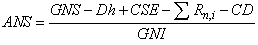

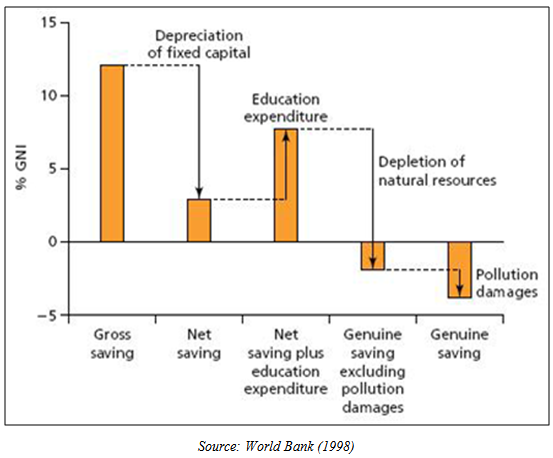

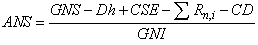

The conventional indicator for economic growth originated from a model by [3], known as The Solow Growth Model. The model assumes a production function with the property of diminishing returns; with technological progress is perceived as increasing productivity. [4] whom developed the “Endogenous Growth Theory” additionally highlighted the technological change as the driving force of economic growth and as a part of an economic good. [5] further argued on the traditional GDP indicator with the theory of intergenerational equity distribution; along with discussion on possible ways to go beyond economic growth, that is; to sustain the development progress. [6] modelled an economic framework with the maintenance of a constant stream of consumption into the infinite future; through saving and investment rule that ensure to keep capital 'intact'. This Hartwick's rule model proposed the basic sustainable development conditions for economies and therefore was considered relevant to indicate nominal wealth across generations. For a joint assessment of the impact of human and natural capital, the World Bank suggests to use the index of adjusted net saving (ANS). This measure is derived from GDP by subtracting the consumption and net amortization of physical and natural capital, and then adding net investments into human capital. The underlying concept was then adopted and further extended by [7], by introducing the calculation of ANS rate to measure sustainable development path for a nation. [8], mentioned that the indicator is one of the most frequently favoured by economists; due to its unique characteristic of augmenting the net national saving rate calculation by including human capital development (indicated by public expenditures on education) and deducting depletion on natural resources together with environmental degradation (pollution). The calculation apparently distinguishes between a level of true output and consumption for a nation, which is the saving index. "Resource dependence" have made efforts to measure 'true rate' of saving to become difficult, since natural resources depletion and environmental damages do not appear in standard national accounts. ANS solve these issues by measuring the change in value of a specified set of assets, excluding capital gains. Economic theory suggests that the present value of wellbeing is increasing, if a country’s net saving is positive and the accounting includes a sufficiently broad range of assets. On the other hand, persistently negative adjusted net saving indicates that an economy is on an unsustainable path [9]. This economic dimension of sustainability suggests that for a sustainable development path, an economy should maintain a positive value of ANS rate. The method of calculation for ANS rate is depicted in Figure 2. | Figure 2. Method of Calculation for Adjusted Net Saving Rate |

All these capitals assets were expressed in monetary unit, as ratio to gross national income (GNI) and given as: WhereANS = Adjusted Net Saving RateGNS = Gross National SavingDh = Depreciation of produced capitalCSE = Current (non-fixed-capital) expenditure on educationRn,i = Rent from depletion of natural capital iCD = Damages from carbon dioxide emissionsGNI = Gross National Income at Market Prices

WhereANS = Adjusted Net Saving RateGNS = Gross National SavingDh = Depreciation of produced capitalCSE = Current (non-fixed-capital) expenditure on educationRn,i = Rent from depletion of natural capital iCD = Damages from carbon dioxide emissionsGNI = Gross National Income at Market Prices

2.4. Purpose of the Study

This study is an attempt to discuss the possible factors that might have impact on sustainable development as proxied by ANS rate. The study embarks on the following objectives:-(i) to determine possible factors of sustainable development based on ANS rate.(ii) to develop a short-run and long-run model of relationships between factors determining ANS rate.

2.5. Significance of Study

ANS rate as the indicator to measure sustainable development could provide a significant policy implications to a nation pursuing ultimate macroeconomic objective like Malaysia. It has the advantage in assisting national-level decision makers with a clear, relatively simple indicator of how sustainable their country’s investment policies are. While standard measures of “saving” and “investment” reflect changes in the value of certain, limited set of assets, a more inclusive and realistic definition of what constitutes an asset can lead to a correspondingly more realistic picture of how a nation invests. ANS is the only indicator that can help policy makers to actually build sustainability policies because it provides a valuable framework for monitoring the evolution of a country’s wealth and for balancing investments between the different forms of capital.

3. Previous Literatures

Following the first conception of sustainable development theory, there were numbers of publications that has defined and redefine the meaning. These literatures can be distinguished from the background of the authors, whether they're from environmental, economic, or social sciences analysts. Academic economist, [10] suggested that the concept of sustainable economic development is applied to the Third World. It is therefore directly concerned with increasing the material standard of living of the poor at the 'grassroots' level, which can be quantitatively measured by means of increased food, real income, educational services, health-care, sanitation, and water supply, emergency stocks of food and cash, etc., and only indirectly concerned, with economic growth at the aggregate. In general terms, the primary objective is reducing the absolute poverty of the world's poor through providing lasting and secure livelihoods that minimize resource depletion, environmental degradation, cultural disruption, and social instability.Since its first conception in 1993, many articles have been produced by several prominent authors in development economic studies, in order to highlight the factors determining sustainable development as proxied by ANS rate. Since it was basically evolved from the calculation of gross national saving, the main factors of national saving is also said to have a similar impact to determine ANS rate. One of the earlier attempts was done by [11] which addresses issue on ‘resource curse’ hypothesis. ‘Resource curse’ hypothesis is seen to be associated with those resource-abundant countries. In their study, countries with lower economic growth rate were found to be significantly determined by excess natural resources, along with weak macroeconomic and public expenditure policies. Another study to analyse determinants of ANS rate that provided same results was from [12]. Resource abundance, together with institutional variables were analyzed on their impacts towards adjusted ANS rate. Variations of gross national saving and ANS rate were modelled in a panel data of 115 countries in a period of 18 years. Economic growth, age dependency ratio found to be consistently significant determinants, while the institutional variables; on the other hand, pointed out that corruption was the significant cause of low adjusted net saving rate in the sample countries.Reference [13] investigated the ‘Hartwick’s Rule’ for saving of a nation; with objective to maintain a constant level of consumption in small open economies with non-renewable (or exhaustive) natural capitals. Findings from the study showed that non-renewable resource exporters would tend to slower resource depletion given the expectation on lower future market’s interest rate or lower future extraction costs. A paper by [14] somehow empirically tested the impact of depletion in renewable resources on ANS rather than most studies that focused on exhaustible resources. The study suggested that some major modifications on ANS calculation should be made to consider the renewable resources. It is also understood that countries with low level of renewable resources do not necessarily will be facing a gloomy future, only if the renewability is guaranteed with no irreversible effect. Study presented by [15] analysed the determinants of ANS rate with regards to its relationship with resource curse (RC) variables. Using a sample of countries from 1970 to 2008, the study showed that the curse of natural resources could have negative impact not only to economic growth, but also to capital stock in average. By using ANS rate as the proxy for sustainability, with its components (human, physical, and natural capitals) as the dependent variables, the study conclusively showed a more appropriate approach to explain Resource Curse hypothesis rather than single regressions on gross domestic product. Another recent paper by [16] investigated the impact of resource-dependence and governance on sustainable development. The study examined the relationship between resource extraction, institutional quality, armed violence and sustainable development; using a panel data of 108 developing countries for the period of 24 years. The result finding highlights a negative relationship between resource extractions and ANS per capita, a different approach from previous authors. The findings showed that armed conflict have negative impact on ANS rate per capita. Armed conflict, as measured by homicide rate; negatively impacted ANS. Another important variable, which is the population growth tend to have negative correlation with ANS rate per capita. It is indeed a consistent conclusion by most authors in this field that growing population would eventually decreases the level of saving in ANS, thus reducing potentiality of sustaining development.

4. Econometrical Method and Data Analysis

This study will be using Malaysia’s annual macroeconomic and national accounts data from 1971 to 2011. All of these data would be taken from various international and local resources. Details on each of the selected variables for this study will be discussed in the following sections.

4.1. Dependent Variable -Adjusted Net Saving Rate (ANSR)

One of the main objectives in this study is to identify significant variables that could influence sustainability in Malaysia. The dependent variable of interest would be adjusted net saving (ANSM) rate as the proxy for sustainable development. ANS rate data set for Malaysia will be extracted from the World Bank’s World Development Indicator (WDI) which is published online.

4.2. Independent Variables

The selection on hypothesized variables is based from previous literatures. This study took the hypotheses that adjusted net saving rate is determined by mostly the determinants of saving. These potential variables were carefully selected in order to identify and analyse their significant contribution towards economic growth in the short-run and sustainable development for the long run, as proxied by ANS rate of Malaysia.

4.2.1. Inflation Rate (INF)

Inflation and national saving were often being perceived as to be correlated. According to [17], the higher the inflation rate would result to a higher saving and income. Therefore, it makes sense to include inflation rate as one of the explanatory variables since ANS rate calculation originates from the basic term of national income and saving. This study adopt Consumer Price Index (CPI) as a proxy for inflation rate.

4.2.2. Financial Development (FIN)

Monetary effects are also presumed to be important elements that influence sustainable development. The extent and effectiveness of financial intermediation in providing productive outlets for saving and growth is important. In previous studies, financial deepening is often measured by the ratio of the M1 money supply to national income (FIN). In this study, a broader definition of financial development, M2 money supply as a percentage of GDP (also defined as broad money by World Bank) is used for explaining sustainability in Malaysia.

4.2.3. Per Capita Income (INC)

National income growth per capita is also assumed to be a possible positive contributors to sustainable development in Malaysia. From many previous studies findings, higher income growth would lead to higher saving. Consistent with the permanent income hypothesis, increases in economic growth may result in an increased share of transitory income in total income and thus raise the average saving rate. Per capita income rises in this study is proxied by Gross National Income per Capita (GNIPC) in constant local currency unit (MYR).

4.2.4. Minerals Export Share of GDP(MNR)

Another important element for the ANS rate would be the extent to which an economy depends on natural resources for generating income, measured by the share of fuels, ores and metals in merchandise exports (denoted by MNR). Natural resource depletion is thought directly to reduce the ANS rate, for a given gross national saving rate, and thus undermine sustainable development and future economic growth. The portion of minerals export shares of GDP is employed in this study to reflect minerals depletion in the sustainable development model.

4.3. Model Specification

This section is to discuss the development of research framework from the theoretical model in earlier studies. The fundamental theory is based from the extended version of economic growth model.

4.3.1. Economic Growth Model

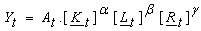

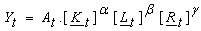

From the basic Cobb-Douglas production function, level of national output for a country can be written as follows:- | (1) |

Where the real national output is a function of effective factors of production

the real national output is a function of effective factors of production  (capital),

(capital),  (labour) and

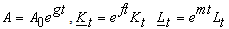

(labour) and  (natural resources) respectively. Along with this, qualities of factors for production (K, L, and R) are assumed to grow exogenously at rates denoted by j, m, and h for each of them. From the above, an index of technological progress (or total factor productivity), A, is to be included. A is assumed to be growing at the exogenous rate denoted by g. Therefore, equation (1) can be written as:-

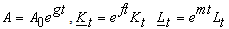

(natural resources) respectively. Along with this, qualities of factors for production (K, L, and R) are assumed to grow exogenously at rates denoted by j, m, and h for each of them. From the above, an index of technological progress (or total factor productivity), A, is to be included. A is assumed to be growing at the exogenous rate denoted by g. Therefore, equation (1) can be written as:- | (2) |

Whereby; and

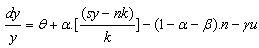

and  The improvements in the quality of capital, with positive rate (j > 0), signifies new technology applied in new capital goods. As for improvements in labour quality (m > 0); would be reflected with human capital formation with investment in education, health and nutrition. In addition, growth rate of natural resources is assumed to be in both ways, either positive or negative. For example, land fertility could be deteriorated by logging activities but it somehow could be offset by applying an efficient fertilization activity. Quality of remaining natural resources maybe reasonably declined, since the best and most accessible ones are being extracted first. From this; equilibrium of a closed economy, where net domestic saving (public and private sector’s saving) are equals net domestic investment. Labour force volume is assumed to grow at rate n. Natural resources is to deplete at rate u. Stocks of non-renewable natural resources are diminished when used. The stocks of renewable natural resources, however, can be maintained, if not utilized beyond regeneration capacities. From all of these assumptions made, we can derive the growth rate of productivity (TFP) as follows:-

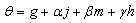

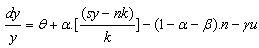

The improvements in the quality of capital, with positive rate (j > 0), signifies new technology applied in new capital goods. As for improvements in labour quality (m > 0); would be reflected with human capital formation with investment in education, health and nutrition. In addition, growth rate of natural resources is assumed to be in both ways, either positive or negative. For example, land fertility could be deteriorated by logging activities but it somehow could be offset by applying an efficient fertilization activity. Quality of remaining natural resources maybe reasonably declined, since the best and most accessible ones are being extracted first. From this; equilibrium of a closed economy, where net domestic saving (public and private sector’s saving) are equals net domestic investment. Labour force volume is assumed to grow at rate n. Natural resources is to deplete at rate u. Stocks of non-renewable natural resources are diminished when used. The stocks of renewable natural resources, however, can be maintained, if not utilized beyond regeneration capacities. From all of these assumptions made, we can derive the growth rate of productivity (TFP) as follows:- | (3) |

Whereby  reflects the comprehensive growth rate all factors,

reflects the comprehensive growth rate all factors,  is output per unit of labour,

is output per unit of labour,  is ratio of capital per unit of labour and s denotes domestic saving rate. Therefore, economic growth can be written as the sum of growth rate in productivity of labour,

is ratio of capital per unit of labour and s denotes domestic saving rate. Therefore, economic growth can be written as the sum of growth rate in productivity of labour,  and aggregate labour force participation rate, n-p (p is population growth rate). Extending the model above, economic growth rate is derived as:-

and aggregate labour force participation rate, n-p (p is population growth rate). Extending the model above, economic growth rate is derived as:- | (4) |

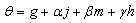

Where y* is the output per capita. In summary, economic growth rate is defined as directly related to net saving rate (s), rate of technological progress (g) and growth rate of factors of production K, L and R (j, m and h) and also with growth rate of labour force (n). However, it would be negatively related with natural resources depletion (u) and population growth rate (p).

4.3.2. ANS Rate Model

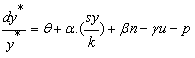

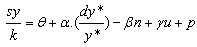

The process of deriving equation (4) has clearly showed that saving is actually part of factors influencing the increase in output. Therefore, identifying the determinants of national saving is crucial to policymakers in order to achieve targeted economic growth rate. Apart from this, equation (4) can also be viewed as a model for sustainable development. This is because; the proposed saving model has made inclusion of natural resources depletion, reflecting on how natural capital reduction would affect level of saving for future generation.From equation (4), we can derive the equation (5) to obtain the relationship of saving with its respective determinants. | (5) |

For this study, main dependent variable of concern is ANSM rate. Therefore it is hypothesized that ANS is a function of equation (6) below:- | (6) |

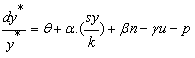

In equation (6), adjusted net saving rate (ANS as a percentage of national income) is assumed as a function to human development index, per capita Gross domestic product, labour force population share, monetary development – M3 money supply, minerals export share of total exports and total factor productivity growth. Therefore, equation (6) can be written as the following equation (7) as to formulate sustainable development:-  | (7) |

4.4. Unit Root Test

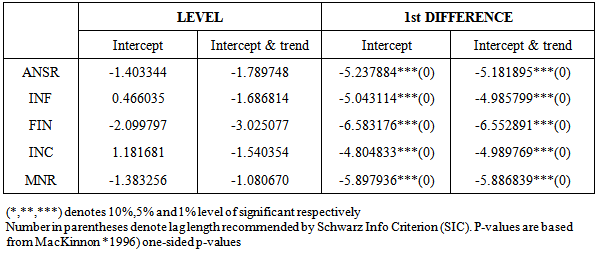

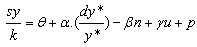

Economic time-series data were often to be containing unit root (i.e. non-stationary) when they were observed at levels' order of integration. Regression on the data which are not stationary at levels might resulting in 'spurious' regression' and thus, is not favourable. Therefore, it is an essential exercise to conduct a unit root test on each variables before proceeding to estimation of the co-integration models. The result of unit root test is depicted in Table 1. In this study, the Augmented-Dickey Fuller (ADF) test of stationarity were employed and it is found that all the variables listed are containing unit root (non-stationary) at their level's order of integration and becoming stationary at their first difference. Accepting more than 1% level of significant, all the variables ANSR, INF, FIN, INC and MNR can be concluded as stationary at their first difference, I(1).Table 1. Augmented Dickey Fuller (ADF) Test for Stationarity

|

| |

|

4.5. Johansen Co-Integration Test

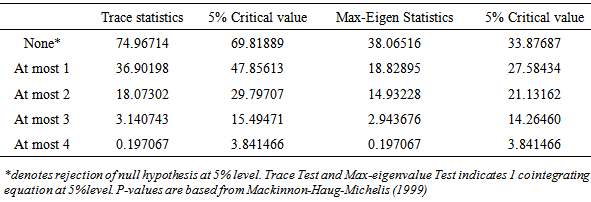

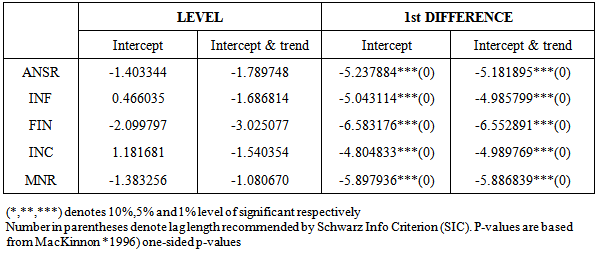

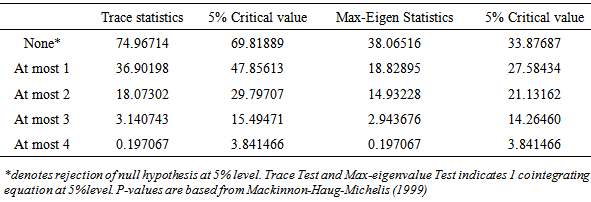

In order to identify the relationships between the selected independent variables with dependent variable (ANSR), this study applies the Johansen Co-integration approach. The first step is to select appropriate lag length for co-integration by using VAR (Vector Auto Regressive) test on the basis of SIC and AIC (Akaike Info Criterion). The VAR estimation test recommended 1 lag to be the optimum lag length for this model. Next process is to conduct Johansen co-integration test [18]. The result of unrestricted cointegration rank test (trace test and Eigenvalue) are presented in Table 2.From Table 2 we can conclude that the null hypothesis of no cointegration among the variables is rejected at both tests. Both trace test and Maximum eigenvalue test indicate one cointegrating equation at 5% level of significant. This means that all variables ANSR, INF, FIN, INC and MNR are cointegrated or have relationship in the long-run. Table 2. Johansen Cointegration Test

|

| |

|

4.6. Long-Run Determinants of Adjusted Net Saving

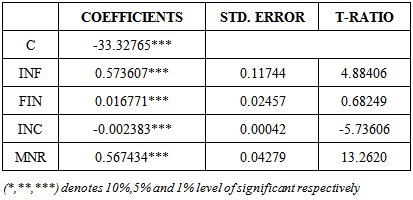

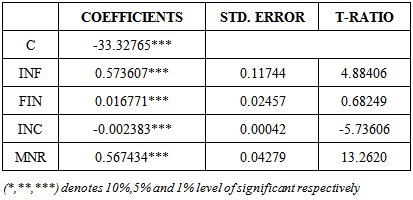

Since the existence of cointegration are found among the variables of interest, the study proceed to estimate the long-run relationship between ANSR and its determinants - INF, FIN, INC and MNR. Restricted VAR (Vector Autoregressive) is run to estimate the long-run relationship model of adjusted net saving in Malaysia. This model is also known as VECM (Vector Error Correction Method) of estimation, as presented in Table 3.Table 3. Long-run Determinants of Adjusted Net Saving

|

| |

|

It is observed that inflation rate, financial development and per capita income have a high significant impact on adjusted net saving at more than 1% level of significance respectively. Some of the findings were consistent with previous literatures on national saving and growth. Surprisingly, an increase in price level could increase ANS rate by 57% which would rise the potentiality of Malaysia to maintain its economic sustainability. As for financial development, the increase in broad money supply in Malaysia is also tend to have positive impact on sustainability. A 1% increase in money supply would increase ANS rate by 1.6% in the long run. A rise in per capita income, however, would decrease ANS rate by 0.02%, which is consistent with saving theory that a rise in income tend to reduce saving.

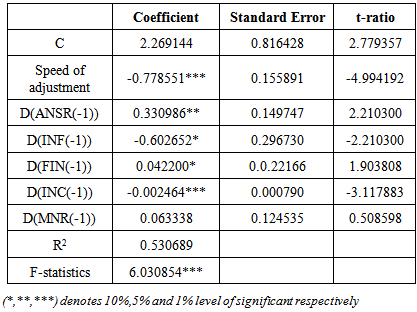

4.7. Short-Run Behaviour of Adjusted Net Saving in Malaysia

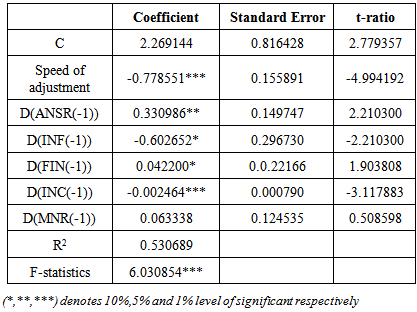

Another issue discussed in this study is to determine whether there is a short-run causality running between the independent variables with ANS rate. An error correction term (ECT) model for short-run behaviour is established and the results are presented in Table 4. For testing whether there exist a short-run causality running from explanatory variables to ANSR, Wald Test have been conducted and null hypothesis of no short-run causality is rejected. In other words, all the dependent variables have a short-run impact on ANSR. The estimation results further showed that a lagged value of ANSR itself and INC have strong impact towards ANSR in the short-run. Furthermore, INF has a negative effect to sustainability in the short-run whereas minerals depletion does not statistically significant determinant of ANSR.Table 4. Short-run Determinants of Adjusted Net Saving

|

| |

|

The speed adjustment term has a strong level of significance with negative value of 0.778551, which means the convergence of this model towards long run equilibrium should be there any shocks occur in the short run.

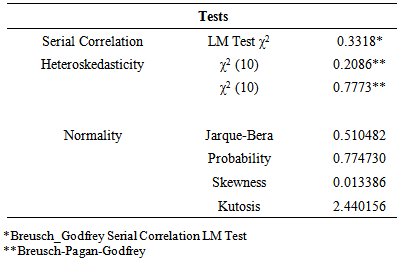

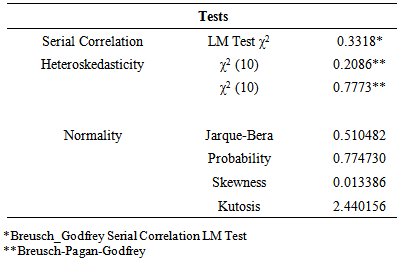

4.8. Diagnostic Check

To examine the 'goodness of fit' of the estimated models, several econometrical testing have been conducted in this study. Firstly, by observing the R2 value of 0.530689 and the F-statistics value of 6.03854 with more than 1% level of significance showed that both short run and long run models seemingly fitted well. Next, residual test conducted for serial correlation. The result shows that alternative hypothesis of serial correlation can be rejected. Diagnostic checking on heteroskedasticity also failed to reject null hypothesis of no heteroskedasticity element in the model. Finally Jarque-Bera normality test also indicates that the residuals were normally distributed. The summary of this findings is depicted in Table 5.Table 5. Diagnostic Check

|

| |

|

5. Conclusions

This study investigated the various determinants of Adjusted Net Saving rate in Malaysia. A VECM approach of long-run and short-run model of relationship between inflation rate, financial development, per capita income and minerals depletion and adjusted net saving rate (ANS) have been estimated and established. The variable of interest employed in this study, ANS rate is perceived as the proxy for sustainable development. ANS rate have been proposed by the World Bank since 1990s as an economic indicator to measure sustainable development. In the short run, it is found that the 1-lagged values of ANS rate, per capita income, financial development and inflation rate have significant impact on sustainable development, as proxied by ANS rate. However in the long-run, all of the variables including minerals depletion tend to have a strong impact on sustainability in Malaysia. The findings from this study has provided some insight to the researcher in terms of more in depth knowledge of saving and income theory. It can be generally concluded that firmed macroeconomic policy should be carefully designed by policymaker in order to ensure a sustainable development progress in both economic and environmental aspects, especially for a country like Malaysia.

References

| [1] | Japelli, T. and M. Pagano Savings, Growth and Liquidity Constraints. Quarterly Journal of Economics, 1994. 109, 83-109. |

| [2] | IUCN, WORLD CONSERVATION STRATEGY- LIVING RESOURCE CONSERVATION FOR SUSTAINABLE DEVELOPMENT, 1980, United Nations Environment Programme (UNEP). |

| [3] | World Wildlife Fund (WWF). p. 77. |

| [4] | Solow, R.M. A Contribution to the Theory of Economic Growth. The Quarterly Journal of Economics, 1956. 70, 65-94. |

| [5] | Romer, P.M. Endogenous Technological Change. The Journal of Political Economy, 1990. 98, 71-102. |

| [6] | Solow, R.M. Intergenerational Equity and Exhaustible Resources. The Review of Economic Studies, 1973. 41, 29-45. |

| [7] | Hartwick, J.M. Intergenerational Equity and the Investing of Rents from Exhaustible Resources. The American Economic Review, 1977. 67, 972-974. |

| [8] | Pearce, D.W. and G.D. Atkinson Capital Theory And The Measurement Of Sustainable Development: An Indicator Of “Weak” Sustainability. 1993. 8, 103-108. |

| [9] | Blanchet, D., J.l. Cacheux, and V. Marcus Adjusted net savings and other approaches to sustainability: some theoretical background. Stiglitz report on the Measurement of Economic Performance and Social Progress, 2009. |

| [10] | Hamilton, K. and M. Clemens Genuine Savings Rates in Developing Countries. THE WORLD BANK ECONOMIC REVIEW, 1999. 13, 333-356. |

| [11] | Barbier, E.B., A. Markandya, and D.W. Pearce, Environmental Sustainability and Cost-benefit Analysis. Environment and Planning A, 1990. 22(9): p. 1259-1266. |

| [12] | Atkinson, G. and K. Hamilton Savings, Growth and the Resource Curse Hypothesis. World Development, 2003. 31, 1793-1807. |

| [13] | Dietz, S., E. Neumayer, and I.D. Soysa Corruption, the Resource Curse and Genuine Saving. Environment and Development Economics, 2007. 12, 33-53 DOI: 10.1017/S1355770X06003378. |

| [14] | Ploeg, F.v.d. Why Do Many Resource-Rich Countries Have Negative Genuine Saving? Anticipation of better times or rapacious rent seeking. Resource and Energy Economics, 2010. 32, 28-44. |

| [15] | Yamaguchi, R. and M. Sato Genuine Savings of Open Economies with Renewable Resources. 2011. |

| [16] | Boos, A. The theoretical relationship between the Resource Curse Hypothesis and Genuine Savings. 2011. |

| [17] | Carbonnier, G. and N. Wagnera Oil, Gas and Minerals: The Impact of Resource-Dependence and Governance on Sustainable Development. 2012. |

| [18] | Farhan, M. and M. Akram, Does Income Level affect Saving Behaviour in Pakistan? An ARDL approach to co-integration for empirical assessment. Far East Journal of Psychology and Business, 2011. 3(3): p. 11. |

| [19] | Johansen, S. and K. Juselius Maximum Likelihood Estimation and Inference on Cointegration - With Applications to the Demand For Money. Oxford Bulletin of Economics and Statistics, 1990. 52, 169-209. |

WhereANS = Adjusted Net Saving RateGNS = Gross National SavingDh = Depreciation of produced capitalCSE = Current (non-fixed-capital) expenditure on educationRn,i = Rent from depletion of natural capital iCD = Damages from carbon dioxide emissionsGNI = Gross National Income at Market Prices

WhereANS = Adjusted Net Saving RateGNS = Gross National SavingDh = Depreciation of produced capitalCSE = Current (non-fixed-capital) expenditure on educationRn,i = Rent from depletion of natural capital iCD = Damages from carbon dioxide emissionsGNI = Gross National Income at Market Prices

the real national output is a function of effective factors of production

the real national output is a function of effective factors of production  (capital),

(capital),  (labour) and

(labour) and  (natural resources) respectively. Along with this, qualities of factors for production (K, L, and R) are assumed to grow exogenously at rates denoted by j, m, and h for each of them. From the above, an index of technological progress (or total factor productivity), A, is to be included. A is assumed to be growing at the exogenous rate denoted by g. Therefore, equation (1) can be written as:-

(natural resources) respectively. Along with this, qualities of factors for production (K, L, and R) are assumed to grow exogenously at rates denoted by j, m, and h for each of them. From the above, an index of technological progress (or total factor productivity), A, is to be included. A is assumed to be growing at the exogenous rate denoted by g. Therefore, equation (1) can be written as:-

and

and  The improvements in the quality of capital, with positive rate (j > 0), signifies new technology applied in new capital goods. As for improvements in labour quality (m > 0); would be reflected with human capital formation with investment in education, health and nutrition. In addition, growth rate of natural resources is assumed to be in both ways, either positive or negative. For example, land fertility could be deteriorated by logging activities but it somehow could be offset by applying an efficient fertilization activity. Quality of remaining natural resources maybe reasonably declined, since the best and most accessible ones are being extracted first. From this; equilibrium of a closed economy, where net domestic saving (public and private sector’s saving) are equals net domestic investment. Labour force volume is assumed to grow at rate n. Natural resources is to deplete at rate u. Stocks of non-renewable natural resources are diminished when used. The stocks of renewable natural resources, however, can be maintained, if not utilized beyond regeneration capacities. From all of these assumptions made, we can derive the growth rate of productivity (TFP) as follows:-

The improvements in the quality of capital, with positive rate (j > 0), signifies new technology applied in new capital goods. As for improvements in labour quality (m > 0); would be reflected with human capital formation with investment in education, health and nutrition. In addition, growth rate of natural resources is assumed to be in both ways, either positive or negative. For example, land fertility could be deteriorated by logging activities but it somehow could be offset by applying an efficient fertilization activity. Quality of remaining natural resources maybe reasonably declined, since the best and most accessible ones are being extracted first. From this; equilibrium of a closed economy, where net domestic saving (public and private sector’s saving) are equals net domestic investment. Labour force volume is assumed to grow at rate n. Natural resources is to deplete at rate u. Stocks of non-renewable natural resources are diminished when used. The stocks of renewable natural resources, however, can be maintained, if not utilized beyond regeneration capacities. From all of these assumptions made, we can derive the growth rate of productivity (TFP) as follows:-

reflects the comprehensive growth rate all factors,

reflects the comprehensive growth rate all factors,  is output per unit of labour,

is output per unit of labour,  is ratio of capital per unit of labour and s denotes domestic saving rate. Therefore, economic growth can be written as the sum of growth rate in productivity of labour,

is ratio of capital per unit of labour and s denotes domestic saving rate. Therefore, economic growth can be written as the sum of growth rate in productivity of labour,  and aggregate labour force participation rate, n-p (p is population growth rate). Extending the model above, economic growth rate is derived as:-

and aggregate labour force participation rate, n-p (p is population growth rate). Extending the model above, economic growth rate is derived as:-

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML