-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(2): 168-176

doi:10.5923/c.economics.201501.20

An Empirical Study of Direct Relationship of Service Quality, Customer Satisfaction and Bank Image on Customer Loyalty in Malaysian Commercial Banking Industry

Zahir Osman , Liana Mohamad , Ratna Khuzaimah Mohamad

OUM Business School, Open University Malaysia

Correspondence to: Zahir Osman , OUM Business School, Open University Malaysia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The aim of this study is to develop a direct effect understanding of service quality, customer satisfaction and image on customer loyalty in Malaysian commercial banking industry. The Structural Equation Model (SEM) adopted to analyze the casual relationships between exogenous variables and endogenous variable. The model was developed and later tested by using the Partial Least Square (PLS) procedure on data collected from a survey that yielded 512 usable questionnaires. The findings demonstrated that service quality, customer satisfaction and image have significant and positive influence on customer loyalty in Malaysian commercial banking industry. It is important to do the study employing experimental design by capturing longitudinal data in Malaysian commercial banking industry using robust measures. The findings imply that the relationship of service quality, satisfaction and trust on customer loyalty will lead to commercial banks’ profitability.

Keywords: Commercial Banks, Service Quality, Customer Satisfaction, Image, Customer Loyalty

Cite this paper: Zahir Osman , Liana Mohamad , Ratna Khuzaimah Mohamad , An Empirical Study of Direct Relationship of Service Quality, Customer Satisfaction and Bank Image on Customer Loyalty in Malaysian Commercial Banking Industry, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 168-176. doi: 10.5923/c.economics.201501.20.

Article Outline

1. Introduction

- In Malaysia, commercial banks play a very important role and are the largest part of financial institution. The banking industry in Malaysia is become more integrated due to the technological environment, liberalization and deregulation. As a result, the market environment in banking sector has become more competitive and complex. The banking product currently very much homogeneous from one bank to another bank and at the same time the demand from bank customers are keep on increasing where banks need to do more effective industry transformation. Banks previously emphasized on their products are gradually shifted to be more customer focus which is parallel with the relational marketing principle where customer loyalty will be the main focus. In view of this, [30] suggested that constant behavior of customer oriented is very crucial to ensure the comprehension of quality in service marketing. Reference [17] stated that customers are unlikely to feel impressed by the core attributes of the products where most financial products are homogeneous. The purpose of this paper to show the relationship of service quality, customersatisfaction and image on customer loyalty in Malaysian commercial banking industry and to test the conceptual research model that connect, service quality, customer satisfaction, image to customer loyalty.

2. Literature Review

2.1. Underpinning Theory

- Cognitive-affect-conation pattern model is the main source of [64] model framework and he proposed that customer can be loyal at every stage of the above mentioned model (cognitive loyalty-affective loyalty-conative loyalty-action loyalty). The first phase which is cognitive loyalty, cognition is the resultant of the earlier or specific comprehension or on current experienced-based information. The customer loyalty in this circumstance is an apparent nature. The strength of loyalty at this phase is weightless because it is just a mere performance. The second phase is affective loyalty. This stage of loyalty is formed based on affect. During this period, a fondness or attitude towards the brand starts to develop through accumulation of satisfying usage occasions. This reveals the pleasure aspect of the satisfaction meaning which is pleasurable fulfillment. The third phase is conative loyalty. The next phase of loyalty development is the conative (behavioral intention) phase. Loyalty during this period is a matter repeated events of encouraging affect in respect to the services. Conation can be defined as the product or service commitment to repurchase or repeat buying. The fourth phase of loyalty is action loyalty. Action loyalty is the last phase of customer loyalty. During this phase, action loyalty emerges out of prior intentions. Action loyalty phase depicts the motivated intention that progress from the previous phases of loyalty transforming into willingness to take action [73].

2.2. Definition of Concept

- Customer LoyaltyThe concept of customer loyalty has been researched for the past decades in business industries. Loyalty is a commitment of current customer in respect to a particular store, brand and service provider, when there are other alternatives that the current customer can choose for [77]. According to [84], customer loyalty is being either attitudinal or behavioral. Reference [33] has defined customer loyalty as a mindset of the customers who hold favorable attitudes towards a company, commit to repurchase the company’s product or service, and recommend the product or service to others. Service QualityService is not the same as goods or products. Service quality as defined by [22] as what the customer gets out and is willing to pay for” rather than “what the supplier puts in. Therefore service quality frequently has been conceptualized as the difference between the perceived services expected performance and perceived service actual performance ([10], [47]). According to [54], service can be defined as an act or performance which will give the benefit to customers. Hence, delivering superior service quality to customers in today’s business environment is very essential and important due the stiff competition in the market. In previous studies, service quality has been defined to the extent where the service fulfills the needs or expectation of the customers ([52], [19]) while [85] has conceptualized service quality as the overall impression of customers towards the service weakness or supremacy.Customer SatisfactionAccording to WTO (1985), customer satisfaction is known as a psychology concept which entail the well being feeling and enjoyment as a result of getting what a person hopes and expects from a product or service which is appealing to that person. Reference [8] suggested that satisfaction is the customers’ assessment of a product or service in terms of whether that product or service has attained their needs and expectations. Reference [11] has defined satisfaction as a positive, affective state as a result of the evaluation of all parts of a party’s working relationship with another.ImageCorporate image has been recognized as an imperative factor in the overall assessment of a firm [9] and is debated to be what comes across to the mind of a customer when they hear the firm’s name [61]. Reference [26] stated that the concept of corporate image as a strategic means that would generate considerable value for the financial sector. According to [12] corporate image is at two levels, one relating to the intended image and the other, construed image. Additionally, [20] suggested that the characteristics of corporate image consist of two types of factors: one is more based on fact in nature such as corporate abilities and financial performance, whereas the other one has a more emotional character such as social accountability and the uniqueness or personality of the organization.

2.3. Conceptual Development

- Relationship between Service Quality and Customer LoyaltyMany studies in various fields have shown positive relationship between service quality and customer loyalty. Most of the findings showed the strong statistical evidence that service quality has a great influence where it positively and significantly correlated with customer loyalty.Previous studies conducted in banking industry such as conducted by [3] in Greece banking industry; [34] and; [74] in India banking industry found that service quality has significantly and positively related to customer loyalty. This similar to the study conducted in China banking industry by [79]; while [81] in Taiwan banking industry that have revealed the same relationship between service quality and loyalty. Few studies also conducted in Iran banking industry such as ([53], [2], [3], [76]) found in their study that service quality has positive and significant impact on customer loyalty. Kenya commercial banking customers has also found that service quality plays an important role to influence their customer loyalty (Aura, 2012). However, [53] conducted a study on bank in Malaysia have found that among the five dimensions used in service quality, only tangible has no significant impact on loyalty. Hence, from all these findings, service quality is the main element to ensure the loyalty of the customers.These finding were similar to those studies conducted in hotel industry. This was proven by [44] in Maldives; [21] and; [25] in United States found that service quality determined the customer loyalty while [48] found the same positive relationship between service quality and restaurant customers’ loyalty in Thailand.According to [43] in their study in e-commerce industry in Australia; while [18] in Europe also found that service quality influence the level of e-commerce customers’ loyalty. Other studies conducted on online shoppers have also found the same finding that service quality plays an important role and has a strong impact on customer loyalty such as [51] in China; [80] in Hong Kong; [40] in Greek; and [78] in Greece e-commerce industry.Reference [39] conducted a study on mobile phone users in South Korea in mobile phone industry and another same study by [41] in Greece showed that service quality also have significant and positive influence on customer loyalty. This was also supported by a study conducted on South Korea telecommunication customers [82]. Reference [72] in their study on students about Malaysian telecommunication industry also revealed the positive relationship between service quality and the customer loyalty.Other industry such as medical has also concluded that service quality has significant impact on customer loyalty [86]. This was also supported by a study on Indonesian hospital patients by [65] which showed the same relationship. Reference [28] conducted a study in Pakistan hospitality industry and [50] in Taiwan leisure industry while [83] in Malaysian rural tourism industry have found that there is a significant and positive relationship between service quality and customer loyalty. However, [29] from their study on railway users in China railways industry reveal that service quality has no impact on customer loyalty.Relationship between Customer Satisfaction and Customer LoyaltyThe survival and sustainability of any business organization is largely depends on the customer satisfaction and customer loyalty. The customer satisfaction arises from the good service quality and thus related to the customer loyalty. Lot of studies has been conducted on the bank customers to conclude the relationship between customer satisfaction and customer loyalty such as [49] in Bangladesh banking industry and [57] in Iran banking industry. They found that customer satisfaction positively and significantly related to customer loyalty. The same results were also proven by some studies conducted in Iran such as [35] and [45]. Reference ([76], [59] and [71]) in their study in Pakistan and [69] in Indonesia banking industry, also concluded that customer satisfaction shows a positive and significant impact on customer loyalty. Moreover, [58] in their study on bank customers in Islamic banking industry in Malaysia also revealed that customer satisfaction is the most important driver to enhance customer loyalty. Study on internet banking customers also proven the same positive relationship between customer satisfaction and loyalty [79]. Many studies on the online buyers have concluded that customer satisfaction obviously has a strong relationship with customer royalty. This were proven by [36] in Taiwan; [80] in Hong Kong and; [40] in Greek. Reference [56] in their study on telecommunication customers in Bangladesh have found that customer satisfaction is significantly and positively related to customer. This was supported in a study by [6] on mobile phone users in Iran and [42] in Pakistan that customer satisfaction plays an important role on customer loyalty relationship where the influence is positive and significant. According to [72] in their study on students about Malaysian, customer satisfaction has significant and positive impact on customer loyalty. Other studies that have shown the same positive relationship between customer satisfaction and loyalty were conducted by [87] in China; [39] in South Korea; [1] in Nigeria and [24] in Iran.Other industries also showed the same positive relationship such as studies conducted by [29] and [13] on the railway users in China railway industry. Reference [32] in their study on airline passengers in Cyprus have found that customer satisfaction has a great impact on customer loyalty and positively and significantly influence customer loyalty. Reference [50] studied the Taiwan leisure industry while [62] in Taiwan travel industry has concluded that customer satisfaction has a positive and significant influence on customer loyalty. The same result found by [21] in United States where she found that hotel customer satisfaction is the determining factor and positively and significant correlated their loyalty. However, some studies have showed negative relationship between customer satisfaction and customer loyalty. The study conducted by [86] on patients in China medical industry found that customer satisfaction does have positive and significant influence on customer loyalty. The same result found in other study conducted by [7] on bank customers in Pakistan. They found that customer satisfaction has very low impact on customer loyalty and not significant correlated. Hence, customer satisfaction does not ensure their loyalty.Relationship between Image and Customer LoyaltyPrevious studies have revealed that image plays an important role in determining customer loyalty. Hence, many studies have been conducted on bank customers in banking industry to prove the positive relationship between image and customer loyalty. Reference [67] in their study in Spain banking industry and a study conducted by [57] in Iran banking industry have found that bank image has positive and significant impact on customer loyalty. The same findings in banking industry were also proven by [7] in Pakistan while [23] in Turkey. In Malaysia, a study conducted on bank customer in Malaysia Islamic banking industry also found that bank image has a positive and significant impact on customer loyalty [58]. Reference [46] in Maldives and [44] in Mauritius have studied the relationship of image and customer loyalty on hotel guests. These studies have found that in hotel industry, image has a strong influence on customer loyalty and positively and significantly correlated. [28] found the same findings in their study on the customers in Pakistan hospitality industry.This relationship is further concurred by [42] in their study on mobile phone users in China mobile phone industry and found that customer loyalty is significantly and positively influenced by image. Reference [6] have found the same finding in their study on Iran telecommunication customers. These were also proven by some studies in South Korea such as study conducted by [82] while in China by [42] and in Pakistan by [60] have concluded in their studies that image has positive and significant influence on telecommunication customers’ loyalty. Thus, image should be maintain good to ensure the loyalty from the customer.

3. Methodology

3.1. Survey Instrument

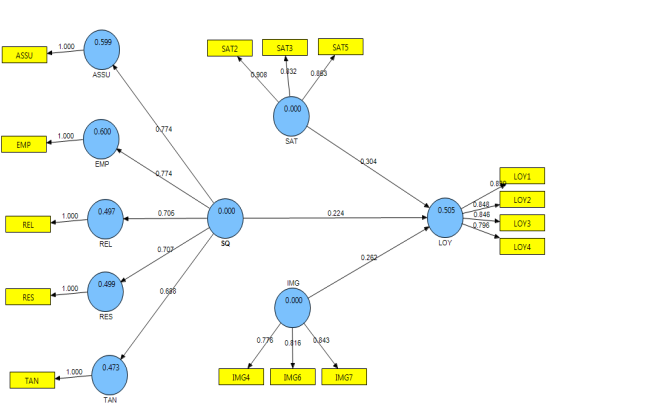

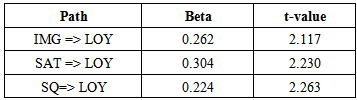

- 45 observed variables form the exogenous independent variable measurement of dimensions of service quality of reliability (7 items), assurance (7 items), empathy (7 items), tangible (7 items) and reliability (7 items) adopted and modified from Parasuraman et al. (1985), bank image (3 items) and customer satisfaction (3 items). The customer loyalty endogenous variable comprises of 4 items (Figure 1). This study applied the 5-point Likert scale of 1-strongly agree, 2-agree, 3-neutral, 4-disagree and 5-strongly disagree. The variables of demographics asked are the respondents’ gender, age, status, place of origin, race, occupation, annual income, and education background.

| Figure 1. Research Model & Path Coefficient |

3.2. Sample

- Total of 830 customer of commercial banking in Klang Valley had been asked to take part and answer the survey questionnaire. After the process of screening, 706 or 70.60% of the participants involved in this study were eligible and can be regarded as respondents. However, after screening the data, only 512 survey questionnaires can be utilized for this study. Therefore, the response rate is adequate for analysis of SEM.

4. Data Analysis and Results

- All the items of each individual dimension of Service Quality have been merged by taking the average as suggested by [15]. Each indicators employed to represent latent variables are bundled by summing or averaging up several individual indicators and then using the scores on the bundles as indicators for the latent variable analysis [33]. There are many advantages of items parceling. It has greater reliability than individual items [15] and permits the decrease in the measured variables number in a model. Model with bundles as indicators tend to fit the model better than items as indicators because the order of the parcel correlation matrix is much lower than the order of the correlation matrix of item. Reference [15] which will make a more parsimonious model. The technique of partial least square (PLS) was used to examine the results in order to assess all constructs influence in the framework simultaneously, including second order construct (service quality). Reference [31] suggested PLS as being sustainable approach to assess the cause and effect relationship in business research which is complex. Reference [38] mentioned that PLS approach can be applied specifically in the situation where there is an adequate strong and fully structured theories. The PLS technique has the capability to support in getting values for latent variables for projecting reasons. PLS never use the model to clarify the all indicators covariance, but decreases all the dependents variables variance with regards to the acquired approximated parameters which are depend on the ability to minimize the dependent variables remaining [14]. Finally, the software used in the analysis was the SmartPls [70].

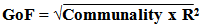

4.1. Convergent Validity

- All the individual dimensions’ items of service quality have been combined through averaging as proposed by [15]. Every indicator used to represent latent variables are put together by averaging up individual item and then take the score on the bundles as indicators for analysis of latent variables [33]. According to [15], item parceling has many advantages and also greater reliability than individual items. It also allows the decrease in measured variables number in the model. Using bundles as indicators in the model will allow fitting the model better than items as indicators because the parcel correlation matrix order is much lesser than the correlation matrix of item order. This tends to make the model more parsimonious. The outer-measurement models convergent validity sufficiency was assessed by calculating composite reliability [37]. The result of convergent validity analysis has confirmed that both outer measurement models and their first-order factors are in line with [63] reliability criteria, 0.70. Table 1 has shown that all constructs composite reliability and their first order factors are in the range of 0.851 to 0.90. Therefore, the constructs linked with outer-measurement models revealed adequate convergent validity.

|

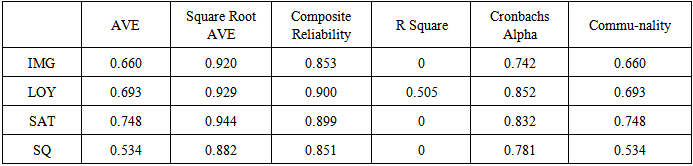

4.2. Discriminant Validity

- Discriminant validity of the constructs was evaluated in three approaches. Reference [27] suggested AVE utilization, which indicates the present of discriminant validity if the AVE square root is greater than all related correlations. As shown in table 2, the AVE square root values are clearly larger than off – diagonal correlations, implying discriminant validity present at the construct level. Table 2 reveals that none correlation (ranged from 0.611 to 0.759) were greater than their respective AVE (ranged from 0.882 to 0.944), thus signifying sufficient all construct discriminant validity, Lastly, all constructs show discriminants validity when every correlation is less than 1 by an amount greater than twice than its respective standard error [5]. Standard error in PLS bootstrap output examination shows that all constructs pass this third test. Therefore, adequate discriminant validity is shown for all constructs.

|

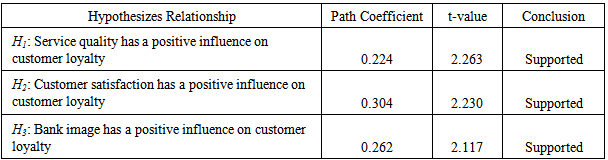

4.3. Hypothesis Testing and Results

- H1 states that service quality is predicted to have positive influence on customer loyalty. Table 3 results confirmed this hypothesis with path coefficient of 0.224 and t-value of 2.263.In H2, customer loyalty is predicted to be positively influenced by customer satisfaction and the results in Table 3 supported H2 with the path coefficient of 0.304 and the t-value of 2.230. In H3, customer loyalty is predicted to be positively influenced by bank image and results in Table 3 supported H3 with the path coefficient of 0.262 and the t-value of 2.117.

|

With regard to the classification of R2 effect sizes by [16] and adopting the of 0.5 cut-off value for commonality [27], GoF criteria for small, medium, and large effect sizes are 0.1, 0.25 and 0.36 respectively [78]. The computed GoF for model was 0.29 signifying that good fit to the data.

With regard to the classification of R2 effect sizes by [16] and adopting the of 0.5 cut-off value for commonality [27], GoF criteria for small, medium, and large effect sizes are 0.1, 0.25 and 0.36 respectively [78]. The computed GoF for model was 0.29 signifying that good fit to the data.

|

5. Discussion & Conclusions

- This study main objective is to form an understanding of the direct effect of service quality on customer loyalty, customer satisfaction on customer loyalty and bank image on customer loyalty relationship in Malaysia banking industry. This research is to build the probable causal relationship among the variables which are service quality, customer satisfaction, bank image and customer loyalty. With regards to this, the review of the previous study in the area of service quality, customer satisfaction, bank image and customer loyalty was carried out. From the academic studies initial findings, the model was developed and it’s revealed that service quality, customer satisfaction and bank image have a positive and significant direct effect on customer loyalty. The empirical testing was performed since it is not easy to justify the superiority of any model theoretically. This study suggested model to empirically test and to verify that are positive direct relationship among service quality, customer satisfaction, bank image on customer loyalty. PLS technique data analysis was employed to achieve this objective Firstly, the most accepted relationship between service quality and customer loyalty is verified. The direct relationship between the service quality and customer loyalty path coefficient is 0.224 and the critical ratio t-value is 2.263 which is significant. Secondly, the most accepted theory that connects customer satisfaction and customer loyalty also well supported with the direct relationship between customer satisfaction and customer loyalty path coefficient is 0.304 and the critical ratio t-value is 2.230 which is significant. Finally, relationship between bank image and customer loyalty is verified. The direct relationship between the customer trust and customer loyalty path coefficient is 0.262 and the critical ratio t-value is 2.117 which is significant. In view of the above, it is concluded that service quality, customer satisfaction and customer trust have positive influence and impact on customer loyalty in Malaysia rural tourism industry.The findings of this study suggested that customer loyalty among commercial banks customers’ can be strengthened and enhanced by emphasizing the factors that can boost service quality, customer satisfaction and bank image. Conversely, commercial banks customers’ loyalty can be reinforced and enhanced by increasing the level of service quality, satisfaction and trust commercial banks’ customers. Ultimately, customer loyalty among commercial banks customers’ should play an important element to increase commercial banks’ profit.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML

8(3/4), pp.

8(3/4), pp. 74-95, 2009.

74-95, 2009.