-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(2): 135-138

doi:10.5923/c.economics.201501.14

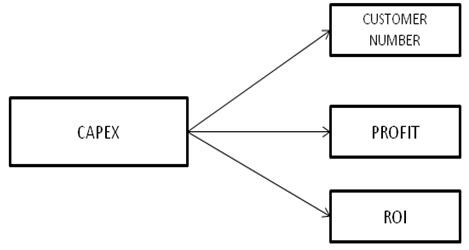

The Impact of Increasing CAPEX on Customer Number, Profit, and ROI in Indonesia Telecommunication Industry

Anisah Firli1, Ina Primiana2, Umi Kaltum2

1Department of Management and Business, Faculty of Economics Padjajaran University, Bandung-Indonesia, Economics and Business Faculty, Telkom University, Bandung, Indonesia

2Department of Management and Business, Faculty of Economics Padjajaran University, Bandung, Indonesia

Correspondence to: Anisah Firli, Department of Management and Business, Faculty of Economics Padjajaran University, Bandung-Indonesia, Economics and Business Faculty, Telkom University, Bandung, Indonesia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Telecommunication industry has unique characteristics in spending its Capital Expenditure. Some studies examine that CAPEX in telecommunication industry is driven by technology and concluded that their CAPEX give small amount of ROI. Different with any other previous researches, this research examines the impact of CAPEX in Customer Number, Profit and Return On Investment (ROI) by quantitative analysis. This research uses regression analysis with secondary data of the big three operator in Indonesia telecommunication industry in the last five years. Research findings conclude that even ROI from the CAPEX is very small; increasing in CAPEX has positive significant impact on Customer Number, Profit and also ROI. This research find that holding company perform better than single company in profit and also ROI. Finally this research suggests for the future research to examine the impact by comparing big company and small company which is small company prefers spending in Operating Expenditure (OPEX) to CAPEX.

Keywords: CAPEX, Customer Number, Profit, ROI, Telecommunication

Cite this paper: Anisah Firli, Ina Primiana, Umi Kaltum, The Impact of Increasing CAPEX on Customer Number, Profit, and ROI in Indonesia Telecommunication Industry, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 135-138. doi: 10.5923/c.economics.201501.14.

Article Outline

1. Introduction

- There are many challenges faced by Telecom Industry globally; pierce of competition among operators, decrease in telecommunication price that impact to ARPU [1] and also high in capital expenditure (CAPEX) with low ROCAPEX in telecommunication industry increases rapidly from just only US $50 billion to about US $ 325 billion over the past 30 years. In fact, this investment didn’t give high ROI (Return on Investment). In the past decade, the average long-term return on investment has only 6%. In other word, telecom industry spent lots of money in investment but didn’t give high returns. Most telecom executives admit deeply frustration in managing capital. Thus it becomes challenge in telecommunication industry nowadays (PWC Analysis, 2013). This research focuses on explaining the CAPEX trend in Indonesia Telecom Industry and also examines the impact of CAPEX on Customer Number, Profit, and ROI by the empirical study in big three telecom operator in Indonesia.

2. Literature Review and Hypothesis

2.1. CAPEX

- Capital expenditure is a function of current and past sales change, current and past profits and depreciation charges. Increases in demand are likely to be increases in sales and input. Change in demand will be felt first in utilization of existing capital. Capital expenditure also depends of the need to replace the portions of existing capital and the measure may be found in depreciation charges. Profitability of investment may be capture in current and past profits. The full role of sales changes involves also their positive relation with profits and also positive relation with capital expenditure [2]. There are some types of capital expenditure; equipment replacement, expansion to meet growth in existing to product, expansion generated by new products, and projected mandated by law [3].Capital expenditure management includes additions, disposition, modification and replacement of fixed assets. Capital expenditure decision has its effect over a long time span and inevitability affect the company’s future cost structure. Capital expenditure decisions are of considerable significance as the future success and growth of the firms depends heavily on them. There are some difficulties: the benefits from the investment are received in some future period and the future is uncertain and element of risk is involved and at least need 15 year forecast. A failure makes a big error that only give expense. The future revenue should be consideration things based on market product or expected share for the company and also the time value of money when the cash inflow come from the long future. It’s very difficult to calculate the benefit related to the cost. Investing decision can be two types; those which expand revenues and whose reduce costs. Expand revenue means give additional revenue for the company. Investment decisions reducing costs, which is company should take decision whether continue with the existing assets or replace them to the new one by consideration that new machine give less expanse than the existing assets [4].

2.2. CAPEX in Telecommunication Industry

- In the telecommunication industry, nearly two-thirds executive argue that CAPEX planning is driven by technology, not business objectives (PWC Analysis, 2013). Changing in Item of capital expenditure reflects the changing of the technology, which is technology, grows so fast. In the fixed line era, capital expenditure of the operator focuses in the building fixed network. In the cellular era, capital expenditure focuses in building coverage network. In 2008, Indonesia’s largest mobile phone operator Telkomsel at least spent USD 1,7 billion in capital expenditure which is 40% of the CAPEX being allocated to network coverage expansion [5]. In 2011, ABI Research said Radio Access Network equipment is still driving a respectable percentage of operators' CAPEX. 56 percent of global operator CAPEX came from base station deployments, upgrades and swap-outs. Many operators are leaning towards small cell deployments (microcells, picocells and femtocells) to fill dead zones and boost coverage inside buildings. However operators are also still investing in improving the downlink and uplink performance of their networks, not just on LTE but also HSPA+. CDMA2000 networks are similarly continuing to upgrade. Core network spending also continues to increase. In 2011, core network expenditure is likely to approach $12 billion. Spending on core network equipment is expanding on a number of fronts. As a number of countries are still very much building out their 3G coverage and services. Overtime, we anticipate greater investment in 4G-capable gateway architecture [6]. Those spending conclude that CAPEX driven by its technology. Technology goes so fast and makes uncertainty from the high investment in CAPEX, it calls CAPEX dilemma in Telecommunication Industry. In 2013, there are nine operators in Indonesia, which are PT Telekomunikasi Indonesia, PT Telkomsel, PT XL Axiata (before PT Excelcomindo Pratama), PT Indosat (before PT Satelite Corporation), PT Hutchison 3 Indonesia, PT Smartfren Telecom (merger between Smart Telekom and PT Mobile 8 Telecom), PT Sampoerna Telekomunikasi Indonesia, PT Axis Telekom Indonesia (before PT Natrindo Telepon Seluler), and PT Bakrie Telecom. At the middle of 2014, PT Axis.Telekom is acquired by PT XL Axiata, so the total operator in 2014 becomes eight operator. From secondary data, incumbent operator or big operators prefer to spend much in CAPEX, while small company or start-up company prefers to spend in OPEX. Small company hasn’t financial as big as the bigger operators, so they prefer to minimize CAPEX due to their uncertainty in investment.

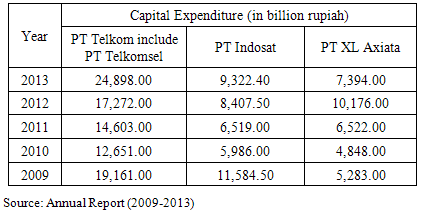

|

2.3. CAPEX in Telecommunication Industry

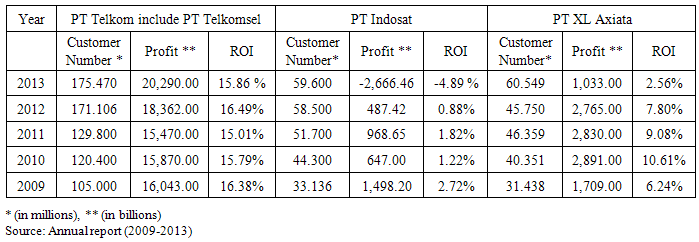

- Customer number tends to increase every year for all the operators. Profit tends to increase only for telkom, but for the others company tends to be lower. And for ROI, the biggest operators are 15% in average, but for the other operator has very small ROI; only 0,35% for Indosat, and 7,26 for XL Axiata. Table 2 shows Customer Number, Profit, and ROI each operator for last five years. We found that Telkom such a holding company perform better in profit and ROI.

|

| Figure 1. Research Framework |

3. Research Methods

- This research uses the big three operator telecommunication in Indonesia as sample. To examine the impact of CAPEX (X) on Customer Number (Y1), Profit (Y2), and ROI (Y3), we collate secondary data from annual report and financial statement of each company and analyze with simple regression by using SPSS Software.

4. Empirical Result

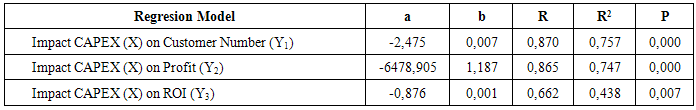

- This research examines three regression models: Impact CAPEX (X) on Customer Number (Y1), Impact CAPEX (X) on Profit (Y2) and Impact CAPEX (X) on ROI (Y3). The empirical results using SPSS shown at Table 3.

|

5. Conclusions

- Using data from the big three operator in Indonesia, this paper concluded that even ROI from the CAPEX is very small, the increasing on CAPEX has positive significant impact on increasing Customer Number, Profit, and ROI in Indonesia Telecommunication Industry. For make customer number, profit and ROI more increasingly, it should be supported not only by the increasing CAPEX in fast technology era but also making efficient operational, improving marketing program, maintaining customer value, etc. In rapid technology lifecycle, operator should maintain their ROI through their CAPEX, lengthening the technology changing covers the initial outlay. For future research, comparative study is needed between big operator and small operator that have different strategy and behaviour in CAPEX and OPEX spending.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML