-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2015; 5(2): 90-94

doi:10.5923/c.economics.201501.07

Virtual Currency: Analysis and Expectation

Li Yusen

The Faculty of Economics and Management, Universiti Kebangsaan Malaysia

Correspondence to: Li Yusen, The Faculty of Economics and Management, Universiti Kebangsaan Malaysia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

With the development of internet and increasing number of users, a new kind of currency come into being—virtual currency. Virtual currency has rapid development, and enter into the life of people quickly. What's the difference between virtual currency and real currency? On the one hand, virtual currency don’t have all the functions of the real currency. On the other hand, virtual currency and real currency have different properties. Virtual currency have their own characteristics, such as issued by a company, operated by the company that issued it, and use is not subject to regional restriction, etc., which real currency do not have. This article discusses these characteristics one by one, and discuss in depth the relationship between virtual currency and real money, and how issuing company and holder use virtual currency to gain benefits. This article builds econometric model and economy model to discuss this problem and use a kind of well-known virtual currency-bitcoin, as a sample. This paper establishes a series of premise assumptions, and using official data from BLOCKCHAIN info website, using the mathematical formula to discuss exchange mode of bitcoin and USD, and establishes the model framework to analyze the factors influencing the bitcoin exchange rate. In the end, this article discusses the future development of virtual currency and the possible risks virtual currency may encounter in the future, and discusses the possible problem about virtual financial system influencing the real financial system if virtual financial system may form. The model use here is original. Hence, it is in quite an extent an advisory one, which gives an idea for the future discuss.

Keywords: Virtual currency, Currency theory, Bitcoin, Risk, Expectation

Cite this paper: Li Yusen, Virtual Currency: Analysis and Expectation, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 90-94. doi: 10.5923/c.economics.201501.07.

Article Outline

1. Introduction

1.1. Introduction

- In today’s world, the telecommunication technology, which is the basis of network marketing technology, develops faster and faster; at the same time, it also promotes the rapid development of network marketing. The Internet was born in the 1960 s, with the development of the network protocols and related hardware and software products, the Internet began to gradually shift from military to commercial and civil. Since the 1990 s, the Internet gradually enter into people’s daily life. The Internet is one of the important economic factors causing worldwide technological change. Such change triggered a new market, which is based on the virtual currency market space. The Internet facilitates communication of consumers, and at the same time provides a market to enterprises (Wikipedia).There are many virtual goods appeared on the internet, such as weapons and equipment in online game, a VIP member of the web portal top-up and so on. Then, virtual currency used to buy these virtual goods appeared simultaneously. Virtual currency, at the beginning just a single application, now has developed into a wide variety and with complete functions of the monetary system. A typical application of virtual currency is the third-party payment platform, which mainly use network to engage in trade in goods, trade in services and intellectual property trade, and other business activities.Now, the most famous virtual currency around the world is Bitcoin. Bitcoin is a software-based online payment system built by Satoshi Nakamoto in 2008 and introduced as open-source software in 2009. Payments are recorded in a public ledger using its own unit of account, which is also called bitcoin. Payments work peer-to-peer without a central repository or single administrator, which has led the US Treasury to call bitcoin a decentralized virtual currency. Although its status as a currency is under fierce dispute, media reports often refer to bitcoin as a cryptocurrency or digital currency (Wikipedia).Virtual currency can be roughly classified into three categories. The first category is the family game currency. In stand-alone game, the protagonist defeat enemy, gaining money on the virtual account, but can only use it in this game, like gambling in the game or buying herbal medicine or equipment. The second category is the portal or instant messaging service provider issuing currency, used to buy services in this web site. The third category of virtual currency, such as COINS (BTC), Wright currency (LTC), etc.; these are a kind of electronic currency produced by open-source P2P software. This kind of virtual currency are mainly used for online financial investment, also can be used directly in real life (Wikipedia).After more than 10 years’ development, virtual currency already have most of the functions of traditional currency, and has its own characteristics, became a new kind of economic phenomenon.

1.2. Objectives

- The main objective of this article is to discuss and analyze virtual currency. It contains analyzing relationship between virtual currency and real currency; discussing the characteristics and functions of virtual currency; discussing the risks and future expectation on virtual currency. As mentioned previous, bitcoin is representative among the various kinds of virtual currencies, our article apply bitcoin to do the analysis and discussions.

1.3. Risks of Virtual Currency

- The rapid development of virtual currency also brings risks, which attract lots of attention. The virtual currency is the currency of the "network society" that imitate the methods of real currency, and is a computing unit used in the virtual world, not real money. Circulation of virtual currency may exposes risks on development of cyber economy and real currency.Virtual currency has a variety of risks, including security risk, liquidity risk, bankruptcy risk and credit risk, the risk of the issuer is mainly manifested in the following aspects: 1. Virtual currency is just a kind of agreement so far, if the issuer cannot meet the needs of the consumers' repurchase, it will generate liquidity risk. The bigger issuing scale of virtual currency, the bigger risk occurred, and business activities of the virtual network advancement speeding up unceasingly more has a tendency to amplify the risk. 2. As a member of the society, virtual currency issuers also bear the social responsibility. The issuer should keep the business secrets and guarantee consumers have right to know of virtual currency at same time. In practice, it is difficult to balance both aspect, because it is difficult to find a good standard to judge what information can be disclosed and what information should be protected. 3. For issuer, hidden trouble mainly from three aspects, namely external attack, the failures of the system itself, and the internal sabotage.The risks of the virtual currency owner are similar to those of the issuer, but mainly in:1. In the virtual economy, virtual currency holders set up a virtual account or use in the process of the virtual currency will leave their information, once the account stolen, the virtual currency of holders will be lost, because of many accounts are using anonymous way, the lost virtual currency is unable to report to get back, which means the corresponding loss of monetary value.2. Virtual currency is the product of virtual economy and information technology rapid development, the issuer is not only to face the risks from the system itself, but also facing the risk of the economy (Jiang Xuping, 2003).

1.4. Expectation on Virtual Currency

- The online games involve large-scale virtual economy, the form is very simple, but with the development of the network, a certain scale of virtual economy system and their own characteristics have been formed. However, virtual currency financial system has not yet formed, the amount of exchange between virtual currency and real currency is small, and do not have virtual financial institutions. With the development of the network, I believe the virtual financial system will be formed in the near future.Here we do a detailed analysis about the possible development direction of virtual currency financial system.1. It will appear virtual central bank, at present, the issue of virtual currency are very casual, network operators in order to pursue interests, according the user needs to issue, unlike the issue of legal tender that has a very strict specification. Every network operators are looked at this huge market, offering their own virtual currency, the virtual currency market is in the stage of fragmentation of a country by rivaling warlords so far. 2. It will appear virtual commercial banks, virtual financial institutions and virtual financial derivatives. The emergence of virtual central bank must bring a unified virtual currency, at present the two-way exchange between virtual currency and real money is still not fully open, also cannot borrow virtual currency. The emergence of virtual central bank can solve the two-way exchange between virtual currency and real money, and virtual commercial banks can be dedicated to the virtual currency borrowing.Furthermore, once the systematic crisis take place in the virtual financial system, the government can control the virtual central banks to solve it through the real central bank, if virtual financial system is too marketization and liberalization, causing the development of virtual economy faster than real economy, more systematic problems that are difficult to solve may come about (Li Yu, 2003.08).

2. Theory of Virtual Currency

- According to the monetary theory of Marx's economics, monetary function is the manifestation of monetary nature. Under the condition of the developed commodity economy, it has five basic functions, there are value scale, circulating medium, storage method, payment method, and the world monetary. Virtual currency development up to now, already have part of the function of traditional currency, although the degree cannot be compared with legal tender issued by a country. The analysis as follow.Monetary value measurement function, is to put the value of all goods are characterized by a certain amount. In the process of commodity exchange, when the monetary value measurement function to measure the value of other goods, make all sorts of commodity value are characterized by a certain amount of money, money became a commodity value of external performance. As well as real money, virtual currency is used as a value scale, it is just as the value of virtual goods.Circulating medium function means the function of currency as a medium of exchange. In the network, virtual currency has become a means of circulation, virtual currency can purchase virtual goods and services in the network, in online game can purchase equipment and weapons. Although there is no unified virtual currency, but virtual currency in the network as a medium of virtual goods exchange with considerable scale.Storage function means currency can initiative adjust the circulation of money. The user temporarily stored virtual currency is a very common phenomenon, in online game and online shopping, user cannot spend all the money at one time. But the effect of virtual money as a store is limited, Is much less than the real currency so persistent, this is because of the virtual currency financial system is not perfect enough as so far. Payment function, the currency as a separate value form make the unilateral movement (such as pay debts, pay taxes, payment of wages and rent, etc.). Credit behavior of virtual goods are rare, and we have not seen pay debts and wages with virtual currency so far. So, the virtual currency does not have payment function.World currency, the currency in the world market performs the function of universal equivalent, has the general purchasing power, and can be used as a general means of payment and as an international means of wealth transfer. The sphere of circulation of virtual currency is limit so far, cannot be a world currency, so virtual currency does not have this function (Du Zhenghua, 2009).

3. Model Presentation and Discussion

3.1. Mathematical Model

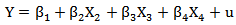

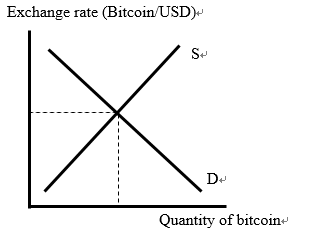

- From the economic theory, exchange rate of bitcoin is influence by many factors; here we discuss the important factors (quantity of supply, difficulty of mining, miner profit). So, I set exchange rate of bitcoin is Y, quantity of supply is X2, difficulty of mining is X3, miner profit is X4. I build multiple regression models for Y, X2, X3 and X4, I used data from Aug 2010 to Aug 2014, and I used SPSS to analysis the data.

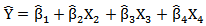

From the multiple regression models, I build estimate function

From the multiple regression models, I build estimate function According the output from SPSS, I get the OLS estimate function:

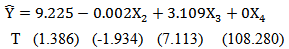

According the output from SPSS, I get the OLS estimate function:

DW=2.300, F=8387.177, P=0From the multiple regression analysis, get quantity of supply is negative trends for exchange rate of bitcoin, and difficulty of mining and miner profit are positive trends for exchange rate of bitcoin.

DW=2.300, F=8387.177, P=0From the multiple regression analysis, get quantity of supply is negative trends for exchange rate of bitcoin, and difficulty of mining and miner profit are positive trends for exchange rate of bitcoin.3.2. Economic Analysis

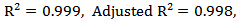

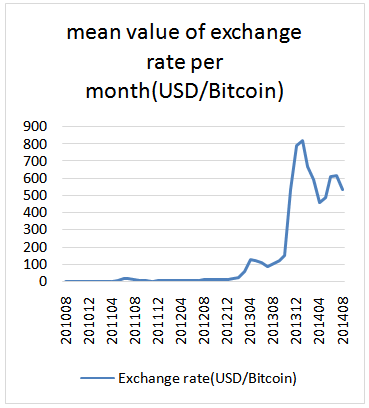

- The following figures are described the trend of exchange rate of bitcoin, the quantity of supply of bitcoin and the difficulty of mining, in order to the accuracy of the data, we use the mean value of them.From the figures we can see, exchange rate of bitcoin had a big increase from October 2013 to January 2014, then going down. There are both growth and decline for exchange rate of bitcoin. On the contrary, there is the tendency of slow decline for quantity of supply of bitcoin and there had a very fast increase for difficulty of mining from December 2013.The bitcoin appeared in 2009, and in 2013 began to be known and accepted, so the data since 2013 have obvious fluctuation. From figure 1 we can see there has a big increase from October 2013 to January 2014, but quantity of supply of bitcoin was decreased, this phenomenon is not in conformity with the principles of economics, in accordance with the principles of economics, supply and price are positively correlation, but here is a negative correlation. Cause of this phenomenon include the contents of two parts: one is the price of bitcoin is follow foreign price, another is a China leading global bitcoin price.The price of bitcoin increase in international market mainly because of the news of US government bankruptcy made people nervous. The main reason for Chinese bitcoin price increase follow the abroad is Chinese bitcoin market prices long-term to connect with the international market. Chinese long-term connect international market because the Chinese bitcoin’s trading market scale is too small, cannot build own standards, so China can only refer to foreign market price guide Chinese bitcoin price.Obvious the turning point of Chinese bitcoin’s market is in October 2013, after that the number of Chinese bitcoin miner began to rapid growth, then Chinese bitcoin industry has formed a relatively complete industrial chain, since then the Chinese bitcoin trading with its global market share has been growing.We can see in figure 1, from January 2014 the price of bitcoin fell, also the quantity of supply of bitcoin fell at same time, this conform to the principles of economics, the price and supply are positively correlation.

| Figure 1. Mean value of exchange rate per month |

| Figure 2. Mean value of supply of bitcoin per month |

| Figure 3. The normal exchange rate model |

3.3. Result

- We can get result from above are price for bitcoin has negative correlation with quantity of supply, has positive correlation with difficult degree of mining and has positive correlation with miner profit. That means, when quantity supply increase the price for bitcoin will decrease, this result accords with the situation, more and more people understand the bitcoin and join the mine, the annual production and total production increase, the price for bitcoin was down. Besides when difficult degree of mining increase, the price for bitcoin will increase then miner profit will increase, this explain why price for bitcoin has positive correlation with difficult degree of mining and miner profit. From the data we can see, bitcoin can conversion to USD and it is very valuable; the highest average exchange rate was 821 USD per unit bitcoin on Jan of 2014. We can see that the bitcoin is unlimited potential, and now there are some countries have admitted its status and value of the bitcoin, bitcoin as a virtual currency has already begun to affect our life, to enter into the real economy.

4. Conclusions

- Virtual currencies (also called crypto-currencies, virtual money, or digital cash), are essentially unique, typically encrypted, computer files that can be converted to or from a government-backed currency to purchase goods and services from merchants that accept virtual currencies. You can buy these virtual currencies online using a virtual “wallet” on your PC or smartphone and, in some states, at kiosks and stores. Virtual currency is accepted as currency by some businesses, exchanged for cash by others, and even purchased as an investment. In this article, we introduce the development of virtual currency at this stage, the categories of virtual currency and the relationship between virtual currency and real currency.We use Marx’s economics theory to compare the virtual currency and real currency, to explain the function of virtual currency. The real currency has five functions, monetary value measurement function, circulating medium function, storage function, payment function and world currency function. The virtual currency already has three of them, as a result of the limitation of internet development and policy virtual currency can’t carry out the payment function and be world currency. But with the development of internet, people pay more attention to virtual currency and governments around the world for the adjustment of the virtual currency policy. I think the virtual currency will development faster and better, and it will become the second currency in the world.After the theoretical analysis we establish the econometric model and economic model to analysis the relationship between virtual currency and real currency, and find out virtual currency will not affect the real economy at this stage. In the end of this article, the author combines the present stage development of virtual currency, predicts the good development prospects of virtual currency, include the development trend of virtual currency and virtual financial system in the future. I think virtual currency will rapid develop in the future, and it will push governments to establish the virtual financial system to manage the virtual currency and recognize the value of virtual currency also open the restrictions for virtual currency like Germany did, so there is more convenience for conversion between virtual currency and real currency, and virtual currency can perform more functions as real currency, like pay salary, pay tax and pay some fees. On the other hand, development associated with the risk. We image some risks for virtual currency and virtual financial system include the risks for issuer of virtual currency and holder of virtual currency. In order to prevent these risks we need governments to manage the virtual financial system and supervise the development of virtual currency, use real financial system to restrict the virtual financial system. Also, we analyzed the virtual financial system from the characteristics of virtual currency, and discussed the possible problem for real financial system when virtual financial system occur.Finally, there are some disadvantages in this article. First, there is no comprehensive analysis of existing literature content, because there are different analysis method for different authors. Second, since there are many different kinds of virtual currency and flexible in form, widely distributed, this article mainly use bitcoin as an example to establish the model and analysis, but cannot find many data to conduct a comprehensive analysis, most of them are theoretical model analysis, this is the insufficient of this article, also marks the future research direction.

ACKNOWLEDGEMENTS

- Li Yusen wishes to acknowledge all the contributors for developing and maintaining this template.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML