Hans Harischandra Tanuraharjo

Faculty of Economics & Business, Padjadjaran University, Bandung, Indonesia

Correspondence to: Hans Harischandra Tanuraharjo, Faculty of Economics & Business, Padjadjaran University, Bandung, Indonesia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

In the last decade (2002 - 2013) the contribution of minimarket sales experienced significant growth every year compared to supermarkets / hypermarkets and traditional stores. But the growth in the number of stores is not accompanied by an increase in the profitability of the business, thus causing the business performance of each minimarket decreased. The low business performance of minimarket network in Indonesia, presumably due to the weakness in designing the competitive strategy caused from the company’ management of minimarket network has not been able to effectively carry out the development of its distinctive capabilities and have not been able to examine and adapt the forces driving industry competition in Indonesia. The objectives of the study are to assess the influence of the forces driving industry competition and the distinctive capabilities on the competitive strategy and its implications on business performance of minimarket network in Indonesia. The methods used are descriptive and explanatory survey. The unit of analysis is minimarket network in Indonesia, which has a business brand with a special segmentation, target market, and positioning of its own with distribution outlets in various areas in Indonesia and a centralized management at headquarters and branch offices in various cities / districts or provinces in Indonesia as the representative of the headquarters. Time horizon is cross-sectional, where the study was conducted over a period of time simultaneously. Data were analyzed descriptively and quantitatively. Hypothesis testing use PLS model (Partial Least Square). The finding of research revealed that there were simultaneous effects of forces driving industry competition and distinctive capabilities on business performance through competitive strategy. However partially, the distinctive capabilities have dominant influences on the competitive strategy compared to the forces driving industry competition in affect the business performance of the minimarket network in Indonesia. Conclusions: the managements have not been able to adapt the forces driving industry competition and to develop distinctive capabilities, that caused the competitive strategy has not been right and its implication on the low business performance.

Keywords:

Forces Driving Industry Competition, Distinctive Capability, Competitive Strategy, Business Performance

Cite this paper: Hans Harischandra Tanuraharjo, The Effects of Forces Driving Industry Competition and Distinctive Capabilities on the Competitive Strategy and Its Implication on Business Performance of Minimarket Network in Indonesia, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 74-81. doi: 10.5923/c.economics.201501.05.

1. Introduction

1.1. Research Background

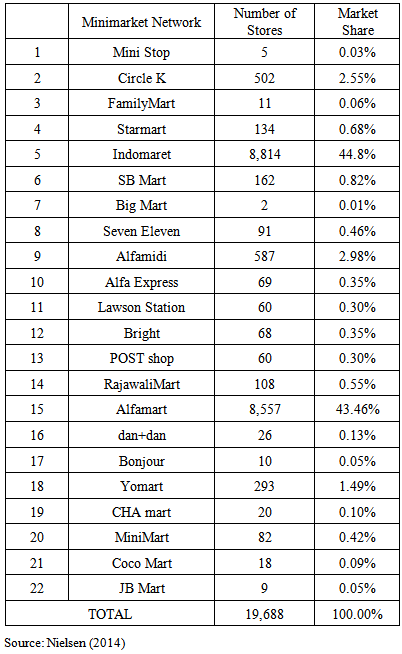

In the last decade (2002 – 2013) minimarket sales grows significantly each year compared to supermarkets/ hypermarkets and traditional stores. Inter-enterprise business competition of minimarket network in Indonesia is very tight which is dominated by two companies, namely Indomaret and Alfamart each with a market share above 43%. But the business performance per-store shop allegedly decreased with increasing the level of competition around the store. Growth in the number of stores is not accompanied by an increase in the profitability of the business, thus causing the business performance of each minimarket store decreased. According to Wheelen & Hunger (2012) business performance can be measured by sales, market share and profitability of the business.The opening of a new store that is increasing every year led to growth in market share. However, the level of competition negatively effect on sales, which an increase in operational costs such as the Minimum Wages Province / City / District, the cost of electricity, the cost of the rental shop / land, transport costs, licensing costs, and so on. This condition causes the level of business profitability per minimarket -stores was also decreased compared to previous years.The low business performance of minimarket network in Indonesia, allegedly because the management of minimarket network has limitations in designing Competitive Strategy. According to Barney (2010), Competitive Strategy can be formed through a differentiation strategy, cost leadership strategy and the strategy of speed. Based on preliminary observations, it is revealed that the competitive strategy that has been implemented by the company is still not completely right. This is indicated by the lack ability of the company in creating a cost leadership, differentiation, and speed of the company in adapting market demands and competitive conditions.The weakness in designing competitive strategy allegedly caused by the minimarket network company is still difficult to be able to precisely monitor and adapt the forces driving industry competition. According to Hunger (2012: 111-114) the concept of the power industry competition consists of several forces, namely the threat of new entrants, competition among players in the industry, threat of substitute products or services / substitutes, the bargaining power of buyers, bargaining power of suppliers, and the relative strength of other stakeholders.The companies of minimarket network are often too late and not optimal in anticipating the strengths of new players. The companies also have not been able to meet the customer expectations effectively. Nowadays the customers are becoming smart shoppers and value seekers. In the other side, the retailers and suppliers have no win-win solutions yet, e.g.: in trading terms, private labels, promotional discount, distribution cost, etc. Along with the changes in the industrial environment, the companies is still not able to anticipate the fast growth of the product / service substitution as specialty stores, e-retailing and the growth of the informal sector (small-micro entrepreneurs). In addition, minimarket network companies are still trying to compete with their main existing competitors tightend that continues to expand their stores network with various of marketing programs and activities. In addition to the five forces of competition problems in the industry, the company turns face huge problems in terms of government regulation. The management should have to always adapt the permitting process and keep a close watch and deal with government regulations. The management must be prepared to adapt all the provisions of the formal and non-formal coordination with the local government (various related agencies) effectively in the permitting process associated with the opening of the minimarket. In the permitting process is usually required high coordination costs and its value can not determined with certainty.In addition to the phenomenon of forces driving industry competition issues mentioned above, it turns out that the minimarket network management companies until now have not been able to effectively perform resource development (distinctive capabilities). According to Pearce and Robinson (2011), possession of adequate resources - in terms of tangible resources, intangible resources and organizational capabilities - is an important element in improving the performance of the company. Along with the increased competition of retail business, as well as an increase in labor turnover. With the opening of more and more new minimarket and various other retail business formats, bring a positive influence to the career development of employees, especially professionals in the retail business. There are many aggressive job advertisements in print, electronic, job fairs, internet and executive search schemes that offer better remuneration in retail business enterprises that are expansive. Minimarket Company faces the problem of how the retaining effective programs so that the key-work people do not move to another company. Therefore based on the above statements, it is important to study about the forces driving industry competition and the distinctive capabilities and its influence on the competitive strategy and its implications in improving business performance of minimarket in Indonesia.

1.2. Literature Review

Wheelen & Hunger (2012: 110) “Michael Porter, an authority on competitive strategy, contends that a corporation is most concerned with the intensity of competition within its industry. The level of this intensity is determined by basic competitive forces. “The collective strength of these forces, he contends: determines the ultimate profit potential in the industry, where profit potential is measured in terms of long-run return on invested capital. In carefully scanning its industry, a corporation must assess the importance to its success of each success of six forces: threat of new entrants’ rivalry among existing firms, threat of substitute products or services, bargaining power of buyers, bargaining power of suppliers, and relative power of other stakeholders”. David (2013:105) “According to Porter, the nature of competitiveness in a given industry can be viewed as a composite of five force:1. Rivalry among competing firm2. Potential entry of new competitors3. Potential development of substitutes products4. Bargaining power of suppliers5. Bargaining power of consumersWheelen & Hunger (2012;138) “Capabilities refer to corporation ability to exploit its resources. A Competency is a cross-functional integration and coordination of capabilities”. Distinctive competencies: when core competencies are superior to those of the competition Resources are an organization’s assets and are thus the basic building block of organization. They include tangible assets, such as its plant, equipment, finances, and location, human assets, in terms of the number of employees, their skill and motivation, and intangible assets, such as its technology (patents and copyrights) culture and reputation”.According to Collins & Montgomery (2005) classifies the company's resources into three groups, namely: tangible assets, intangible assets and capabilities of the organization. Pearce & Robinson (2011) suggests that there are three basic resources required by an enterprise, namely tangible assets, intangible assets and organizational capabilities. Barry Berman (2011) on Competing in Though Times which is a business lessons from a variety of world-class retail company in the United States, has further developed the theory of Porter's Competitive Strategy, namely: Cost-Based Strategy, Differentiation-Based Strategy and Value-Based Strategy. Pearce and Robinson (2011: 215) argue that competitive strategy is an effort for the creation of a sustainable competitive advantage through cost leadership and product uniqueness.According to Wheelen & Hunger (2012: 332) business performance can be measured by sales, market share and profitability. Meanwhile, according to Best (2009: 66), business performance is the output or result of the implementation of all activities related to business activities, business performance indicator is the growth in sales and profitability. Hubbard and Beamish (2011: 140) argued that an indicator of business performance can be seen from the aspect of marketing and through the company's financial performance. Measurement of business performance through marketing performance can be measured such as by sales, market growth, and market share. Perspective of financial performance is measured by using: (1) return on investment (ROI), (2) the mix of income (revenue mix), (3) the utilization of assets (measured by asset turnover), and (4) reduced costs significantly.

1.3. Research Objectives

To obtain the results of a study on the influence of the forces driving industry competition and the distinctive capabilities on competitive strategy and its implications on business performance of minimarket network in Indonesia.

2. Research Methods

2.1. Methods Used

The methods used in this paper were descriptive and explanatory survey. The objective of descriptive survey was to acquire an overview of the characteristics of each variable, while on the explanatory survey, bassically was used to test the truth of a hypothesis that has been conducted through data collection in the field.The unit of analysis in this study is minimarket network in Indonesia, which has a business brand with a special segmentation, targeting and positioning in its own market with distribution of outlets in various regions in Indonesia with centralized management at headquarters and branch offices in various cities / countries or provinces in Indonesia as the representative of the head-office. Time horizon in this research is a cross section / one shoot. Cross section/one shoot. A cross section/one shoot in which one sample of respondent is drwan from the target population and information is obtained from this sample once. Malhotra (2010: 108).

2.2. Sampling Techniques

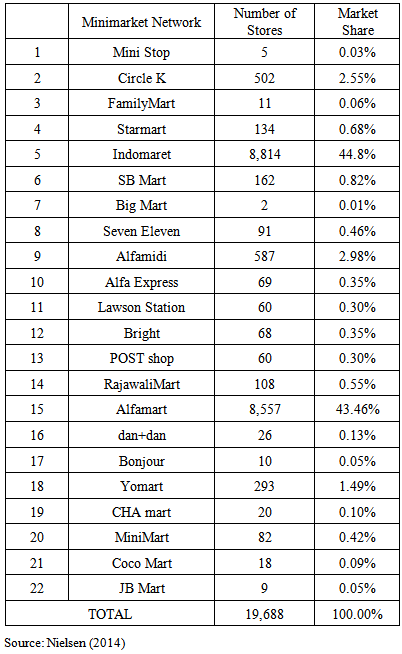

The population in this study was a composite of all elements of minimarket’s network company in Indonesia which has the same set of characteristics. Small population had cause the used of census technique for this research. Census, itself, is an examination that involved whole population members to be examined (Zikmund et.all, 2010: 387).There are two conditions that are appropriate for census study, first, it is feasible when the population is small; second, it is necessary to be done when the elements are quite different from each other (Donald et.all, 2011:365).Thus with the small population mentioned above, sample used for this research is a whole population number, which is 22 companies involved in minimarket network.Table 1. Companies of Minimarket Network in Indonesia (2013)

|

| |

|

2.3. Hypothesis Testing Design

The analysis design using PLS (Partial least Square) which indicates that the forces driving competition and distinctive capabilities can improve business performance through competitive strategy as well, can be seen on the component-based structural equation models or variants (PLS). PLS has several advantages and one of it is will provide a solution even when problem exist that may prevent a solution in SEM. PLS also readily handles both formative and reflective constructs and insensitive to sample size consideration. (Hair, et al 2010:776).

3. Discussion

This section will discuss the results of the verification study through hypothesis testing using Partial Least Square (PLS). Prior to the discussion, it will first be analyzed test results of suitability models. In PLS, the model estimates the evaluation is done through the analysis of the Inner and Outer models.Model EvaluationMeasurement Model Evaluation (Outer Model)

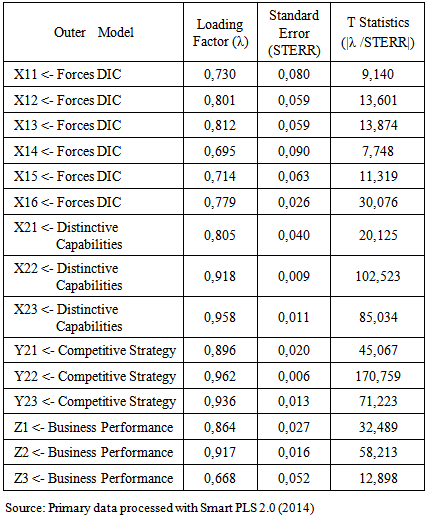

3.1. Validity Test

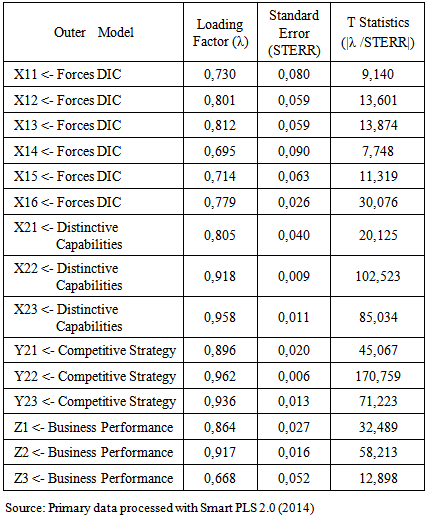

An indicator is valid if it has a factor loading above 0.5 on the intended constructs. Smart PLS output for the loading factor gives the following results:Table 2. Loading Factor

|

| |

|

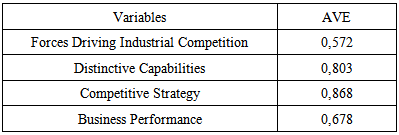

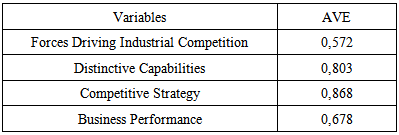

The table above shows that the loading factor value above the recommended value that is equal to 0.5. Smallest value is equal to 0.601 for the indicator Y15. Meaningful indicators used in this study are valid or has met the convergent validity. Another method is by the discriminant validity that is to look at the value of the square root of average variance extracted (AVE). The recommended value is above 0.5. Table 3. Average Variance Extracted (AVE)

|

| |

|

The above table gives the value AVE above 0.5 for all constructs contained in the research model.

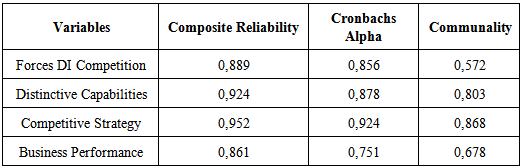

3.2. Reliability Test

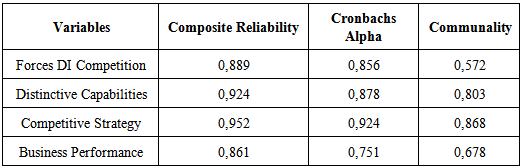

Reliability analysis aims to obtain reliable latent variables. In testing the reliability of the PLS model can use the composite reliability. Reliability Test can also be strengthened by Cronbach's Alpha. (Suggested value is above 0.6) and Communality (> 0.5). The results show the value of reliability to be satisfactory if above 0.7. Here are the composite reliability values at the output:Table 4. Reliability

|

| |

|

From the table above it is known that for all variables Cronbachs Alpha> 0.7, as well as the value of the Composite Reliability> 0.7. Similarly, in all constructs communality values above 0.5 which strengthens the results of the test, meaning that the four variables measurement model has the consistency and accuracy in measuring the construct.

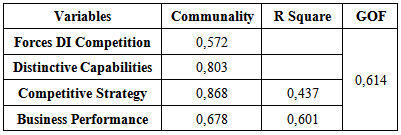

3.3. Structural Model Evaluation (Inner Model)

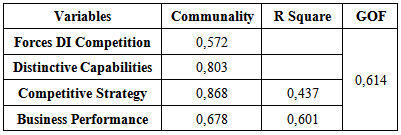

After the model is estimated to meet the criteria of the Outer Model, subsequent testing of structural models (Inner models). Here is the R-square value in the construct: Structural Model in PLS was evaluated using Goodness of Fit model, which shows the difference between the observed values and the values predicted by the model. The following table shows the value of R2 and the GOF of the research model:Table 5. Structural Model Testing (Inner Model)

|

| |

|

R-squared Test (R2) aims to determine how well the inner workings of the model (structural model) are formed. Ghozali (2011: 27) stated that if the R2 value of 0.67 (good), 0.33 (moderate) and 0.19 (weak) for the endogenous latent variables in the inner models. This study has a value of R-squared (R2) = 0.613. This shows that this research has a good inner model, as well as the GoF value of 0.614 so it can be concluded that the research model is supported by empirical conditions or model fit.The influence of forces driving industry competition and the distinctive capabilities on business performance through competitive strategy revealed in the following figure: | Figure 1. Diagram of Hypothesis Path |

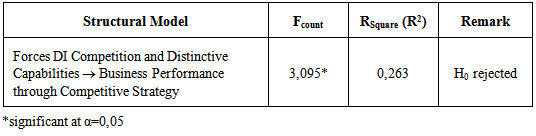

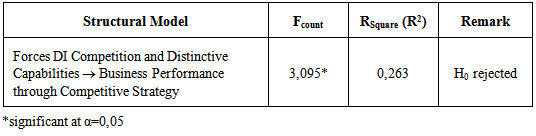

The result of hypothesis testing show below. Table 6. Simultaneous Hypothesis Test Results

|

| |

|

The test results in the above table simultaneously ataobtained F value is greater than the F-table (2.975), so that it can be concluded that there is a simultaneous effect of forces driving industry competition and the distinctive capabilities on business performance through competitive strategy where the influence of a total of 26.3% with effect another factor is 73.7%. From the measurement results, it is seen that the dimensions of the Power of Suppliers is the most valid dimension reflects the strength of competition in the industry, followed by the dimensions of the power of the customer, then the dimensions of the regulatory power of the government, the power of newcomers dimension, the dimension of the strength of competitors, and the dimensions of the power of substitution products. Dimensions of organizational capability is the most valid dimension in reflecting Distinctive capabilities followed by the dimensions of intangible assets, and tangible assets. Whilst competing strategy for latent variables, dimensions Differentiation Based Strategy is the most dominant dimension in reflecting competitive strategy variables, followed by the dimensions of Value-Based Strategy, next dimension Cost-Based Strategy. As for the variable performance of the business, profitability dimension is the dimension that most reflect business performance, followed by sales volume and market share.The findings of the above study revealed that the distinctive capabilities within the minimarket network company has a dominant influence when compared with the effect of the forces driving industry competition in improving business performance through competitive strategy. The dimensions that contribute most in reflecting the distinctive capabilities is the organizational capability in the form of management’s capabilities in conducting organizational development, the ability of the company in the development of its employees career, and the ability of the company in the development of corporate culture. While the dimensions that give the highest contribution to reflect competitive forces is the power of supplier in the form of: the ability of management to adapt the bargaining power of suppliers, the company control over the distribution of products from suppliers, and corporate control of the purchase price of the product from the supplier. From this situation, the management is necessary to increase the contribution of distinctive capabilities to the achievement of business performance. To make it happen, then step of operational strategy priority is to increase organizational capabilities that include: management’s capabilities in conducting organizational development management’s capabilities to develop its employee’s career, and the ability of the company in the development of corporate culture. In promoting the development of intangible assets, then it would need to improve the management’s ability to maintain the company's reputation, creating excellence customer service, and adapting the use of technology systems. Furthermore, the management needs to make distinctive capabilities in terms of tangible assets in the form of an increased ability to obtain strategic store locations, the ability to provide the appearance of adequate facilities and equipment, as well as the ability to provide competent employees. This was done to improve visitors so as to improve their business performance. Furthermore, the management needs to improve in terms of adapting the power suppliers. This was done because the supplier plays an important role for the company's business operations and related to the goods and services produced to achieve high competitiveness and attract visitors. For those reasons, the management of the minimarket needs to improve in terms of: adapting the bargaining power of the Supplier Company, corporate control over the distribution of products from suppliers, and corporate control of the purchase price of products from suppliers.The result of this study supports Mirza Hassan Hosseini; Shakhsian, Fatemeh; Moezzi, Hamed; Seyed Mohammad Sadeq Khaksa (2012) on “Top Management's Role In Coordinating Human Resources With Corporate Strategy” which revealed that in order for an airline to be successful in the strategy and maintain the highest standards, is to invest in the people who would implement such a strategy.The result of this study also supports Eva M. Pertusa-Ortega, Jose´ F. Molina-Azorı´n and Enrique Claver-Corte´s (2010) on “Competitive strategy, structure and firm performance: A comparison of the resource-based view and the contingency approach” that studied the link between competitive strategy, structure, and firm performance. The company's competitive strategy should be supported by the resources and capabilities available to the organization. Many studies claim that successful strategies must be based on the organization’s main distinctive capabilities and skills in order to achieve sustainable competitive advantage (Prahalad and Hamel, 1990; Snow and Hrebiniak, 1980) (p1284).

4. Conclusions

The management of minimarket’s network company in Indonesia, has not been able to better adapt the forces driving industry competition and develop the distinctive capabilities in designing appropriate competitive strategy for improving business performance of minimarket netwok in Indonesia. The abilities to develop the distinctive capabilities have a dominant role compared to the adaptability of forces driving industry competition in designing competitive strategies to improve business performance. The weaknesses of distinctive capabilities caused the capability in adapting the indutrial competitive forces was not optimal. Synergy between the industrial competitive forces and the distinctive capabilities result in a significant contribution on business performance through competitive strategy. Based on the research findings, it is recommended some practical and academic advices as follows :

4.1. Practical Recommendations

a) How to improve the distinctive capabilities of minimarket Network Company is a very important aspect to be considered in the management of the partnership strategy. The management should consider some important points as follows: 1) Upgrading the company’s adaptability: i. in the development of corporate culture,ii. in the development of the organization, iii. in the career development of employees, 2) Enhancing the company's ability:i. to provide competent employees, ii. to create excellent customer service, iii. to optimize the use of systems and technology, iv. to obtain prime store locations, v. to upgrade the appearances of store outlook and ambience with adequate facilities and equipment, vi. to maintain the company’s reputationb) Development of adapting the forces driving industry competition can be considered in improving sustainable business performance through a appropriate competitive strategy. Some of the recommendations related to all aspects that need to be implemented by the management company in efforts to win the competition are as follows: 1) Improving the management capabilities: i. in adapting the company's bargaining position of suppliers, ii. in conducting the logistics management (the supply of goods from suppliers and the distribution of goods to the stores), iii. to control the cost price from suppliers and the pricing tactics, 2) Improving the management capabilities: i. to understand the needs and expectations of customers ii. to meet customer needs and expectations 3) Improving the management capabilities:i. in facing the power of government regulations in the industry, ii. in dealing with the power of government officials associated with the regulation in the industry iii. in dealing with the power of coordination costs in accelerating of the process of licenses, 4) Improving the management capabilities: i. to adapt and to face the new players,ii. to compete all promotional programms and activities of the new players, 5) Improving the management capabilities: i. to adapt and to face existing competitors, ii. to compete all promotional programms and activities of the existing competitors, 6) Improving the management capabilities:i. to adapt and to face any substitution retailers in the retailing industry, ii. to compete all promotional programms and activities of any substitution retailers in the retailing industry.

4.2. Recommendations for Academic

Based on the findings in this paper, is expected to be a reference for academics in conducting research development, where these findings are as part of the premise in developing framework. In the future be expected there are academician who are interested in doing research on minimarket network with different viewpoints as well as specificity in the field of marketing management.

References

| [1] | Barry Berman & Joel R. Evans, “Retail Management: A Strategic Approach”, 12th Ed., Prentice Hall: Upper Saddle River, New Jersey, 2013. |

| [2] | Donald R. Cooper, Pamela S. Schindler, Business Research Methods (p.365), 2011. |

| [3] | D. J. Collins, C. A Montgomery, “Corporate Strategy: A Resources-Based Approach”, Boston: McGraw Hill Companies, Inc, 2005. |

| [4] | Fred R. David, “Strategic Management, Concepts & Cases”. Pearson Education Limited, England, 2013. |

| [5] | Graham Hubbard, and Paul Beamish, “Strategic Management: thinking, analysis, action, Frechs Fores”, N.S.W: Pearson Australia, 2011. |

| [6] | Hair, Joseph F., William C. Black, Barry J. Babin, Rolph E. Anderson. "Multivariate Data Analysis" 2010. |

| [7] | Hosseini, Mirza Hassan; Shakhsian, Fatemeh; Moezzi, Hamed, “Top Management's Role in Coordinating Human Resources with Corporate Strategy”, International Journal of Business and Social Science Vol. 2 No. 12, 2011. |

| [8] | J.A. Pearce, R.B. Robinson, “Strategic Management – Formulating, Implementation and Control”, 12th Edition, McGraw Hill International Edition, 2011. |

| [9] | Jay B. Barney, “Gaining and Sustaining Competitive Advantage”. 4th Edition, Prentice Hall. New York, 2010. |

| [10] | Naresh K. Malhotra, Marketing Research: “An Applied Orientation International Edition”. Pearson Education, Inc, New Jersey: 2010. |

| [11] | Pertusa-Ortega, Eva M. ; Molina-Azorı´n, Jose´ F.; and Claver-Corte´s, Enrique , Competitive strategy, structure and firm performance A comparison of the resource-based view and the contingency approach, Management Decision Vol. 48 No. 8, pp. 1282-1303 q Emerald Group Publishing Limited , 2010. |

| [12] | Roger J. Best, “Market-Based Management: Strategies For Growing Customer Value and Profitability”. 3rd Edition. Prentice Hall: Upper Saddle R New Jersey, 2009. |

| [13] | Thomas L. Wheelen, J. David. Hunger, “Strategic Management and Business Policy: Concepts”. 13th Edition, Pearson/Prentice Hall, 2012. |

| [14] | Zikmund G. William., Babin. Barry J., Carr. Jon C., Griffin Mitch. “Business Research Methods.” 8th Edition. South-Western, 2010. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML