Irni Yunita1, 2

1Padjadjaran University

2Telkom University

Correspondence to: Irni Yunita, Padjadjaran University.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

Shariah financial products is currently developing in Indonesia, one of them is Sukuk which is the instrument of long-term securities letter based on the Islamic principles given by the issuer to the holders of Islamic bonds. The objective of these study is to describe about sukuk and the development in Indonesia using descriptive analysis methode. Sukuk instruments that have been widely traded in Indonesia until now are sukuk Ijarah and Mudharabah. The difference between the two lies in the distribution of rewards in the form of fees for Sukuk Ijarah and principles of dividing the results to Sukuk Mudharabah. There are risks embedded in sukuk instruments such as systematic risk and idiosyncratic risk. These risks are associated with the type and schemes of various sukuk. Currently, the reasonable price reasonable assessment of sukuk is still using valuation models such as the assessment of conventional bonds. This concept is the basis for the authors in conducting further research on the design process forreasonable pricing model Sukuk Ijarah and Mudharabah.

Keywords:

Sukuk ijarah, Sukuk mudharabah, Risk, Scheme, Fair value of sukuk

Cite this paper: Irni Yunita, The Development, Scheme, Risk and Fair Market Value Model of Sukuk Ijarah and Mudharabah in Indonesia, American Journal of Economics, Vol. 5 No. 2, 2015, pp. 56-63. doi: 10.5923/c.economics.201501.03.

1. Introduction

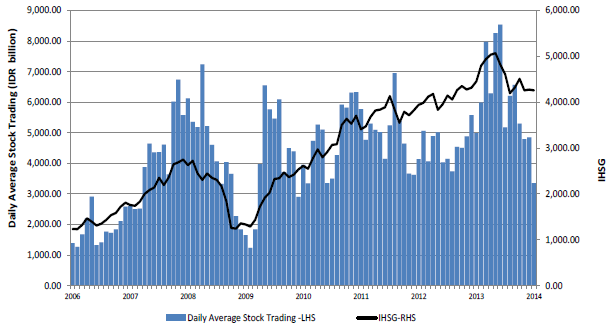

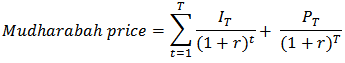

The Development of Capital Markets, Conventional Bonds and Sukuk in IndonesiaCapital Market is the market for various long-term financial instruments that can be traded, such as debt (bond), equities (stock), mutual funds, derivative instrument and other instruments. According to the Capital Market Law No. 8, 1995, the capital market is defined as an activity concerned with the Public Offering and Securities Trading, Public Company relating to the Securities it produces, as well as institutions and professions related to Securities. The capital market is a means of financing for companies and other institutions (eg, government), and as a means for investing activities. Thus, capital market provides facilities and infrastructures for various trading activities and other related activities. Financial instruments that are traded in a capital market are long term instruments (over a period of 1 year) such as stocks, bonds, warrants, rights, mutual funds, and various derivative instruments such as options, futures, and others [1]. The development of capital markets in Indonesia has increased. It is characterized by the rising of the Composite Index from year to year and the average daily trading on the Indonesia Stock Exchange is shown in figure 1. | Figure 1. IHSG Movement and Daily Average Stock Trading Januari 2006 – 3 Januari 2014. Sumber: Capital Market Statistic, Otoritas Jasa keuangan, 2014 |

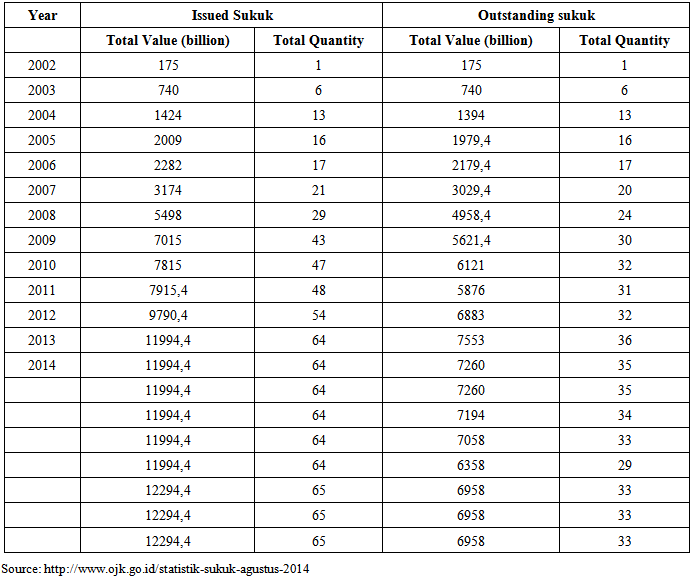

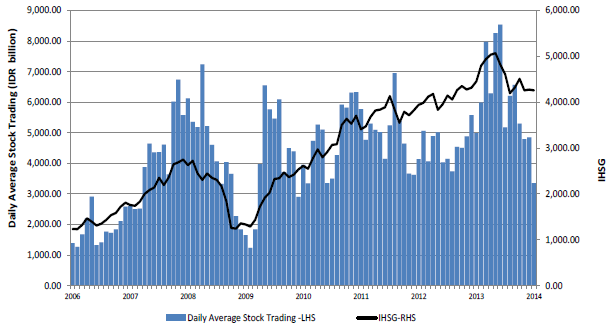

One of the financial instruments that have been developing at the moment is Bond. Bond is one of the financial instruments in the form of long-term debt instruments published by the company with the purpose of getting funds. According to [2], bonds are securities that are favored because the publishing cost is less expensive compared to issue shares, besides it also has taxshield effect for the company. The development of bond products in Indonesia is increasing every year. This can be seen in Table 1. | Table 1. Bond’s Trading in Indonesia Stock Market |

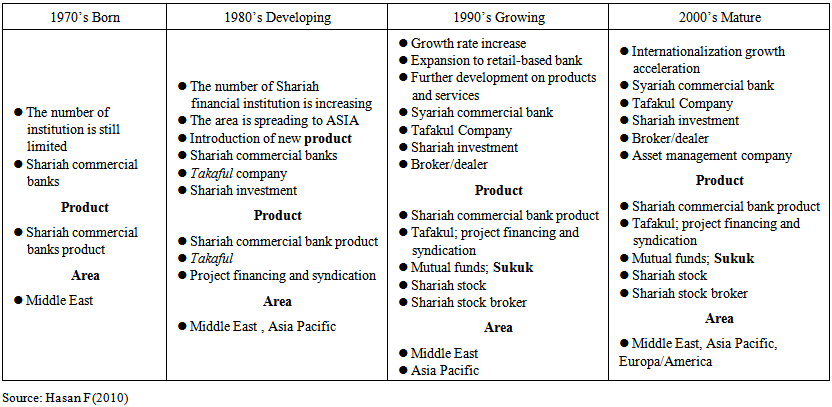

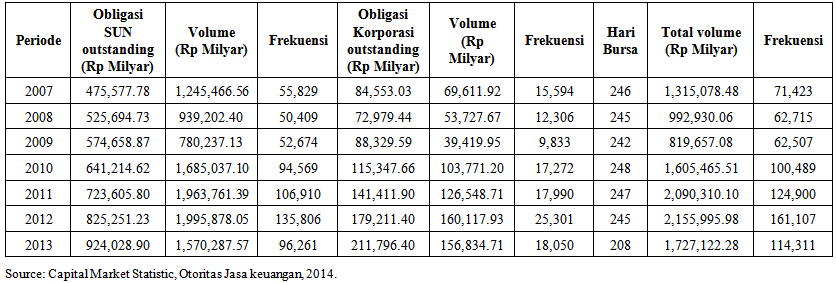

Table 1 shows that the development of capitalization bonds of both government and corporate bonds has increased. This shows the increasing interest of the issuer to issue bonds as an alternative companies financing as well as the increasing number of investors that are interested in buying the securities bond seen from the increasing frequency of transactions in the Indonesia Stock Exchange on such securities.In Indonesia there are various forms of bonds, including bonds issued by the government, known as Government Securities (SUN), corporate bonds, as well as Shariah bonds (sukuk), which is one of the Islamic financial market products.Currently the development of the Islamic financial market has increased. It is marked by the increasing variety of Islamic financial instruments in both the financial institutions and capital markets. The evolution of the Islamic financial market can be seen in Table 2. | Table 2. The Evolution of Syaria Financial Market |

One of the Islamic financial products is currently being developed and introduced in the Indonesian capital market. It is bond shariah (sukuk). Sukuk is derived from the Arabic, which is , the plural from of

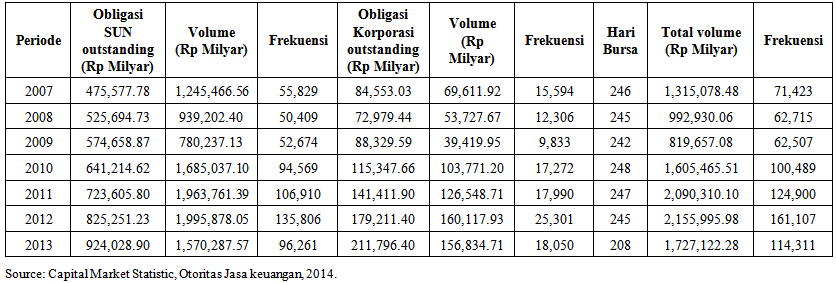

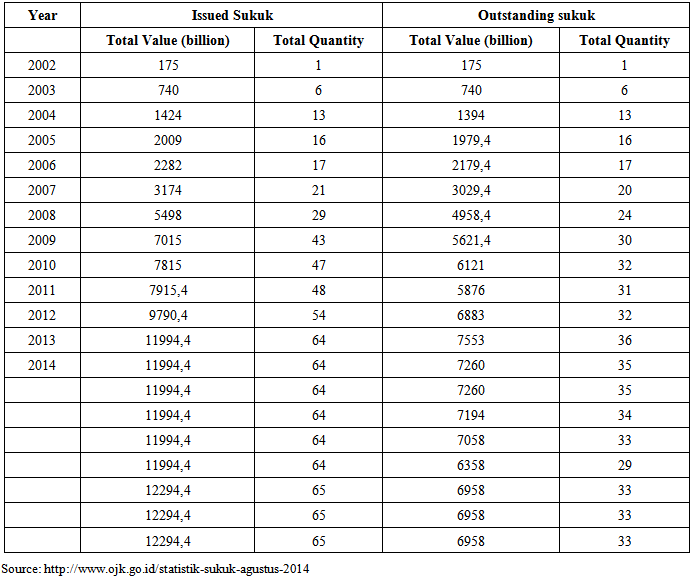

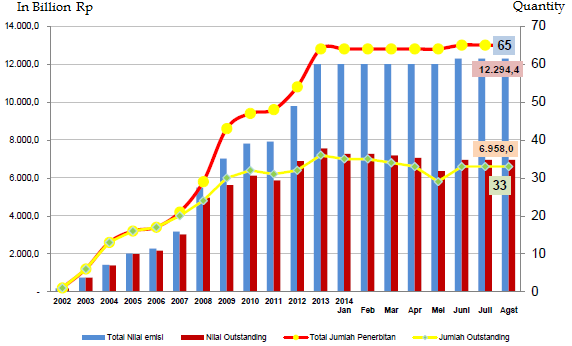

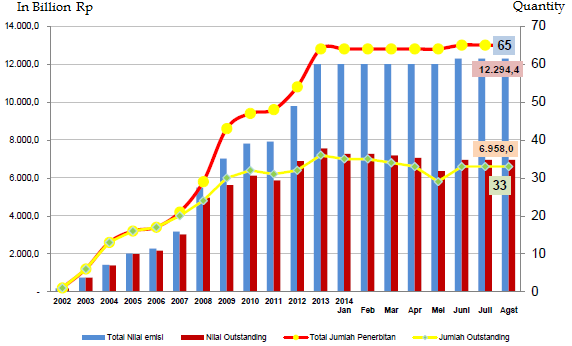

, the plural from of  is an Arabic term that can be interpreted as certificate [3]. From Figure 1.2, sukuk began to develop in 1990s in Middle East and Asia Pacific. But in Indonesia, sukuk began developing in 2002.According to [4], "Shariah Bond is a long-term securities based on the Shariah principles that is given by the Issuer to the holders of Shariah bond that obligates the issuer to pay income to the holders of Shariah bond form results / margins / fees, as well as to pay back the bond fund at due". In issuing sukuk, several requirements must be met, ie the main activity (core business) are halal, and not in contrast to the substance of the National Shariah Council Law.In Indonesia, the legal protection on which the sukuk issuance is based in Law No. 19 of 2008 on Islamic securities. Based on the development, the search for the legal basis form of the legal protection about shariah securities had a long process, ie since 2003 when the National Islamic Council of Indonesian Ulama Council voiced sukuk issuance to capture investment opportunities as well as the economic development of shariah in Indonesia. In 2005, National Islamic Council of Indonesian Ulama Council proposed that the government immediately issued a law on Islamic securities, the act has been a success by the issuance of Law No. 19 of 2008.The Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI) defines sukuk as certificates of equal value that functions asnon-distributed evidence of ownership of an asset, the right to benefits and services, or ownership of a particular project or investment activities. Issuance of investment instruments can be seen as a new innovation in the Islamic finance as one of the answers to the prohibition of usury, and selling in Islam is permitted (Surah Albaqarah: 275) [5].The development of sukuk issuance in Indonesia is increasing even more. This is shown in Figure 3. While the amount of the total value and number of sukuk emission and sukuk outstanding can be seen in Table 3.

is an Arabic term that can be interpreted as certificate [3]. From Figure 1.2, sukuk began to develop in 1990s in Middle East and Asia Pacific. But in Indonesia, sukuk began developing in 2002.According to [4], "Shariah Bond is a long-term securities based on the Shariah principles that is given by the Issuer to the holders of Shariah bond that obligates the issuer to pay income to the holders of Shariah bond form results / margins / fees, as well as to pay back the bond fund at due". In issuing sukuk, several requirements must be met, ie the main activity (core business) are halal, and not in contrast to the substance of the National Shariah Council Law.In Indonesia, the legal protection on which the sukuk issuance is based in Law No. 19 of 2008 on Islamic securities. Based on the development, the search for the legal basis form of the legal protection about shariah securities had a long process, ie since 2003 when the National Islamic Council of Indonesian Ulama Council voiced sukuk issuance to capture investment opportunities as well as the economic development of shariah in Indonesia. In 2005, National Islamic Council of Indonesian Ulama Council proposed that the government immediately issued a law on Islamic securities, the act has been a success by the issuance of Law No. 19 of 2008.The Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI) defines sukuk as certificates of equal value that functions asnon-distributed evidence of ownership of an asset, the right to benefits and services, or ownership of a particular project or investment activities. Issuance of investment instruments can be seen as a new innovation in the Islamic finance as one of the answers to the prohibition of usury, and selling in Islam is permitted (Surah Albaqarah: 275) [5].The development of sukuk issuance in Indonesia is increasing even more. This is shown in Figure 3. While the amount of the total value and number of sukuk emission and sukuk outstanding can be seen in Table 3.Table 3. Total Value, Issuance of Sukuk and Sukuk Outstanding

|

| |

|

| Figure 3. The Issuance Development of Sukuk in Indonesia. Source: http://www.ojk.go.id/statistik-sukuk-agustus-2014 |

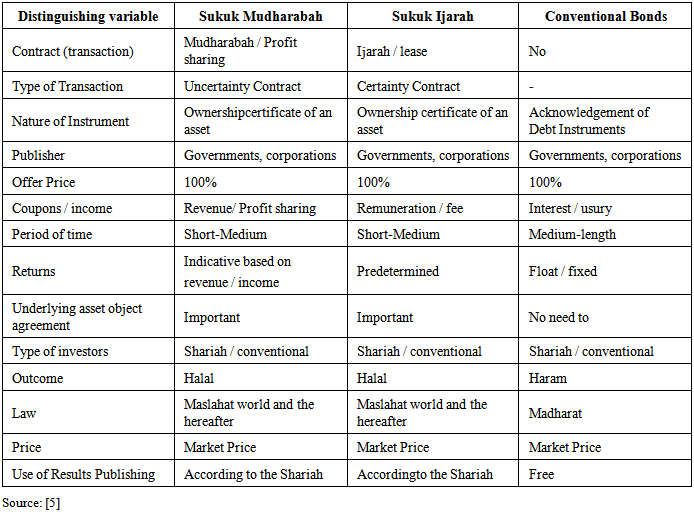

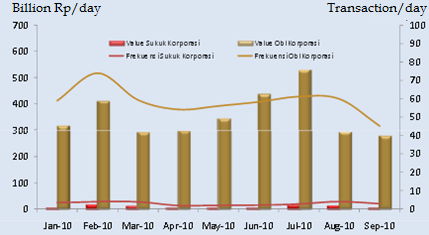

2. The Trading of Sukuk in Secondary Market, Indonesia Stock Exchange

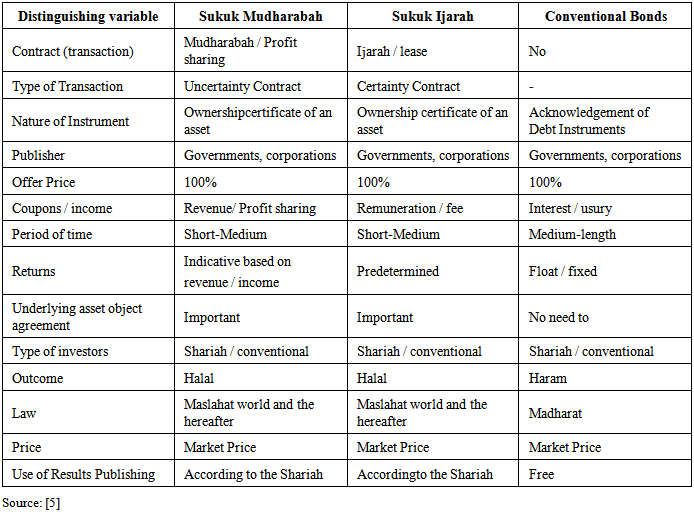

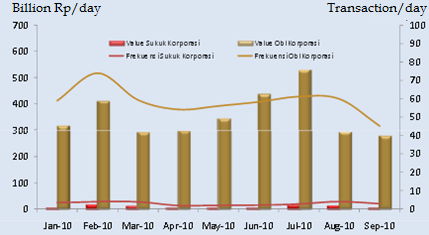

Table 4 shows that the development of sukuk in Indonesia is increasing as indicated by the increasing number of sukuk issuance. This condition is different from the development of the volume and frequency of transactions in the secondary market trading of sukuk as total of sukuk traded by investors in the capital market is decreasing. An example is the transaction of corporate sukuk in Indonesia in 2010 which is shown in Figure 4.Table 4. The Differences between Sukuk Mudharabah, Ijarah Sukuk, and Conventional Bond

|

| |

|

| Figure 4. The Trading Transaction of Corporate Sukuk. Source: PLTE, Hasan F (2010) |

According to [6], the value of corporate sukuk trading in the secondary market is very small compared to corporate bonds which is: Rp.8 4 billion/day vs. Rp353,1 billion/day. Corporate sukukis traded only 3 times/day compared to the corporate bonds which is 58 times/day.Based on the results of [7], there are several factors that influence it, the factors are: first, the limited issuance of corporate sukuk in Indonesia, either from the aspect of the amount, tenor and type of contract variations. Secondly, the investor has a lack of understanding about the corporate sukuk trading in the secondary market. Thirdly, the issuance of corporate sukukis offered non-retail to the society but limited to the institution investor or individual with relatively big nominal value, although some existed regulations have facilitated enough to serve as a cornerstone in the corporate sukuk publishing retail. Fourth, the majority of sukuk investor characters are local institutional investors such as Insurance Companies, Pension Funds and structured mutual funds that have a tendency in buying to be kept until due time. (hold to maturity).

3. The Differences between Sukuk and Conventional Bonds

Sukuk can be issued by using the principle of Mudharabah, Musharaka, Ijarah,Istisna", Salam, and Murabaha. But among the principles of these bonds the most widely used is sukuk with the instruments of Mudharabah principles and Ijarah [8].According to [9], Shariah Mudharabah Bond is the Islamic bonds, which use Mudharabah and also in line with the substance of the National Islamic Council Fatwa Indonesian Ulama Council 7/DSN-MUI/IV /2002 on the Mudharabah financing. In other words, the term Mudharabah Islamic bonds contract is defined as the issuance of a letter of cooperation to run a business based on the principle of profit sharing (profit and loss sharing). The ratio of revenue sharing (ratio) can be determined based on the components of income (revenue sharing) or gain (profit sharing). Ratio can be determined as constant, increased or decreased by taking into account the earnings, but has been set at the beginning of the contract [3].Sukuk Ijarah is an Islamic bond using Ijarah contract. Ijarah is a contract to use the benefits of a good or service with a reward. This means that the lessor would entitle the other party to use the objects, but the tenant has the obligation to provide compensation in accordance with the agreement. In Ijarah contract basically there is a transfer of temporary benefits, but without any transfer of ownership. Regulation of Sukuk Ijarah is contained in Fatwa Indonesian Ulama Council No. 41/DSN-MUI/III/2004 about the special regulation of Islamic bonds [3]. There is a basic difference among sukuk with conventional bonds. The difference lies in the determination of interest on the amount of conventional bonds specified in the initial transaction. While sukuk use the concept of reward and profit sharing instead of interest, the existence of a transaction support in the form of a certain number of assets on which the sukuk issuance, and any contract or agreement between the parties which is based on the principles of shariah [5]. The difference between Mudharabah sukuk, ijarasukuk, and conventional bond can be seen in Table 4.Issuance of sukuk investment instruments can be seen as a new innovation in the Islamic finance and one of the answers to the prohibition of usury, and that trading is permitted in Islam (Qur'an. Albaqarah: 275). Sukuk is not a debt instrument with interest (usury), like the bond commonly known as conventional finance, but as an investment instrument. Sukuk isued by an underlying assets Islamic principles that are obvious [5].

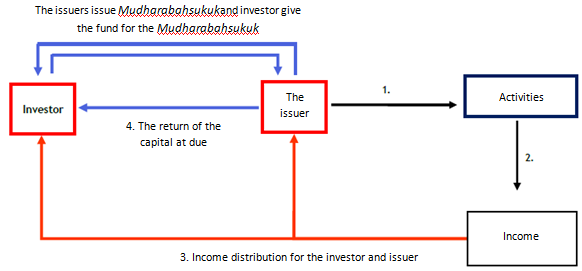

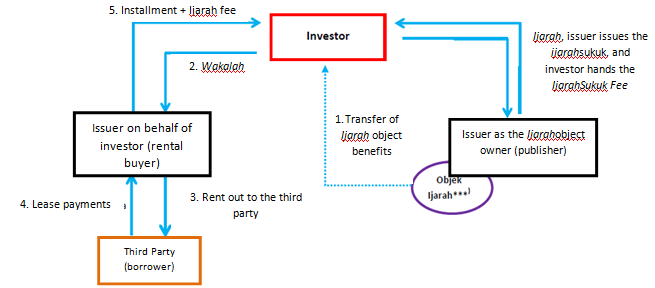

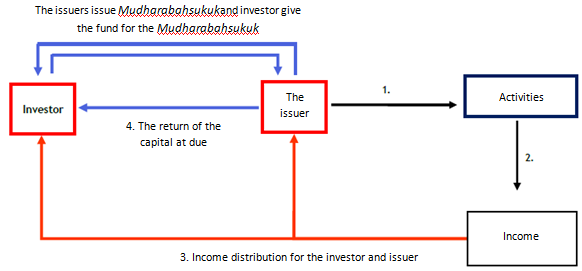

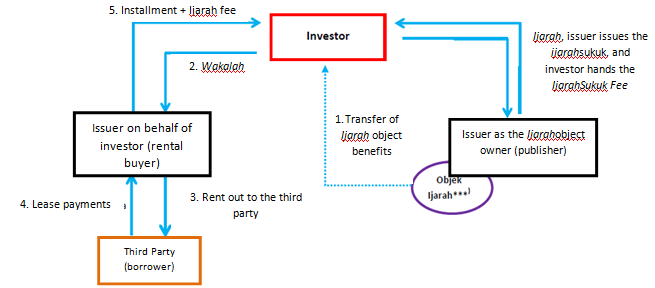

4. The Scheme of Sukuk Mudharabah and Ijarah

Sukuk Mudharabah and Ijarah are divided into several schemes. This set of Sukuk scheme contains chemes or structures of sukuk that have ever issued in Indonesia. Based on the identification of [7] there are 19 (nineteen) sukuk structure, which consists of 7 (seven) structure for sukuk Mudharabah and 12 (twelve) ijarasukuk structures. Sukuk structures are arranged according to the condition of each issuer by using the best possible contract to be applied at the time of publication and have been discussed with those who understand the principles of sharia in the capital market. In general, Mudharabah sukuk schemes can be seen in Figure 5 and Figure 6. While the overall sukuk schemes can be seen in appendix 1. | Figure 5. The Scheme of Sukuk Mudharabah. Source: [7] Processed |

| Figure 6. The Scheme of Sukuk Ijarah. Source: [7] Processed |

Specification:1. The increase in earning assets/development of Islamic finance/ business financing (production contract).2. Revenue margin* Activity in the form of murabahah financing, conventional activities, business activities (production of the issuer), a project funded by sukuk.* Revenue in the form of gross profit, contract sales subsidiary, revenue marginsSpecification:*** ijarah object used as the underlying in the issuance of sukuk is fixed assets (eg ships, electrical networks, land, machinery, buildings, circuits, vehicles, business spaces, engine power plants,) or services (contract/ purchase agreement , transport services).

5. Risk of Sukuk

There are risks embedded in sukuk investment instruments such as systematic risk and idiosyncratic risk. Systematic risk includes interest rate risk, exchange rate risk, equity value risk and commodity value risk. Idiosyncratic risk encompasses such factors like credit risk, Shariah compliance risk, operational risk and institutional risk Heffernan in [10].According to [11], the risk on conventional bonds and sukuk, are: business risk/ financial risk, risk of recall, liquidity risk, interest rate risk, inflation risk, exchange rate risk, price risk, risk of non-compliance with the principle shariah, operational risks and legal risks.

5.1. Systematic Risk

a. Interest rate riskSukuk Ijarah provides a fixed fee payment in each period so that the price of the sukuk may be affected by the level of interest rates prevailing in the market as a reference for the investors in determining sukuk yield. The higher the level of market interest rates, the bond's value would be lower [12]. According to [12], sukuk are not directly related to the fluctuations in benchmark interest rates, such as LIBOR market return.According to [10], if the market interest rate is greater than a fixed sukuk payment rate, then the value of sukuk will decrease, and vice versa.b. Exchange Rate RiskExchange rate risk can affect sukuk if the issuance is using foreign currency so that the relative changes in exchange rates may affect the price of sukuk.c. Risk Value CommoditiesAccording to [10], the price risk associated with the price of the underlying asset that can be depreciated faster than the market price. Keeping up with it is one important factor in the sukuk price assessment process, especially sukuk Ijarah. This risk is associated with the risk of asset impairment.

5.2. Idiosyncratic Risk

a. Credit RiskCredit risk factor is associated with failure in paying of the fee/profit sharing based on the income levels and corporate profits. Risk factors can be seen through the bond rating. Bond rating indicates the level of risk or safety of a bond so that it can provide a signal about the company's liquidity to pay profits to the sukuk holders. The higher the rank, the more protected the company is from the credit risk.b. Shariah compliance riskSyari’a compliance risk is associated with failure to follow the Islamic principles. The Supervising Body should always ensure that the standard, regulations and rules are consistent with Islamic financial system to reduce this risk [13]. If the system is not in accordance with the shariah, the sukuk agreement can be canceled [10]. c. Operational RiskOperational risks includes the failure in paying risk, the risk of coupon payments, the specific risks of the SPV and the specific risk of the investor. The bond rating indicates the level of the operational risk of company that issue ssukuk.

6. Establishing the Sukuk Fair Market Value

The fair market value of conventional bonds and sukuk in Indonesia are determined by the Impact Assessment Price Board, PT. Indonesia Stock Price Rating which was established in late 2007. In establishing the fair market price, PT. Indonesia Stock Price Rating uses a method that has been recognized by other impact assessment price boards.Based on the study results of [7], PT. Indonesia Stock Price Rating used the same method in terms of assessing the fair market value both for conventional bonds and sukuk. The assessment methodology that is conducted by the PT. Indonesia Stock Price Rating is not based on a particular type of effect, but based on the nature of the cash flows of these securities that are calculated on the time the investor receives an income from interest/Ijarah fee/profit sharing periodically before accepting the principal amount at the end of the validity period of these securities.

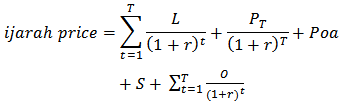

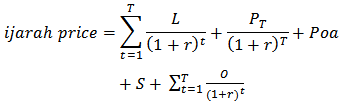

6.1. Establishing the Fair Value of Sukuk Ijarah

Based on the results of [7], the establishment of fair value of sukuk are based on several assumptions, they are: periodic payment of rental costs, the repurchase price, costs that are related to expenses used during sukuk period of the assets and transaction costs at the time of bond issuance in capital markets, the fee given to the SPV at the beginning of the contract. By paying attention to these assumptions, the fair value of Sukuk Ijarah is as follows: Specification:L = Fee /rental costPt = the repurchase value of assetsPo = the assets price given by the borrowera = Fee Percentage Value for SPVo = Cost of operations (Maintenance and Insurance)Currently, the stock market does not take into account the variable volatility of the asset and transaction costs so that they are likely to follow the model of conventional bonds.In the assessment model there are additional elements at the beginning of the contract fee (fee to the SPV or investment bank), maintenance and insurance costs while the contracts is in progress and using London Interbank Offered Rate (LIBOR) /Singapore Interbank Offered Rate (SIBOR) as the basis in determining the fee /rental cost.

Specification:L = Fee /rental costPt = the repurchase value of assetsPo = the assets price given by the borrowera = Fee Percentage Value for SPVo = Cost of operations (Maintenance and Insurance)Currently, the stock market does not take into account the variable volatility of the asset and transaction costs so that they are likely to follow the model of conventional bonds.In the assessment model there are additional elements at the beginning of the contract fee (fee to the SPV or investment bank), maintenance and insurance costs while the contracts is in progress and using London Interbank Offered Rate (LIBOR) /Singapore Interbank Offered Rate (SIBOR) as the basis in determining the fee /rental cost.

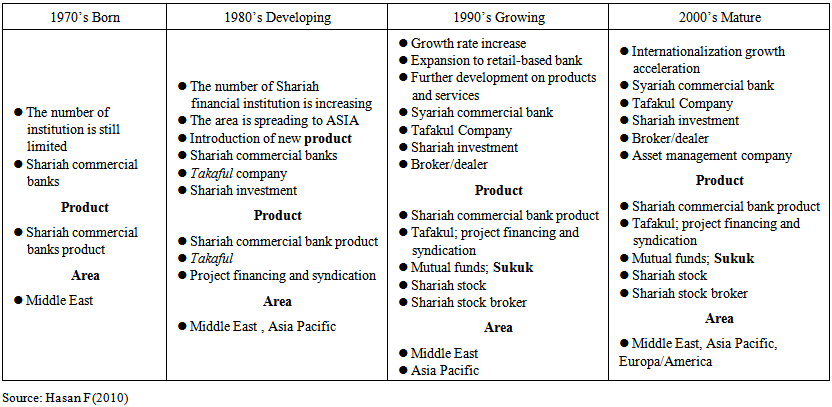

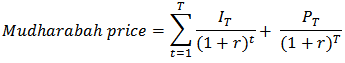

6.2. Establishing the Fair Value of Sukuk Mudharabah

The establishment of the fair value Mudharabah sukuk is as follows [7]: Specification:It = the yield based on project profits of each period.Pt = capital which is returned at dueOn the pricing of sukuk Mudharabah, the yield levels rate depends on the cash flow that is generated during the project. Therefore, the yield rate is estimated based on historical data of the company's profits every period. London Interbank Offered Rate (LIBOR) or Singapore Interbank Offered Rate (SIBOR) is used as the reference market return in the assessment of the fair market value of Mudharabah sukuk.[14] Safari et all (2013) found that there are differences between the fair value and the market value. It is obvious that valuation of sukuk is not fitted using conventional bond valuation model.

Specification:It = the yield based on project profits of each period.Pt = capital which is returned at dueOn the pricing of sukuk Mudharabah, the yield levels rate depends on the cash flow that is generated during the project. Therefore, the yield rate is estimated based on historical data of the company's profits every period. London Interbank Offered Rate (LIBOR) or Singapore Interbank Offered Rate (SIBOR) is used as the reference market return in the assessment of the fair market value of Mudharabah sukuk.[14] Safari et all (2013) found that there are differences between the fair value and the market value. It is obvious that valuation of sukuk is not fitted using conventional bond valuation model.

7. Discussion and Recommendations

Discussion1. The development of sukuk issuance in Indonesia is not in line with the development of sukuk trading. According to [7], there are several factors that caused it, they are: the limited issuance of sukuk corporate in Indonesia, the investor has a lack of understanding about the corporate sukuk trading in the secondary market. The issuance of corporate sukuk is offered non-retail to the society but limited to the institution investor or individual with relatively big nominal value, although some existed regulations have facilitated enough to serve as a cornerstone in the corporate sukuk publishing retail. The majority of sukuk investor characters are local institutional investors such as Insurance Companies, Pension Funds and structured mutual funds that have a tendency in buying to be kept until due time (hold to maturity).2.There are fundamental differences between conventional bonds and sukuk in which sukuk are securities which payment is in form of fee for the Ijarah and profit sharing for the Mudharabah. While a conventional bond is a debt acknowledgment letter with a payment is in the form of coupon with interest rate that must be paid to the investor during the term of the bond.3. There are differences in Ijarah and Mudharabah sukuk schemes. The scheme adapted to the condition of each issuer.4. There are risks associated with the sukuk which includes systematic risk and idiosyncratic risk. The risk must be considered as it relates to the determination of the value of sukuk.5. Now, the establishment of Sukuk Fair Value method is not different to the conventional bonds Fair Value establishment. Errors in assessing the fair value of sukuk lead to the potential for fraud (gahrar). it is necessary to assess the fair price of sukuk in order to create conditions of sukuk market to be more efficient, transparent , and liquid.Recommendations1.Spreading the information about sukuk to the community as an alternative financing and investment in addition to conventional bonds.2. Find factors that affecting the market value of sukuk.3. An optimization is needed for sukuk fair market value of the both for sukuk Ijarah and Mudharabah by observing the characteristics/schemes of each sukuk as well as the systematic risk and idiosyncratic risk factors respectively on sukuk instruments.

References

| [1] | www.idx.co.id |

| [2] | J. Keown, dkk, 2011. Manajemen Keuangan. edisi sepuluh jilid 1. Jakarta: Indeks. |

| [3] | Burhanuddin S. 2009. Pasar Modal Syariah. Tinjauan Hukum. Yogyakarta: UII Press. |

| [4] | The National Shariah Council Fatwa No: 32/DSN-MUI/ IX/2002. |

| [5] | Umam, Khaerul. 2013. Pasar Modal Syariah dan Praktik Pasar Modal Syariah. Bandung: PT. Pustaka Setia. |

| [6] | Hasan Fawzi. Valuasi Harga Pasar Wajar Sukuk. PT. Penilai Harga Efek Indonesia. |

| [7] | Sukuk Scheme Set Compiler Team. 2012. |

| [8] | Firdaus, Muhammad, Dkk. 2005. Konsep Dasar Obligasi Syari’ah. Renaisans: Jakarta. |

| [9] | Himpunan Fatwa Dewan Syari’ah Nasional, DSN MUI-BI. 2006: Jakarta. |

| [10] | El Shazly, Mona R and Pragya Tripathy. 2013. Proceedings of Academy of Business Education. 2013. Proceedings. |

| [11] | A. Afshar, Tahmoures. 2013. Compare and Contrast Sukuk (Islamic Bonds) with Conventional Bonds, Are They Compatible?. The Journal of Global Business Management. Vol:9. Number 1. February. |

| [12] | Tariq, Arsalan Ali dan Dar Humayon. Risks of Sukuk Structure: Implications for Resource Mobilization. Thunderbird International Business Review, Vol 49(2) 203-223. March-April 2007. |

| [13] | Bose, Sanjoy and Rober W. Mcgee, (2008), Islamic Investment Funds: An Analysis of Risks and Returns, Florida International University, Working Paper. |

| [14] | Safari Meysam, Ariff M. and Shamsher M. 2013. Do Debt Markets Price Ṣukūk and Conventional Bonds Differently?. JKAU: Islamic Econ., Vol. 26 No. 2, pp: 113-149 (2013 A.D./1434 A.H.) DOI: 10.4197 / Islec. 26-2.4. |

, the plural from of

, the plural from of  is an Arabic term that can be interpreted as certificate [3]. From Figure 1.2, sukuk began to develop in 1990s in Middle East and Asia Pacific. But in Indonesia, sukuk began developing in 2002.According to [4], "Shariah Bond is a long-term securities based on the Shariah principles that is given by the Issuer to the holders of Shariah bond that obligates the issuer to pay income to the holders of Shariah bond form results / margins / fees, as well as to pay back the bond fund at due". In issuing sukuk, several requirements must be met, ie the main activity (core business) are halal, and not in contrast to the substance of the National Shariah Council Law.In Indonesia, the legal protection on which the sukuk issuance is based in Law No. 19 of 2008 on Islamic securities. Based on the development, the search for the legal basis form of the legal protection about shariah securities had a long process, ie since 2003 when the National Islamic Council of Indonesian Ulama Council voiced sukuk issuance to capture investment opportunities as well as the economic development of shariah in Indonesia. In 2005, National Islamic Council of Indonesian Ulama Council proposed that the government immediately issued a law on Islamic securities, the act has been a success by the issuance of Law No. 19 of 2008.The Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI) defines sukuk as certificates of equal value that functions asnon-distributed evidence of ownership of an asset, the right to benefits and services, or ownership of a particular project or investment activities. Issuance of investment instruments can be seen as a new innovation in the Islamic finance as one of the answers to the prohibition of usury, and selling in Islam is permitted (Surah Albaqarah: 275) [5].The development of sukuk issuance in Indonesia is increasing even more. This is shown in Figure 3. While the amount of the total value and number of sukuk emission and sukuk outstanding can be seen in Table 3.

is an Arabic term that can be interpreted as certificate [3]. From Figure 1.2, sukuk began to develop in 1990s in Middle East and Asia Pacific. But in Indonesia, sukuk began developing in 2002.According to [4], "Shariah Bond is a long-term securities based on the Shariah principles that is given by the Issuer to the holders of Shariah bond that obligates the issuer to pay income to the holders of Shariah bond form results / margins / fees, as well as to pay back the bond fund at due". In issuing sukuk, several requirements must be met, ie the main activity (core business) are halal, and not in contrast to the substance of the National Shariah Council Law.In Indonesia, the legal protection on which the sukuk issuance is based in Law No. 19 of 2008 on Islamic securities. Based on the development, the search for the legal basis form of the legal protection about shariah securities had a long process, ie since 2003 when the National Islamic Council of Indonesian Ulama Council voiced sukuk issuance to capture investment opportunities as well as the economic development of shariah in Indonesia. In 2005, National Islamic Council of Indonesian Ulama Council proposed that the government immediately issued a law on Islamic securities, the act has been a success by the issuance of Law No. 19 of 2008.The Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI) defines sukuk as certificates of equal value that functions asnon-distributed evidence of ownership of an asset, the right to benefits and services, or ownership of a particular project or investment activities. Issuance of investment instruments can be seen as a new innovation in the Islamic finance as one of the answers to the prohibition of usury, and selling in Islam is permitted (Surah Albaqarah: 275) [5].The development of sukuk issuance in Indonesia is increasing even more. This is shown in Figure 3. While the amount of the total value and number of sukuk emission and sukuk outstanding can be seen in Table 3.

Specification:L = Fee /rental costPt = the repurchase value of assetsPo = the assets price given by the borrowera = Fee Percentage Value for SPVo = Cost of operations (Maintenance and Insurance)Currently, the stock market does not take into account the variable volatility of the asset and transaction costs so that they are likely to follow the model of conventional bonds.In the assessment model there are additional elements at the beginning of the contract fee (fee to the SPV or investment bank), maintenance and insurance costs while the contracts is in progress and using London Interbank Offered Rate (LIBOR) /Singapore Interbank Offered Rate (SIBOR) as the basis in determining the fee /rental cost.

Specification:L = Fee /rental costPt = the repurchase value of assetsPo = the assets price given by the borrowera = Fee Percentage Value for SPVo = Cost of operations (Maintenance and Insurance)Currently, the stock market does not take into account the variable volatility of the asset and transaction costs so that they are likely to follow the model of conventional bonds.In the assessment model there are additional elements at the beginning of the contract fee (fee to the SPV or investment bank), maintenance and insurance costs while the contracts is in progress and using London Interbank Offered Rate (LIBOR) /Singapore Interbank Offered Rate (SIBOR) as the basis in determining the fee /rental cost. Specification:It = the yield based on project profits of each period.Pt = capital which is returned at dueOn the pricing of sukuk Mudharabah, the yield levels rate depends on the cash flow that is generated during the project. Therefore, the yield rate is estimated based on historical data of the company's profits every period. London Interbank Offered Rate (LIBOR) or Singapore Interbank Offered Rate (SIBOR) is used as the reference market return in the assessment of the fair market value of Mudharabah sukuk.[14] Safari et all (2013) found that there are differences between the fair value and the market value. It is obvious that valuation of sukuk is not fitted using conventional bond valuation model.

Specification:It = the yield based on project profits of each period.Pt = capital which is returned at dueOn the pricing of sukuk Mudharabah, the yield levels rate depends on the cash flow that is generated during the project. Therefore, the yield rate is estimated based on historical data of the company's profits every period. London Interbank Offered Rate (LIBOR) or Singapore Interbank Offered Rate (SIBOR) is used as the reference market return in the assessment of the fair market value of Mudharabah sukuk.[14] Safari et all (2013) found that there are differences between the fair value and the market value. It is obvious that valuation of sukuk is not fitted using conventional bond valuation model.  Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML