-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(C): 125-130

doi:10.5923/c.economics.201301.21

Moderating Effect of Market practices on the Government Policy-Performance Relationship in Iraq SMEs

Emad Harash1, Fatima Jasem Alsaad2, Essia Ries Ahmed3

1School of Management, Universiti Sains Malaysia, Penang, 11700, Malaysia

2College of administration and Economics, University of Basra, Basra, Iraq

3School of Business Innovation & Technopreneurship, Universiti Malaysia Perlis, Perlis, 02600, Malaysia

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Previous studies that examined the effect of government policy on the performance mainly concentrated large companies. The review of the small and medium enterprises (SMEs) literature reveals limited research has attempted to investigate the moderating effect of market practices in SMEs, particularly in the Iraq context. This study general review the moderating effect of market practices on the relationship between government policy and financial performance of SMEs in the Iraq. Findings of the study indicate the performance of SME vary with the choice of the government policies they adopted. Additionally, to a certain degree, the discussions of the study suggest market practices as measured by market complexity of process moderates the relationship between government policy and the financial performance of SMEs.

Keywords: Financial Performance of SMEs, Government Policy, Market Practices

Cite this paper: Emad Harash, Fatima Jasem Alsaad, Essia Ries Ahmed, Moderating Effect of Market practices on the Government Policy-Performance Relationship in Iraq SMEs, American Journal of Economics, Vol. 3 No. C, 2013, pp. 125-130. doi: 10.5923/c.economics.201301.21.

Article Outline

1. Introduction

- Small and medium enterprises (SMEs) are the focus of this study as they are a key economic sector in many countries. They are the prime mover of economic undertakings and the importance of small and medium enterprises (SMEs), which have the capacity to create sufficient levels of skilled and semi-skilled employment, innovation, the long-term growth and development of both developed and developing countries. As well as, some of the greatest opportunities for small medium enterprises (SMEs) will derive from their ability to participate in the global marketplace (Kongolo, 2010; Mutula and Brakel, 2006; Ogechukwu & Latinwo, 2010). More specifically, in Iraq, Available data from the Central Organization for Statistics (COS) indicates that private sector in Iraq consists primarily of small and medium enterprises (SMEs) where those small and medium enterprises (SMEs) represent 99 percent of all companies in Iraq. This target group has been identified as the catalyst for the economic growth of the country as they are a major source of income and employmentوintroduce innovations, stimulate competition, and assist large companies (USAID, 2010). Despite the significant role of SMEs in the Iraq economy, research involving SMEs still appears to be only neglected, but also limited in their scope. The review of the SMEs literature in Iraq reveals that SMEs have received limited empirical attention as a field of study. Although in recent years there has been number of research on SMEs (Sanaa & Abbas, 2005; USAID, 2011; 2010,209), these studies have limited focus and as such do not seem to be able to increase as well as improve our knowledge in this area of study.Due to the importance of small and medium enterprises (SMEs) in relation to the economic development in a country and the limited scope of past researches, more focused studies is needed in this field of study. One such significant area of studies is to address the issue of market practices in influencing the government policies-financial performance relationship in SMEs. The review of the SMEs literature indicates that very few studies have adequately addressed this researches issue. Past empirical research on the relationships between government policies, market practices, and performance have largely emphasized on large enterprises (Mohd Shariff et al. 2010; Mohd Shariff & Peou, 2008; Peou, 2009). In addition, with the effects of globalization, the prospects of stiffer competition, maturing markets, and limited local market opportunities, the importance of government policies and market practices for Iraq SMEs are obvious. Based on the contingency framework, the present study seeks to determine whether market practices moderate the relationship between government policies and financial performance of SMEs in Iraq.

2. Financial Performance of SMEs

- In any business, the related parties always want to see good performance in their business. In short, performance is the key interest of every owner or business manager (Njanja & Pellisier, 2011; Njanja et al., 2010). Given that small and medium enterprises (SMEs) often play a significant role in improving the economy of a country and leads to economy development globally, this puts performance as one of the key issues for small and medium enterprises (SMEs) where management is concerned (Abdullah & Zain, 2011; Hudson et al., 1999). Usually a firm’s performance is seen from the extent it manages to achieve its objectives and aims (Chong, 2008; Ittner et al. 2003; Taticchi et al. 2008).The financial performance of small and medium enterprises (SMEs) depends on the success of firms in the market, both locally and internationally. For each individual, success may be dependent on his/her own target or desire to achieve certain outcomes (Davis & Cobb, 2010; Islam, et al., 2011). Commonly used financial performance as an indicator of a company's financial health over a certain period of time. Despite, many studies have found that different companies in developed and developing countries tend to emphasize on different performance measurement, the literature suggests Return Equity (ROE), Return on Investment (ROI), Operating Profit, and Sales growth rate to be the most common measures of financial performance.According to Hoque & James (2000), financial performance refers to the level of companies’ financial performance relative to their major competitors over the past years. It is literally refers to financial measures, such as Return Equity (ROE), Return on Investment (ROI), Operating Profit, and Sales growth rate (Chenhall & Langfield-Smith, 2007; Govindarajan, 1988; Hoque & James, 2000). Hoque & James (2000) claimed these indicators is the best indicator to identify whether an organization is doing things right and hence these indicators can be used as the primary measure of organization success. Furthermore, Doyle (1994) pointed profitability as the most common measure of performance in companies. These indicators are considered to be the common measures of financial profitability (Robinson, 1982).

3. Government Policy

- Government policy, positions and guidelines of government, schemes and incentives and support systems for the private sector, and particularly for the small and medium enterprises (SMEs) (Dandago & Usman, 2011; Mohd Shariff et al. 2010; Mohd Shariff & Peou, 2008). Many recommendations have emerged from the studies deliberate efforts are still needed on the part of governments, through its series of efficient policies affecting competition in the market to nurture a climate that is conducive to successful and profitable operations of small and medium enterprises (SMEs) (Dandago & Usman, 2011; Sobri Minai & Lucky, 2011). Previous empirical studies on the relationship between government policy and performance have mainly concentrated on large firms. These studies provide strong evidence that suggests government policies are associated with the performance of large firms. Although most of the empirical studies have centered upon large firms, findings of an increasing number of studies have suggested that government policy also influenced the performance of SMEs (Dandago & Usman, 2011; Mohd Shariff et al. 2010; Mohd Shariff & Peou, 2008). For example government policy can behave an entrepreneurial role to impact the creation of a sustainable market factors. It also can act an entrepreneurial role to impact the creation of a land infrastructure conditions to support SMEs (Nguyen et al. 2009). The results of previous studies (Sanaa & Abbas 2005; USAID, 2009; 2010; 2011) indicate that economies in transition (Iraq, for example) need to take some specific measures to establish the conditions to promotion of entrepreneurial activities and for small and medium enterprises (SMEs) to create opportunities to grow in different sectors of the economy. The results of studies (Mohd Shariff et al. 2010; Mohd Shariff & Peou, 2008; Nguyen et al. 2009; Sobri Minai & Lucky, 2011) also indicate that in the absence of sturdy market forces in these countries transitional economy, the Government must to play a decisive role to create those conditions. In addition, the previous studies underlined that government policies have an impact on SMEs activities, linkages and networking in order to cooperation and utilizing resources (Brimble et al. 2002; Harvie, 2001; Harvie, 2002 and Tambunan, 2005). Theoretical and empirical studies (Herri, 2002; Opara, 2010; Mohd Shariff & Peou, 2008) have shown government policy that seems to be more consistent in influencing the performance of the small and medium enterprises (SMEs). In developed and developing countries, government policies that provide support are a critical factor for small and medium enterprises (SMEs) growth (Nguyen et al. 2009). Although the relevance of the government policies few studies have examined them in the context of SMEs. Accordingly, this study adopts the following types of government policies: the call government to take concrete actions to curb dumping, smuggling and importation of cheap foreign products; reduce corruption practices; providing social justice; providing market information; improvements in infrastructure; providing training for small and medium enterprises (SMEs) and encourage private investment.

4. Market Practices

- Over the recent years, the world in which marketing operates has fundamentally changed (Wind, 2009). Marketing is constantly evolving and many authors are calling for a new definition. Shift in thinking is necessary for to identifying new opportunities and re-examine the conventional models (Malter et al. 2005). The recent market practice series of research has looked at describing Market practices within the marketing context. The market practices has been defined are all activities that contribute to constitute markets (Kjellberg and Helgesson, 2006; Kjellberg and Helgesson, 2007). Some argue that Market practices is a philosophy, or way of being, while others argue that it is a set of business practices to be implemented. Others see authors that it is a combination of these two, aligned with the strategic mandate of the firm (Sheppard, 2011). According to, Avlonitis & Gounaris (1997 p:386) Felton (1959) regarded market practices as "a way of thinking in doing business that is based on the integration and coordination of all marketing activities which, in turn, will integrate with the rest activities of the company in an effort to maximize long- term profitability."Market practices are differing from continent to continent, countries to countries, cities to cities and sector to sector in relation with social, cultural and economic backgrounds. The differentiation among space, time and effectiveness of market practices could be the distinction for any firm or business in particular environment. Different methods of practices and marketing planning are used in different phases of the life of companies. In most countries, majority of small businesses and even some big corporate companies involved in peculiar market practices (Ghouri et al. 2011).A review of the extant literature shows that market practices has attracted a lot of interest from both academics and practitioners. Studies Shapiro (1988), Webster (1992) posits the notion that market practices theory promotes a uniform orientation throughout the enterprise, and a consistently external focus on markets. These studies provide the foundation of market practices (Sheppard, 2011): 1. Market practices are defined as a sequence of information based behaviors, and a culture of customer and competitor orientations and inter-functional co-ordination. 2. Market practices places high priority on the creation and delivery of superior customer value. 3. Market practices provide behavioral norms for gathering, sharing and responding to market information. 4. Market practices require organizational systems and processes for the assessment of customer needs and market intelligence dissemination. 5. Market practices require adaptive organizational structures. 6. Market practices require the commitment of top management.A review of the literature provides the foundation of market practices. The findings show that, the market practices is an important aspect within the world of business, as it provides a continuous value contribution to any organization and its key stakeholders (Fine, 2008). Marketers practices capable of helping the organization drive growth and profitability’ (Kumar, 2009), and is considered as one of the internal and external contingency variable that also influenced of an organization.Conceptual and empirical studies on the market practices construct in the extant literature (Araujo et al. 2008; Barry and Slater, 2002; Kjellberg and Helgesson, 2006; Kjellberg and Helgesson, 2007 and Mahmoud, 2010). These works span from both developed (Low et al., 2007; Ozer et al. 2006; Sen, 2006) and developing (Hinson et al. 2008; Mahmoud, 2010) economies. The central argument of the developed and developing countries’ studies demonstrates the indispensable role that market practices plays in achieving superior performance in its chosen markets (Mahmoud, 2010).The previous study by Nyoni (2004) indicated that lack of market knowledge to the constraints on the performance of small and medium enterprises (SMEs). Here, a lack of market knowledge and expertise is a major constraint hindering the growth performance of small and medium enterprises (SMEs). The study conducted by Mohammed (2011) found the small and medium enterprises (SMEs) sector need to have more customer focus, competitive trends monitoring and appropriate responses to market intelligence in order to achieve success. Another study carried out by Hay (1992) determined that variable that is believed to have an influence on performance of the small and medium enterprises market practices. He posited that most owners or managers of small and medium enterprises (SMEs) did not have enough skills and knowledge with regard to comprehending the conception of their product, marketing. He stated that by training the managers and employees, and then the company will definitely be able to perform better since the variable can be controlled.In contrast, Blankson & Stokes (2002) found that small and medium enterprises (SMEs) utilize marketing in such a general and inappropriate way that it is unlikely to have any significant impact on performance.Although no empirical test of the moderating role or market practices in relationship between government policy and performance of small and medium enterprises is found in the literature, the available empirical evidence shows that the effects of government policy on performance might be moderated by the turbulent environment. This indicates that market practices can be a unique resource that supports government policy directed at achieving superior performance. As to the direction of this relationship i.e. whether market practices leads to better performance, evidence exists which demonstrate that it is the development of market practices that contributes to the company’s performance and not the other way round. Within this framework, the previous studies provide evidences to support perceived market practices as a moderator for the relationship between government policy and financial performance of small and medium enterprises. As well as it provides a solid ground those support the existence of a relationship between market practices as a moderator adoption government policy, and financial performance of small and medium enterprises (SMEs).

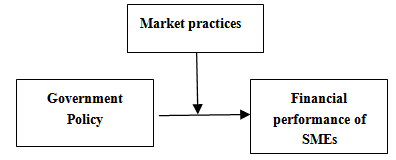

5. Contingency Framework

- According to the contingency framework, market practices are considered as an important contingency variable. This framework viewed market practices as source of competitive advantage for a company. However, a company will need to align its market practices to its strategy. The contingency theory suggests that companies that adapt their market practices to their government policy tend to improve their performance. From the contingency viewpoint, different types of companies operating in different situations require different market practices. Market practices are normally effective for companies involve in high volume products. Similarly, unit product or less complex market practices is more suited for companies involve with the production of customized products. The following Figure 1 presents the research model of the present study.

| Figure 1. Proposed theoretical framework |

6. Conclusions

- This study was found the Relationship between government policy and financial performance of small and medium enterprises (SMEs). Conceptually, the study indicate the performance of SME vary with the choice of the government policies they adopted. Additionally, to a certain degree, the findings of the study suggest market practices as measured by market complexity of process moderates the relationship between government policy and the financial performance of SMEs, it was re-conceptualized in the context of modern markets which include among others. This is significant for at least three parties, i.e. customers, companies and the relevant authorities’ bodies, to strategize on containing the existence of the effect in SMEs by accordingly controlling the selected factors.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML