-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Economics

p-ISSN: 2166-4951 e-ISSN: 2166-496X

2013; 3(C): 22-28

doi:10.5923/c.economics.201301.05

Macroeconomics Shocks and Stability in Malaysian Banking System; A Structural VAR Model

Mohammadreza Alizadeh Janvisloo1, Junaina Muhammad2, Taufiq Hassan2

1Faculty of Economics and Management, UPM, Serdang, 43400, Malaysia, Ph.D. candidate and Credit Expert in Bank Tejarat, Iran

2Faculty of Economics and Management, UPM, Serdang, 43400, Malaysia

Correspondence to: Mohammadreza Alizadeh Janvisloo, Faculty of Economics and Management, UPM, Serdang, 43400, Malaysia, Ph.D. candidate and Credit Expert in Bank Tejarat, Iran.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Negative effects of 1997 financial crisis in Malaysia, such as other emerging countries, led to the development and restructuring of financial system in this country. Hence many big firms and corporations to provide their required funds shift towards newly established markets like stock and bond markets. Under these conditions, many banks maintained their profitability by attracting new customers especially Small and Medium size Entrepreneurs (SMEs) and increased their loans and credits to the household sector. Now a significant share of loans has been given to the household sector and SMEs and this feature caused the banking system to become more vulnerable against external and internal shock. So, increasing unemployment and reducing income for any reason will be a threat for banks by Default risk. Thus, anticipated effects of macro-economic shocks on banks’ operation are more important to policy makers and bankers. Hence in this study, a Structural Vector Autoregressive (SVAR) model is employed to show how a macroeconomic shock effects on Non-Performing Loan changes (NLP) as a credit risk indictor in Malaysian commercial banking system for period of 1997-2012. The designed Model is called AB model that is limited based on IS-LM theory. According to results the demand and supply shock have negative and monetary shock has positive effects on NPL ratio. Mean while simultaneous effects of monetary and demand shocks are more than supply shocks effects but the supply shocks’ impact is more persistent. Comparison response of NPL ratio with capital ratio shows that the commercial banks against domestic shocks are safe and adequate capital to deal with the risks arising from internal shocks in the economy are considered. The results of this study can help policy makers to pursue suitable monetary policies and decrease banks failing in front of any macroeconomic shocks.

Keywords: Banking, Macroeconomics, Credit Risk, Structural VAR

Cite this paper: Mohammadreza Alizadeh Janvisloo, Junaina Muhammad, Taufiq Hassan, Macroeconomics Shocks and Stability in Malaysian Banking System; A Structural VAR Model, American Journal of Economics, Vol. 3 No. C, 2013, pp. 22-28. doi: 10.5923/c.economics.201301.05.

Article Outline

1. Introduction

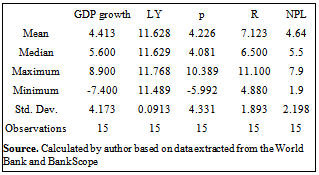

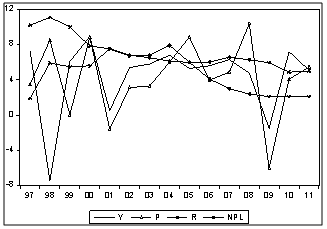

- Development of financial markets, economic globalization and the expansion of banking activities has led to a close relationship between economic conditions and the operation of banks. Banking crises in different countries during last decades and their negative effects on host and other economies make it necessary to examine the relationship between macroeconomic variables and banks' behaviour and operation. On the other hand banks have an important role in the monetary policy transmission. Hence understanding of the relationship between macroeconomic indicators and the performance of banking system is so important for economists. Negative effects of 1997 financial crisis in Malaysia, such as other emerging countries, led to develop and restructure of financial system in this country. Thereafter many big firms and corporations to provide their required funds shifted from banking system towards newly established markets like stock and bond markets. Under these conditions, many banks maintained their profitability by attracting new customers especially Small and Medium size Entrepreneurs (SMEs) and increased their loans and credits to the household sector. Now a significant share of loans has been given to the household sector and SMEs and this feature caused the banking system to become more vulnerable against external and internal shocks.SMEs established by bank loans are very sensitive to shocks and macroeconomic volatility like constraint on banks’ credit and international trade. So it is possible that any alteration in government policies make SMEs encounter in/directly with several problems like decrease in sale and production and liquidity crisis. Finally they cannot continue their activity and make default on loans that cause more limitation in bank credits. On the other hands, due to the limitation of the funds and credit risk control banks may restrict their financing roles. All these problems reduce the level of total products, employments and economic growth. Increasing unemployment and reducing disposable income for any reason will be a threat for banks by Default risk. Accordingly in order to make better economic policies to improve the SMEs' share from GDP growth, as the driving engine of the economy, with maintaining the quality of the banking system, it is important to investigate the interaction between banks operation such as credit risk and macroeconomic shocks such as monetary policy, aggregate demand and supply shocks. In 1997 the average mine of total capital to risk weighted assets ratio in commercial banks was 6 percent. After 1997 financial crisis the banks increased their capital ratio and during the period (1998 – 2012) equal to minimum 10.62% (2008) and a maximum of 15.7 per cent in 2010 (See Figure (1)). Compared with the NPL ration during this period, it seems that banks have enough adjusted their capital with risky conditions. But given the current state banks, a measure of the health of the banking system to macroeconomic shocks is essential.

| Figure (1). NPL ratio and Capital ratio in Malaysian aggregate commercial banking system |

2. Theoretical Background and Literature

- After Wilson[21] who examined the relationship between the probability of default of financial institution with a group of macroeconomic variables under distress condition, a wide range of studies have done about different credit risk models and relationship between risk factors in different macro environment situation. Some of these researches have gotten the Non-Performing Loans (NPL) ration to total asset as a credit risk indicator. Since based on risk models it can be selected different type of risk indicators, so in literature review in line with the purpose of study it has tried to point out that researches which used the NPL as a risk indicator It is notable that studies in this area are called stress test that have done in order to test healthy of banking system in front of different macroeconomic shocks. The literature in this area has divided in two groups. The first set of studies are called sensitivity test that examine the effects of a shocked variable on risk without any interdependence to other risk factors (See[3];[7],[11],[17],[20] and[22]).The other groups of researches are scenario analyses that use a combination of comprehensive economic and financial information to assess systematically the risk. Most of these studies have a top down approach that means they used aggregate finance and economic data (See[6],[8],[10],[12], and[20]). According to results of these studies the gross domestic products (GDP) growth always and real interest rate sometime have indirectly negative effects on NPL ratio. Also unemployment, consumer price index (CPI) and real exchange rate influence on loan quality. In these studies the Vector Auto Regressive models is the most important method to accesses interaction between macroeconomic and financial variables. This model has been used widely to understand dynamics behaviour of macroeconomic variables in front of each other’s change, since the[19] done an initial study in this regard. One of the drawbacks of VAR models is the lack of theoretical background about the connection between the variables and only it makes a statistical relationship between them. Initially[4],[5] and[18] and then[9] and[13] suggest usage of predefinetion structures based on theories to overcome this limitation. In this paper the AB model that disigned by[2] is used to make theoretical restriction and structural VAR model. This model has been used in so many studies such as[1],[14],[15] and[16]. The most important theory to create restriction in these studies is the IS-LM models. Based on aggregate demand and supply and also money market equations and the economic policies behind these equations the sign of coefficient between macroeconomic variables in VAR model can be determined.

3. Data and Methodology (SVAR Model)

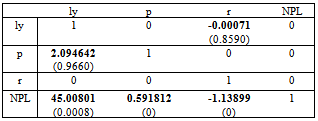

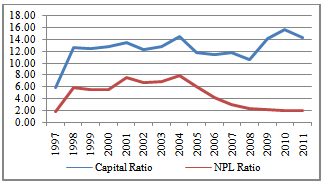

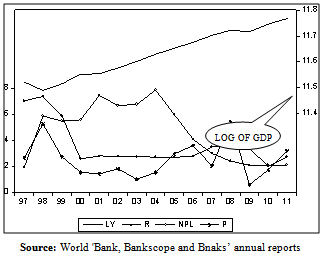

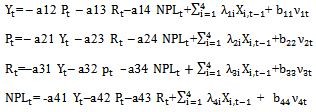

- The foundation of the SVAR model in this study is IS-LM model that has an important role on the policy makers and academicians decisions. Model includes variables like output (y) and price (p), money stock (m) and interest rate (r). The reasons for including these variables are: (a) basic macroeconomic models developed in the Keynesian idea include these variables; (b) theoretical predictions discussed above involve dynamic interactions among these variables. On the other hand GDP, interest rate and consumer price index based on literature and imperial studies are the most important macroeconomic variables that affect on banks’ loan quality that here its’ indicator is the Non-Performing Loan (NPL) to total loan ration for aggregate commercial banking system. Also the transmission role of banks in monetary policies is another reason to add this variable to the model. Since the main objective of this paper is to investigate the relationship between the NPL ratio and the macro variables; thus, in the model just related variables into NPL ratio have been selected. On the other hand due to the limitations of the data, entering additional variables causing the Matrix Algebra problems and coefficients is not possible to estimate. There for the money stock (M) is omitted from model. Also none of the empirical studies about NPL does not include the money stuck as explanatory variables. So our variables are defined follow: Y: Real GDP P: Inflation (based on consumer price index),R: Money market interest rate, NPL: Non-Performing Loan ratio to total loans(Aggregate commercial banks)(LOG of Y (LY) has been used)Table (1) and figures (2&3) show description from statistics of variables.

|

| Figure (2). trend of GDP growth, inflation, lnterest rate and NPL ratio in Malaysia (1997-2011) |

| Figure (3). trend of GDP (LOG), inflation, interest rate and NPL ratio in Malaysia (1997-2011) |

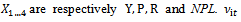

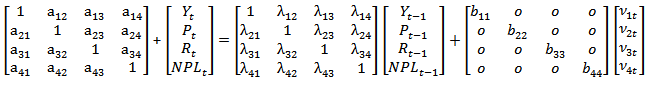

4. Econometrics Model

- While the main aim is investigation the relationship between macroeconomic variables and bank loan quality, so that this relationship is modelled within a general equilibrium framework in which major macroeconomic variables interact contemporaneously and over time. If it is assumed that each variable be contemporaneously correlated with others variables and also related to lagged level of itself and other variables, so the system of equation for this relationship can be designed as the following:

That,

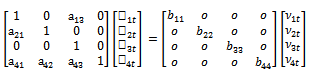

That,  is the structural shocks of independent variables. This matrix can be written in the other shape:

is the structural shocks of independent variables. This matrix can be written in the other shape: This is SVAR or primitive VAR. Following the AB-model[2] restrictions for A and B is combined, so that the model for innovations becomes

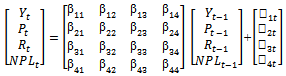

This is SVAR or primitive VAR. Following the AB-model[2] restrictions for A and B is combined, so that the model for innovations becomes  To achieve this combination initially the reduce form of model is extracted:

To achieve this combination initially the reduce form of model is extracted:  This is the reduced form of the model that can be compared with the original model and combination of

This is the reduced form of the model that can be compared with the original model and combination of  =

=  is extracted:

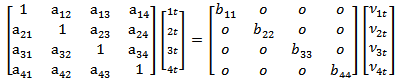

is extracted: If the amount of variables is K so that there are altogether

If the amount of variables is K so that there are altogether  elements in the structural form matrices, and the maximum identifiable parameters in these matrices is K(K + 1)/2, we need

elements in the structural form matrices, and the maximum identifiable parameters in these matrices is K(K + 1)/2, we need  – K(K + 1)/2 further restrictions for exact identification. Accordingly the number of extra needed restriction in this study is 32-10 = 22. Meanwhile 12 restriction in matrix B (equal to zero) and 4 restriction in matrix A (equal to one) are clear so it is necessary to identify only 8 more restriction that can be extracted from theories.

– K(K + 1)/2 further restrictions for exact identification. Accordingly the number of extra needed restriction in this study is 32-10 = 22. Meanwhile 12 restriction in matrix B (equal to zero) and 4 restriction in matrix A (equal to one) are clear so it is necessary to identify only 8 more restriction that can be extracted from theories.5. Policy Identification Based on Theory

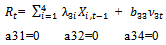

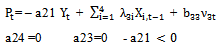

5.1. Monetary Policy

- A linear function relating the monetary policy instrument to the information set available to the central bank. Monetary policy shocks

is identify as innovations to the monetary policy instrument given a set of conditioning variables. The monetary policy instrument is the interest rate and the conditioning variables for the feedback rule include the contemporaneous lagged values of all the variables included in the model. Since output and prices are not observed by the central banks when they use a monetary policy, it can only adjust interest rate immediately to changes in money stock. One of the other assumptions in this regard, can be related to relationship between quality of bank loans (NPL ratio) and interest rate. This is evident that change in NPL does not directly affect the volatility of interest rates. Since banks through the transitional role can affect on monetary policy performance; So to counteract the negative effects of the banking system in response to cope with the NPL, the interest rate may be changed on the recommendation of economists. Hence it can be said that the interest rate does not change directly by any change in NPL ratio. Based on these restrictions the equation of interest rate is equal to:

is identify as innovations to the monetary policy instrument given a set of conditioning variables. The monetary policy instrument is the interest rate and the conditioning variables for the feedback rule include the contemporaneous lagged values of all the variables included in the model. Since output and prices are not observed by the central banks when they use a monetary policy, it can only adjust interest rate immediately to changes in money stock. One of the other assumptions in this regard, can be related to relationship between quality of bank loans (NPL ratio) and interest rate. This is evident that change in NPL does not directly affect the volatility of interest rates. Since banks through the transitional role can affect on monetary policy performance; So to counteract the negative effects of the banking system in response to cope with the NPL, the interest rate may be changed on the recommendation of economists. Hence it can be said that the interest rate does not change directly by any change in NPL ratio. Based on these restrictions the equation of interest rate is equal to:

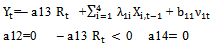

5.2. Aggregate Demand

- One of the assumptions of IS-LM model is that price level is given and thus does not change in response to demand shocks. On demand side it is allowed movement of price due to favourable or adverse supply shocks. Especially in developing countries price is not contemporaneously influenced by other variables in the system but by the adverse supply shocks will increase price. So that there are three restrictions in price equation:

5.3. Aggregate Supply

- Since real output can only respond to monetary policy shocks with the lag thus aggregate supply is identified as a function of the lagged values of all the variables in the model. So that supply equation is equal to:

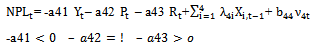

Apart from the restrictions imposed by the New Keynesian model, it can also be applied to other constraints about relationship between bank risk indicator (NPL ratio) and other variables. Based on empirical studies, change in output has contemporaneous negative effect on NPL ratio. And any increasing in interest rate has simultaneously positive effects on NPL ratio. In relation to price shocks, it is noteworthy that the different results of the studies in this regard have been issued; thus the expected sign of the coefficient on this variable will be assigned preferably the estimated results of model. So the NPL ratio function can be wrote such as:

Apart from the restrictions imposed by the New Keynesian model, it can also be applied to other constraints about relationship between bank risk indicator (NPL ratio) and other variables. Based on empirical studies, change in output has contemporaneous negative effect on NPL ratio. And any increasing in interest rate has simultaneously positive effects on NPL ratio. In relation to price shocks, it is noteworthy that the different results of the studies in this regard have been issued; thus the expected sign of the coefficient on this variable will be assigned preferably the estimated results of model. So the NPL ratio function can be wrote such as: Based on restrictions the

Based on restrictions the  will be:

will be:

6. Estimation Results

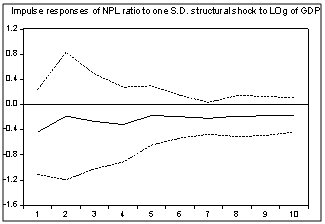

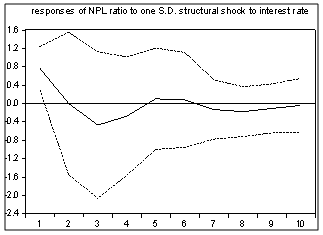

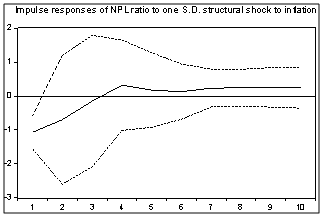

- Before model estimation, initilly the stationery of variables has been tested. According to results of ADF unit root test the LOG of GDP and inflation are stationary with trend. Also the money market intrest rate and NPL ratio with out trend and intercept are stationary. So that level variables are used to estimate the model. The model was estimated on LOG of GDP (LY), inflation based consumer price index (p), money market inerest rate and NPL ratio. Also model was estimated with replasing GDP growth by LY seperatly. In both model the parametrs of A matrix shows that any Supply shock (shock on GDP) and demand shock (shock to inflation) have a negative effect on NPL and monetary shock (shocks on interest rate) has positive effects on NPL ratio (seeTable (2)).

|

| Figure (4). |

| Figure (5). |

| Figure (6). |

7. Conclusions

- The main purpose of this study is investigating the effects of macroeconomic shocks on commercial banks’ loan quality in Malaysian economy. To this end we used a structural VAR (SVAR) model to analyse the response of loan’s quality to monetary policy shocks, supply and demand shocks. The most important real economy variable including the real GDP, inflation and interest rate and also NPL ratio as an indicator of loan quality in aggregate banking sector have been used in this model. In order to predicts the macroeconomic shocks’ effects some restriction based on IS-LM models applied in model. According to results the simultaneous effects of monetary (interest rate) and demand (inflation) shocks on NPL ratio are more than supply (GDP) shocks effects but the supply shocks’ impact is more persistent. Any increasing in GDP and inflation lead to decrease in NPL but effect of inflation is more than GDP. The contemporaneous effect of monetary policy shock (negative) differs from its lag effects (Positive). Based on macroeconomic shocks effects on NPL ratio and compared with capital ratio in commercial banks it can be said that the banking system (commercial banks) against domestic shocks are safe and adequate capital to deal with the risks arising from internal shocks in the economy are considered. But since Malaysia is a country dependent on the export sector and its financial system is interconnected with international financial markets, it is also important to investigate the effects of external shocks on health of banking system.

Notes

- 1. Household debts in Malaysia as a proportion of GDP have increased to 76.6% at end of 2011. Also based on Asian Development Bank’s (ADB) study the share of SMEs in GDP and industrial employment in Malaysia was respectively 17.4 and 59 percent in 2012.2. Note that in the matrix A, each negative coefficient means that incoming shock has a positive effect on related variable to that coefficient and vice versa.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML